Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Half of Kinder Morgan’s Stake in Georgia LNG Facility is Sold to Unknown Company

Kinder Morgan Inc. decided to sell half of its 51% interest in an LNG facility in Georgia on September 27 with proceeds allocated by the Houston-based company to pay short-term debt and buy back shares. As it is acknowledged, an undisclosed financial buyer purchases the 25.5% equity interest in Elba Liquefaction Co. LLC (ELC) for approximately $565 million. ELC is a joint venture (JV) established in 2017 to build and own the Elba liquefaction facility situated on #Elba Island in Chatham County, Georgia. After completion, Kinder Morgan and the undisclosed financial buyer will each hold a 25.5% stake in ELC. Meanwhile, Blackstone Credit will continue to hold a 49% interest. The value of the equity interest considers an enterprise value of almost $2.3 billion for ELC, which is about 13 times 2022E EBITDA. The transaction has an economic effective date of July 1. The Elba liquefaction facility has 10 modular liquefaction units for a total capacity of roughly 2.5 million tonnes per year of LNG. Kinder Morgan considers it equivalent to almost 350 MMcf/d of natural gas.

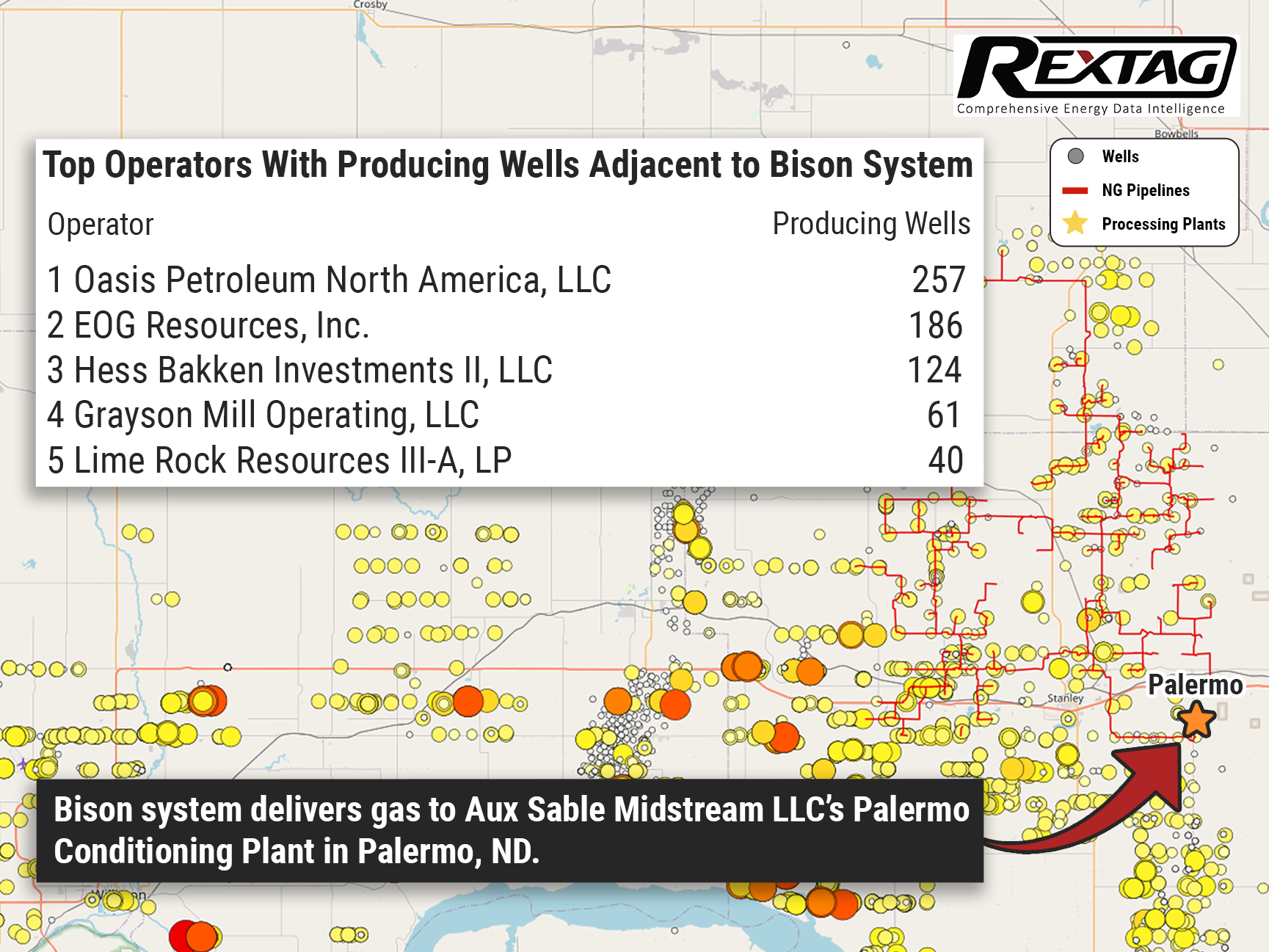

Bison Gas Gathering System Sold: $40M Cash Paid By Summit Midstream to Steel Reef

Steel Reef acquires Summit Midstream’s Bison Gas gathering system in North Dakota for $40 million in cash as part of Houston-based Summit’s plans to streamline its portfolio. According to a release on September 19, with the sale of Bison Midstream, Summit’s focus in the Williston Basin will be on increasing its crude oil and produced water gathering systems mainly situated in Williams and Divide Counties, North Dakota. The Bison agreement follows the sale of Summit’s Lane gathering and processing system in the #PermianBasin to Matador Resources Co. in June for $75 million. The merger of the divestitures creates additional financial flexibility to reinvest in more strategic scale-building opportunities across Summit’s footprint. Summit Midstream is interested in the status of customer development activity in central Williams County and pro forma for the transaction and anticipates over 50 new wells behind our liquids system in 2023. Pro forma for the Bison transaction, Summit will have about $90 million drawn on its $400 million ABL credit facility, resulting in over $300 million of available liquidity, according to Deneke. The company continues to anticipate to trend toward the high end of our 2022 Adjusted EBITDA guidance range of $205 million to $220 million.

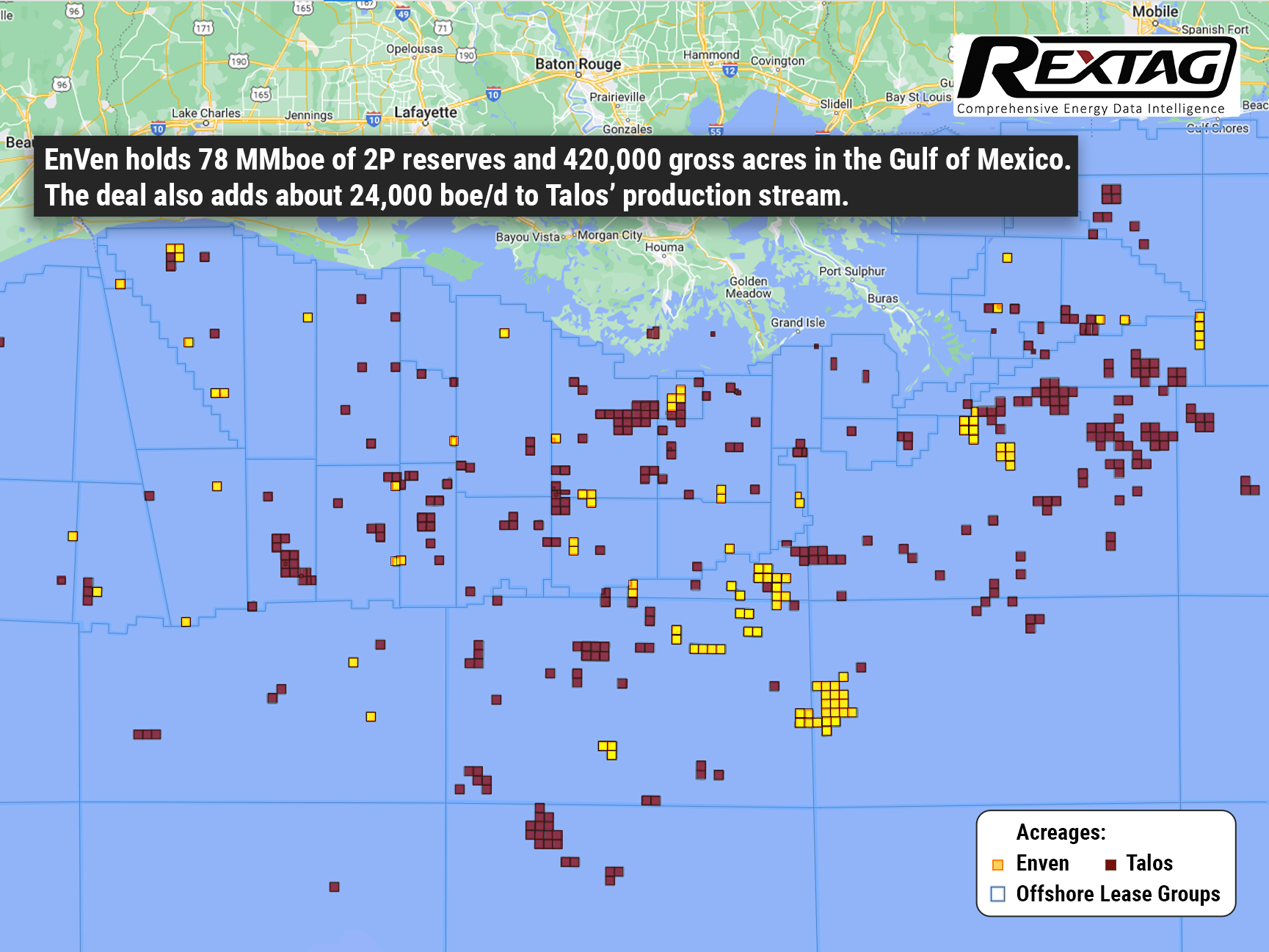

Talos Energy Buys EnVen for $1.1 Billion to Expand

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

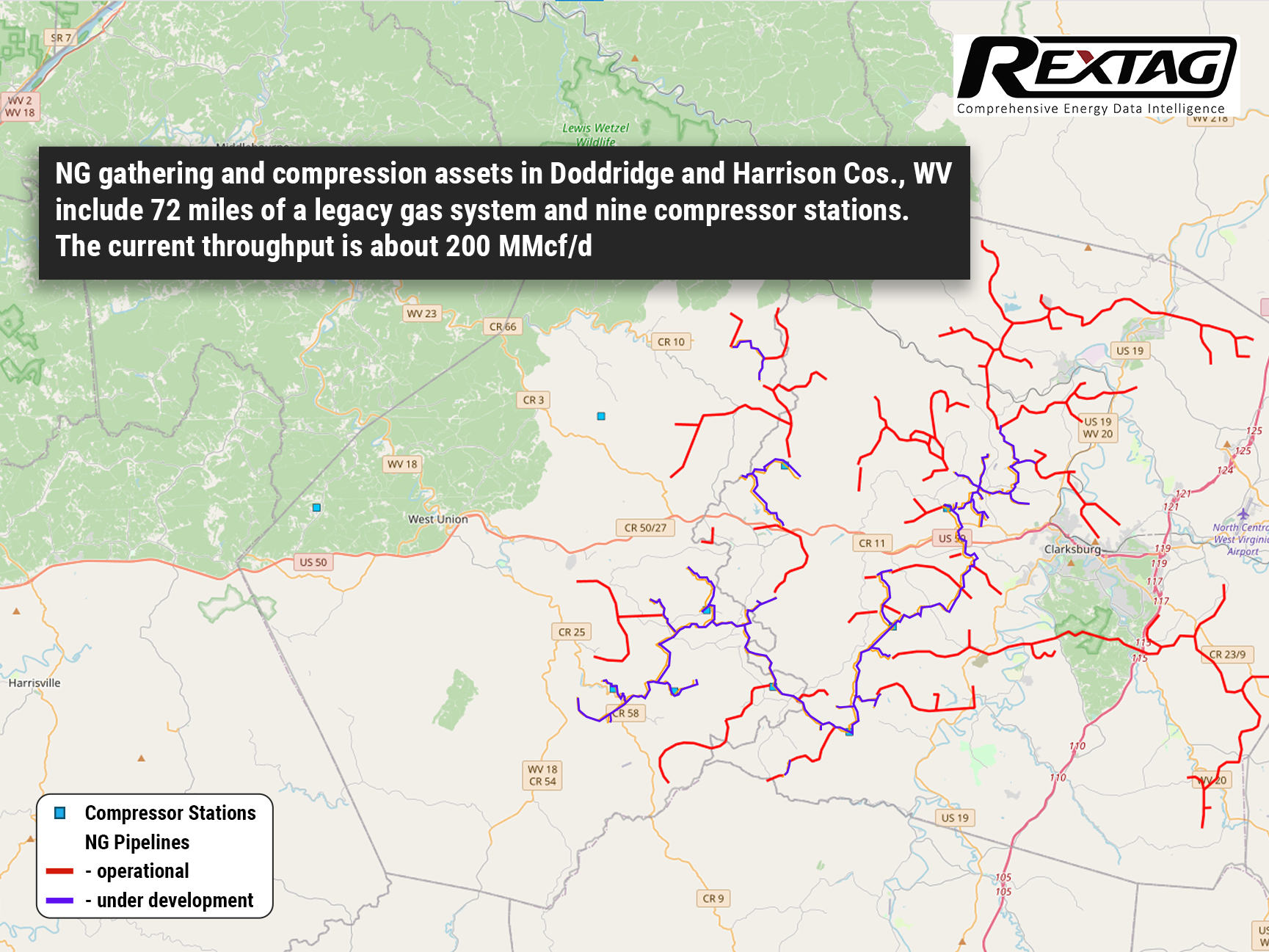

$205 Million for Marcellus Assets Divested by Crestwood to Antero

Antero Midstream Corp. bought Marcellus assets of Crestwood Equity Partners LP on September 12 for $205 million in cash, signing another sale of noncore assets by the Houston-based company. Crestwood has strategically enhanced its asset portfolio through a series of A&D transactions for the previous 18 months to create a competitive scale in the Williston, Delaware, and Power River basins. The strategy covered acquisitions of Oasis Midstream Partners, Sendero Midstream, and Crestwood Permian Basin Holdings LLC (CPJV), which was a 50:50 joint venture of Crestwood and First Reserve. The assets to be bought cover 72 miles of dry gas gathering pipelines and nine compressor stations with about 700 MMcf/d of compression capacity. The current throughput on the system is approximately 200 MMcf/d, resulting in important available capacity for increase without major capital investment. The deal includes almost 425 undeveloped drilling locations and 120,000 gross dedicated acres from Antero Resources mainly in Harrison County. The acquisition is also anticipated to raise Antero Midstream’s compression capacity by 20% and gathering pipeline mileage by 15%.

Momentum Midstream Becomes a Leader in Haynesville Due to Latest Acquisitions

Houston-based company Momentum Midstream LLC on September 22 purchased Midcoast Energy LLC’s East Texas business from an affiliate of Arc Light Capital Partners LLC and Align Midstream LLC from Tailwater Capital and claimed that it establishes a leading presence in the Haynesville Shale. New Generation Gas Gathering or NG3 project will collect natural gas produced in the Haynesville Shale for re-delivery to premium Gulf Coast markets, including LNG export. Moreover, the NG3 project includes a carbon capture and sequestration component that will eliminate 100% of the CO₂ and accumulate it underground for a long time, creating a net negative carbon footprint. With the combined assets of Midcoast ETX and Align Midstream, Momentum is currently delivering volumes of more than 2 Bcf/d for a diverse customer base composed of producers, utilities, end-users, and LNG exporters. Momentum’s footprint in the Haynesville includes about 3,000 miles of gathering pipelines, 1.5 Bcf/d of treating capacity, 700 MMcf/d of processing capacity, 200,000 HP of compression, and 820 miles of pipelines transporting gas to the Gulf Coast markets in southeast Texas and the Carthage and Bethel markets in East Texas.

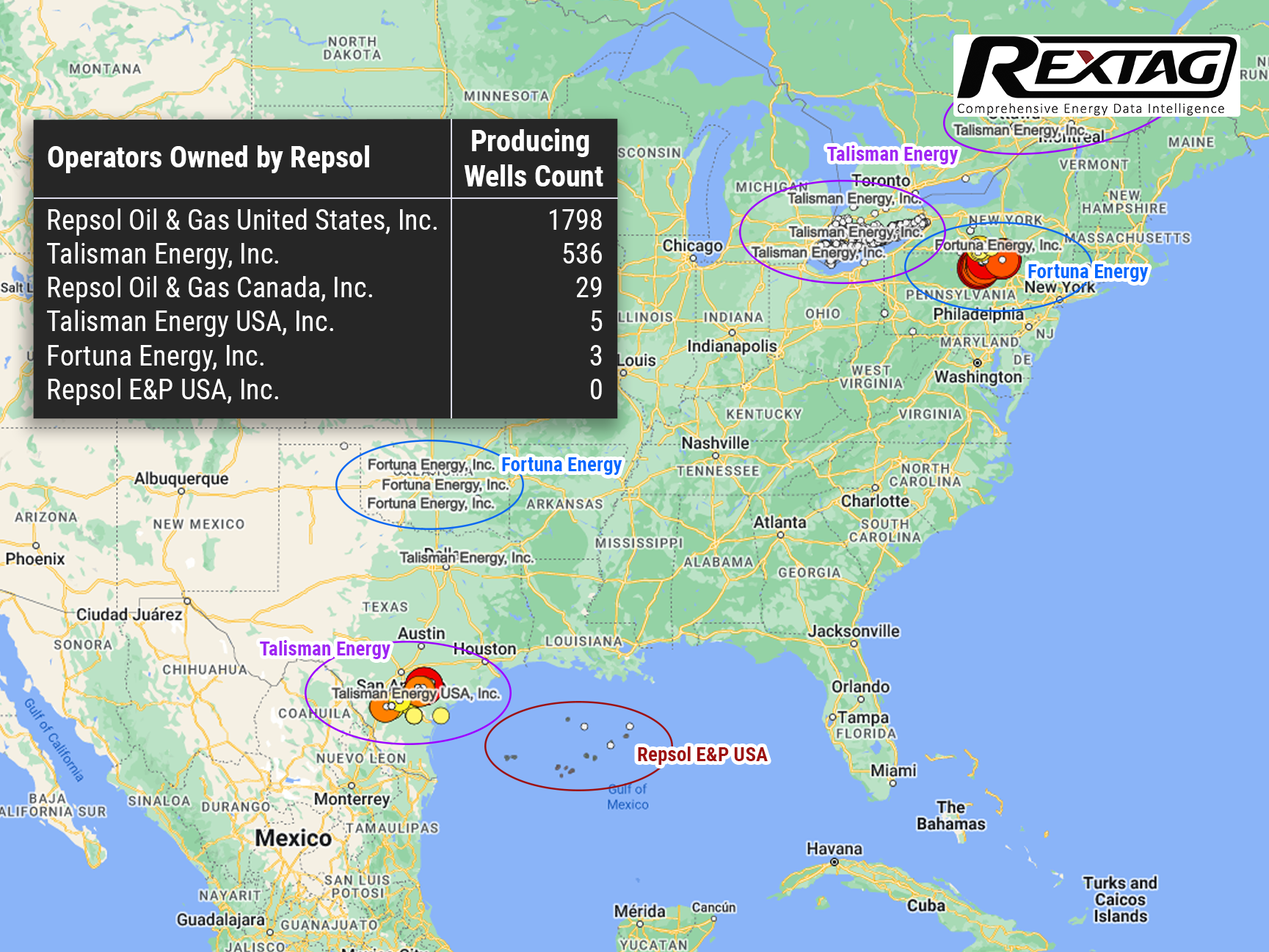

EIG Buys 25% of Repsol’s Oil and Gas Unit for $4.8 Billion

Spanish energy group Repsol is putting a 25% stake in its oil and gas exploration division on the market. U.S. fund EIG purchases it for $4.8 billion and builds up a war chest for renewables projects due to the transition of the energy industry to a lower-carbon future. As Reuters reported earlier this year, the deal values the whole business at $19 billion including debt, and may conduct a U.S. stock market listing of a stake in the unit after 2026, according to Repsol’s statement. The process commenced with an unsolicited offer from EIG, Reuters said in June, increasing Repsol's shares to a 14-year high. Moreover, shares grew up after an announcement on September 7 before declining 1.8% by 7:46 GMT. Nevertheless, they outperformed the European oil and gas index, which was down 2.3%.

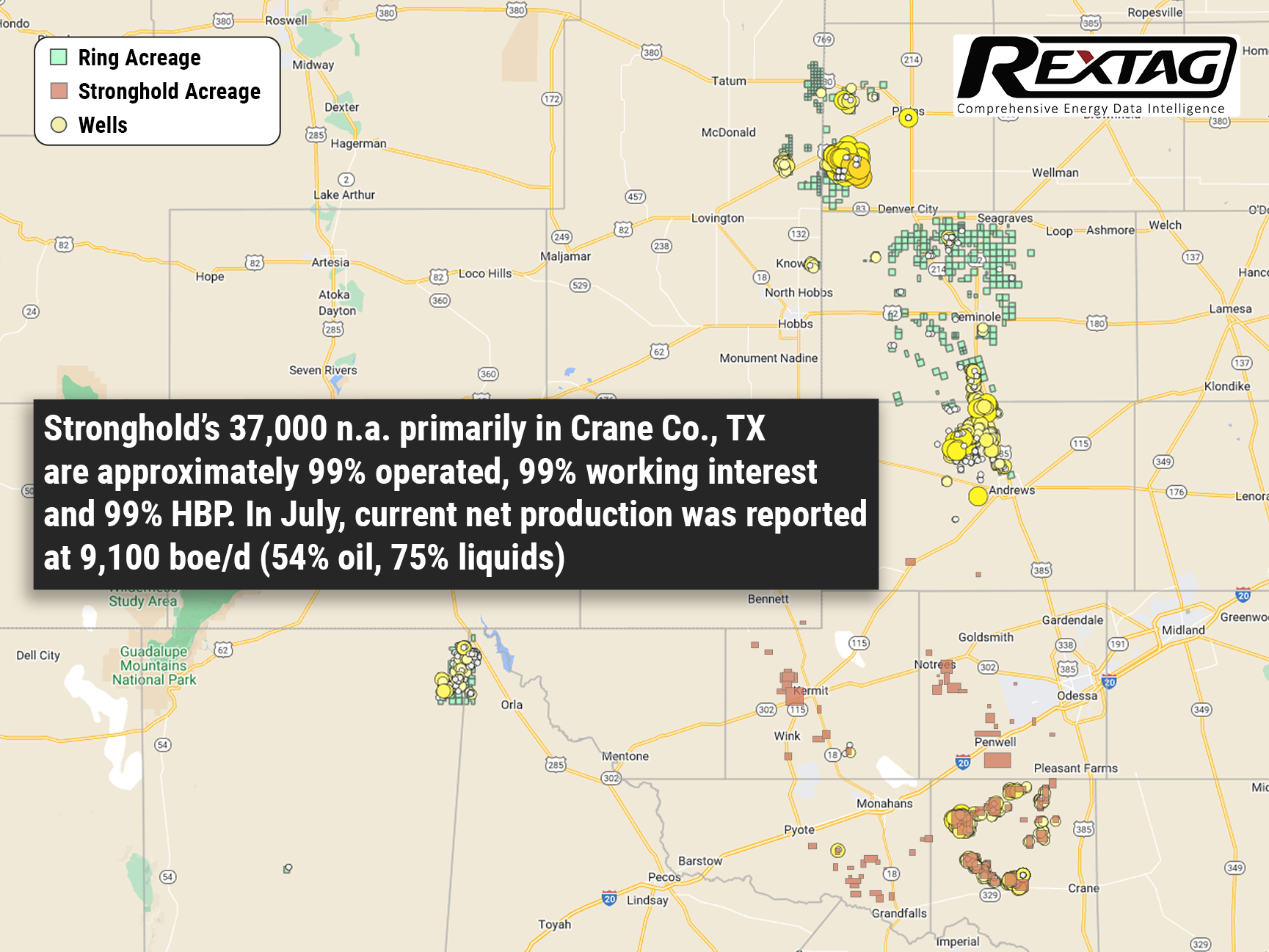

$465 Million for Stronghold Energy; Ring Energy Completes the Acquisition

On August 31 Ring Energy Inc. purchased privately-held Stronghold Energy, adding operations that are mainly situated in Crane County, Texas, in the Permian Basin’s Central Basin Platform. According to a September 1 Ring Energy release, this transaction fully complements the conventional-focused Central Basin Platform and Northwest Shelf asset positions in the Permian Basin. The majority owned by Warburg Pincus LLC, Stronghold’s operations are concentrated on the development of about 37,000 net acres situated mainly in Crane County. In July Ring Energy entered into an agreement to buy Stronghold Energy II Operating LLC and Stronghold Energy II Royalties LP for $200 million in cash at closing and $230 million in Ring equity based on a 20-day volume weighted average price. Consideration also involved a $15 million deferred cash payment due six months after closing and $20 million of existing Stronghold hedge liability increasing the total transaction value to $465 million. Stronghold’s asset base is almost 99% operated, 99% working interest, and 99% HBP. In July, Ring announced the current net production of Stronghold’s asset base was approximately 9,100 boe/d (54% oil, 75% liquids).

.png)

.png)