Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

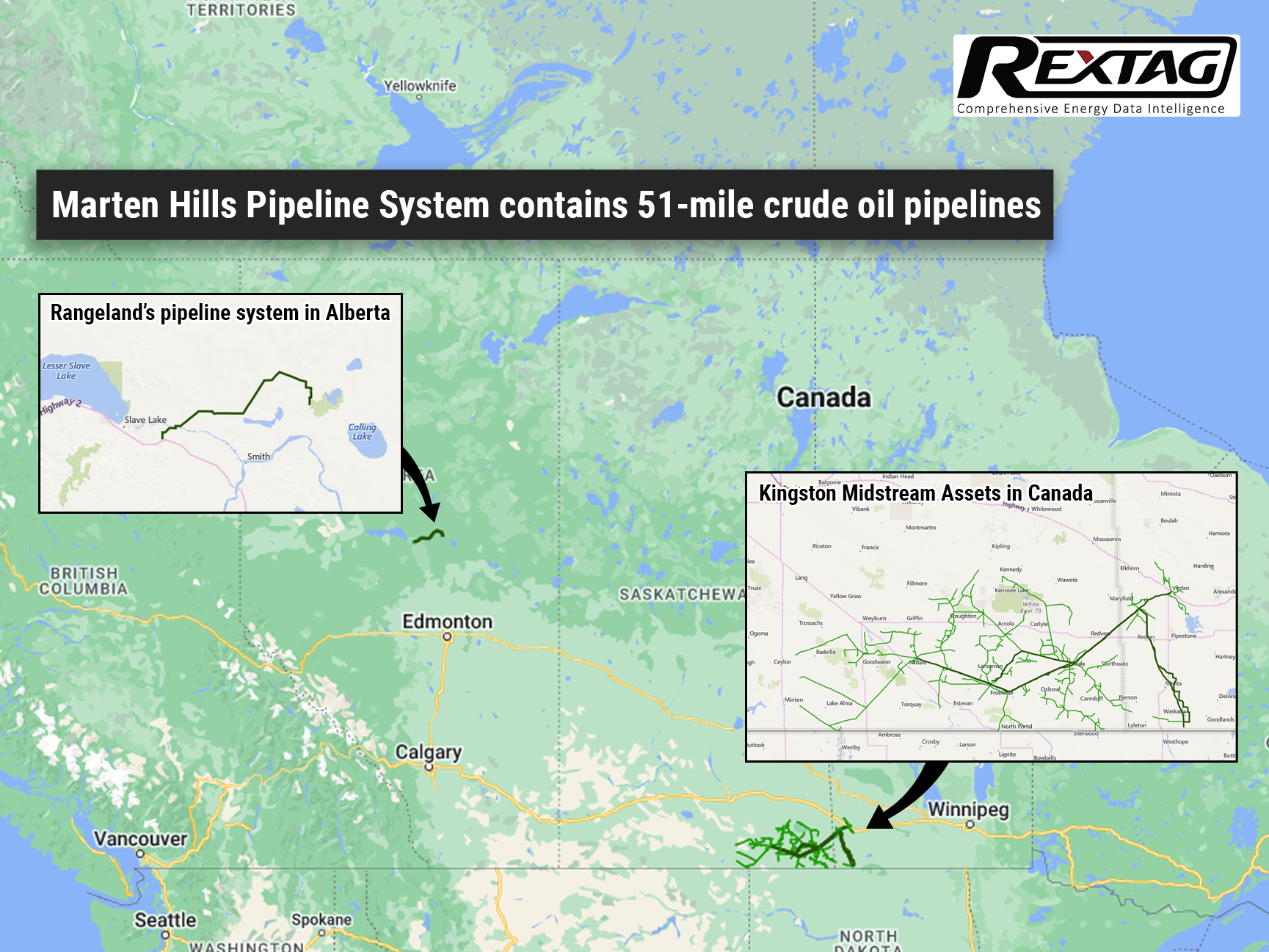

Kingston Midstream Secures Deal to Acquire Clearwater Assets from Rangeland Midstream Canada

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

Tivoli Services Acquires Barnett NTX Pipeline from Phillips 66

Tivoli Services finalized the purchase of the NTX pipeline system from Phillips 66, backed by a long-term transportation services agreement. Tivoli Services LLC, a branch of Tivoli Midstream LLC, completed the purchase of the NTX oil pipeline system in the Barnett Shale from Phillips 66 affiliates, according to press release by Tivoli Midstream. The financial terms remain undisclosed.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

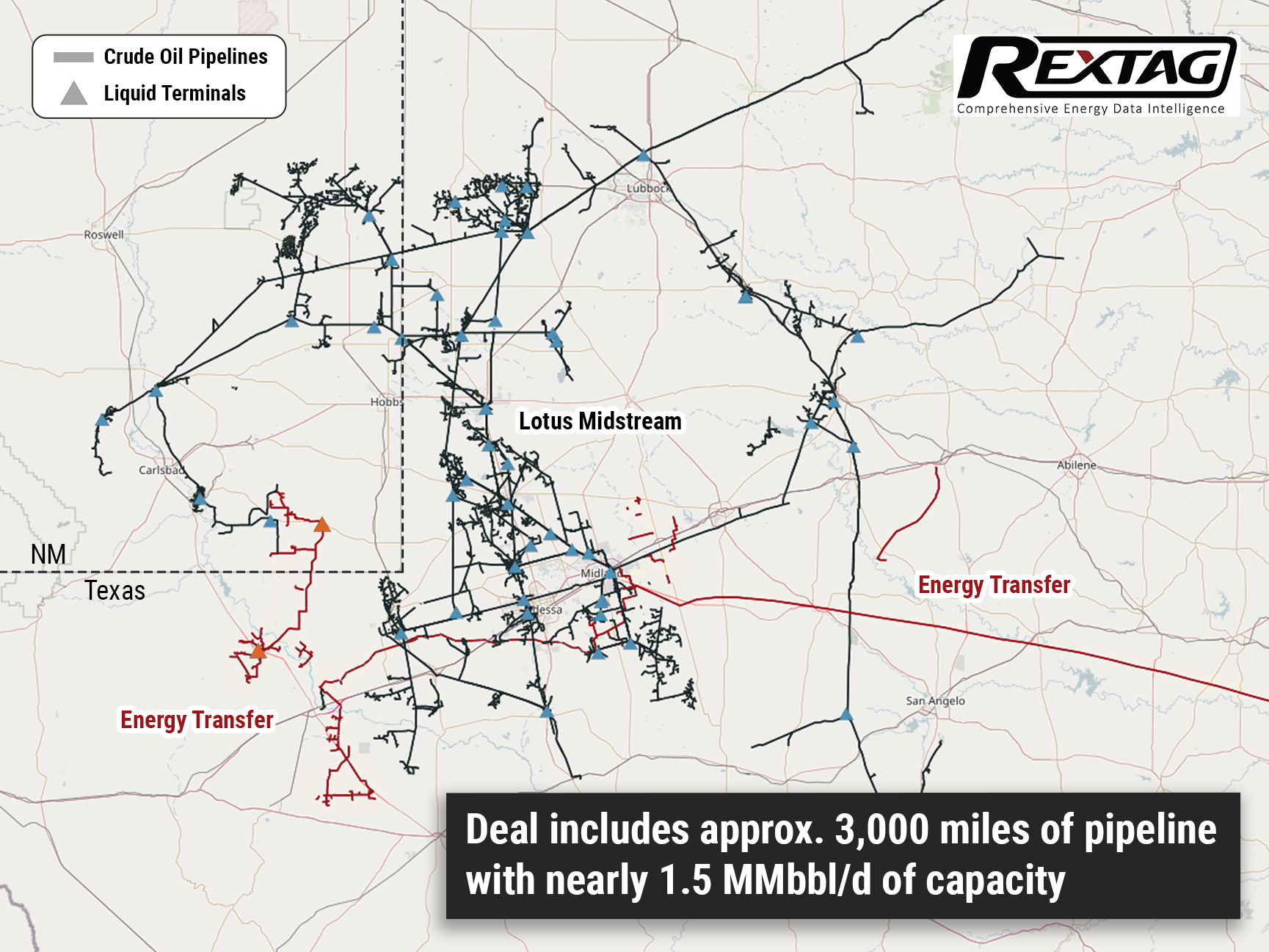

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

Under Construction Pipelines: Outlook 2023 by Rextag

According to Globaldata, 196,130km of planned and announced trunk oil and gas pipelines are anticipated to become operational globally between 2023 and 2030. This consists of 113,099km of planned pipelines that have identified development plans, and 83,031km of early-stage announced pipelines currently under conceptual study, expected to receive development approval. Based on Global Energy Monitor's 2023 data, Africa and the Middle East account for 49% of the global oil transmission pipeline construction, valued at US$25.3 billion. The report indicates these regions are currently constructing 4,400 km of pipelines with an investment of US$14.4 billion. There are plans for an additional 10,800 km at an approximate cost of US$59.8 billion.

TC Energy sells 40% Stake in Columbia Gas Pipeline Systems for $3.9 Billion to GIP

Calgary-based pipeline operator TC Energy is selling a 40% stake in its natural gas pipeline systems for $3.9 billion as part of its efforts to reduce debt. TC Energy Corporation (TRP) has agreed to sell a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission systems to Global Infrastructure Partners (GIP). This move will help TC Energy reduce its debt and establish a valuable long-term partnership with GIP, a prominent infrastructure investor.

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

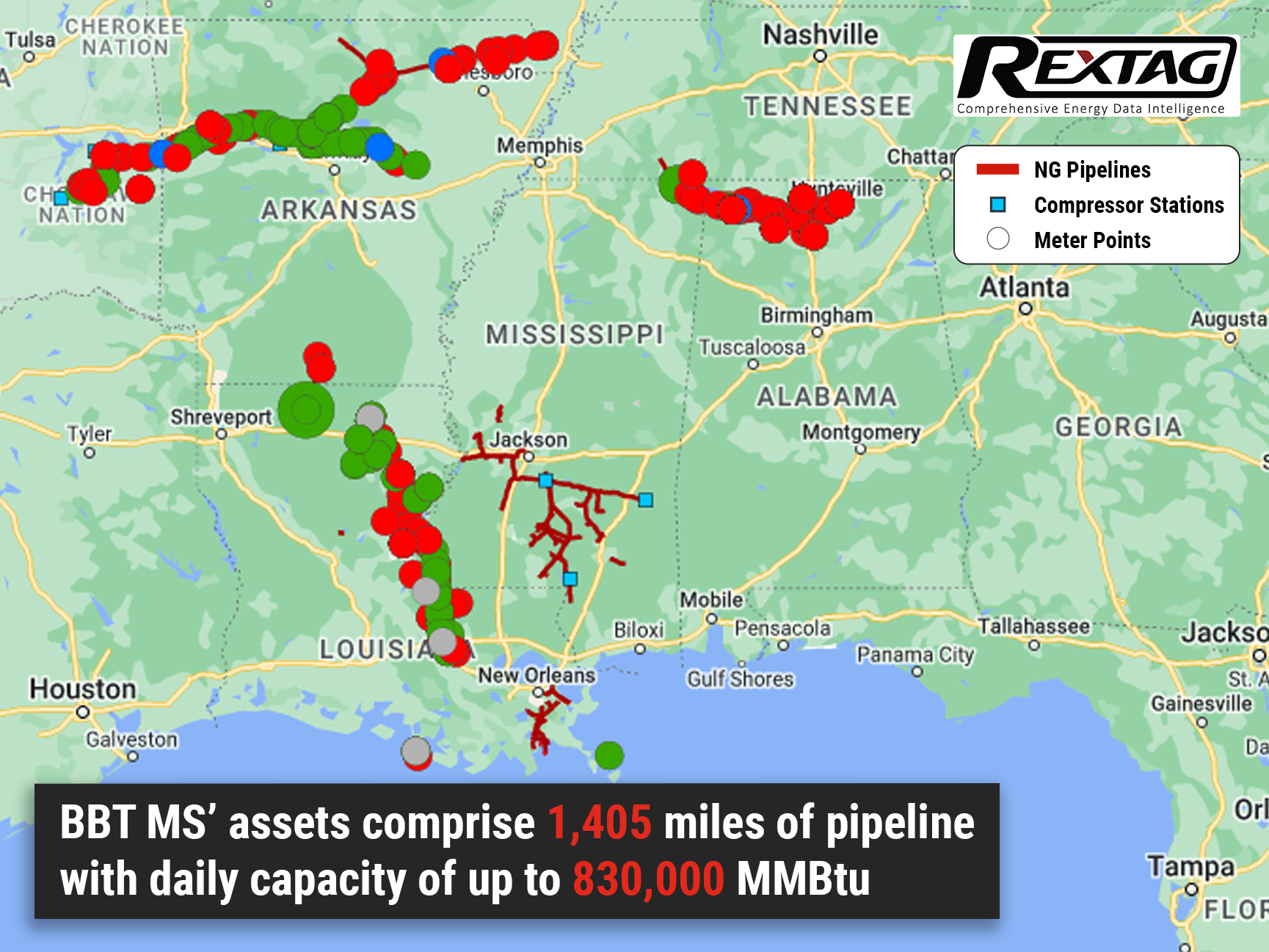

Black Bear Roars with Success: Mississippi Gas Gathering Assets Sold

Skye MS LLC purchased a package deal from Black Bear, which included over 120 miles of natural gas pipelines and eight active metered locations. Black Bear Transmission LLC, based in Houston, successfully finalized the sale of gas gathering assets owned by BBT Mississippi LLC (BBT MS) to Skye MS LLC of Columbia, Mississippi. The specific amount of the transaction remains undisclosed. BBT MS is the proud owner and operator of a fee-based, natural gas transmission system that efficiently supplies gas to utility, industrial, and power generation customers. It facilitates the connection of wellhead production in Mississippi to regional long-haul pipelines.

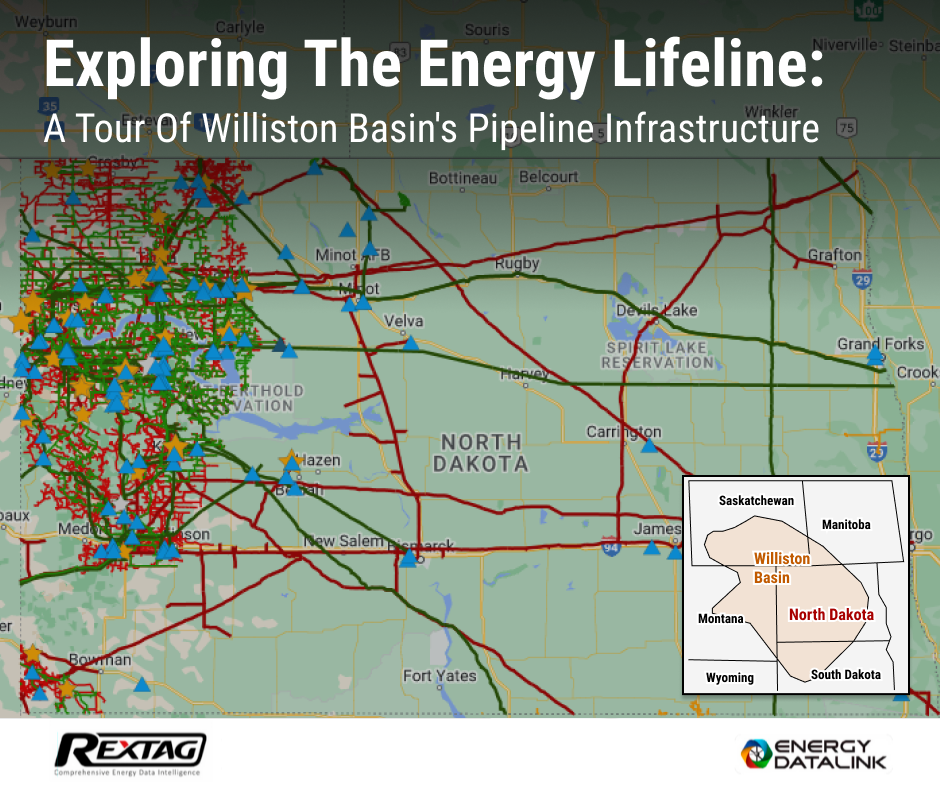

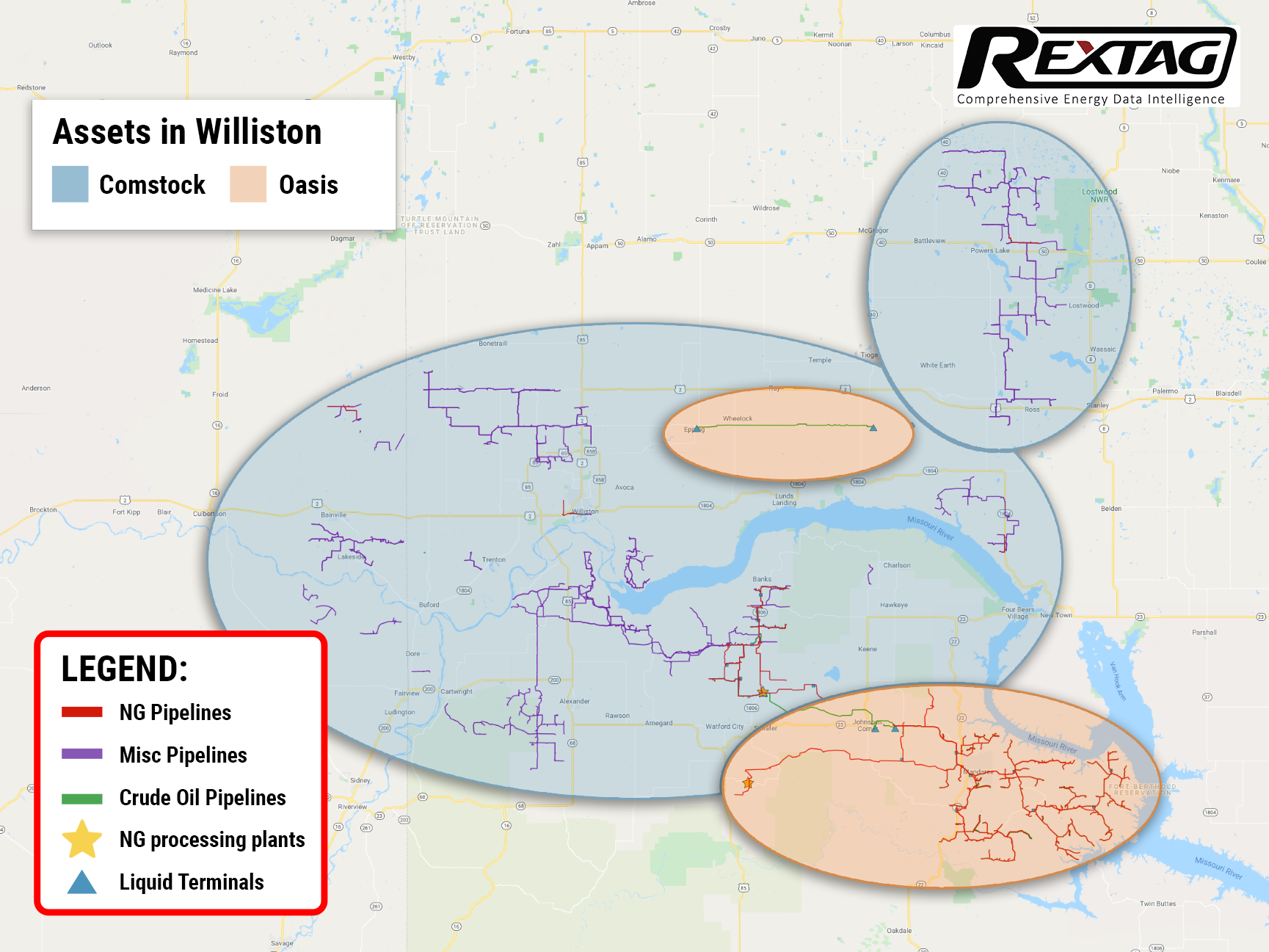

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

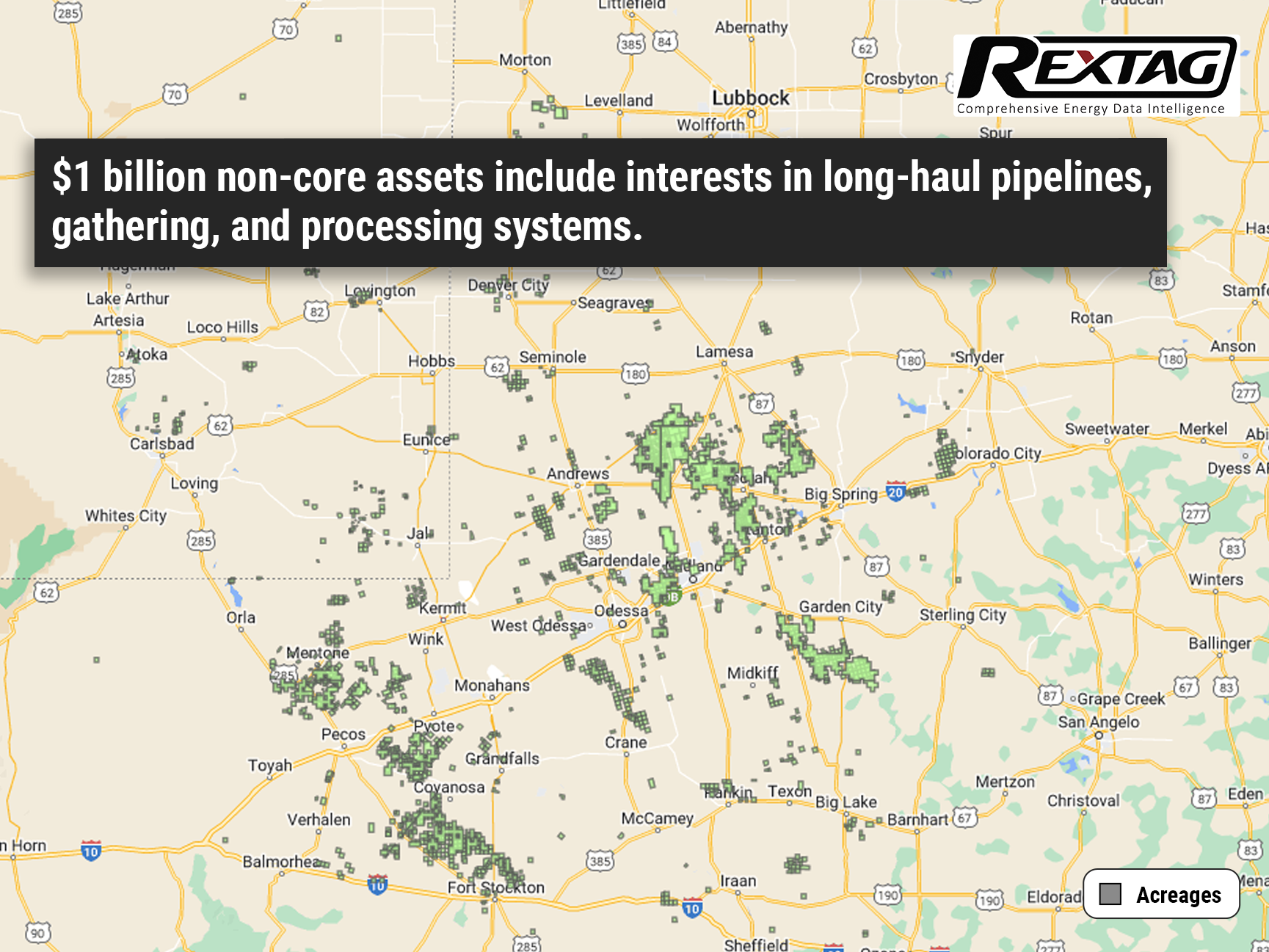

Massive Energy Deal Alert: Energy Transfer to Acquire Lotus Midstream in Permian Basin for $1.45 Billion!

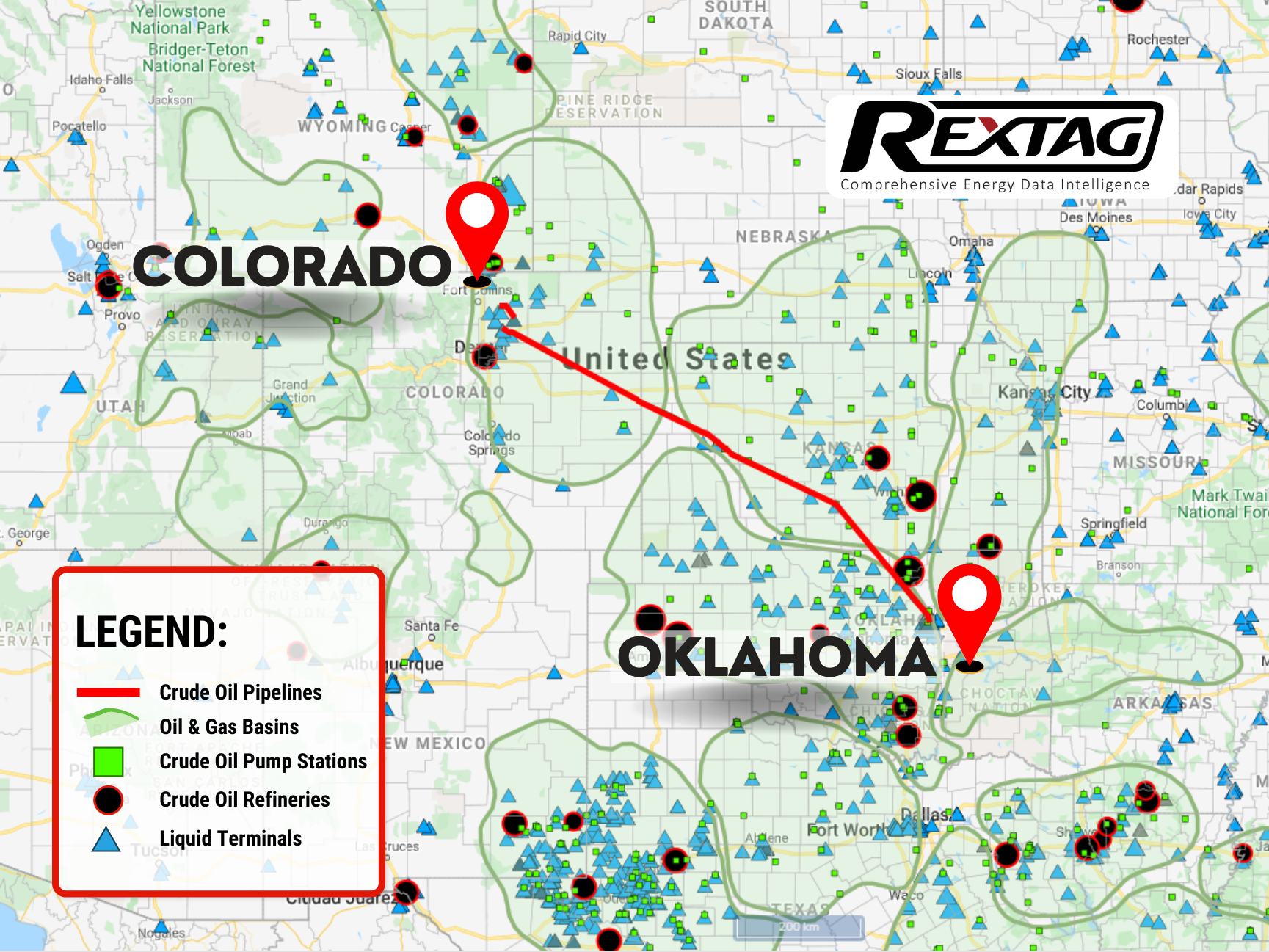

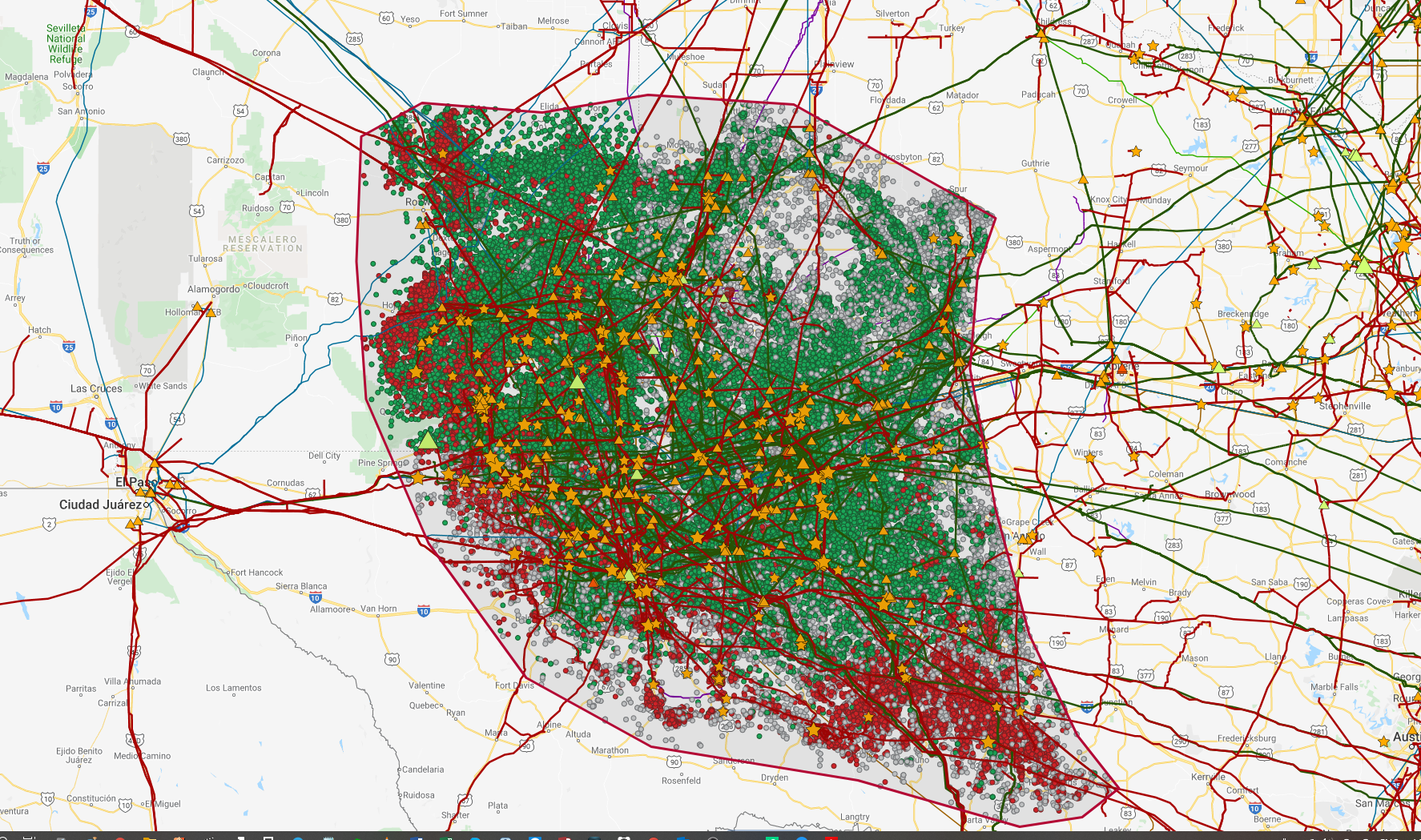

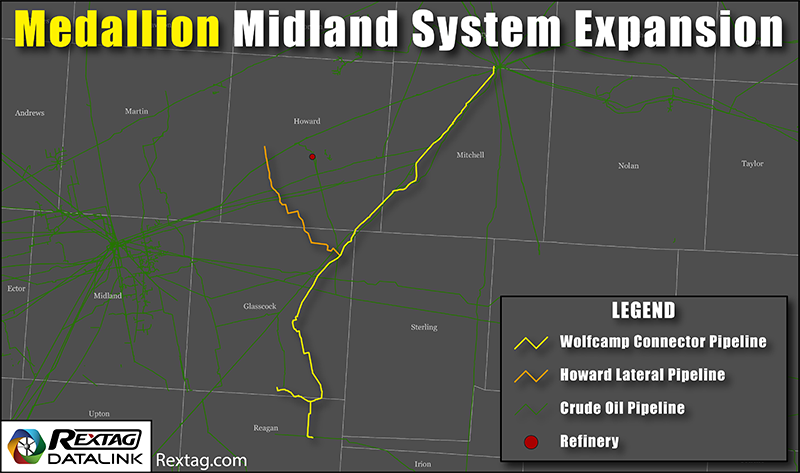

Energy Transfer's recent acquisition of Lotus Midstream's infrastructure for $1.45 billion is a remarkable feat that is bound to shake up the energy industry. This strategic move grants Energy Transfer access to the highly prized Centurion Pipeline, as well as an additional 3,000 miles of crude gathering and transportation pipelines. These pipelines span across the vast Permian Basin of West Texas, stretching all the way from New Mexico and culminating at the bustling energy hub of Cushing, Oklahoma.

Enbridge agreed to acquire the Tres Palacios gas storage facility in Texas for $335 million

Enbridge acquired Tres Palacios natural gas storage facility in Texas for $335 million, adding approximately 35 Bcf of natural gas storage to their portfolio. The facility uses salt caverns for storage and has a gas header pipeline system that spans 62 miles and links to 11 major gas pipelines. Crestwood Equity Partners LP intends to divest its interests in Tres Palacios by the second quarter.

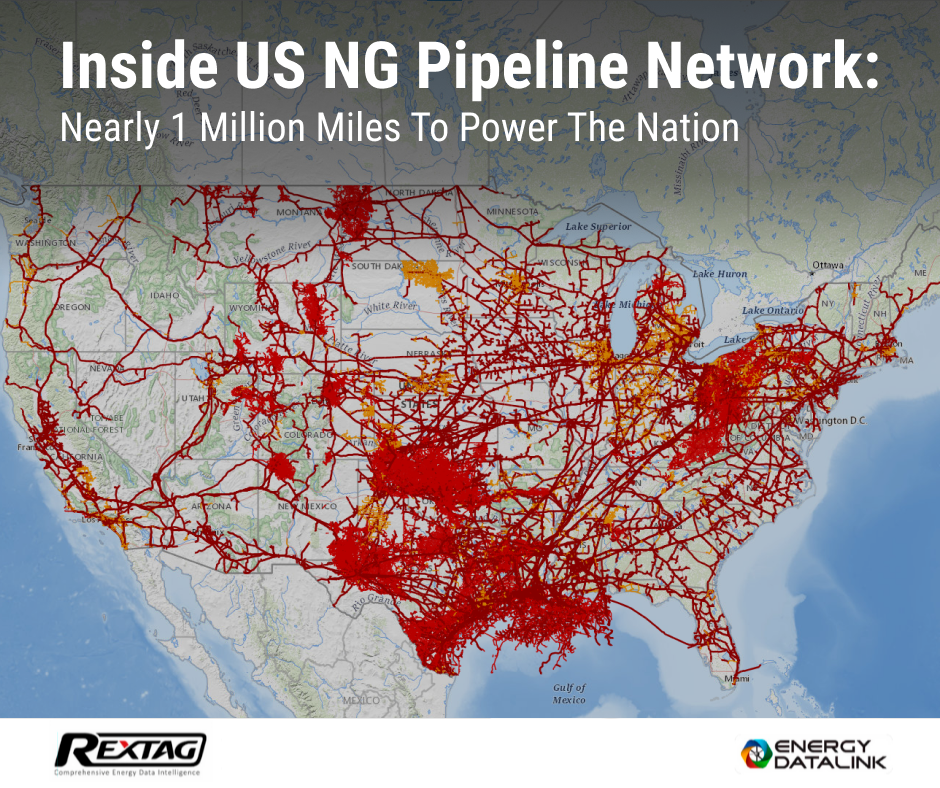

U.S. Natural Gas Pipelines Infrastructure Overview by Rextag

The U.S. natural gas pipeline network is a complex system of pipelines that transport natural gas from production areas to consumers across the country. The pipeline network consists of three main types of pipelines: gathering pipelines, transmission pipelines, and distribution pipelines. Gathering pipelines are small-diameter pipelines that transport natural gas from production wells to processing facilities or larger transmission pipelines. Transmission pipelines are large-diameter pipelines that transport natural gas over long distances, sometimes across multiple states. Distribution pipelines operate at low pressure and are located in or near urban areas. They are often referred to as "utility pipelines" because they are typically owned and operated by local gas utility companies.

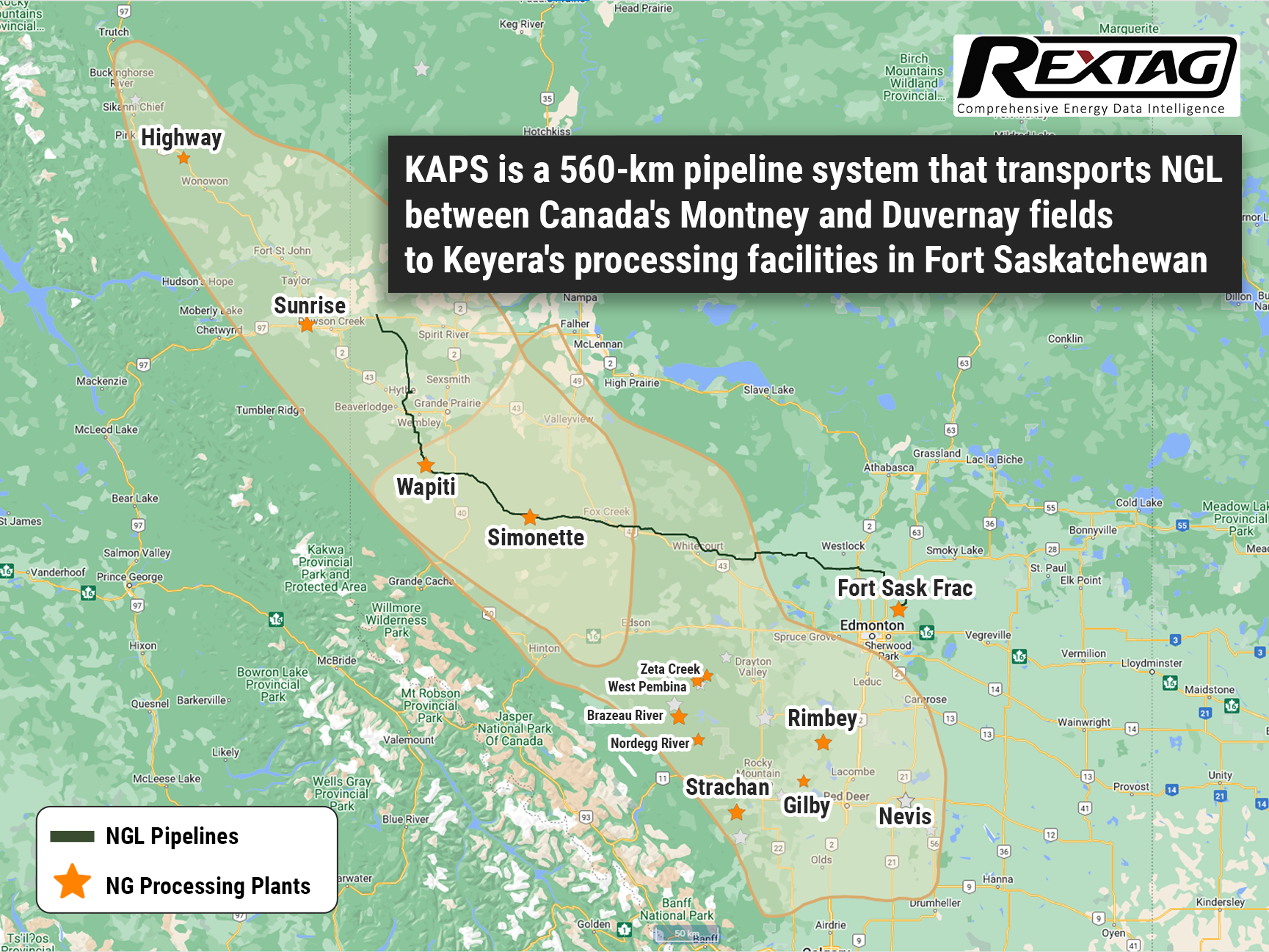

Pembina's Stake in Key Access Pipeline System Is Sold to Stonepeak Partners

Canadian pipeline operator Pembina Pipeline Corp.'s joint venture with KKR & Co. is selling for C$662.5 million ($484.89 million) its 50% stake in the Key Access Pipeline System to private equity firm Stonepeak Partners. The agreement allows Stonepeak to maintain a pipeline system that conveys NGL to processing facilities for export to Asia, a market with a raising appetite for North American LNG as it refuses to use coal and as the decrease in Russian exports leaves a void in global supply.

Grand Prix Pipeline Will Be Completely Owned by Targa: To Buy Remaining Stake For $1.05 Billion

On January 3, Targa Resources Corp asserted that it is purchasing the remaining stake for $1.05 billion in cash from BlackstoneInc's energy unit in its Grand Prix NGL Pipeline that it does not already own. Targa, which is going to acquire a 25% stake from Blackstone Energy Partners, purchased 75% interest in the pipeline last year when it repurchased interests in its development company joint ventures from investment firm Stonepeak Partners LP for almost $925 million. The Stonepeak agreement also included 100% interest in its Train 6 fractionator in Mont Belvieu, Texas, and a 25% equity interest in the Gulf Coast Express Pipeline. Grand Prix has the capacity to transfer up to 1 MMbbl/d of NGL to the NGL market hub at Mont Belvieu. The same day Targa maintained the price of the Blackstone Energy Partners agreement, which is anticipated closing in the first quarter of 2023, representing roughly 8.75 times Grand Prix's valued 2023 adjusted EBITDA multiple.

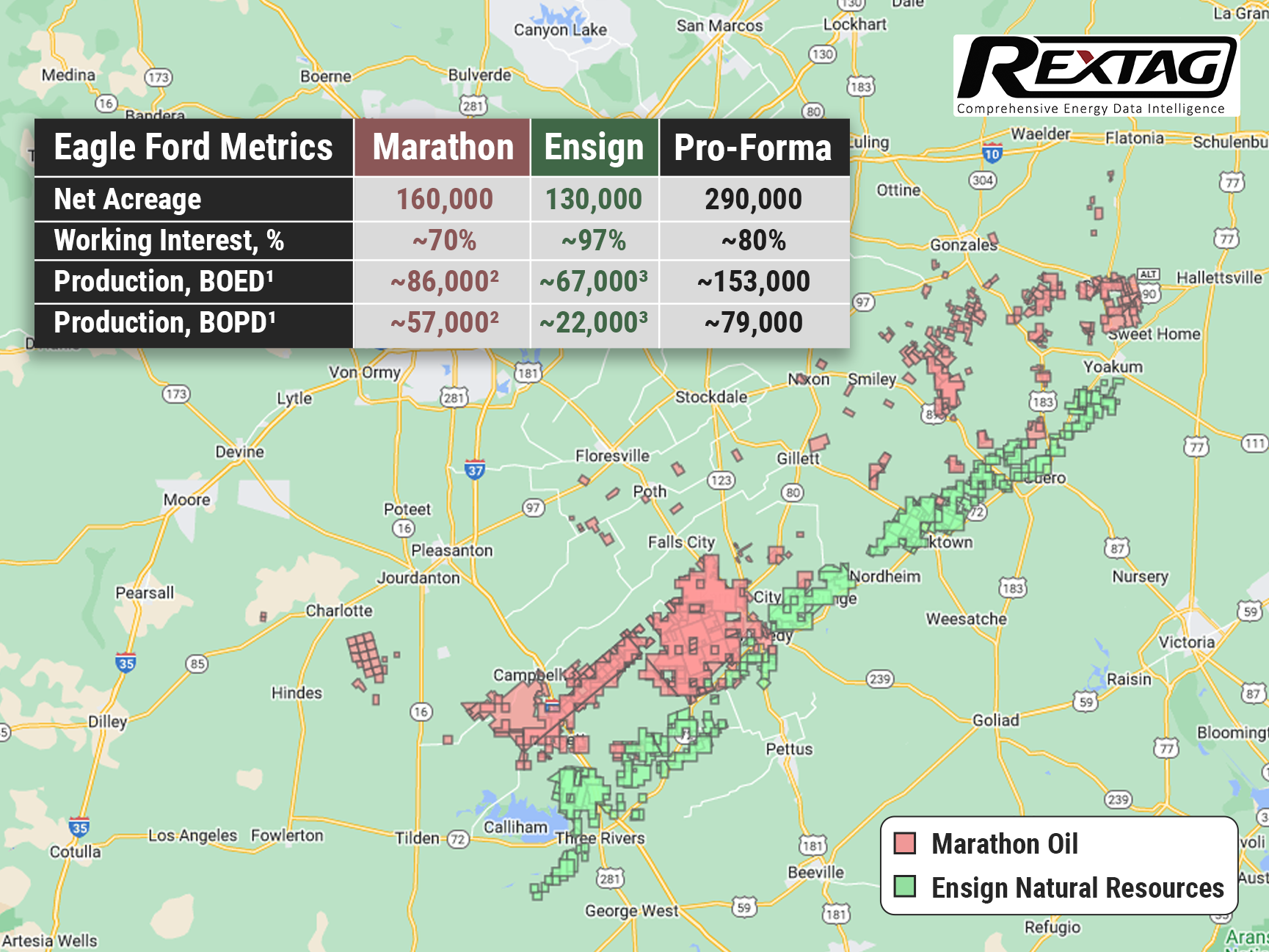

Ensign’s Assets Are Acquired by Marathon for $3 Billion

Marathon Oil Corp. closes the acquisition of Ensign Natural Resources’ Eagle Ford assets for $3 billion cash, according to the company’s release on December 27. The purchase includes 130,000 net acres (99% operated, 97% working interest) in acreage adjacent to Marathon Oil’s existing Eagle Ford position. Ensign’s estimated fourth-quarter production will average 67,000 net boe/d, including 22,000 net bbl/d of oil.

Williams Buys MountainWest Pipeline System for $1.5 Billion

On December 15, Pipeline giant Williams made a deal to purchase MountainWest Pipelines Holding Co. from Southwest Gas Holdings Inc. for almost $1.5 billion including debt. Williams is paying $1.07 billion in cash and assuming $0.43 billion of debt to buy MountainWest, which comprises approximately 2,000 miles of interstate natural gas pipeline systems mainly situated across Utah, Wyoming, and Colorado.

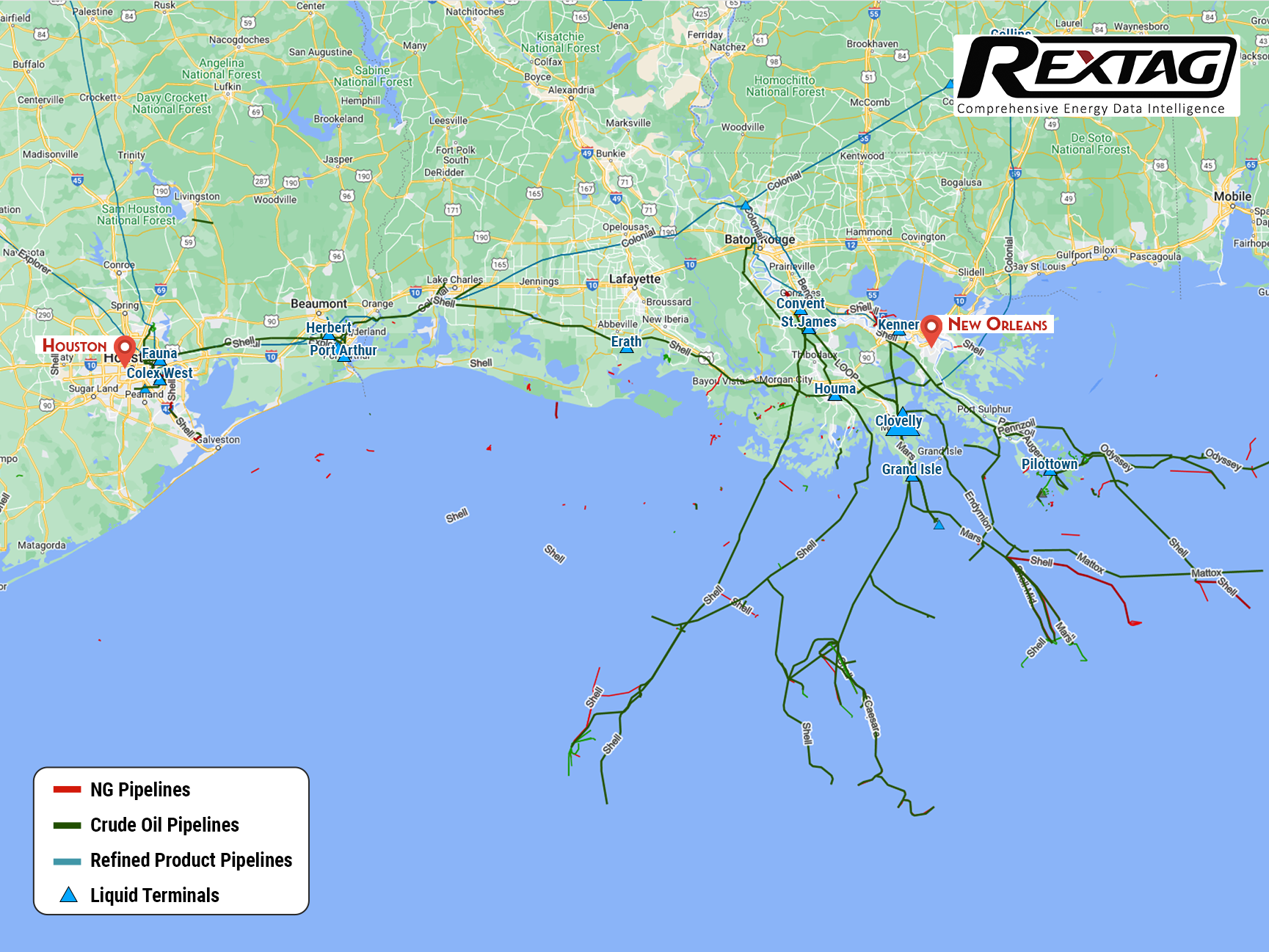

Shell's Midstream Assets in TX and LA (Gulf area)

On October 19, Shell USA completed the almost $1.96 billion acquisition of the master limited partnership. The company paid $15.85 in cash for every common unit representing limited partner interests in SHLX not held by Shell USA or its affiliates. A subsidiary of Shell USA has 269,457,304 SHLX common units or roughly 68.5% of SHLX common units.

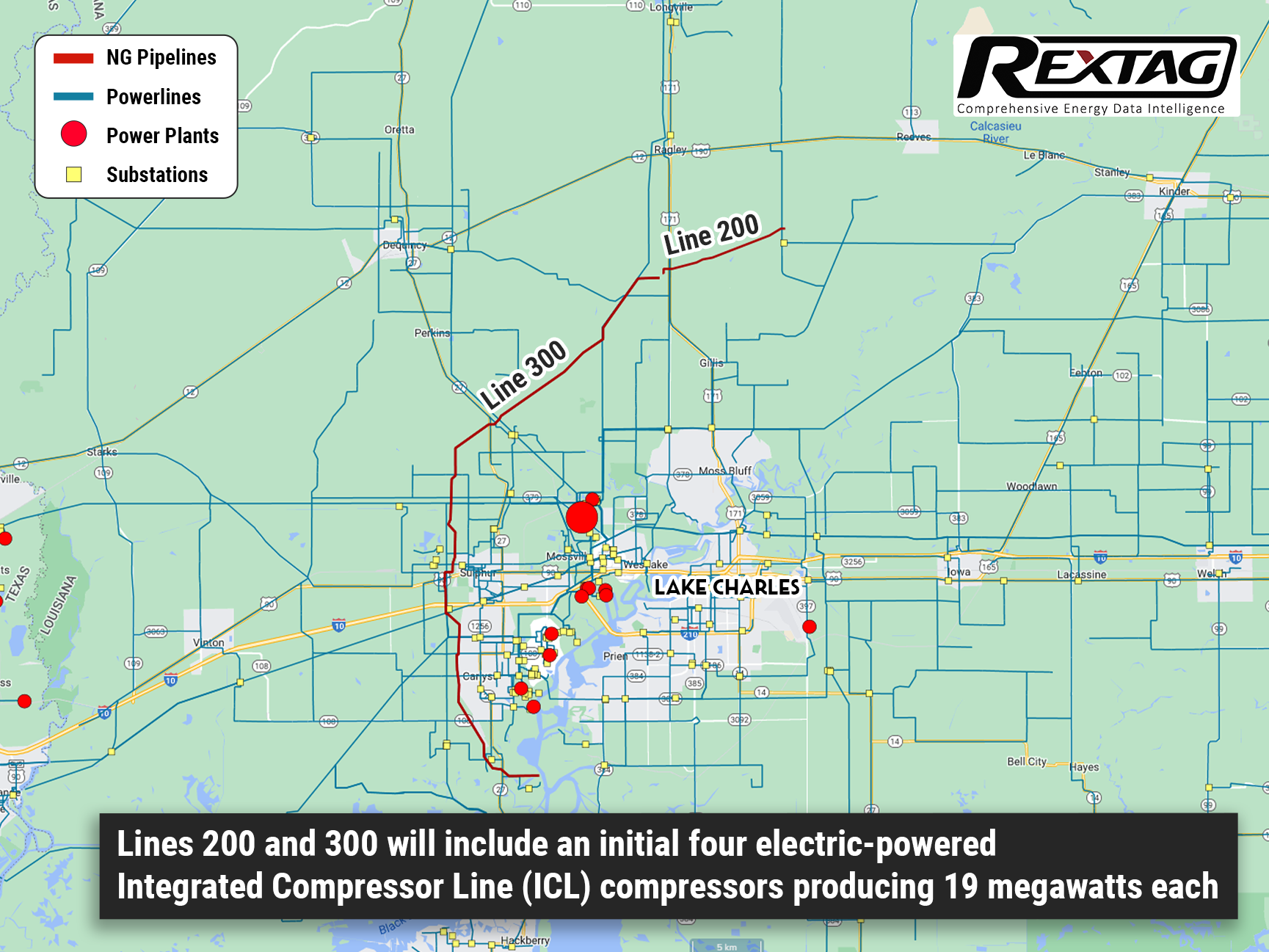

Baker Hughes To Help Driftwood Pipeline Decarbonize Its Lines 200 and 300 Projects

According to a press announcement on June 29, Baker Hughes got a contract to supply electric-powered Integrated Compressor Line (ICL) decarbonization technology and turbomachinery equipment for an upcoming natural gas transmission project by a subsidiary of Tellurian Inc. – Driftwood Pipeline LLC. Driftwood Pipeline decided that the projects of Lines 200 and 300 would be situated in Beauregard and Calcasieu Parishes in southwest Louisiana and it will be the first time when Baker Hughes installs its ICL technology for pipeline compression in North America. Joey Mahmoud, president of Tellurian Pipelines, says the company expects that the project will give upwards of 5.5 Bcf of natural gas every day, with virtually no emissions. As a part of the agreement, Tellurian makes the initial $240 million pipeline investment as part of the broader Driftwood Pipeline system, which will keep enhanced supply reliability to meet the area’s projected industrial enlargement in a purer, more sustainable way. Baker Hughes has installed over 50 ICL units across the different pipeline and offshore applications, mainly in Europe. The compressors exert a reduced environmental footprint because their hermetically sealed casing prevents emissions from obviating. It is important to mention, that they require minimal downtime as magnetic bearings are resulting in more efficient operations and low maintenance.

Earthstone Expands Due to Acquisition of Titus’ Delaware

Earthstone Energy Inc., based in Texas, announced the transaction on June 28: the acquisition of Titus Oil&Gas which will raise production in the Delaware Basin by 26%. The $627 million acquisition fills the Permian Basin in Eddy and Lea counties, N.M. with 86 net locations on 7,900 net acres of leasehold, while it is not clear how much of the leasehold might be on federal acreage It is Earthstone’s seventh acquisition since 2021, a span that includes the closing of approximately $1.89 billion in acquisitions in the Permian Basin. The purchase of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, is estimated at $575 million in cash and it is the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price). Titus shared that its net production in June was 31,800 boe/d. The company had reserves of approximately 28.9 MMboe. Earthstone is sure its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

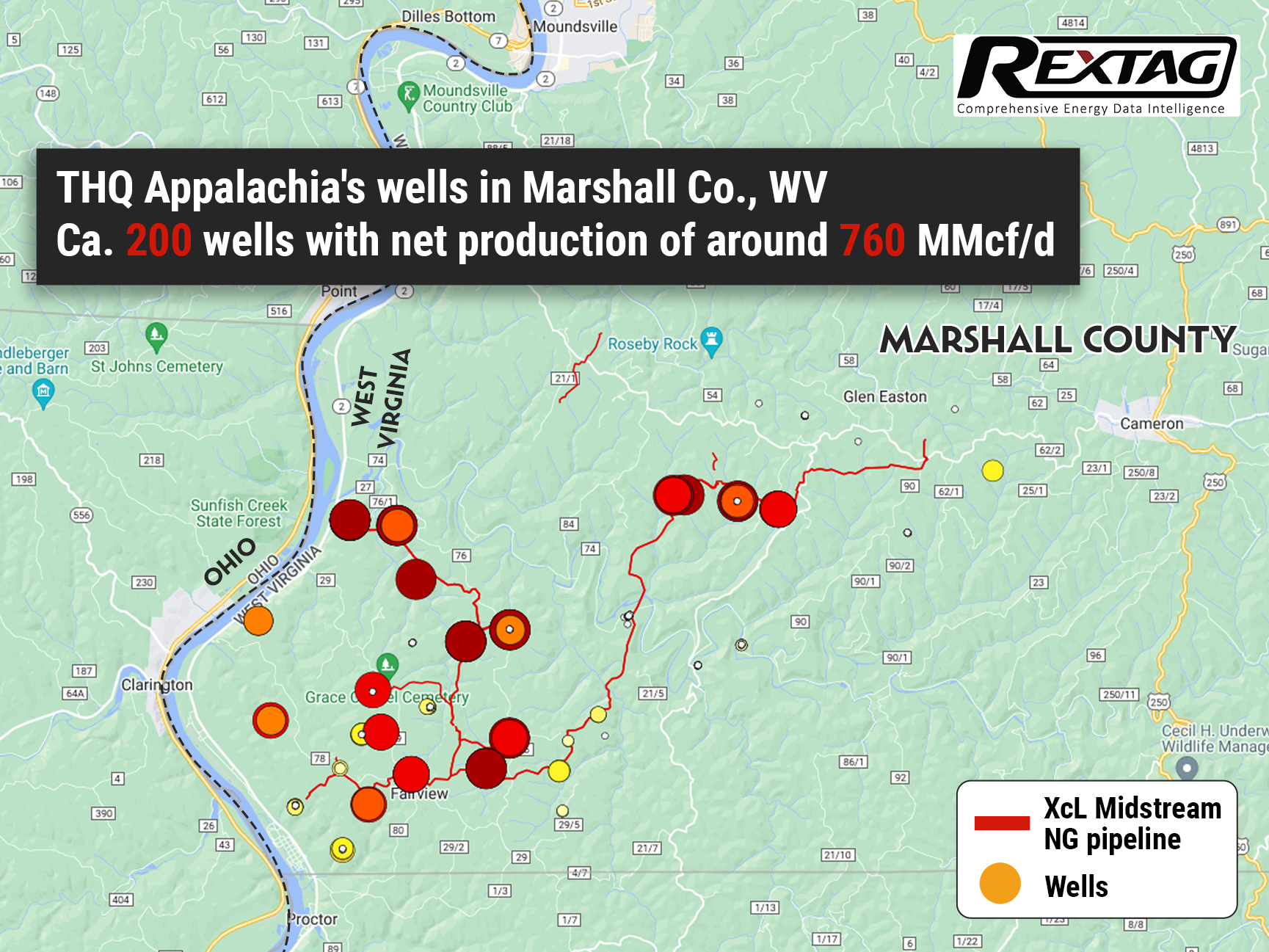

Potential Deal for $5 Billion: Tug Hill and Quantum Energy Seek Sale

Undisclosed industry sources said that THQ Appalachia I LLC (Tug Hill and Quantum Energy) is seeking a sale of the U.S. natural gas producer for more than $5 billion, including debt. Mainly operating in the Marshall and Wetzel counties in West Virginia, THQ Appalachia has net production of around 760 MMcf/d. Despite volatility in commodity markets which has made the valuation of energy producers tougher, THQ Appalachia is anticipating more than $5 billion due to the worth of its existing production and the possible value of its undeveloped acreage, the sources said on June 17. Additionally to purchasing THQ Appalachia, possible bidders in the sale process also have the opportunity to buy XcL Midstream, the pipeline firm that moves the company’s gas to market and has the same CEO as in Tug Hill. If the same buyer chooses to purchase XcL, the deal consideration will increase further. However, the anonymous sources admitted that the sale depends on the market conditions and is not guaranteed since Tug Hill and Quantum could ultimately decide to retain some or all of THQ Appalachia and XcL’s assets. Tug Hill and Quantum refused to comment on these statements and XcL did not respond to a comment request.

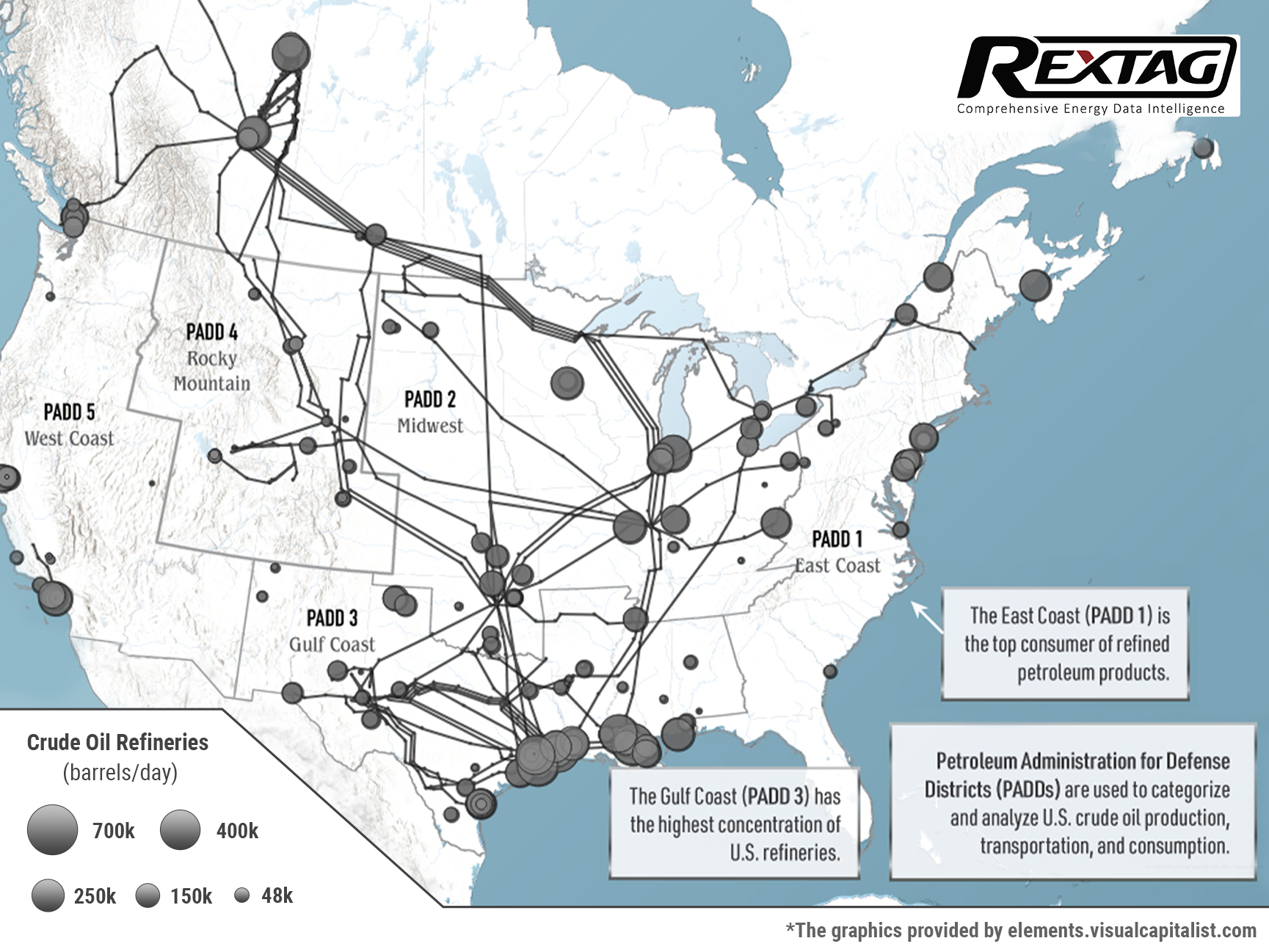

Crude oil pipelines in North America: a current perspective

Being the main means of transferring crude oil around the world, pipelines rapidly route oil and its derivative products (gasoline, jet fuel, diesel fuel, heating oil, and heavier fuel oils) to refineries and empower other businesses. The U.S. and Canada solely make North America a major oil hub for more than 90,000 miles of crude oil and petroleum product pipelines, which are connected to more than 140 refineries daily processing about 20 million barrels of oil. Compared to 2010, U.S. crude oil production has increased more than twice: from 5.4 to 11.5 million barrels a day. Therefore, newly produced oil obliged energy companies to expand their pipeline networks, but it has only increased by 56%. According to the latest data, Plains manages the largest pipeline network across the U.S. and Canada (its diameter is at least 10 inches) which is the 14,919-mile network that spans from the northwestern tip of Alberta down to the southern coasts of Texas and Louisiana. The place where all these various spreading pipeline networks carry crude oil is refineries, where it is transformed into different petroleum products. Gulf Coast (PADD 3) possesses several refineries with the largest throughput in North America that process more than 500,000 barrels per day. Not only does the development of new pipelines give a plethora of opportunities for economic growth but also it remains a contentious issue in Canada and the U.S., with the cancellation of the KeystoneXL pipeline emblematic of growing anti-pipeline sentiment. In 2021, only 14 petroleum liquids pipeline construction plans were completed in the U.S., which is considered the lowest amount of new pipelines and expansions ever since 2013. Anti-pipeline sentiment did not come out unexpectedly as leaks and spills in just the last decade have resulted in billions of dollars of damages. From 2010 to 2020, the Pipelineand Hazardous Materials Safety Administration reported 983 incidents that resulted in 149,000 spilled and unrecovered barrels of oil, even five fatalities, 27 injuries, and more than $2.5B in damages.

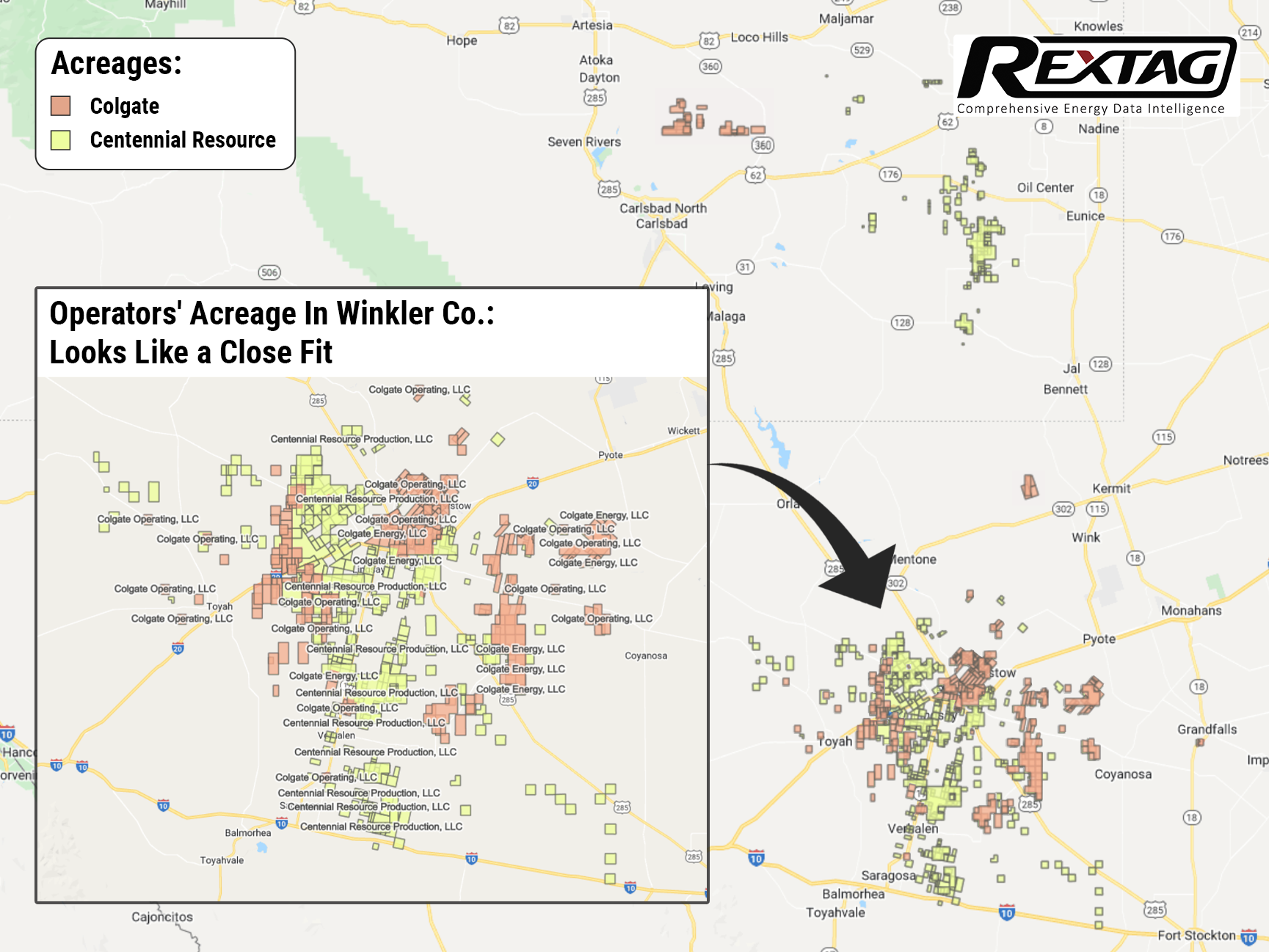

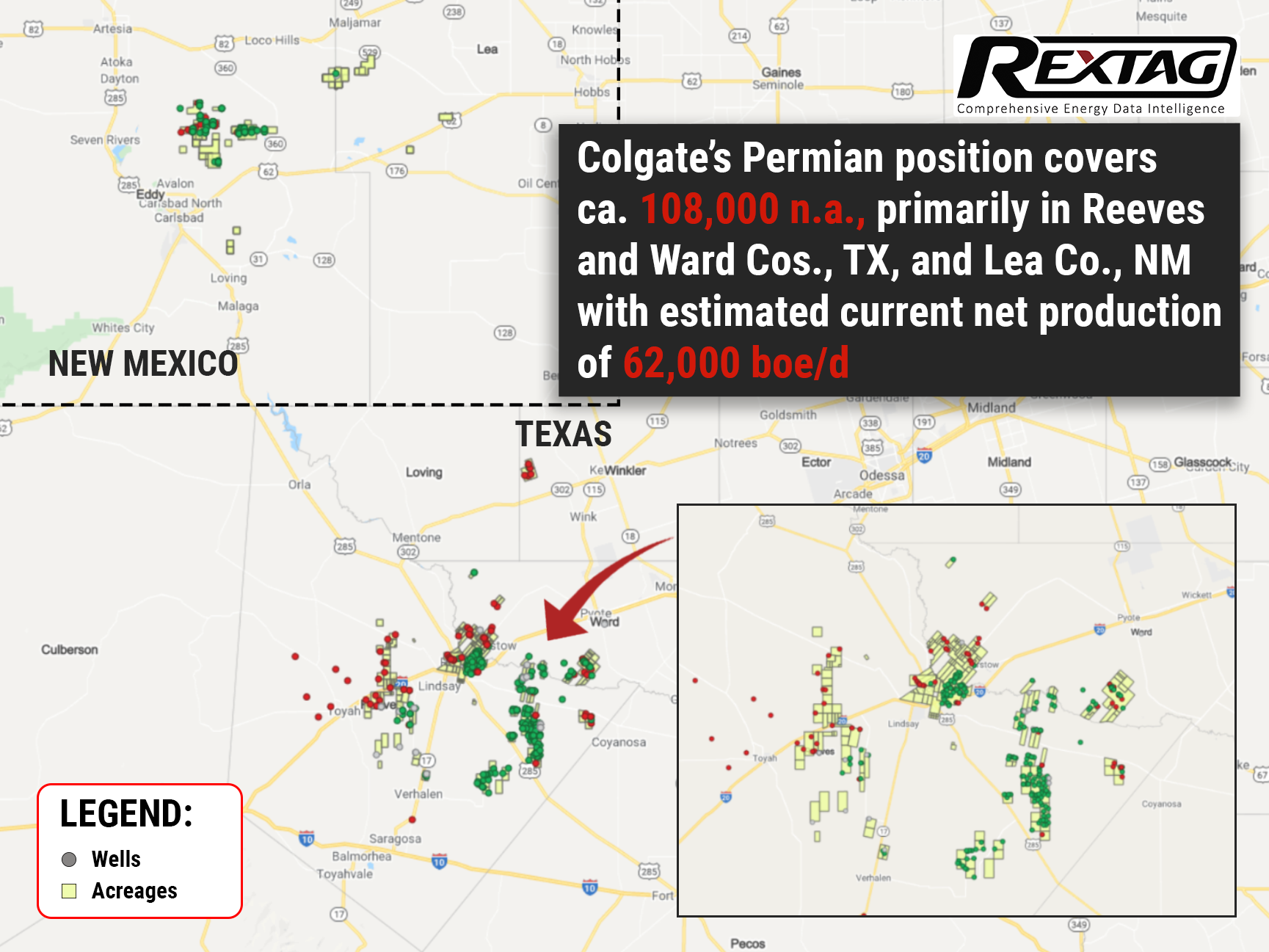

$7 Billion Merger of Colgate and Centennial, the 2 Largest Permian Operators

Despite the circulating rumors concerning Colgate’s attempt to launch an IPO, on May 19 the company decided to combine with Centennial Resource Development Inc. This merger of equals is estimated at $7 billion and will found the biggest pure-play E&P company in the Delaware Basin of the Permian. The transformative combination essentially enlarges companies’ potential and hastens the growth across all financial and operating metrics. According to Centennial CEO Sean Smith, the combined company is anticipated to furnish shareholders with quickened capital return program due to a fixed dividend coupled with a share repurchase plan. Due to a recent report, the merger would increase production 7%, to 145,000 boe/d by the fourth quarter would further ratchet up next year. By third-quarter 2023, the company predicted 160,000 boe/d based on a drilling program of 140 wells per year. Colgate Energy was reported to be getting an IPO last December that sources said would value the company at approximately $4 billion. The combined company will have over 15-years of drilling inventory, assuming its current drilling pace, the companies will produce over $1 billion of free cash flow in 2023 at current strip prices.

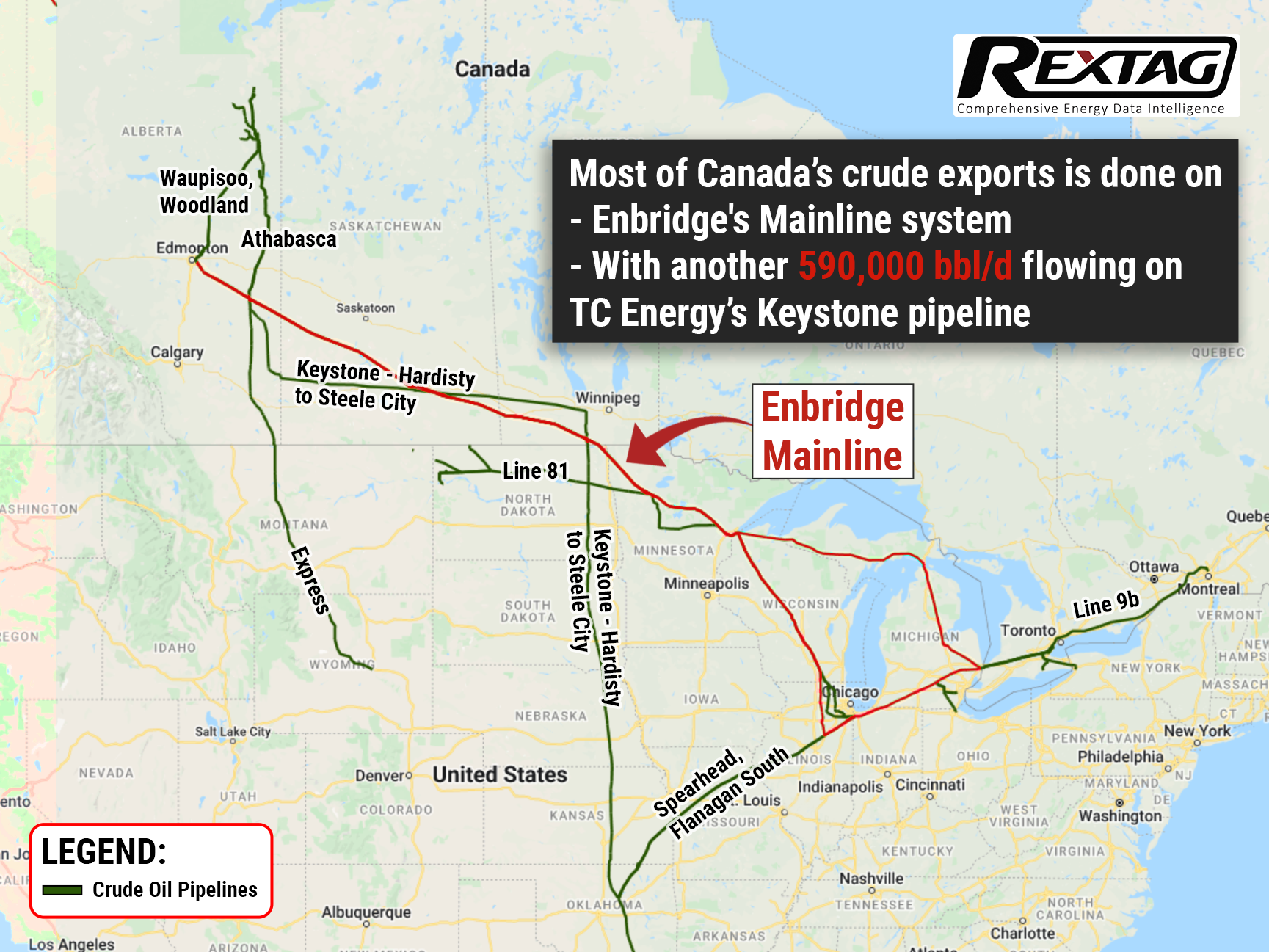

As Countries Shun Russian Crude, Canada Plans to Boost Its Oil Exports

Canada is looking at ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its reliance on Russian oil At the moment, oil exports from Canada to the U.S. are approximately 4 million barrels of oil per day, with a portion reexported to other countries. At the end of 2021 Canadian oil companies exported a record amount of crude from the U.S. Gulf Coast, mostly to big importers India, China, and South Korea. And this will only increase in the future.

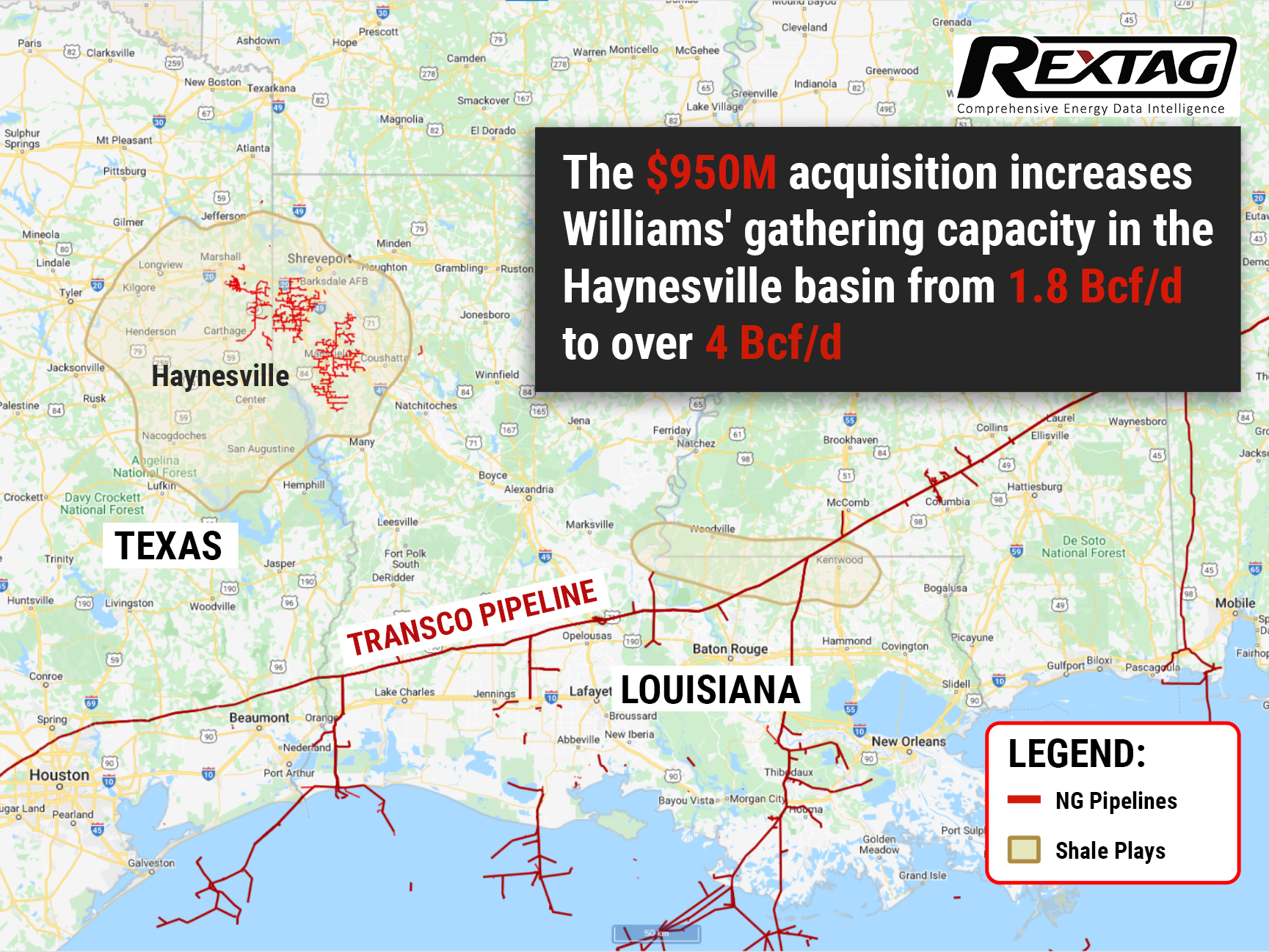

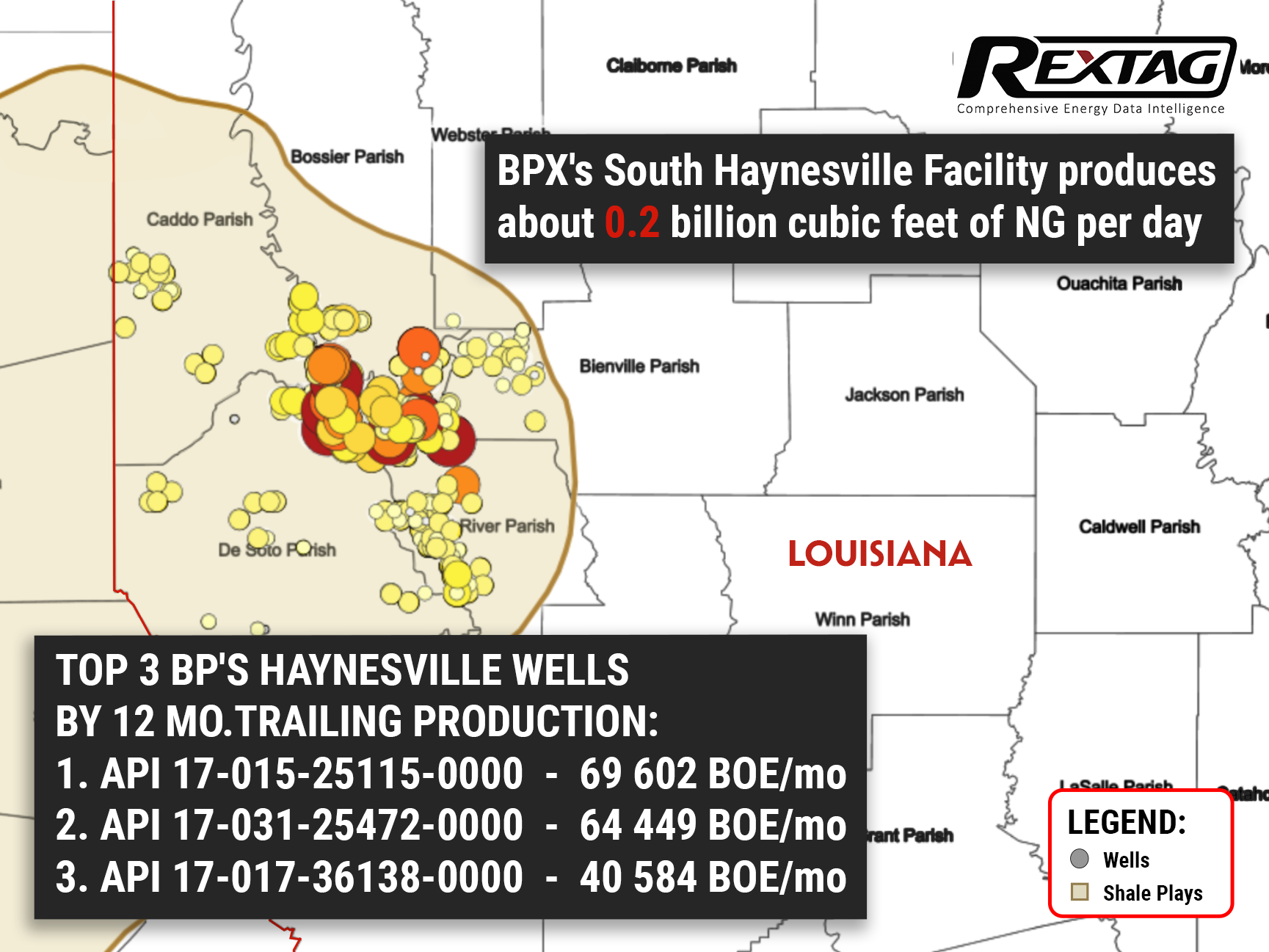

$1B Deal: Williams Buys Out Houston-based Midstream in Haynesville Basin

By purchasing the gathering and processing assets of Trace Midstream, Williams' existing footprint gains expanded capacity in one of the nation's largest growth basins, bringing its Haynesville gathering capacity to over 4 Bcf/d — increasing more than 200% from 1.8 Bcf/d. The deal also includes a long-term commitment from Trace and Quantum to support Williams' Louisiana Energy Gateway project (LEG), which is aimed to deliver responsibly sourced Haynesville’s naturalgas to markets along the Texas and Louisiana GulfCoast

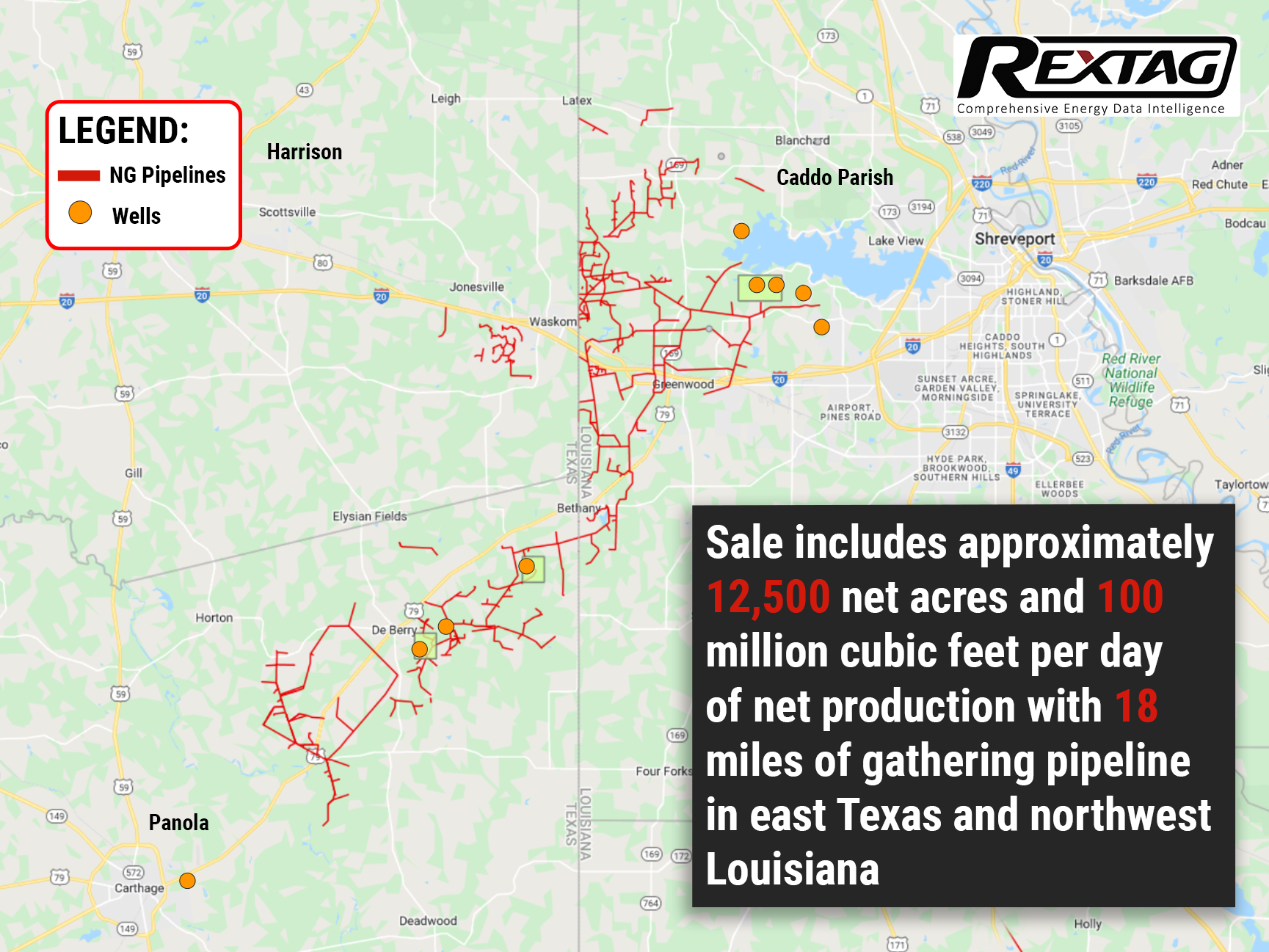

Pine Wave Energy and Silver Hill Reached an Agreement Over Haynesville Assets — Deal is Sealed

Looks like Pine pulled the plug on its properties in Caddo Parish, Louisiana, and Harrison and Panola counties, Texas. Which includes a total of 12,500 acres and ownership interests in 10 operated wells with a production capacity of 100 million cubic feet per day along with 18 miles of naturalgas gathering pipelines. Did Pine just give up on Haynesville?

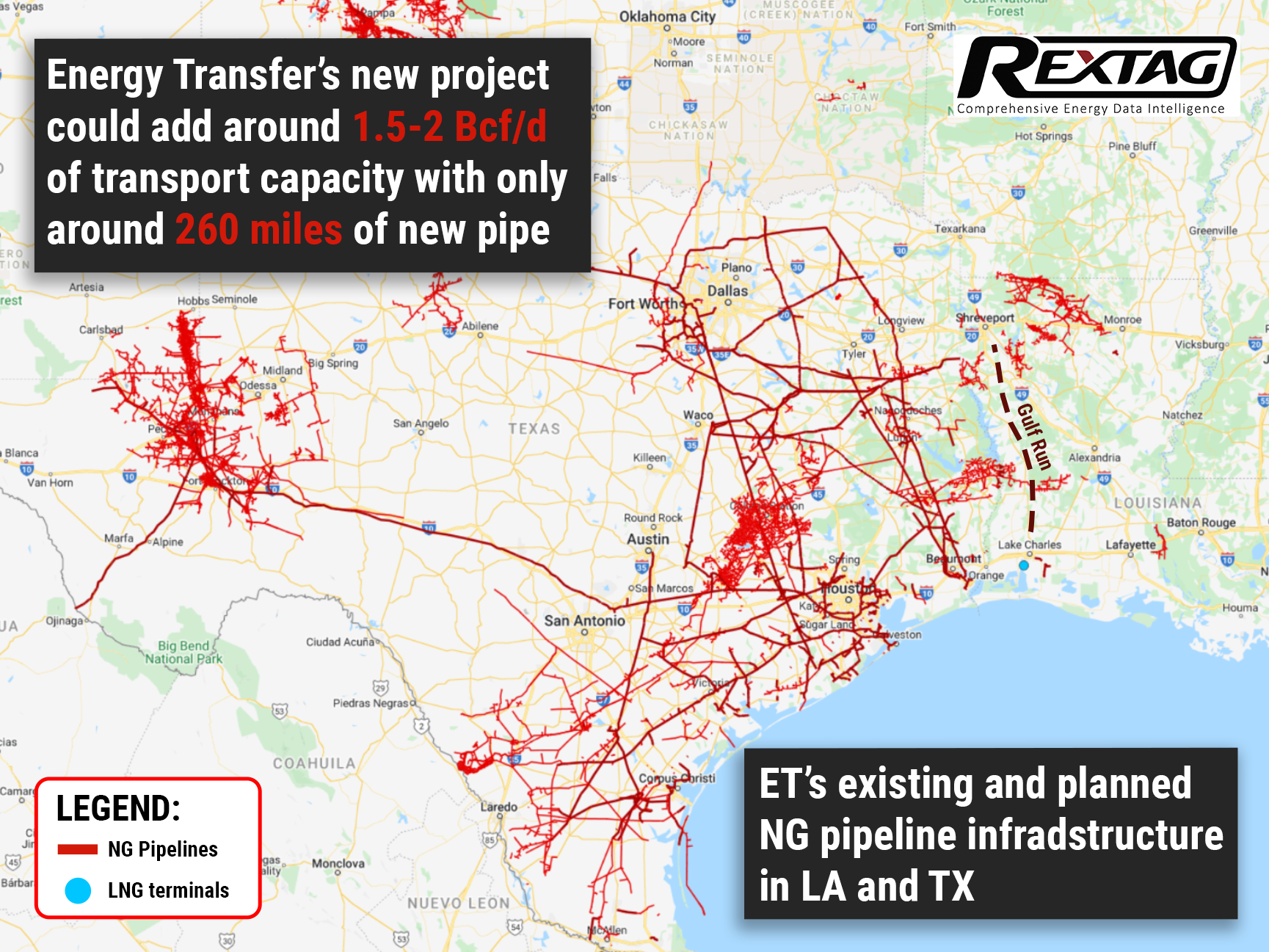

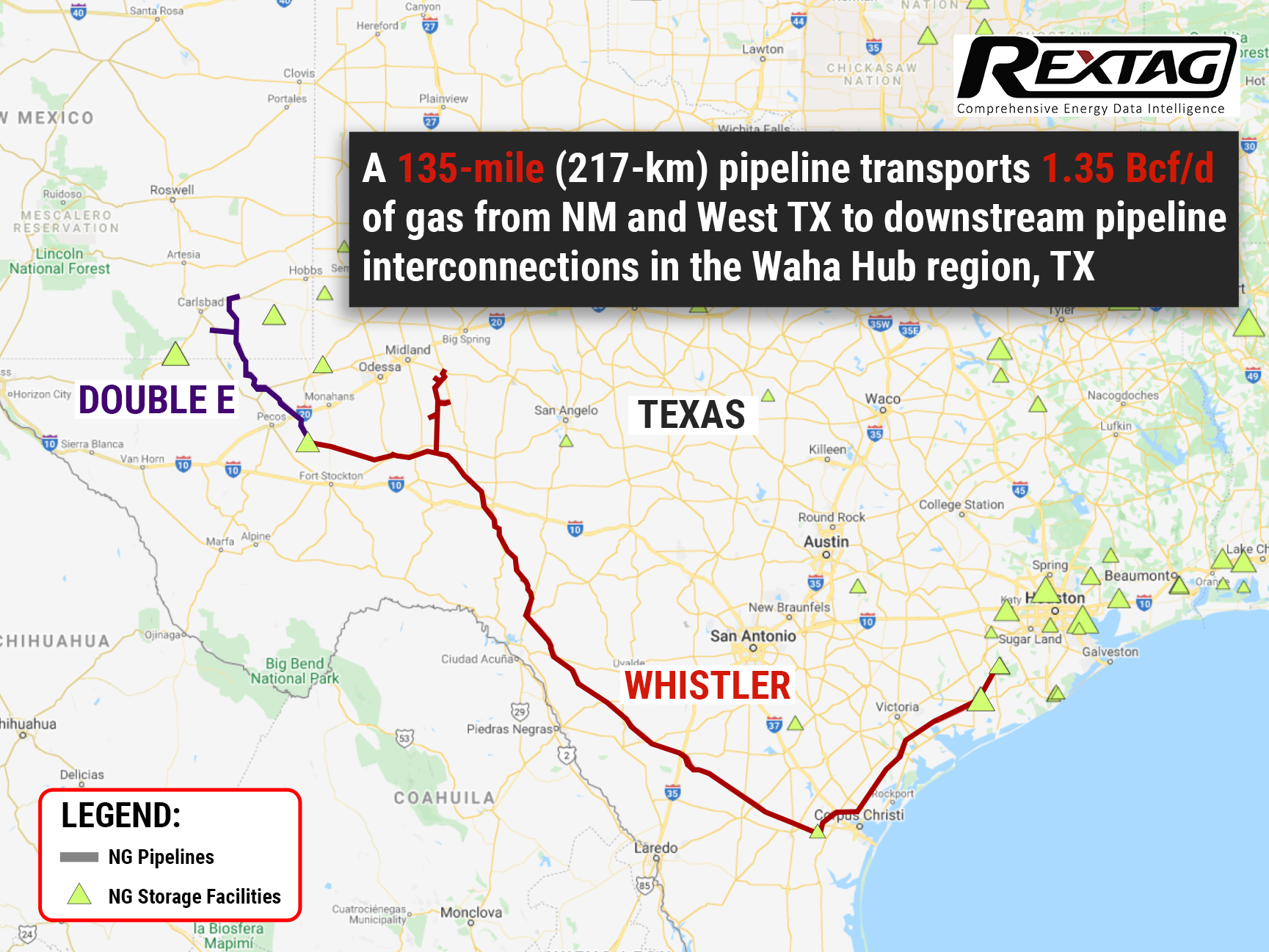

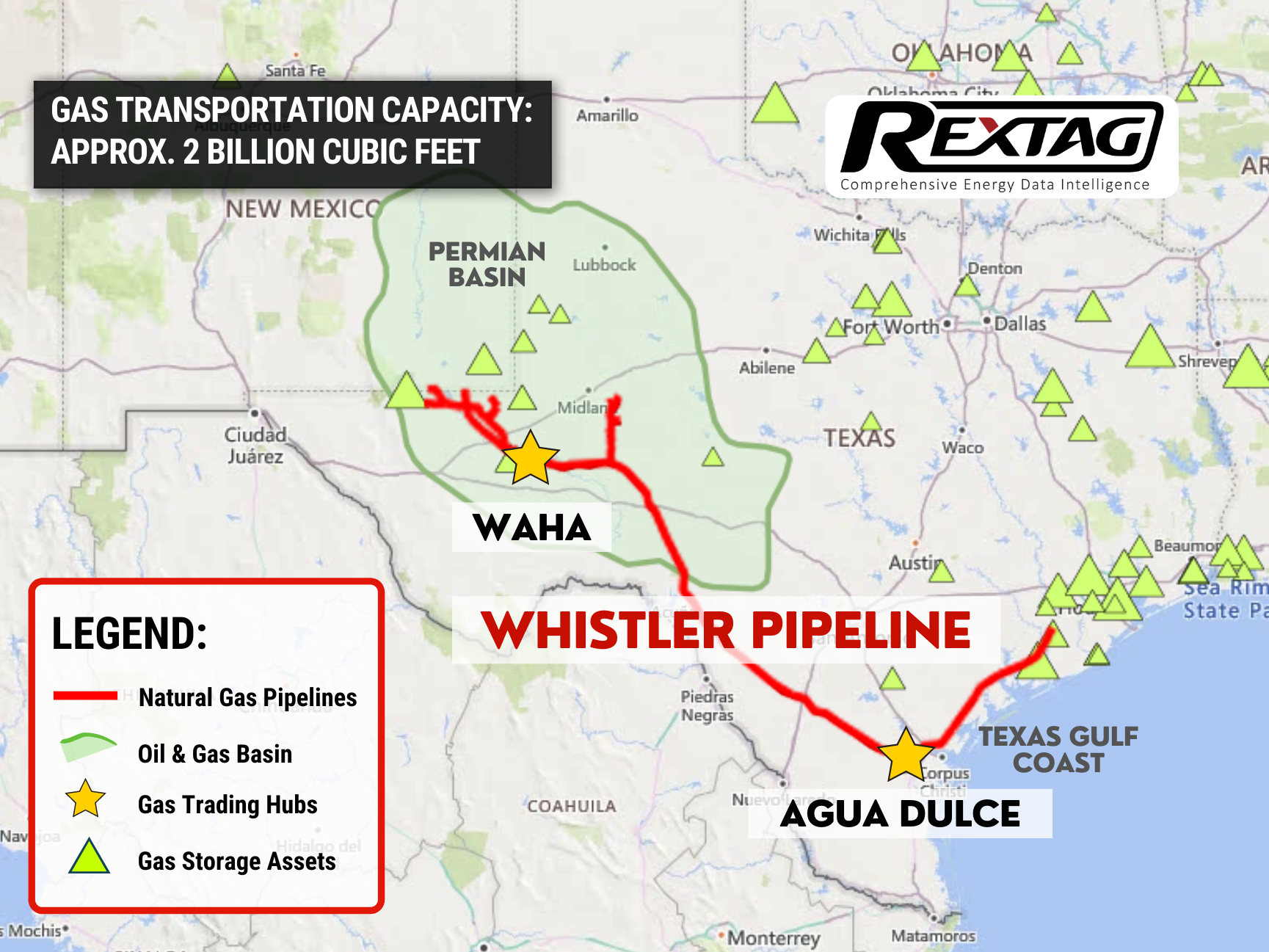

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

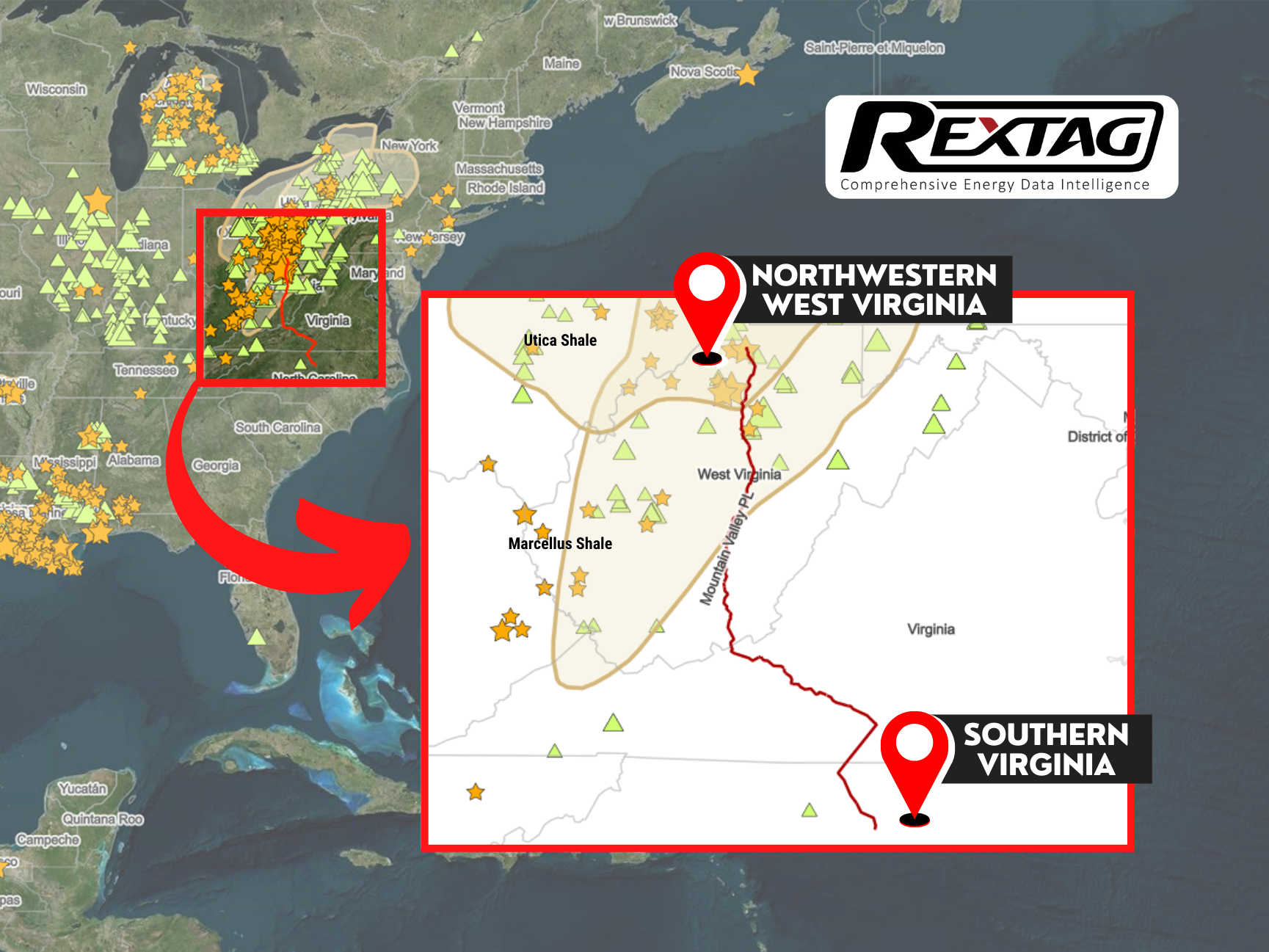

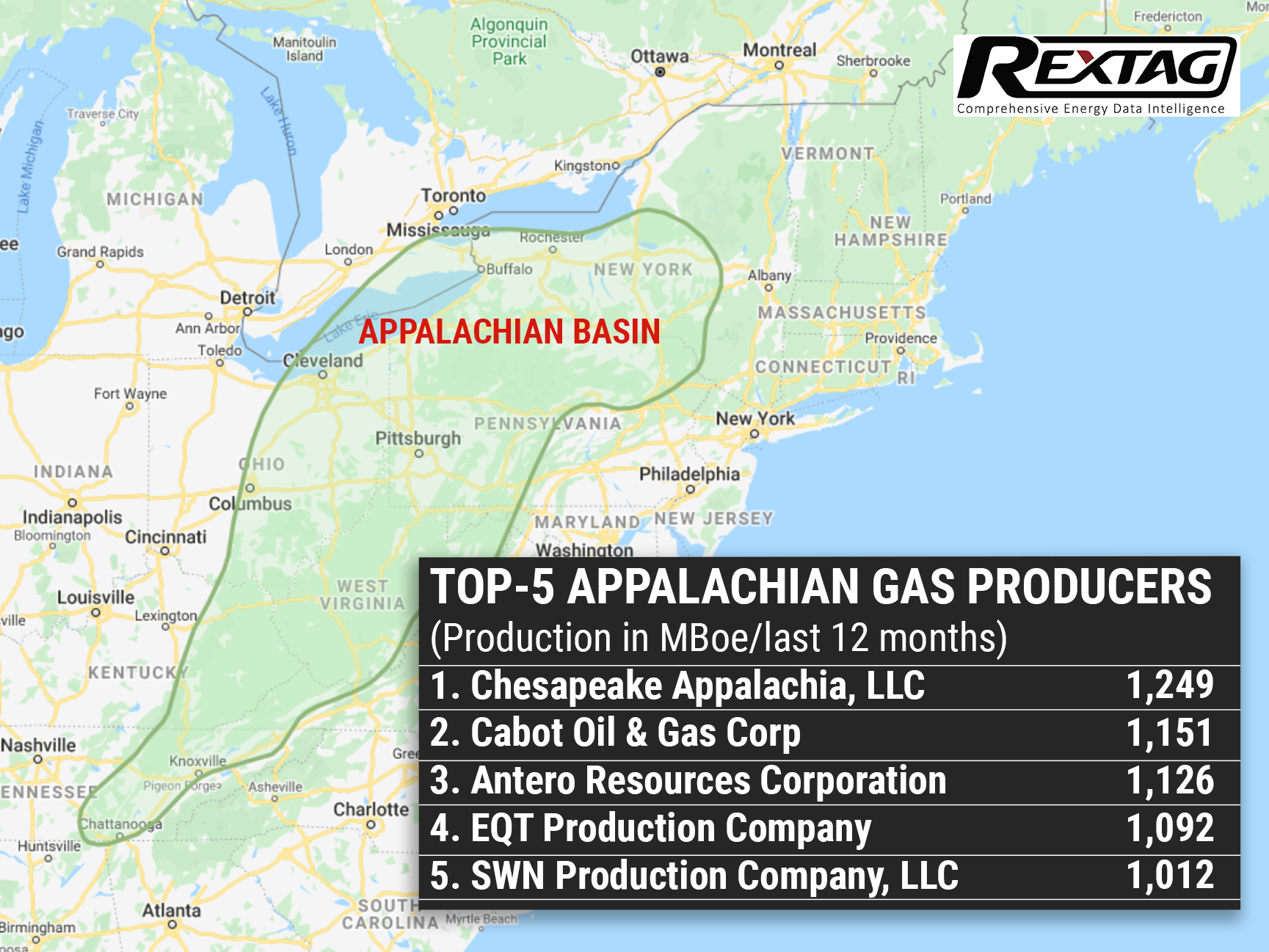

Look At The Future Of American And Appalachian Gas Production

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

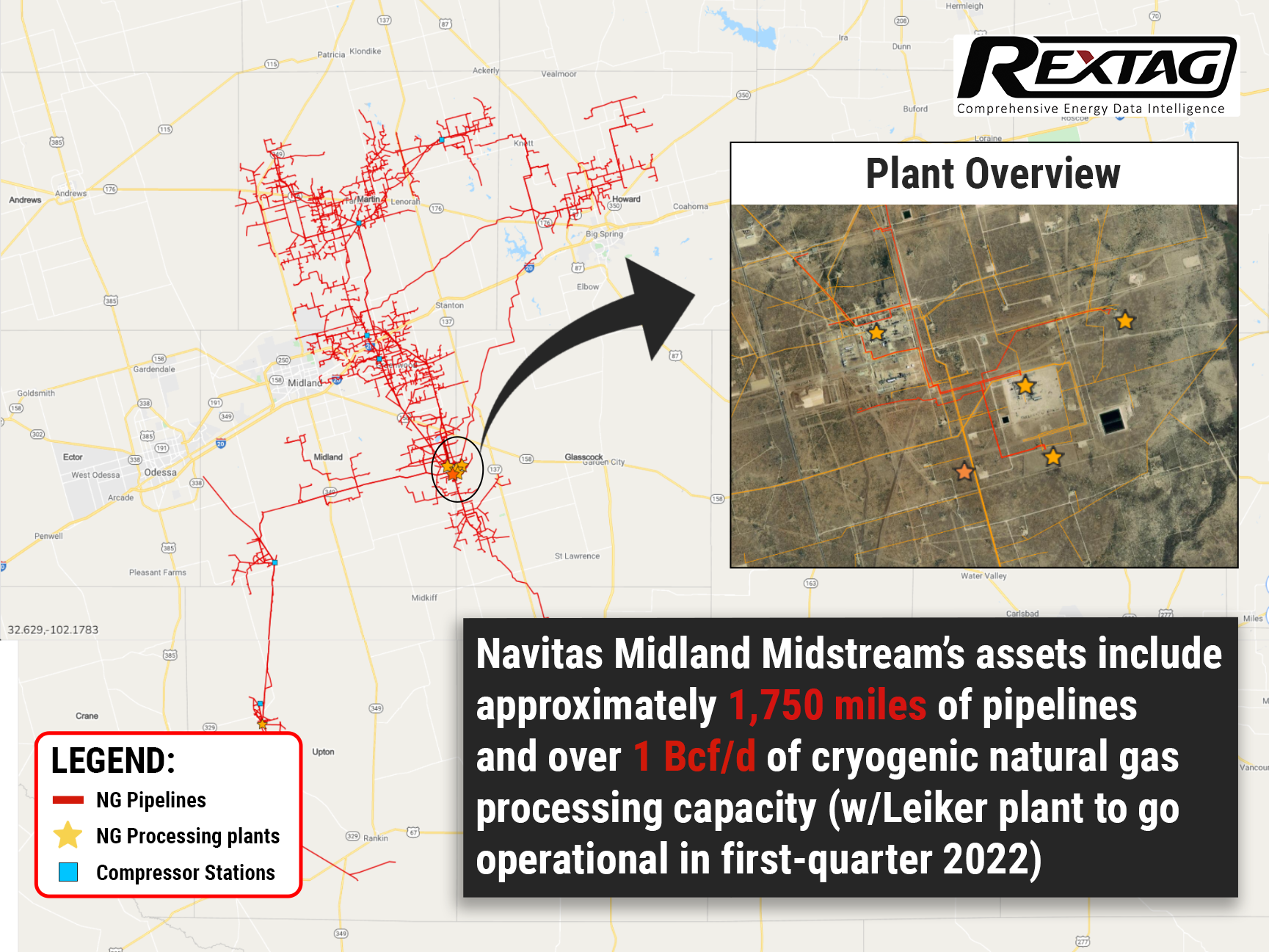

Enterprise acquires Navitas Midstream for $3.25 billion in cash

Enterprise decided to go in on the Permian Basin. With the surprise purchase of Navitas Midstream for $3.25 billion in cash, the company gained a foothold in the Midland Basin, as it previously lacked #naturalgas or NGL infrastructure apart from downstream pipelines in the region. Enterprise estimates that distributable cash flow accretion will be in the range of $0.18 to $0.22 per unit in 2023, while simultaneously supporting additional capital returns to their limited partners through distribution growth and buybacks of common units.

Colgate Energy's owners are planning to go public

Colgate Energy is planning to float its shale oil producer in the Permian's Delaware Basin on the stock market. If successful, this IPO would be the first major U.S. oil producer offering since Jagged Peak Energy's IPO in January 2017. Looks like investors’ confidence in the sector is returning as U.S. crude prices hit their highest in seven years late last year S&P energy index delivered roughly twice the return of the S&P 500 in 2021.

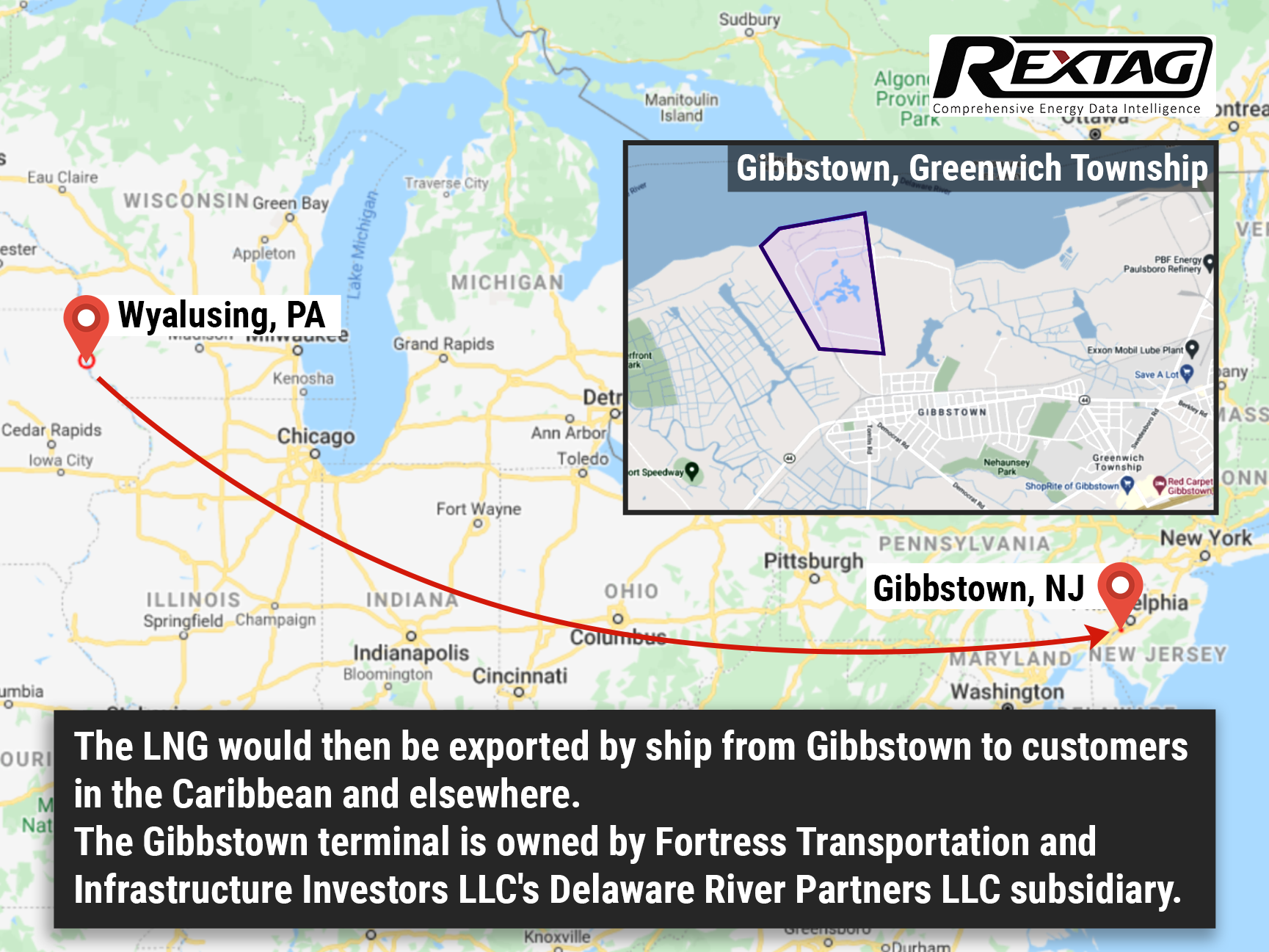

Rail Permit for New Fortress to Ship LNG Expired, Putting Future Projects at Risk

Uncertainty grows: as New Fortresses permit to ship LNG by rail expires, PHSMA explores temporal pausing of the method to provide more time to study safety-related issues. The news prompts one to wonder whether Fortress will proceed with its Pennsylvanian LNG project, in which it has already sunk about $159 million in development.

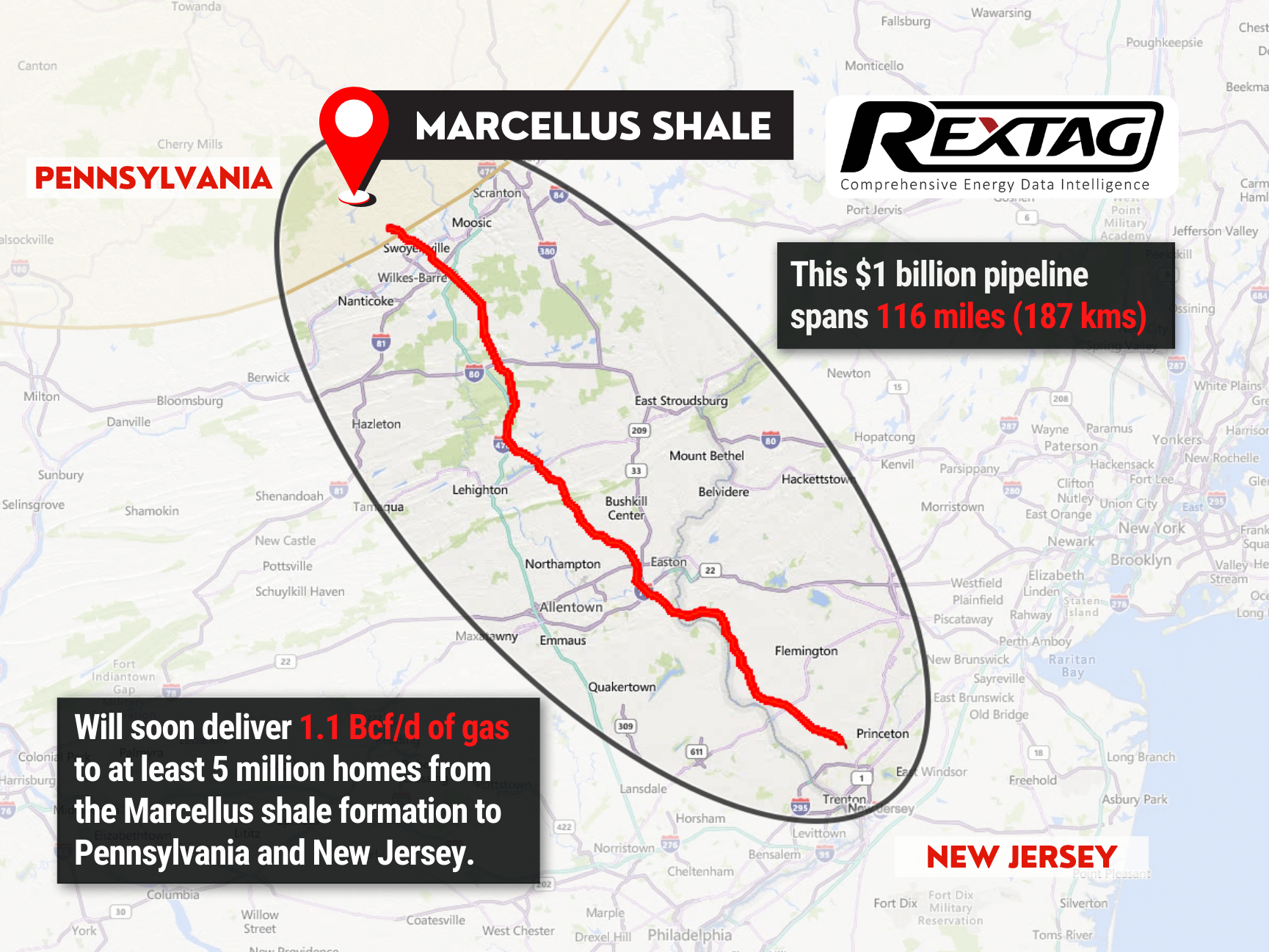

No More Gas Flaring: the Permian's Double E Pipeline is brought into service in West Texas

Permian Basins gas infrastructure boom: Summit Midstream puts into service a new pipeline system, aimed at reducing gas flaring in the area. Besides ecological concerns, the project will also transport almost 1,5 billion cubic feet of gas per day — enough to supply 5 million U.S. homes every day. According to Federal Energy Statistics, the project cost a whopping $450 million.

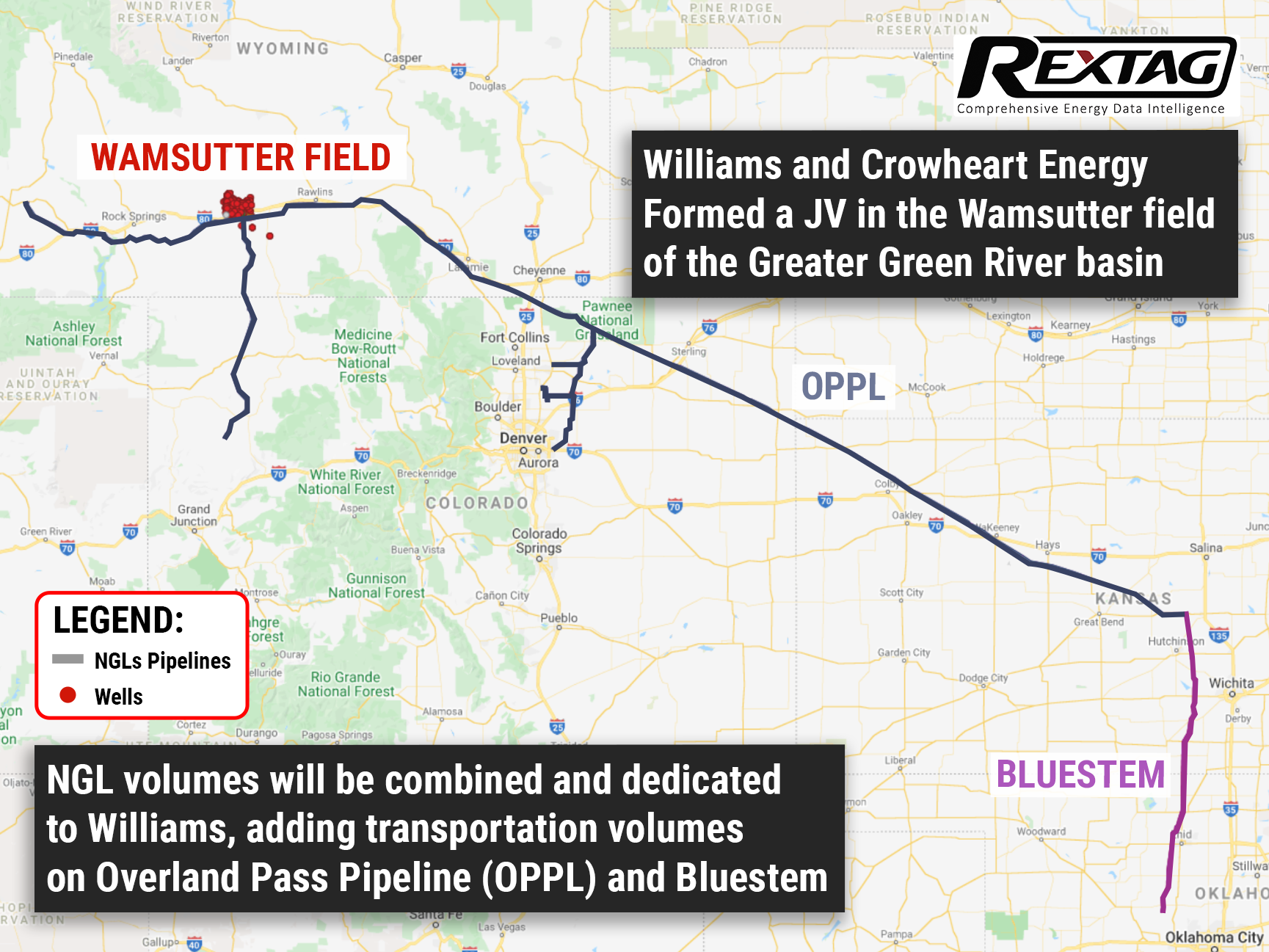

Smart Investments Are The Key To Success: Williams JV Brought Benefits At The End Of The Year

Williams boasts its Q3 results. With a revenue of $2.48 billion, the company beat the analyst estimate of $2.09 billion and also improved upon its own results over the same period in 2020. Mind you, much of this success was attributed to production in Wyoming's Green River Basin's Wamsutter Field and Williams JV with Crowheart.

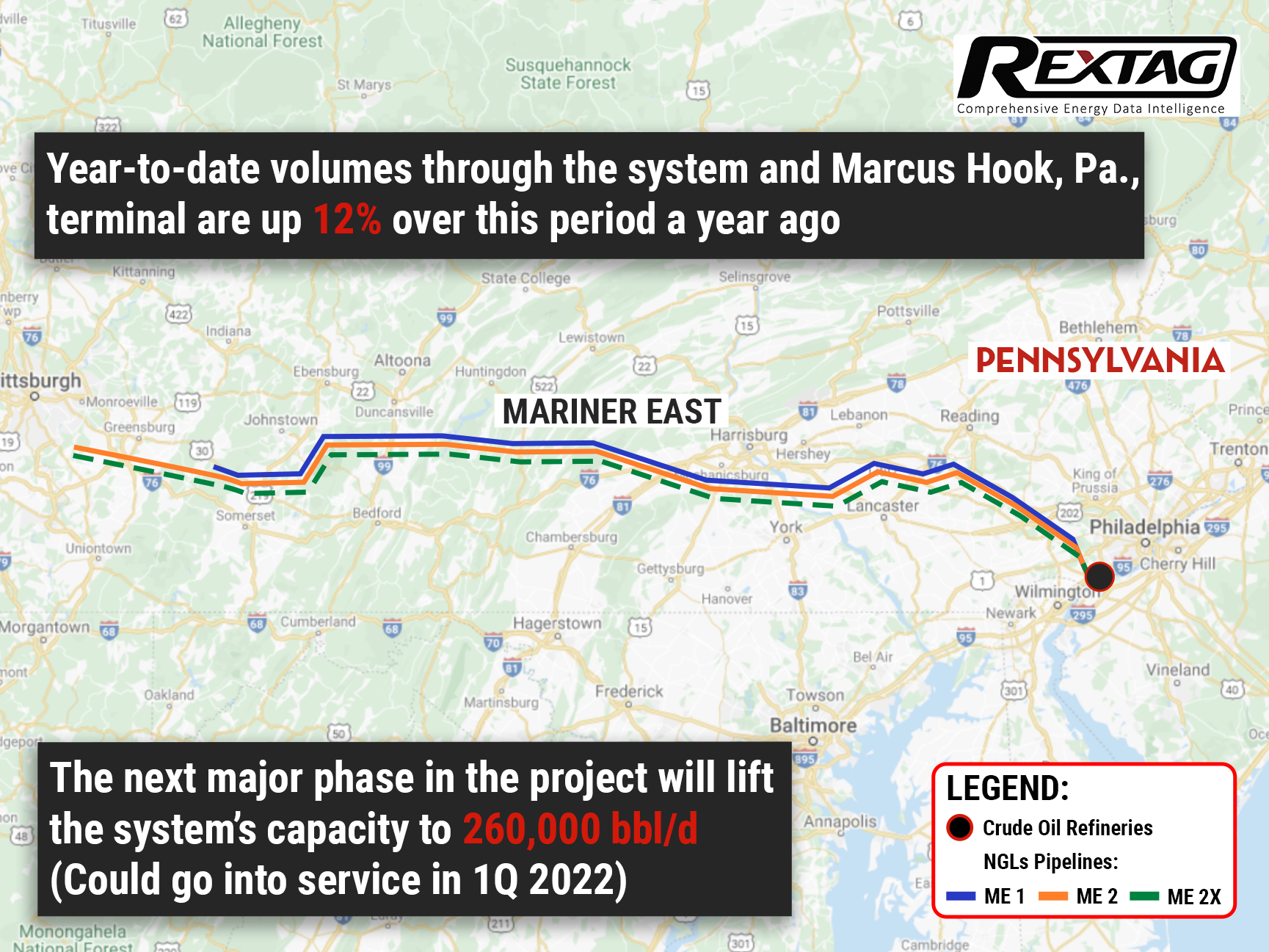

The Final Stretch: Energy Transfer Pushes For Mariner East Project Ahead Of The Stunning Q3 Results

Energy Transfer's lead in the world's NGL exports booked the company another successive quarter. With a global market share of almost 20%, the company is nigh unstoppable. But will it be enough to, finally, push the Mariner East project over the edge? If everything goes as planned, Mariner East's last segment could be operational by the end of the first half of 2022.

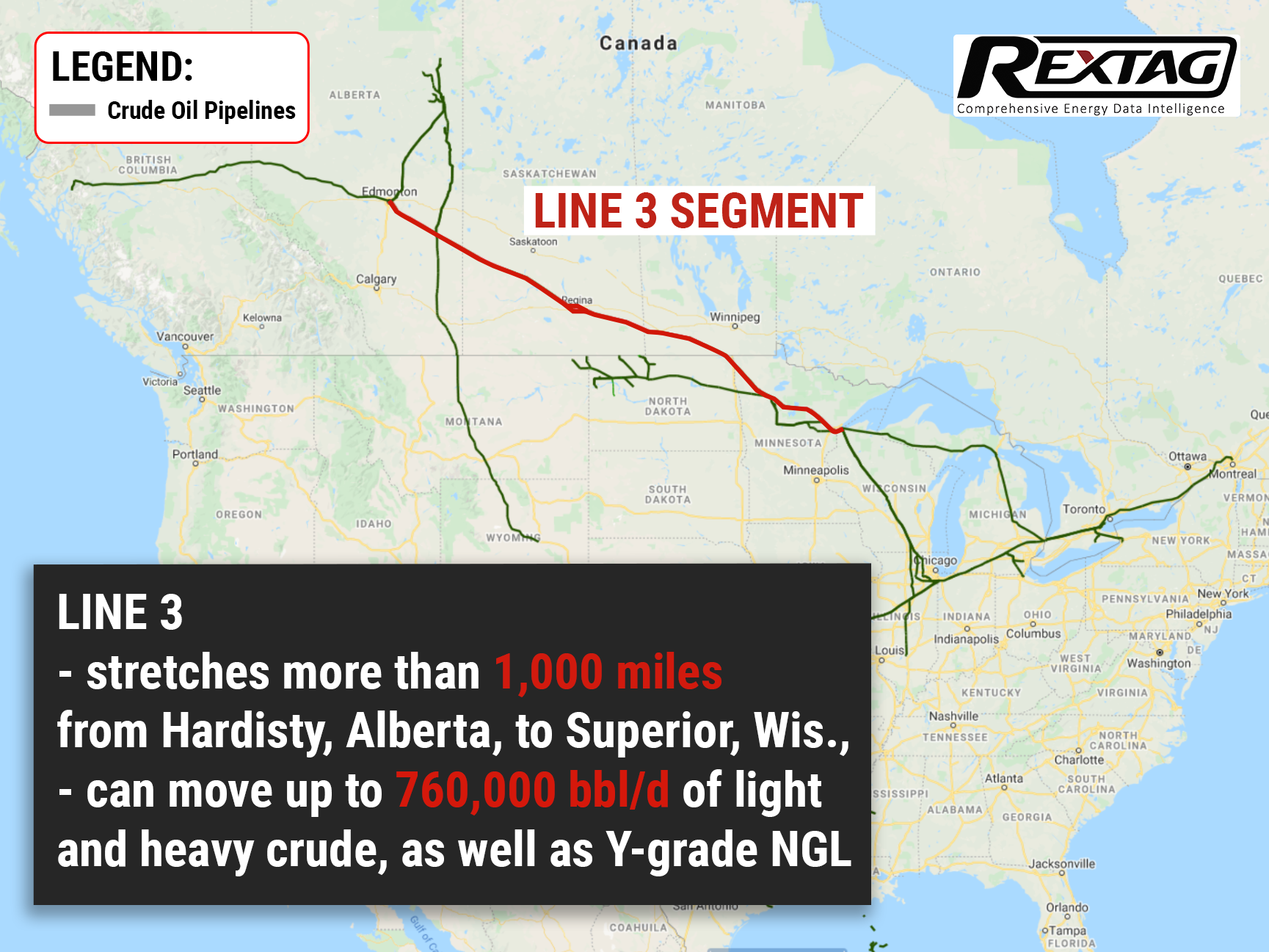

Delays Are Finally Over: Enbridge Reports Strong Third Quarter 2021

Enbridge Inc. finally delivered on several of its long-overdue promises, including the $4 billion Line3 Replacement project. Which consisted of replacing an existing 34-inch pipe with a new 36-inch one for 13 miles in North Dakota, 337 miles in Minnesota, and 14 miles in Wisconsin. Midstream companies, in general, had a stunning Q3. It was the first quarter in two years that no midstream index members cut their dividends.

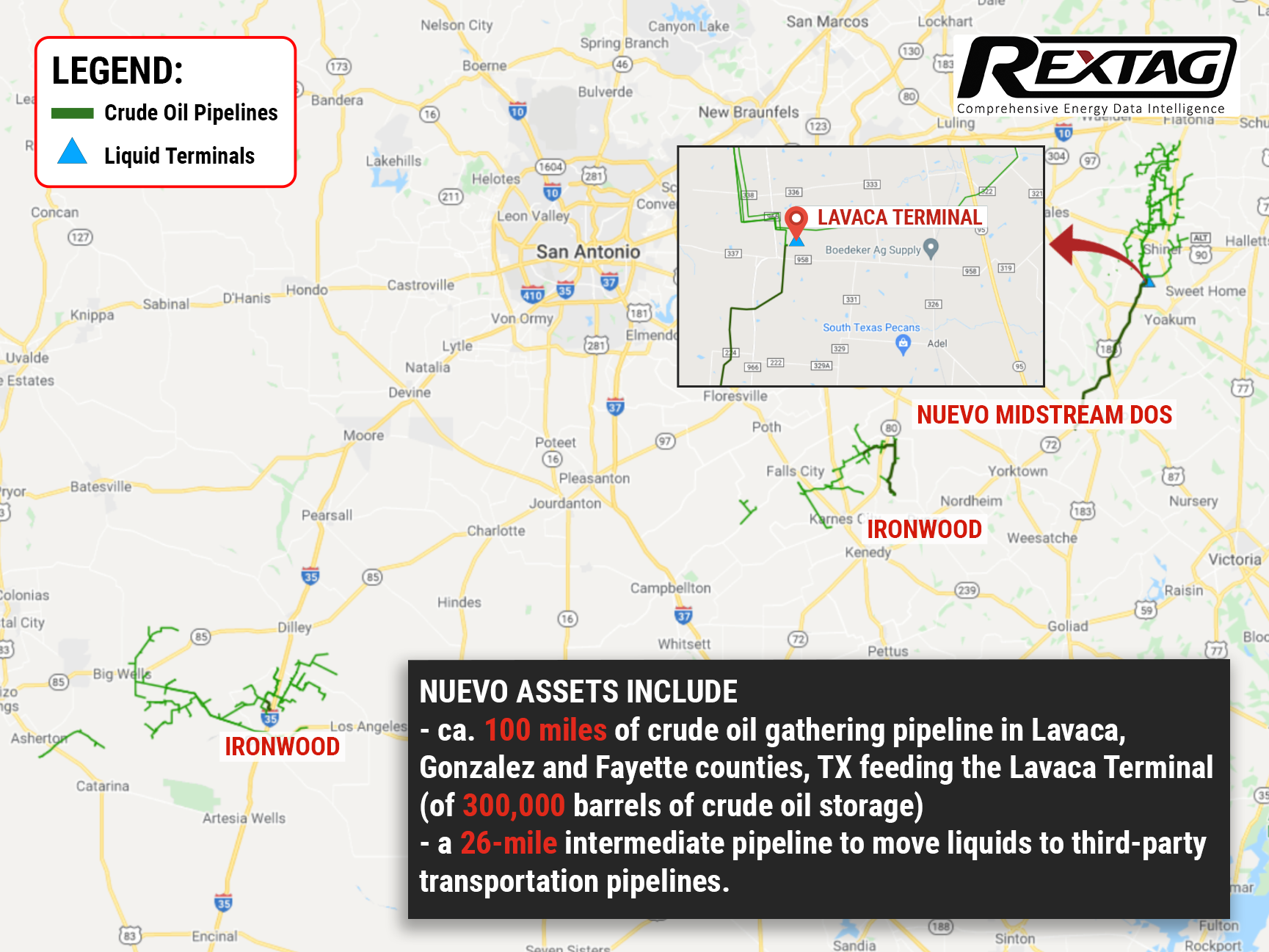

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

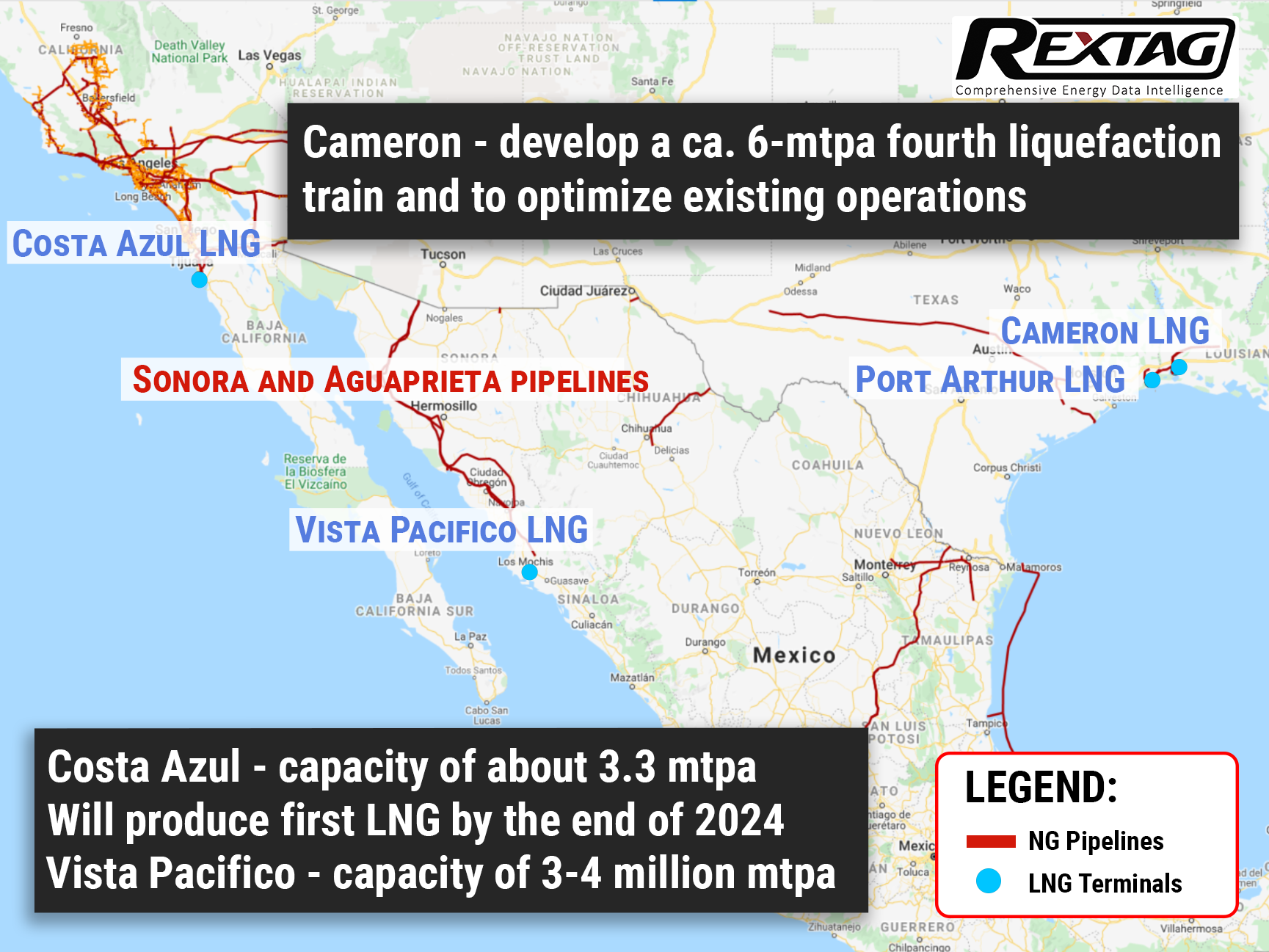

Pivot to the South: LNG Plants Under Development by Sempra Energy in Louisiana and Mexico

Sempra Energy would develop the 4.0-mmtpa Vista Pacifico LNG export facility located next to the company's Terminal for Refined Products in Topolobampo in a bid to provide gas from the Permian basin in Texas and New Mexico to Asian markets. Once marketing begins, Sempra's management expects Vista Pacifico to be oversubscribed.

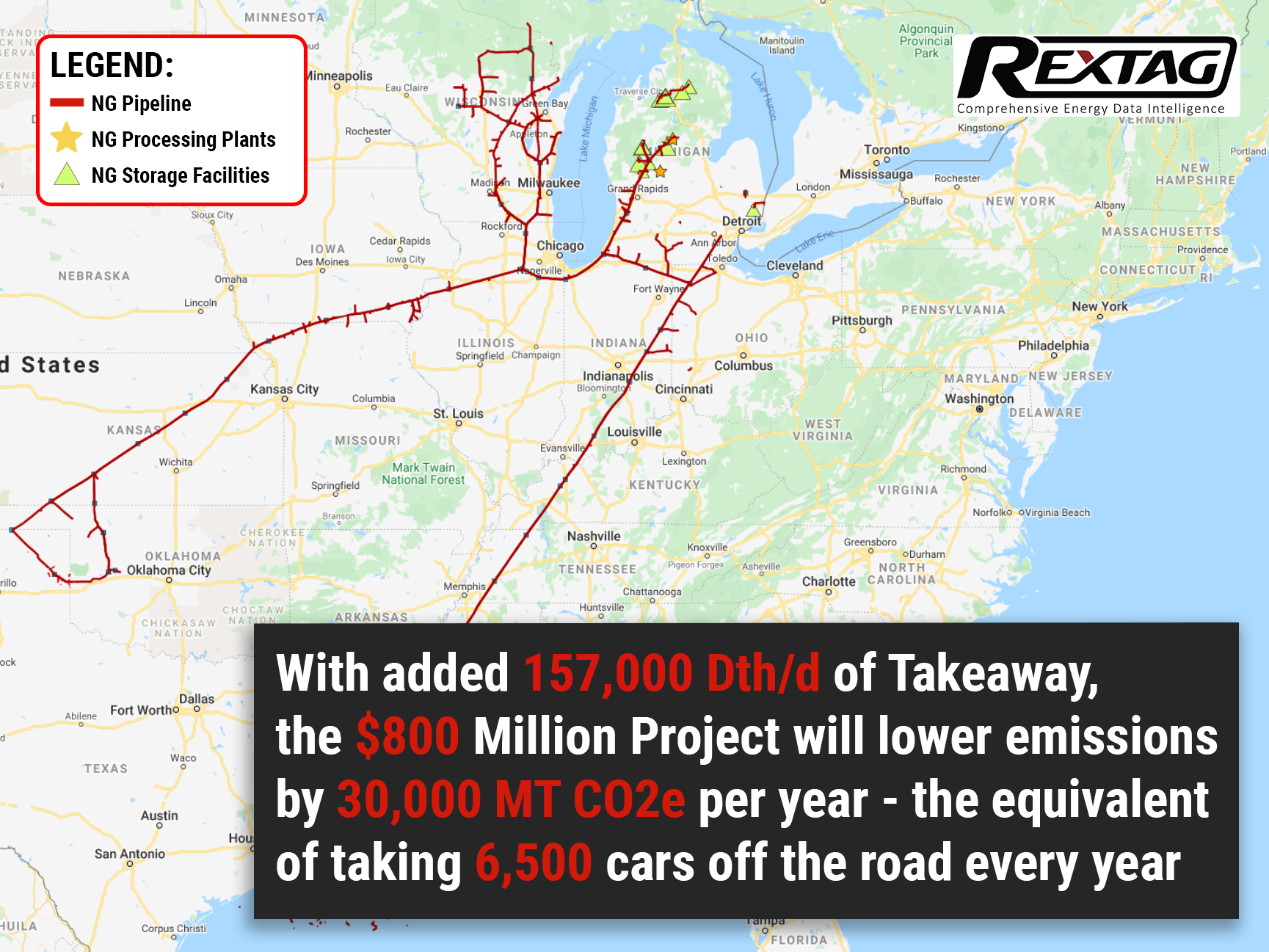

Expansion for TC Energy in Midwest US to cost $800 million

TC Energy splurged $0.8 billion on the project that targets emissions. Well, sorta. According to the idea, existing lines of the ANR Pipeline Company will be expanded to serve markets in the #Midwestern US and simultaneously updated to reduce discharge by 30,000 metric tons CO2e per year - equivalent to removing almost 7000 cars from the road annually. Remarkable goals. With the current timeline, the project will be fully operational by the end of 2025, thanks to long-term transportation agreements secured by ANR.

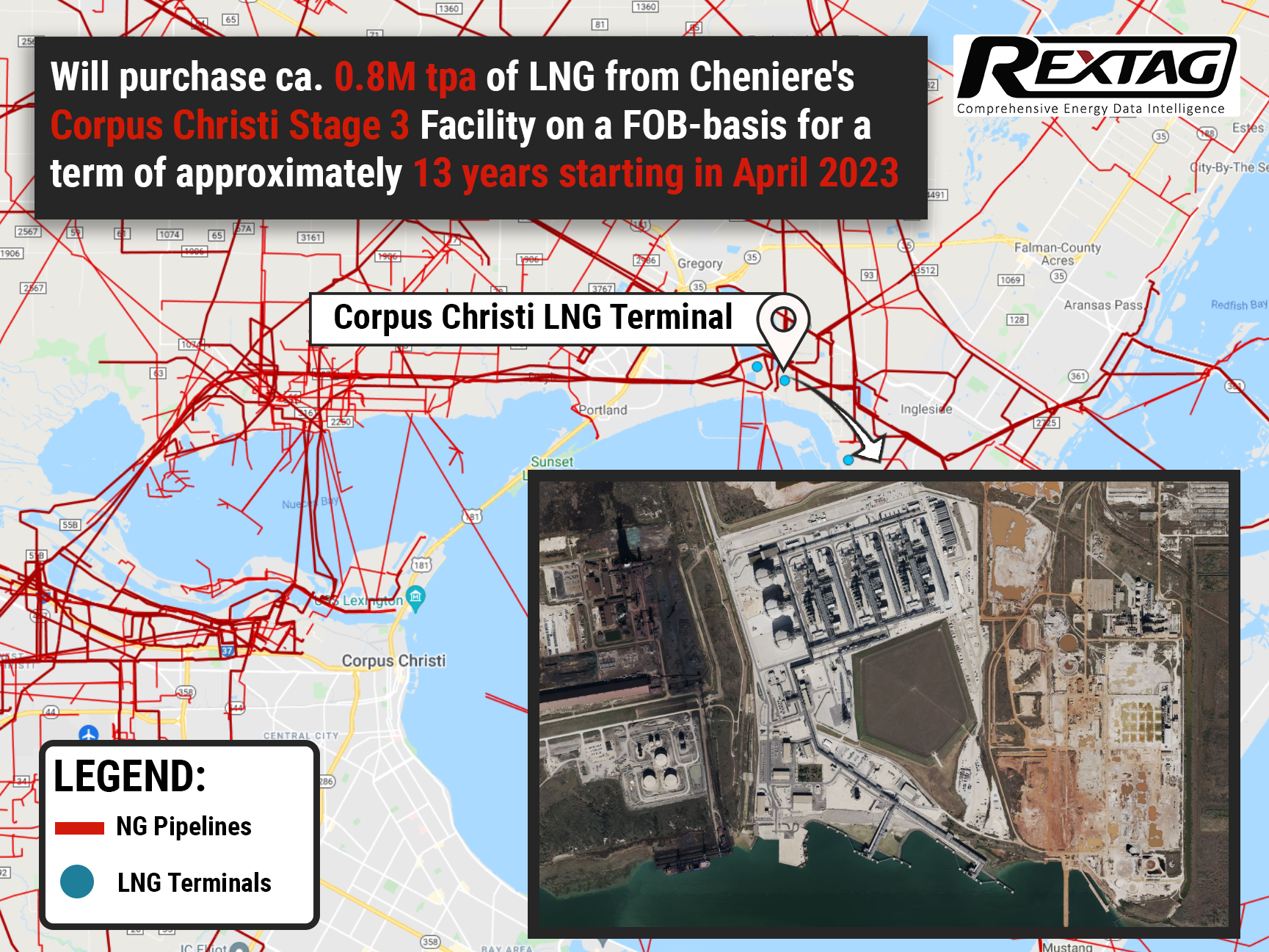

13 years is not long enough: Glencore and Cheniere Sign Long-Term LNG Deal

Texas Cheniere and Swiss Glencore had entered into a free-on-board agreement for approximately 0.8 million tonnes of LNG per annum, starting in April 2023 for 13 consecutive years. This SPA demonstrates the commercial momentum Cheniere has been enjoying and marks an important milestone, as the company lays the groundwork for a final investment decision on Corpus Christi Stage 3, which is expected to occur next year.

Ain't Nothing Like a $2 Billion Deal: Oasis Sells Midstream Affiliate to Crestwood

Crestwood & Oasis Midstream merge to create a top Williston #basin player. $1.8 billion deal is expected to close during the Q1 of 2022. The transaction will result in a 21.7% ownership stake for Oasis in Crestwood common units. The remaining ownership of Oasis in Crestwood will also be of benefit to the company since it will create a diversified midstream operator with a strong balance sheet and a bullish outlook after this accretive merger.

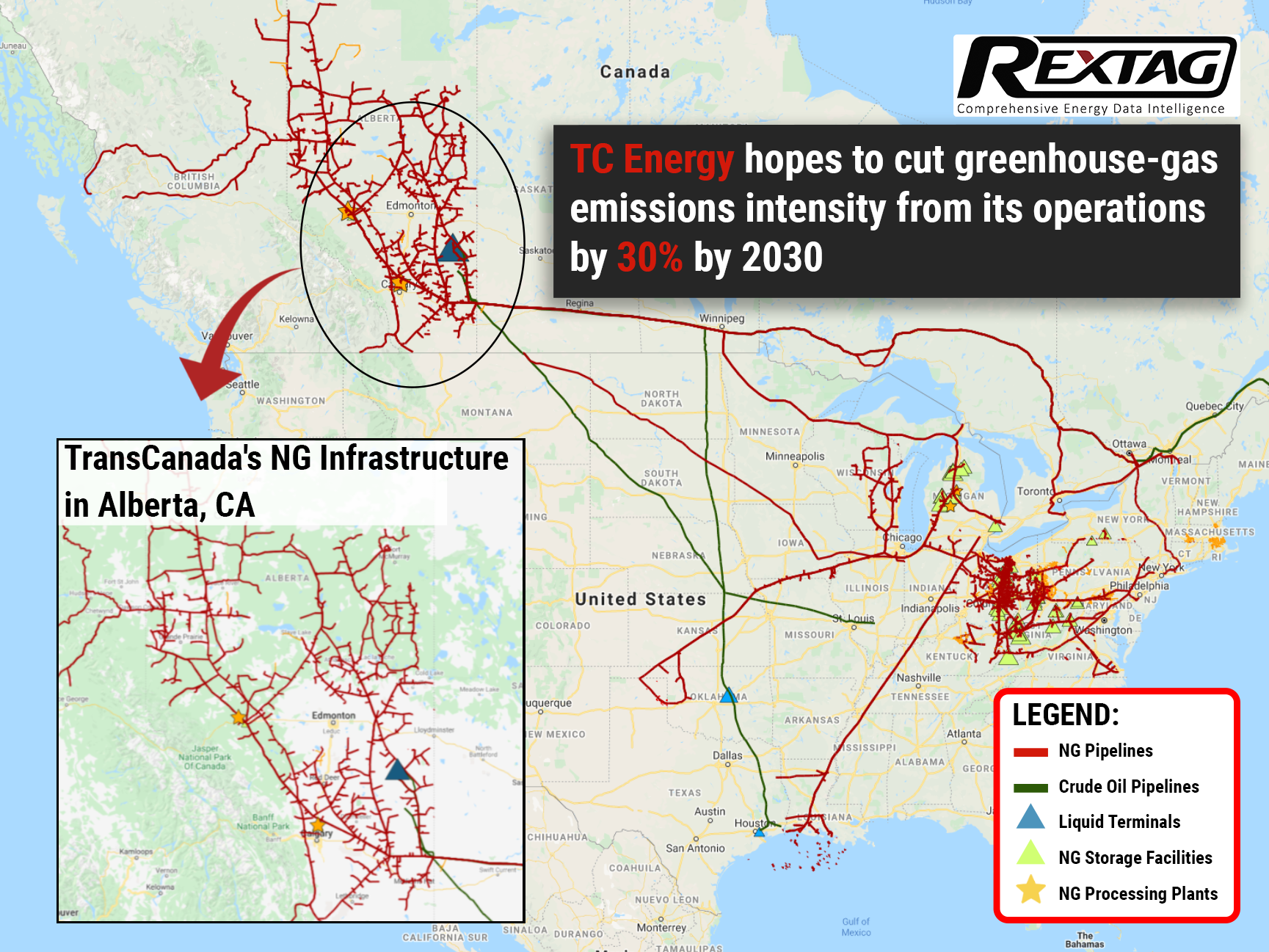

The green trend: TC Energy pledges to be carbon-free by 2050

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.

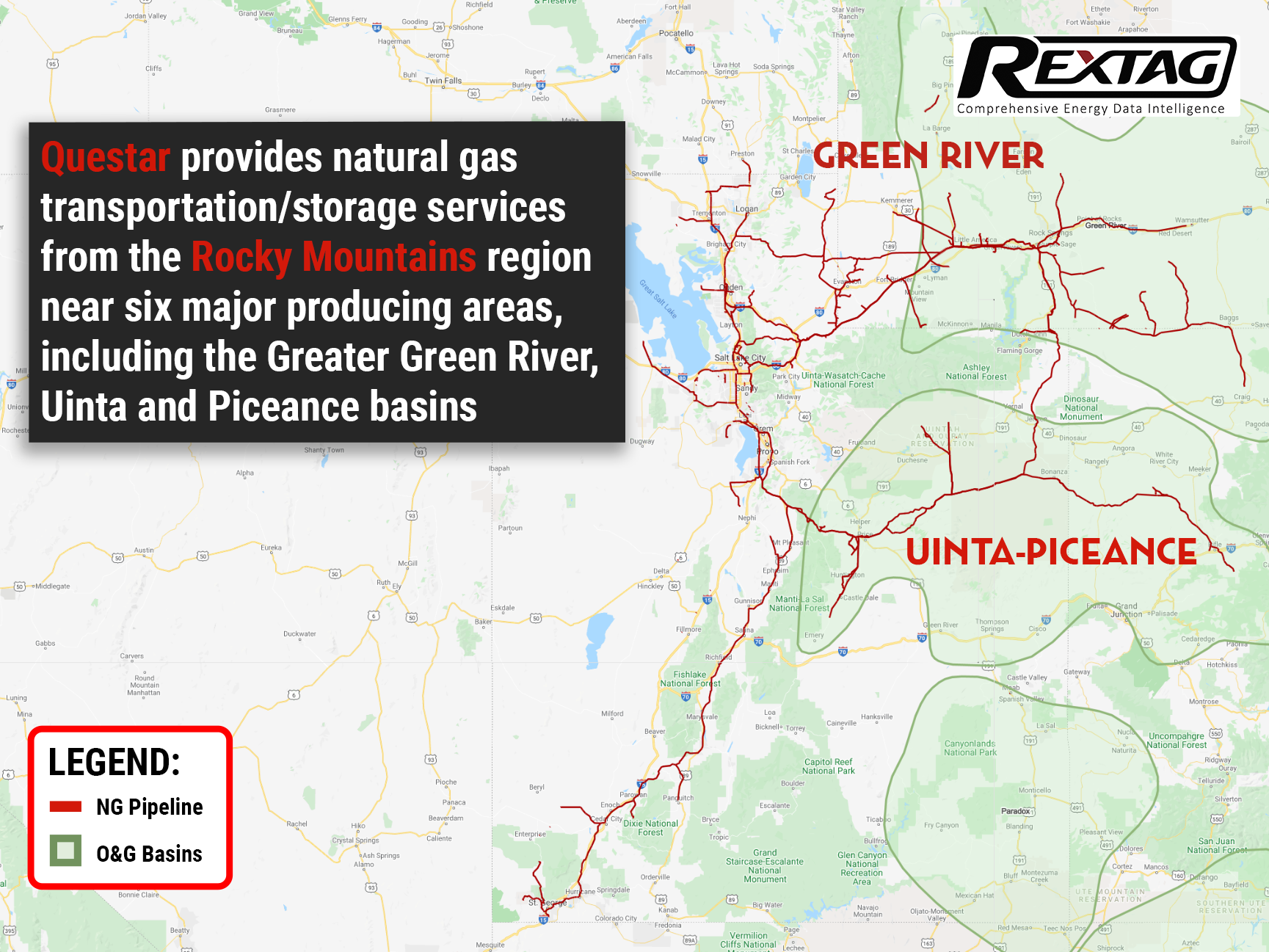

A $2 billion deal saw Dominion Energy sell Questar Pipelines to Southwest Gas

A good asset will not sit on the market for long. After a deal with Berkshire Hathaway fell through, Dominion Energy managed to secure another one for Questar Pipelines in a drop of a hat. And get that, it is better than the former one by more than half a billion! Although not everyone is happy with such decisions, it seems that even Carl Icahn’s complaints won't be able to sway Southwest Gas Holdings’ decision. Though we will have our eyes peeled in any case… If everything goes as planned, a $2 billion deal will be closed before the end of the year.

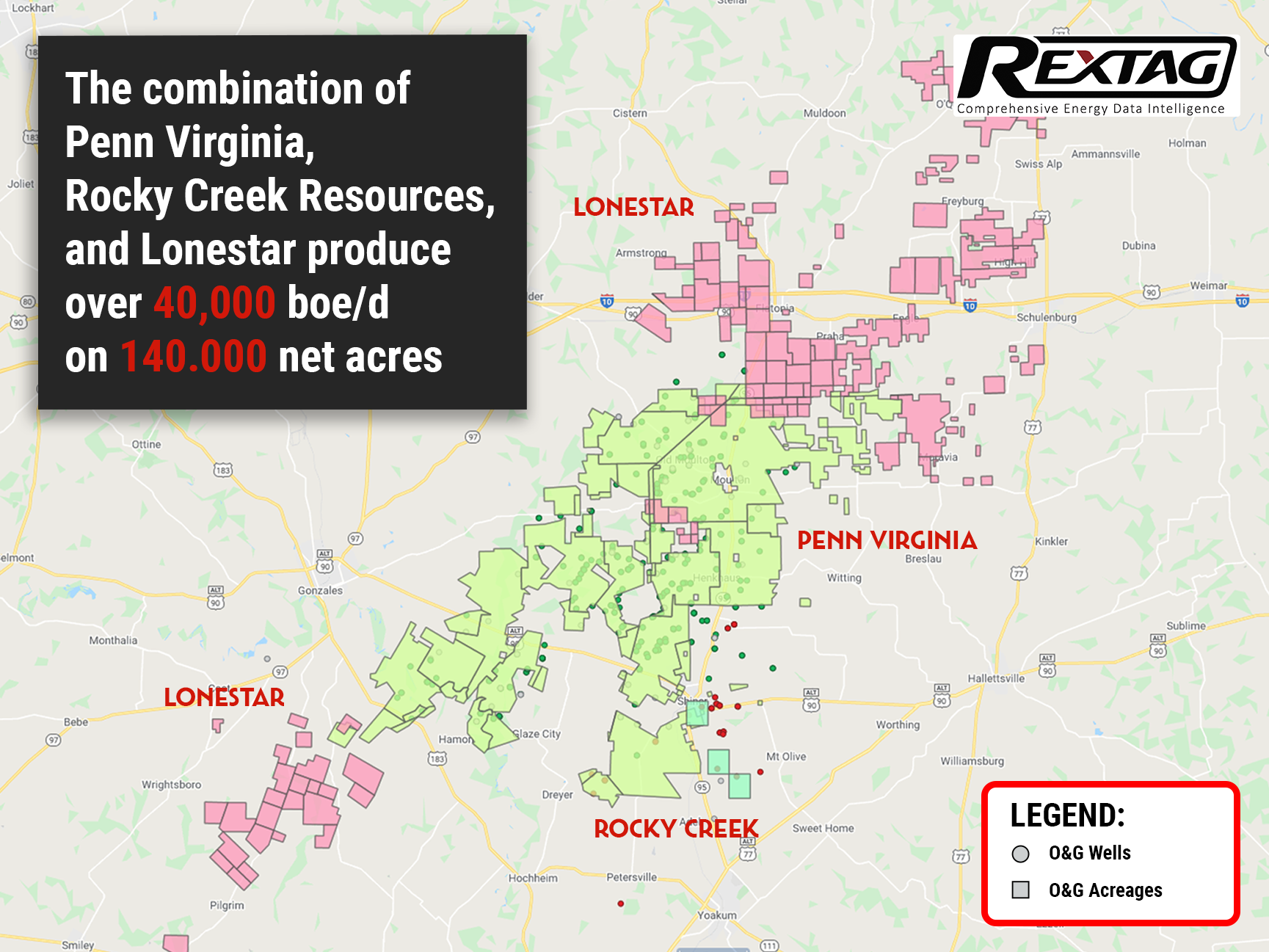

There is a new guy on the block: Penn Virginia rebrands to Ranger Oil

Penn Virginia announced a rebranding to Ranger Oil on 6 Oct. following the close of the Lonestar acquisition. This Texas oil & gas giant reinvents itself anew, shifting its energy development in the lone star state towards safer and more efficient oil and gas operations. The company's consolidated assets now amount to over 140,000 net acres strategically positioned in the Eagle Ford play of south Texas, making it one of the biggest players. It is anticipated that the full rebranding will be complete by the year-end of 2021. For the full rundown of the situation visit our blog.

.png)

.png)

.png)

.png)

.png)

.png)