Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

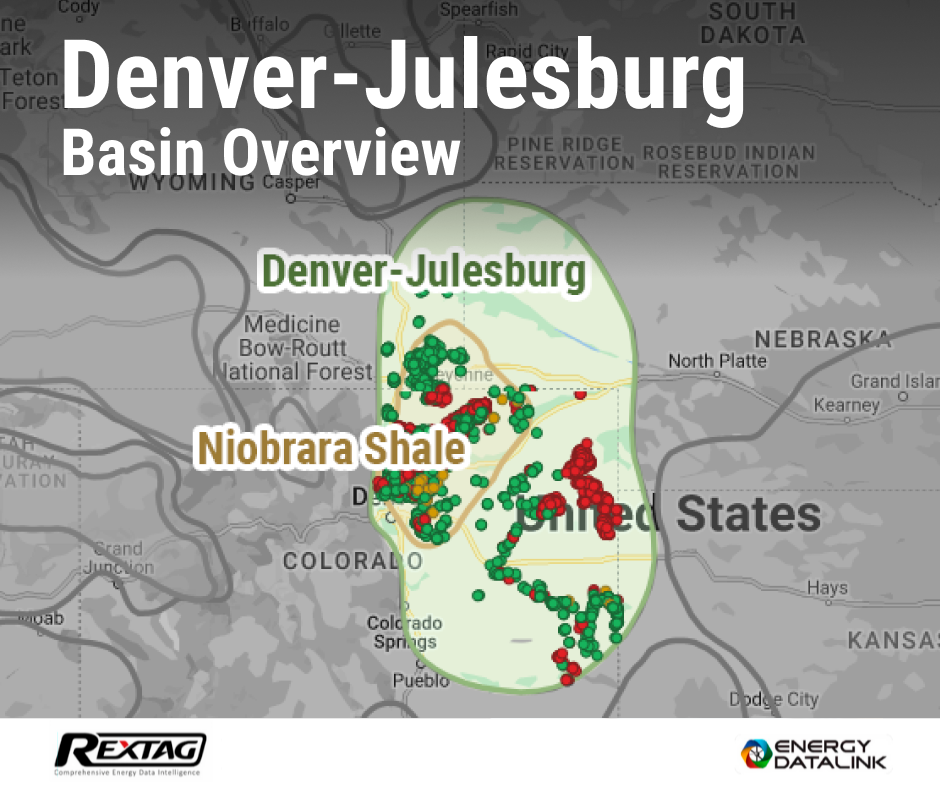

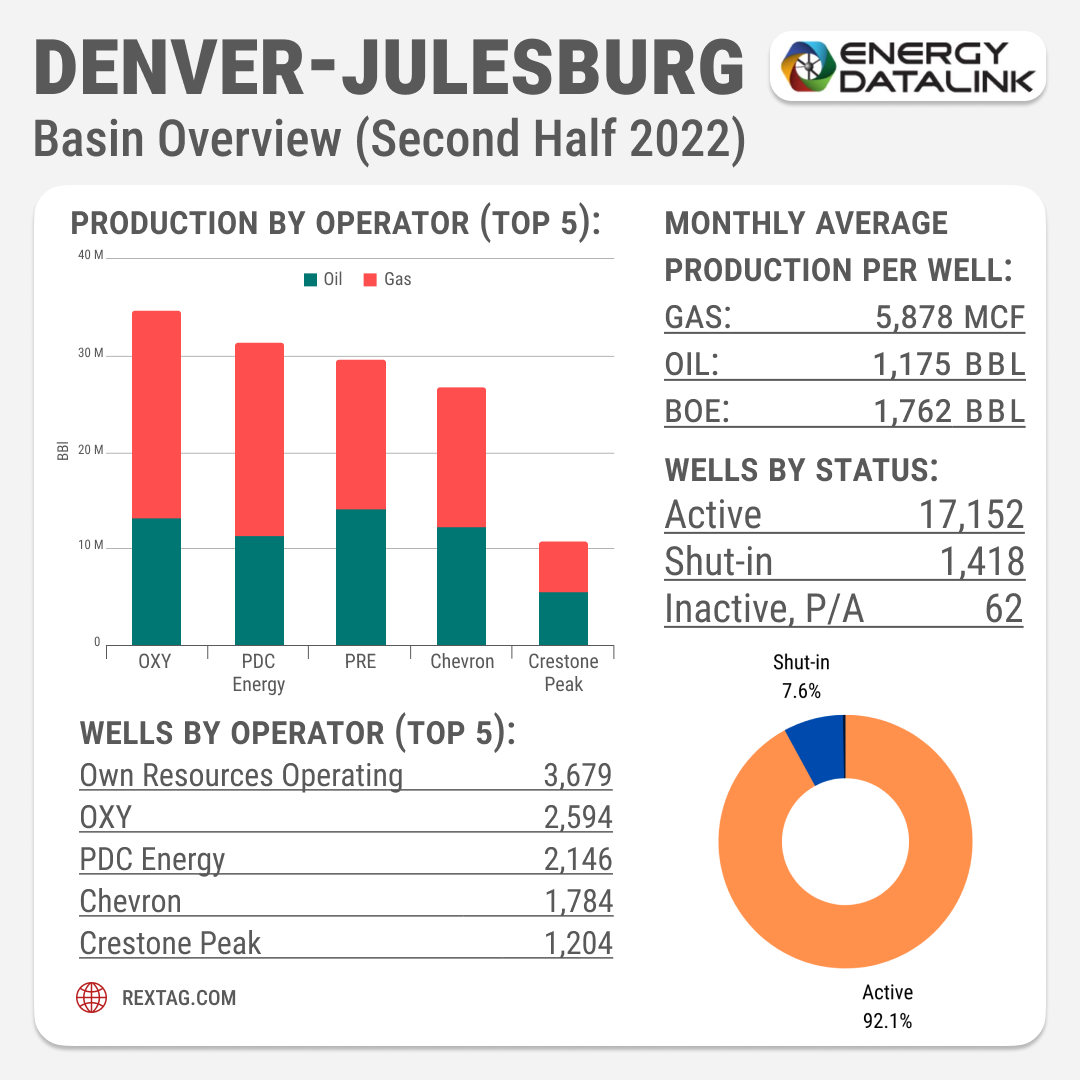

The Denver-Julesburg Basin Overview

05/03/2023

Geologically, the Denver-Julesburg (DJ) Basin is a large structural basin with a complex history of sedimentary deposition, tectonic activity, and hydrocarbon generation. The basin covers approximately 20,000 square miles and extends into parts of Colorado, Wyoming, Nebraska, and Kansas. It is primarily composed of several stacked formations, including the Niobrara, Codell, and Greenhorn formations, which contain significant amounts of oil and gas reserves.

In terms of economics, the DJ Basin has been a major contributor to the U.S. energy industry for decades. According to the U.S. Energy Information Administration (EIA), the DJ Basin was the fifth-largest producing basin in the U.S. in 2020, with an average daily production of 510,000 barrels of oil and 5.1 billion cubic feet of natural gas. This production has helped to make the U.S. one of the world's leading oil and gas producers, with significant implications for the global energy market.

The basin encompasses several fields and formations, including the Wattenberg Field, Niobrara, Codell, Greenhorn, Adena field, Hereford area, and Redtail field area. The Wattenberg Field, in particular, is one of the most productive and well-known areas within the basin, with significant reserves of shale gas and tight oil. The Niobrara and Codell formations are also important sources of unconventional oil and gas within the DJ Basin. The Greenhorn formation is another source of oil and gas within the basin, and the Adena and Redtail fields are also productive areas of the basin. The Hereford area, located in the southern part of the DJ Basin, is an emerging source of oil and gas production.

The DJ Basin has a diverse resource base that includes not only conventional oil and gas reserves, but also significant unconventional resources like shale oil and gas. This diversity of resources helps to ensure a stable and reliable supply of energy for the US.

The oil and gas industry in the DJ Basin, including these specific fields and formations, is a significant employer, with thousands of jobs supported by exploration, production, and related activities. These jobs have a ripple effect throughout the local economy, supporting other industries and contributing to economic growth.

The development of oil and gas resources in the DJ Basin, including these specific fields and formations, has led to the creation of significant infrastructure, including pipelines, refineries, and other facilities. This infrastructure supports not only production in the DJ Basin, but also the transport and refining of oil and gas from other regions.

The DJ Basin has also played a key role in the job market, providing employment opportunities for many energy professionals. The oil and gas industry is a major employer in the region, with an estimated 105,000 jobs supported by oil and gas production in Colorado alone. Additionally, the industry has contributed significant revenue to local communities, providing a boost to the economy and supporting infrastructure development.

The history of development in the DJ Basin has been marked by both successes and challenges. Early exploration and production efforts in the basin focused primarily on conventional drilling techniques, with significant discoveries made in the 1970s and 1980s. However, more recently, the industry has shifted towards unconventional techniques such as hydraulic fracturing, which has enabled greater production from tight formations such as the Niobrara.

In terms of costs and prices, the DJ Basin has generally been a profitable area for energy companies, with relatively low production costs and high resource potential. However, like any commodity market, oil and gas prices can fluctuate widely based on supply and demand factors, geopolitical events, and other market forces. In recent years, the COVID-19 pandemic and the associated drop in demand for oil and gas has had a significant impact on the industry, leading to lower prices and reduced production levels.

The commencement of drilling and production in the Denver-Julesburg Basin

The Denver-Julesburg Basin has a long and complex history of drilling and production, with exploration efforts dating back to the early 1900s. However, it was not until the 1970s and 1980s that significant discoveries were made in the basin, leading to a boom in oil and gas production.

Early exploration efforts in the DJ Basin focused on conventional drilling techniques, with companies targeting the basin's stacked formations, which include the Niobrara, Codell, and Greenhorn formations. These formations contain significant amounts of oil and gas reserves, and early drilling efforts were successful in tapping into these resources.

In the 1980s, advancements in drilling technology and seismic imaging helped to increase production levels in the DJ Basin, with companies using horizontal drilling and other techniques to reach previously untapped reserves. This led to a period of significant growth in the oil and gas industry in the region, with many new companies entering the market and existing companies expanding their operations.

However, the DJ Basin faced challenges in the 1990s and early 2000s, as production levels began to decline and the industry faced increasing competition from other regions.

The commencement of drilling and production in the DJ Basin has had a significant impact on the local economy and job market, with many energy professionals finding employment in the industry.

The first and best-known producers in the Denver-Julesburg basin

One of the earliest companies to explore the DJ Basin was Great Western Oil and Gas Company, which was founded in 1901. Great Western was one of the first companies to drill for oil in the Denver area and was instrumental in the early development of the DJ Basin. The company was later acquired by Noble Energy, which continues to operate in the basin today.

Another early player in the DJ Basin was Kerr-McGee, which began drilling in the region in the 1940s. Kerr-McGee was one of the first companies to use horizontal drilling and hydraulic fracturing in the basin, techniques that are now widely used in the industry. Kerr-McGee was later acquired by Anadarko Petroleum, which is now a subsidiary of Occidental Petroleum.

One of the most significant producers in the DJ Basin is Anadarko Petroleum, which has been operating in the basin for more than 60 years. Anadarko is one of the largest oil and gas producers in the U.S. and has made significant investments in the DJ Basin in recent years, particularly in the Niobrara shale formation.

Other notable companies that have operated in the DJ Basin include Noble Energy, Chesapeake Energy, and Encana Corporation (now Ovintiv). These companies have made significant contributions to the development of the basin and have helped to establish it as a major producer of oil and gas in the U.S.

Has the unconventional drilling age changed the Denver-Julesburg?

The advent of unconventional drilling techniques such as hydraulic fracturing (fracking) and horizontal drilling has allowed companies to access previously inaccessible reserves, with some estimates suggesting that unconventional drilling has contributed to more than 90% of the basin's current production.

The increased use of unconventional drilling techniques has also led to significant changes in the economics of oil and gas production in the DJ Basin. While conventional drilling techniques are typically less expensive, they often result in lower yields and require more frequent drilling operations. Unconventional drilling techniques, on the other hand, require more upfront investment but can result in higher yields and longer-lasting wells.

The rise of unconventional drilling has also led to increased regulatory and environmental scrutiny in the DJ Basin. Environmental groups and regulatory agencies have expressed concerns about the potential impact of fracking on groundwater and air quality, as well as the potential for increased seismic activity in the region.

What were the major technological challenges that the O&G companies faced when continuing working in the Denver-Julesburg in 2010 and after?

As production in the DJ Basin increased, so did the demand for water, leading companies to develop new techniques for recycling and reusing water, as well as to explore new sources of water.

As companies began to target tighter formations in the DJ Basin, they needed to develop new drilling and completion techniques to access and produce oil and gas from these formations. This required significant investments in research and development and the use of advanced technologies such as 3D seismic imaging, directional drilling, and advanced completion methods.

The growth in oil and gas production in the DJ Basin required significant investments in infrastructure, including pipelines, storage facilities, and processing plants. Companies needed to develop new technologies and methods for transporting and storing oil and gas, as well as to work with regulators and local communities to ensure that infrastructure development was done in a safe and environmentally responsible manner.

The biggest drops in production

The Denver-Julesburg Basin has experienced several significant drops in oil and gas production over the years. Some of the biggest drops in production include:

In the 1980s, a sharp decline in oil prices led to a significant drop in oil production in the DJ Basin. Many small and medium-sized producers were forced out of business, and production levels in the basin fell by more than 40%.

The global financial crisis of 2008-2009 had a significant impact on the oil and gas industry, and the DJ Basin was no exception. Oil prices dropped from over $140 per barrel in July 2008 to under $40 per barrel by the end of the year, leading to a sharp drop in drilling activity and production levels in the basin.

The COVID-19 pandemic, which began in early 2020, had a significant impact on oil and gas markets, as travel restrictions and reduced economic activity led to a sharp drop in demand for oil and gas. In the DJ Basin, production levels fell by more than 20% in 2020 as companies reduced drilling activity and shut down wells in response to the drop in demand.

What environmental challenges the Denver-Julesburg Basin has faced?

The Denver-Julesburg Basin has faced a variety of environmental challenges associated with oil and gas development. Some of the most significant challenges include:

- The process of hydraulic fracturing requires large volumes of water, which can strain local water resources and lead to the disposal of contaminated wastewater. In the DJ Basin, companies have developed new techniques for recycling and reusing water, as well as exploring new sources of water.

- Oil and gas production can release a variety of air pollutants, including methane, volatile organic compounds, and nitrogen oxides. In the DJ Basin, air pollution has been a particular concern due to the region's geography and weather patterns, which can trap pollutants close to the ground.

- Oil and gas development can impact wildlife and their habitats through habitat fragmentation, noise pollution, and disturbance of sensitive species. The DJ Basin is home to a variety of wildlife species, including the threatened Gunnison sage-grouse, and companies operating in the region have worked to minimize their impact on local ecosystems.

- The production and use of oil and gas can contribute to climate change through the release of greenhouse gases, particularly carbon dioxide and methane. In the DJ Basin, companies have faced increasing pressure to reduce their greenhouse gas emissions and to transition to cleaner energy sources.

Mergers and acquisitions

The Denver-Julesburg Basin has seen significant merger and acquisition (M&A) activity over the years as companies have sought to expand their operations and increase their access to key resources. Some of the most notable M&A deals in the DJ Basin include:

- In 2019, Anadarko Petroleum Corporation, one of the largest oil and gas producers in the DJ Basin, was acquired by Occidental Petroleum Corporation in a deal valued at $57 billion. Prior to this acquisition, Anadarko had acquired Noble Energy Inc. in a $13 billion deal in 2018, further expanding its operations in the DJ Basin.

- In 2014, Whiting Petroleum Corporation acquired Kodiak Oil & Gas Corp. in a $6 billion deal that gave Whiting increased access to the DJ Basin's Niobrara shale formation.

- In 2018, Encana Corporation announced its acquisition of Newfield Exploration Company in a deal valued at $7.7 billion. The acquisition gave Encana a larger presence in the DJ Basin and helped to solidify its position as one of the region's top oil and gas producers.

M&A activity in the DJ Basin has been driven by a variety of factors, including the need to expand operations, access new resources, and achieve economies of scale. While these deals have been transformative for the companies involved, they have also had a significant impact on the broader oil and gas industry in the region, as well as on local communities and economies. As such, it is important for companies to approach M&A activity with a focus on responsible and sustainable growth that takes into account the interests of all stakeholders involved.

What new technologies have Denver-Julesbury oil and gas companies adopted to maximize efficiency in production?

Horizontal drilling allows companies to access oil and gas reserves that were previously inaccessible using conventional vertical drilling techniques. By drilling horizontally through the shale rock formations in the DJ Basin, companies are able to extract more oil and gas with fewer wells, reducing costs and environmental impacts.

Hydraulic fracturing, also known as "fracking," is a process that involves injecting water, sand, and chemicals into shale rock formations to release oil and gas trapped within. This technique has revolutionized the oil and gas industry in the DJ Basin, making it possible to extract previously unreachable reserves.

Digital oilfield technologies, such as advanced sensors, data analytics, and automation systems, are increasingly being used to optimize production in the DJ Basin. These technologies allow companies to monitor well performance in real-time, identify potential issues before they occur, and make data-driven decisions to improve efficiency and reduce costs.

Companies are continually developing and refining well completion techniques, such as multistage hydraulic fracturing, to maximize the amount of oil and gas extracted from each well. These techniques involve breaking up the rock formation in multiple stages, allowing for more efficient extraction of oil and gas.

What is the importance of the Denver-Julesburg for the rest of the O&G industry in the US?

The DJ Basin is one of the largest oil and gas producing regions in the US, with estimated reserves of over 5 billion barrels of oil equivalent (BOE). This makes it an important source of domestic energy production that can help to reduce reliance on foreign sources of oil and gas.

The DJ Basin has a diverse resource base that includes not only conventional oil and gas reserves, but also significant unconventional resources like shale oil and gas. This diversity of resources helps to ensure a stable and reliable supply of energy for the US.

The oil and gas industry in the DJ Basin has been at the forefront of technological innovation, with companies investing in new technologies to improve production efficiency and reduce costs. These innovations have had a significant impact on the industry as a whole, driving increased production and helping to keep energy prices low.

The oil and gas industry in the DJ Basin is a significant employer, with thousands of jobs supported by exploration, production, and related activities. These jobs have a ripple effect throughout the local economy, supporting other industries and contributing to economic growth.

The development of oil and gas resources in the DJ Basin has led to the creation of significant infrastructure, including pipelines, refineries, and other facilities. This infrastructure supports not only production in the DJ Basin, but also the transport and refining of oil and gas from other regions.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Appalachian O&G Basin 2022 Review

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Post 143 Blog Appalachian Basin Overview 1.png)

The Appalachian oil and gas basin is a geological formation that spans several states in the eastern United States, including Pennsylvania, West Virginia, Ohio, and New York. It is one of the largest natural gas reserves in the world, with estimates of recoverable natural gas exceeding 141 trillion cubic feet. The Marcellus Shale formation was formed over 350 million years ago and is composed of sedimentary rocks. Initially, the Marcellus Shale was not considered a significant source of natural gas due to the low permeability of the rock, which made it difficult for gas to flow through it and be extracted. However, with the development of hydraulic fracturing and horizontal drilling technologies in the early 2000s, it became economically viable to extract natural gas from the Marcellus Shale, and it has since become a major source of natural gas production in the United States.

The Final Stretch: Energy Transfer Pushes For Mariner East Project Ahead Of The Stunning Q3 Results

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Energy-Transfer-Pushes-For-Mariner-East-Project-Ahead-Of-The-Stunning-Q3-Results .png)

Energy Transfer's lead in the world's NGL exports booked the company another successive quarter. With a global market share of almost 20%, the company is nigh unstoppable. But will it be enough to, finally, push the Mariner East project over the edge? If everything goes as planned, Mariner East's last segment could be operational by the end of the first half of 2022.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.