Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

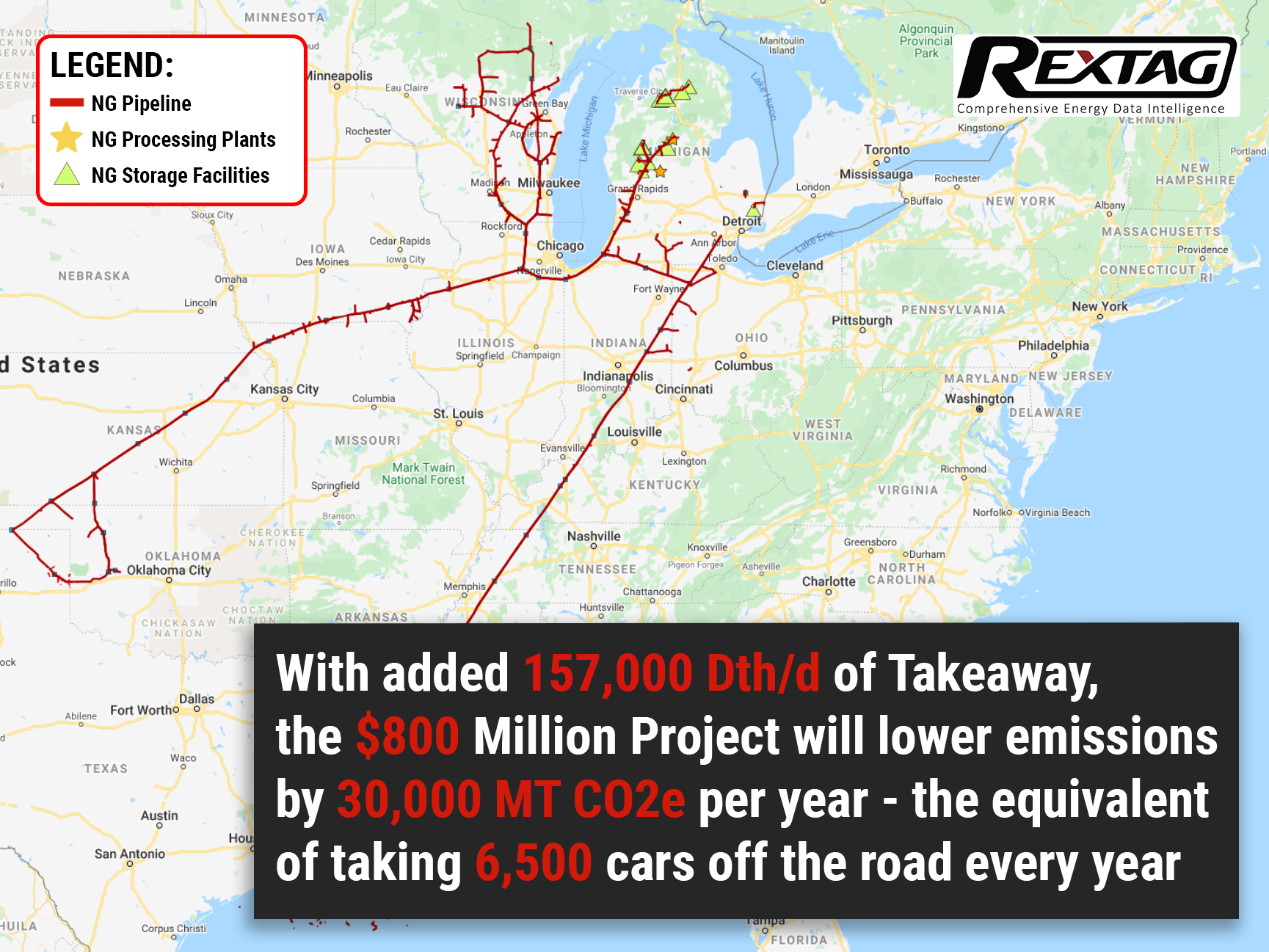

Expansion for TC Energy in Midwest US to cost $800 million

11/17/2021

The WR Project, consisting of a series of ventures, is expected to represent a capital investment of about $800 million. Approximately four years after its inception, the project will go into service.

According to the idea, existing lines of the ANR Pipeline Company (ANR) will be expanded to serve markets in the Midwestern United States simultaneously reducing discharge by 30,000 metric tons CO2e per year - equivalent to removing more than 6,500 cars from the road each year.

TC Energy approved the project after ANR secured long-term transportation agreements to meet demand in the Midwest.

The expansion of ANR's natural gas system will provide local area distribution networks and electric producers with an additional natural gas capacity of up to 157,000 dekatherms per day in markets where significant coal-fired and vintage gas generation has recently been retired. Another part of the project will also include the replacement of existing natural gas-powered compressor units with electric motor compressors equipped with fuel switching capability.

In TC Energy's view, if the electric drive units are fully utilized, the electrification of horsepower for the project is expected to result in a 43% reduction in carbon dioxide equivalent emissions at the source. According to the CEO and the president of the company, François Poirier, such an outcome is consistent with its business strategy to optimize an existing footprint while building more sustainable infrastructure and growing organically through an existing corridor.

The project is expected to be operational by the end of 2025, thanks to long-term transportation agreements secured by ANR.

It is anticipated that the company will convert even more natural gas compressors to electric motors in order to reduce the volume of emissions generated from its transmission and storage facilities in the coming years.

To ensure compliance with these objectives, TC Energy is currently working on additional renewable energy projects. A number of initiatives include pumped hydro storage, solar and wind alternatives, carbon transportation, and sequestration, as well as large-scale hydrogen production hubs.

A similar set of upgrades was sanctioned earlier this year by TC Energy for a Lower 48 pipeline in the Northeast. By 2025, the $700 million VR Project will partially electrify the Columbia Gas Transmission system. The project stretches accordingly from New York to the Midwest and Southeast.

The energy industry is undergoing unprecedented growth: due to both an increase in energy demand and a shift toward cleaner energy sources. This has created a significant number of investment opportunities and favorable market conditions to exploit. TC Energy is just one of those who lead this trend.

As such, the company has set itself a goal of achieving net-zero emissions by 2050 with an intermediate point of a 30% emission reduction from its operations by 2030. But whether it will be achieved in time remains to be seen.

If you also share such aspirations or simply want to stay atop of industry trends, do not shy away from contacting us - we have plenty of useful data for you to enjoy.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

The green trend: TC Energy pledges to be carbon-free by 2050

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/TC_Energy_carbon-free_greenhouse-gas_emissions_ESG_midstream_GIS_NG_data_hydrogen_pipeline_maps.png)

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.

2022 A&Ds in O&G Summary and Trends for the past 4 years

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R125Post_B_2022_A&Ds_in_O&G_Summary_and_Trends_for_the_past_4_years.png)

More than 60% of all A&D deals by value are in US oil and gas companies. Despite their leading market position, U.S. fields are developing unevenly, and investors are quite cautious about investing in them at this stage. The top 5 oil & gas industry A&D deals in 2022 were concluded by Omega Acquisition, Tokyo Gas, Diamondback Energy, Suncor Energy, and IMM Private Equity. The main motives of oil and gas companies to carry out A&D transactions can be considered the achievement of the synergy effect, and the presence of fundamental shocks in the market.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.