Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

05/25/2023

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres.

In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

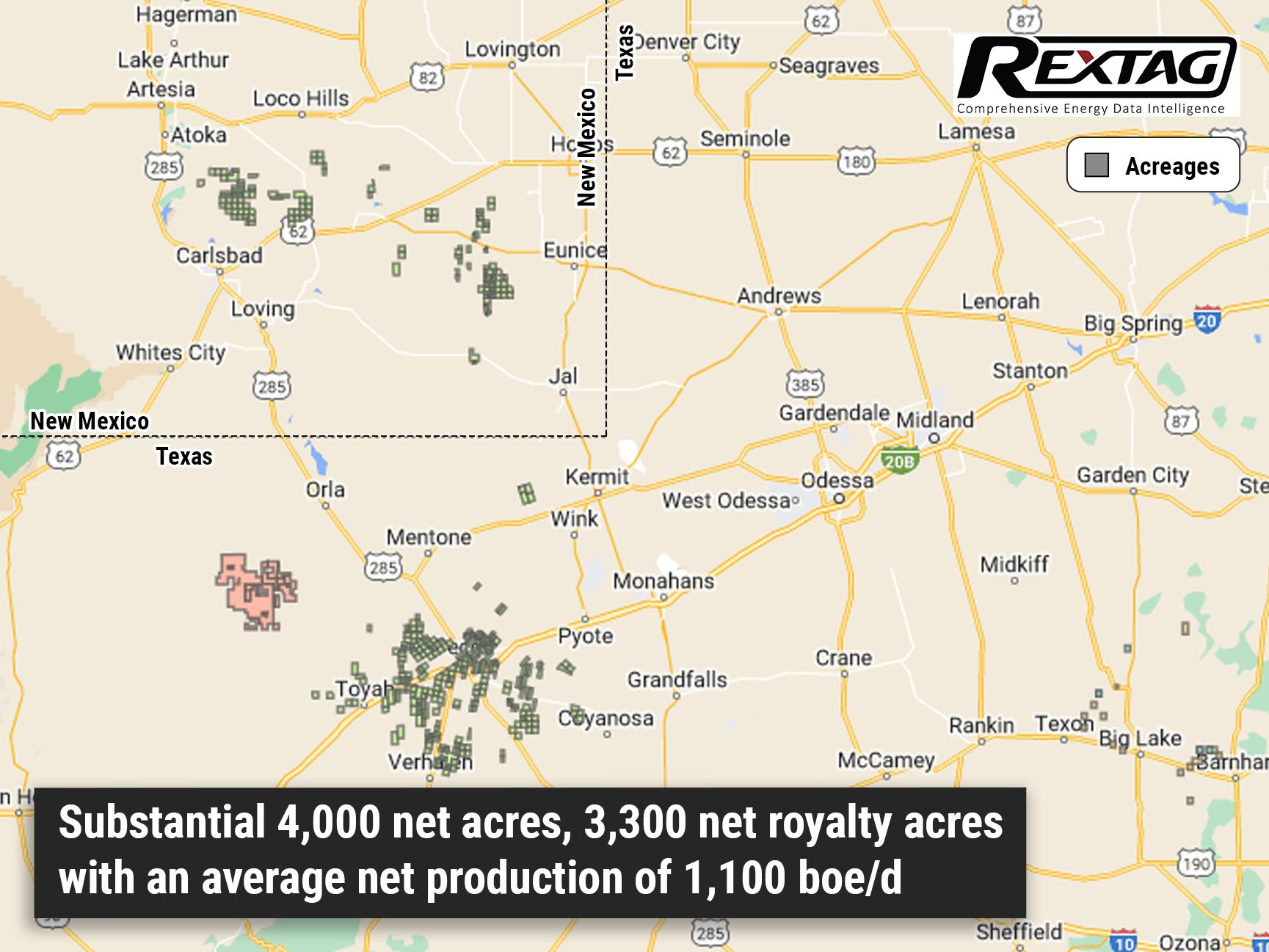

One of the highlights of Permian Resources' quarter was the acquisition of a substantial 4,000 net acres, comprising 3,300 net royalty acres with an average net production of 1,100 barrels of oil equivalent per day (boe/d). This bold move cements its foothold in the energy landscape, bolstering its portfolio with promising assets and strengthening its overall market position.

What we already know

Permian Resources recently announced a major transaction, adding to its already substantial acreage in Lea County. The company successfully executed a strategic acreage trade during the first quarter 2023. This trade involved:

- Approximately 3,400 net acres in Eddy County, New Mexico.

- About 3,200 net acres of lower working interest acreage.

- Among these transactions were grassroots acquisitions that resulted in an impressive addition of approximately 530 net acres to Permian Resources' portfolio. The company secured around 20 net royalty acres, further strengthening its position in the market.

- Permian Resources didn't limit its transactions solely to upstream activities and made divestments in its saltwater disposal wells and the corresponding produced water infrastructure located in Reeves County, Texas.

Co-CEO James Walter enthusiastically shared the impact of this trade during a recent analyst call, stating, "This trade significantly enhances our working interest in high-return locations and paves the way for the creation of several newly operated drilling units." He further revealed that development activity is expected to commence in about half of the inbound acres over the next 12 months. Such a transaction promises remarkable growth and value for shareholders, making it a highly accretive move.

Permian Resources demonstrated its commitment to expansion by executing over 45 transactions in the first quarter alone.

Path to A&D Success

Permian Resources, the result of a successful merger between Colgate Energy Partners II LLC and Centennial Resource Development Inc., has emerged as the pure-play E&P company in the Delaware Basin. With a strategic focus on efficiency and cost reduction, the company has achieved remarkable progress since its inception a year ago.

Permian Resources portfolio of mineral and royalty interests in the Permian’s Delaware Basin.

Co-CEO Will Hickey highlighted the achievements resulting from the combination and integration process, emphasizing significant operating cost reductions, improvements in drilling and completion costs, and overall operational efficiencies. This commitment to excellence is a testament to the talented team driving Permian Resources' success.

Looking ahead, Hickey expressed the company's determination to enhance capital efficiency further and reduce costs, enabling incremental free cash flow that can be returned to shareholders. Permian Resources recognizes the importance of maximizing value for its investors and remains dedicated to identifying new opportunities for growth.

Notably, the company's royalty-focused entity is currently generating over $50 million of annual free cash flow, solidifying Permian Resources' position as a formidable player in the industry.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Riley Permian Secures $330 Million Acquisition in Thriving New Mexico: A Strategic Move with Promising Returns

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/144Blog_Riley Permian $330 Million Acquisition.png)

In a big move for Riley Permian, the company has just closed a deal to acquire top-of-the-line oil and gas assets in the heart of New Mexico. The acquisition, which was made in February, saw Riley Permian snapping up these highly sought-after resources from none other than Pecos Oil & Gas LLC for $330 million.

Callon Acquires $1.1 Billion Delaware Assets and Bows Out of Eagle Ford - Here's What You Need to Know

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/151Blog_Percussion acquisition map in the Eagle Ford $1.1 Billion Delaware Asset.png)

Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million. In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.