Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

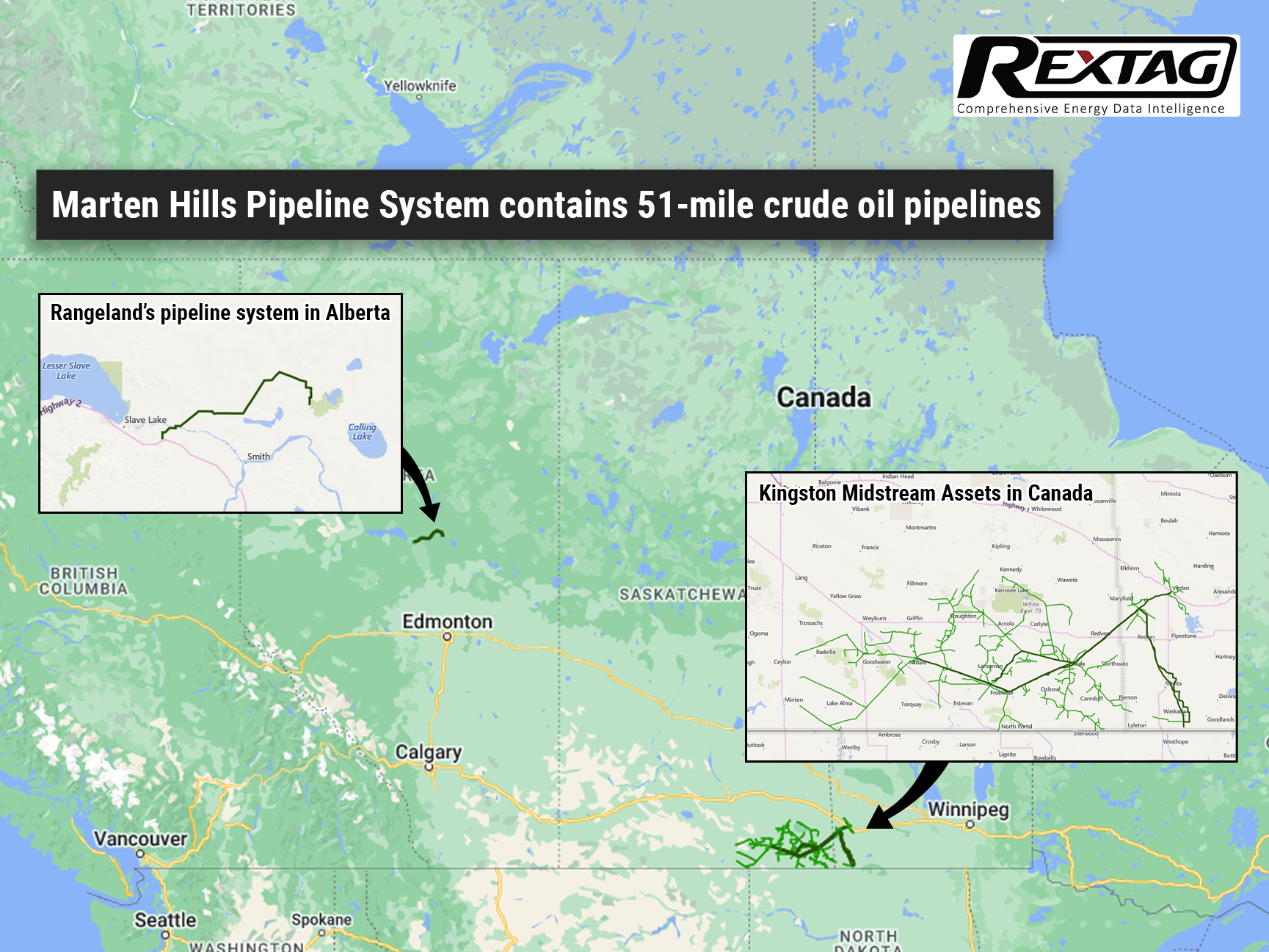

Kingston Midstream Secures Deal to Acquire Clearwater Assets from Rangeland Midstream Canada

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

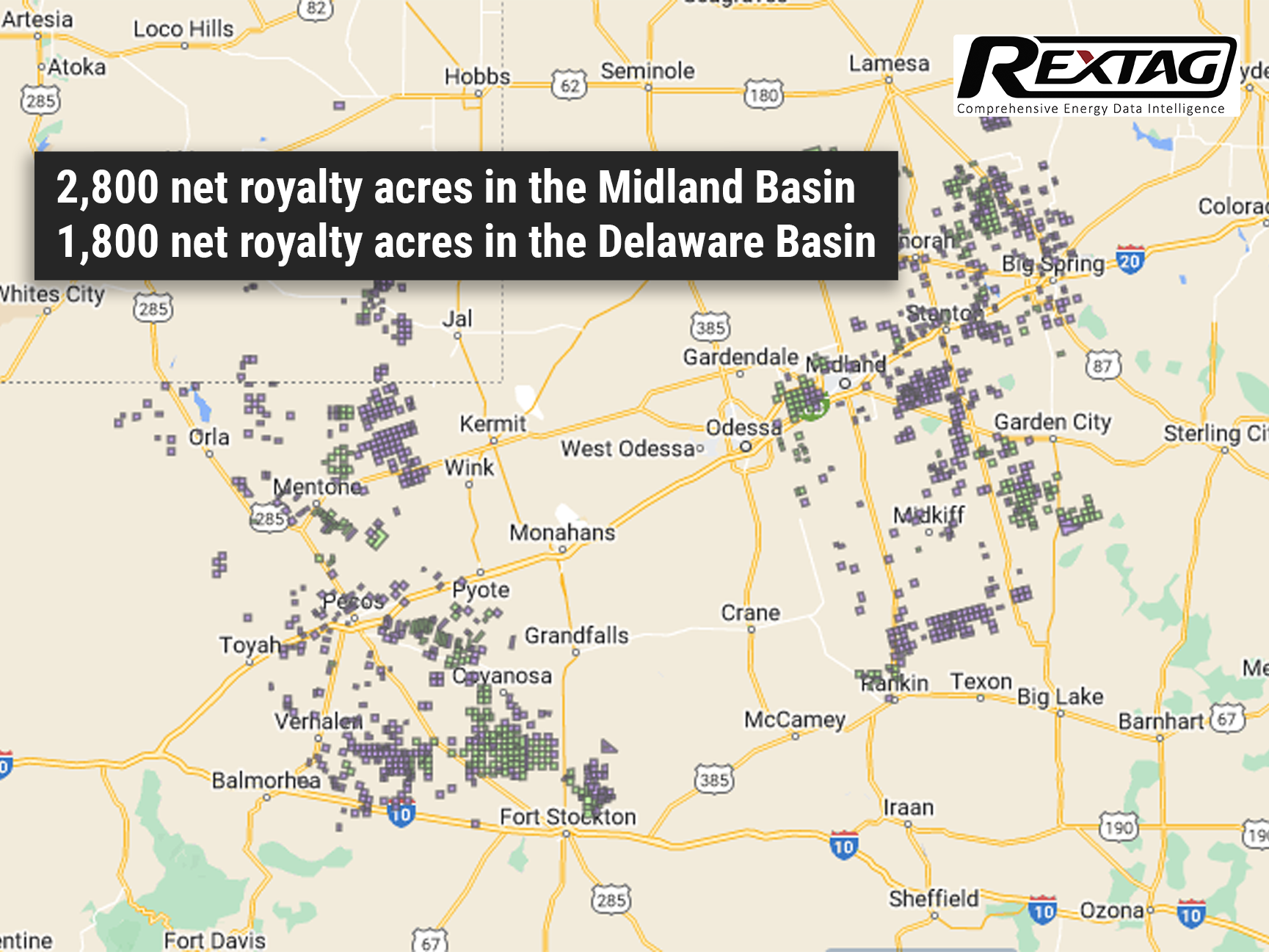

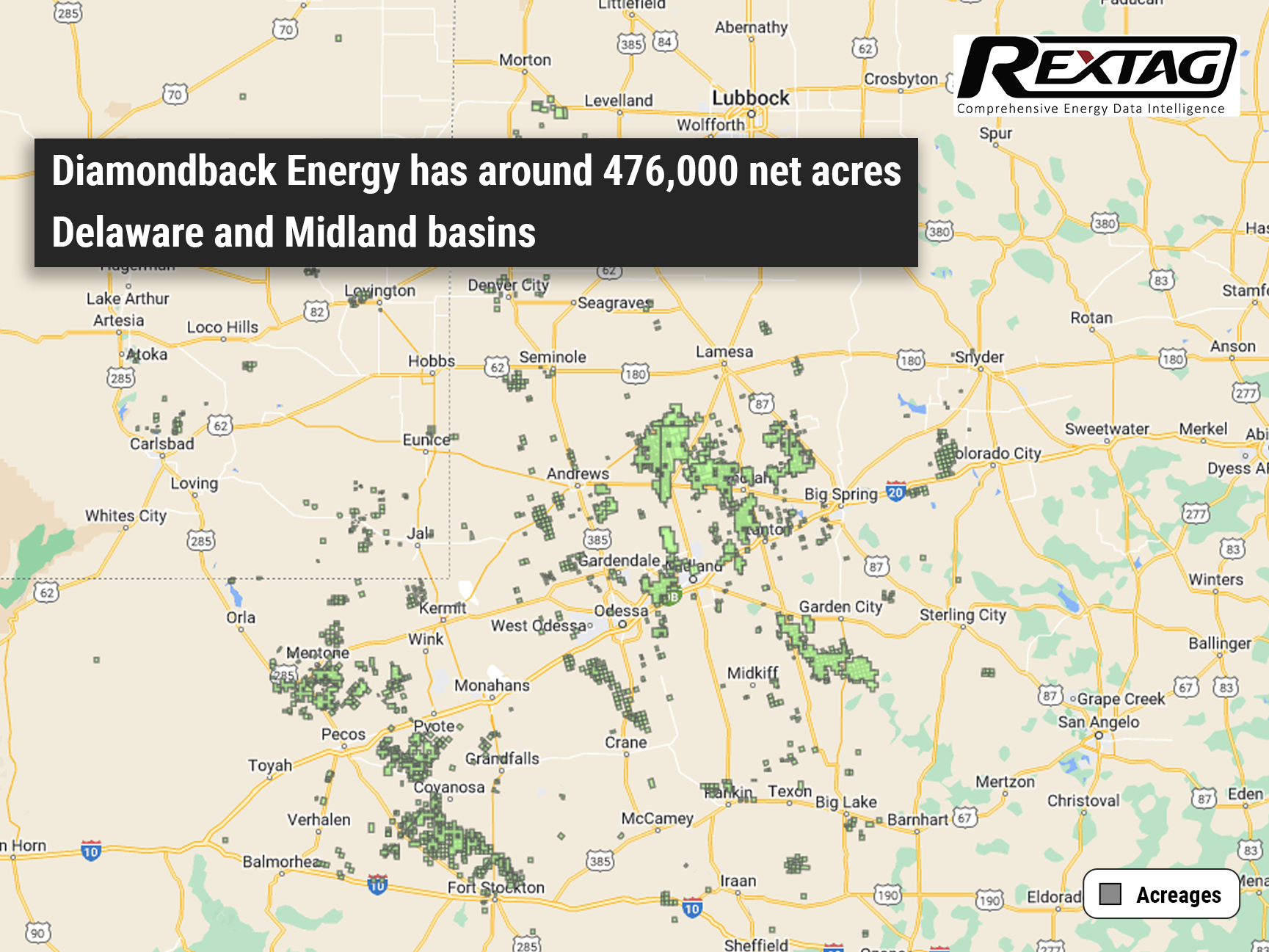

Diamondback's Viper Energy Acquires $1 Billion in Royalty Interests in the Permian Basin

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

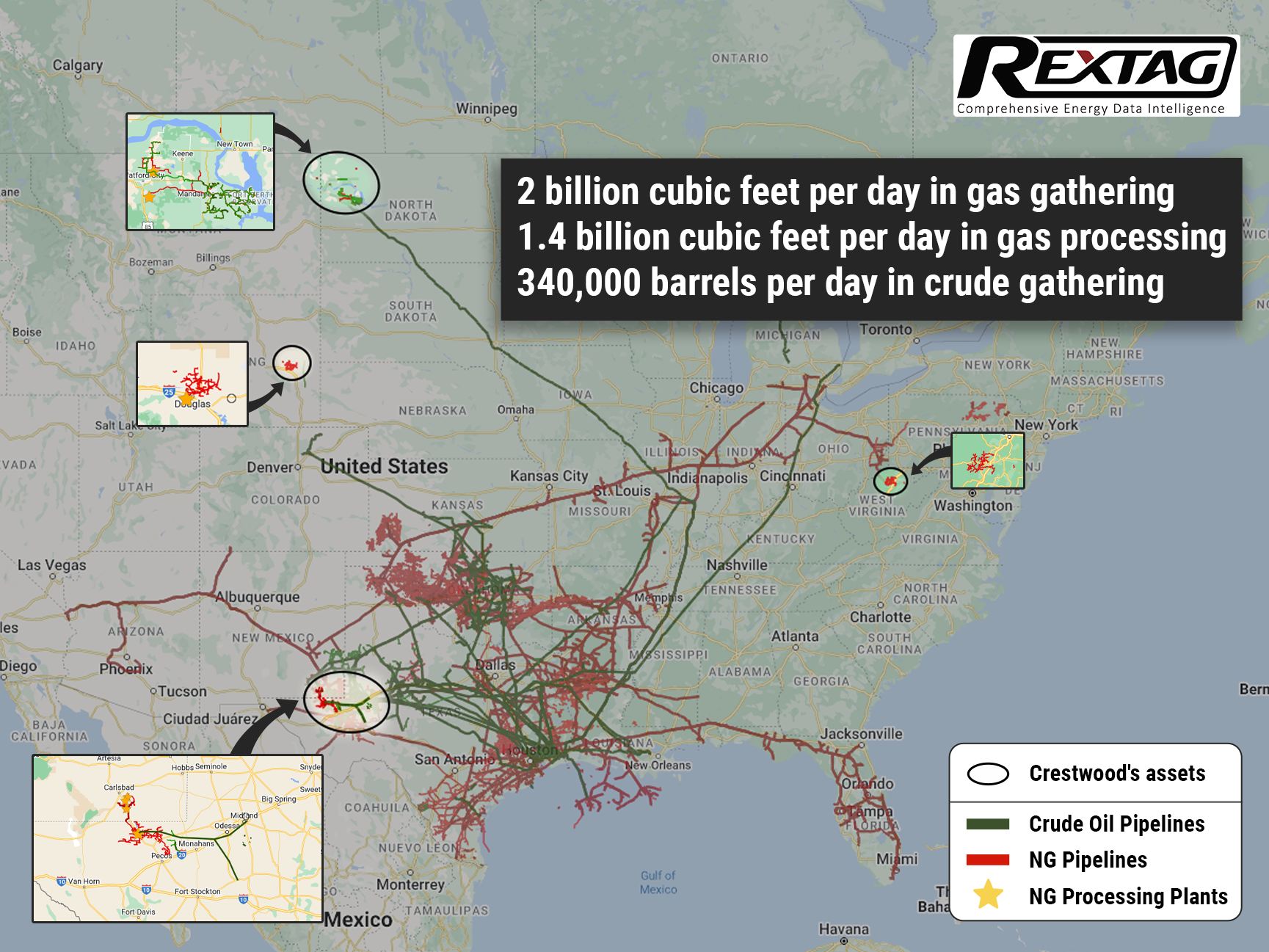

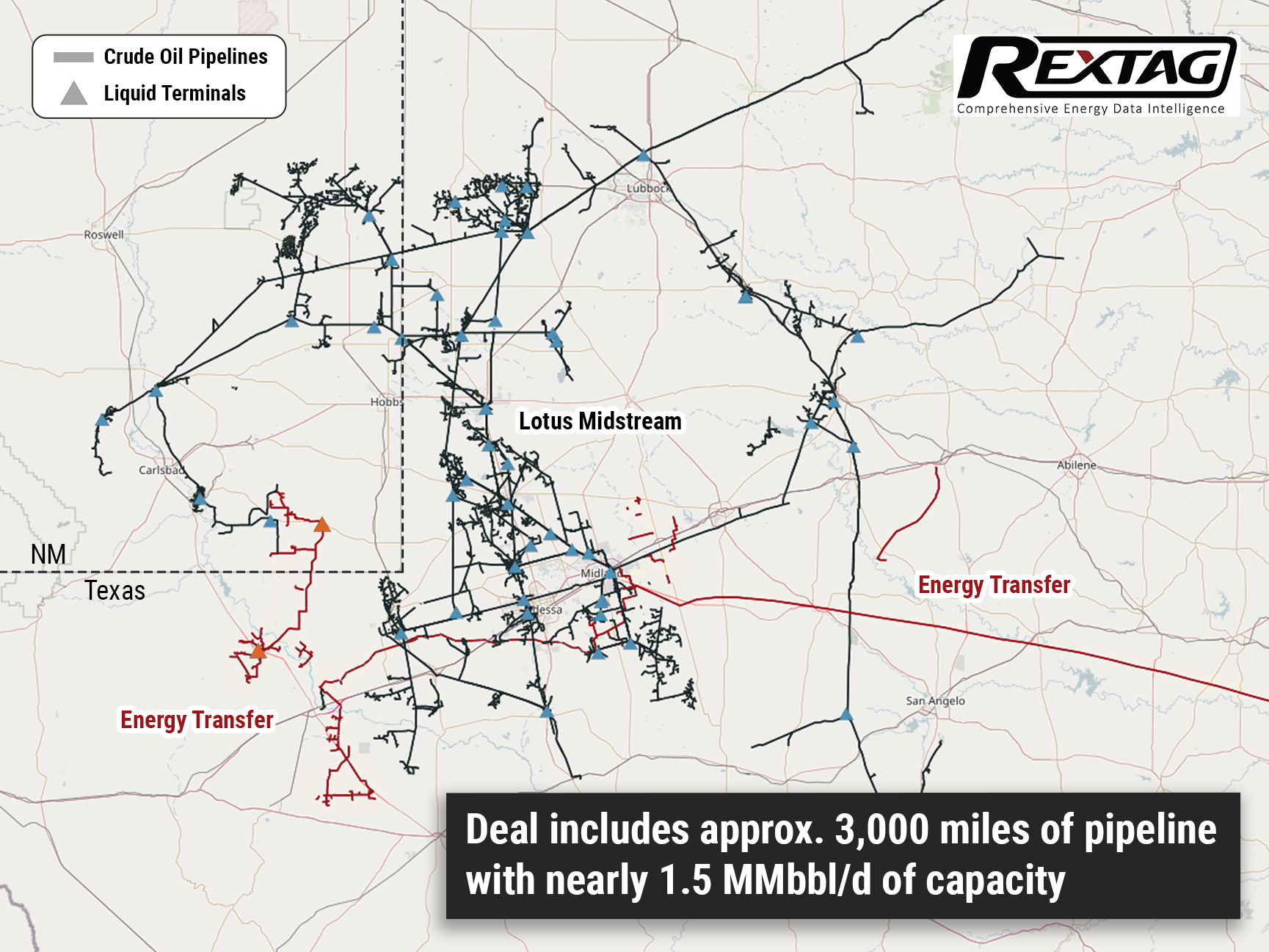

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

Under Construction Pipelines: Outlook 2023 by Rextag

According to Globaldata, 196,130km of planned and announced trunk oil and gas pipelines are anticipated to become operational globally between 2023 and 2030. This consists of 113,099km of planned pipelines that have identified development plans, and 83,031km of early-stage announced pipelines currently under conceptual study, expected to receive development approval. Based on Global Energy Monitor's 2023 data, Africa and the Middle East account for 49% of the global oil transmission pipeline construction, valued at US$25.3 billion. The report indicates these regions are currently constructing 4,400 km of pipelines with an investment of US$14.4 billion. There are plans for an additional 10,800 km at an approximate cost of US$59.8 billion.

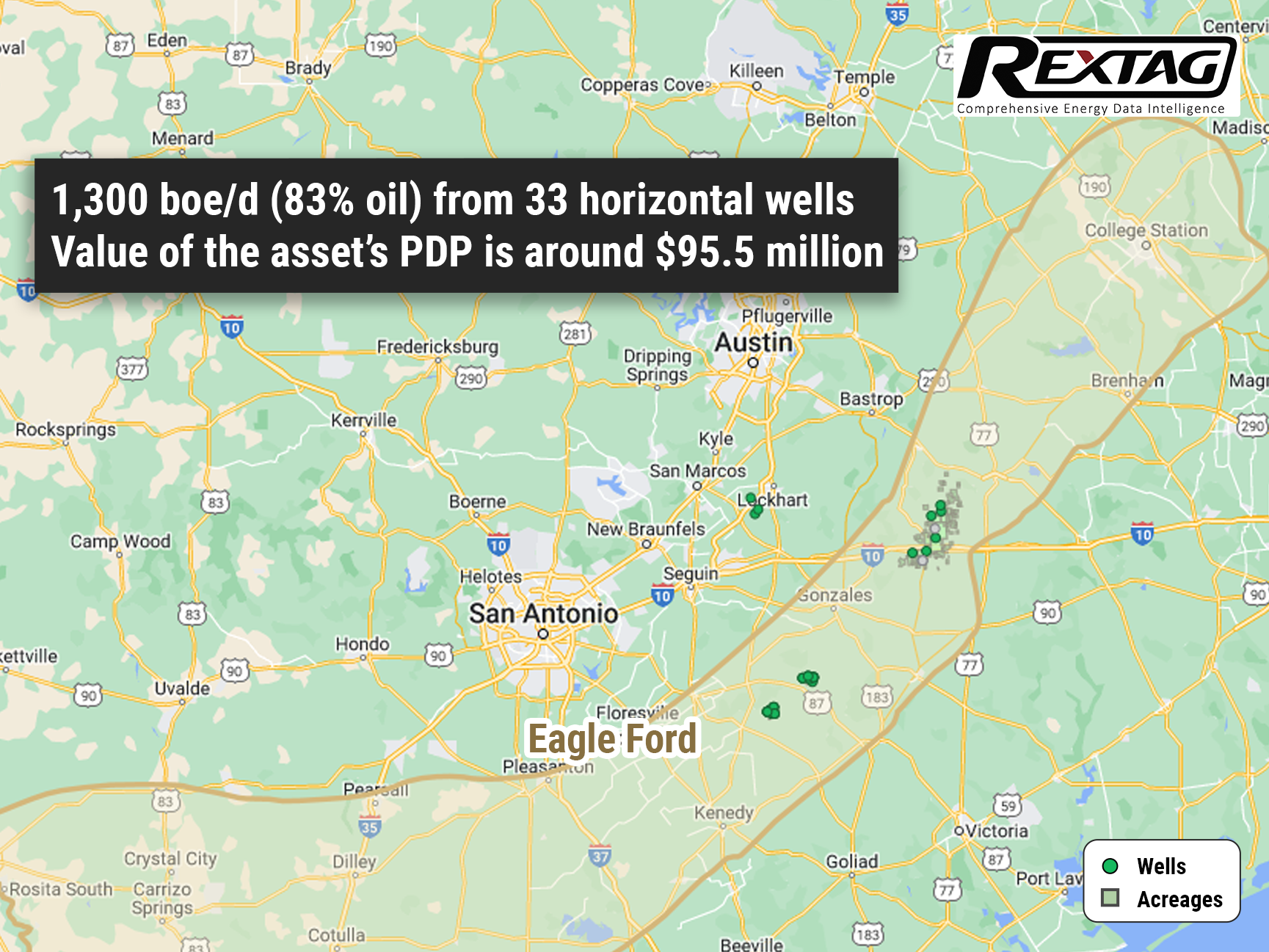

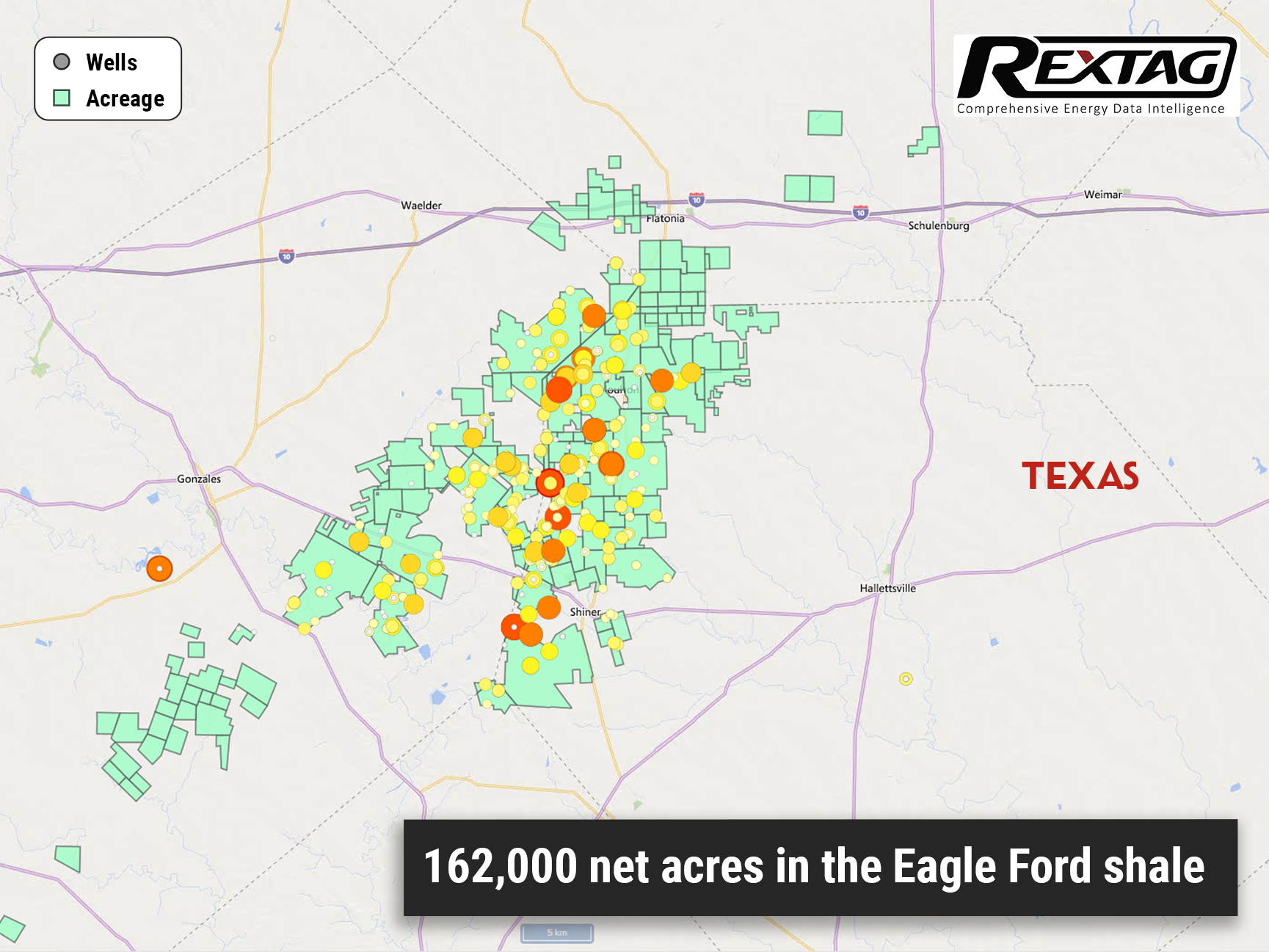

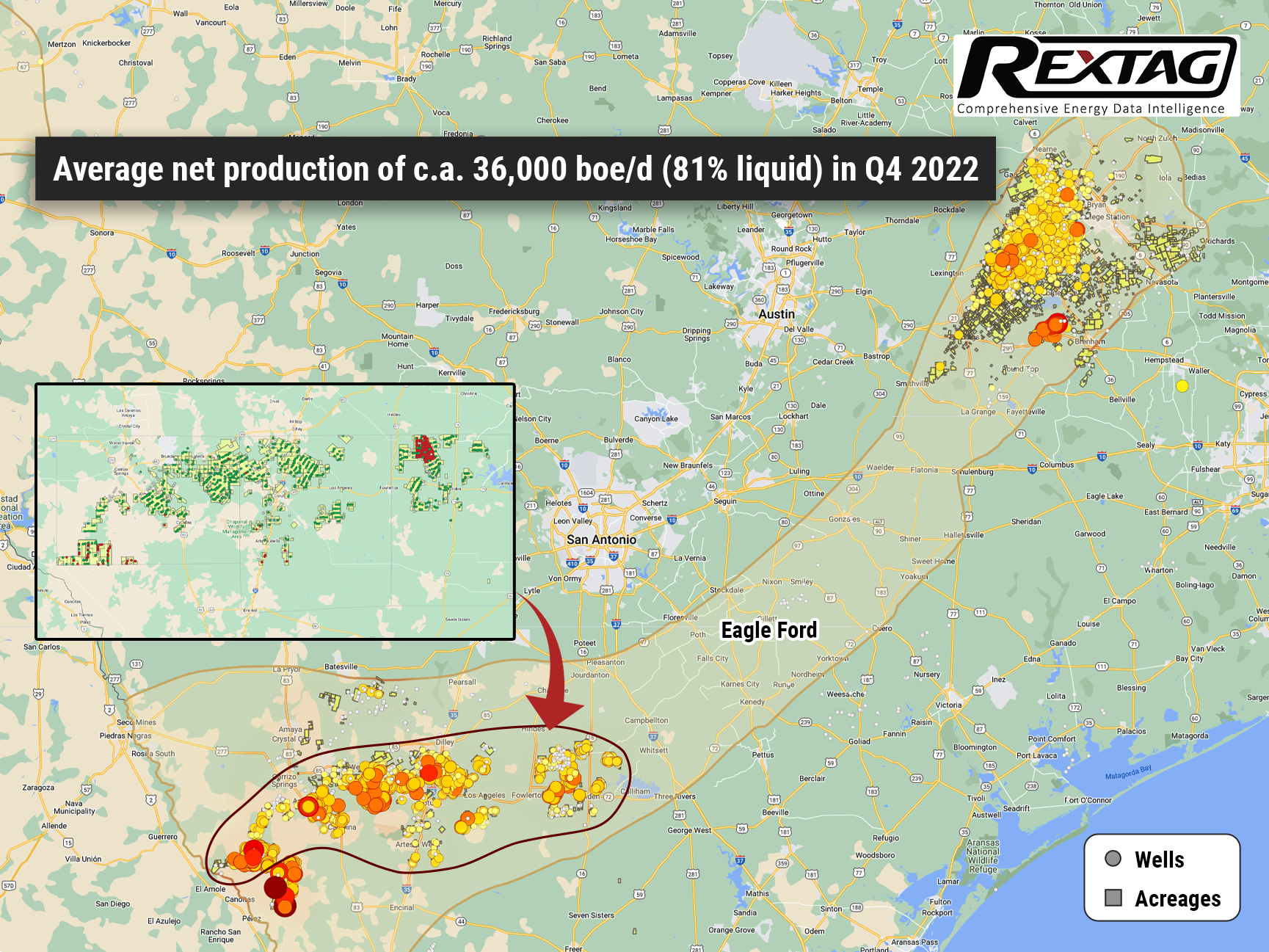

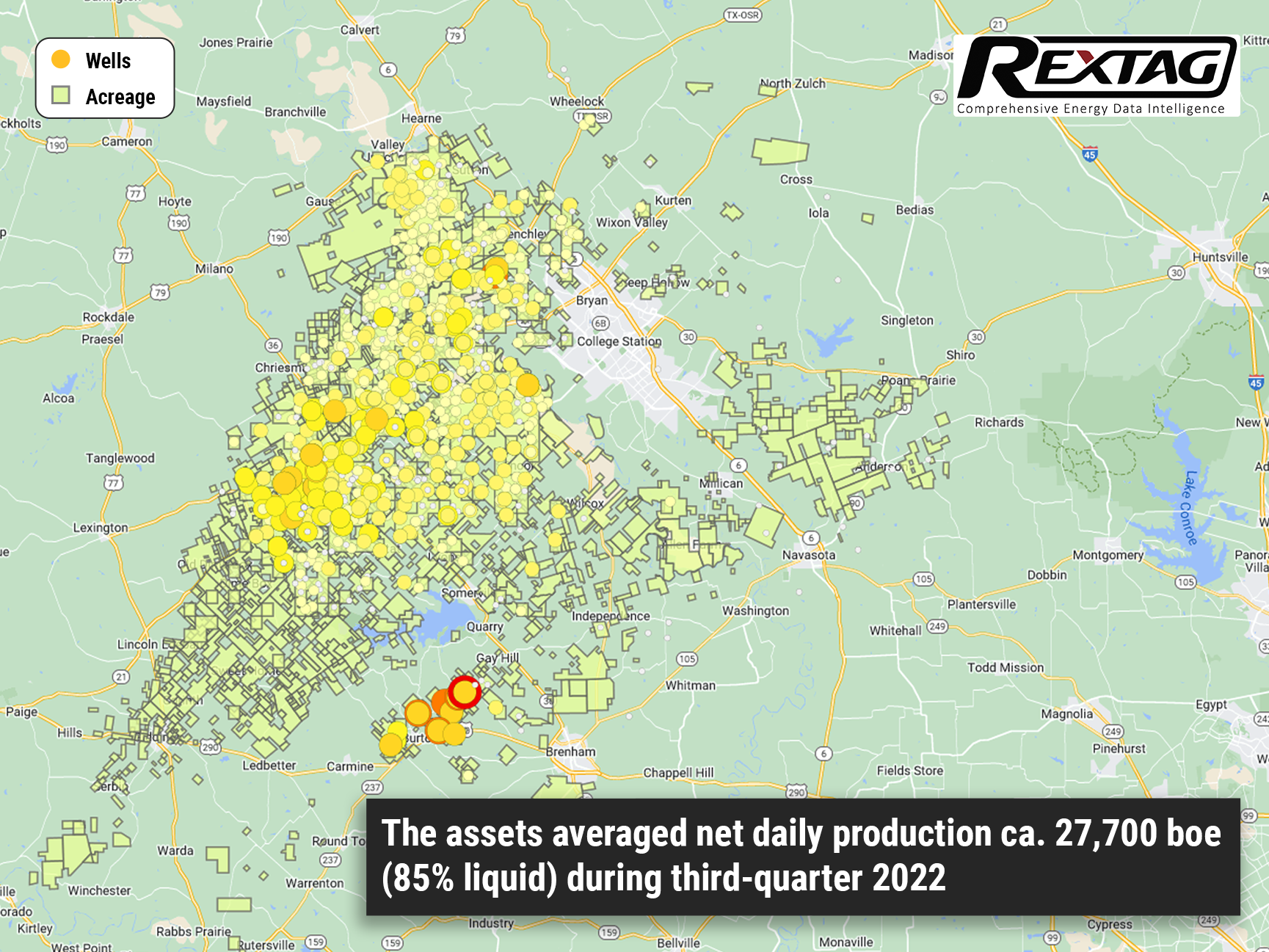

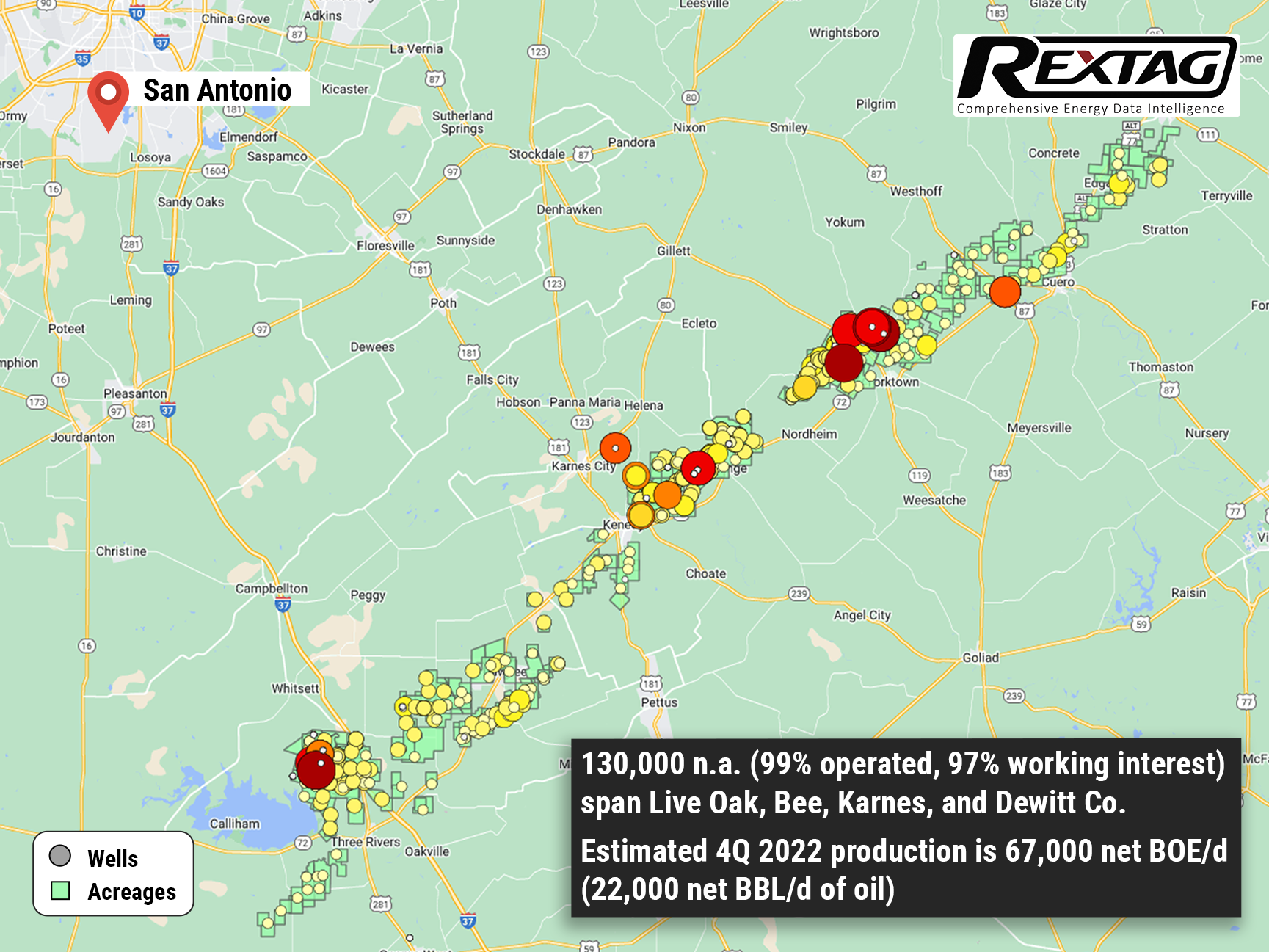

Earthstone Offers Eagle Ford Assets for Sale, Considers Departure from South Texas

Earthstone Energy is selling Eagle Ford locations to concentrate on the Permian Basin, streamlining its exploration and production focus. Earthstone Energy Inc., based in The Woodlands, Texas, is putting an Eagle Ford asset on the market as the company focuses on divesting non-core properties and directing investment towards the Permian Basin. The assets that Earthstone is planning to sell include production and land in northeast Karnes County, Texas, as well as in southern Gonzales County, Texas, as outlined in the marketing documents. For the sales process, Earthstone has engaged Opportune Partners LLC to serve as its exclusive financial adviser.

WhiteHawk Energy Secures $100M Finance Facility for Core Natural Gas Asset Acquisition

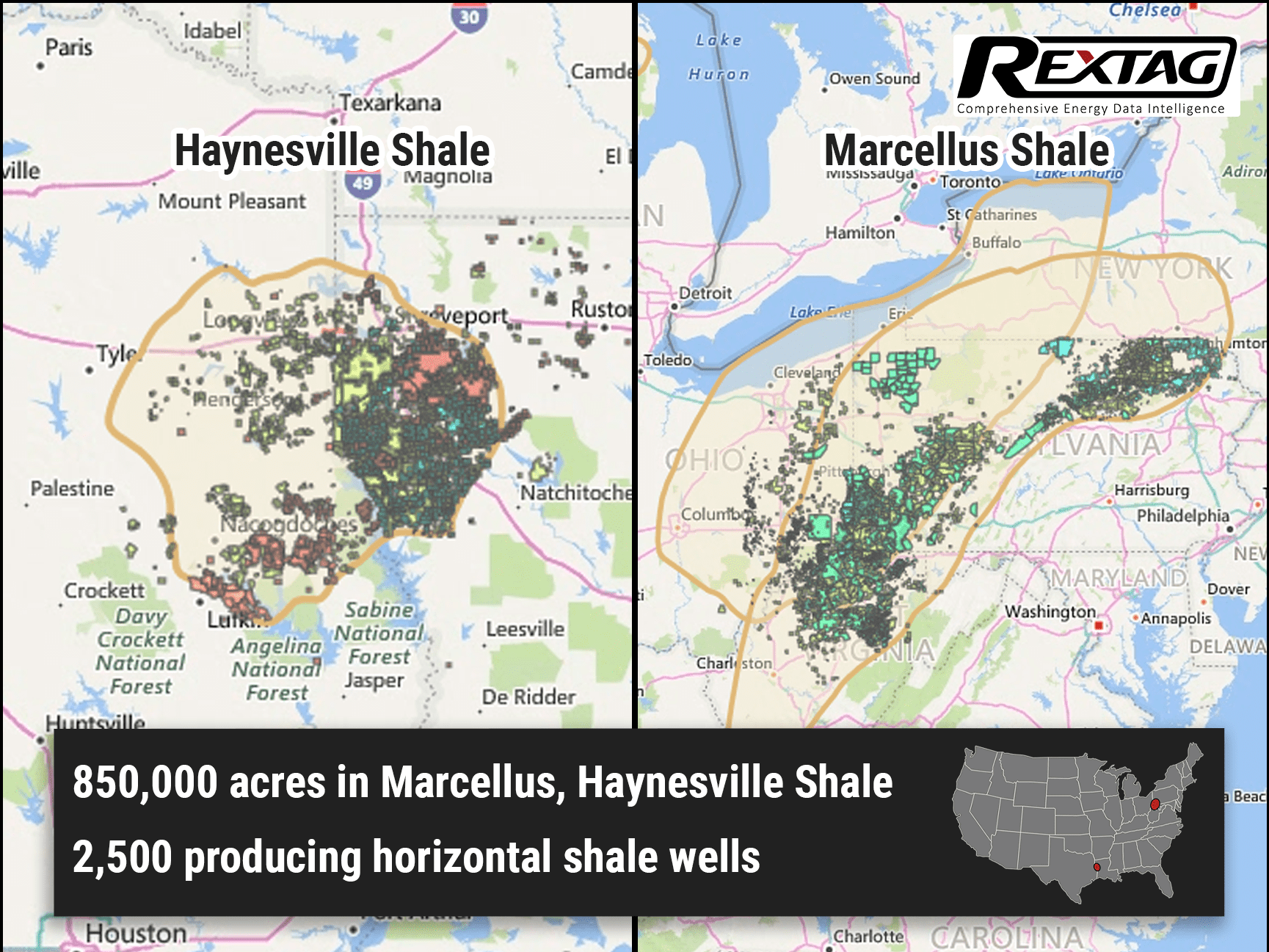

WhiteHawk Energy LLC completed its second Haynesville Shale mineral and royalty acquisition of the year, spanning northwestern Louisiana and eastern Texas. WhiteHawk also secured a $100 million acquisition finance facility from an undisclosed "top tier institution." The company will utilize $20 million from this facility to fund the Haynesville purchase from Mesa Minerals Partners II LLC

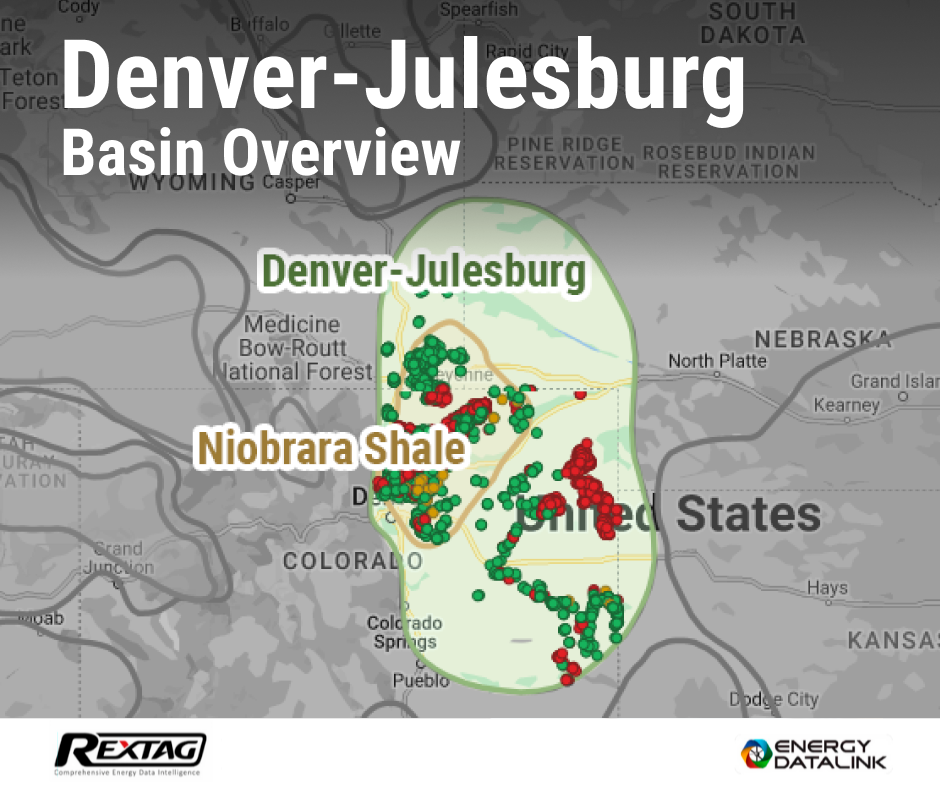

Chevron (CVX) Set to Purchase PDC Energy for $6.3B

Chevron Corp. has finalized the acquisition of PDC Energy Inc.'s land holdings in the Denver-Julesburg and Permian basins. Chevron Corporation (CVX) has announced its intention to acquire PDC Energy, Inc. (PDCE) in an all-stock deal valued at $6.3 billion. Under the agreement terms, PDC stockholders will receive 0.4638 Chevron shares for each PDCE share, bringing the total enterprise value to $7.6 billion, inclusive of debt. The acquisition is seen as a strategic step to enhance Chevron's position in vital U.S. production basins, unlocking new opportunities and potentially driving higher returns. As part of the agreement, Chevron will issue around 41 million shares of common stock at the deal's closure. Both Chevron's and PDC Energy's boards of directors have unanimously approved the acquisition.

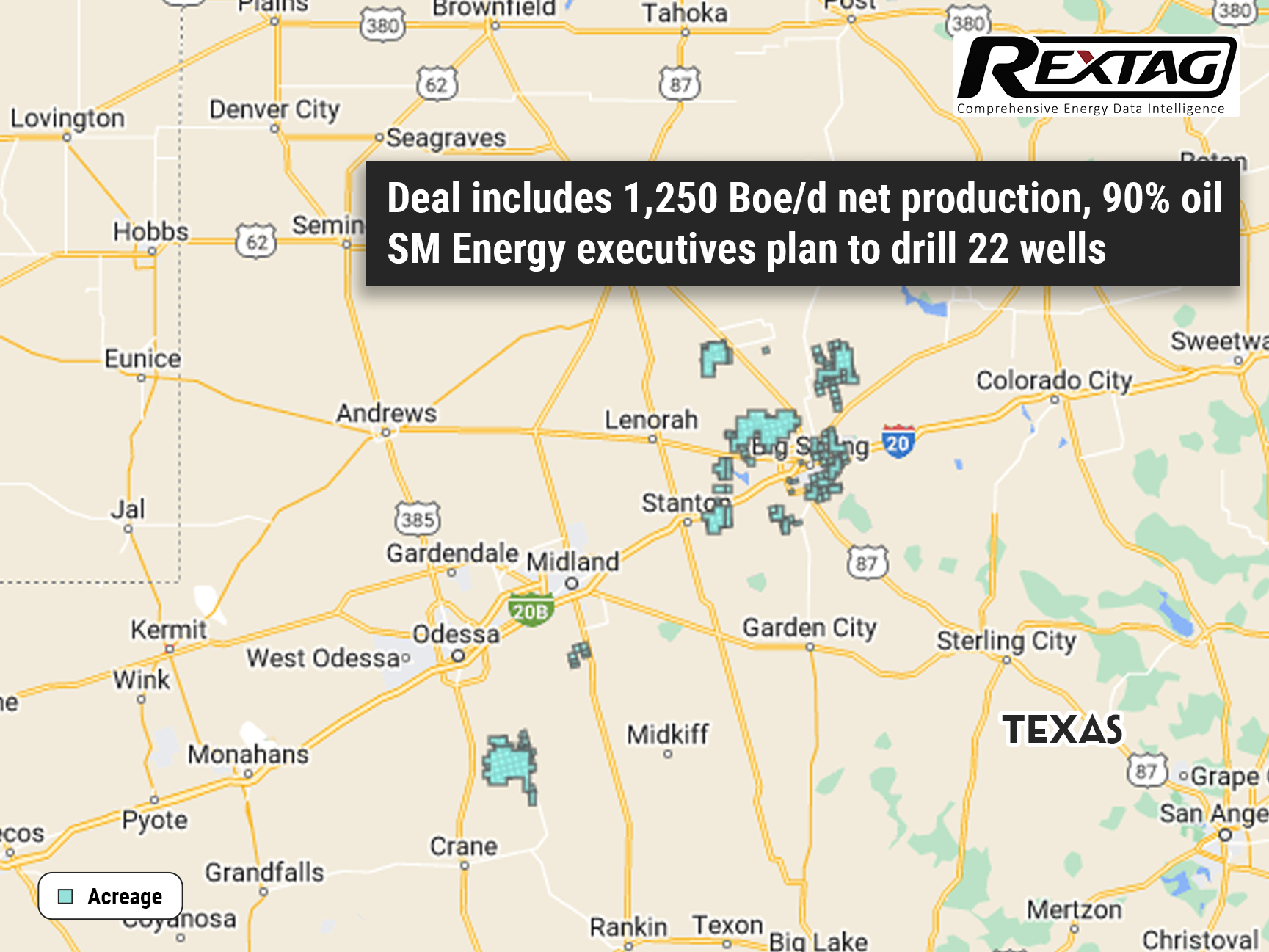

SM Energy Acquires 20,000 Acres in Texas for $90.6M

SM Energy acquired 20,000 net acres in Dawson and north Martin counties in Texas, completing the transaction in cash. SM Energy Co., based in Denver, intends to expand on its success from the second quarter by increasing its drilling and completion activities in the coming quarter. This plan also includes preparations to develop the newly acquired land in the Midland basin. In June, the company's president and CEO, Herb Vogel, along with his team, raised their target for total oil and gas production for the second quarter to 13.9 MMboe, up from 13.4 MMboe. They exceeded this target, reaching nearly 14.1 MMboe, with oil making up 42% of that figure. During the quarter, SM Energy drilled 17 wells, with 12 located in South Texas and five in the Midland basin. They also completed 25 wells, 17 of which were in the Midland basin.

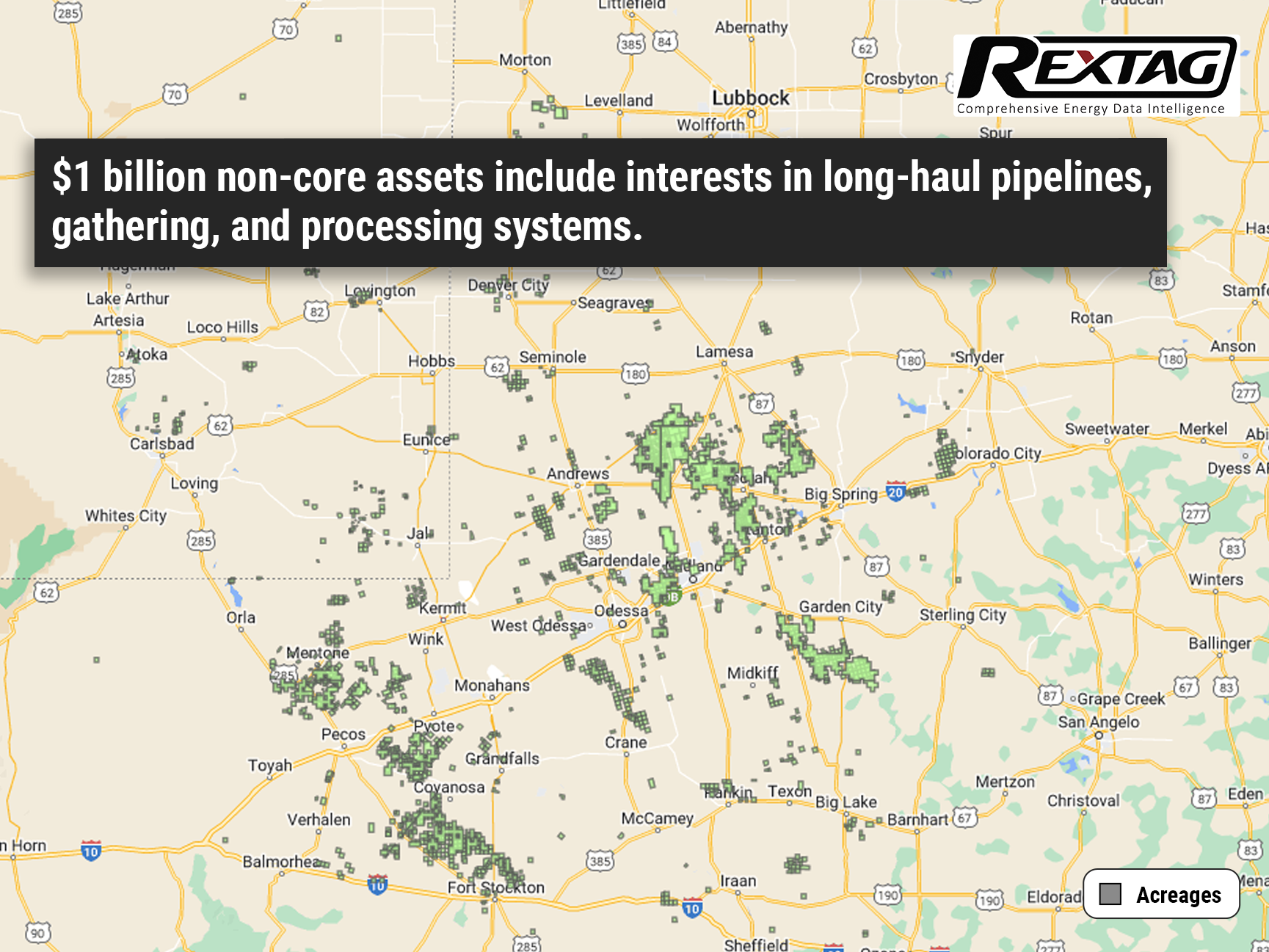

Diamondback Sells More After Hitting $1B Target

Diamondback Energy sold more midstream assets in Q2 as part of a $1B plan to shed non-core assets, reducing debt in the Permian Basin. In July, Texas-based Diamondback Energy Inc. sold a 43% stake in the OMOG crude oil system, revealing this in its Q2 earnings on July 31. OMOG JV LLC, running 400 miles of pipelines and 350,000 bbl of storage in Midland, Martin, Andrews, and Ector counties, was detailed in Diamondback's filings. The sale provided $225 million in gross proceeds. Diamondback has announced or completed $1.1 billion in non-core asset sales since initiating the program. Initially aimed at raising $500 million, the 2023 target was increased to $1 billion.

TC Energy sells 40% Stake in Columbia Gas Pipeline Systems for $3.9 Billion to GIP

Calgary-based pipeline operator TC Energy is selling a 40% stake in its natural gas pipeline systems for $3.9 billion as part of its efforts to reduce debt. TC Energy Corporation (TRP) has agreed to sell a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission systems to Global Infrastructure Partners (GIP). This move will help TC Energy reduce its debt and establish a valuable long-term partnership with GIP, a prominent infrastructure investor.

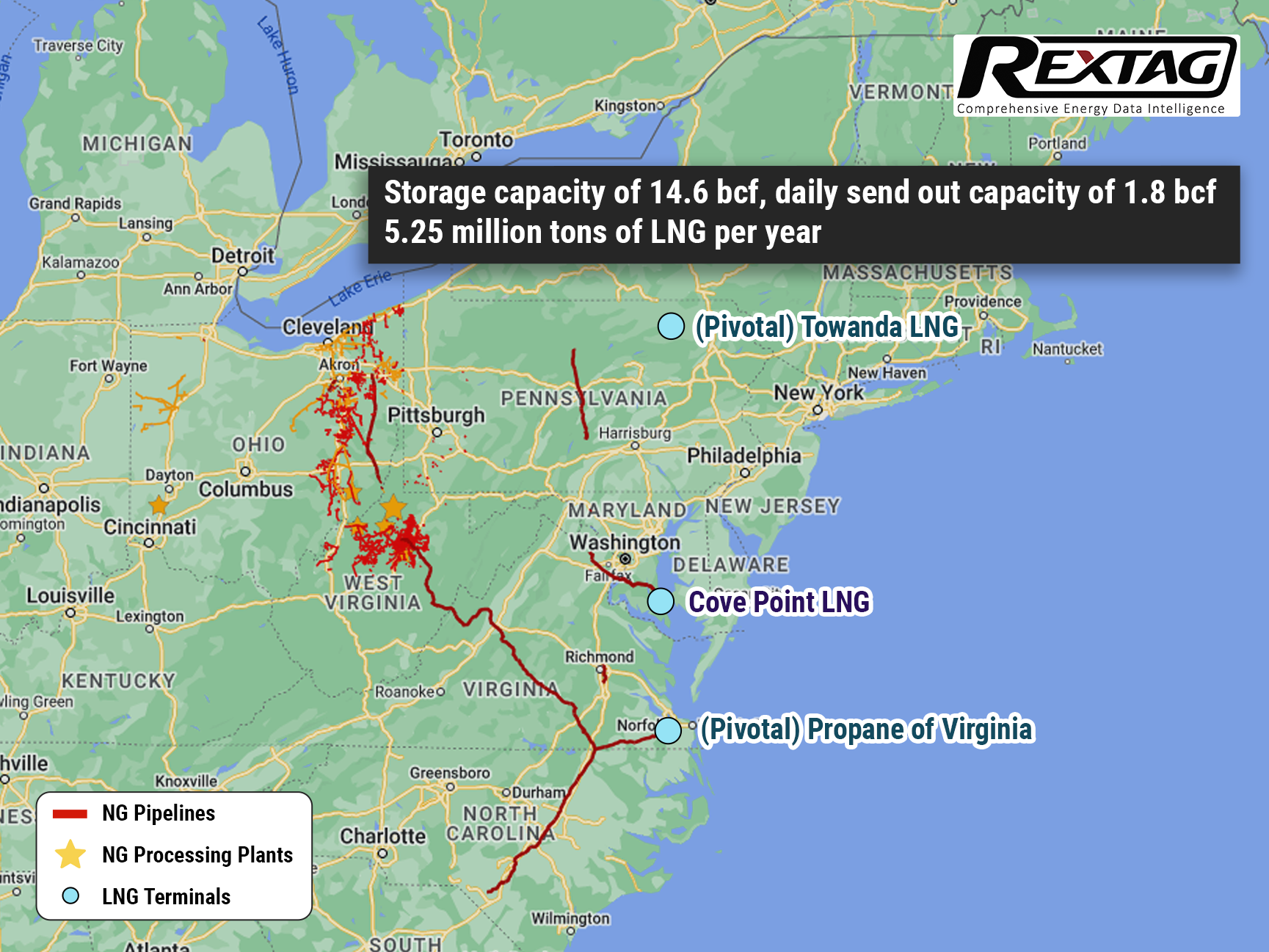

Warren Buffett’s Berkshire Hathaway Energy Acquires $3.3 Billion Stake in LNG Terminal

One of Warren Buffett's Berkshire Hathaway subsidiaries is set to raise its ownership in the Cove Point liquefied natural gas (LNG) export terminal located in Maryland. This comes after the company signed a substantial $3.3 billion agreement with Dominion Energy. Under the agreement, Dominion Energy has agreed to sell its 50 percent noncontrolling limited partner interest in Cove Point LNG to Berkshire Hathaway Energy. Berkshire Hathaway Energy is the current operator of the facility and already holds a 100 percent general partner interest and a 25 percent limited partner interest.

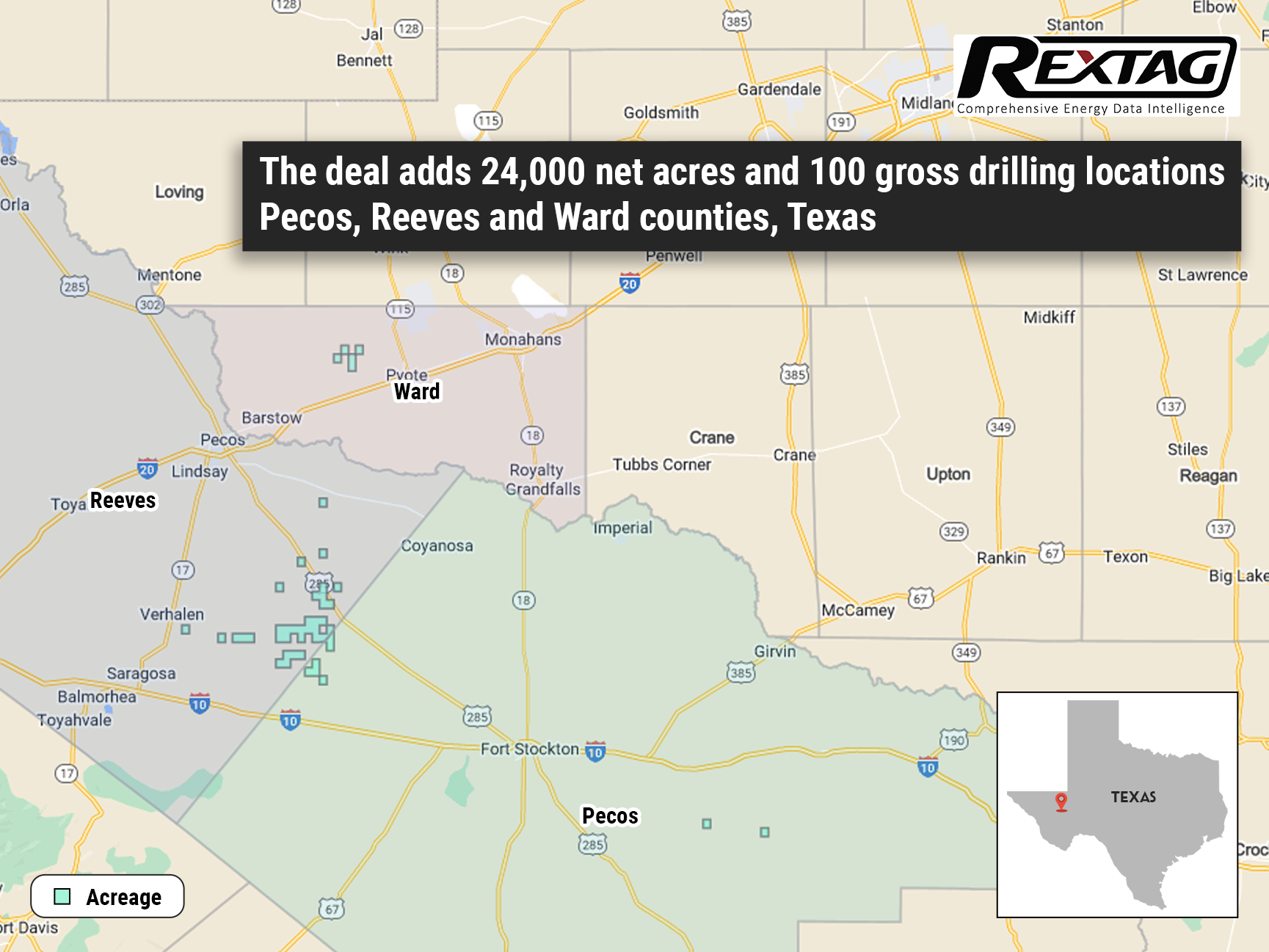

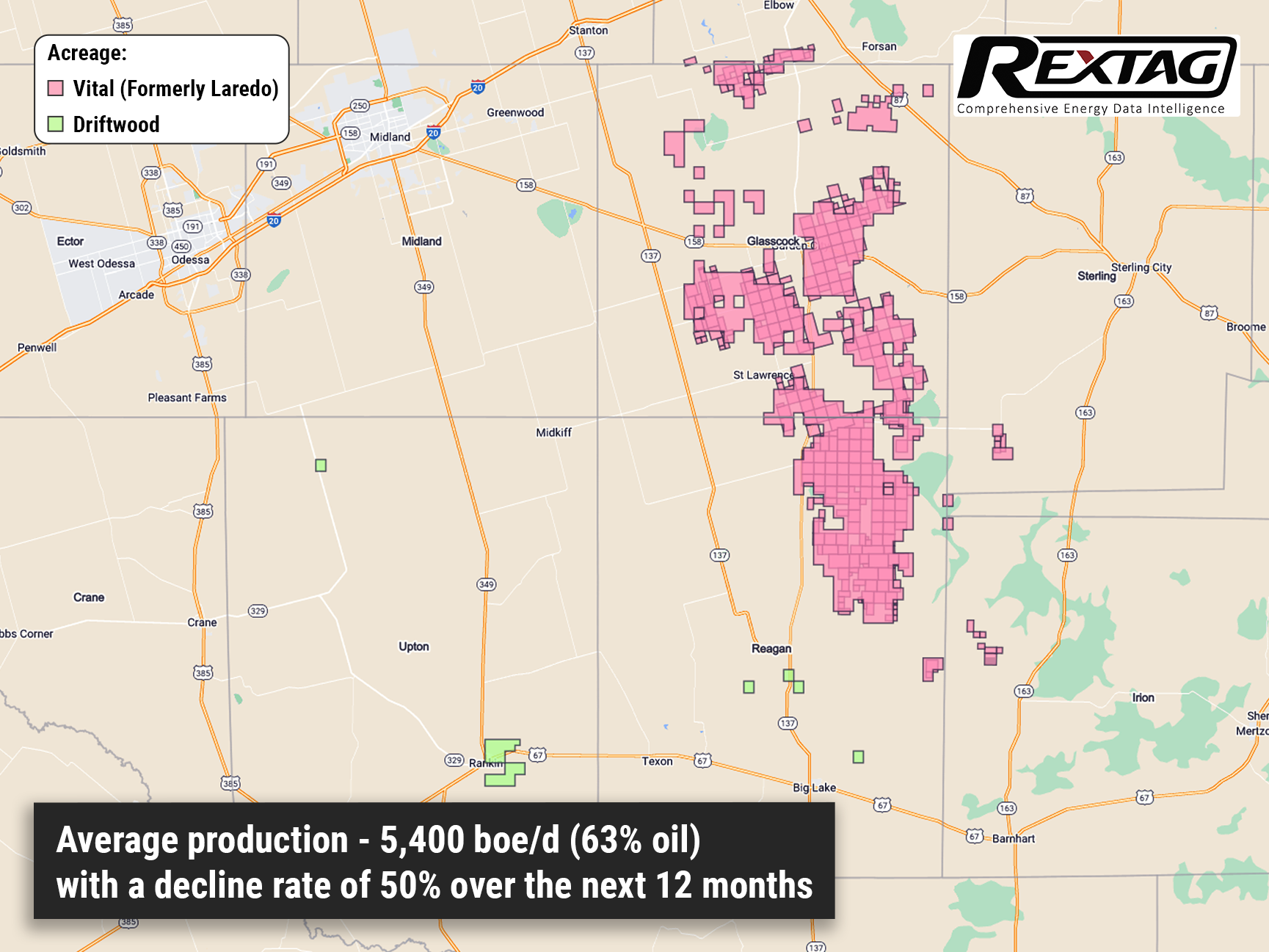

Vital Energy Raises Production Outlook and Capital Spending with Significant Permian Basin Acquisition

Vital Energy’s deal adds 24,000 net acres and 100 gross drilling locations in Texas, growing its Permian Basin footprint to around 198,000 net acres. Vital Energy is revising its projections for oil and gas production and capital spending upward following the successful acquisition of a substantial area in the Permian Basin. The company has gained around 24,000 net acres and 100 gross drilling locations in Texas. As a result of this deal, Vital Energy is now increasing its full-year production and capital spending guidance.

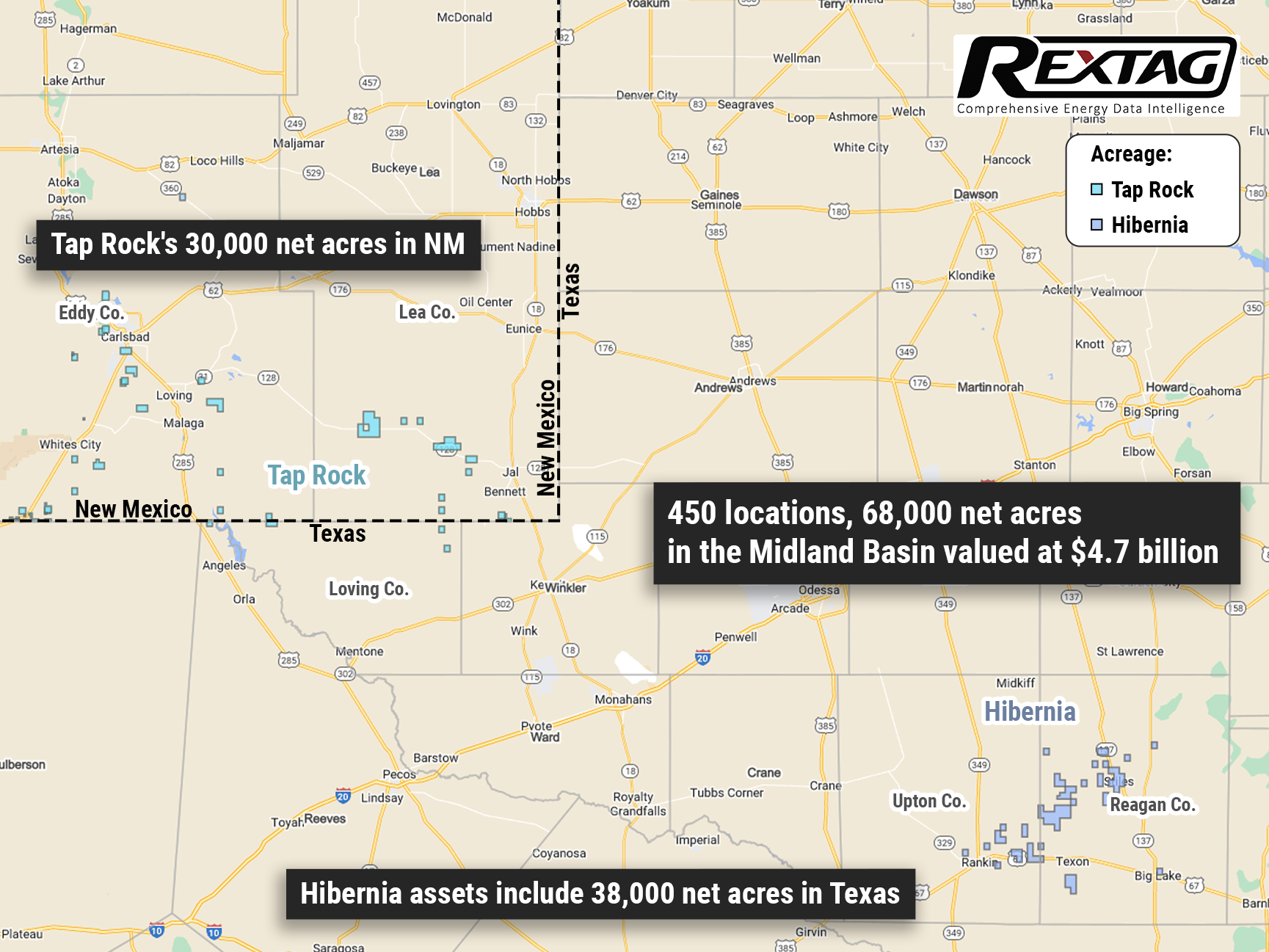

Civitas Makes $4.7B Entry into Permian Basin

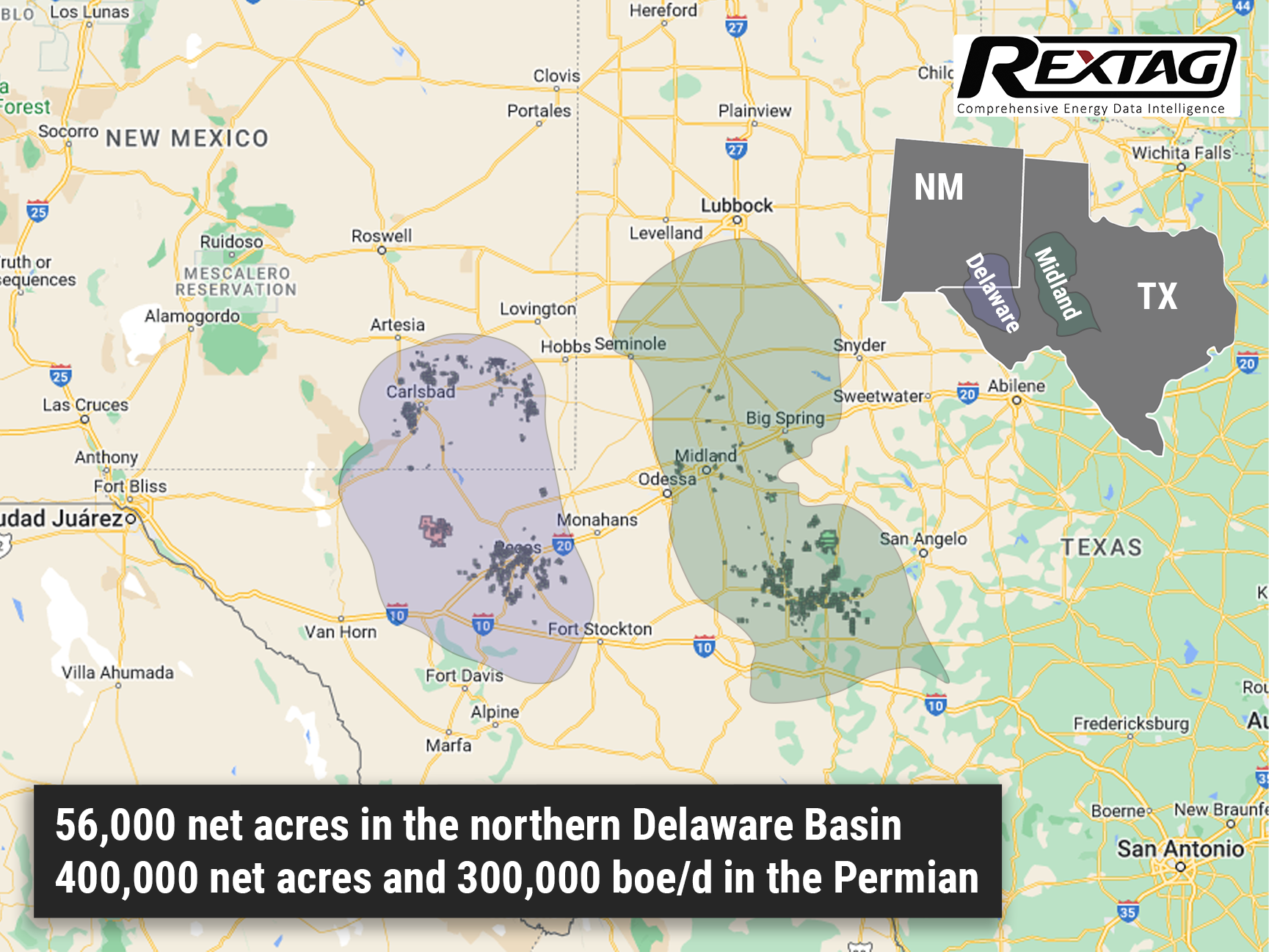

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia. Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

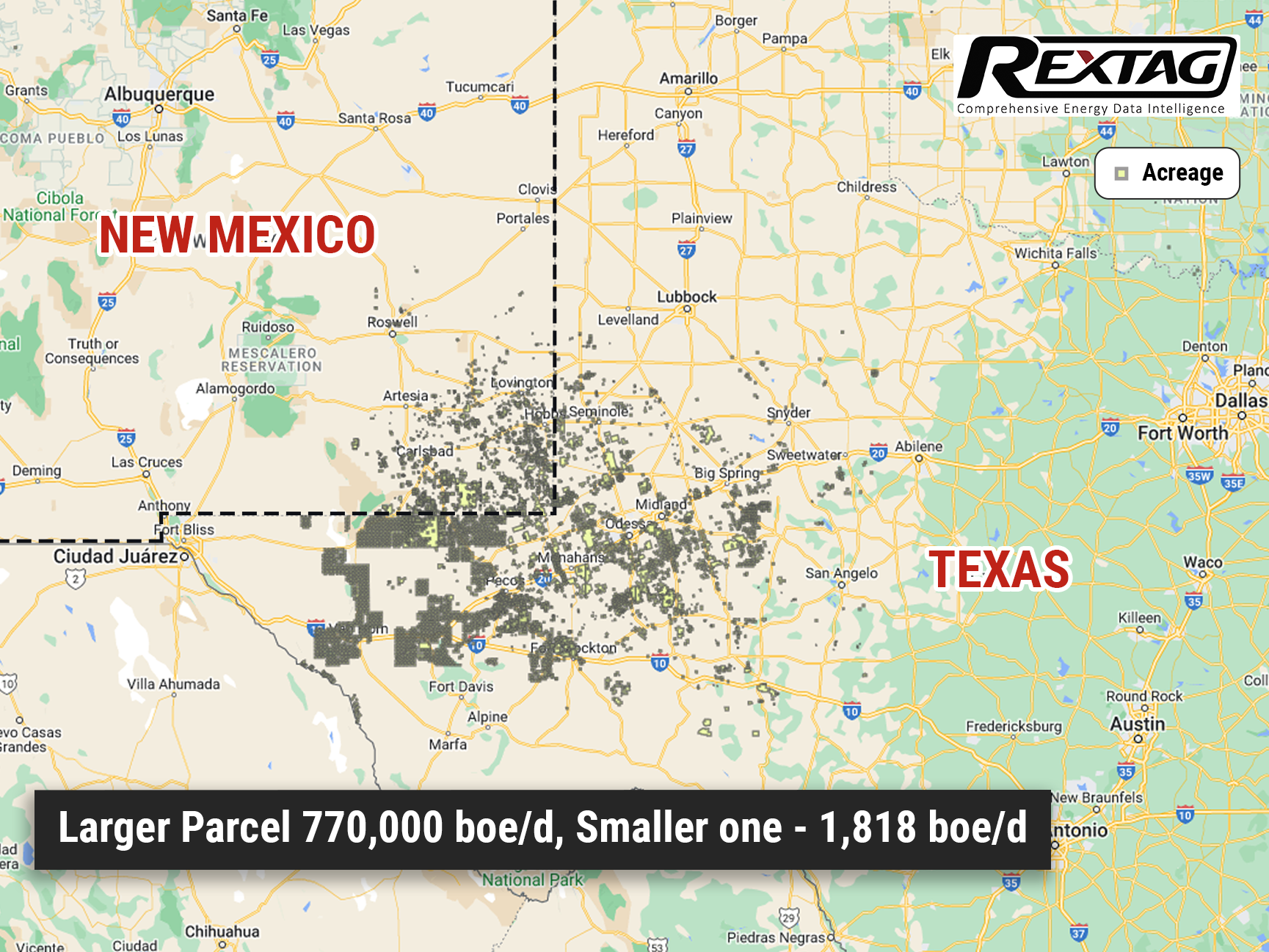

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

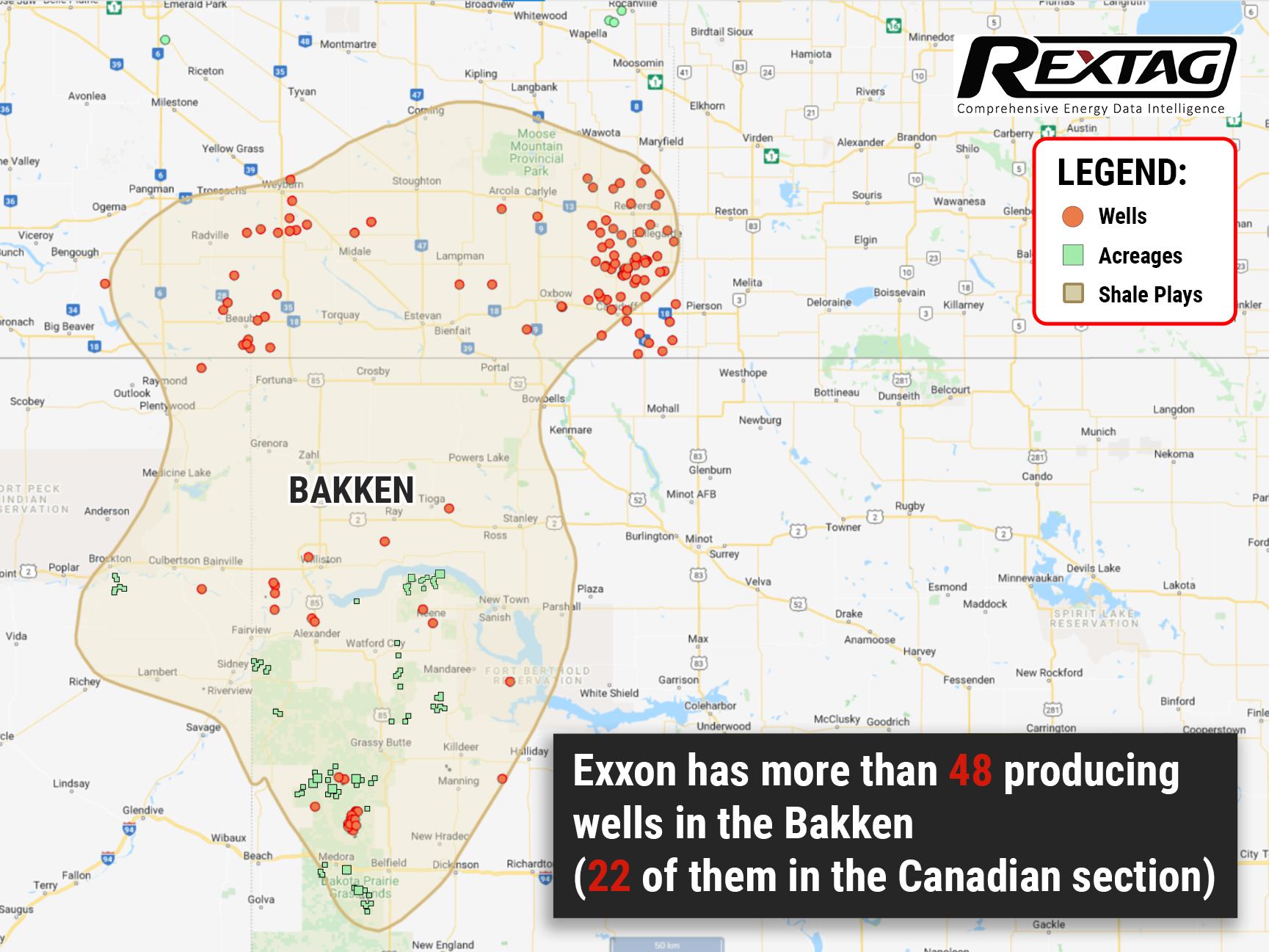

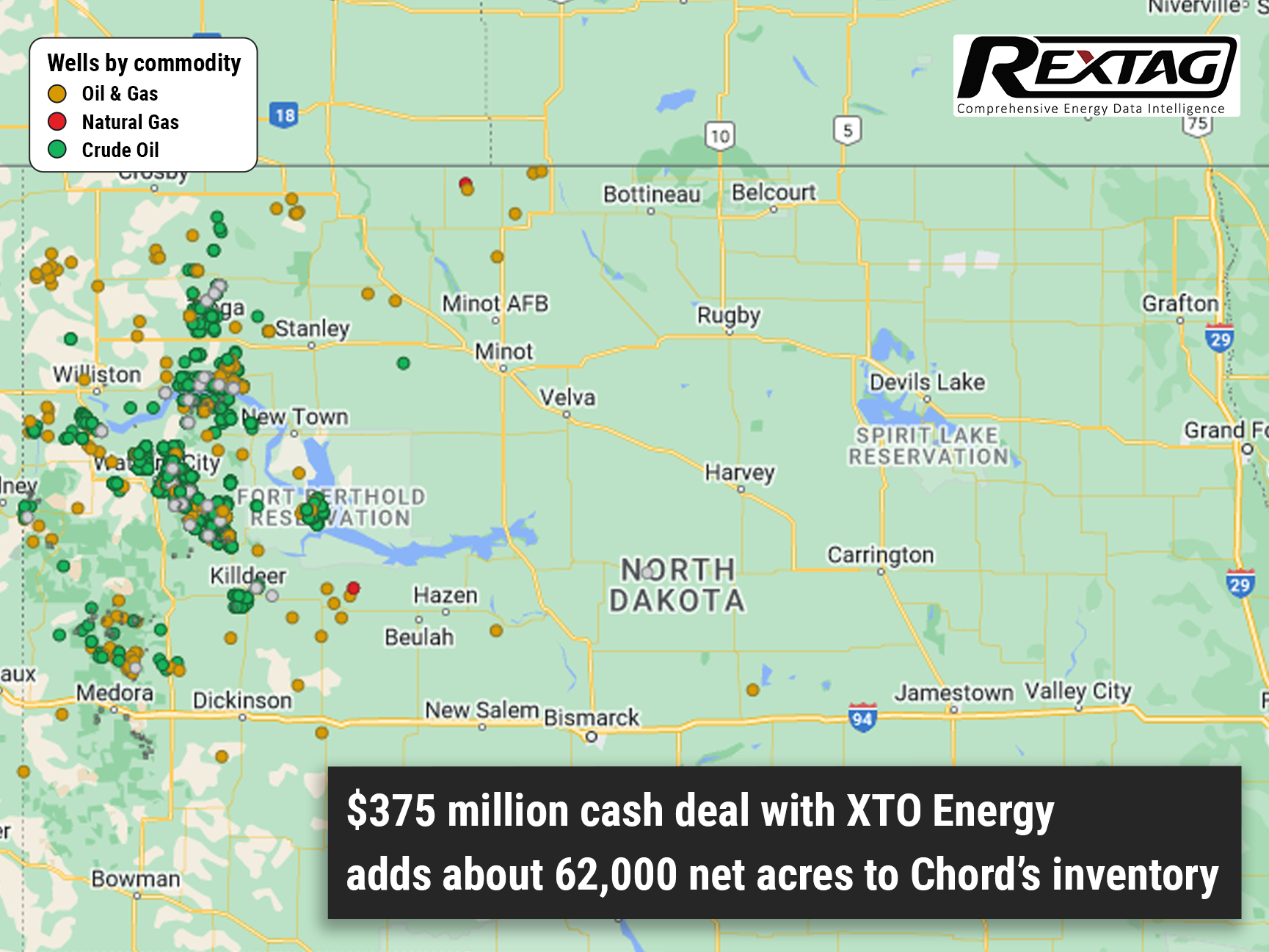

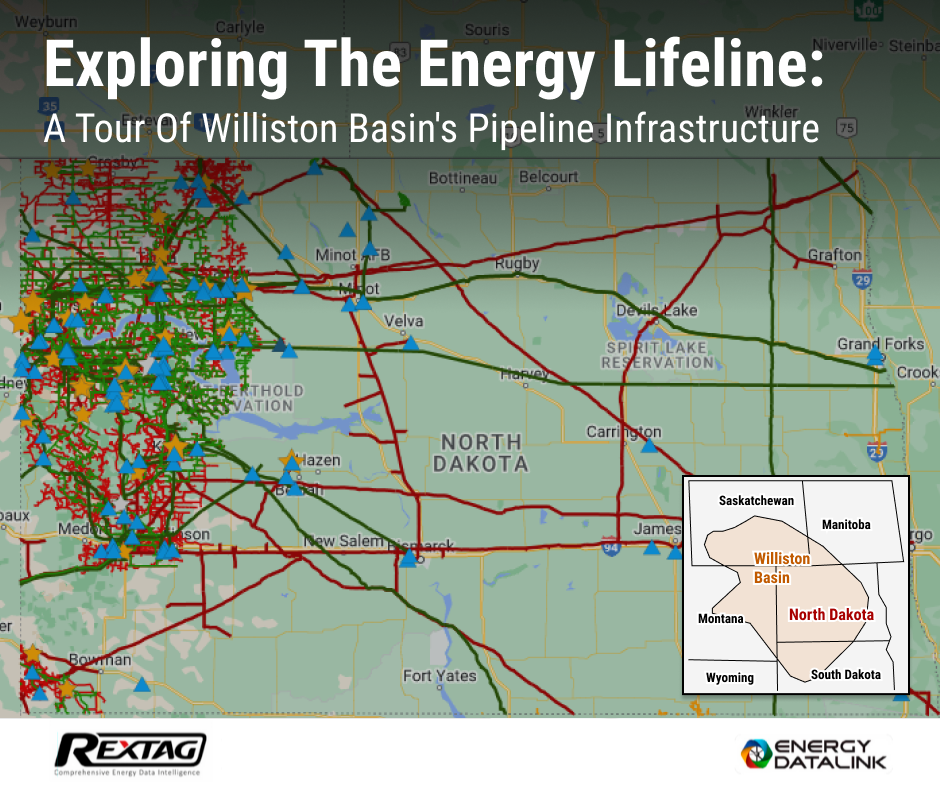

Chord Energy Corp. Expands Williston Basin Footprint with $375 Million Acquisition from Exxon Mobil

Chord Energy Corp.'s subsidiary has entered into an agreement to purchase assets in the Williston Basin from Exxon Mobil, and its affiliates for $375 million. Chord Energy, a US independent company, is strategically expanding its presence in the Williston Basin of Montana and the Dakotas. While industry attention remains fixated on the Permian Basin, Chord Energy recognizes the potential of the Williston Basin and is capitalizing on the opportunity to enhance its reserve portfolio. Chord Energy successfully completed the acquisition of 62,000 acres in the Williston Basin from XTO Energy for a substantial cash consideration of $375 million.

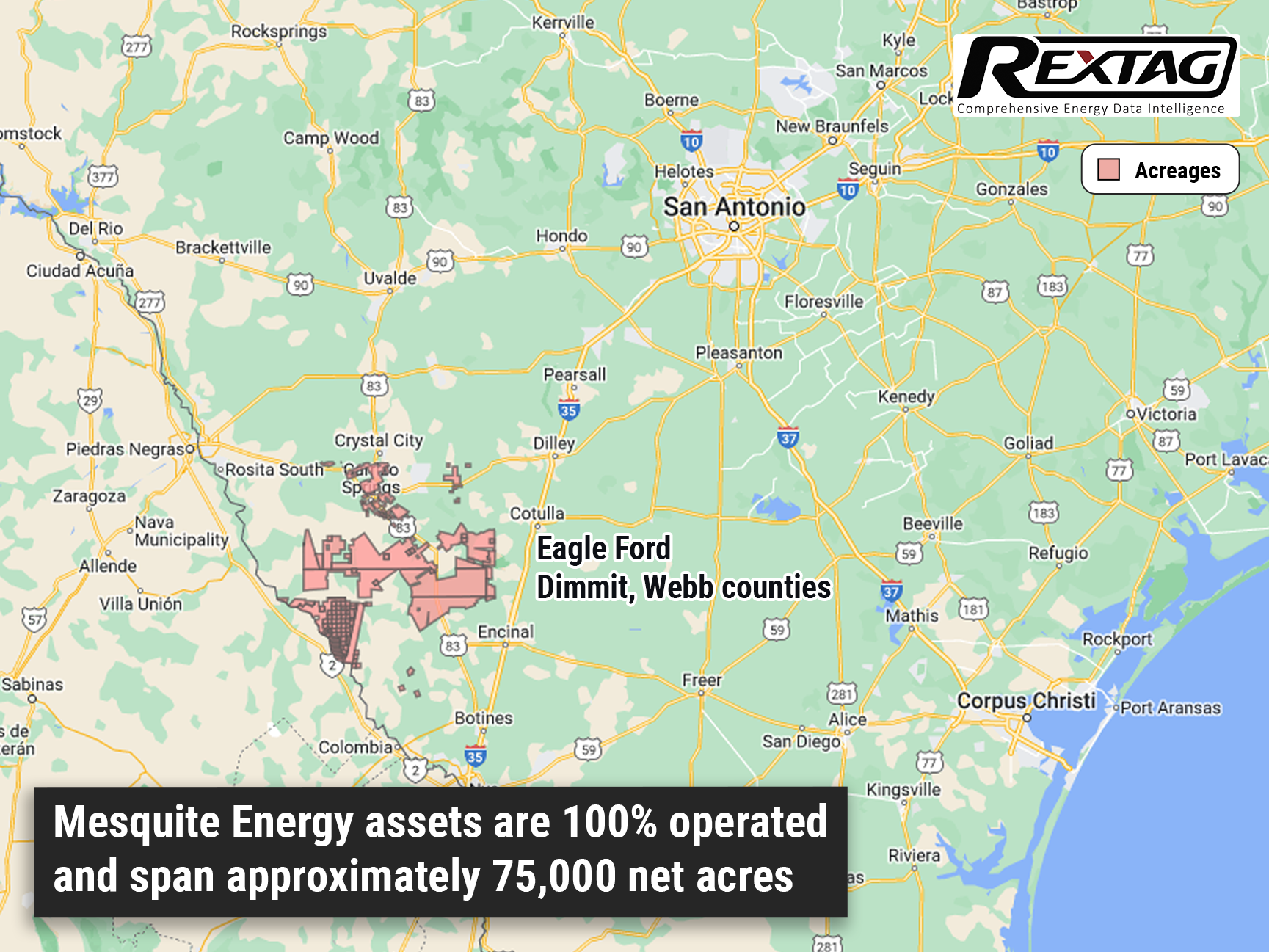

Crescent Energy Boosts Portfolio with Eagle Ford Acquisition: Expands Non-Operated Assets

Big announcement! Crescent Energy is set to bolster its inventory in the play by acquiring operated and working interests from Mesquite Energy. Crescent Energy Co. seals a $600 million cash deal to acquire assets in the Eagle Ford Shale from Mesquite Energy Inc. (formerly Sanchez Energy).

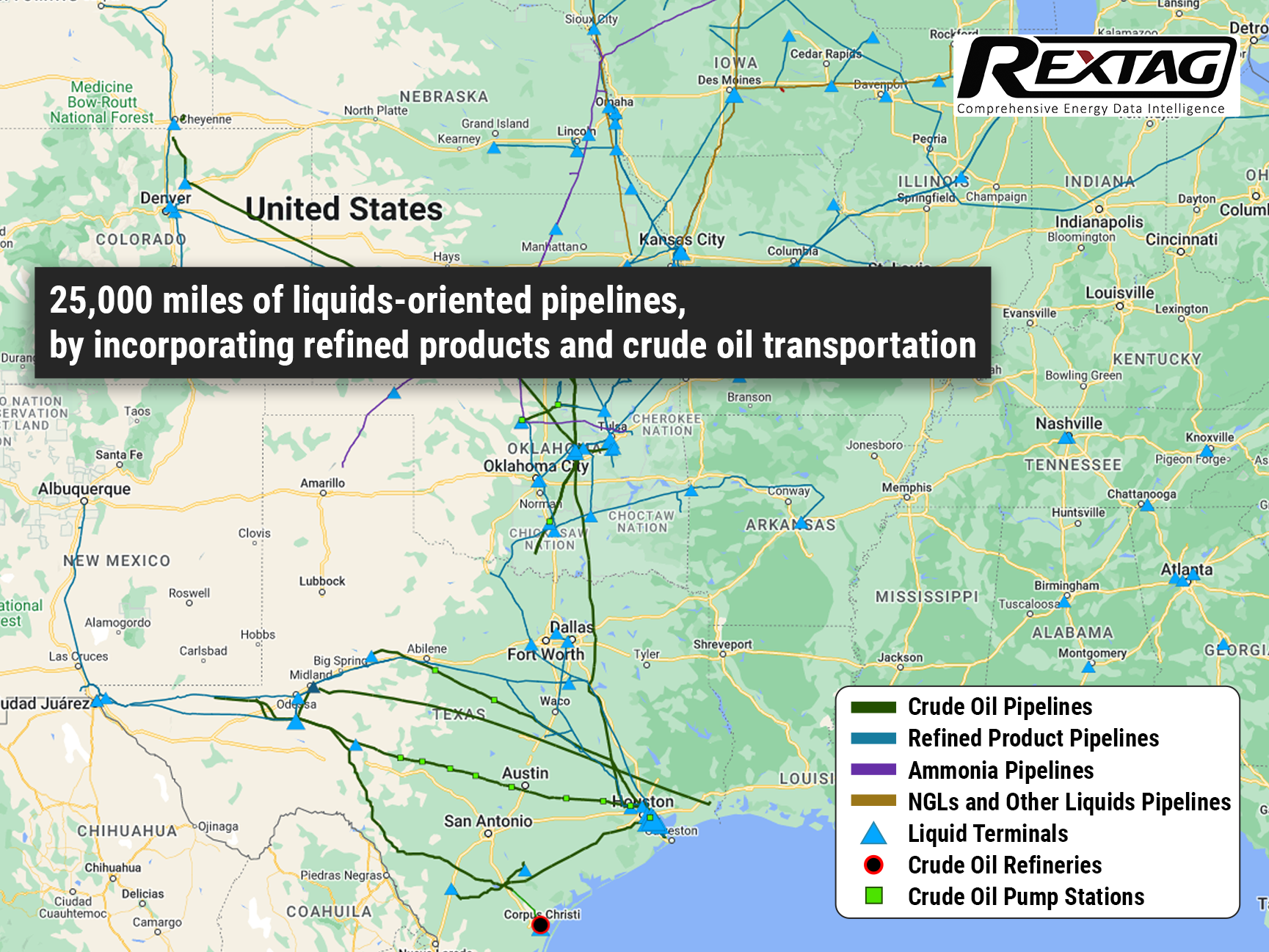

ONEOK Buys Magellan for $18.8 Billion: Overview of the Huge M&A Deal in the Pipeline Industry

In May, ONEOK (OKE) made an announcement regarding its acquisition of Magellan Midstream Partners LP (MMP) for a total value of $18.8 billion, which includes cash and stocks. This move drew attention as it positions ONEOK, primarily known for its involvement in the provision, gathering, and processing of Natural Gas (NG), to become one of the largest pipeline companies in the United States. The acquisition also allows ONEOK to expand its services by including Oil (CL), another significant energy commodity.

Global Oil Supply and Demand Trends Overview: Insights from Rextag

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East. OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

Callon Acquires $1.1 Billion Delaware Assets and Bows Out of Eagle Ford - Here's What You Need to Know

Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million. In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

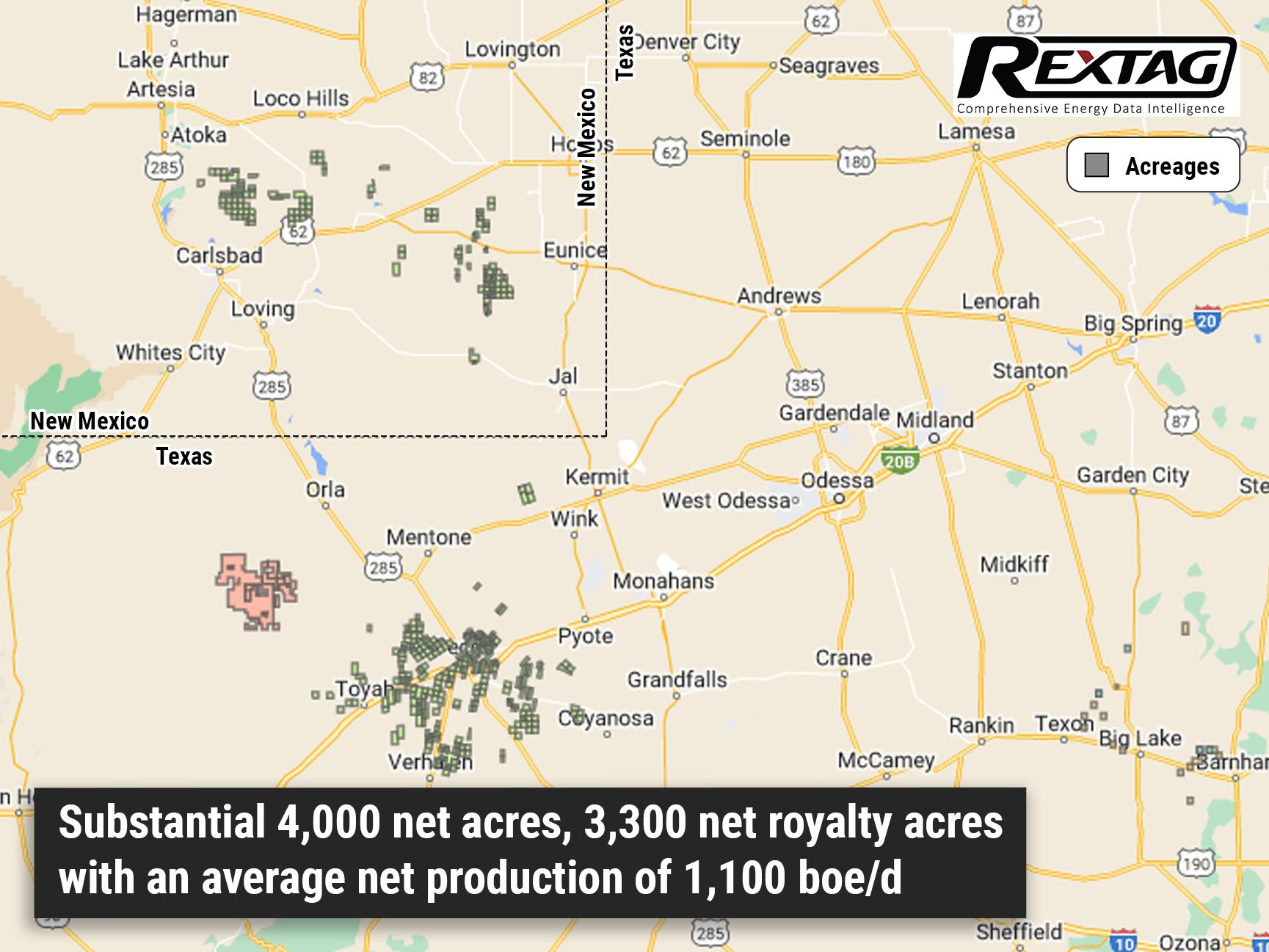

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres. In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

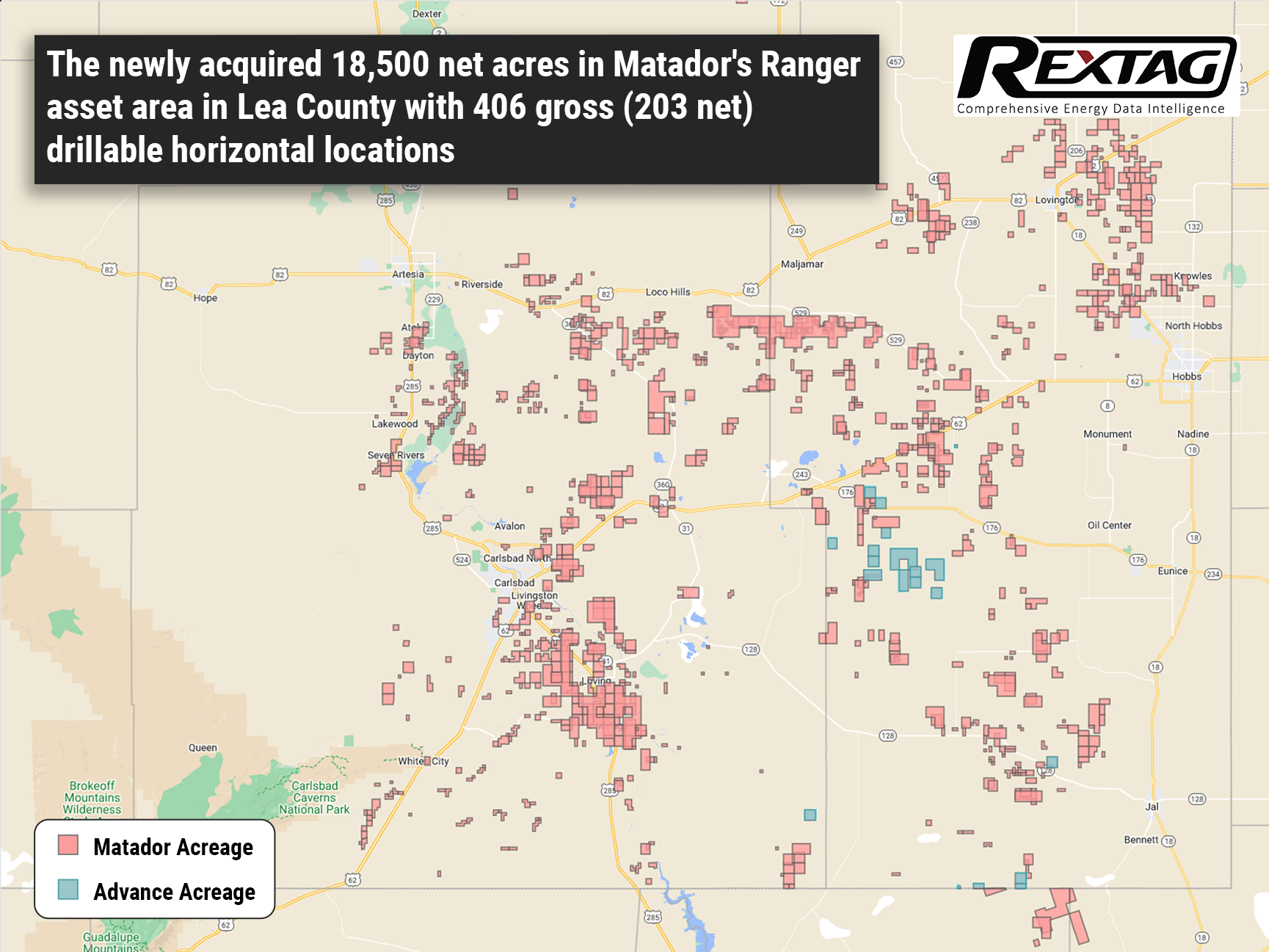

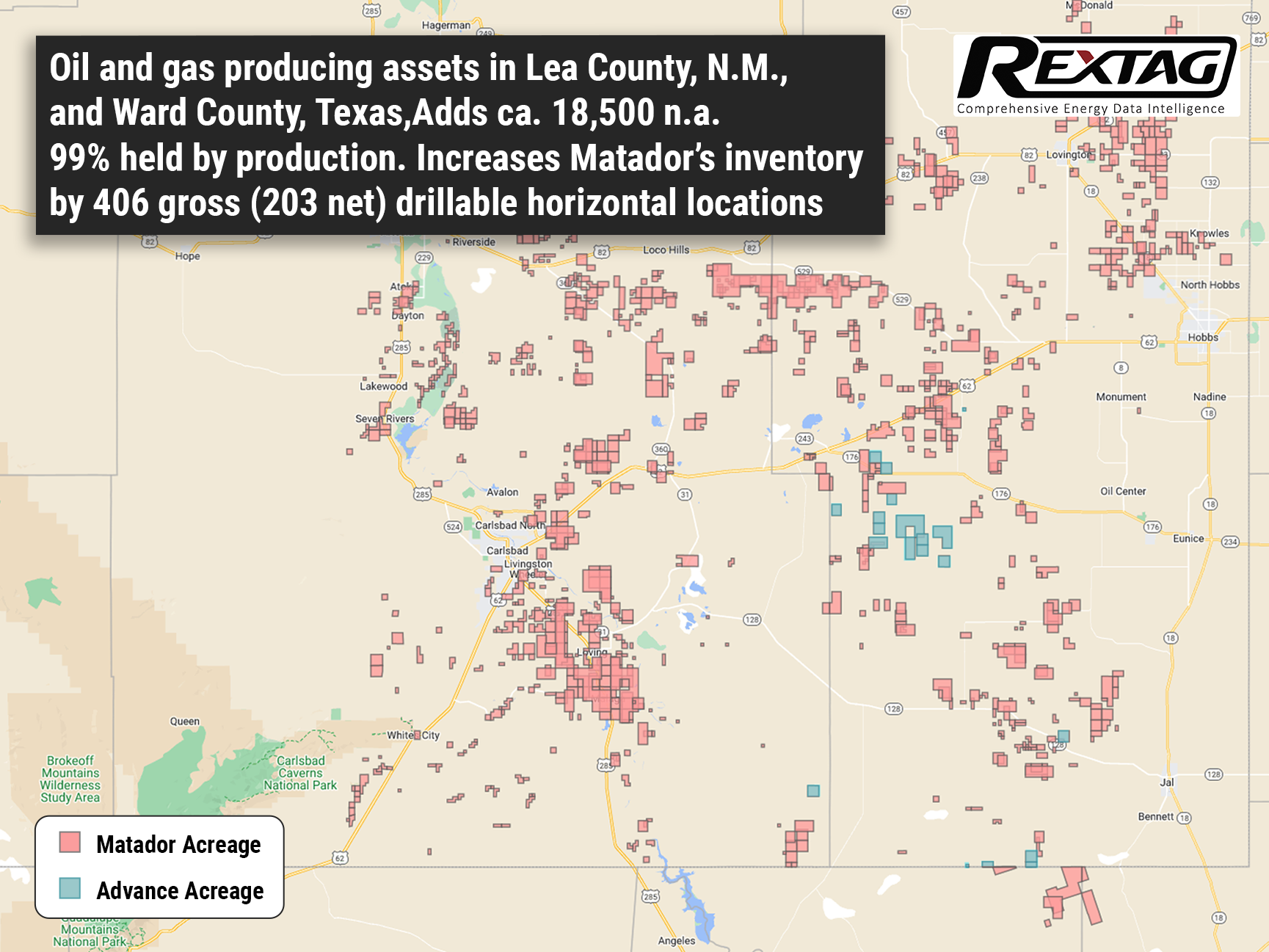

Matador Acquires Additional Land in Delaware from Advance Energy for $1.6 Billion

Matador Resources Co. is making a big move in the oil and gas industry by acquiring Advance Energy Partners Holdings LLC, a major player in the northern Delaware Basin. The acquisition, which comes with a hefty price tag of at least $1.6 billion in cash, includes valuable assets in Lea County, N.M., and Ward County, Texas, as well as key midstream infrastructure.

The Denver-Julesburg Basin Overview

Geologically, the Denver-Julesburg (DJ) Basin is a large structural basin with a complex history of sedimentary deposition, tectonic activity, and hydrocarbon generation. The basin covers approximately 20,000 square miles and extends into parts of Colorado, Wyoming, Nebraska, and Kansas. It is primarily composed of several stacked formations, including the Niobrara, Codell, and Greenhorn formations, which contain significant amounts of oil and gas reserves.

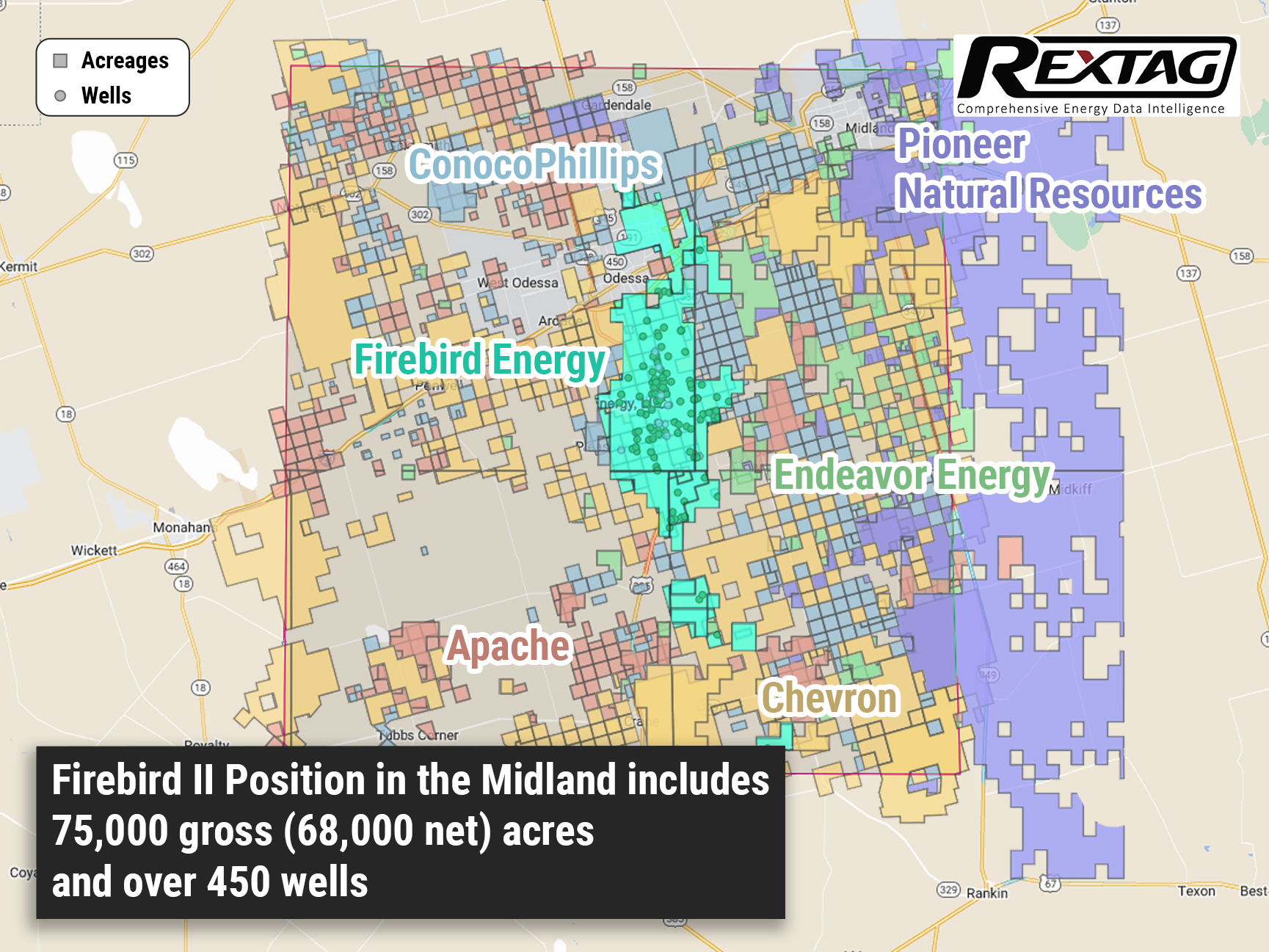

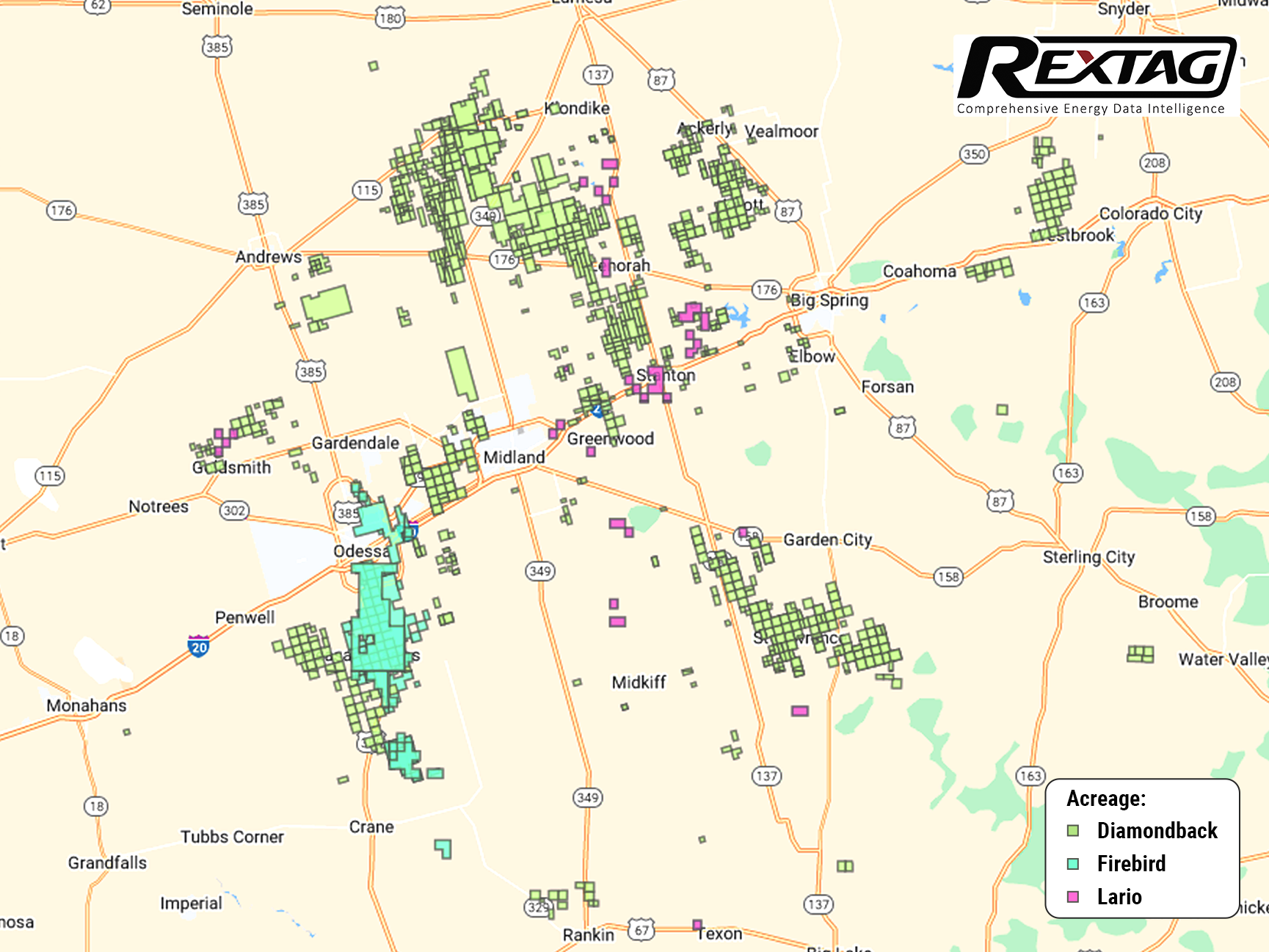

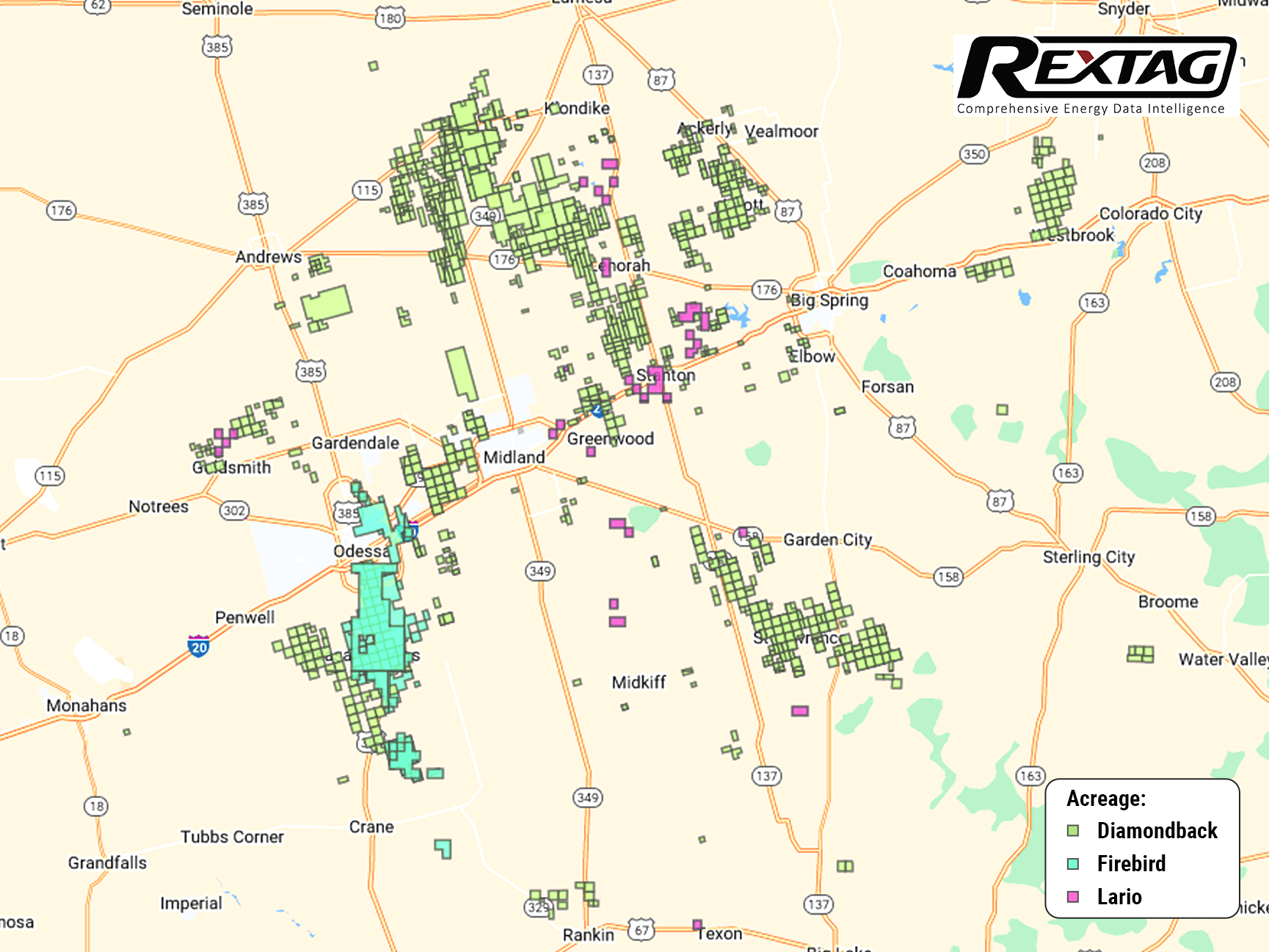

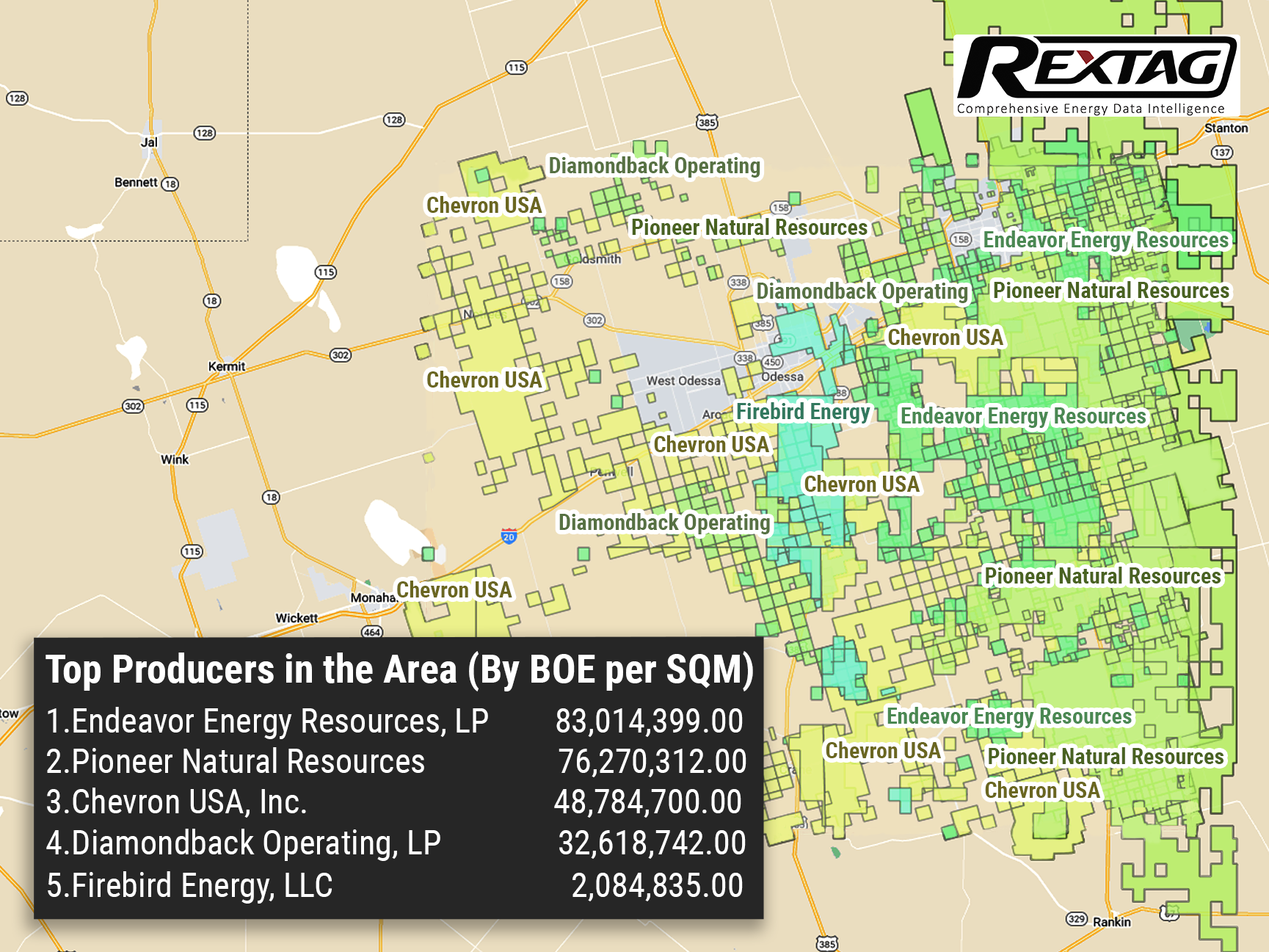

Breaking Barriers FireBird II, Empowered by Quantum Technology, Surpasses $500MM Funding Milestone for Permian Ventures

Following the success of FireBird Energy's $1.75 billion sale to Diamondback last year, the emergence of FireBird II signals a new chapter in the Permian Basin. Get ready for some exciting news from the energy industry. FireBird Energy II, the new player in the Permian Basin, has just secured $500 million in equity funding to fuel their acquisitions. With backing from the esteemed private equity firm Quantum Energy Partners, FireBird Energy II is poised to make waves in the industry.

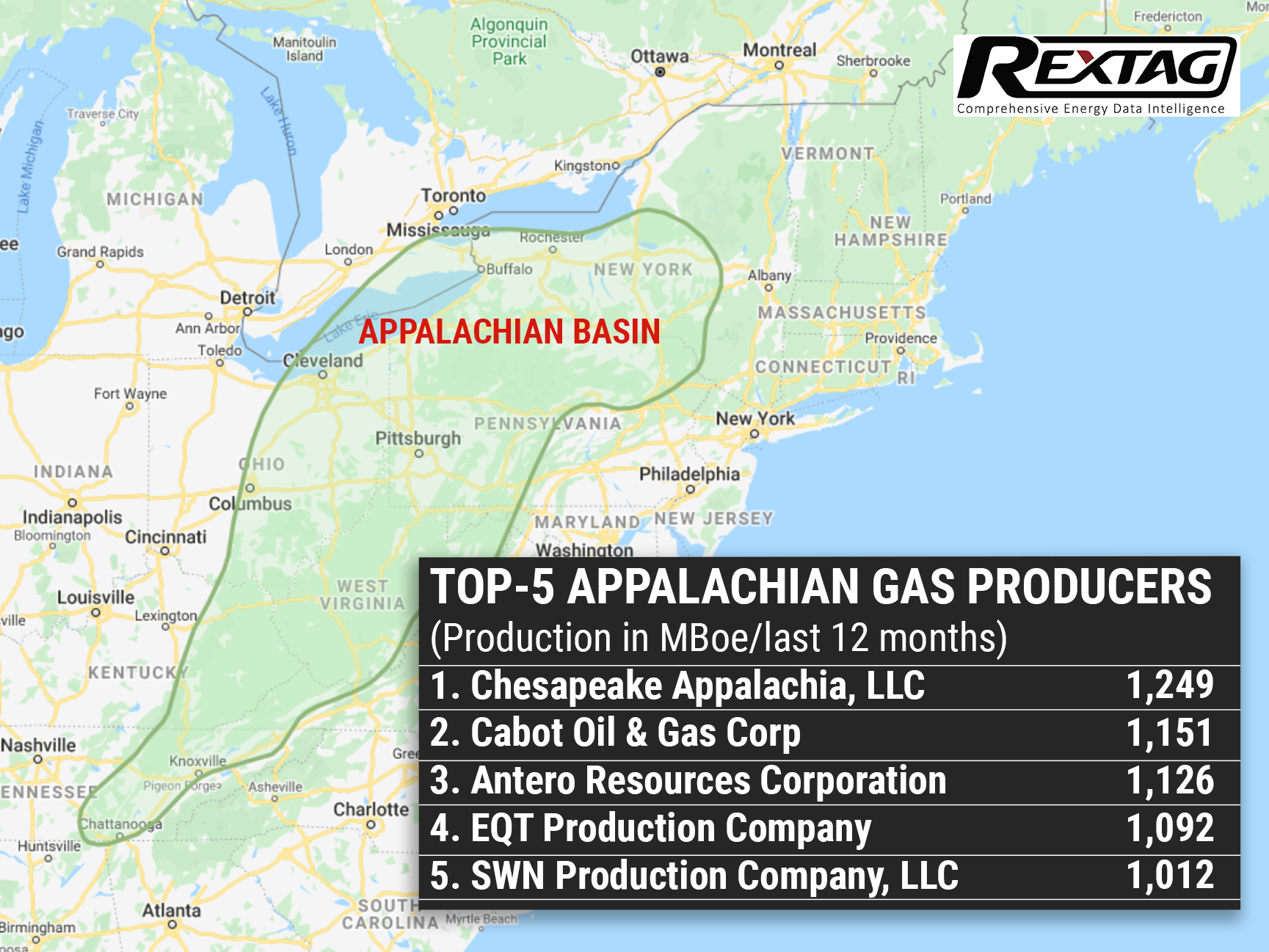

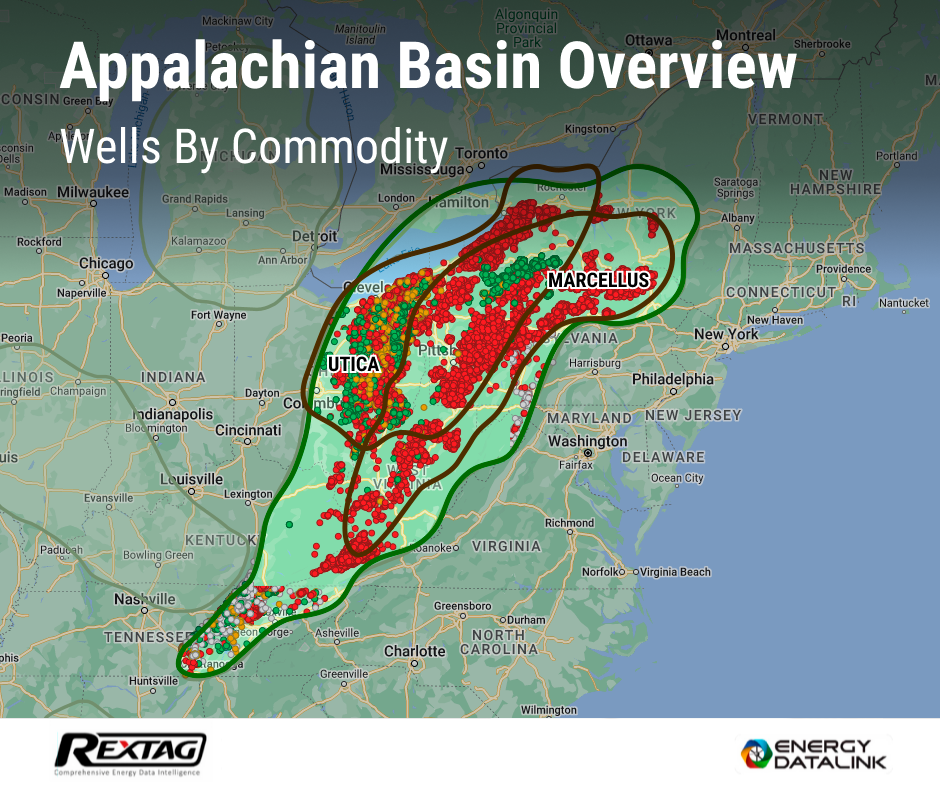

Appalachian O&G Basin 2022 Review

The Appalachian oil and gas basin is a geological formation that spans several states in the eastern United States, including Pennsylvania, West Virginia, Ohio, and New York. It is one of the largest natural gas reserves in the world, with estimates of recoverable natural gas exceeding 141 trillion cubic feet. The Marcellus Shale formation was formed over 350 million years ago and is composed of sedimentary rocks. Initially, the Marcellus Shale was not considered a significant source of natural gas due to the low permeability of the rock, which made it difficult for gas to flow through it and be extracted. However, with the development of hydraulic fracturing and horizontal drilling technologies in the early 2000s, it became economically viable to extract natural gas from the Marcellus Shale, and it has since become a major source of natural gas production in the United States.

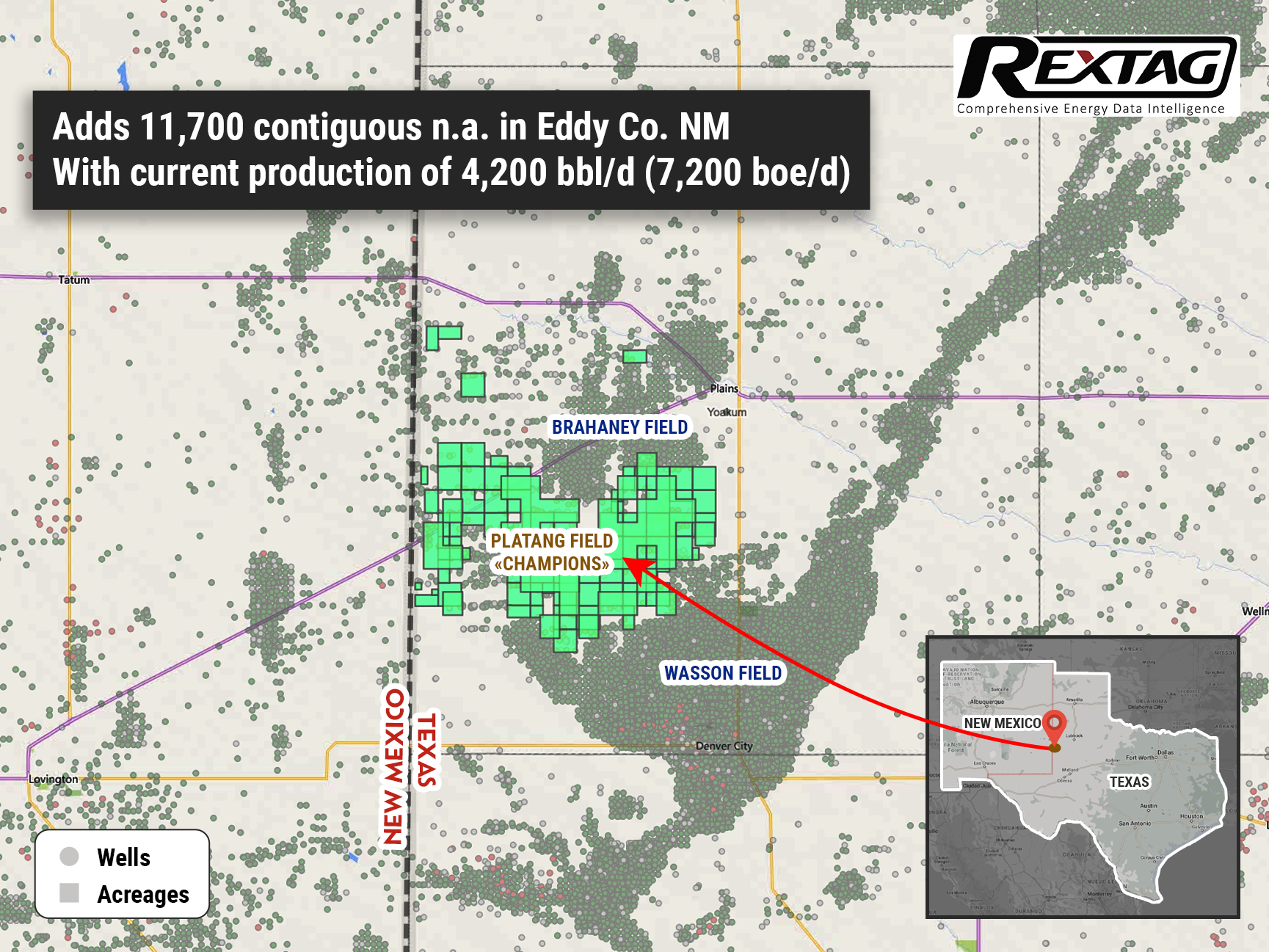

Riley Permian Secures $330 Million Acquisition in Thriving New Mexico: A Strategic Move with Promising Returns

In a big move for Riley Permian, the company has just closed a deal to acquire top-of-the-line oil and gas assets in the heart of New Mexico. The acquisition, which was made in February, saw Riley Permian snapping up these highly sought-after resources from none other than Pecos Oil & Gas LLC for $330 million.

Massive Energy Deal Alert: Energy Transfer to Acquire Lotus Midstream in Permian Basin for $1.45 Billion!

Energy Transfer's recent acquisition of Lotus Midstream's infrastructure for $1.45 billion is a remarkable feat that is bound to shake up the energy industry. This strategic move grants Energy Transfer access to the highly prized Centurion Pipeline, as well as an additional 3,000 miles of crude gathering and transportation pipelines. These pipelines span across the vast Permian Basin of West Texas, stretching all the way from New Mexico and culminating at the bustling energy hub of Cushing, Oklahoma.

Energy Giant Baytex Makes a Bold Move: Snaps Up Ranger Oil in $2.5 Billion Deal

Baytex Energy Group has announced that it will acquire Eagle Ford exploration and production company, Ranger Oil, for approximately $2.5 billion in cash and stock, which includes taking over the company's existing debt. Upon the successful closure of the acquisition, Baytex will have a controlling stake of approximately 63% in the newly merged company, leaving Ranger shareholders with around 37%. This significant move is in line with a trend of substantial mergers and acquisitions in the Eagle Ford area, with Marathon Oil, Devon Energy, and Chesapeake Energy among the companies involved in recent transactions.

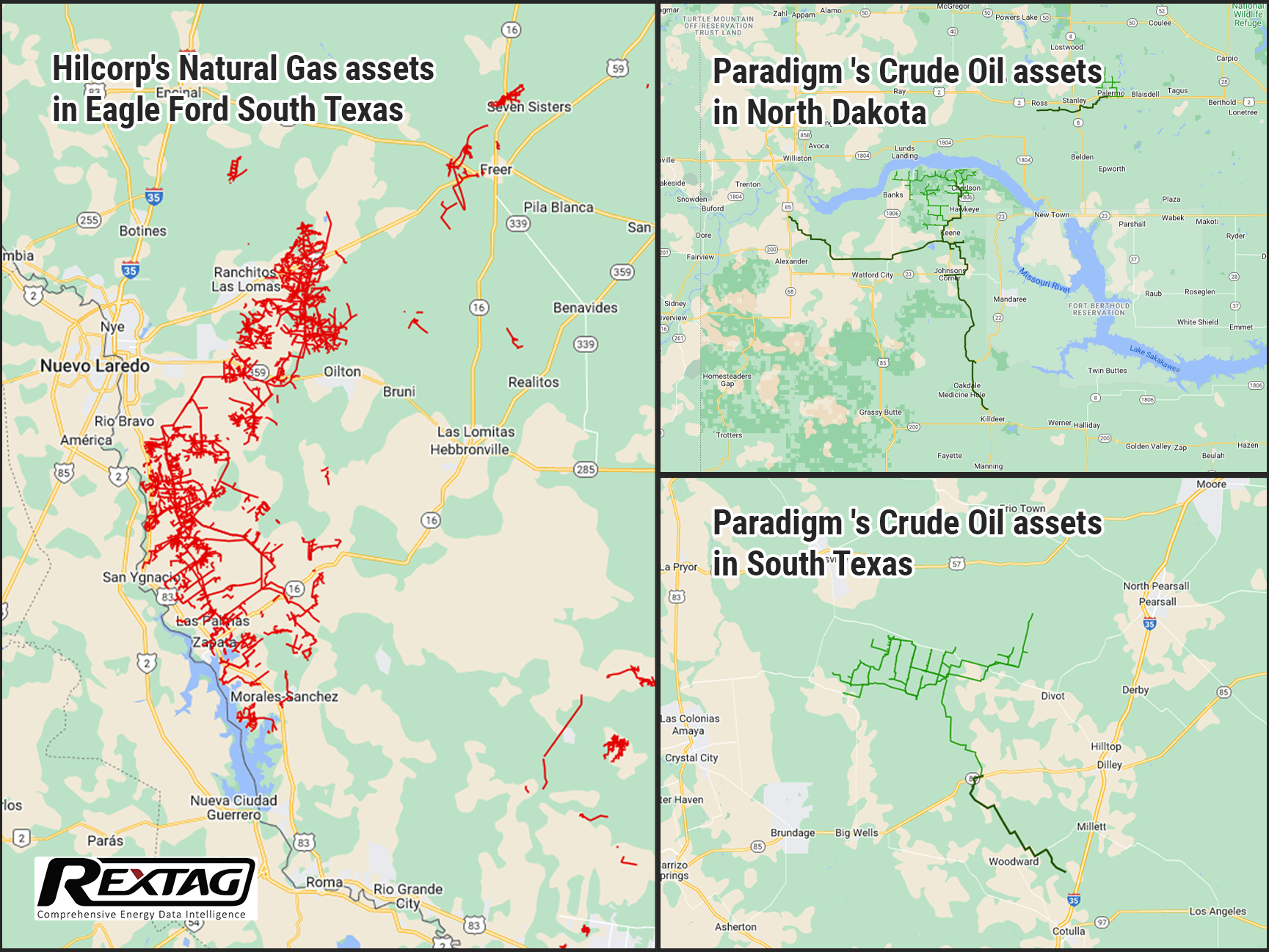

Fueling Up for Success: Harvest Midstream, Hilcorp's Affiliate, to Acquire Bakken and Eagle Ford Assets from Paradigm

Harvest Midstream, a Hilcorp affiliate, is set to acquire three midstream gathering systems that serve the Bakken, as well as system located in the Eagle Ford. Harvest, an affiliate of Hilcorp Energy Corp, has entered into an agreement to purchase three Bakken midstream gathering systems and one in the Eagle Ford from Paradigm. Paradigm is set to sell these midstream assets to Harvest in the near future.

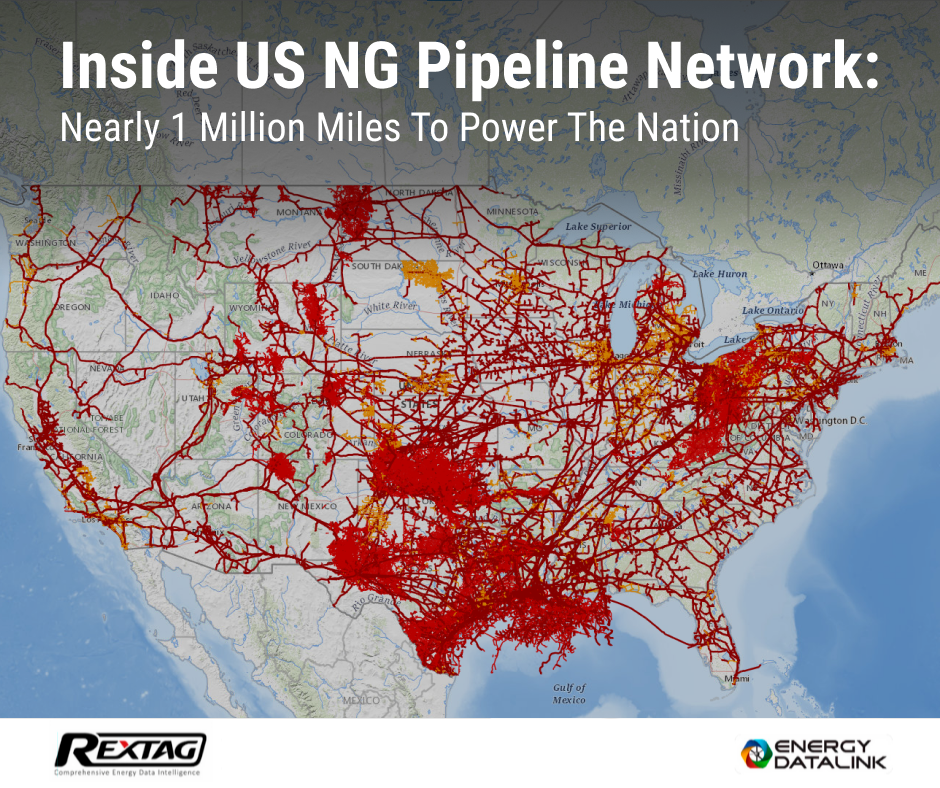

U.S. Natural Gas Pipelines Infrastructure Overview by Rextag

The U.S. natural gas pipeline network is a complex system of pipelines that transport natural gas from production areas to consumers across the country. The pipeline network consists of three main types of pipelines: gathering pipelines, transmission pipelines, and distribution pipelines. Gathering pipelines are small-diameter pipelines that transport natural gas from production wells to processing facilities or larger transmission pipelines. Transmission pipelines are large-diameter pipelines that transport natural gas over long distances, sometimes across multiple states. Distribution pipelines operate at low pressure and are located in or near urban areas. They are often referred to as "utility pipelines" because they are typically owned and operated by local gas utility companies.

Chesapeake Divests More Eagle Ford Assets; 172,000 n.a. and 2K+ Wells Sold to INEOS For $1.4 billion

Chesapeake Energy Corp. has announced that it will receive $1.4 billion from INEOS Energy for the sale of its remaining Eagle Ford asset, just a month after selling its Brazos Valley assets for a similar amount. This brings the total value of Chesapeake's Eagle Ford assets to over $2.82 billion. The Oklahoma City-based company will continue to market its other Eagle Ford assets.

Vital (Formerly Laredo) Expands in Midland, Purchases Acreage From Driftwood Energy

Vital Energy Inc. has made a significant acquisition, purchasing 11,200 net acres in Upton and Reagan counties, Texas. The deal, which involved a combination of cash and stock, was worth almost $214 million. This move comes shortly after the company's rebranding from Laredo Petroleum just one month ago.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

Exploring ESG in Upstream Operations: Examining Achievements, Obstacles, and Emerging Patterns

ESG considerations are becoming increasingly essential for companies operating in the upstream sector. Failure to address ESG concerns may result in financial and reputational risks, given the growing focus from investors, regulators, and other stakeholders. Companies must prioritize ESG performance and engage with stakeholders to address concerns and mitigate risks. By doing so, they can improve their reputation, attract investment, and contribute to a more sustainable future

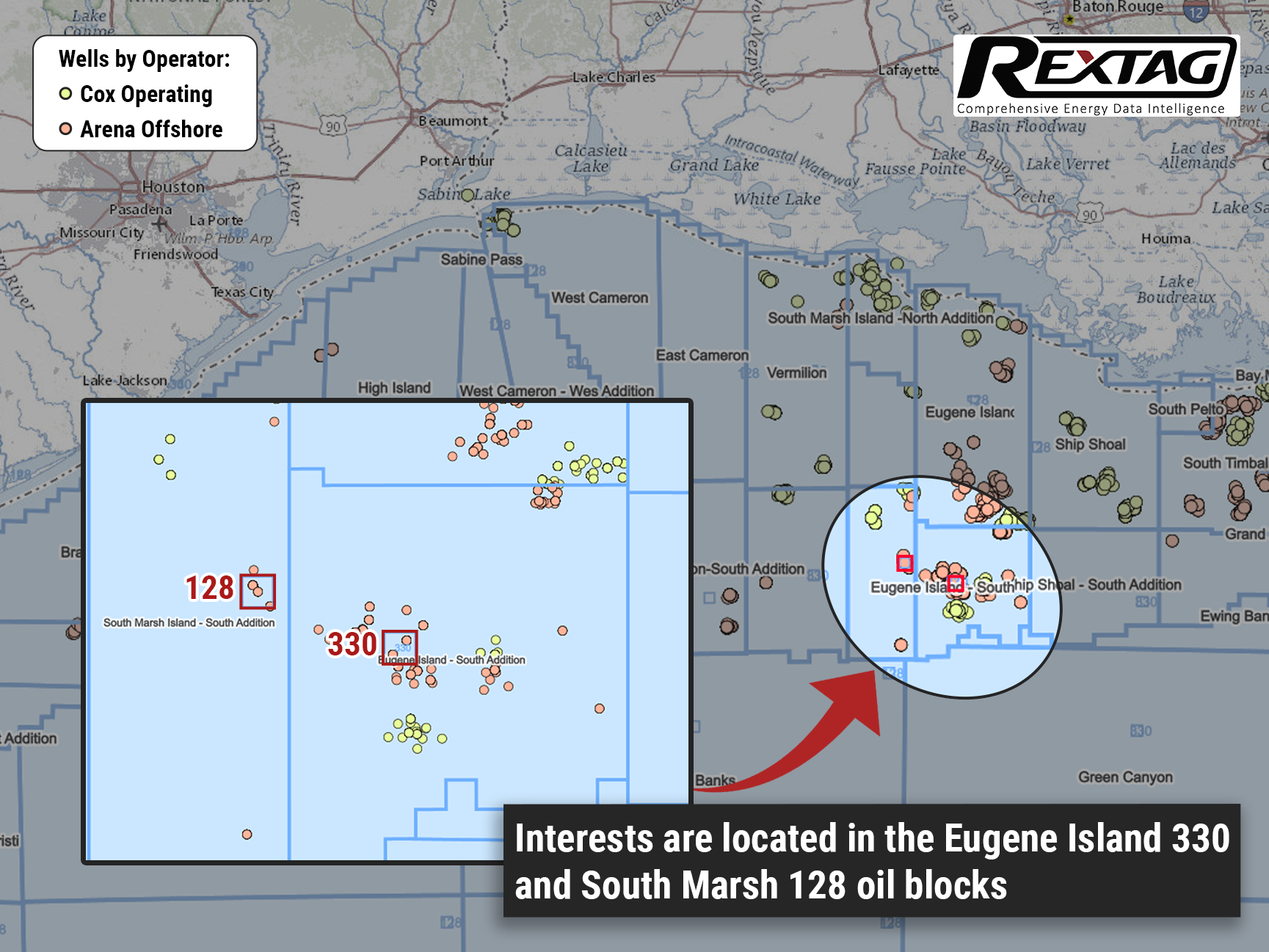

Arena Energy Makes a Deal with Cox in GoM, Adding ca. 1,000 net boe/d to Arena's Total Production

On January 24 Independent E&P Arena Energy LLC acquired Cox Operating LLC's interests in the Eugene Island 330 and South Marsh 128 oil blocks. Cox Operating, based in Dallas, Texas, includes interests to Arena's existing ownership interest in the Gulf of Mexico fields, which it purchased from GOM Shelf LLC.

A&Ds in O&G forecast for 2023, trends and factors that influence this

“Our view is in 2023 M&A picks up. There was some this 2022 year, but again, it was such a funky, weird macro world. We expect fewer surprises in 2023.” — Dan Pickering, Pickering Energy Partners. Modern companies in the world operate in a rapidly changing external environment, so the process of reorganization is one of the basic tools for solving the problem of adapting companies to new conditions. Recently, the number of Acquisitions and Divestitures in the oil and gas industry has been growing rapidly, i.e. it can be said that the market for these deals is dynamically developing.

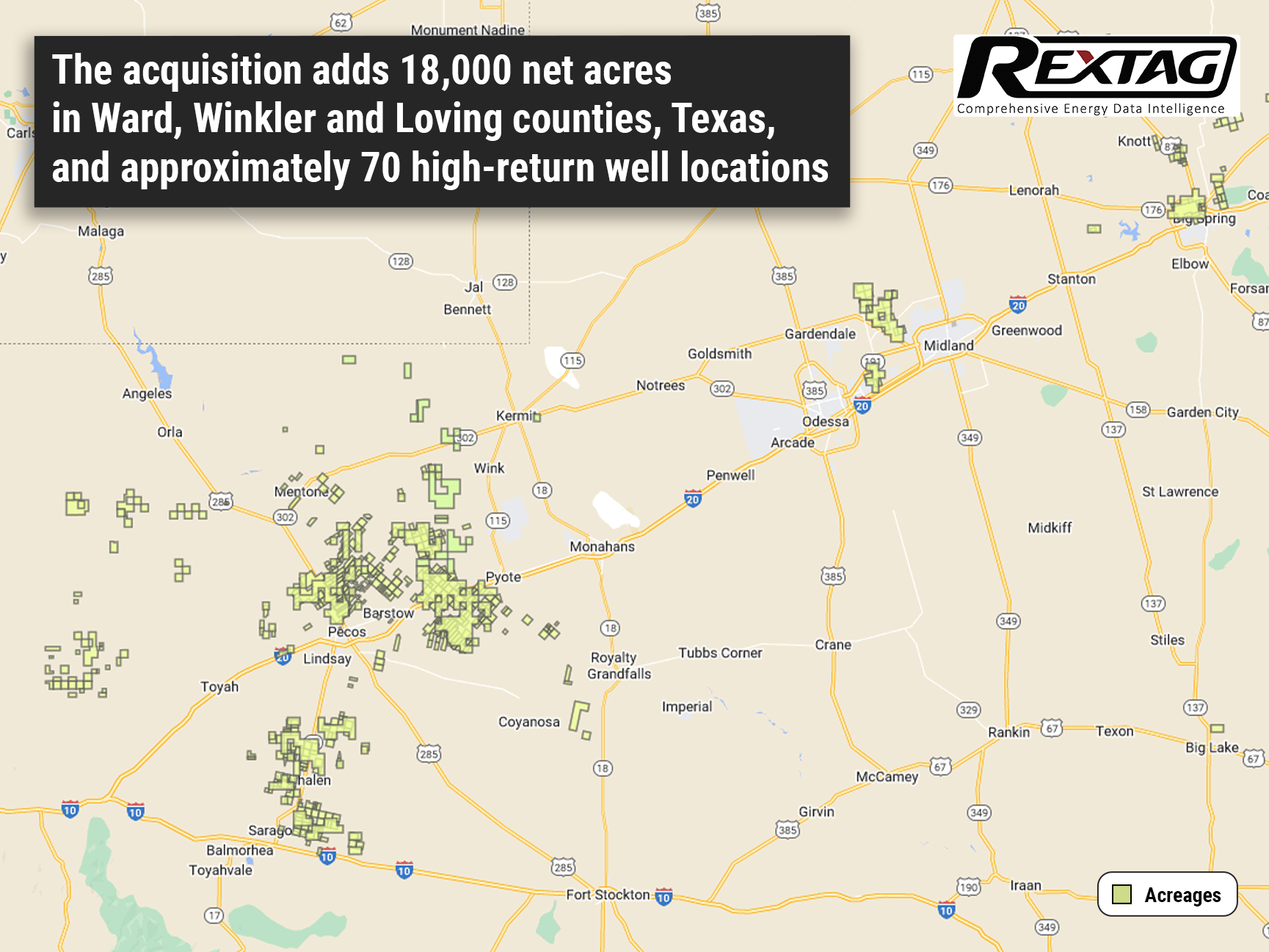

Matador Expands In Delaware; Purchases Acreage from Advance Energy at $1.6 Billion

On January 24, Matador spread the word that it will add oil- and gas-producing assets in Lea County, N.M., and Ward County, Texas, and some midstream infrastructure. Most of the acreage is strategically situated in Matador’s Ranger asset area in Lea County. The bolt-on includes about 18,500 net acres, 99% held by production, in the core of northern Delaware. The deal would also extend Matador’s inventory by 406 gross (203 net) drillable horizontal locations with prospective targets in the Wolfcamp, Bone Spring, and Avalon formations.

2022 A&Ds in O&G Summary and Trends for the past 4 years

More than 60% of all A&D deals by value are in US oil and gas companies. Despite their leading market position, U.S. fields are developing unevenly, and investors are quite cautious about investing in them at this stage. The top 5 oil & gas industry A&D deals in 2022 were concluded by Omega Acquisition, Tokyo Gas, Diamondback Energy, Suncor Energy, and IMM Private Equity. The main motives of oil and gas companies to carry out A&D transactions can be considered the achievement of the synergy effect, and the presence of fundamental shocks in the market.

ESG - what are the criteria O&G companies should meet?

Most companies have plans in place to identify and manage the normal operational risks of enterprise asset management (EAM). But, it is equally important to consider the potential emergence of ESG risks that a company may face. While predicting events such as hurricanes, pandemics, and regulatory violations is difficult, preparing for or mitigating the impact can avoid potentially devastating effects on an asset-rich organization, as well as its employees and shareholders. As a reminder, ESG investing looks at three elements: environmental (E), social (S), and governance (G) issues, with stakeholders looking not only at the financial parameters of a transaction but also the non-financial parameters. For example, oil and gas companies should develop plans to restore power lines or pipelines after an earthquake or other natural disaster. These plans should describe procedures for how employees will access remote sites, which assets will be prioritized, what additional equipment will be needed, and how it will be obtained.

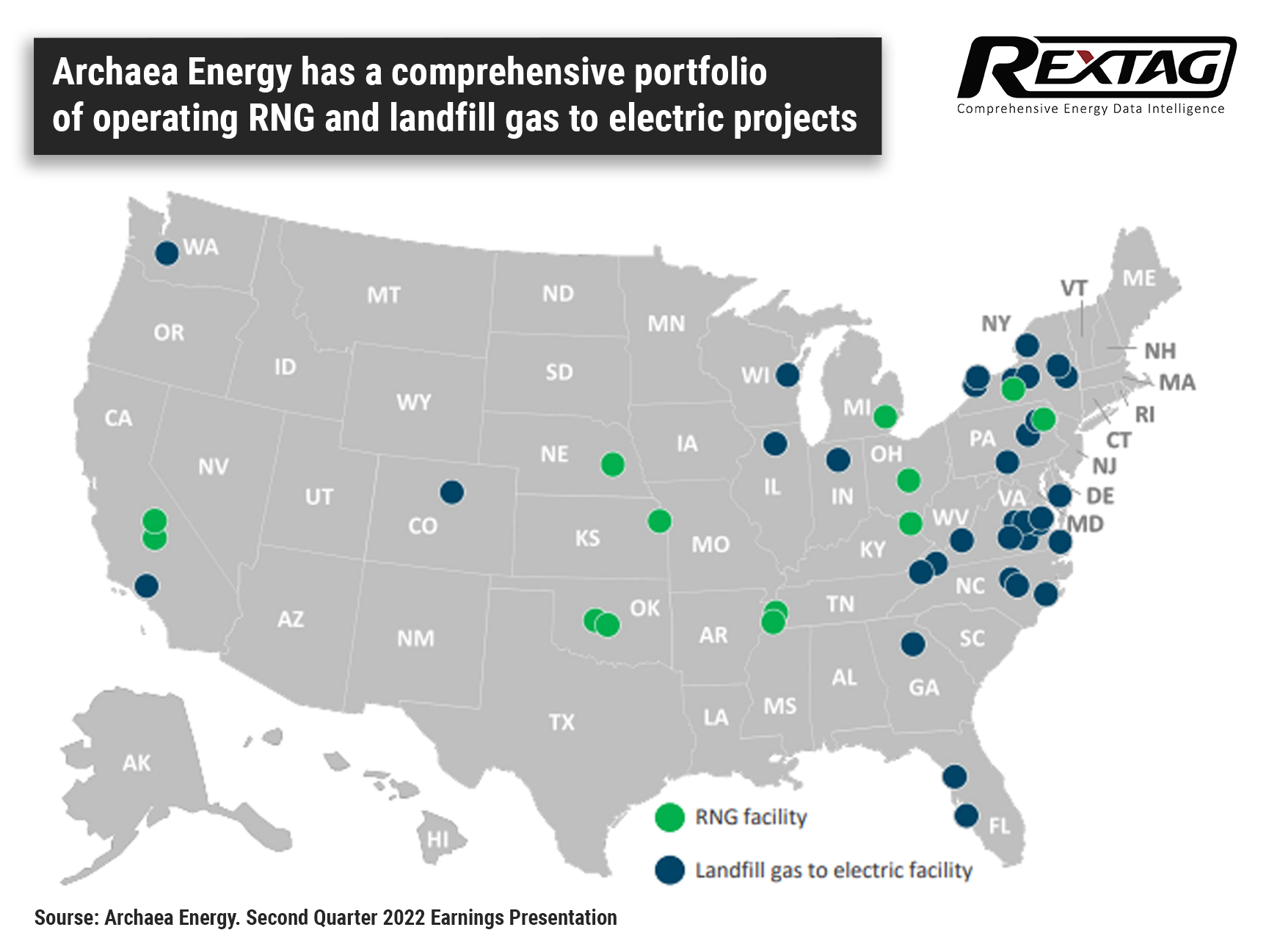

BP Has Acquired Archaea Energy for $4.1 Billion Developing Its bioenergy business

BP acquired renewable natural gas (RNG) provider Archaea Energy Inc. for $4.1 billion on December 28, marking a milestone in the growth of BP’s strategic bioenergy business. The acquisition, announced in October, was finalized following BP’s completion of regulatory requirements and Archaea obtaining shareholder approval.

Blockchain as a technology for smart contracts in O&G

The oil and gas industry has long relied on the recommendations of trusted experts to make key supply chain decisions. The growing popularity of Blockchain technology could significantly disrupt these relationships by providing an unbiased methodology for sourcing, tracking, and executing transactions on behalf of customers with transparent data sets across supply chain endpoints. Blockchain technology has already been used by many global companies in the last two years in various areas such as IoT (Internet of Things), smart contracts, and cryptocurrencies. It has enabled businesses to benefit from the inherent trust and transparency of the technology.

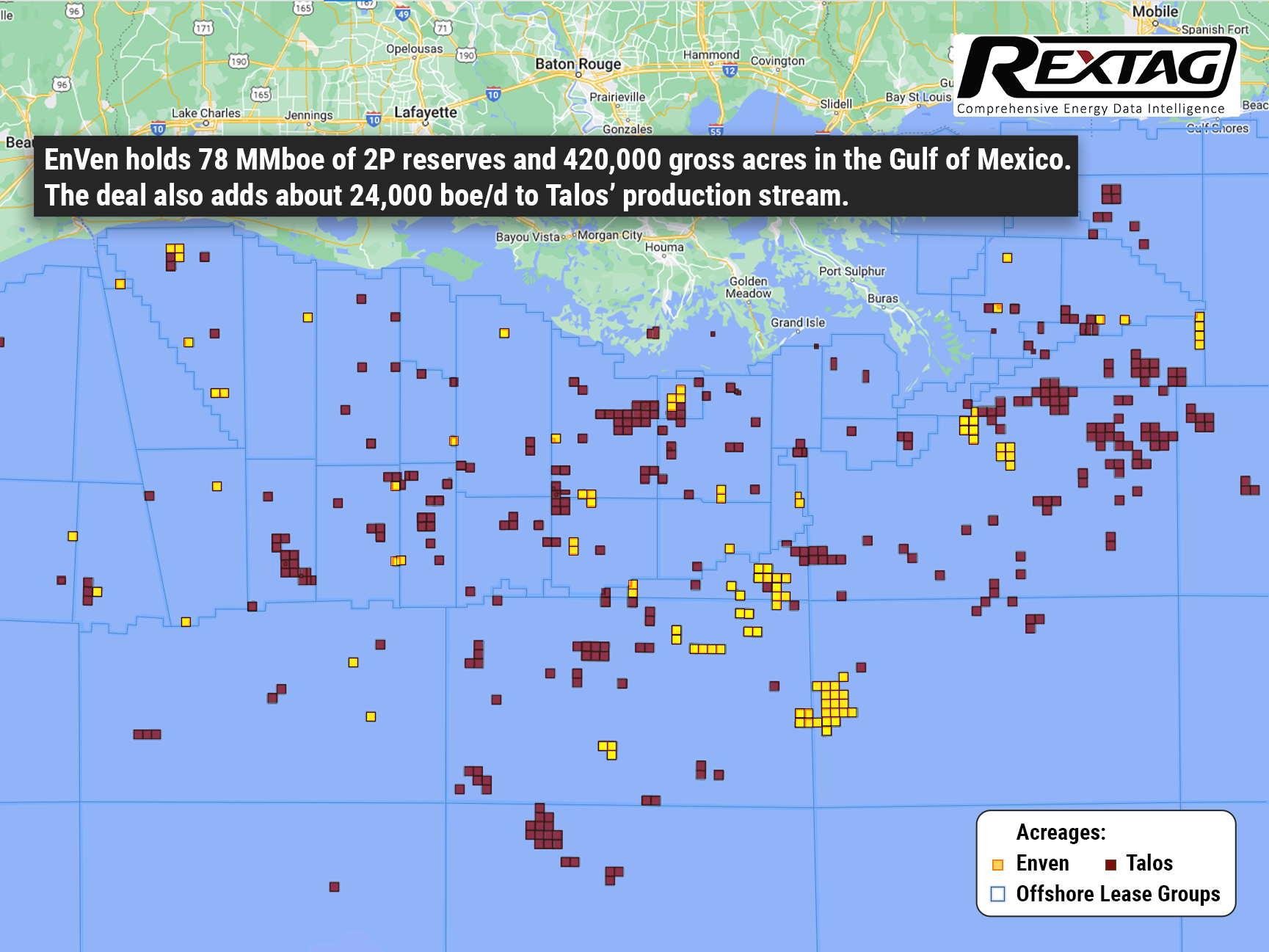

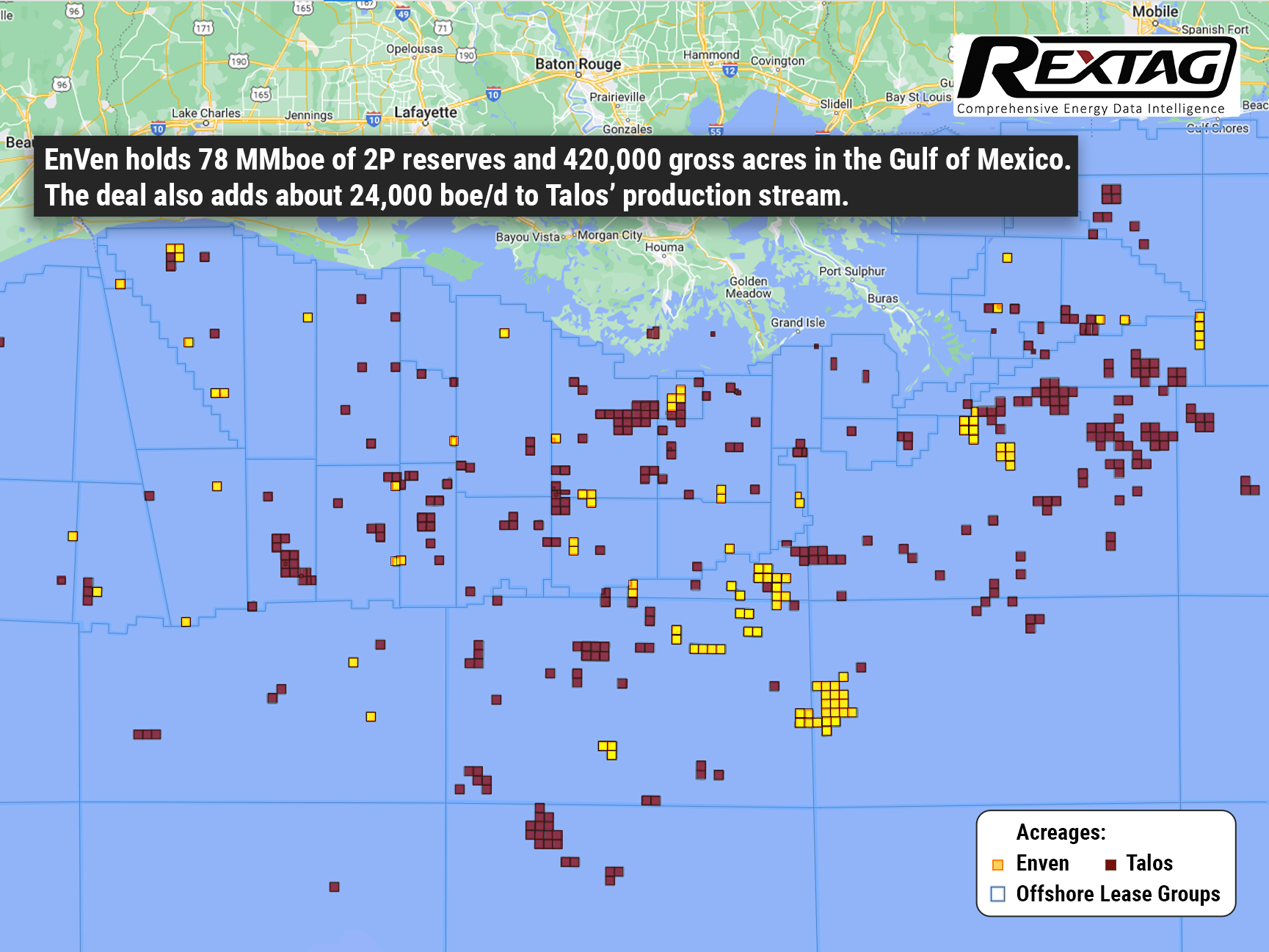

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

Grand Prix Pipeline Will Be Completely Owned by Targa: To Buy Remaining Stake For $1.05 Billion

On January 3, Targa Resources Corp asserted that it is purchasing the remaining stake for $1.05 billion in cash from BlackstoneInc's energy unit in its Grand Prix NGL Pipeline that it does not already own. Targa, which is going to acquire a 25% stake from Blackstone Energy Partners, purchased 75% interest in the pipeline last year when it repurchased interests in its development company joint ventures from investment firm Stonepeak Partners LP for almost $925 million. The Stonepeak agreement also included 100% interest in its Train 6 fractionator in Mont Belvieu, Texas, and a 25% equity interest in the Gulf Coast Express Pipeline. Grand Prix has the capacity to transfer up to 1 MMbbl/d of NGL to the NGL market hub at Mont Belvieu. The same day Targa maintained the price of the Blackstone Energy Partners agreement, which is anticipated closing in the first quarter of 2023, representing roughly 8.75 times Grand Prix's valued 2023 adjusted EBITDA multiple.

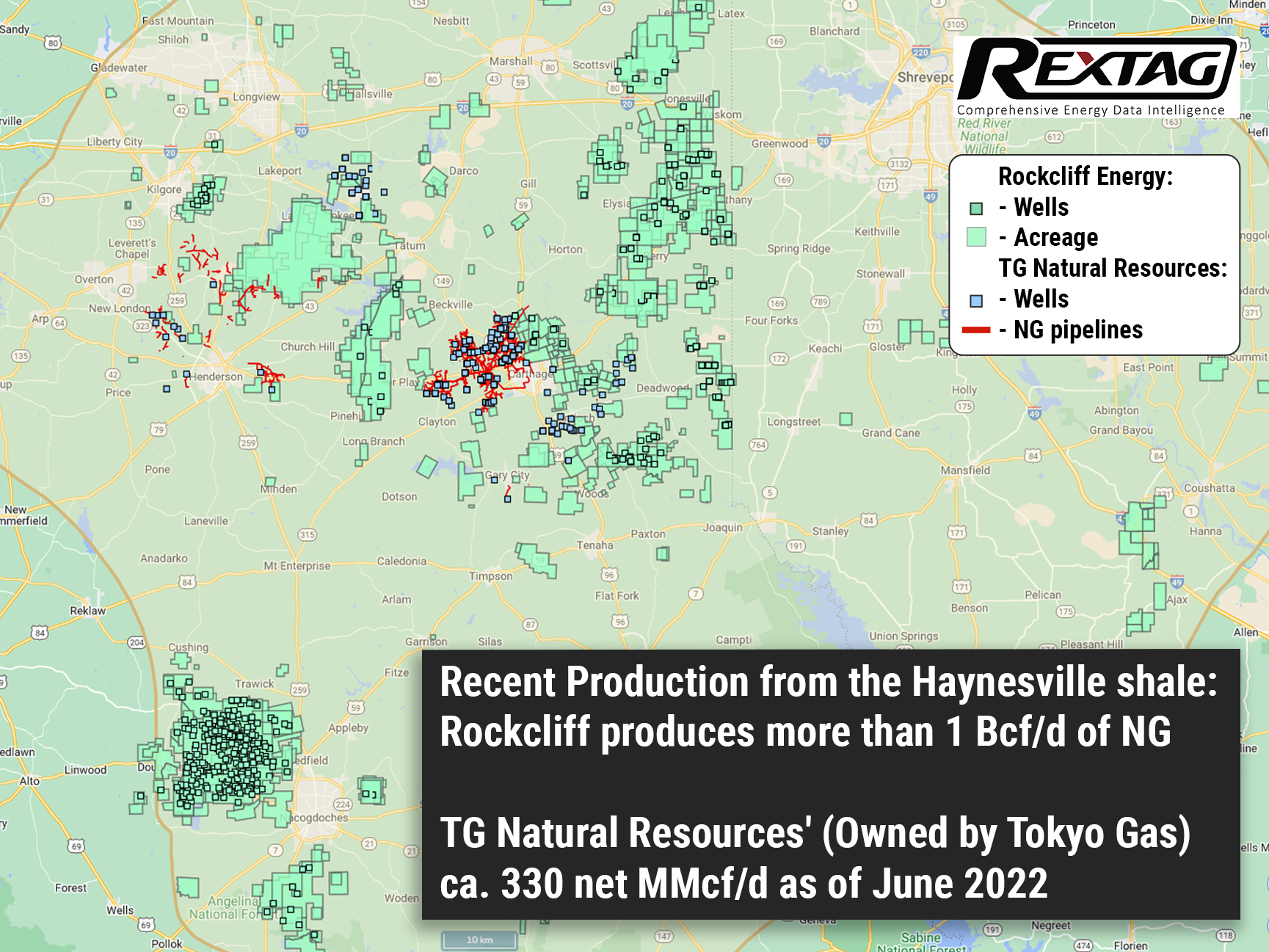

Tokyo Gas Is Set to Buy Rockcliff Energy: One of the Top Haynesville's Producers

On January 3, U.S. natural gas producer Rockcliff Energy from private equity firm Quantum Energy Partners was set to be sold to a unit of Tokyo Gas Co. Ltd. for roughly $4.6 billion, including debt. The all-cash agreement with Houston-based TG Natural Resources, which is 70% possessed by the Japanese energy firm, is decided to be claimed this month, according to anonymous resources, as the discussions were requested to be confidential. Castleton Commodities International (CCI) owns the rest of TG Natural Resources.

NOG Grows Its Acreage Position in Delaware

According to the company’s press release on December 19, Northern Oil and Gas Inc. (NOG) closed its announced deal with a private seller of non-operated interests in the Northern Delaware Basin for $131.6 million in cash. The acquisition was announced with a $13 million deposit in October and is the third Permian Basin acquisition since August, adding to NOG’s $400 million of Permian Basin acquisitions in 2022. The assets of 2,100 net acres are primarily operated by a private company Mewbourne Oil Co., with production anticipated to total almost 2,500 boe/d in 2023. Also, Coterra Energy Inc. and Permian Resource Corp. are operators of the assets. The assets contain high-quality, low breakeven development that is leveraged to some of NOG’s top operating partners, as our investors have come to expect.

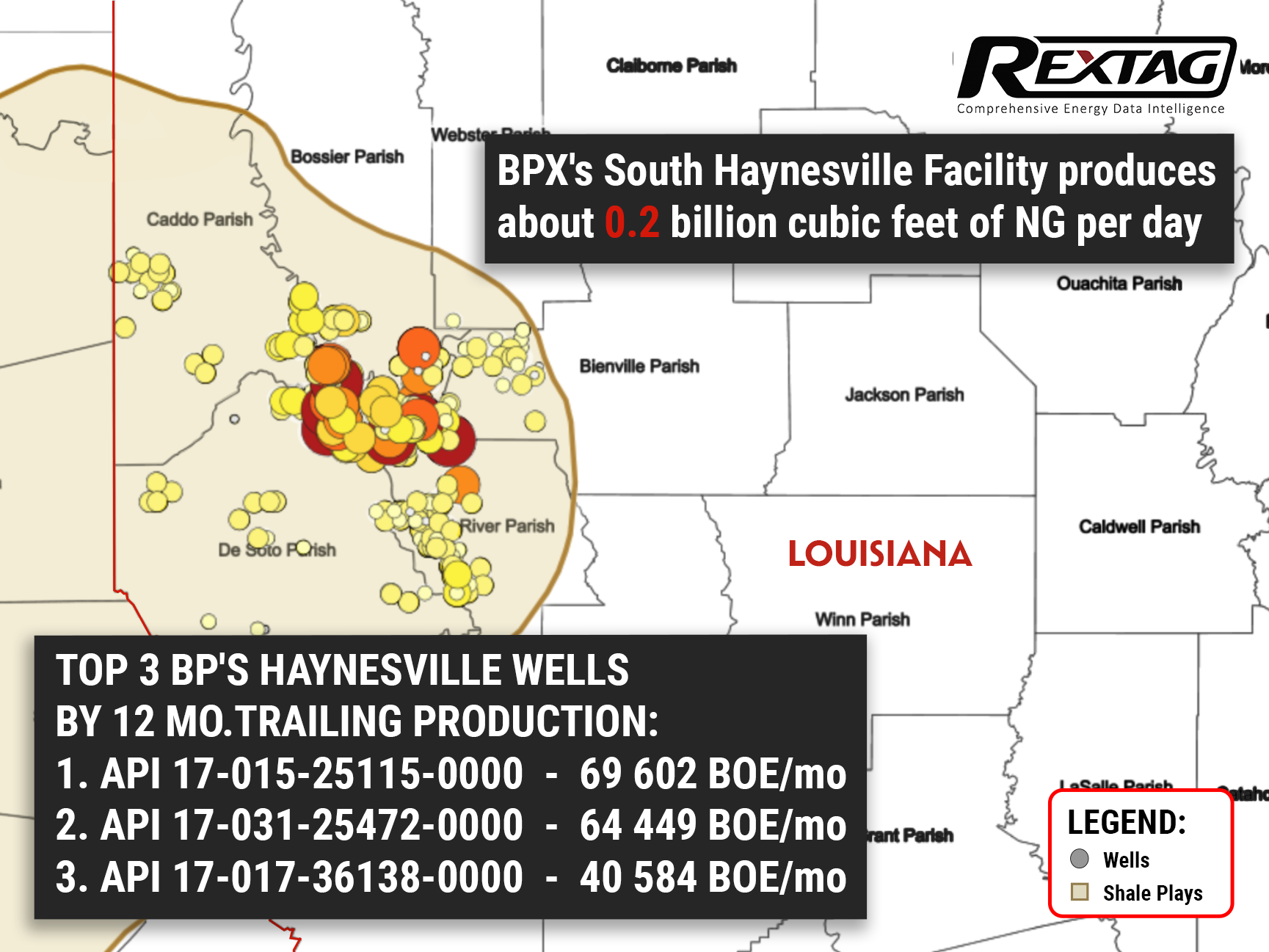

Haynesville's Top 2022 Players That Made It Happen

After reaching record-high production in 2021, the Haynesville Shale seemed to have a quiet 2022, with a smattering of deal activity and attention seemingly focused more on LNG exports than production. Meanwhile, the indications are that the third-largest producing gas shale in the U.S. is growing up for a robust 2023 if commodity prices stand still. Top basin performers Chesapeake Energy, Southwestern Energy, Comstock Resources, Aethon Energy, and Rockcliff Energy II produced a combined total of 1.53 MMboe/d, 83 bbl/d of oil, and 9.2 Bcf/d of gas in the first half of 2022.

Williams Buys MountainWest Pipeline System for $1.5 Billion

On December 15, Pipeline giant Williams made a deal to purchase MountainWest Pipelines Holding Co. from Southwest Gas Holdings Inc. for almost $1.5 billion including debt. Williams is paying $1.07 billion in cash and assuming $0.43 billion of debt to buy MountainWest, which comprises approximately 2,000 miles of interstate natural gas pipeline systems mainly situated across Utah, Wyoming, and Colorado.

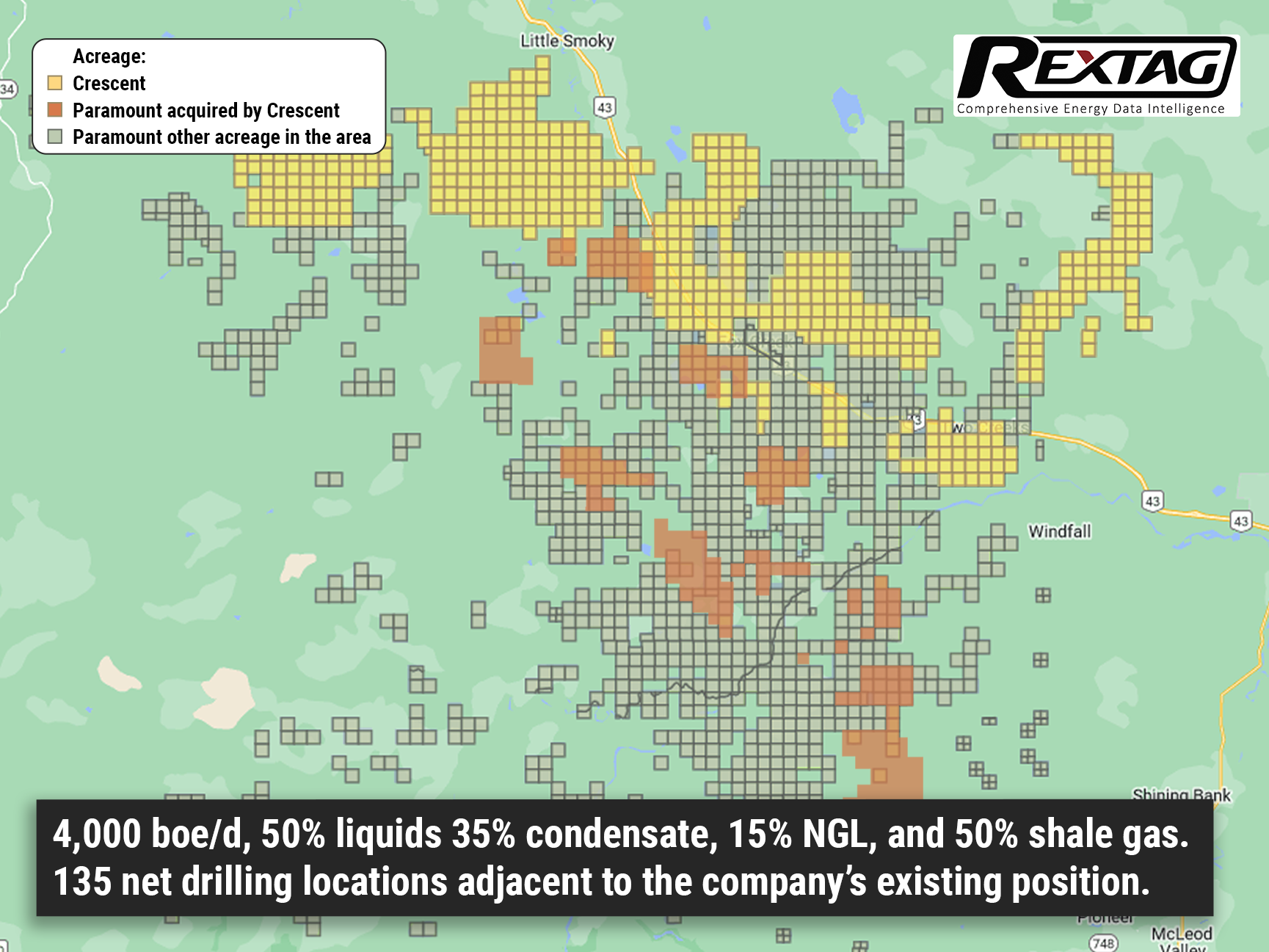

CA$375 Million Bolt-on Deal to Expand Crescent Point

On December 9, Crescent Point Energy Corp. announced a purchase and sale agreement to develop its core Kaybob Duvernay assets, which will bolt on production, the midstream infrastructure and technical data. With the deal, the company has committed more than US $1 billion to the play. Crescent Point, the Alberta-based company, is purchasing almost 65,000 net acres from Paramount Resources Ltd. for CA $375 (US $274 million) cash. The assets estimate more than 4,000 boe/d, 50% liquids, and include a gas plant, associated pipelines, water infrastructure, and seismic data. The acquired asset’s production consists of 35% condensate, 15% NGL, and 50% shale gas.

$1.55 Billion Deal, Diamond Energy Acquires Lario Permian

On November 16 Diamondback Energy Inc. decided to expand in the Midland portion of the Permian Basin with the acquisition of Lario Permian LLC in a $1.55 billion cash-and-stock transaction. The Permian operator announced another billion-dollar agreement to purchase FireBird Energy LLC, a private Midland Basin operator. In total, Diamondback is paying almost $3.3 billion to extend in the Midland Basin. When combined with the pending FireBird acquisition, Diamondback is increasing its Midland Basin footprint by roughly 83,000 net acres, is adding 500 high-quality drilling opportunities that compete for capital with the current development plan and is raising the 2023 production profile by almost 37,000 bbl/d of oil (50,000 boe/d).

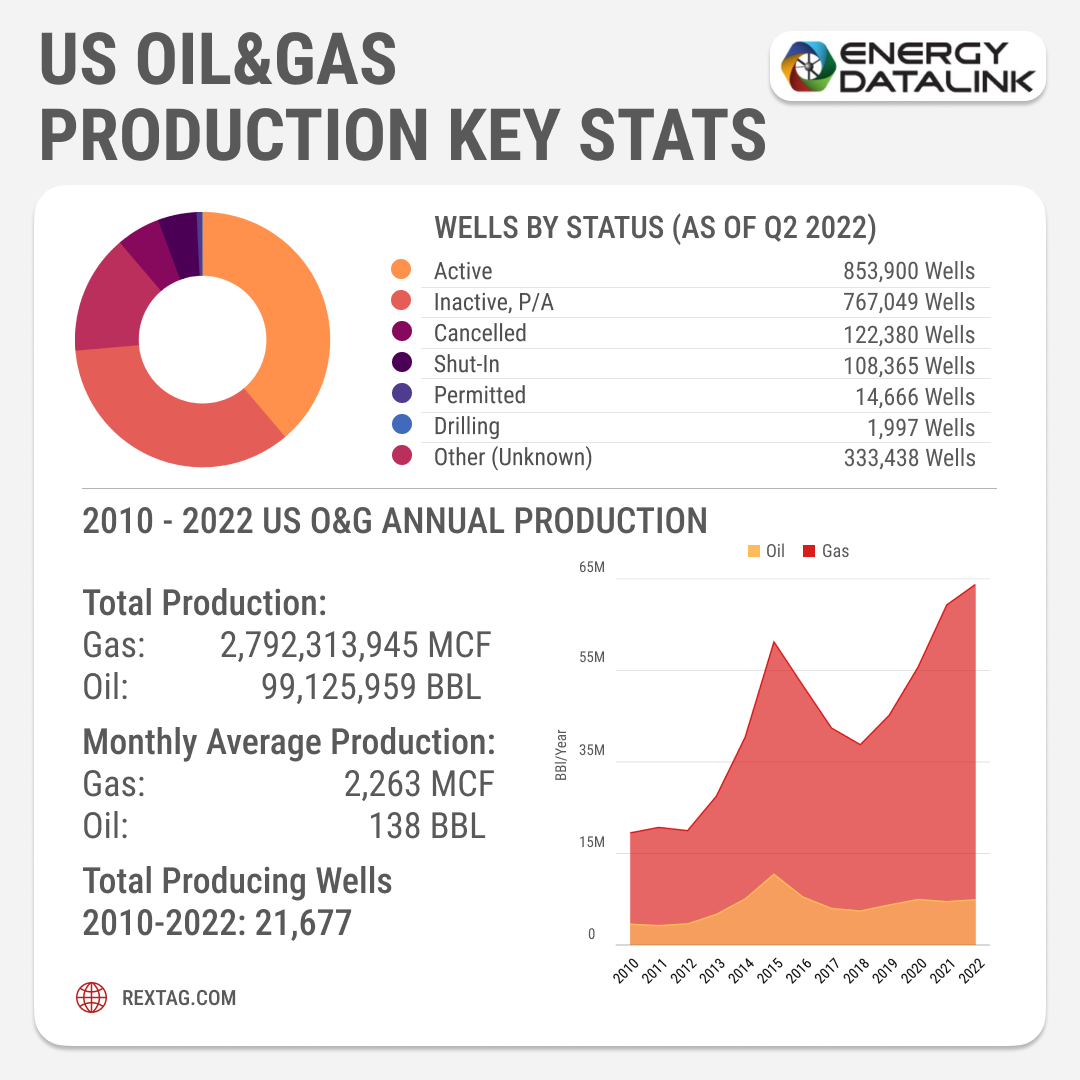

Key statistics on oil and gas production in the USA

2022 is almost over. Full of global uncertainty, it brought a lot of disturbance to the energy markets. It is a good opportunity to say that again and again we are proud of the U.S. energy industry. Despite all odds, this sector has shown remarkable growth in the past years. In the past decade, the industry twice faced dramatic price collapses and successfully navigated between global oversupply and insufficient demand situations. Even the unprecedented pandemic market disruption did not undermine the strengths and perspectives of the U.S. industry players. As of today, we enjoy historical production at its highest. More than 850 thousand wells are delivering steady production to domestic and foreign customers. More than 14,600 approved permits are soon to start producing. At Rextag, we track and analyze petroleum production data. If you want to explore production trends by basin, formation, operator, etc., learn more about our services here

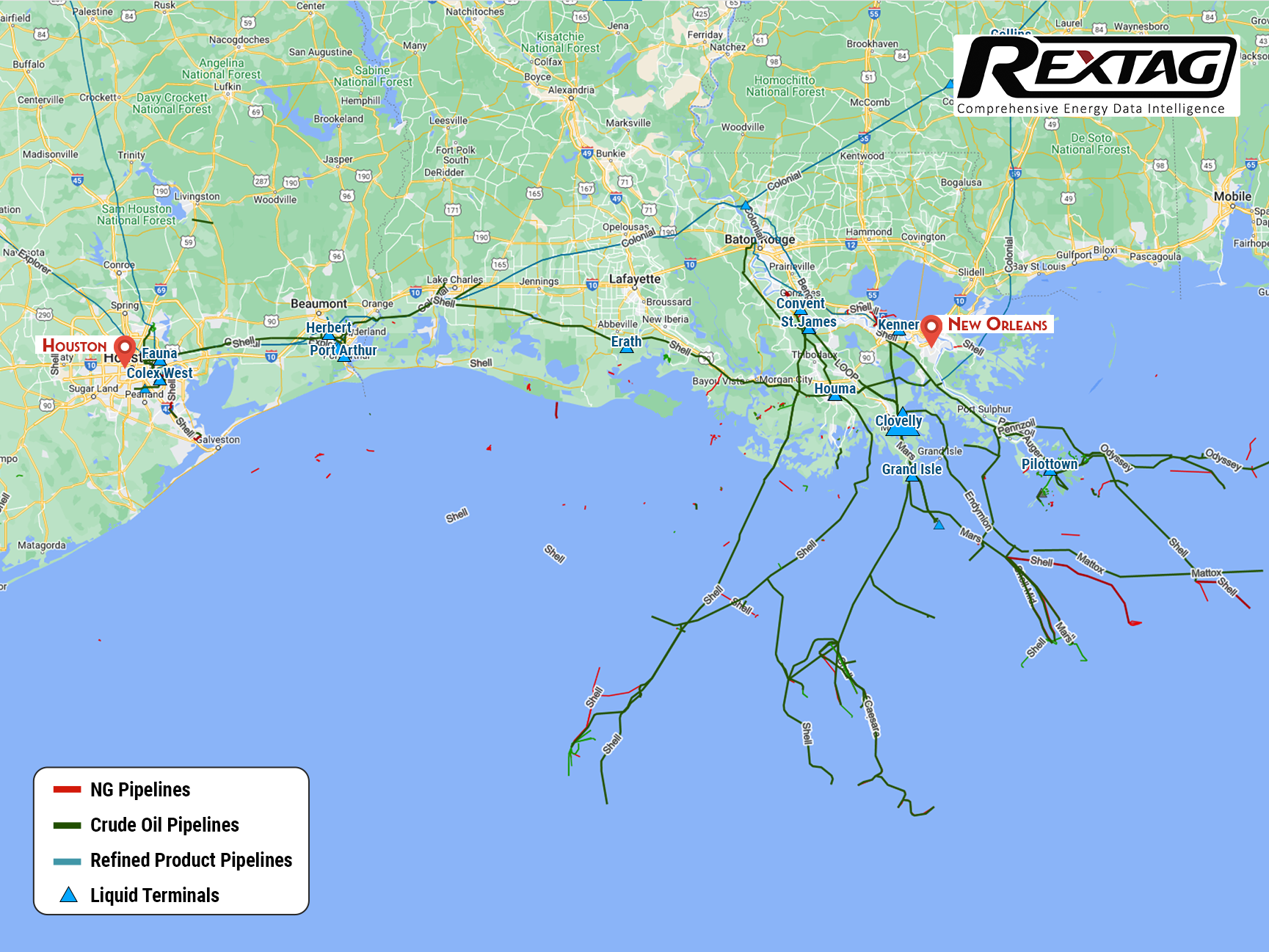

Shell's Midstream Assets in TX and LA (Gulf area)

On October 19, Shell USA completed the almost $1.96 billion acquisition of the master limited partnership. The company paid $15.85 in cash for every common unit representing limited partner interests in SHLX not held by Shell USA or its affiliates. A subsidiary of Shell USA has 269,457,304 SHLX common units or roughly 68.5% of SHLX common units.

Diamondback Acquires FireBird In Midland, For $1.6 Bln

FireBird Energy LLC, a private Midland Basin operator backed by RedBird Capital Partners and Ontario Teachers’ Pension Plan, purchases Diamondback Energy Inc. in a cash-and-stock transaction estimated at almost $1.6 billion, according to a company release on Oct. 11. Moreover, Diamondback also unveiled an aim to sell not less than $500 million of noncore assets by year-end 2023, with proceeds earmarked for further debt reduction, to support the Midland, Texas-based company’s pledge to reward shareholders.

Talos Energy Buys EnVen for $1.1 Billion to Expand

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

Momentum Midstream Becomes a Leader in Haynesville Due to Latest Acquisitions

Houston-based company Momentum Midstream LLC on September 22 purchased Midcoast Energy LLC’s East Texas business from an affiliate of Arc Light Capital Partners LLC and Align Midstream LLC from Tailwater Capital and claimed that it establishes a leading presence in the Haynesville Shale. New Generation Gas Gathering or NG3 project will collect natural gas produced in the Haynesville Shale for re-delivery to premium Gulf Coast markets, including LNG export. Moreover, the NG3 project includes a carbon capture and sequestration component that will eliminate 100% of the CO₂ and accumulate it underground for a long time, creating a net negative carbon footprint. With the combined assets of Midcoast ETX and Align Midstream, Momentum is currently delivering volumes of more than 2 Bcf/d for a diverse customer base composed of producers, utilities, end-users, and LNG exporters. Momentum’s footprint in the Haynesville includes about 3,000 miles of gathering pipelines, 1.5 Bcf/d of treating capacity, 700 MMcf/d of processing capacity, 200,000 HP of compression, and 820 miles of pipelines transporting gas to the Gulf Coast markets in southeast Texas and the Carthage and Bethel markets in East Texas.

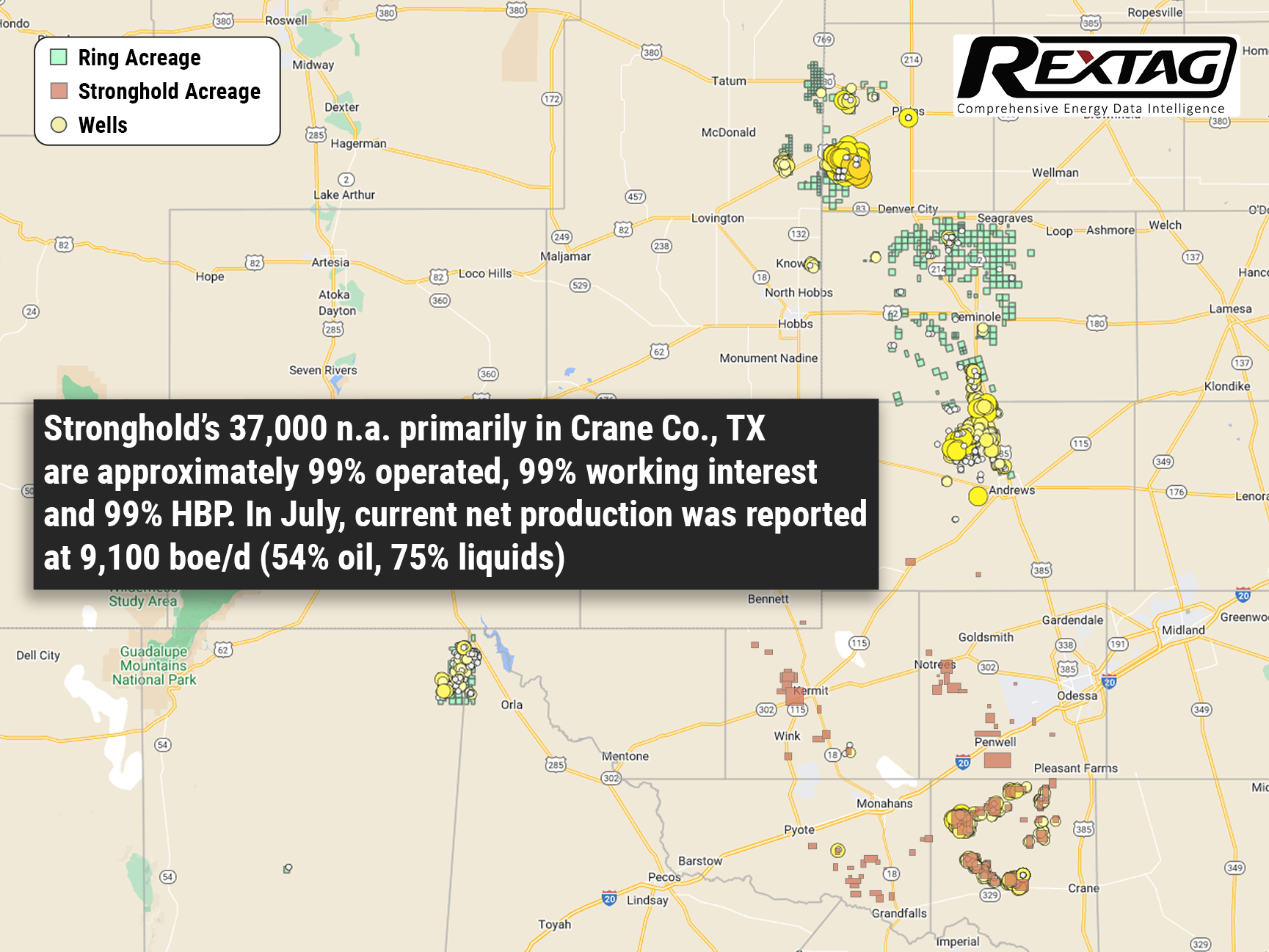

$465 Million for Stronghold Energy; Ring Energy Completes the Acquisition

On August 31 Ring Energy Inc. purchased privately-held Stronghold Energy, adding operations that are mainly situated in Crane County, Texas, in the Permian Basin’s Central Basin Platform. According to a September 1 Ring Energy release, this transaction fully complements the conventional-focused Central Basin Platform and Northwest Shelf asset positions in the Permian Basin. The majority owned by Warburg Pincus LLC, Stronghold’s operations are concentrated on the development of about 37,000 net acres situated mainly in Crane County. In July Ring Energy entered into an agreement to buy Stronghold Energy II Operating LLC and Stronghold Energy II Royalties LP for $200 million in cash at closing and $230 million in Ring equity based on a 20-day volume weighted average price. Consideration also involved a $15 million deferred cash payment due six months after closing and $20 million of existing Stronghold hedge liability increasing the total transaction value to $465 million. Stronghold’s asset base is almost 99% operated, 99% working interest, and 99% HBP. In July, Ring announced the current net production of Stronghold’s asset base was approximately 9,100 boe/d (54% oil, 75% liquids).

$5 Billion Returns for ConocoPhillips’ Shareholders as Prices Grow

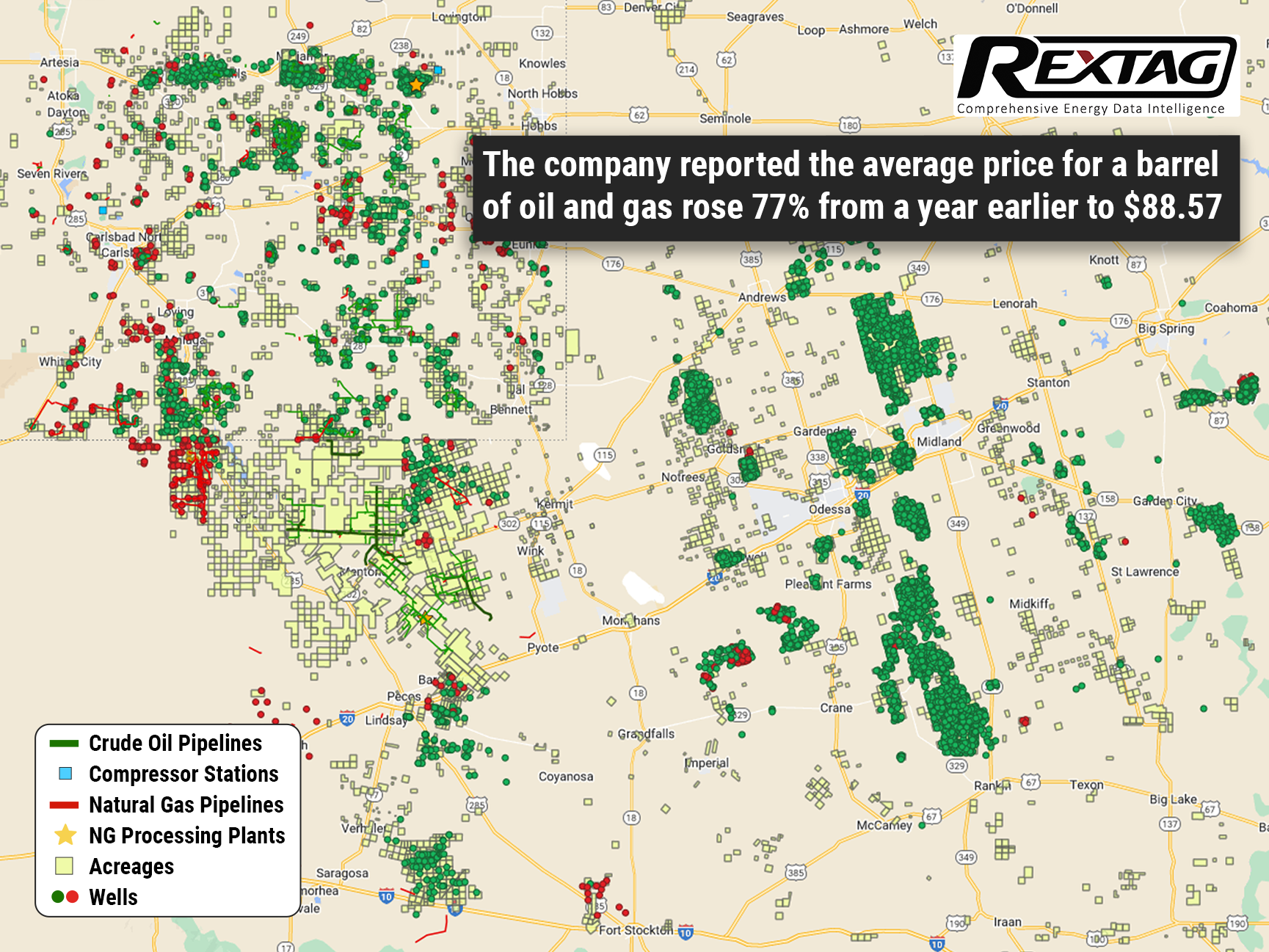

Shareholder’s payout target was increased by 50% after the largest U.S. independent oil producer surpassed Wall Street’s earnings estimates on growing energy prices, said Houston-based Conoco Phillips Co. on Aug. 4. Due to Western sanctions on major producer Russia throttling energy supply amid a rebound in demand from pandemic lows, oil and gas #prices have soared. Crude has been trading more than 25% higher since the start of the year and results also benefited from high natural gas prices. Meanwhile, shares were down a fraction, to $91.03, in early trading but are up about 26% year to date. Conoco Phillips stated, that the average price obtained for a barrel of oil and gas accelerated 77% from a year earlier to $88.57. The company acknowledges that it has not hedged any of its oil and gas sales to make the most of higher market prices. The capacity of 1.69 million boe/d was in line with Wall Street estimates, however, the company expected the current quarter’s output would be between 1.71 million and 1.76 million boe/d.

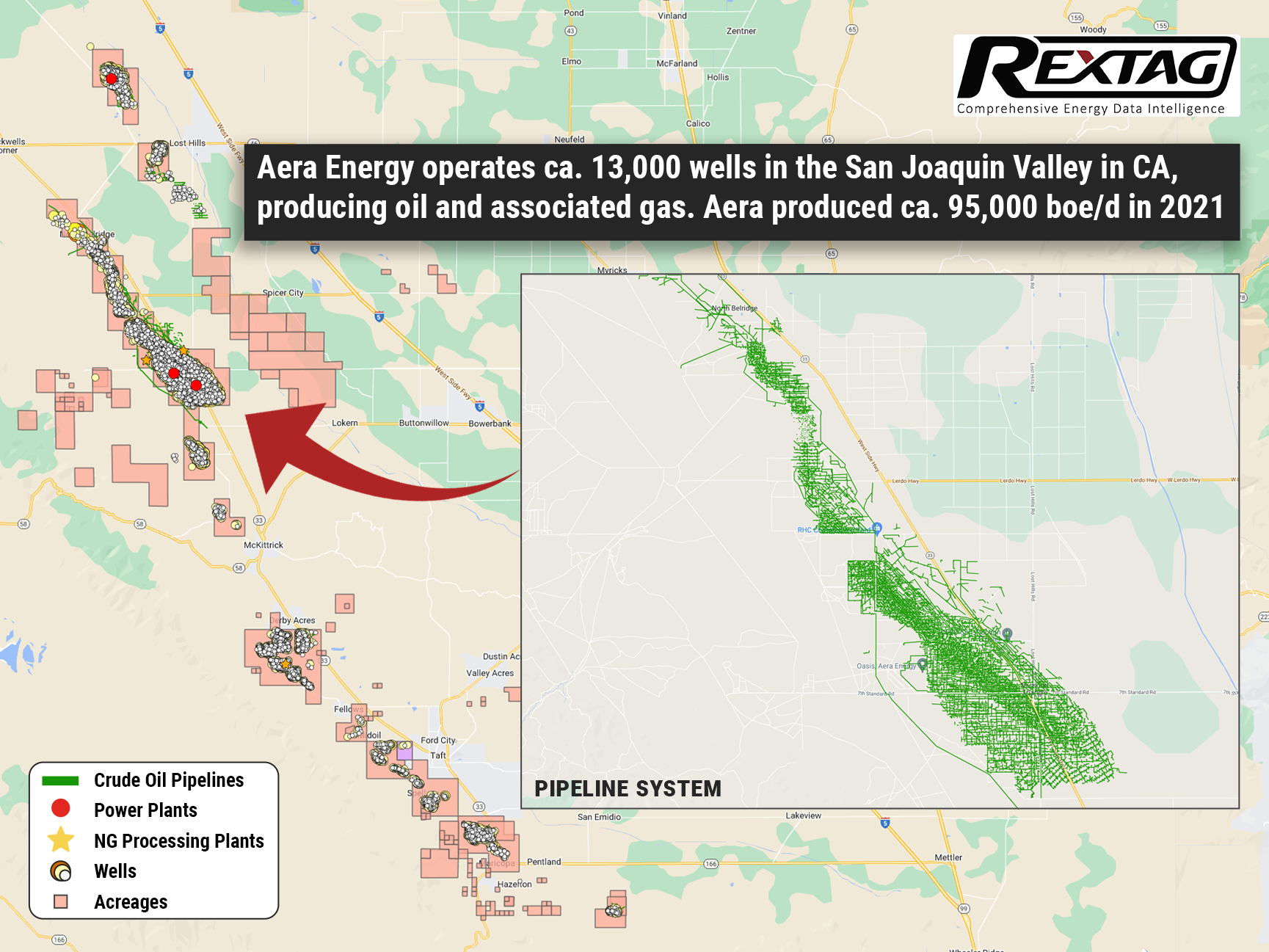

Aera Energy Sold to IKAV Exxon&Shell Divest of CA Crude Producer

California oil joint venture, Aera Energy, of Exxon Mobil Corp. and ShellPlc is being sold to German asset manager IKAV, according to the agreement of Sept. 1. Shell noted that the sale of its 51.8% membership interest in Aera Energy is for a total consideration of about $2 billion in cash with additional contingent payments based on future oil prices, subject to regulatory approval. However, the total transaction value was not disclosed. Being one of California’s largest oil and gas producers, Aera Energy accounts for nearly 25% of the state’s production. The sale by Exxon Mobil and Shell ends a 25-year-long partnership in California, meanwhile, it persists a streak of divestments of mature oil and gas properties by the two supermajors. Aera Energy LLC operates about 13,000 wells in the San Joaquin Valley in California, producing oil and associated gas. In 2021, Aera took out about 95,000 boe/d. Exxon Mobil’s interests in the Aera oil-production operation in California contained a 48.2% share of Aera Energy LLC and a 50% share of Aera Energy Services Co. held by Mobil California Exploration & Producing Co. Moreover, Exxon Mobil affiliates have signed a separate agreement for the sale of an associated loading facility and pipeline system. The sale effectively ends Shell’s upstream position in California. The company reported that the divestiture is valued to result in a post-tax impairment of $300 million to $400 million, subject to adjustments.

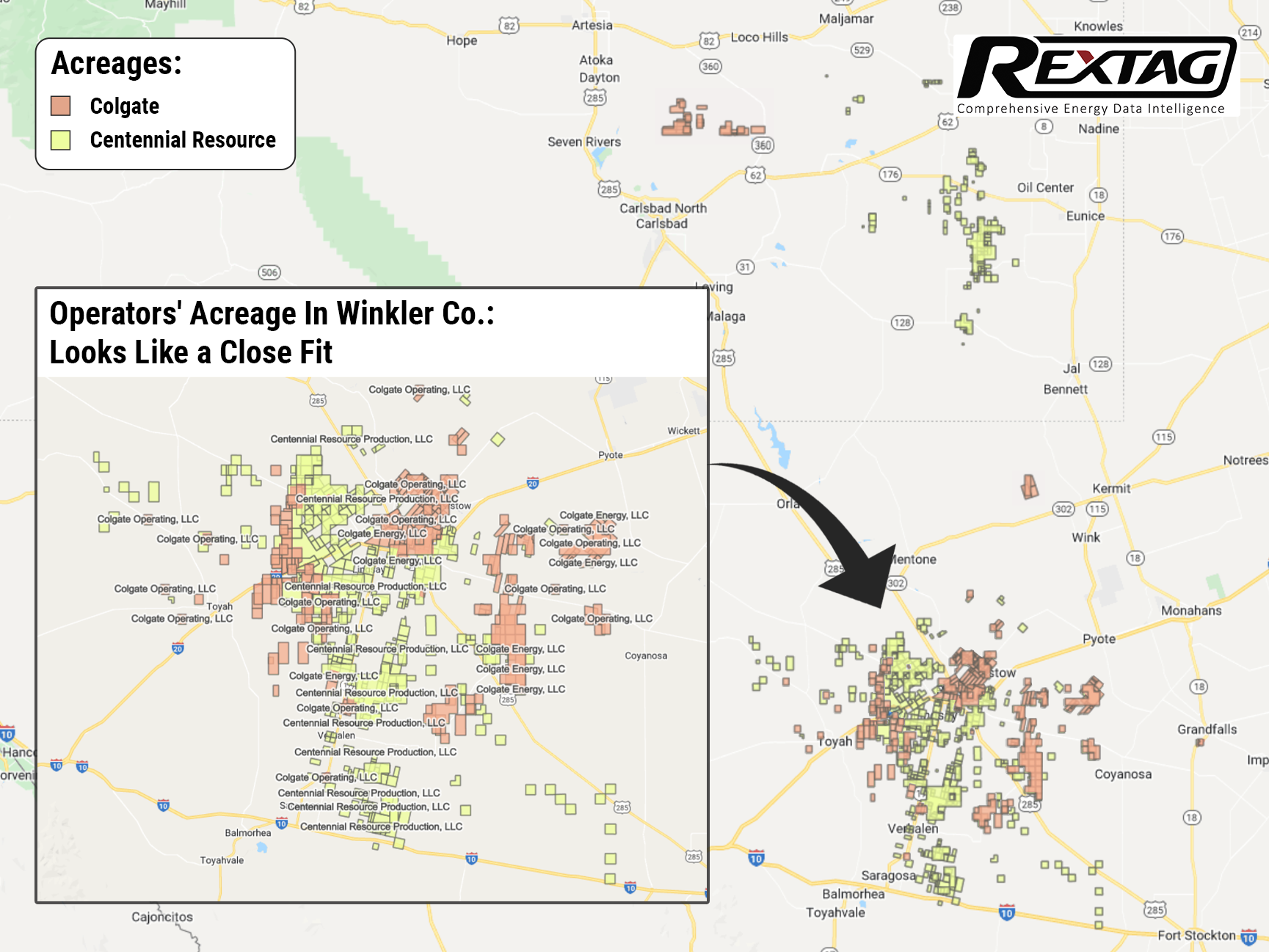

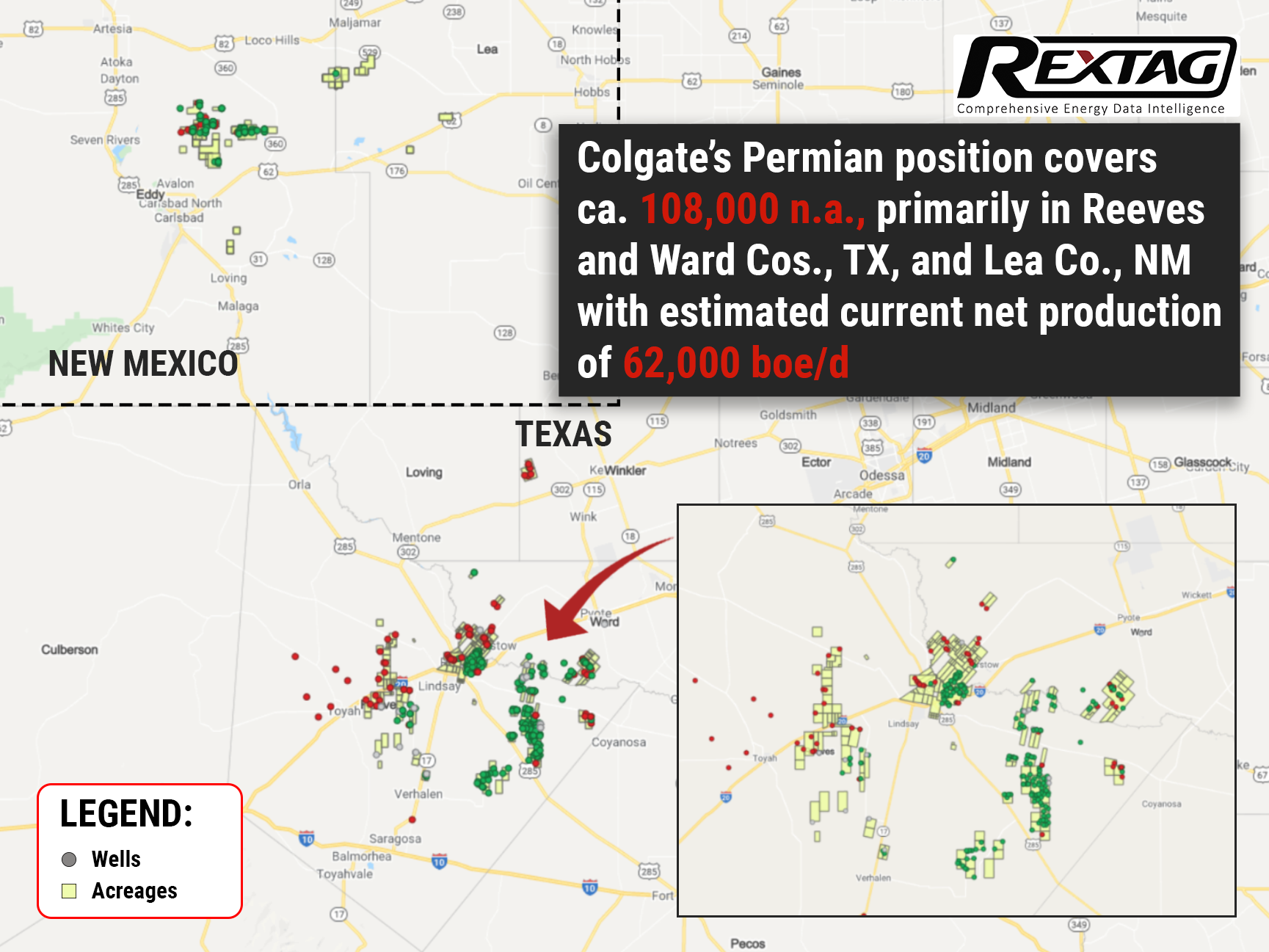

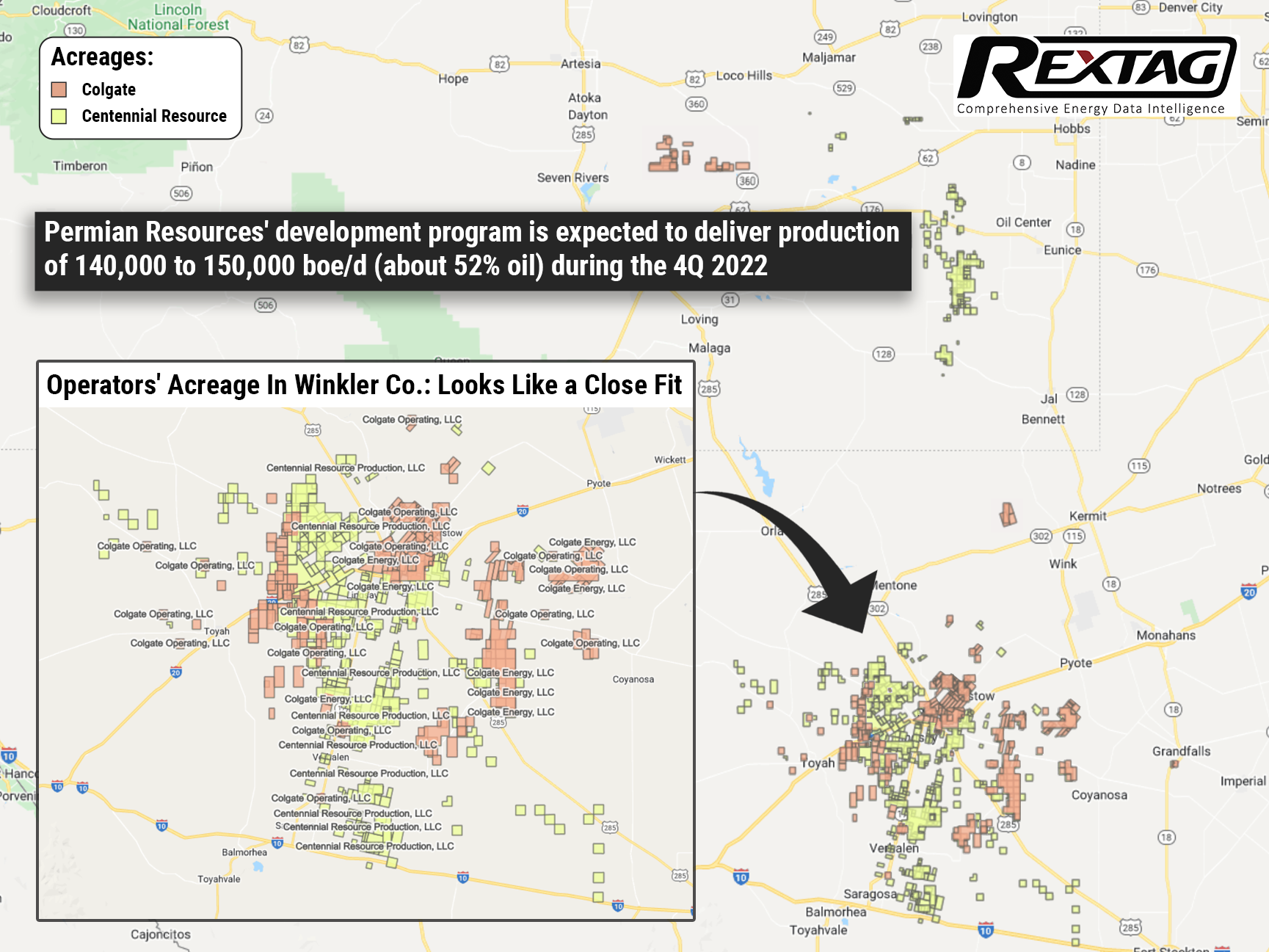

Centennial, Colgate Merger Is Completed on Sep.1

The completion of the merger between Centennial Resource Development Inc. and Colgate Energy Partners II LLC happened on Sept. 1, sealing the debut of Permian Resources Corp., which is considered the largest pure-play E&P company in the Delaware Basin. Permian Resources’ idea was to combine two successful E&P companies, creating a better, stronger, and more strategically compelling company. Centennial and Colgate announced an agreement to merge in May, denying rumors that Colgate, a privately held independent Midland-based company, had been seeking an IPO. The merger estimated Colgate at about $3.9 billion and consists of 269.3 million shares of Centennial stock, $525 million of cash, and the assumption of approximately $1.4 billion of Colgate’s outstanding net debt. Permian Resources, being the combined company, has a deep inventory of “high-quality” drilling locations on around 180,000 net acres the companies anticipate will provide more than $1 billion of free cash flow in 2023 at current strip prices, in accordance with the company release on Sept. 1.

The Deal between TC Energy and Mexican Utility is Concluded to Build $4.5 Billion Gas Pipeline

TC Energy Corp. had reached a deal with a Mexican state utility to build a $4.5 billion natural gas pipeline, according to a company release on Aug. 4. The natural gas to Mexico's central and southeast regions will be furnished by the 1.3 bcfd offshore Southeast Gateway Pipeline, the Canadian pipeline operator said. Due to the most serious trade spat with #Mexico over the United States-Mexico-Canada Agreement, Canada and the United States made the deal with Comisión Federalde Electricidad (CFE). TC Energy and CFE in conjunction with the alliance also took the final investment decision (FID) on the 715-km Southeast Gateway. The pipeline will serve southeast Mexico, starting onshore in Tuxpan, Veracruz, then proceeding offshore, making landfall at Coatzacoalcos, Veracruz, and Dos Bocas, Tabasco.

Certified Low Emissions Gas - Williams & PennEnergy Partner Together

Williams said on Aug. 8, that it concluded an agreement to support the selling and transportation of certified, low emissions next-gen natural gas from PennEnergyResources LLC. According to the deal, Williams will construct a marketing portfolio to market the natural gas to utilities, LNG export facilities, and other facilities which can efficiently use clean energy. Moreover, the agreement involves a certification process that verifies best practices are being followed to reduce emissions and produce natural gas in an environmentally responsible manner collaborating with an independent third party. The partnership with PennEnergy is a continuation of Williams' strategy to collect, market, and deliver low-carbon natural gas to the end user from the wellhead. PennEnergy’s 378 production wells in southwest Pennsylvania supply the US with natural gas and they have achieved Platinum status from Project Canary’s TrustWell certification.

Earthstone Expands Due to Acquisition of Titus’ Delaware

Earthstone Energy Inc., based in Texas, announced the transaction on June 28: the acquisition of Titus Oil&Gas which will raise production in the Delaware Basin by 26%. The $627 million acquisition fills the Permian Basin in Eddy and Lea counties, N.M. with 86 net locations on 7,900 net acres of leasehold, while it is not clear how much of the leasehold might be on federal acreage It is Earthstone’s seventh acquisition since 2021, a span that includes the closing of approximately $1.89 billion in acquisitions in the Permian Basin. The purchase of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, is estimated at $575 million in cash and it is the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price). Titus shared that its net production in June was 31,800 boe/d. The company had reserves of approximately 28.9 MMboe. Earthstone is sure its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

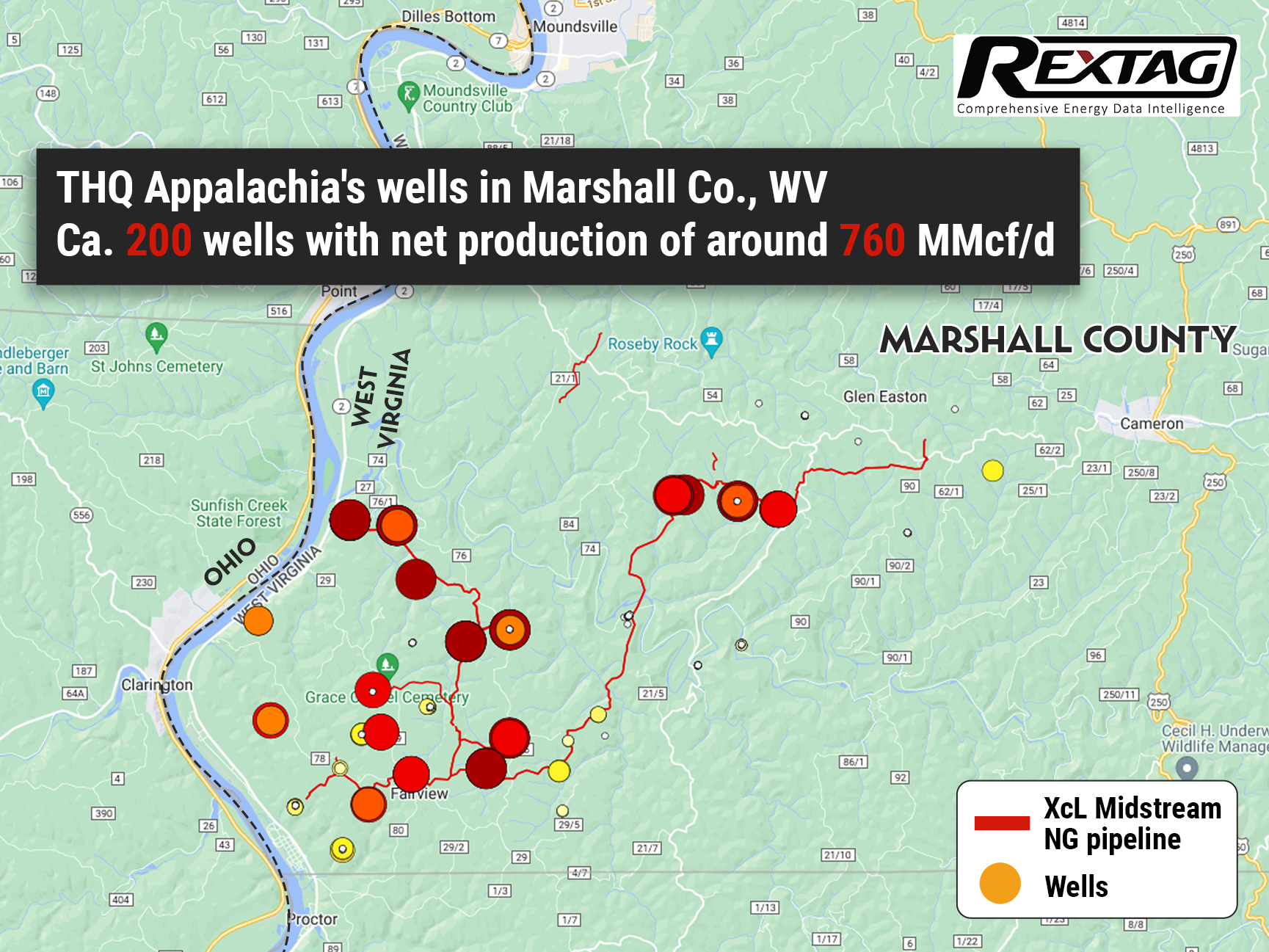

Potential Deal for $5 Billion: Tug Hill and Quantum Energy Seek Sale

Undisclosed industry sources said that THQ Appalachia I LLC (Tug Hill and Quantum Energy) is seeking a sale of the U.S. natural gas producer for more than $5 billion, including debt. Mainly operating in the Marshall and Wetzel counties in West Virginia, THQ Appalachia has net production of around 760 MMcf/d. Despite volatility in commodity markets which has made the valuation of energy producers tougher, THQ Appalachia is anticipating more than $5 billion due to the worth of its existing production and the possible value of its undeveloped acreage, the sources said on June 17. Additionally to purchasing THQ Appalachia, possible bidders in the sale process also have the opportunity to buy XcL Midstream, the pipeline firm that moves the company’s gas to market and has the same CEO as in Tug Hill. If the same buyer chooses to purchase XcL, the deal consideration will increase further. However, the anonymous sources admitted that the sale depends on the market conditions and is not guaranteed since Tug Hill and Quantum could ultimately decide to retain some or all of THQ Appalachia and XcL’s assets. Tug Hill and Quantum refused to comment on these statements and XcL did not respond to a comment request.

Cheniere’s LNG Is on the Next Level Due to Corpus Christi Expansion FID

According to CheniereEnergy’s board of directors announcement on June 22, the company declared the further expansion of its CorpusChristi, Texas. Moreover, the LNG plant could come sooner than expected due to the announcement of a final investments decision (FID) related to Stage 3 Liquefaction Project work at the export facility. It will ensure the capacity to ship 10-plus million tonnes per annum (mtpa) from 7 midscale trains. Furthermore, TudorPickering, Holt & Co. (#TPH) declared on June 23, that the possible ultimate capacity of the facility could be in the 11-12 mtpa range given 10.7 mtpa of long-term contracts have been signed with companies such as CPC, PGNiG, Sinochem, Foran, ENGIE, Apache, EOG and ARX CN. Additionally, Cheniere announced two sale and purchase agreements (SPAs) with #ChevronCorp.: Firstly, Chevron will obtain 1 mtpa of LNG from Sabine Pass Liquefaction LLC with deliveries considered to start in 2026. Deliveries will reach full capacity in 2027 and expire in mid-2042. Secondly, Chevron will obtain 1 mtpa of LNG from Cheniere Marketing LLC with deliveries considered to start in 2027 and continue for about 15 years. The purchase price for the LNG under both SPAs will be indexed to the Henry Hub price, plus a fixed liquefaction fee as Cheniere claimed. Since the expansion will have been completed, Cheniere’s aggregate nominal production capacity will be increased to more than 55 mtpa by the end of 2025 compared to 45 mtpa now. It will become a part of the industry-wide decarbonization movement away from coal and oil as this allows Cheniere to provide the global market with additional low-carbon fuels. First exports from the facility are anticipated in 2025.

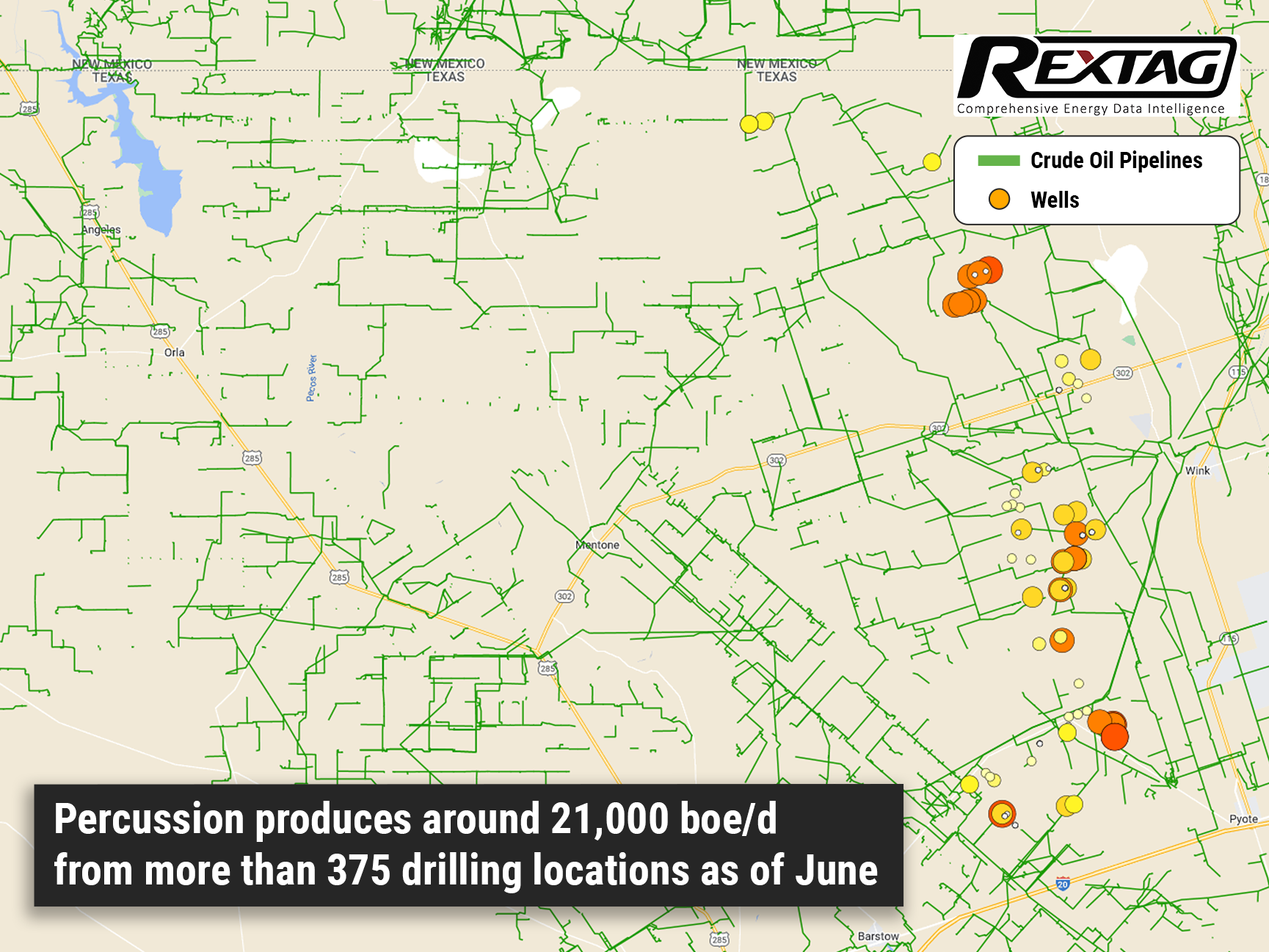

Up to $1.5 Billion for Percussion Petroleum in the Permian Basin

Around 25,000 net acres in the Permian are being sold by Percussion Petroleum II, looking to fetch up to $1.5 billion, as some sources bet on rising oil prices to pocket more than double what it paid in 2021. The company spent $375 million plus contingent payments a year ago to buy the bulk of its assets in one of the most prolific crude-producing areas in the U.S. from Oasis PetroleumInc. The oil prices increased to triple digits and buyers wanted to gain a toehold in the basin, whereas backers of private shale companies such as Percussion use it as a chance to exit their investments with big profits. Remarkably, U.S. crude oil futures have grown about 50% to approximately $109/bbl since June 29, 2021, when Percussion closed its deal with Oasis.

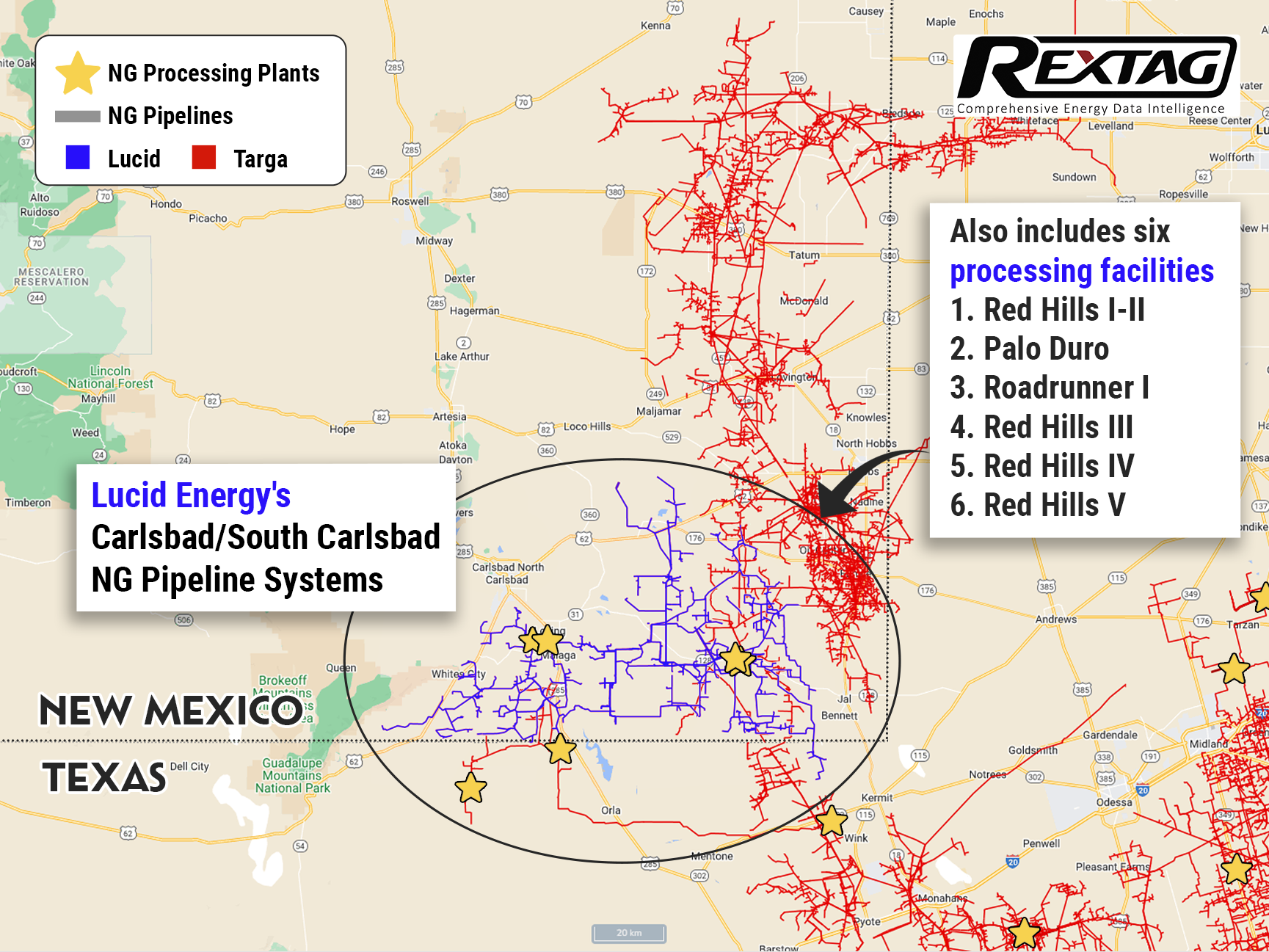

Targa Resources: $3.55 Billion Cash Transaction to Acquire Lucid Energy

On June 16 Targa Resources Corp. decided to acquire Lucid Energy Group, located in the Permian Basin, which is a part of Riverstone Holdings LLC and Goldman Sachs Asset Management. Firstly, Targa enlarged due to the recent “blot-on” acquisition of Southcross Energy in the Eagle Ford for $200 million and it will become bigger thanks to the $3.55 billion cash transaction. Targa’s financial position allowed it to utilize convenient opportunities to extend its company so it bought #Lucid using available cash and debt with an estimated pro forma year-end 2022 leverage around 3.5 times. According to Targa’s estimates, the acquisition of Lucid will increase the number of natural gas pipelines by 1,050 miles and add about 1.4 Bcf/d of cryogenic natural gas processing capacity in service or under construction located mainly in Eddy and Lea counties of New Mexico. The investment-grade producers source approximately 70% of current system volumes. According to the press release, a full-year standalone adjusted EBITDA is expected to be between $2.675 billion and $2.775 billion and reported year-end leverage ratio of about 2.7 times. Targa’s updated financial expectations assume NGL composite prices average $1.05 per gallon, crude oil prices average $100/bbl, and Waha natural gas prices average $6 per MMBtu for the remainder of 2022.

Co-Location Energy Infrastructure Analysis at Your Fingertips

Your team’s ESG performance can be greatly improved applying the asset co-location analysis within upstream or midstream use cases. This has been a topic for a discussion at Rextag’s ‘Is ESG Improvement Next Door?’ webinar. We reviewed some cases like curbing gas flaring or renewable energy sourcing to power the fossil fuel infrastructure. Many combinations are available with access to the data Rextag provides on wells, acreages, power lines, substations, and such renewable infrastructure as wind turbines, methane landfills, etc.

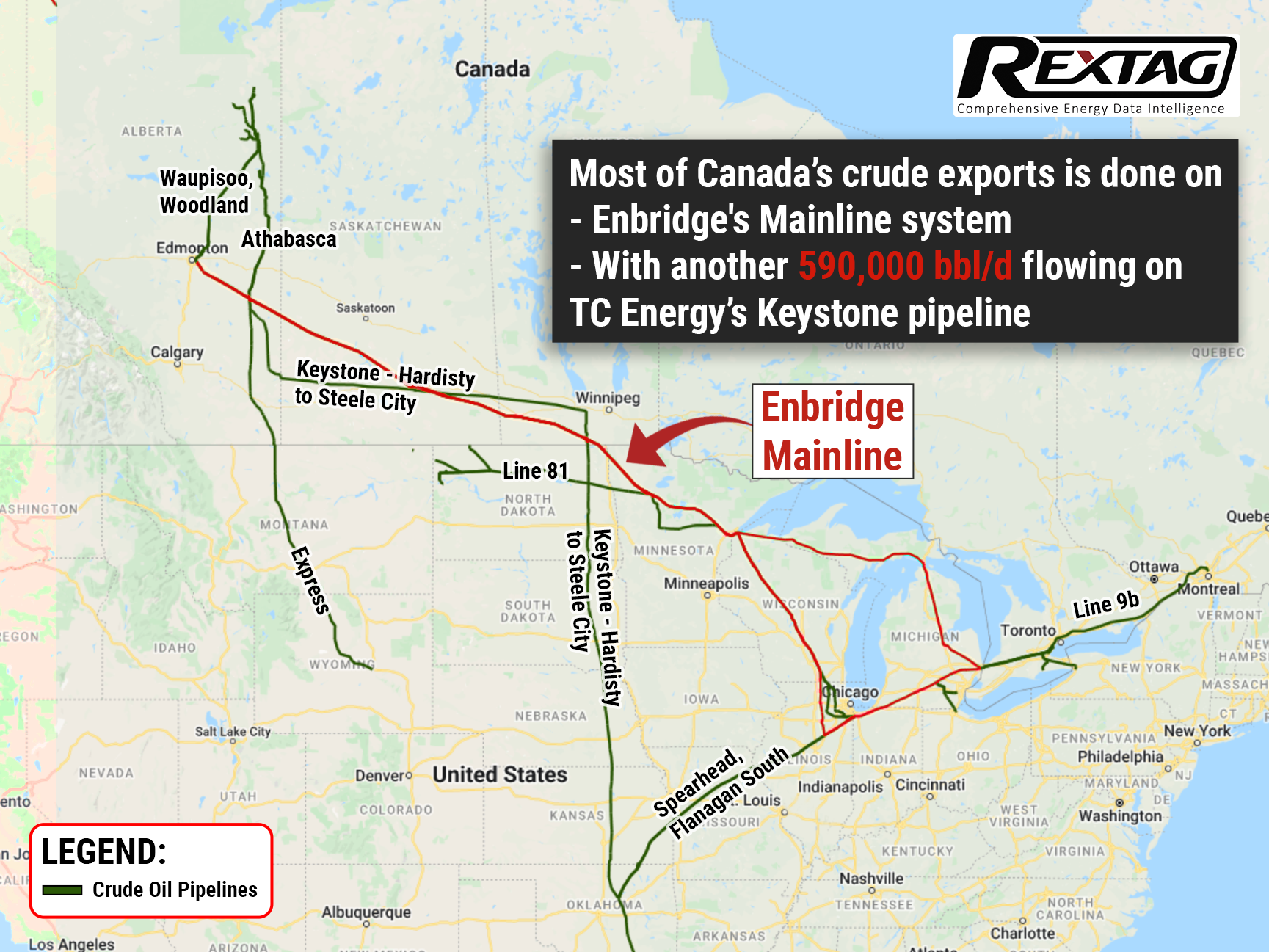

Inconvenient Time for Canadian Crude: US Gulf Coast Is Glutted

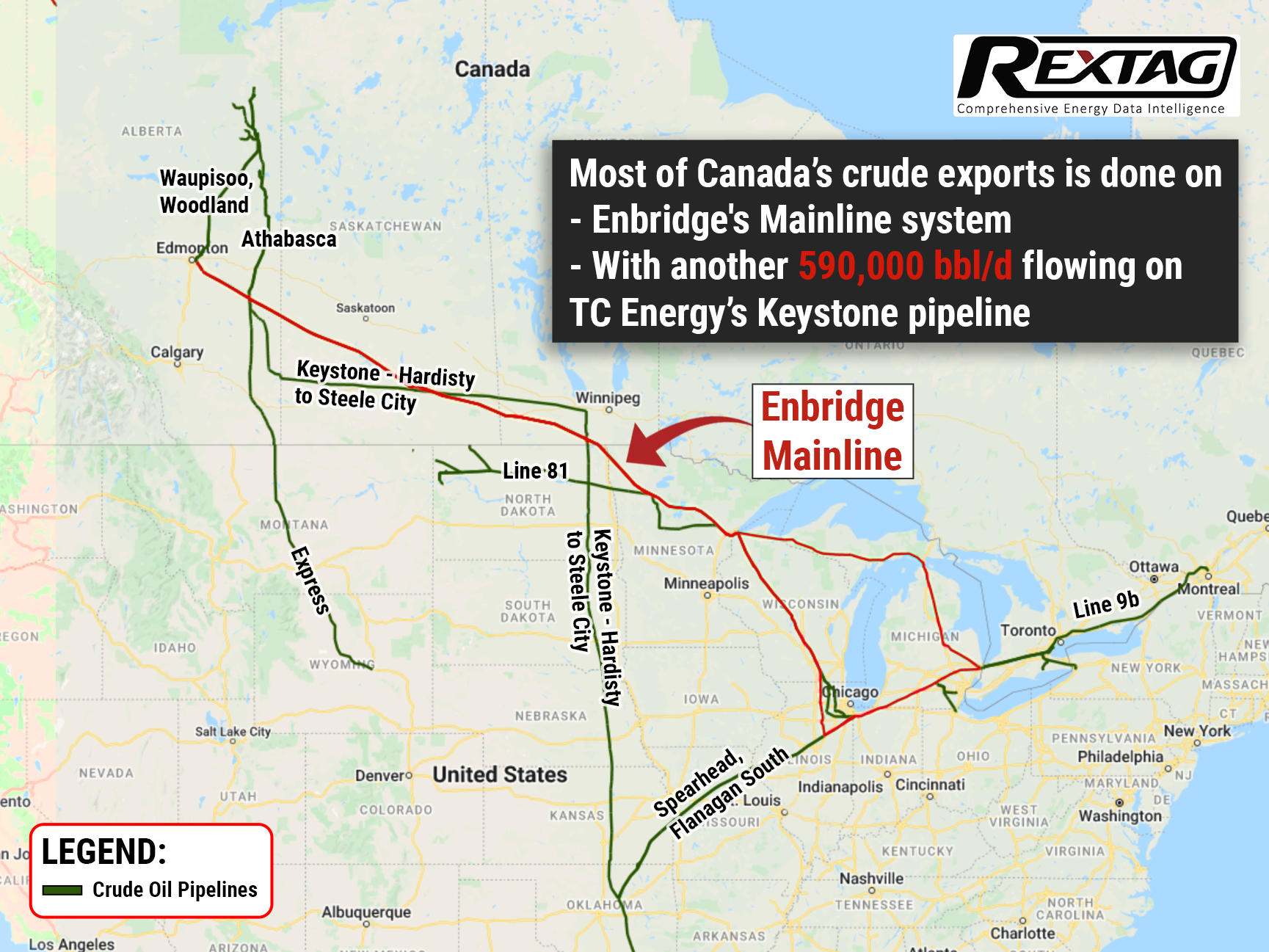

Canadian heavy crude, being deeply discounted for several years due to a lack of pipelines, is eventually trading like a “North American” grade, moving in tandem with U.S. sour crudes sold on the GulfCoast thanks to Enbridge’s expansion of its 3 pipeline late last year. Meanwhile, the Gulf is full of sour crude over Washington’s largest-ever release from the Strategic Petroleum Reserve (SPR) that will amount to 180 MMbbl during six months, trying to tame exorbitant fuel prices after the Russian invasion of Ukraine. The market is flooded with millions of barrels of sour crude from storage caverns in Louisiana and Texas. At the world’s biggest heavy crude refining center, U.S. Gulf Coast, heavy grades like Mars and Poseidon are languishing. According to U.S. Energy Information Administration (EIA) data, Canada exports around 4.3 MMbbl/d to the United States, whereas until last year demand to ship crude on export pipelines increased capacity, leaving barrels bottlenecked in Hardisty.

New Player In Lake Charles LNG Project: China Gas’ First Long-Term Agreement with Energy Transfer

On June 5 China Gas Hongda Energy Trading Co. Ltd. has made an LNG sale and purchase agreement (SPA) with Energy Transfer LNG Export, LLC concerning its Lake Charles LNG project. In the course of the 25-year contract, Energy Transfer LNG will provide 0.7 million tonnes per annum (mtpa) of LNG to China Gas on a free-on-board basis. The purchase price is indexed to the Henry Hub benchmark plus a fixed liquefaction charge, with first deliveries expected as early as 2026. Being a premier natural Chinese gas distribution company, China Gas enchants Energy Transfer LNG to sign the 25-year LNG offtake agreement. From the direction of ChinaGas, it will be a significant step along the way to realizing China’s carbon peaking and carbon neutrality goals as it is their first long-term agreement.

$7 Billion Merger of Colgate and Centennial, the 2 Largest Permian Operators

Despite the circulating rumors concerning Colgate’s attempt to launch an IPO, on May 19 the company decided to combine with Centennial Resource Development Inc. This merger of equals is estimated at $7 billion and will found the biggest pure-play E&P company in the Delaware Basin of the Permian. The transformative combination essentially enlarges companies’ potential and hastens the growth across all financial and operating metrics. According to Centennial CEO Sean Smith, the combined company is anticipated to furnish shareholders with quickened capital return program due to a fixed dividend coupled with a share repurchase plan. Due to a recent report, the merger would increase production 7%, to 145,000 boe/d by the fourth quarter would further ratchet up next year. By third-quarter 2023, the company predicted 160,000 boe/d based on a drilling program of 140 wells per year. Colgate Energy was reported to be getting an IPO last December that sources said would value the company at approximately $4 billion. The combined company will have over 15-years of drilling inventory, assuming its current drilling pace, the companies will produce over $1 billion of free cash flow in 2023 at current strip prices.

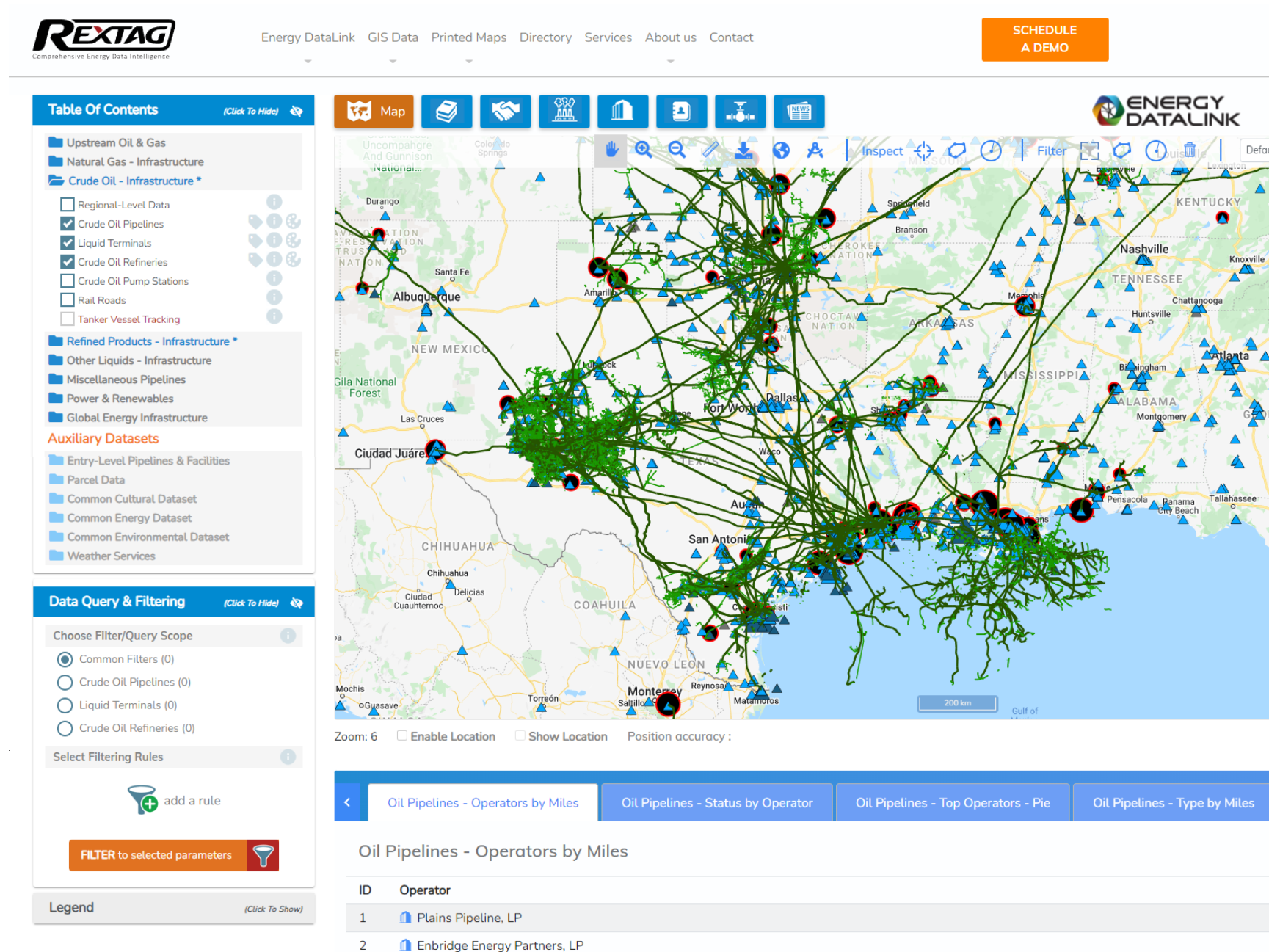

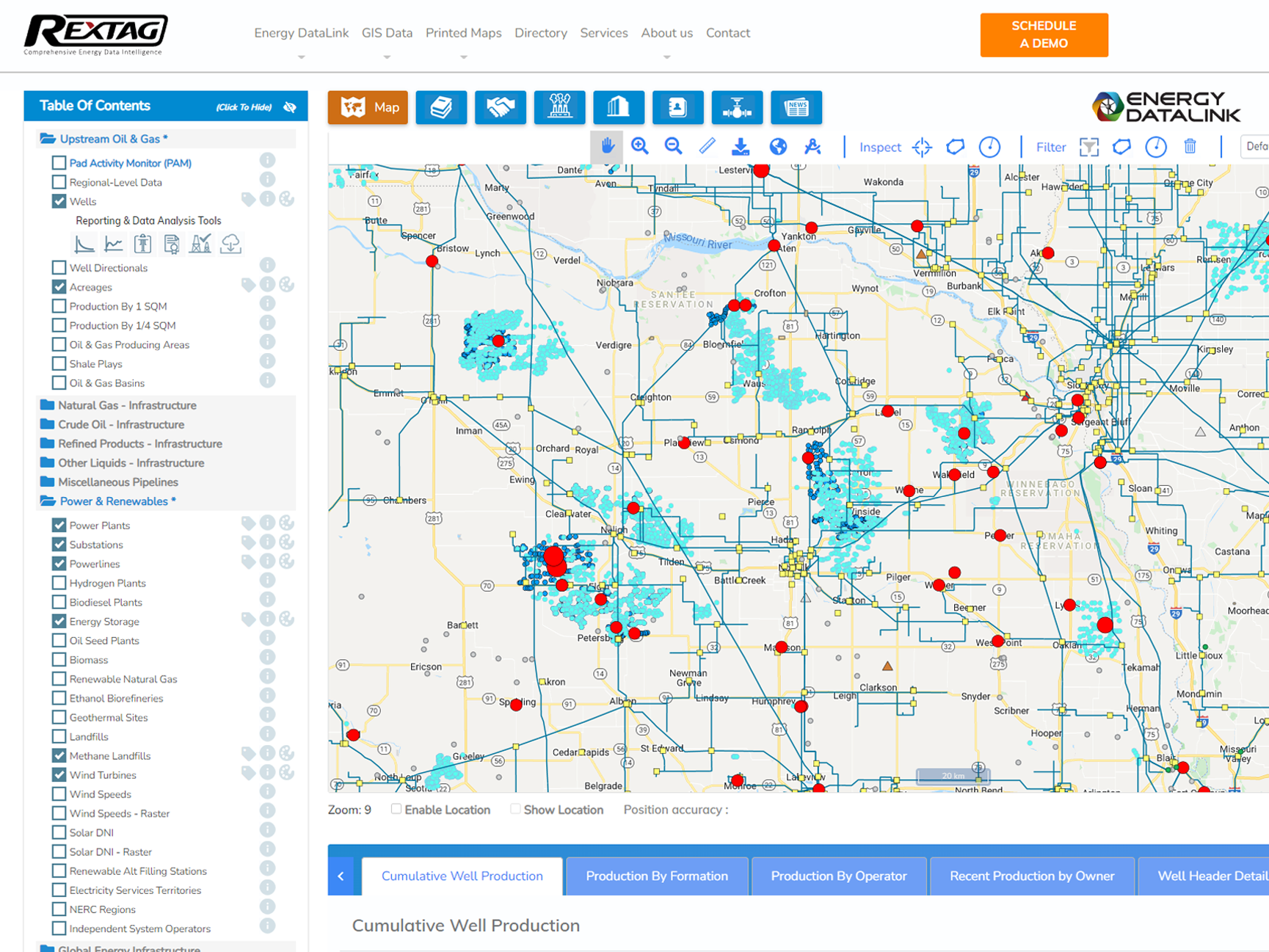

Get Your Energy Data Research Done

Below is our webinar review of what Rextag is. Being a division of Hart Energy, Rextag is aimed at providing data services. You should be already familiar with Hart Energy conferences and publications about oil and gas basins, etc. What we want to show are the use cases of our clients, what our product is, how it is used, what data services are there, and some of the key scenarios, that our customers shared with us. We licence the data by datasets (the ones you see on the left pane within the Energy DataLink application. Our customers can licence access to the data based on the folders (or modules) here. e.g. Upstream oil and gas, and other modules below. So if you are an operator who works on Upstream or Midstream assets or you are interested in them you would licence both the Upstream dataset and respective midstream datasets. They are delivered to the customers in different ways. If you are familiar with GIS databases or SQL you can consume the data in those forms or set up web services connection to your cloud database. If you do not need to save the raw data on your computer, you can access our web application that you now see in the video. If you are a software developer or a product developer within your organisation you can use this information via API access to embed it inside your application. Also, we licence the data for an unlimited number of users for this application.

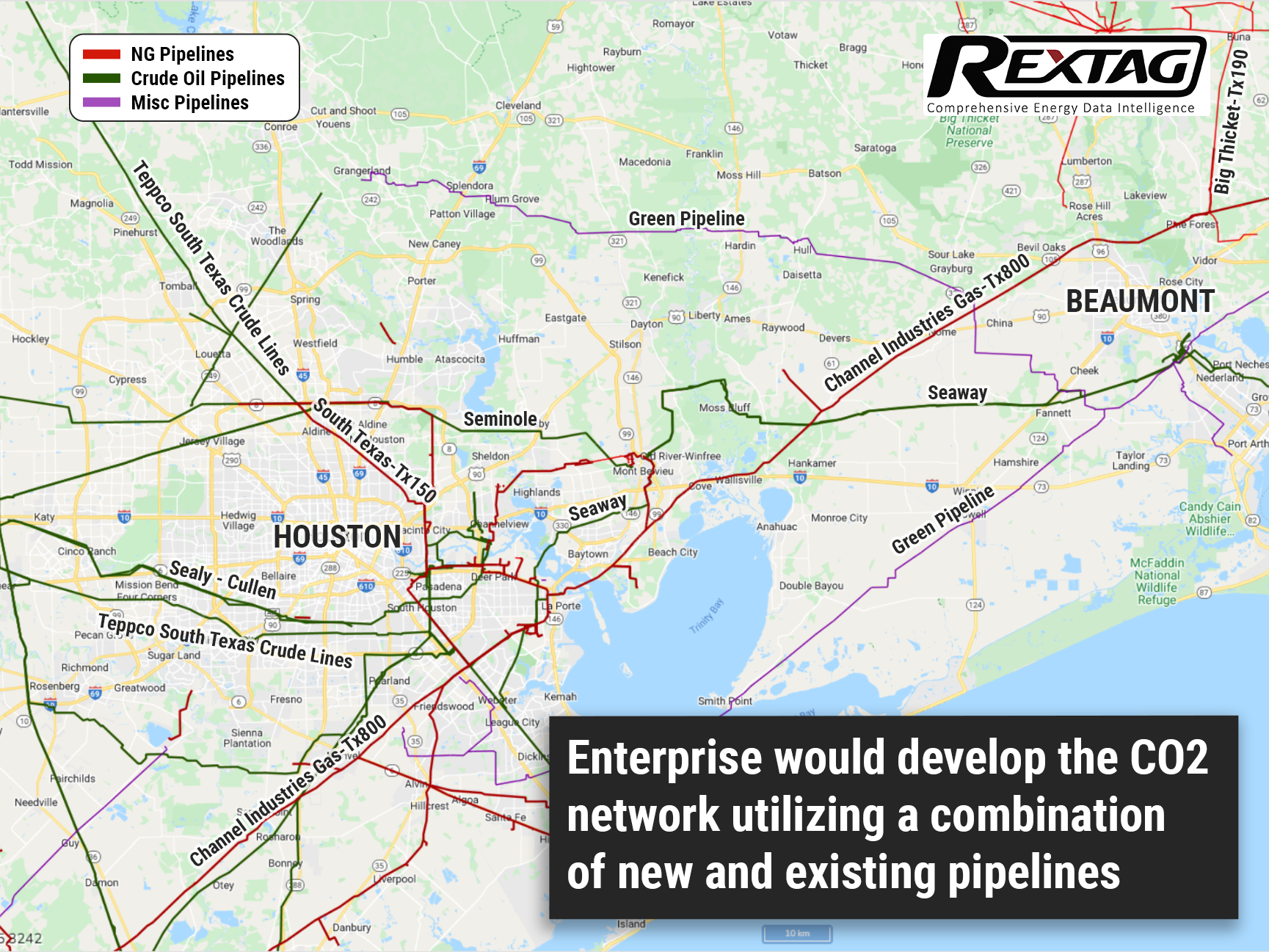

Enterprise, Oxy Low Carbon Ventures Will Join Efforts on Houston Area CO2 Project

Oxy Low Carbon Ventures and Enterprise Products Operating will partner in order to provide services to carbon emitters from Houston to Port Arthur, Texas, due to the development of CO2 transportation and sequestration. Enterprise would develop the CO2 aggregation and transportation network utilizing a combination of new and existing pipelines along with its expansive Gulf Coast footprint. The partnership’s assets include more than 50,000 miles of pipelines; over 260 million barrels of storage capacity for NGLs, crude oil, refined products and petrochemicals; and 14 billion cubic feet of natural gas storage capacity.

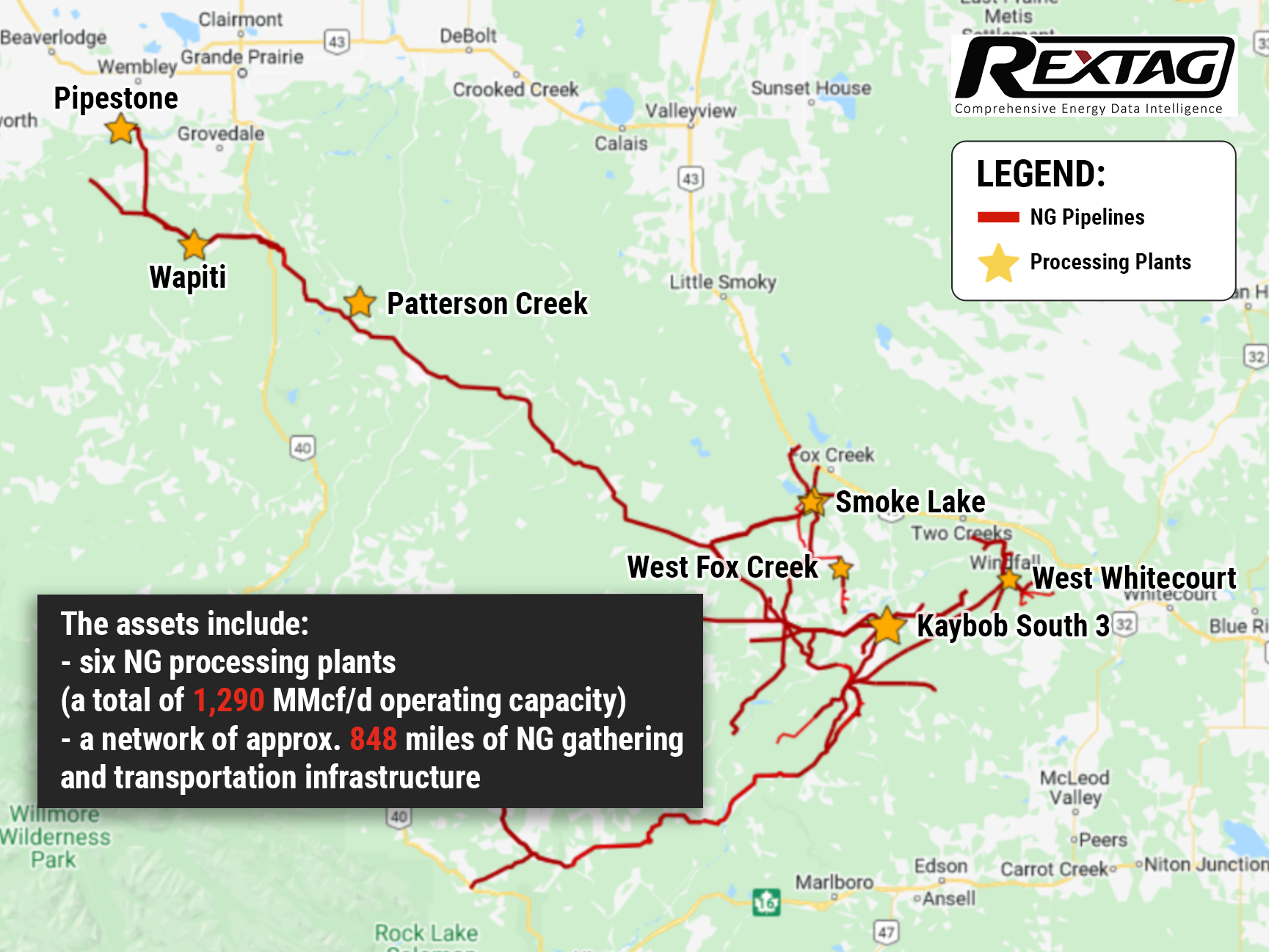

Canadian Assets on Sale: Energy Transfer Sells Gas Processing Bussines to Pembina-KKR for $1.3 Billion

Under the agreement, Energy Transfer will sell its 51% interest in Energy Transfer Canada to the Pembina-KKR joint venture, for more than CA$1.6 billion (US$1.3 billion) including debt and preferred equity. KKR's funds already own the remaining stake. TC’s assets include 6 natural gas processing plants with a combined operating capacity of 1.29 Bcf/d and an 848-mile naturalgas gathering and transportation network in the Western Canadian Sedimentary (WCS) basin. While this process is underway, Pembina and KKR will combine their Western Canadian natural gas processing assets into a single, new joint venture entity — Newco, owned 60% by Pembina and 40% by KKR. This new entity is expected to have a natural gas processing capacity of about 5 Bcf/d or about 16% of Western Canada’s total processing capacity.

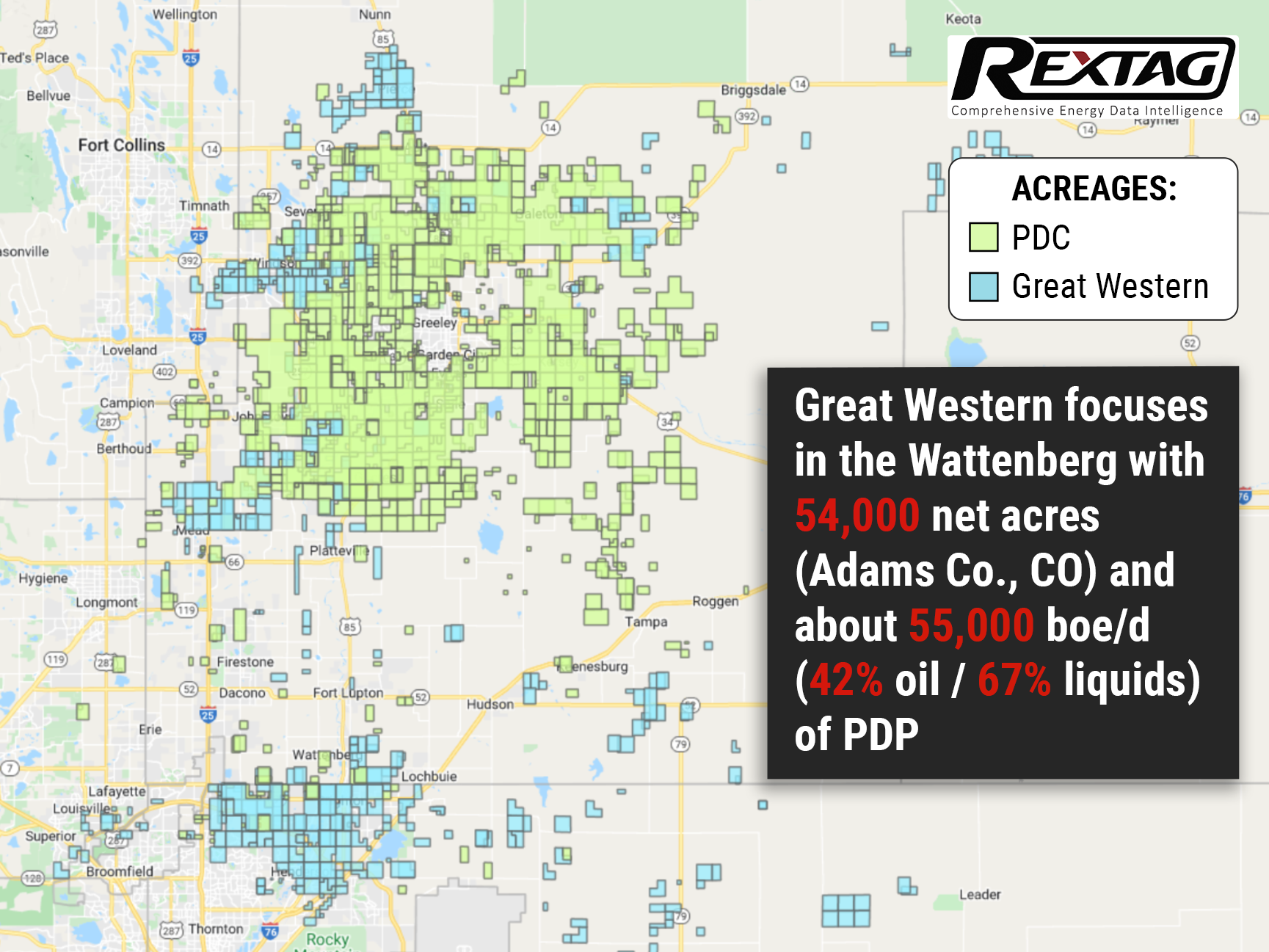

All Eyes Are on the Rocky Mountains State, as PDC Acquires Great Western for $1.3B

Great Western Petroleum's assets will be acquired by PDC Energy for $1.3 billion. Via this deal, PDC Energy’s position in the D-J basin increases roughly to 230,000 net acres. Denver-based Great Western has core operations in Weld and Adams counties in Colorado with 54,000 net acres and about 55,000 boe/d (42% oil / 67% liquids) of PDP. As part of the agreement, the acquisition will be financed by issuing 4 million shares of common stock to existing Great Western shareholders and by providing $543 million in cash to the company. All in all, PDC expects to increase its total production by 25% and its oil production by 35% as a result of the deal. The deal should also result in some synergies including a 15% reduction in overall cost per BOE.

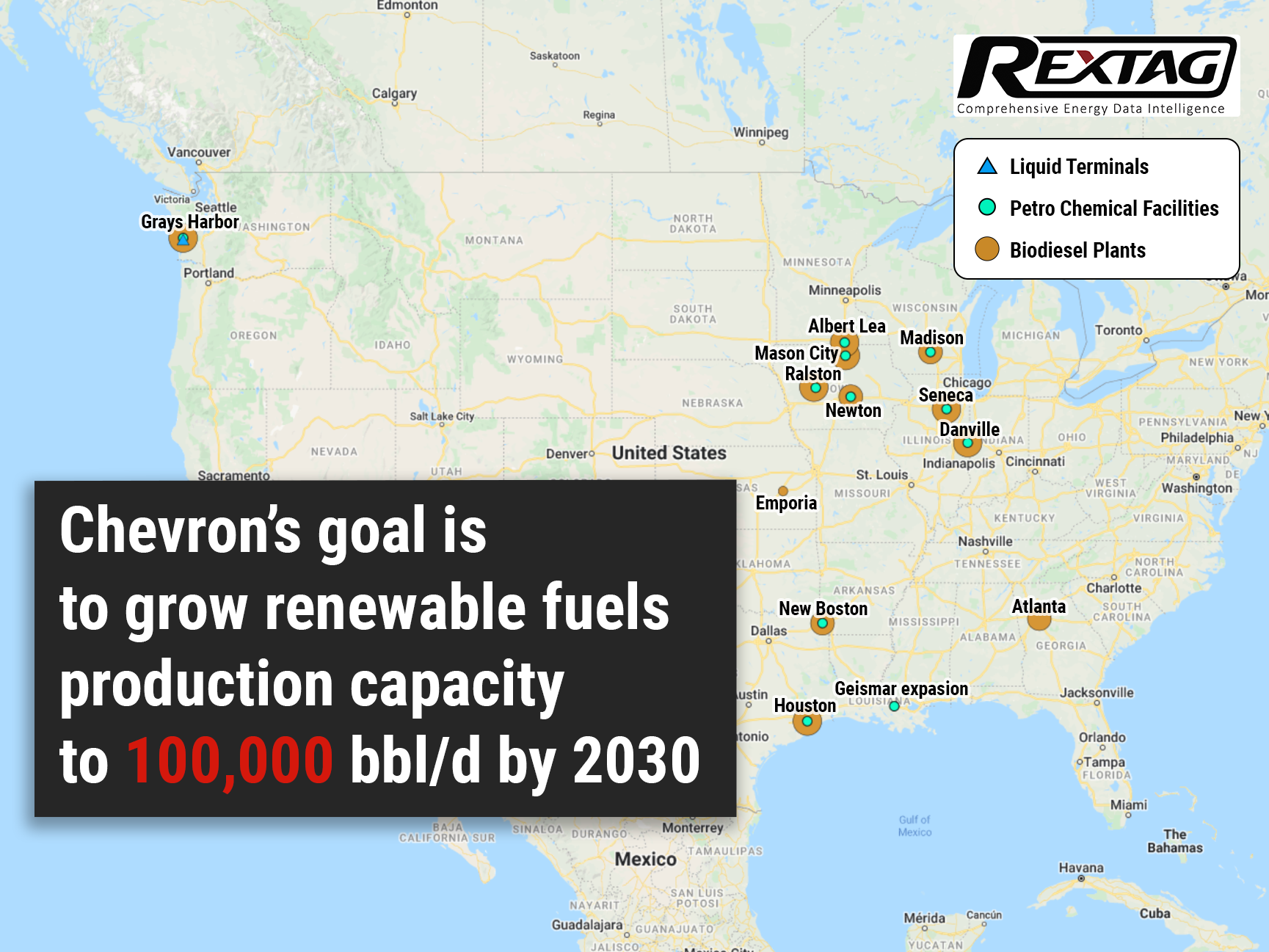

All-in: Chevron Invests $3 Billion in Alternative Fuels

With the purchase of Renewable Energy Group Inc. for $3.15 billion, Chevron makes its largest investment in alternativefuels. This turn in investments highlights the shift in the world’s attitude toward climatechange. Since oil companies contribute heavily to global #emissions, governments and investors are increasingly urging them to reduce their #carbonfootprints and join the fight against emissions. As state and federal subsidies to decarbonize fuels increase, U.S. refineries have likewise increased the production of renewable diesel. In line with this, by 2050, Chevron aims to cut gas emissions to zero.

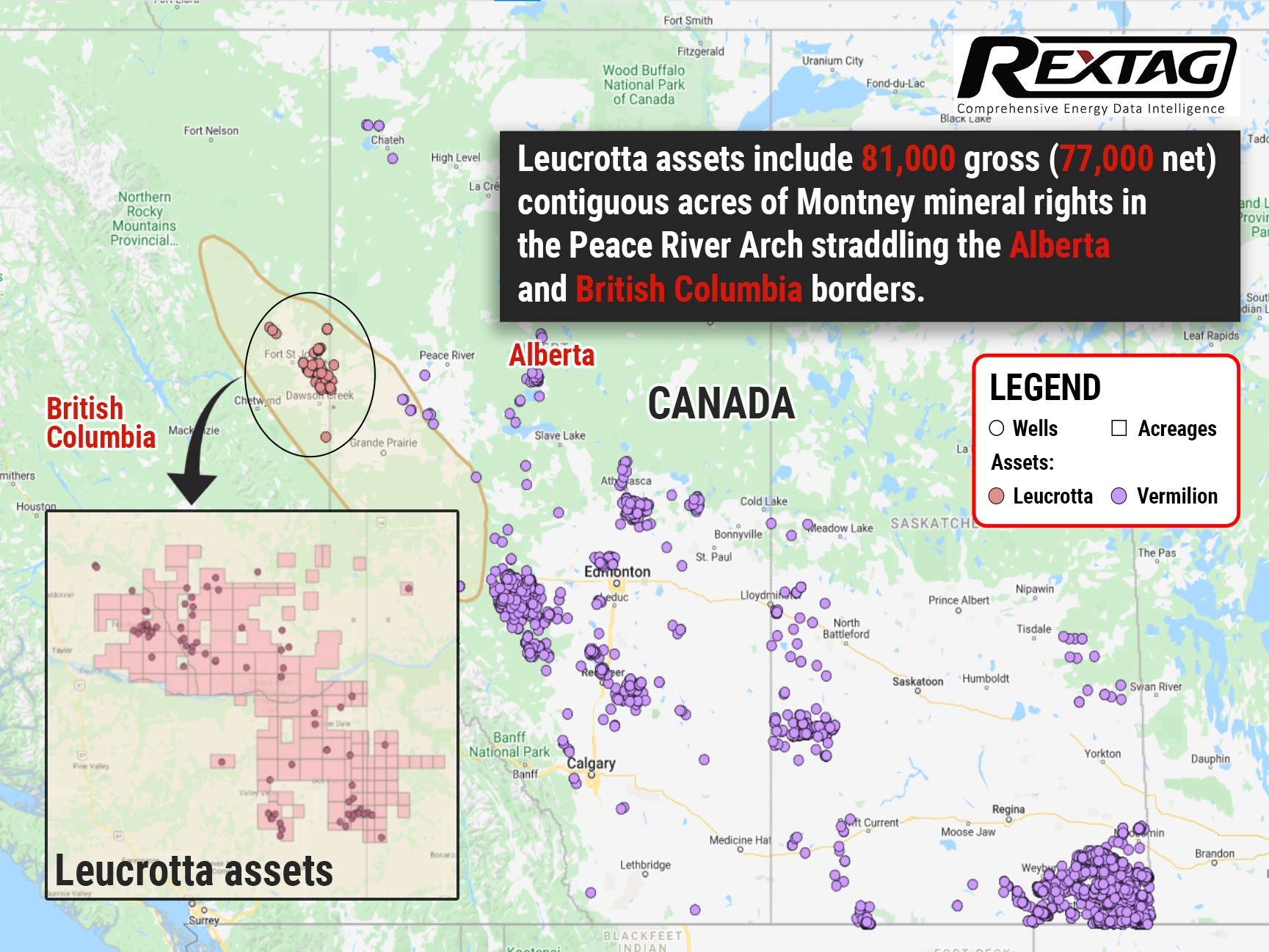

Decades of free inventory from one deal: Vermilion Energy buys Leucrotta Exploration for $477 million

As part of its effort to expand its Montney Shale play, Vermilion Energy Inc. recently acquired Leucrotta Exploration Inc. for a net cash purchase price of CA$477 million. Vermilion has identified 275 high-quality, high-return, low-risk multi-zone drilling prospects. Top management believes, these prospects represent 20 or more years of low-risk, self-funding, high-deliverability shale drilling. Assuming the anticipated May closing date, Vermilion is increasing its capital budget for E&D in 2022 to $500 million and increasing guidance for production from 86,000 to 88,000 boe/d to take into account the Leucrotta acquisition.

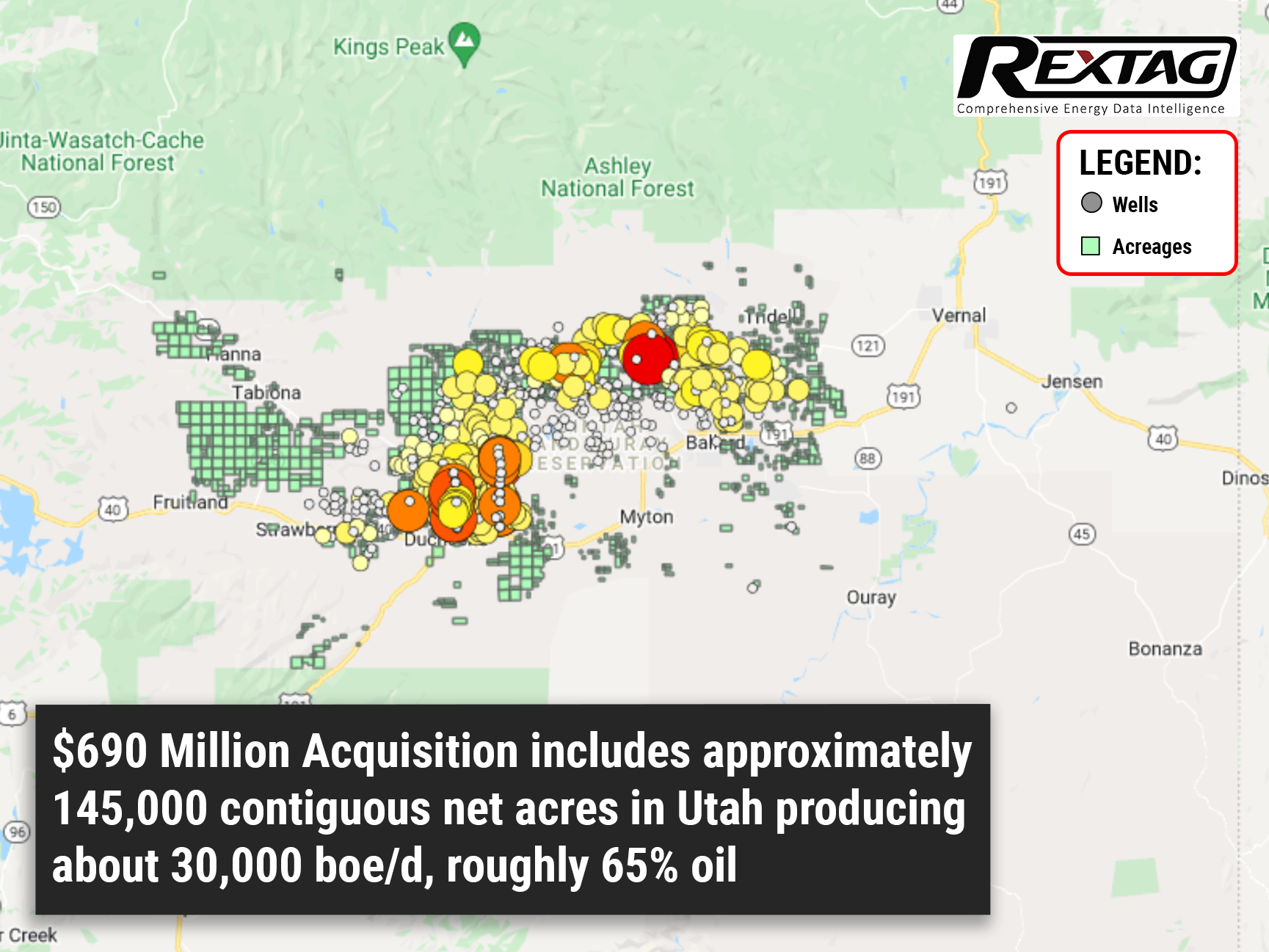

$690 Million Deal Moves Ahead: Crescent Energy to Complete Purchase of EP Energy's Uinta Assets

Crescent Energy closed the acquisition of Uinta Basin assets in Utah that were previously owned by EP Energy for $690 million, a few hundred million dollars below the original price. The accretive deal increases Crescent's Rockies position and adds significant cash flow and a portfolio of high-quality oil-weighted undeveloped sites. In addition to its acquired Uinta assets, Crescent's pro forma year-end 2021 provided reserves totaled 598 million boe, of which 83% was developed, 55% was liquid, and its provided PV-10 was $6.2 billion.

To Be or Not To Be: Bakken Assets Could Fetch $5 Billion for Exxon Mobil

Exxon Mobil Corp. is weighing prospects of selling its assets in North Dakota’s Bakken, after gauging interest from potential buyers — 5 billion is the issue price, at least according to rumors. The price point came about after the news that the oilgiant is in the final round of hiring bankers to help launch the sale. Yet Exxon Mobil itself stays tight-lipped regarding the situation.

As Countries Shun Russian Crude, Canada Plans to Boost Its Oil Exports

Canada is looking at ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its reliance on Russian oil At the moment, oil exports from Canada to the U.S. are approximately 4 million barrels of oil per day, with a portion reexported to other countries. At the end of 2021 Canadian oil companies exported a record amount of crude from the U.S. Gulf Coast, mostly to big importers India, China, and South Korea. And this will only increase in the future.

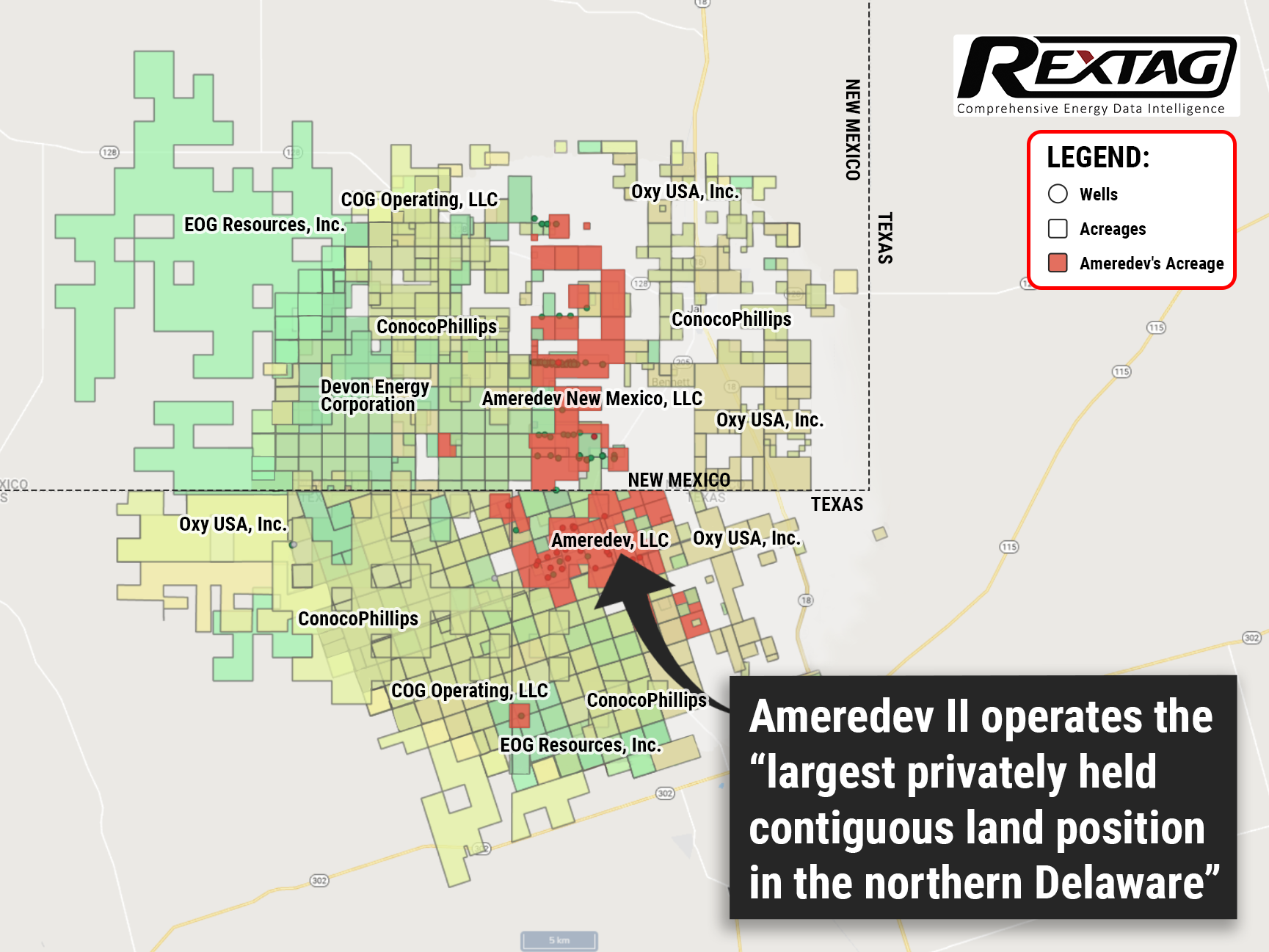

Major: Ameredev II Oil Producer to be Sold for $4 Billion by EnCap

In light of the conflict in Ukraine, buyout firms are currently scurrying to make cash from the U.S. crudeprices reaching their highest level since 2008. And one of the largest privately-owned US-based oilproducers may be up for sale. EnCap Investments looks to sell its portfolio company Ameredev II for over $4 billion including debt. It’s important to note, however, that both EnCap and Ameredev II alike are staying tight-lipped on the matter.

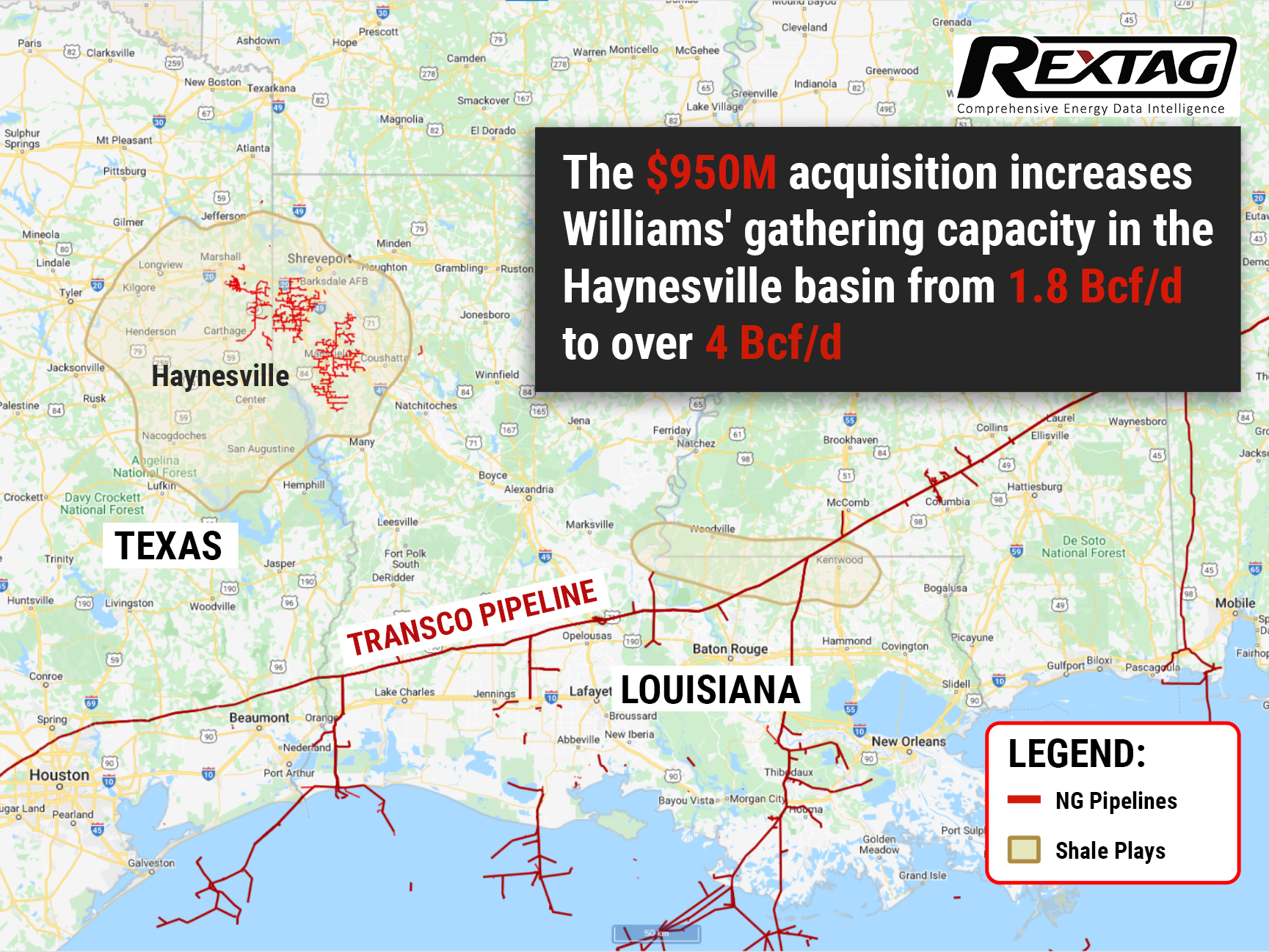

$1B Deal: Williams Buys Out Houston-based Midstream in Haynesville Basin

By purchasing the gathering and processing assets of Trace Midstream, Williams' existing footprint gains expanded capacity in one of the nation's largest growth basins, bringing its Haynesville gathering capacity to over 4 Bcf/d — increasing more than 200% from 1.8 Bcf/d. The deal also includes a long-term commitment from Trace and Quantum to support Williams' Louisiana Energy Gateway project (LEG), which is aimed to deliver responsibly sourced Haynesville’s naturalgas to markets along the Texas and Louisiana GulfCoast

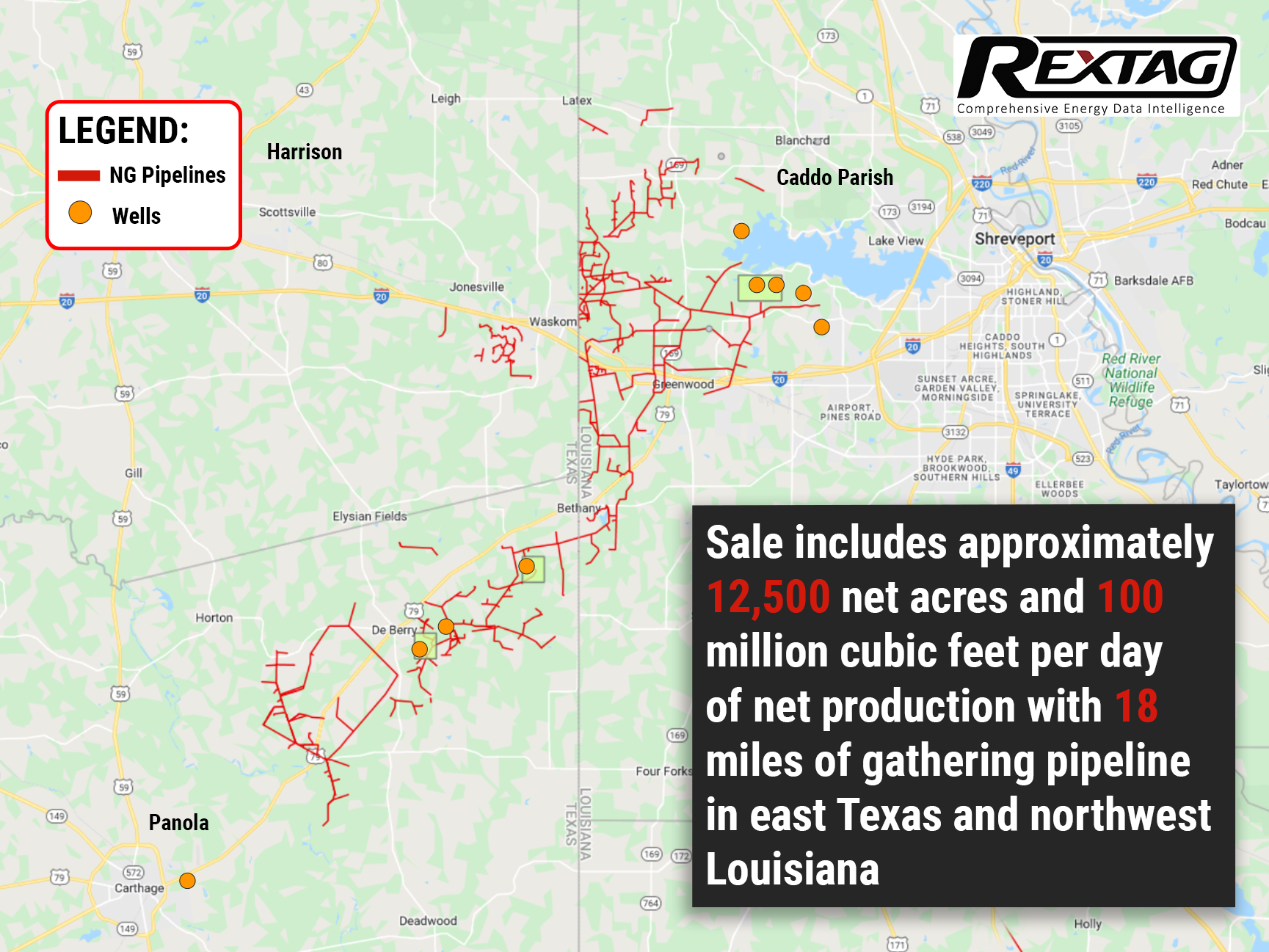

Pine Wave Energy and Silver Hill Reached an Agreement Over Haynesville Assets — Deal is Sealed

Looks like Pine pulled the plug on its properties in Caddo Parish, Louisiana, and Harrison and Panola counties, Texas. Which includes a total of 12,500 acres and ownership interests in 10 operated wells with a production capacity of 100 million cubic feet per day along with 18 miles of naturalgas gathering pipelines. Did Pine just give up on Haynesville?

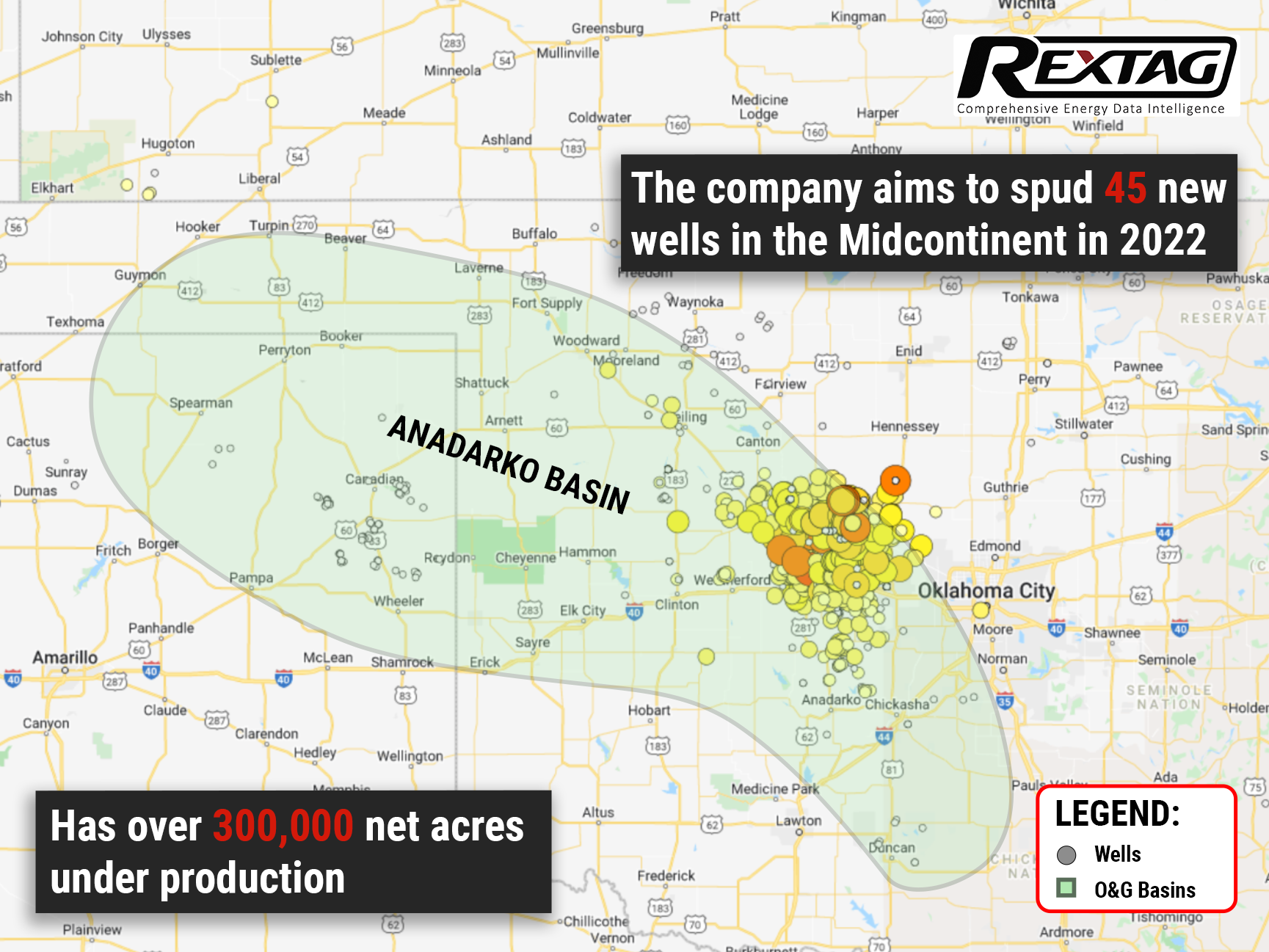

All In: Devon Energy is Banking on a Rebound for Anadarko

Devon Energy Corp. believes that the Anadarko Basin is a hidden treasure and aims to use its position in it to fuel a robust cash return model and establish itself as an industry leader in promoting ESG. This E&P company plans to drill 45 new wells in the Midcontinent by 2022, as well as to produce 600,000 boe/d across five operating basins, including the Eagle Ford Shale, Permian, Powder River, and Williston basins. And given that Devon's recent fourth-quarter results were better than Street estimates. It appears that they are doing something right, at least for the moment.

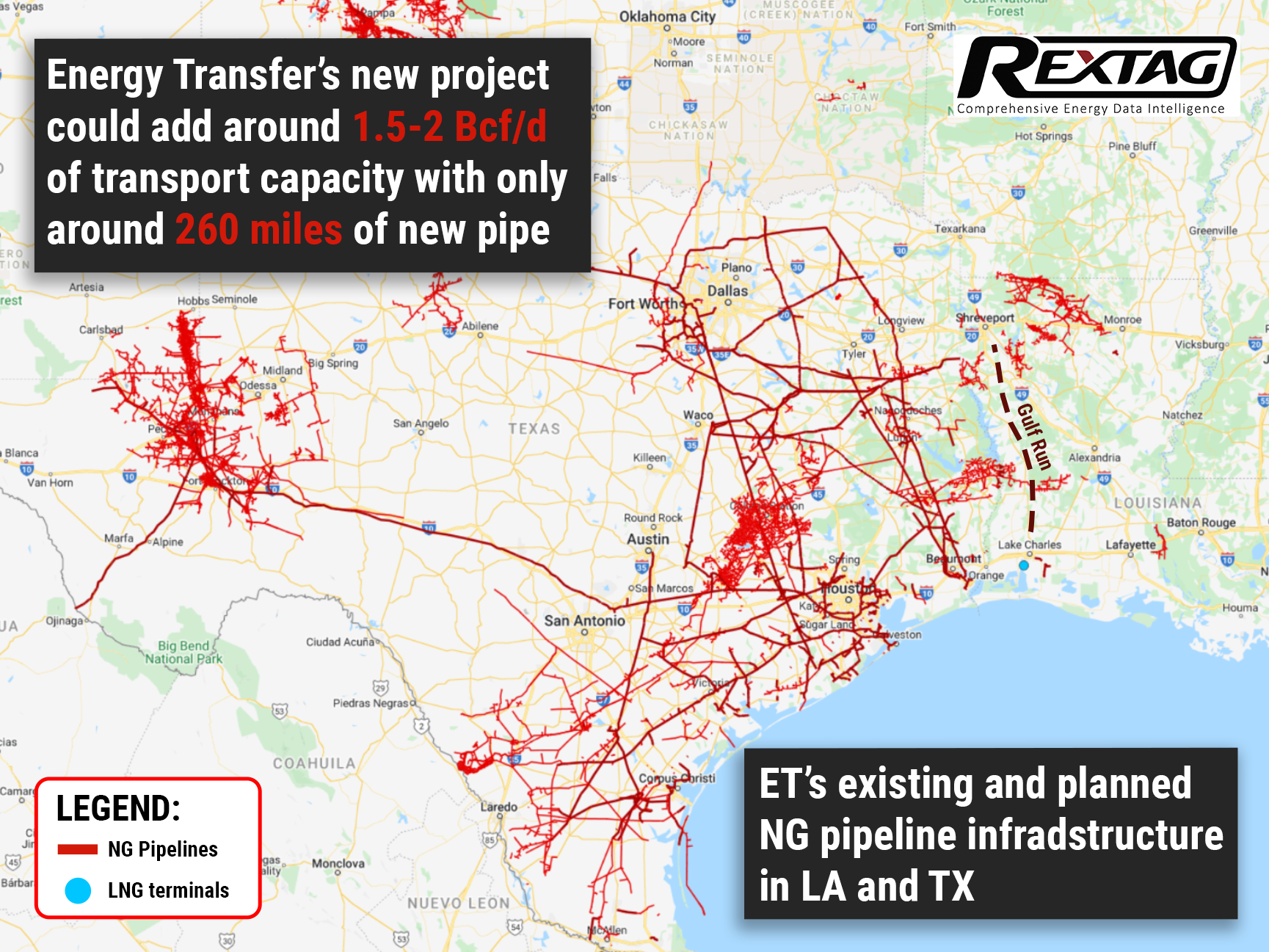

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

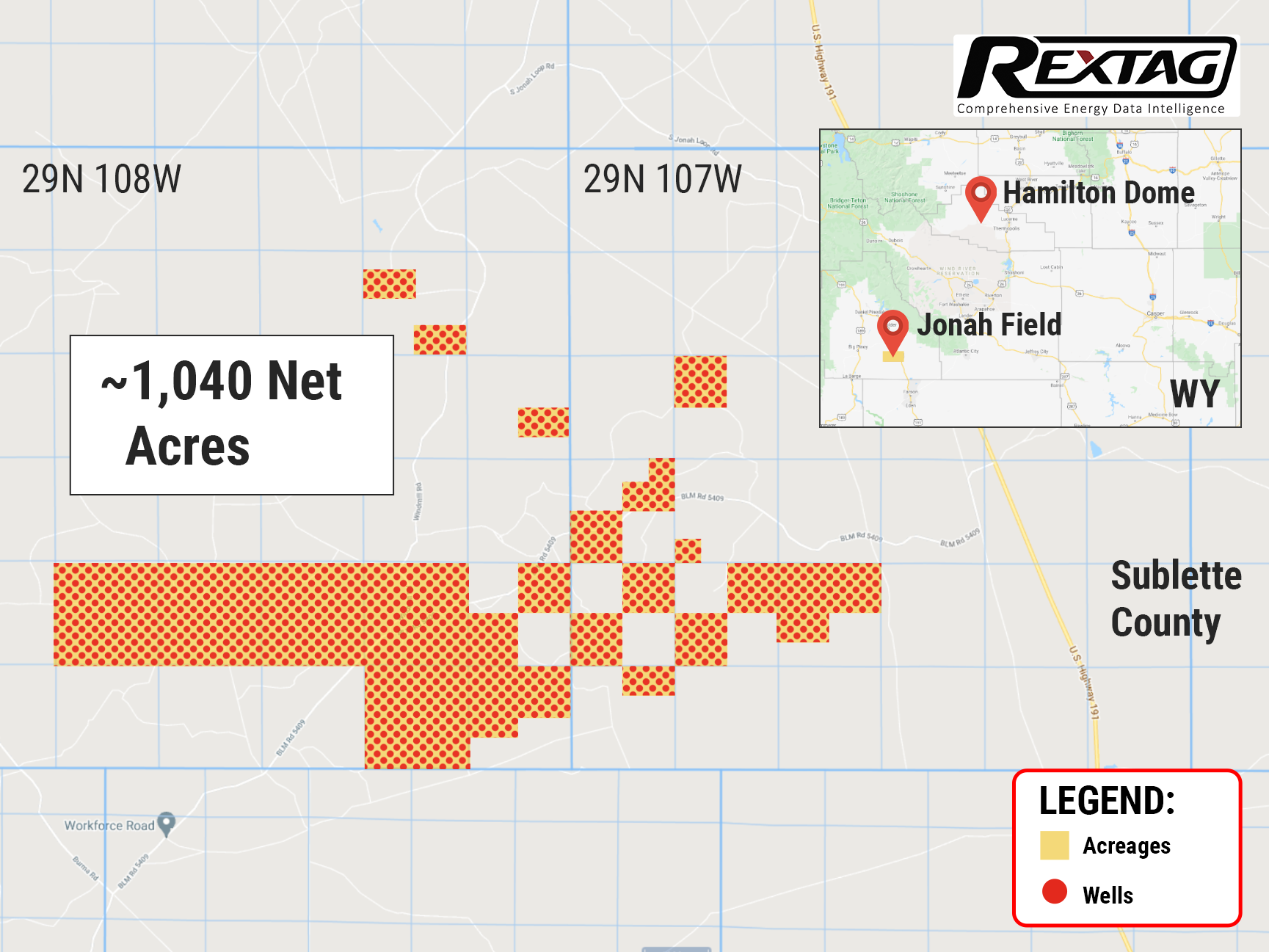

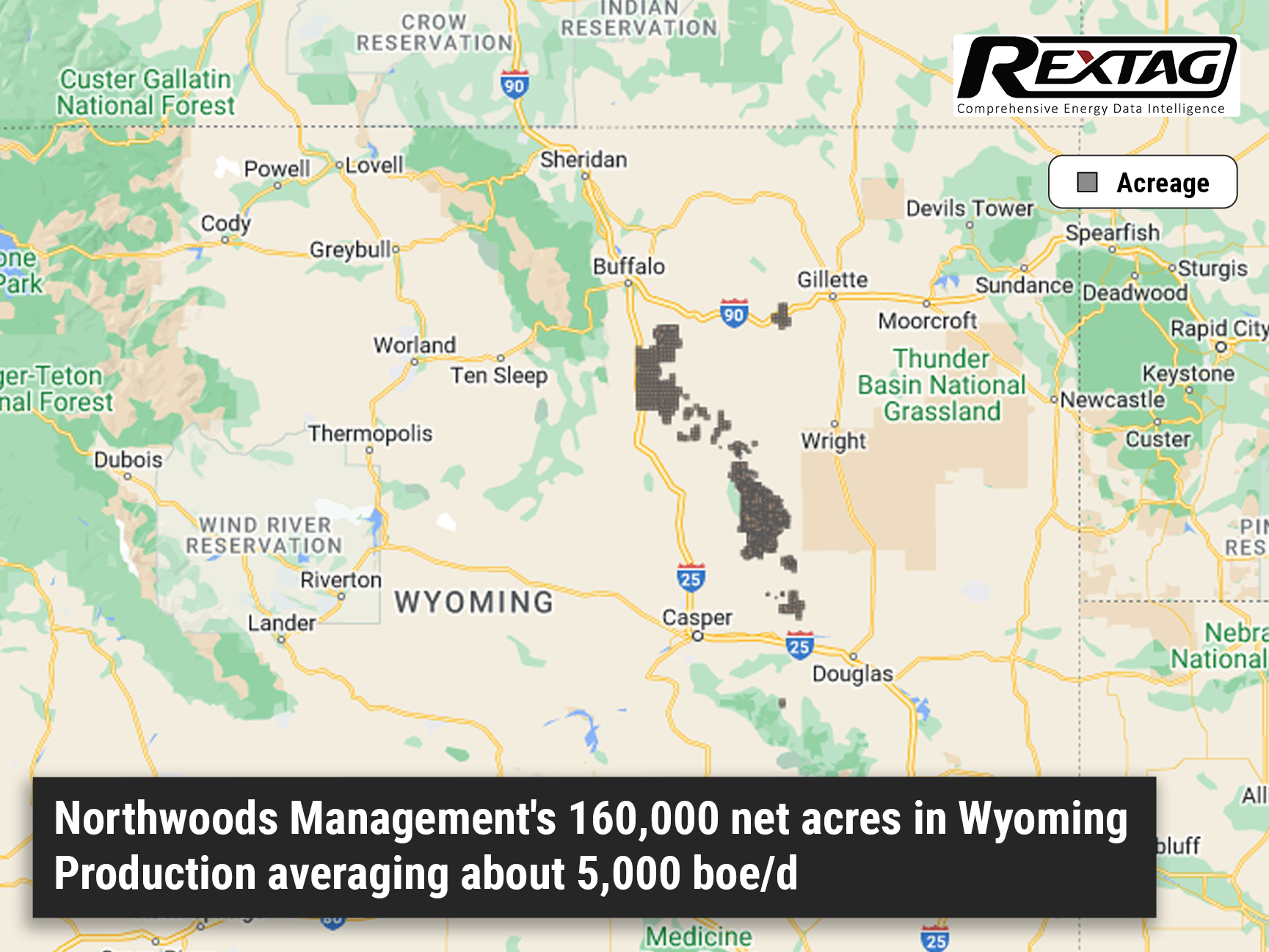

Evolution Acquires Non-operated Wyoming Natural Gas Interests

Evolution Petroleum just spend a fortune on Jonah’s Field right after acquiring Hamilton Dome Field in Wyoming. The price of the transaction is $29.4 million. The Houston-based company aims to diversify into natural gas assets, providing access to the western markets through the Opal market hub, with the optionality to flow to the east. That transaction took effect on February 1. We anticipate closing on or about April 1.

Look At The Future Of American And Appalachian Gas Production

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

Colgate Energy's owners are planning to go public

Colgate Energy is planning to float its shale oil producer in the Permian's Delaware Basin on the stock market. If successful, this IPO would be the first major U.S. oil producer offering since Jagged Peak Energy's IPO in January 2017. Looks like investors’ confidence in the sector is returning as U.S. crude prices hit their highest in seven years late last year S&P energy index delivered roughly twice the return of the S&P 500 in 2021.

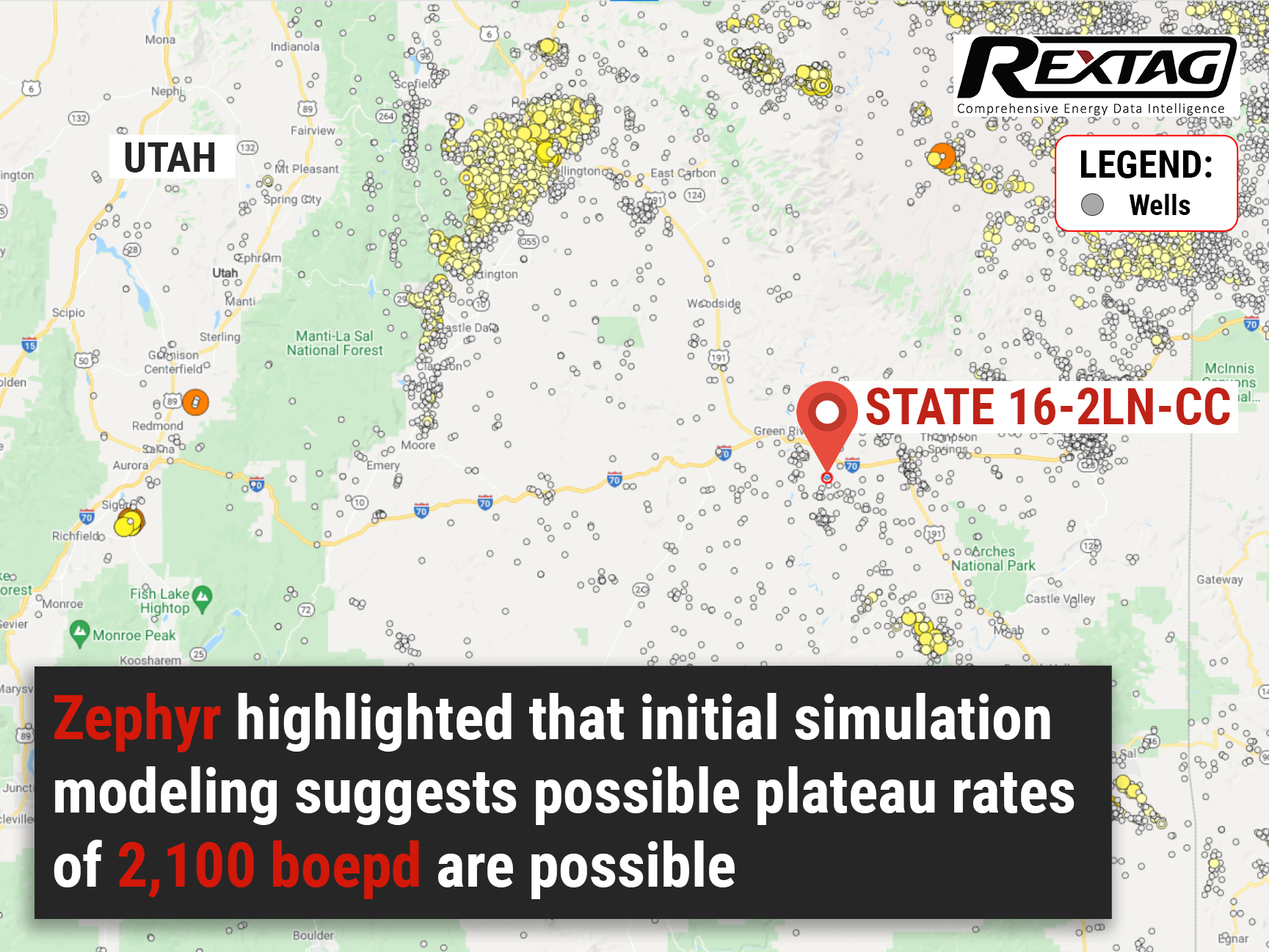

Northern Paradox Basins Rediscovered by Zephyr

After probing the initial discovery of eight high-grade hydrocarbon reservoirs, Zephyr Energy estimates that up to 200 wells could be drilled, creating a potential resource of 125 million barrels of oil equivalent in the area. In an investor presentation, Zephyr said that gas rates may reach plateaus of 10 million square cubic feet per day and 500 boepd of liquids. Quite an impressive number. But The key to tapping in such potential lies in the development of hydraulically stimulated resources rather than treating them as natural fracture plays.

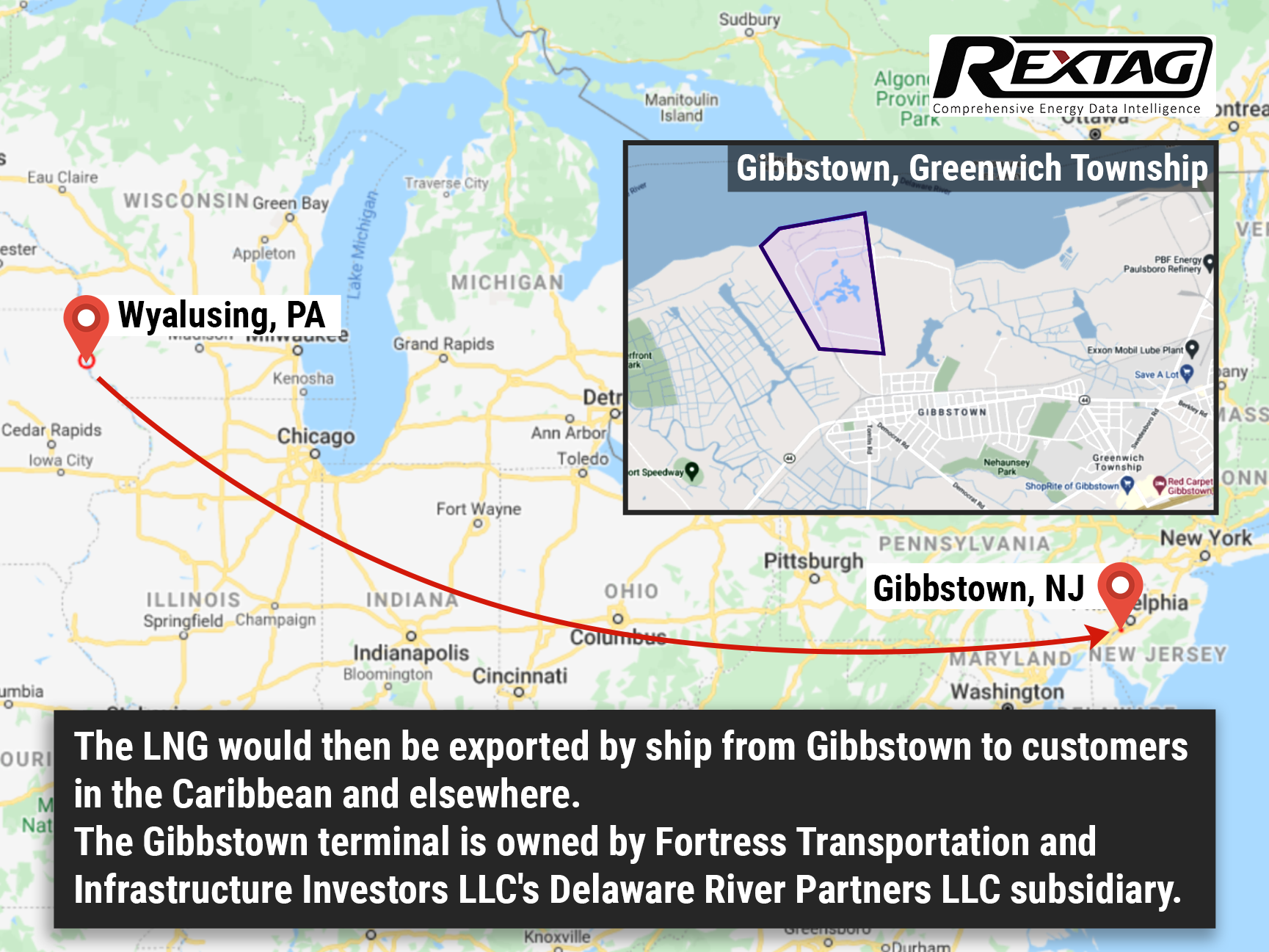

Rail Permit for New Fortress to Ship LNG Expired, Putting Future Projects at Risk

Uncertainty grows: as New Fortresses permit to ship LNG by rail expires, PHSMA explores temporal pausing of the method to provide more time to study safety-related issues. The news prompts one to wonder whether Fortress will proceed with its Pennsylvanian LNG project, in which it has already sunk about $159 million in development.

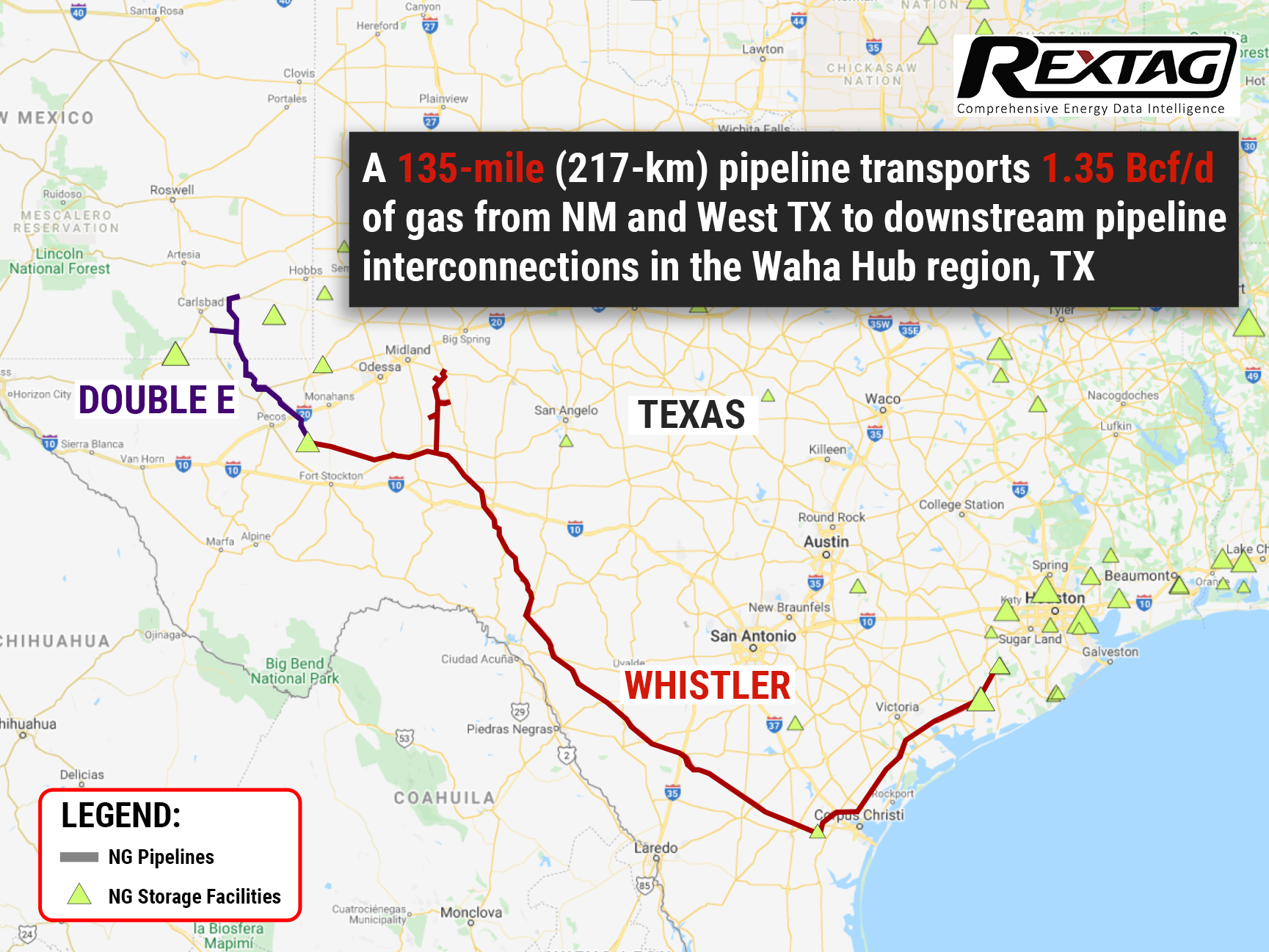

No More Gas Flaring: the Permian's Double E Pipeline is brought into service in West Texas

Permian Basins gas infrastructure boom: Summit Midstream puts into service a new pipeline system, aimed at reducing gas flaring in the area. Besides ecological concerns, the project will also transport almost 1,5 billion cubic feet of gas per day — enough to supply 5 million U.S. homes every day. According to Federal Energy Statistics, the project cost a whopping $450 million.

to Acquire PDC Energy for 6.3B.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)