Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

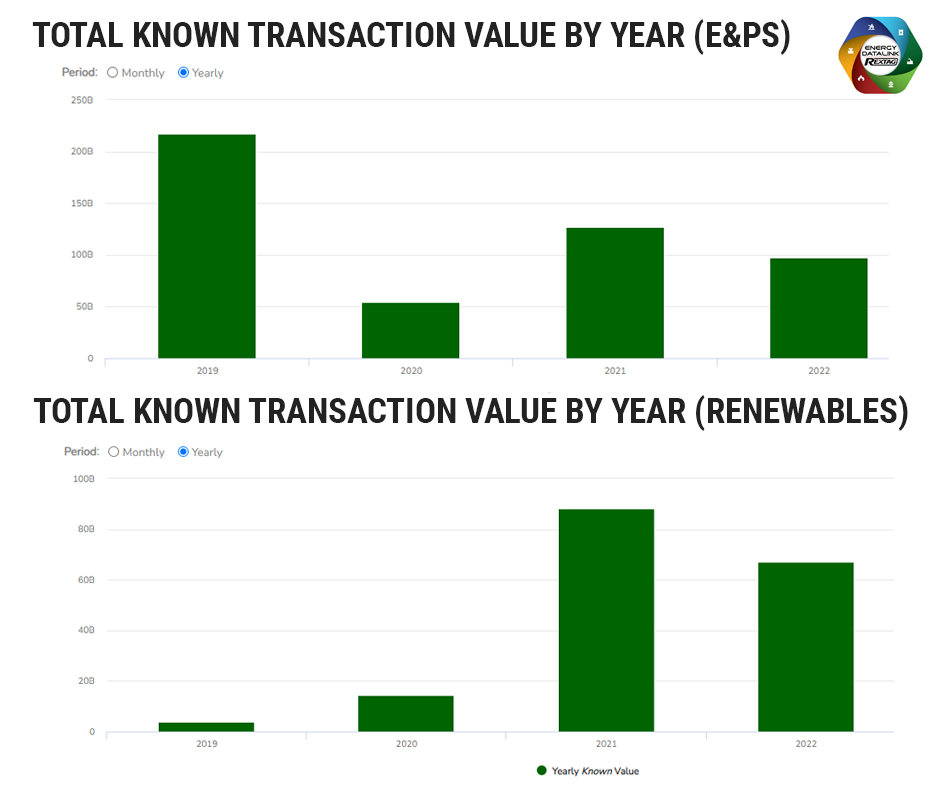

2022 A&Ds in O&G Summary and Trends for the past 4 years

02/15/2023

Acquisitions and Divestitures (A&D) deals are one of the most important indicators of the development of the oil and gas industry. With the help of A&D transactions, companies change the organization of the internal components of companies, combining resources for joint action. In this way, the resources of companies are merged under a new common organizational structure.

Many A&D deals in the oil and gas industry do not pay back the money invested in them, and many merged companies lose their competitiveness in the oil and gas market. At the same time, oil and gas companies experience external shocks associated with the volatility of global oil prices, which can have a significant impact on the effectiveness of A&D deals. Therefore, the problem of analyzing the effectiveness of A&D transactions in the oil and gas industry is promising and relevant.

According to Deloitte statistics, the volume of transactions in 2019 was $382 billion, while in 2018 this value was only $265 billion. At the same time, the total value of transactions in 2019 increased significantly, which is associated with the trend of consolidation of assets from the largest companies due to low prices for oil and gas resources and the need to find new sources of income. For example, in 2019, Total Corporation acquired Occidental in Africa for $8.8 billion, and Hilcorp Corporation acquired BP assets for $5.6 billion.

If the land has already been used by other oil or gas producers, companies may still be interested in acquiring that land, especially if the companies have new technology to re-drill and extract previously inaccessible reserves. These characteristics of A&D deals in the oil and gas industry can have a significant impact on the factors that determine the effectiveness of these deals, as well as on the motivations that guide companies in executing transactions.

A&D transaction is a serious challenge for the companies involved in the transaction. Companies are actually risking their competitive positions, so the analysis of the A&D deal's effectiveness plays a big role in the deal's organization. With this analysis, companies can choose the most attractive areas to invest in.

A&D deals in the US O&G market

More than 60% of all A&D deals by value are in US oil and gas companies. Despite their leading market position, U.S. fields are developing unevenly, and investors are quite cautious about investing in them at this stage.

The top 5 oil & gas industry A&D deals of 2022 were:

1) Omega Acquisition’s $4.31bn acquisition deal for 17% stake in Continental Resources

2) The $2.15bn acquisition of Tokyo Gas Australia by MidOcean Energy Holdings

3) Diamondback Energy’s $1.6bn acquisition deal with Firebird Energy

4) The $731.4m asset transaction of 21.3% stake in Teck Resources by Suncor Energy

5) IMM Private Equity’s $700m acquisition deal for 30% stake in AirFirst

Relatively low oil prices are not conducive to the full development of shale production technology, so investors tend to invest in the least risky assets. For example:

- Creation of a joint venture by Ecopetrol and Oxy in the developed Midland basin with a total investment of $1.5 billion (2019).

- Fortuna Resources cooperation with North Hudson (2020). Fortuna is a Houston-based oil and gas company that has been focused on acquiring and participating in non-operated interests in leading operators in the Permian Basin.

- Permian Resources is a mid-cap company in the Permian Basin, created in 2022 as a result of the merger of Centennial and Colgate. The newly formed company owns 180,000 net acres, and production is expected to reach nearly 150,000 boe/d.

- Kimbell Royalty Partners acquired the Midland and Delaware Basin assets in Permian from Hatch Royalty (2022). The transaction re-establishes the Permian Basin as Kimbell's leading basin for production, active rig count, DUC, permits, and undrilled reserves. Kimbell estimated the acquired assets to average approximately 2072 boe/d (1198 bbl/d of oil, 372 bbl/d of NGLs, and 3012 MMcf/d of natural gas). Kimball estimates that production will increase to an average of 2,522 boepd in 2023.

- A subsidiary of Tokyo Gas is in talks to buy US natural gas producer Rockcliff Energy from private equity firm Quantum Energy Partners for about $4.6 billion, including debt (2023).

The role of the production process in A&Ds

Reserves are one of the key assets that are acquired as part of an A&D transaction. This is due to the fact that the future capitalization of an oil and gas company and its financial results are determined by the dynamics of reserves. The peculiarity of the oil and gas industry is a constant reduction of reserves in the process of production, so if the company does not explore independently or acquire fields owned by other companies, it will not be able to operate in the long term.

Exploration on its own is quite a costly process for the company and requires a constant flow of investment to achieve results. At the same time, the company still bears the risk that promising fields will not be found, despite the exploration processes carried out. Therefore, companies may be interested in the alternative option - a direct purchase of the assets of another company, which owns promising oil and gas fields. The advantages of this option are saving on the exploration process, reducing the risk of unsuccessful field exploration, and the opportunity to earn extra income in case the market conditions improve.

At the development stage, buying companies look at the results of initial oil and gas production in the field. If the actual production corresponds to the planned results, the asset is attractive to potential buyers. The value of unproven reserves tends to increase as the field's development progresses. Consequently, the more the oil and gas company's production activities are deployed, the higher its value is estimated.

Oil and Gas A&D Trends

- Cash Only

Oil price volatility helped cast A&D markets adrift leaving many E&P companies in a “no-wind” scenario in 2019.

At Hart Energy’s Executive Oil Conference in Dallas, S. Wil VanLoh, founder and CEO of private-equity provider Quantum Energy Partners, said displacing the inventory of top-tier producers is a challenge. The top 10 producers, drilling at their current pace, have another 44 years of inventory remaining, he said.

- Indie Oil and Gas Deal-Making

So far in 2019, oil and gas deals have taken an indie turn in the market with mid-sized deals transacting in Alaska and the southern Midland Basin. Occidental Petroleum Corp.'s merger agreement with Anadarko Petroleum Corp., smaller deals have been drowned out. The much-ballyhooed $2.2 billion Comstock Resources Inc. combination with Covey Park Energy LLC dominated analysis with the novel concept of private companies selling to public E&Ps.

- Apocalypse Pricing Ends Soon

In 2021, Enerplus Corp. agreed to acquire Bruin E&P Partners LLC for $465 million cash in a deal it described as “highly complementary” to its existing acreage. Bruin holds a 150,000 net acre position in the Bakken, including 30,000 net acres around Fort Berthold, with 135 net drilling locations.

According to Jason Martinez, head of BMO's U.S. A&D business, companies should expect additional deals in more mature basins in 2021. As he noted at the time, "I believe there are literally hundreds of millions of barrels of production waiting to change hands, and they're waiting for prices, and they're waiting for financing."

- M&A has explosive power

Most analysts expect another year of high-intensity firepower from upstream oil and gas deals, largely directed at the Permian Basin, as well as the Marcellus and Haynesville shales. The announcement of Navitas Midstream Partners LLC for $3.25 billion only served to draw the Midland Basin in stronger contrast with its rival basins.

For natural gas deals, higher prices and improved access to capital will allow larger gas-focused producers to chase M&A more easily in 2022. But the same higher valuations found in the oil patch will likely be a motivator for sellers to engage “actively” with potential buyers.

- Giddy or Giddy Up?

In 2022, Chesapeake Energy Corp. announced that it would acquire Chief Oil & Gas while transferring its Powder River Basin assets to Continental Resources Inc.

The capture of Vine Energy Inc. in a $2.2 billion zero-premium merger kept the company from adding debt, added production, 227,000 net acres in the Haynesville Shale and Mid-Bossier, and cash flow. The company said that the deal increased Chesapeake’s five-year free cash flow by $1.5 billion, or about 68% of the transaction value.

Let's summarize

Thus, in the oil and gas industry, the concept of A&D transactions is understood in a broader sense than the usual approach and includes any major acquisition of assets and reserves of the company, not necessarily implying the acquisition of the entire enterprise. The main motives of oil and gas companies to carry out A&D transactions can be considered the achievement of the synergy effect, the presence of fundamental shocks in the market, and the possibility of increasing their own reserves in the long term.

Data has the potential to be a game changer and is essential for monitoring processes and operations. As data becomes more accessible, organizations can process raw data into meaningful information. Oil and gas giants are already realizing the value of this information and are investing in doing more with their data to solve business problems in a rapidly changing and competitive industry.

Rextag offers a comprehensive solution that provides companies with the insight and critical factory information to stay ahead of the curve and leverage data to drive operating profits. With Rextag, O&G companies can take back control of their data, make smarter decisions, and improve their facilities' overall efficiency and effectiveness.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

A&Ds in O&G forecast for 2023, trends and factors that influence this

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R126_B_A&Ds_in_O&G_forecast_for_2023.png)

“Our view is in 2023 M&A picks up. There was some this 2022 year, but again, it was such a funky, weird macro world. We expect fewer surprises in 2023.” — Dan Pickering, Pickering Energy Partners. Modern companies in the world operate in a rapidly changing external environment, so the process of reorganization is one of the basic tools for solving the problem of adapting companies to new conditions. Recently, the number of Acquisitions and Divestitures in the oil and gas industry has been growing rapidly, i.e. it can be said that the market for these deals is dynamically developing.

Diamondback finalizes $1.55 billion acquisition of Lario, enhancing Midland Basin portfolio

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/135Blog_Diamondback_Acquires_Lario_Permian.png)

Diamondback Energy, an independent oil and gas company, has successfully completed the acquisition of Lario Permian, marking the closure of two major deals in the fourth quarter of 2022. The company purchased two private operators in the Midland Basin for approximately $3.3 billion.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.