Blog

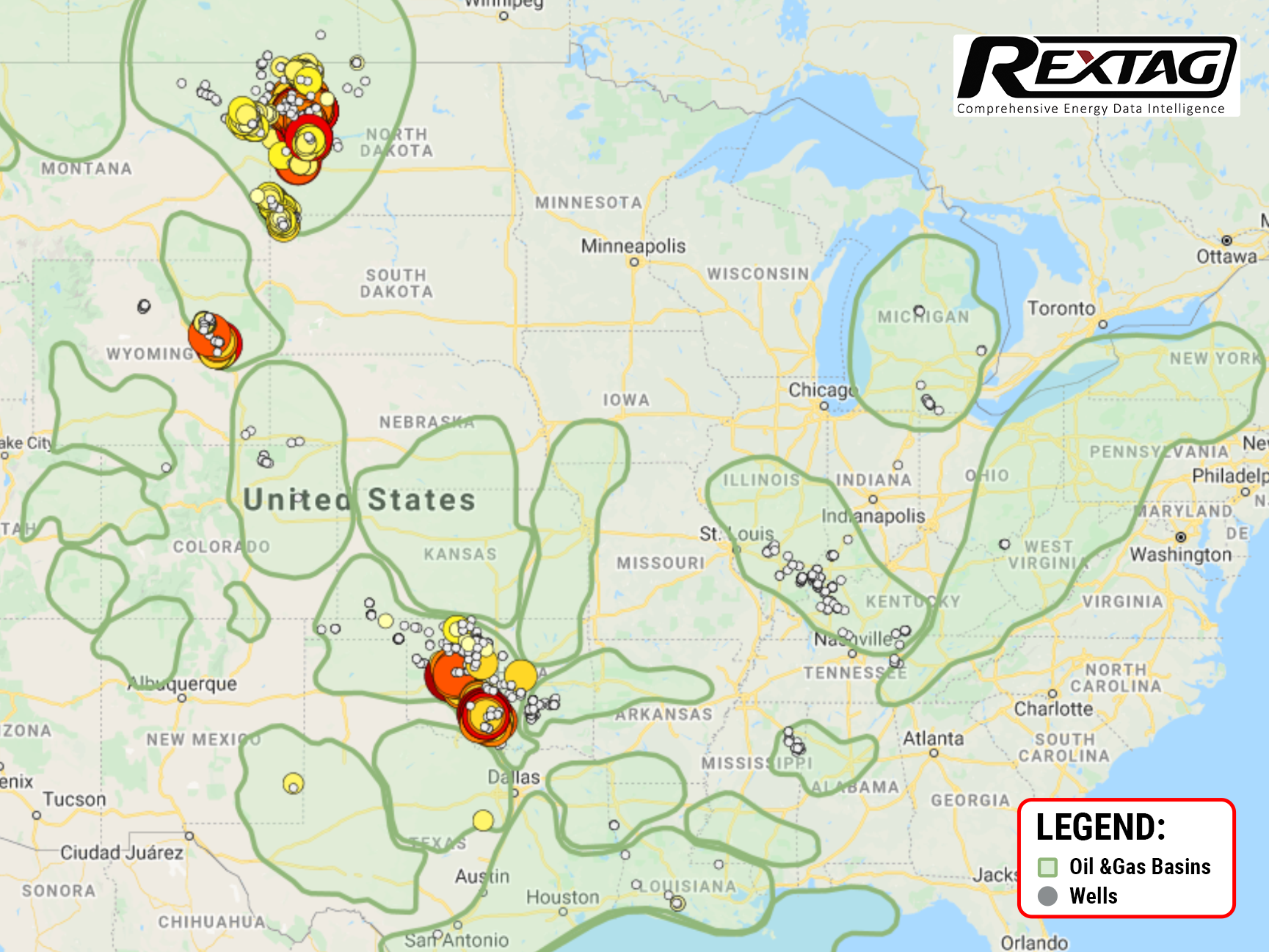

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

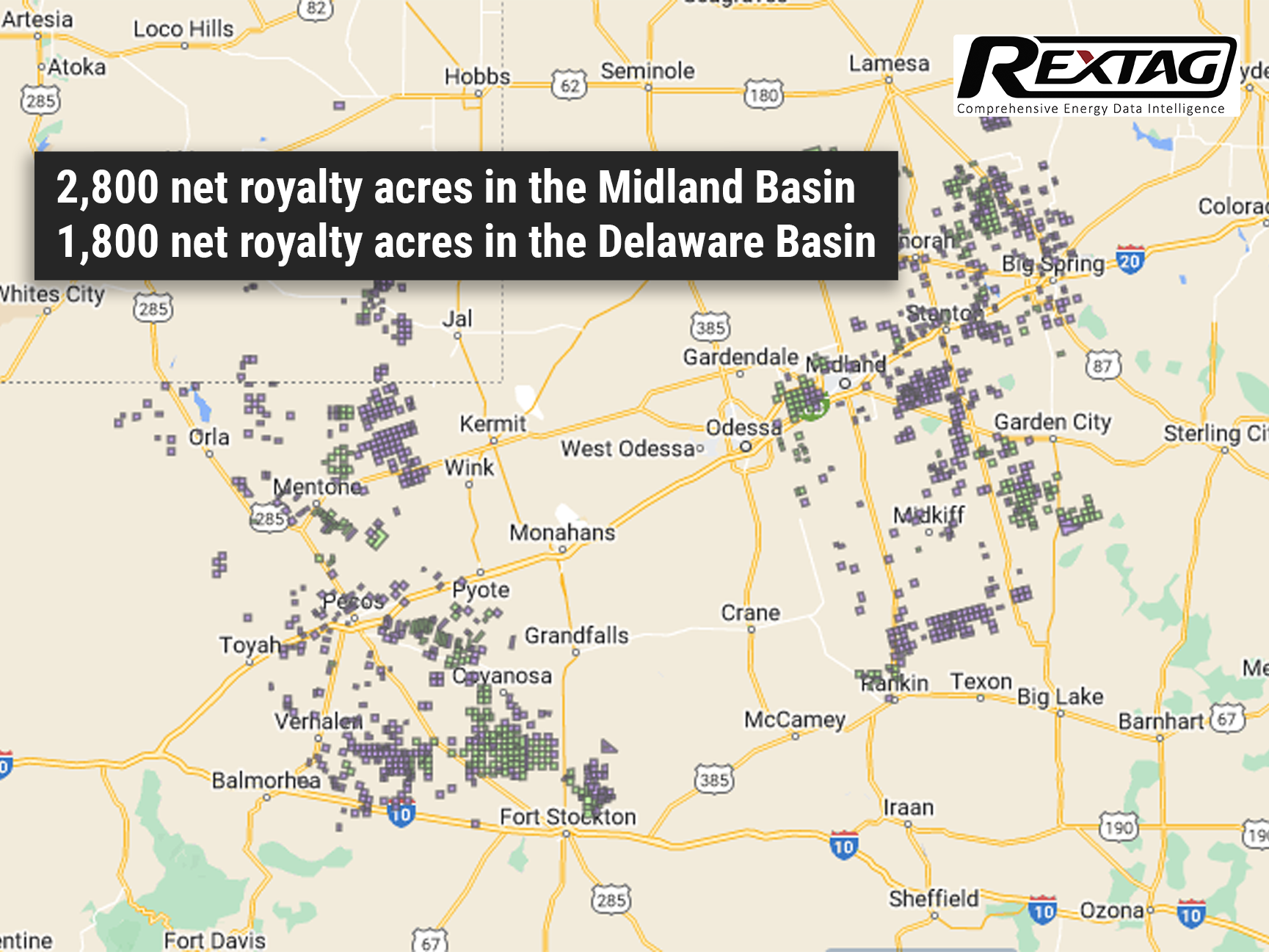

Diamondback's Viper Energy Acquires $1 Billion in Royalty Interests in the Permian Basin

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

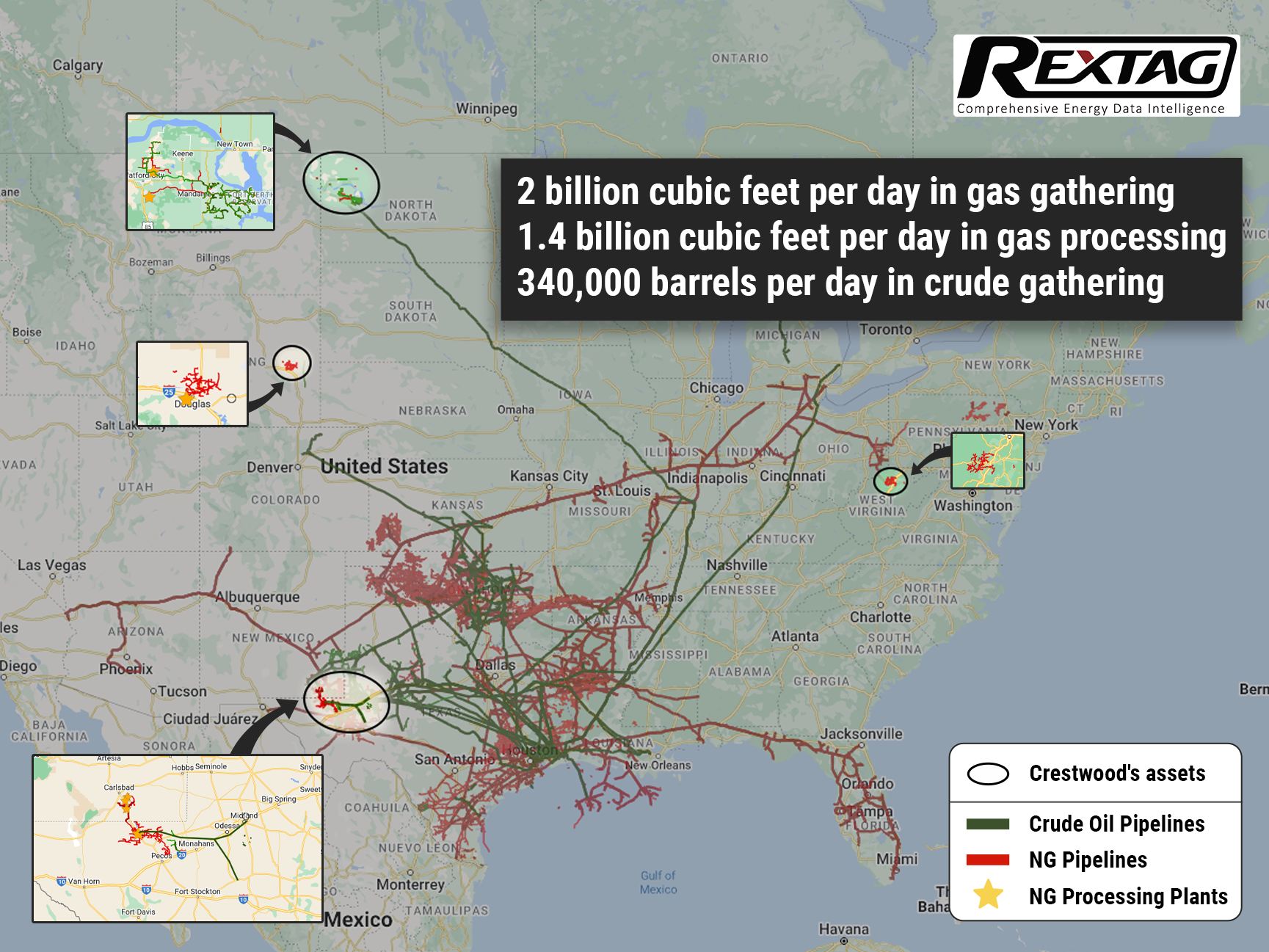

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

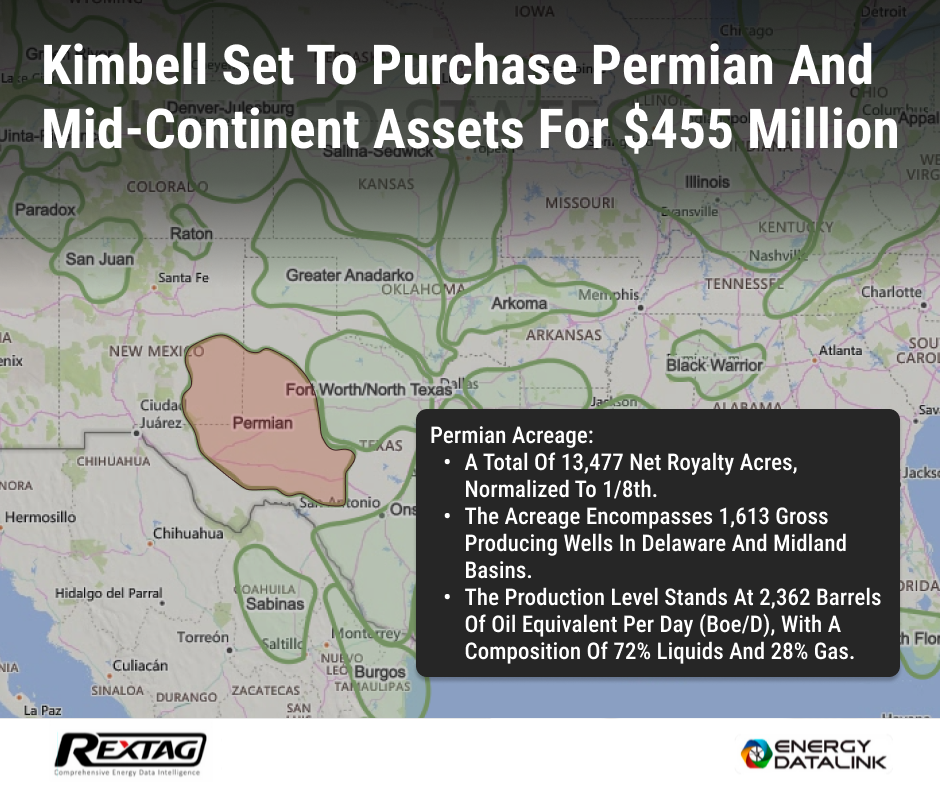

Kimbell Set to Purchase Permian and Mid-Continent Assets for $455 Million

Kimbell Royalty Partners' acquisition adds land in Delaware & Midland basins, enhancing its lead in production, active rigs, DUCs, permits & undrilled inventory. Kimbell Royalty Partners LP has recently announced a landmark deal, the largest in its history, to expand its foothold in the oil and gas industry. The company has agreed to purchase Permian Basin and Midcontinent assets for a staggering $455 million in cash from a private seller.

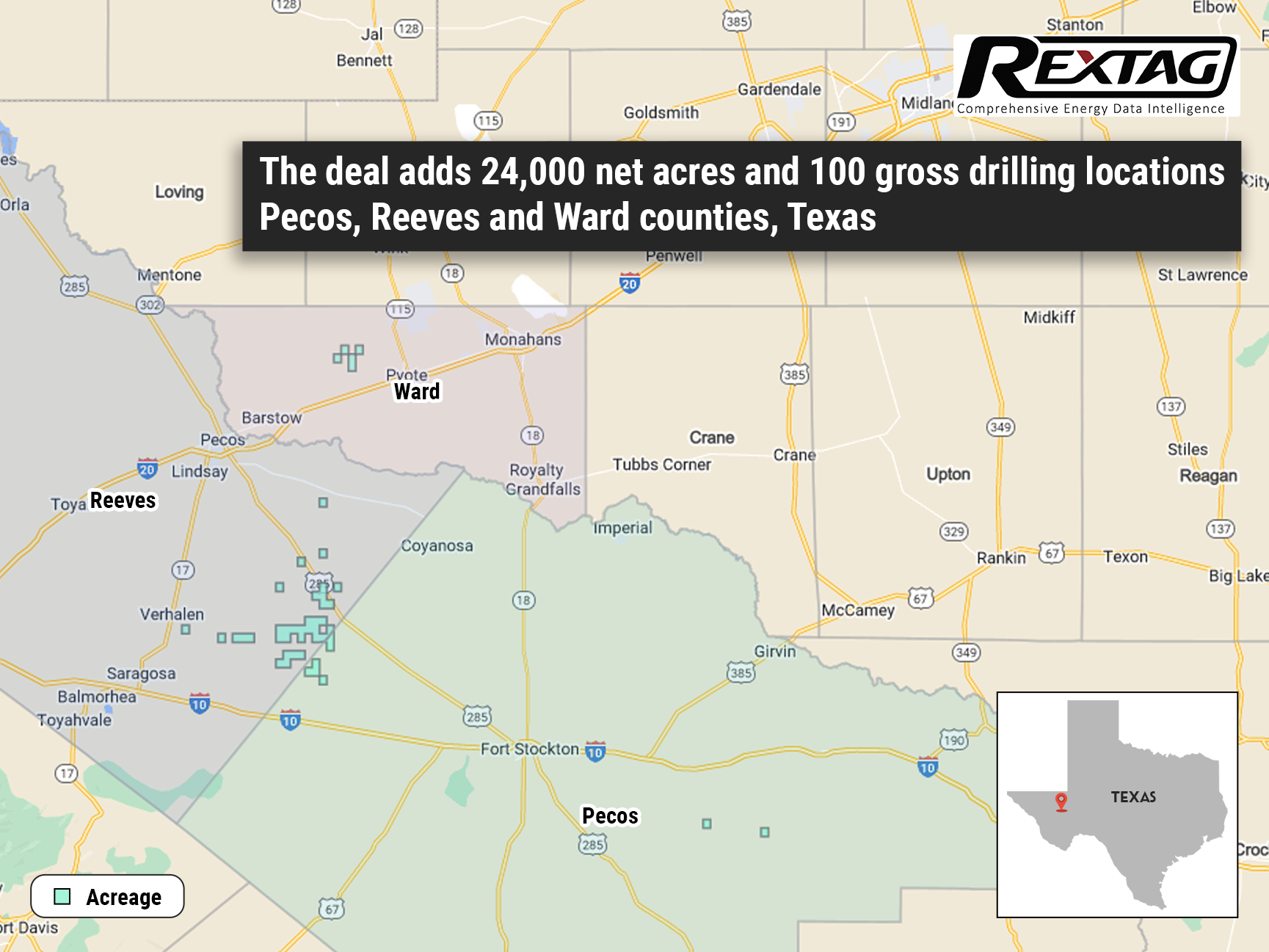

Vital Energy Raises Production Outlook and Capital Spending with Significant Permian Basin Acquisition

Vital Energy’s deal adds 24,000 net acres and 100 gross drilling locations in Texas, growing its Permian Basin footprint to around 198,000 net acres. Vital Energy is revising its projections for oil and gas production and capital spending upward following the successful acquisition of a substantial area in the Permian Basin. The company has gained around 24,000 net acres and 100 gross drilling locations in Texas. As a result of this deal, Vital Energy is now increasing its full-year production and capital spending guidance.

Callon Acquires $1.1 Billion Delaware Assets and Bows Out of Eagle Ford - Here's What You Need to Know

Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million. In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres. In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

Matador Acquires Additional Land in Delaware from Advance Energy for $1.6 Billion

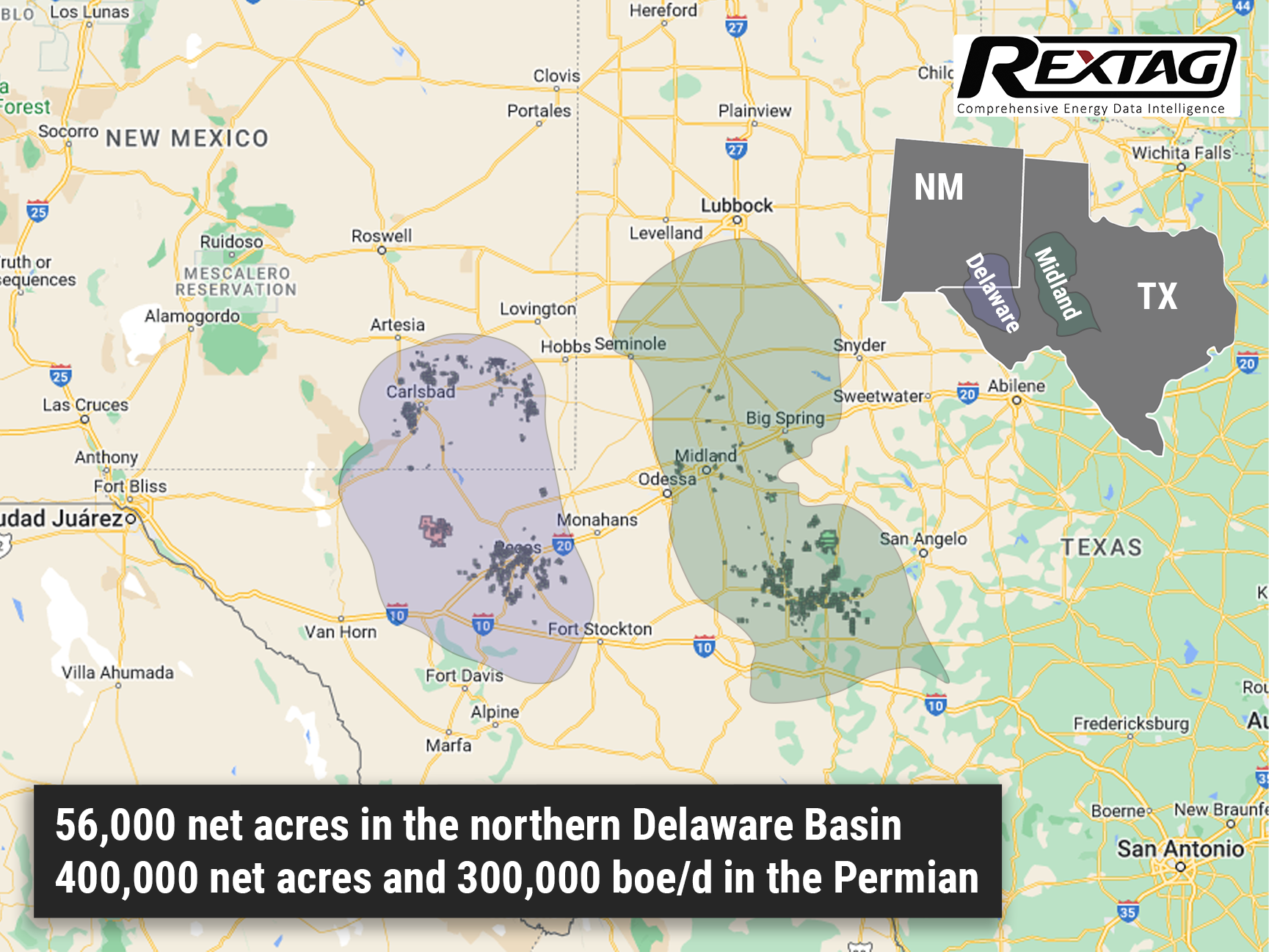

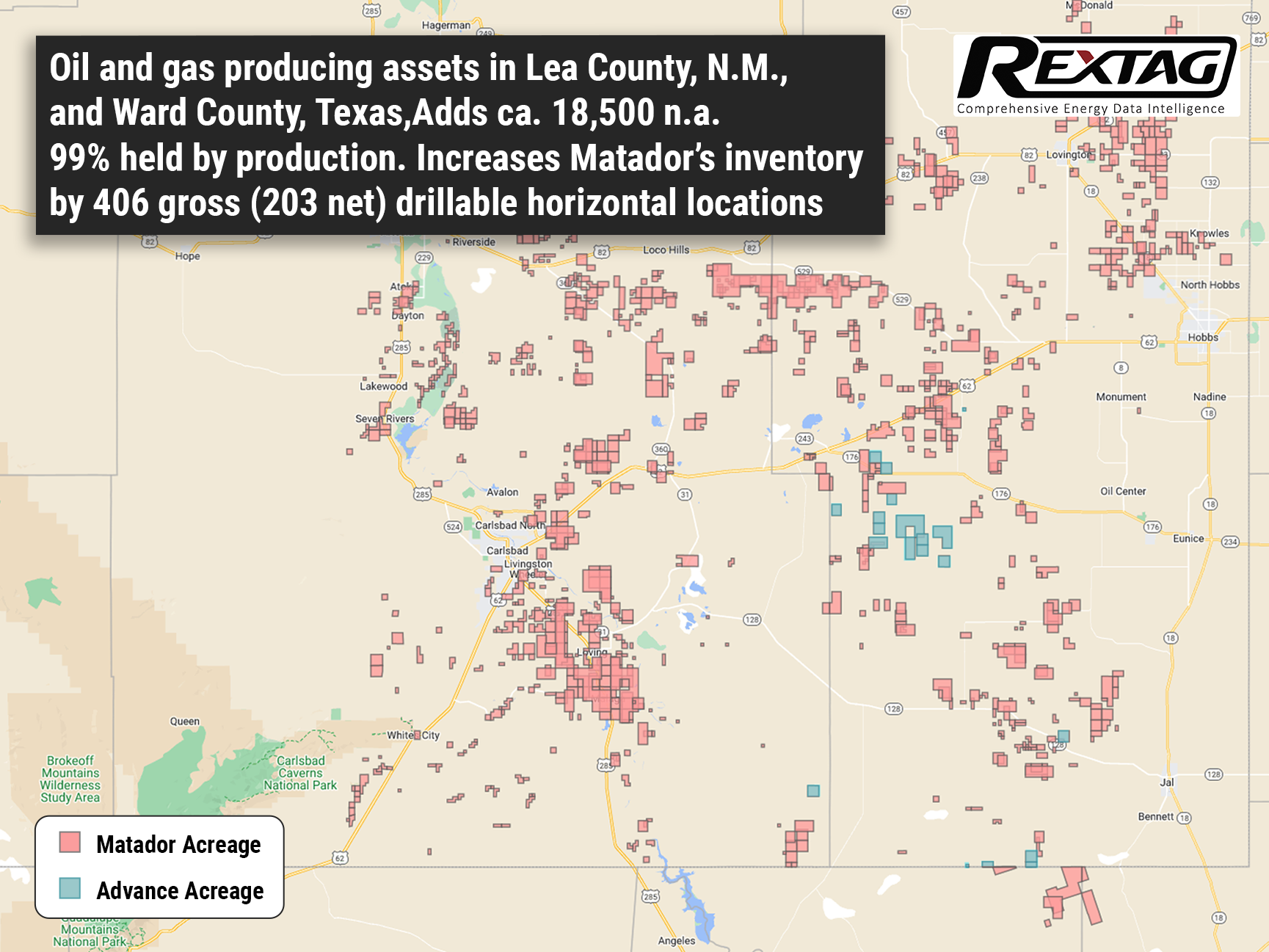

Matador Resources Co. is making a big move in the oil and gas industry by acquiring Advance Energy Partners Holdings LLC, a major player in the northern Delaware Basin. The acquisition, which comes with a hefty price tag of at least $1.6 billion in cash, includes valuable assets in Lea County, N.M., and Ward County, Texas, as well as key midstream infrastructure.

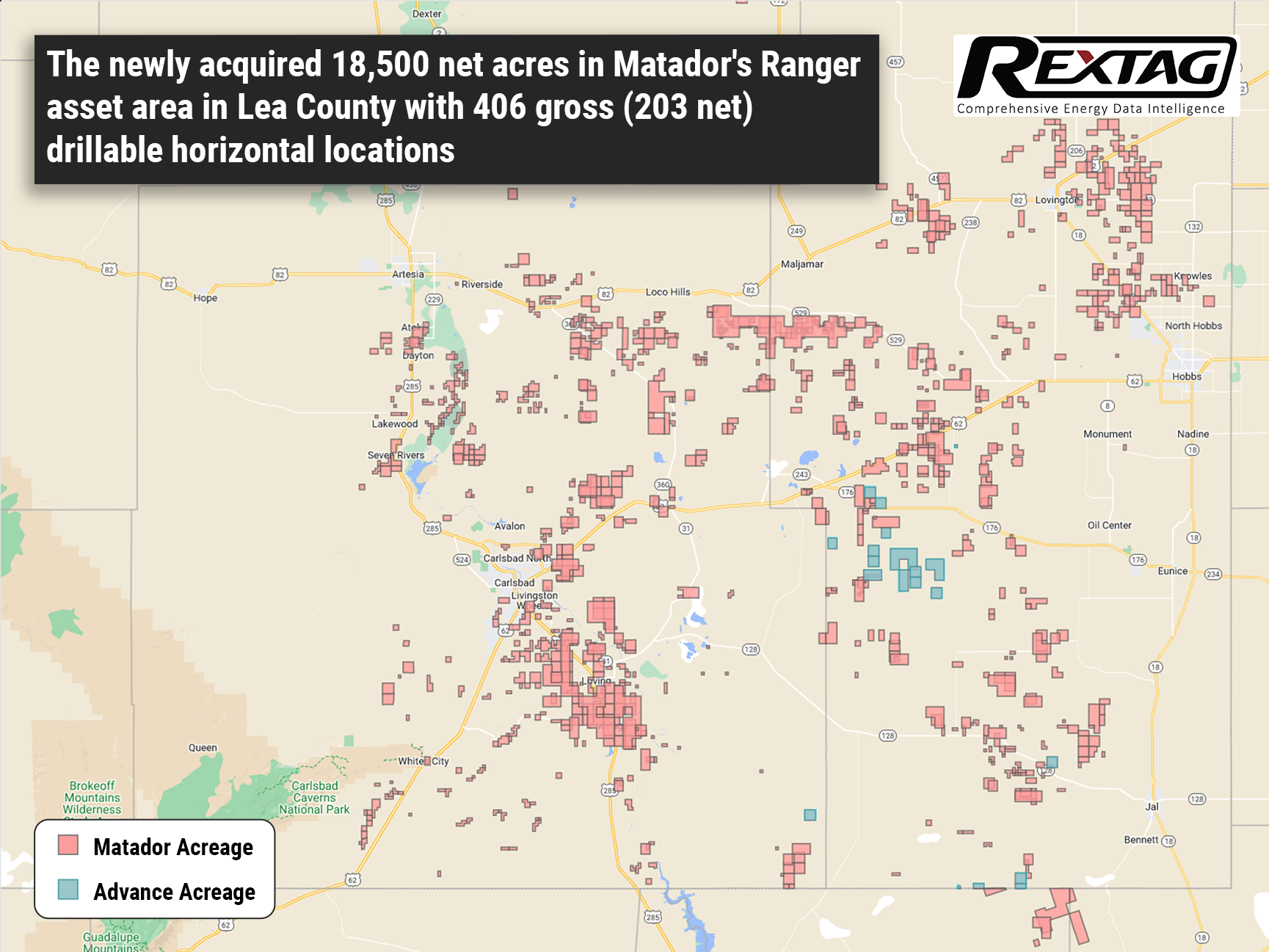

Matador Expands In Delaware; Purchases Acreage from Advance Energy at $1.6 Billion

On January 24, Matador spread the word that it will add oil- and gas-producing assets in Lea County, N.M., and Ward County, Texas, and some midstream infrastructure. Most of the acreage is strategically situated in Matador’s Ranger asset area in Lea County. The bolt-on includes about 18,500 net acres, 99% held by production, in the core of northern Delaware. The deal would also extend Matador’s inventory by 406 gross (203 net) drillable horizontal locations with prospective targets in the Wolfcamp, Bone Spring, and Avalon formations.

2022 A&Ds in O&G Summary and Trends for the past 4 years

More than 60% of all A&D deals by value are in US oil and gas companies. Despite their leading market position, U.S. fields are developing unevenly, and investors are quite cautious about investing in them at this stage. The top 5 oil & gas industry A&D deals in 2022 were concluded by Omega Acquisition, Tokyo Gas, Diamondback Energy, Suncor Energy, and IMM Private Equity. The main motives of oil and gas companies to carry out A&D transactions can be considered the achievement of the synergy effect, and the presence of fundamental shocks in the market.

NOG Grows Its Acreage Position in Delaware

According to the company’s press release on December 19, Northern Oil and Gas Inc. (NOG) closed its announced deal with a private seller of non-operated interests in the Northern Delaware Basin for $131.6 million in cash. The acquisition was announced with a $13 million deposit in October and is the third Permian Basin acquisition since August, adding to NOG’s $400 million of Permian Basin acquisitions in 2022. The assets of 2,100 net acres are primarily operated by a private company Mewbourne Oil Co., with production anticipated to total almost 2,500 boe/d in 2023. Also, Coterra Energy Inc. and Permian Resource Corp. are operators of the assets. The assets contain high-quality, low breakeven development that is leveraged to some of NOG’s top operating partners, as our investors have come to expect.

Cardinal Acquires Natural Gas Business in Prolific Delaware Basin to Expand

On November 2, Cardinal Midstream Partners, an independent Dallas-based midstream energy company, concluded definitive agreements with Medallion Midstream Services to purchase Medallion’s natural gas gathering and processing business in the Delaware Basin in West Texas. The transaction is subject to customary closing conditions and is expected to close in early 2023.

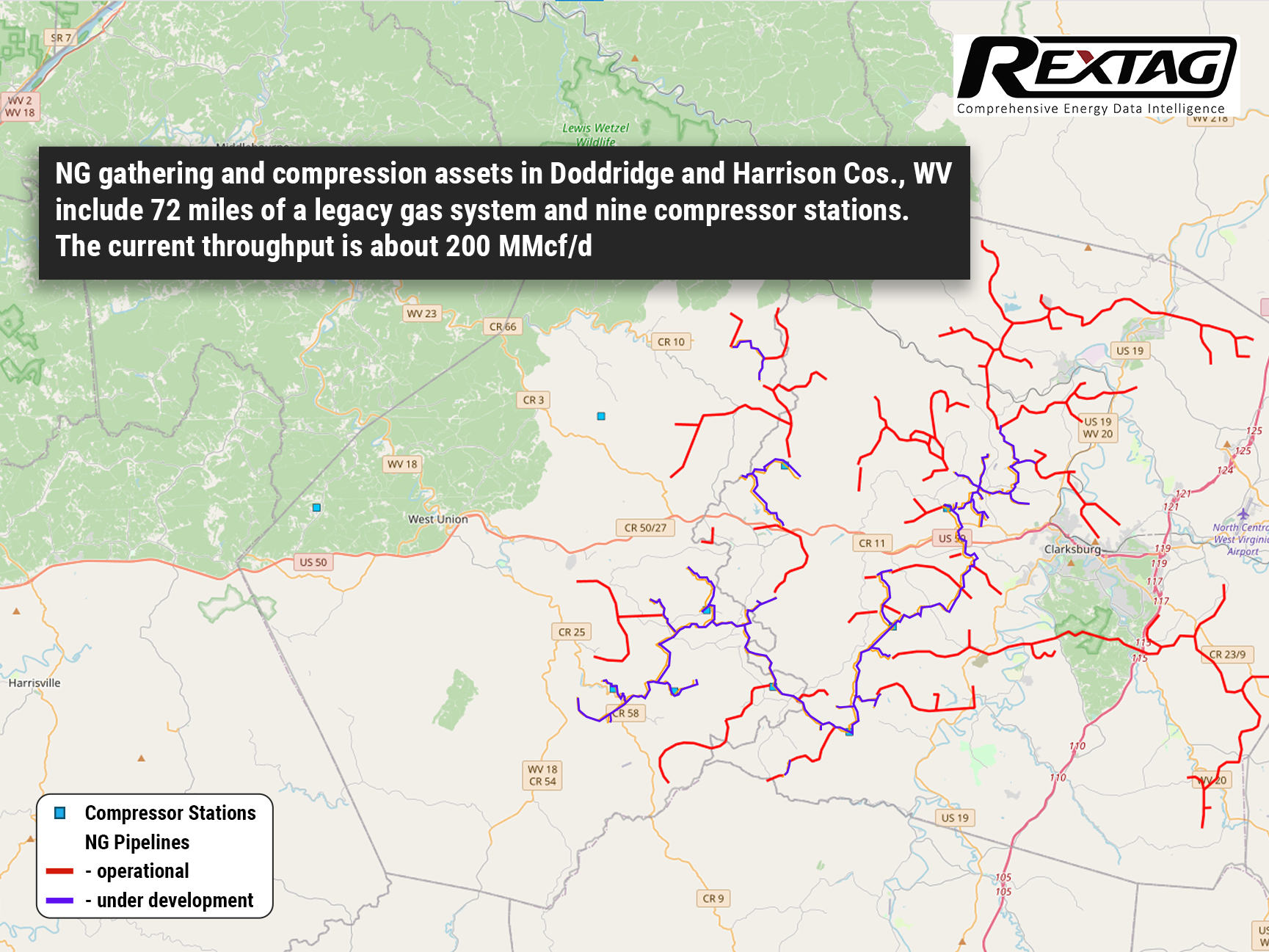

$205 Million for Marcellus Assets Divested by Crestwood to Antero

Antero Midstream Corp. bought Marcellus assets of Crestwood Equity Partners LP on September 12 for $205 million in cash, signing another sale of noncore assets by the Houston-based company. Crestwood has strategically enhanced its asset portfolio through a series of A&D transactions for the previous 18 months to create a competitive scale in the Williston, Delaware, and Power River basins. The strategy covered acquisitions of Oasis Midstream Partners, Sendero Midstream, and Crestwood Permian Basin Holdings LLC (CPJV), which was a 50:50 joint venture of Crestwood and First Reserve. The assets to be bought cover 72 miles of dry gas gathering pipelines and nine compressor stations with about 700 MMcf/d of compression capacity. The current throughput on the system is approximately 200 MMcf/d, resulting in important available capacity for increase without major capital investment. The deal includes almost 425 undeveloped drilling locations and 120,000 gross dedicated acres from Antero Resources mainly in Harrison County. The acquisition is also anticipated to raise Antero Midstream’s compression capacity by 20% and gathering pipeline mileage by 15%.

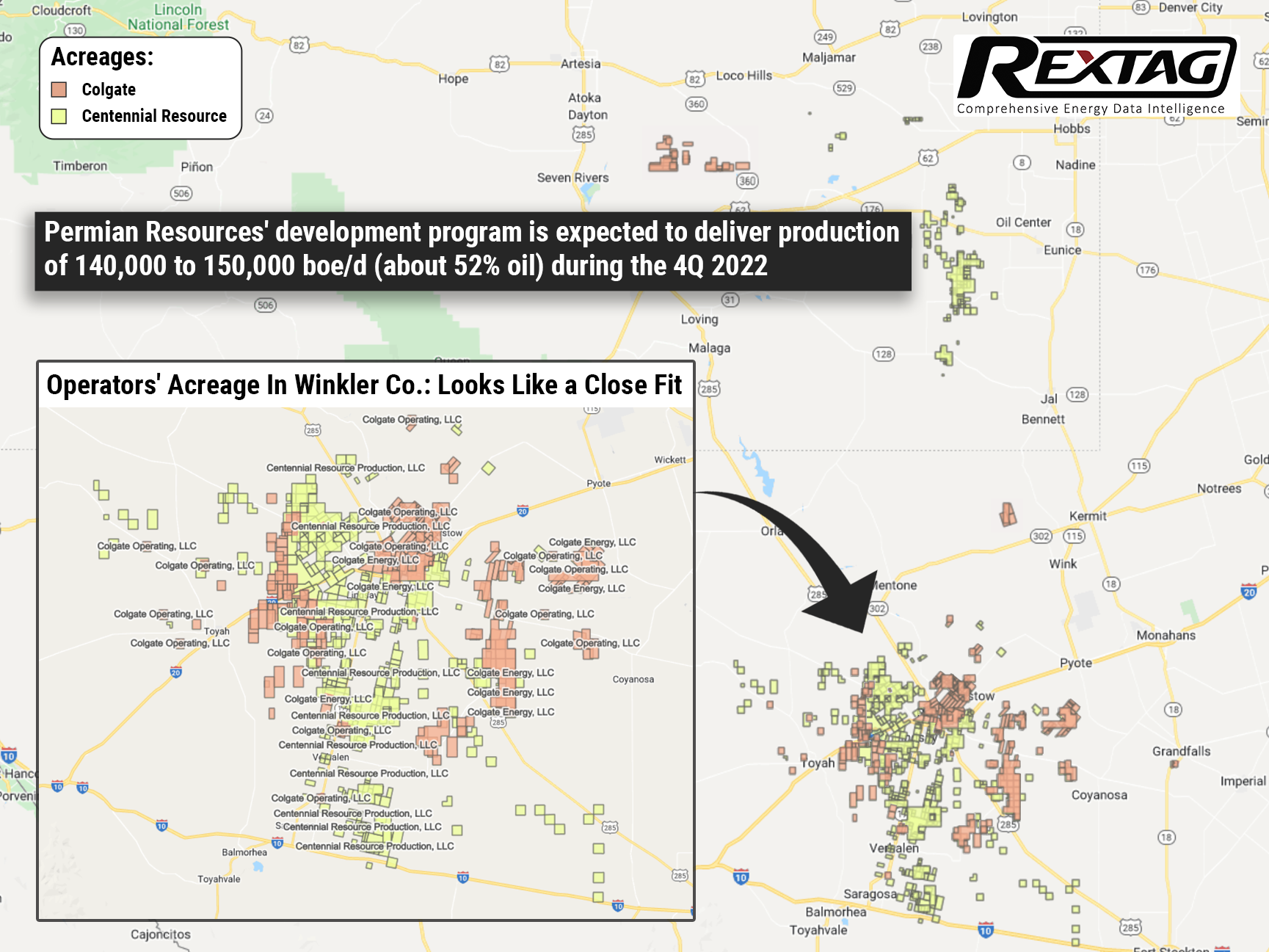

Centennial, Colgate Merger Is Completed on Sep.1

The completion of the merger between Centennial Resource Development Inc. and Colgate Energy Partners II LLC happened on Sept. 1, sealing the debut of Permian Resources Corp., which is considered the largest pure-play E&P company in the Delaware Basin. Permian Resources’ idea was to combine two successful E&P companies, creating a better, stronger, and more strategically compelling company. Centennial and Colgate announced an agreement to merge in May, denying rumors that Colgate, a privately held independent Midland-based company, had been seeking an IPO. The merger estimated Colgate at about $3.9 billion and consists of 269.3 million shares of Centennial stock, $525 million of cash, and the assumption of approximately $1.4 billion of Colgate’s outstanding net debt. Permian Resources, being the combined company, has a deep inventory of “high-quality” drilling locations on around 180,000 net acres the companies anticipate will provide more than $1 billion of free cash flow in 2023 at current strip prices, in accordance with the company release on Sept. 1.

Earthstone Expands Due to Acquisition of Titus’ Delaware

Earthstone Energy Inc., based in Texas, announced the transaction on June 28: the acquisition of Titus Oil&Gas which will raise production in the Delaware Basin by 26%. The $627 million acquisition fills the Permian Basin in Eddy and Lea counties, N.M. with 86 net locations on 7,900 net acres of leasehold, while it is not clear how much of the leasehold might be on federal acreage It is Earthstone’s seventh acquisition since 2021, a span that includes the closing of approximately $1.89 billion in acquisitions in the Permian Basin. The purchase of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, is estimated at $575 million in cash and it is the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price). Titus shared that its net production in June was 31,800 boe/d. The company had reserves of approximately 28.9 MMboe. Earthstone is sure its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

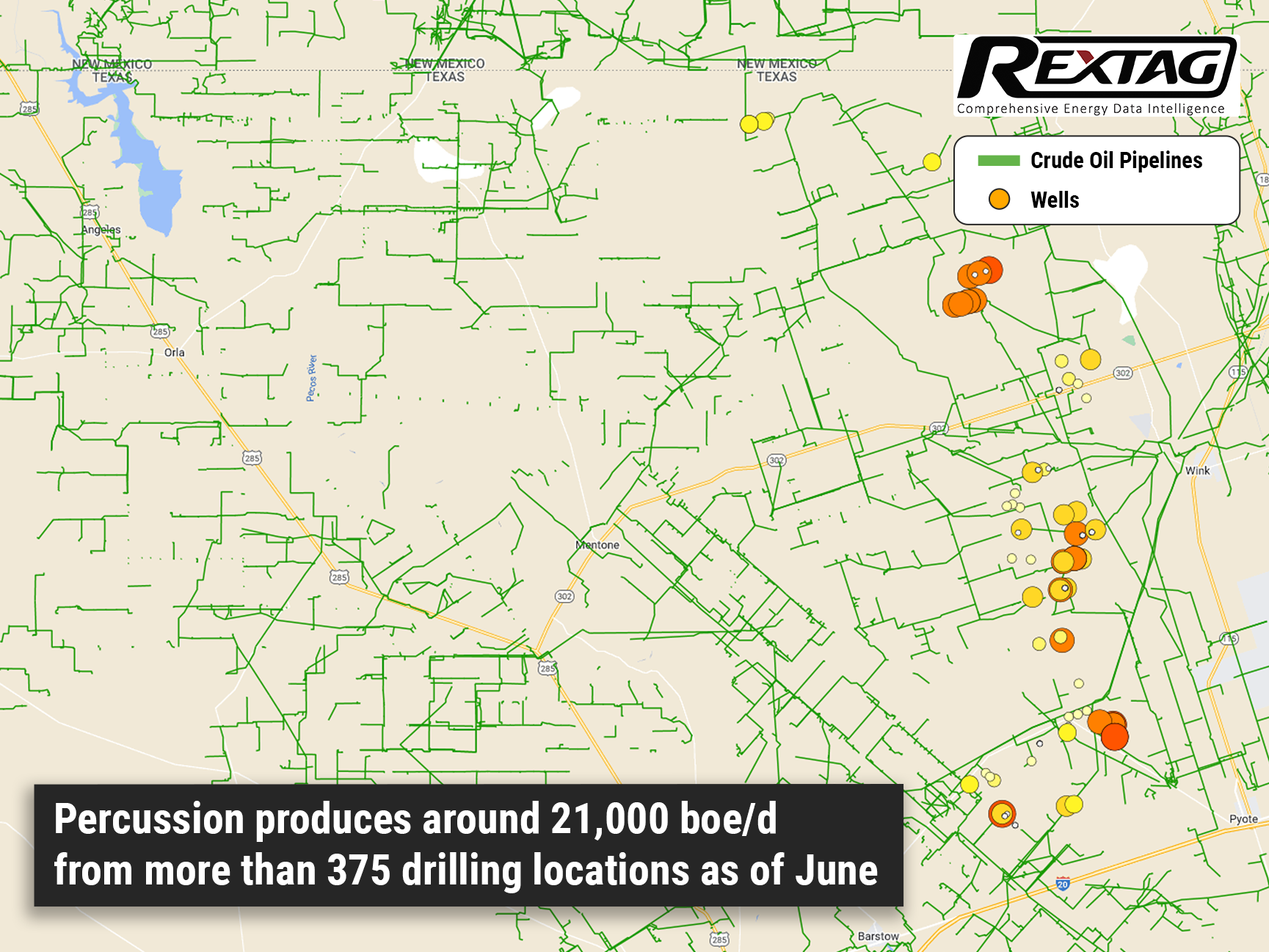

Up to $1.5 Billion for Percussion Petroleum in the Permian Basin

Around 25,000 net acres in the Permian are being sold by Percussion Petroleum II, looking to fetch up to $1.5 billion, as some sources bet on rising oil prices to pocket more than double what it paid in 2021. The company spent $375 million plus contingent payments a year ago to buy the bulk of its assets in one of the most prolific crude-producing areas in the U.S. from Oasis PetroleumInc. The oil prices increased to triple digits and buyers wanted to gain a toehold in the basin, whereas backers of private shale companies such as Percussion use it as a chance to exit their investments with big profits. Remarkably, U.S. crude oil futures have grown about 50% to approximately $109/bbl since June 29, 2021, when Percussion closed its deal with Oasis.

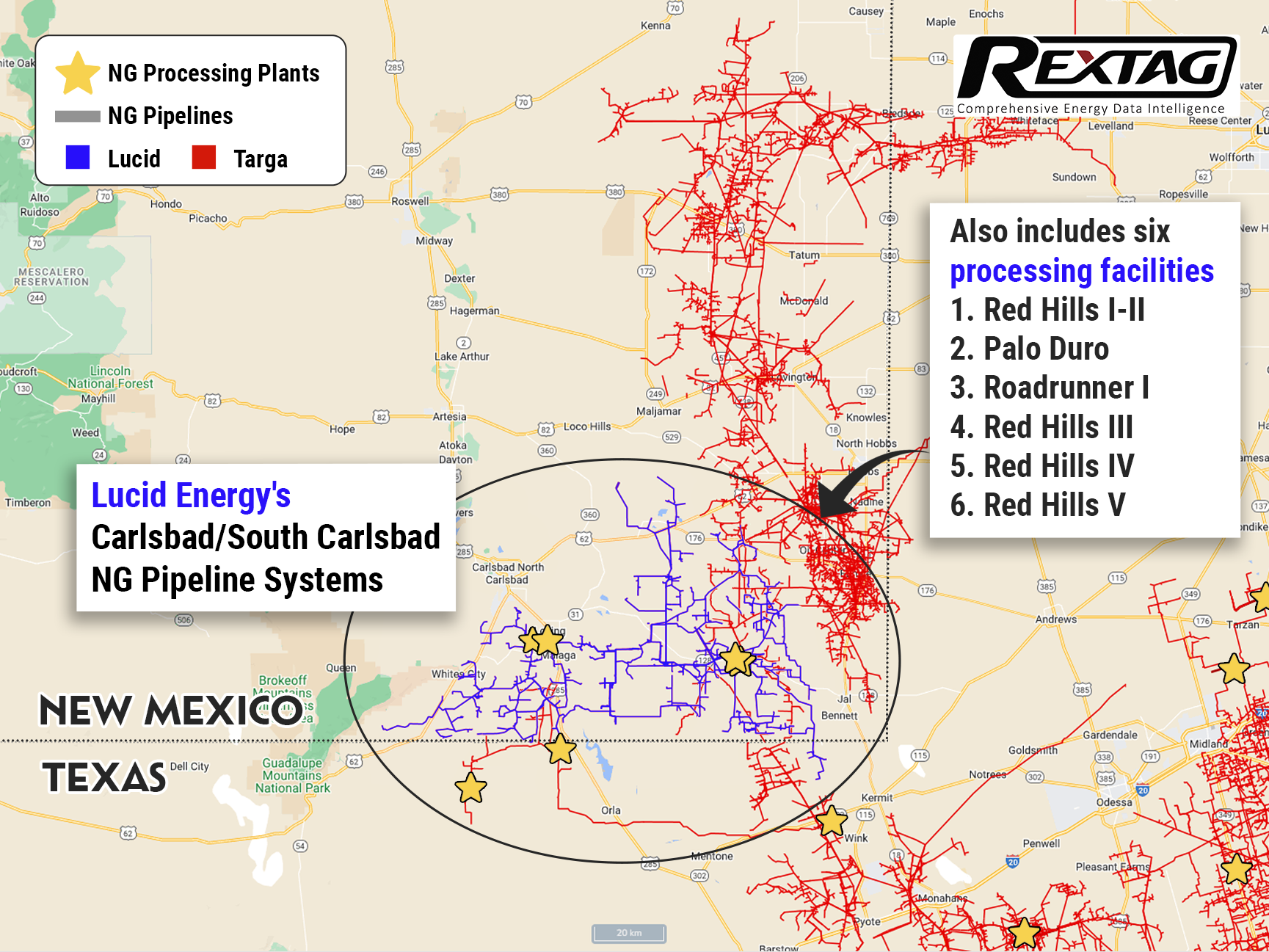

Targa Resources: $3.55 Billion Cash Transaction to Acquire Lucid Energy

On June 16 Targa Resources Corp. decided to acquire Lucid Energy Group, located in the Permian Basin, which is a part of Riverstone Holdings LLC and Goldman Sachs Asset Management. Firstly, Targa enlarged due to the recent “blot-on” acquisition of Southcross Energy in the Eagle Ford for $200 million and it will become bigger thanks to the $3.55 billion cash transaction. Targa’s financial position allowed it to utilize convenient opportunities to extend its company so it bought #Lucid using available cash and debt with an estimated pro forma year-end 2022 leverage around 3.5 times. According to Targa’s estimates, the acquisition of Lucid will increase the number of natural gas pipelines by 1,050 miles and add about 1.4 Bcf/d of cryogenic natural gas processing capacity in service or under construction located mainly in Eddy and Lea counties of New Mexico. The investment-grade producers source approximately 70% of current system volumes. According to the press release, a full-year standalone adjusted EBITDA is expected to be between $2.675 billion and $2.775 billion and reported year-end leverage ratio of about 2.7 times. Targa’s updated financial expectations assume NGL composite prices average $1.05 per gallon, crude oil prices average $100/bbl, and Waha natural gas prices average $6 per MMBtu for the remainder of 2022.

In Matador's Favor, For $75 Million Summit Sells Its Permian Midstream Assets

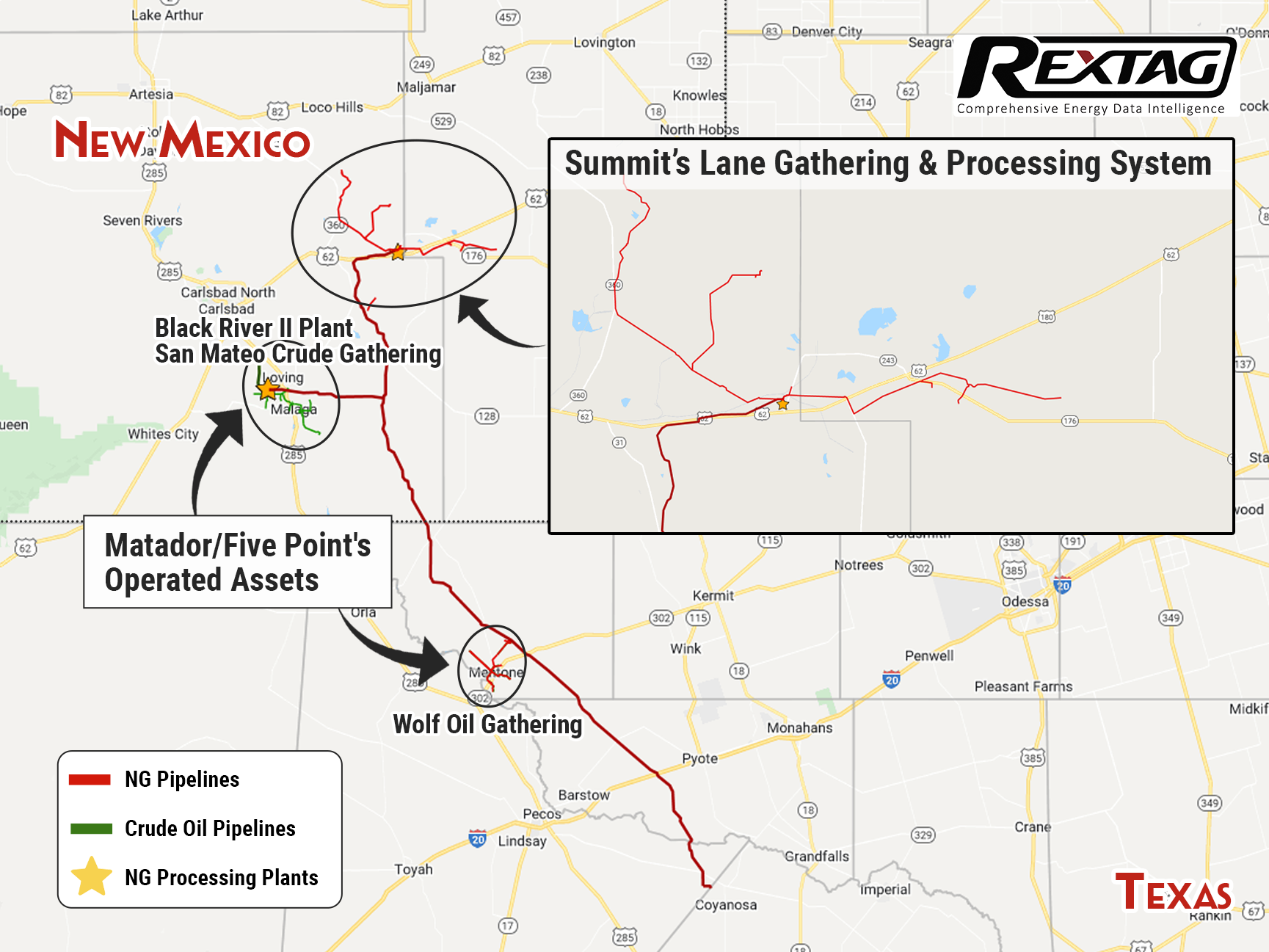

Matador Resources Co. acquires a gathering and processing system for $75 million in New Mexico’s Eddy and Lea counties from Summit Midstream Partners LP, filling up Matador’s midstream portfolio in the Permian Basin. Matador reached an agreement with a subsidiary of Summit to gain Summit’s Lane Gathering and Processing System on June 9. Nowadays, the Lane G&P System combines a 60 MMcf/d cryogenic natural gas processing plant, three compressor stations, and about 45 miles of natural gas gathering pipelines. As an investor presentation says, Matador began its initial midstream build-out in the Delaware Basin in 2015-2016. Since then the company has extended its midstream footprint in the Delaware using the San Mateo I and San Mateo II joint venture partnerships with Five Point Energy LLC

All Eyes Are on the Rocky Mountains State, as PDC Acquires Great Western for $1.3B

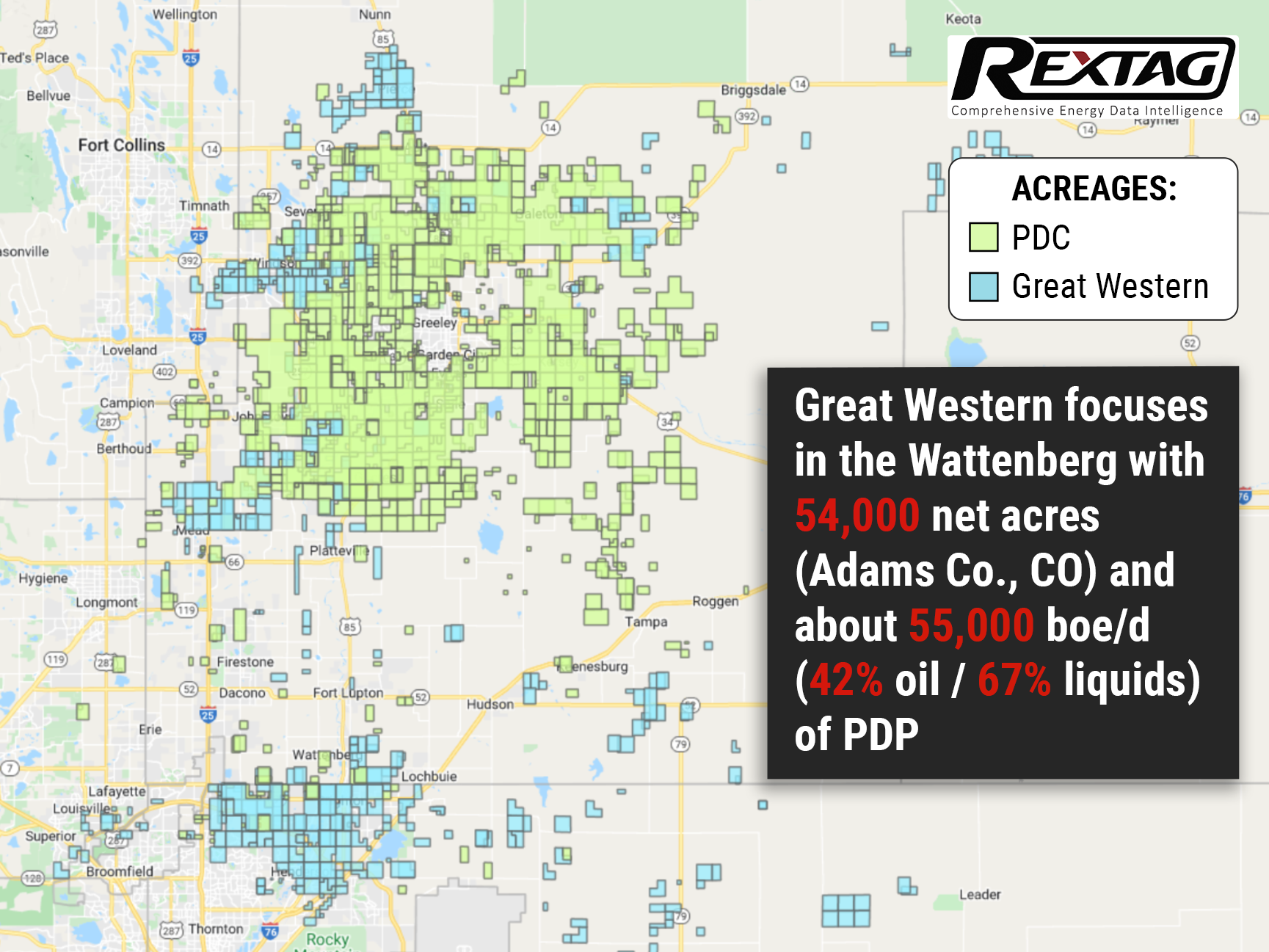

Great Western Petroleum's assets will be acquired by PDC Energy for $1.3 billion. Via this deal, PDC Energy’s position in the D-J basin increases roughly to 230,000 net acres. Denver-based Great Western has core operations in Weld and Adams counties in Colorado with 54,000 net acres and about 55,000 boe/d (42% oil / 67% liquids) of PDP. As part of the agreement, the acquisition will be financed by issuing 4 million shares of common stock to existing Great Western shareholders and by providing $543 million in cash to the company. All in all, PDC expects to increase its total production by 25% and its oil production by 35% as a result of the deal. The deal should also result in some synergies including a 15% reduction in overall cost per BOE.

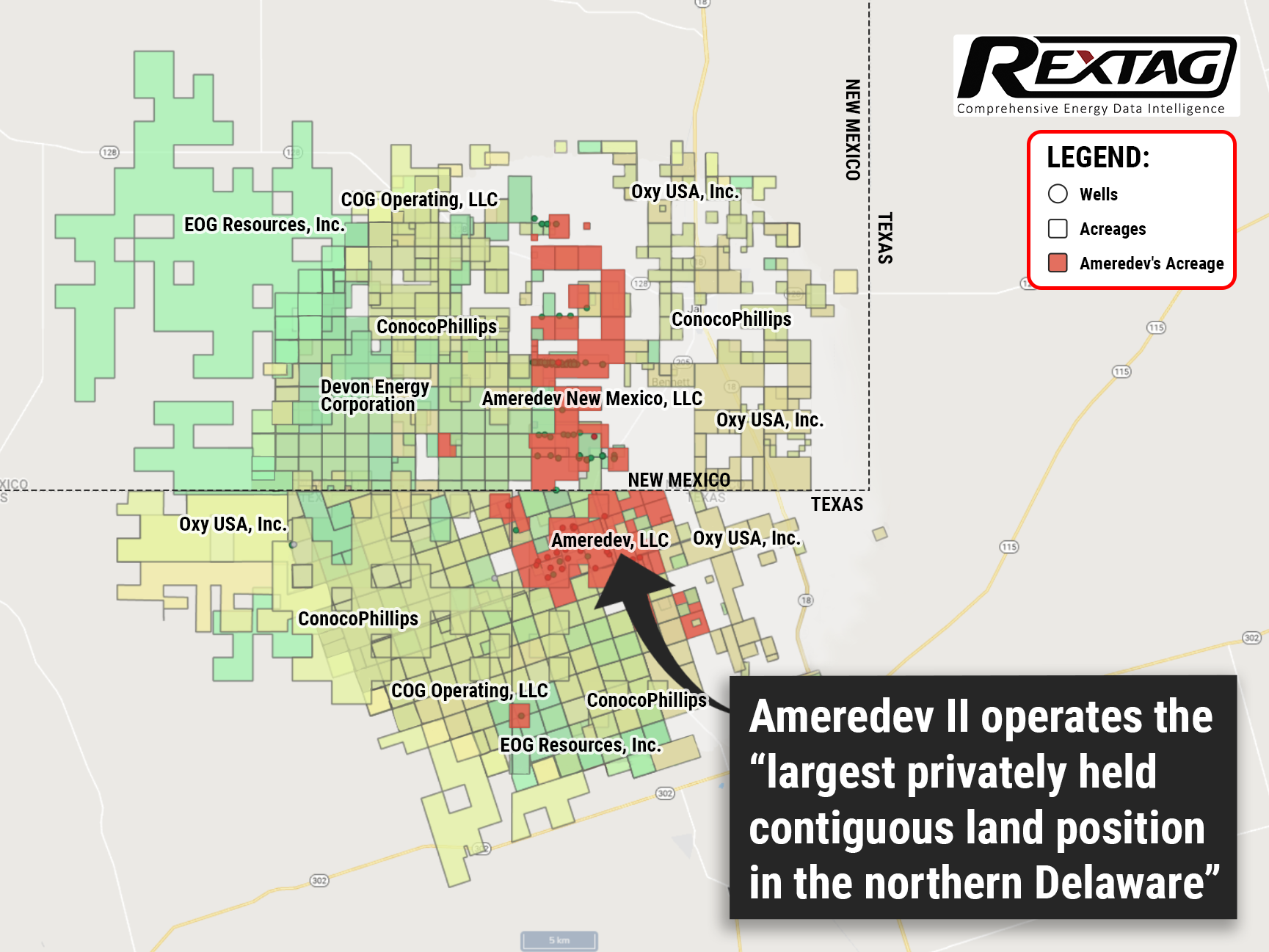

Major: Ameredev II Oil Producer to be Sold for $4 Billion by EnCap

In light of the conflict in Ukraine, buyout firms are currently scurrying to make cash from the U.S. crudeprices reaching their highest level since 2008. And one of the largest privately-owned US-based oilproducers may be up for sale. EnCap Investments looks to sell its portfolio company Ameredev II for over $4 billion including debt. It’s important to note, however, that both EnCap and Ameredev II alike are staying tight-lipped on the matter.

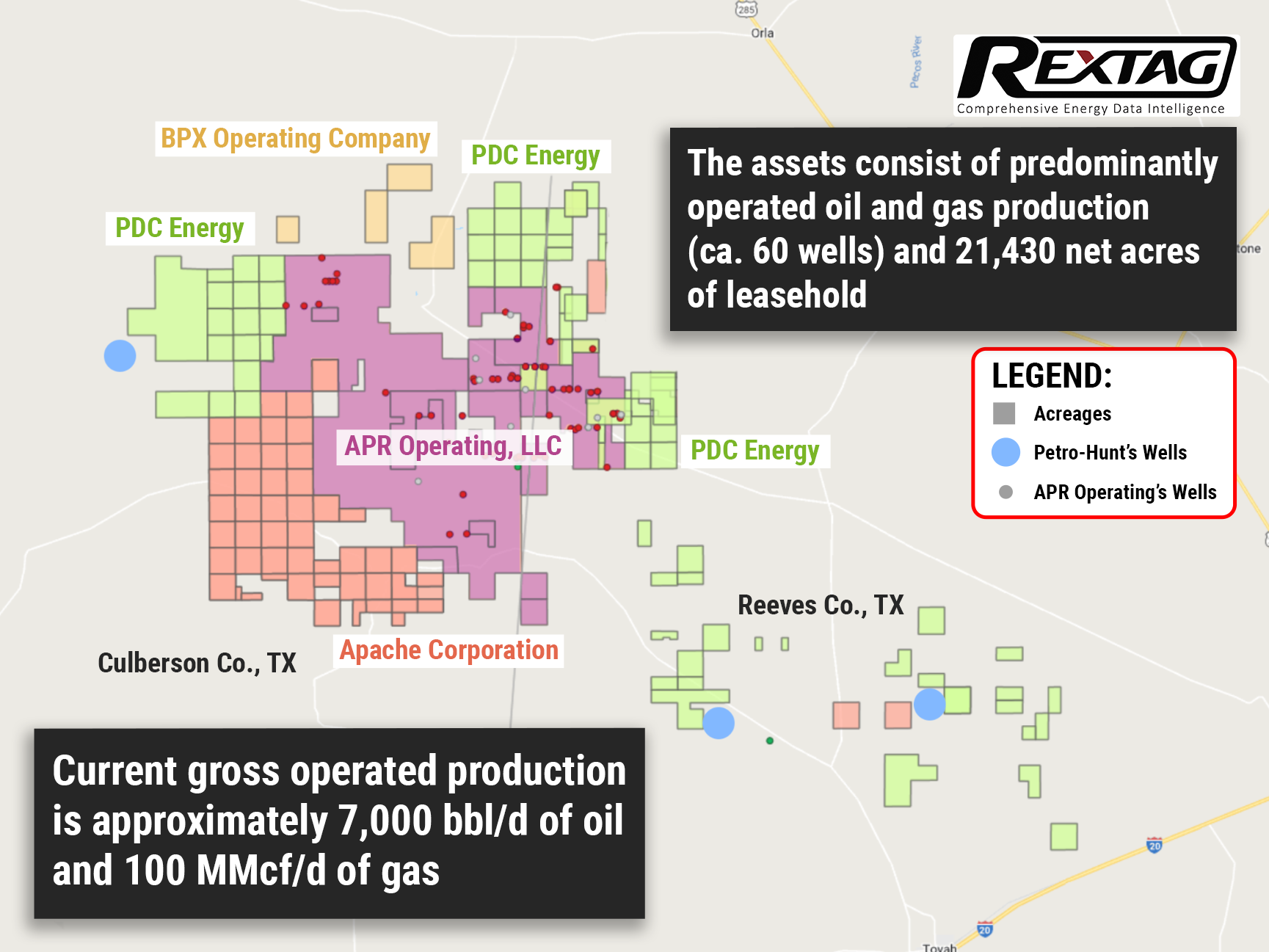

Winds of Change: Admiral Sold Its Assets in Delaware Basin

And Petro-Hunt E&P is the new sheriff in town with 21,430 net acres of leasehold in the Basin, production of which surpasses 7,000 bbl/d and 100 MMcf/d respectively. To take advantage of it, Petro-Hunt plans to begin an active development drilling program on these assets in the coming months heavily upgrading the numbers of its 775 operating oil wells and contributing to over 8,100 non-operated wells. Time will tell, however, whether or not this move will be able to deliver such results.

Continental Resources Raises Dividends Following a Quarter of Profit

The future of shale is looking bright: economic recovery and a spike in travel lifted oil prices to multi-year highs, helping Continental Resources to a fourth-quarter profit that exceeded Wall Street expectations. Coming off such a high note, the company plans to increase its dividend rates by 15% to 23 cents per share!

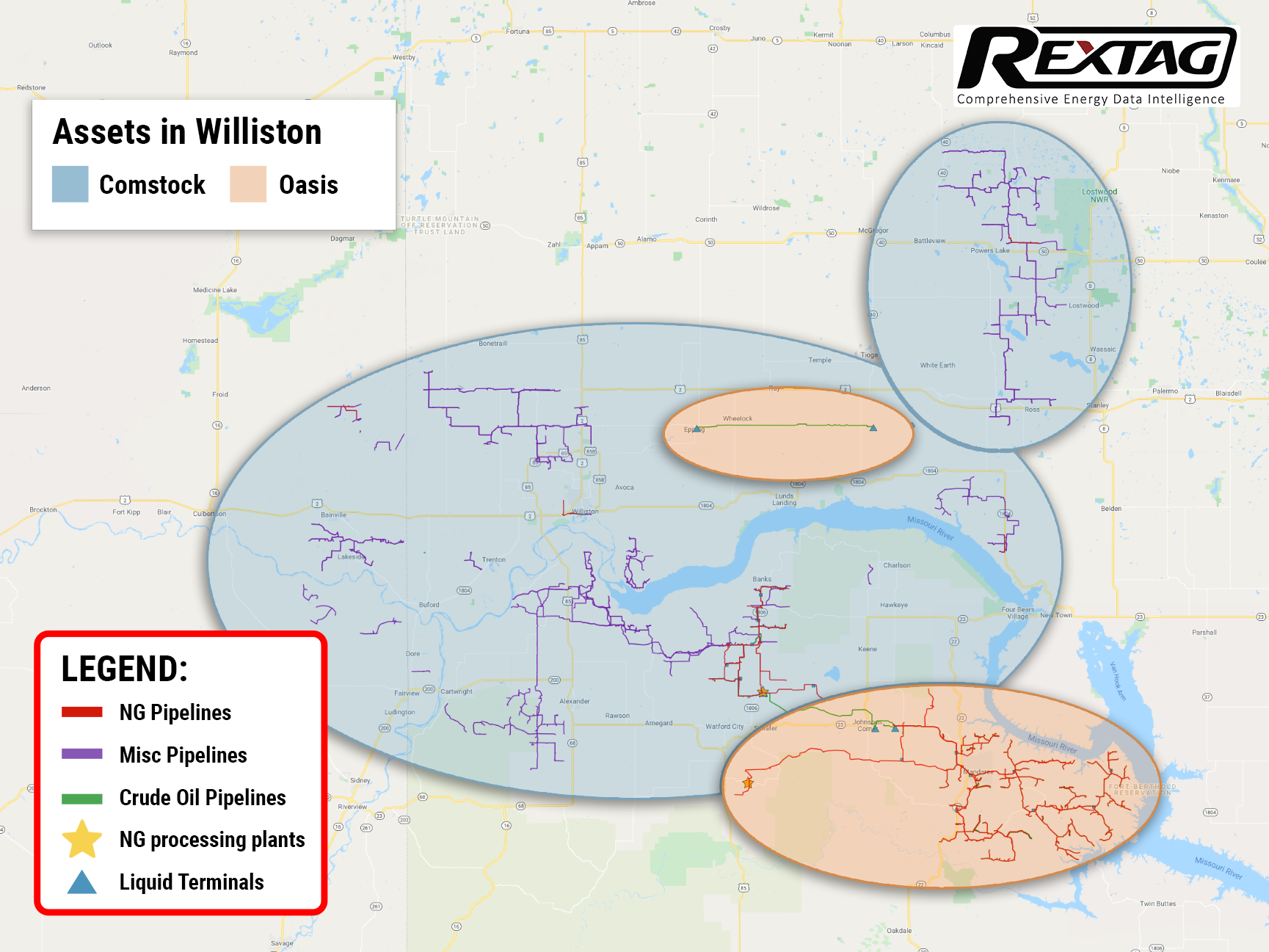

Ain't Nothing Like a $2 Billion Deal: Oasis Sells Midstream Affiliate to Crestwood

Crestwood & Oasis Midstream merge to create a top Williston #basin player. $1.8 billion deal is expected to close during the Q1 of 2022. The transaction will result in a 21.7% ownership stake for Oasis in Crestwood common units. The remaining ownership of Oasis in Crestwood will also be of benefit to the company since it will create a diversified midstream operator with a strong balance sheet and a bullish outlook after this accretive merger.

Restructuration is in a full-speed: Comstock to sell Bakken for $154 million

Comstock Resources decided to go through with asset divestment, selling its Bakken Shale actives for $150M to Northern Oil and Gas. The proceeds from these sales will be reinvested by Comstock Resources Inc. into the Haynesville Shale, at which point the company may acquire additional leasehold and fund drilling activities starting in 2022. Meanwhile, Northern clearly gunning for the pack leading position in the Texas shale play, but whether they succeed or not is remains to be seen.

A major U.S. shale oil producer is looking to start a land selloff in the lone star state

Pioneer Natural resources is looking to divest properties in the lone star state. According to Rextag, Pioneer’s Delaware assets on sale have a trailing 12 month production of just over 22 MBOE against a total Permian Basin production of almost 212 MBOE. (The sale, if it happens, will effectively lead to a 10% decrease of Pioneer’s asset base in terms of the previous year's production.)

.png)

.png)