Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

Global Oil Supply and Demand Trends Overview: Insights from Rextag

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East. OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

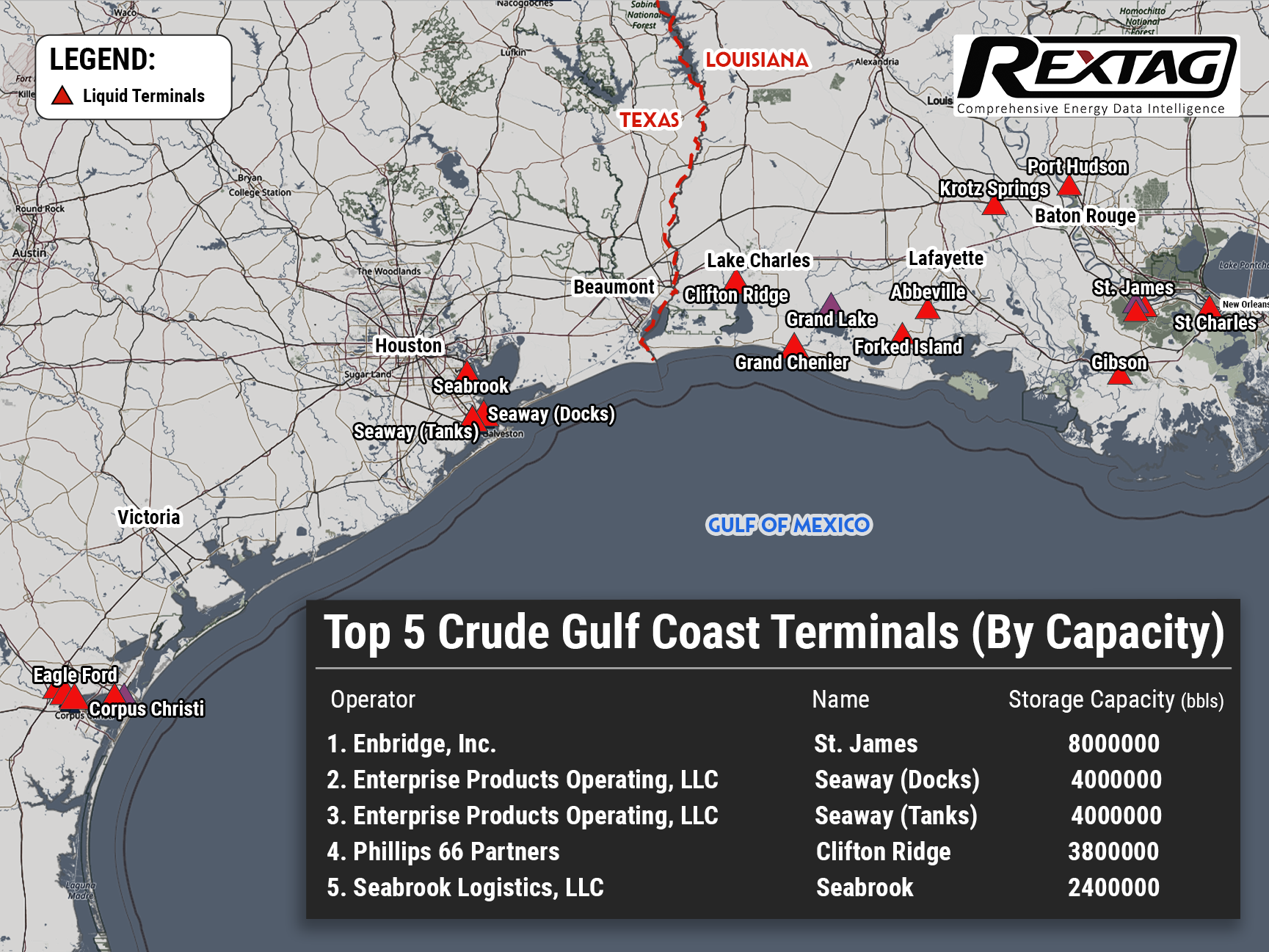

Growing Export of US Crude Oil Is Expected to Set Record This Quarter

On 27 June, the analysts at Kpler spread the word that the exports of crude oil from the U.S. Gulf Coast could break a record 3.3 MMbbl/d this quarter as Europe has regard to U.S. crude which can outweigh sanctioned Russian oil. Due to Washington's decision to release 180 MMbbl of oil from the nation's Strategic Petroleum Reserve, U.S. exports have increased in the last three months, as it has flooded the domestic market. Exports to Europe are anticipated averaging approximately 1.4 MMbbl/d this quarter, about 30% higher than the year-ago quarter, meanwhile, export to Asia is set to decrease to less than 1 MMbbl/d. Despite that the U.S. has lost about 1 MMbbl/d of refining capacity since 2020, it also boosted exports thanks to the government’s intervention to back crude supplies which has had consequences in growth in exports. Throughput via the Port of Corpus Christi has grown by more than 150,000 bbl/d and has become 1.86 MMbbl/d. Nevertheless, Port of Houston exports also have been increasing since the third quarter of last year, they remain below pre-pandemic levels.

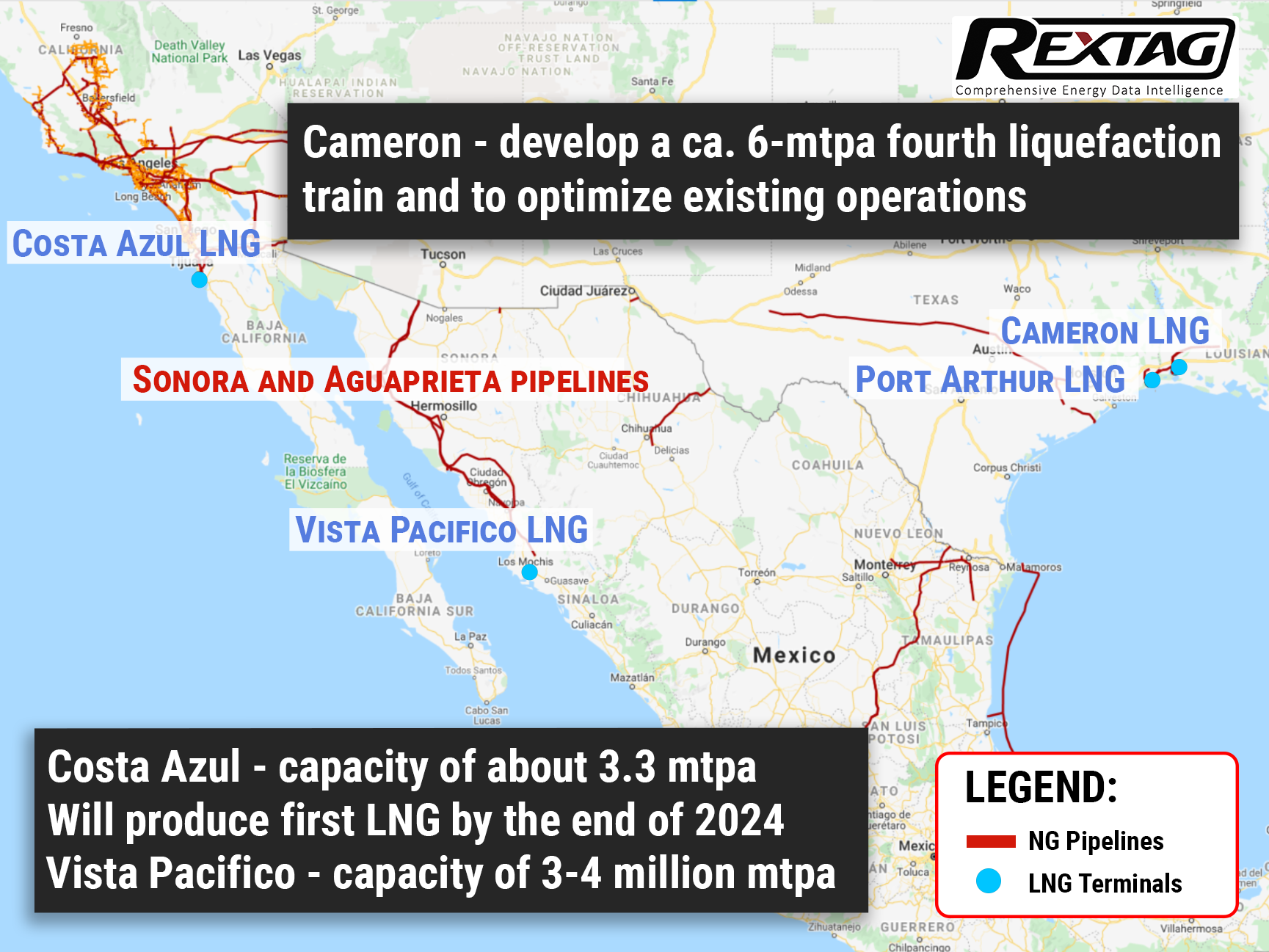

Pivot to the South: LNG Plants Under Development by Sempra Energy in Louisiana and Mexico

Sempra Energy would develop the 4.0-mmtpa Vista Pacifico LNG export facility located next to the company's Terminal for Refined Products in Topolobampo in a bid to provide gas from the Permian basin in Texas and New Mexico to Asian markets. Once marketing begins, Sempra's management expects Vista Pacifico to be oversubscribed.