Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

$465 Million for Stronghold Energy; Ring Energy Completes the Acquisition

10/03/2022

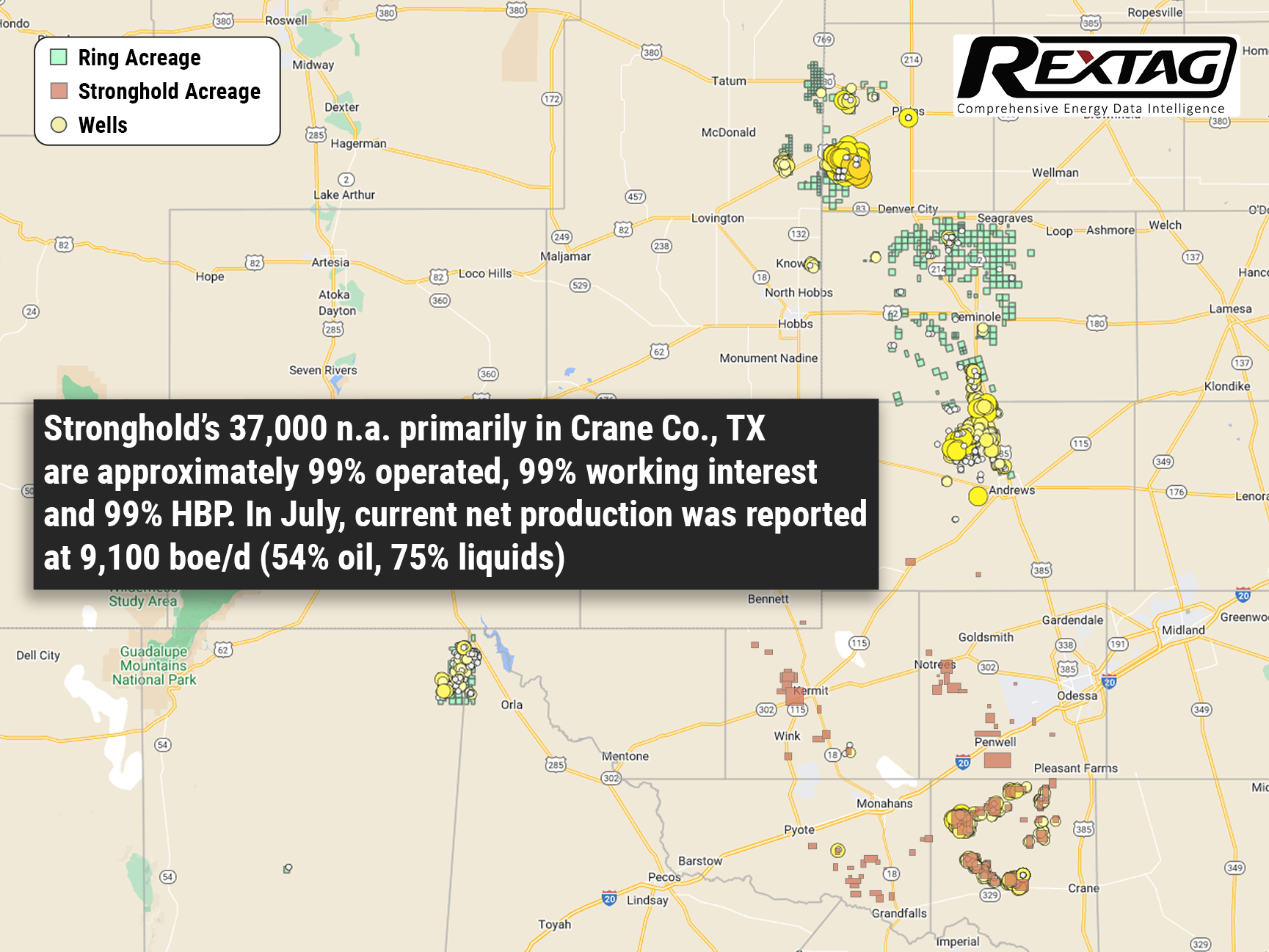

On August 31 Ring Energy Inc. purchased privately-held Stronghold Energy, adding operations which are mainly situated in Crane County, Texas, in the Permian Basin’s Central Basin Platform.

According to a September 1 Ring Energy release, this transaction fully complements the conventional-focused Central Basin Platform and Northwest Shelf asset positions in the Permian Basin.

The majority owned by Warburg Pincus LLC, Stronghold’s operations are concentrated on the development of about 37,000 net acres situated mainly in Crane County. The company was established in 2017 by father and son duo Steve and Caleb Weatherl.

In July Ring Energy entered into an agreement to buy Stronghold Energy II Operating LLC and Stronghold Energy II Royalties LP for $200 million in cash at closing and $230 million in Ring equity based on a 20-day volume weighted average price. Consideration also involved a $15 million deferred cash payment due six months after closing and $20 million of existing Stronghold hedge liability increasing the total transaction value to $465 million.

The cash portion of the consideration was funded mainly from borrowings under a new fully committed revolving credit facility endorsed by Truist Securities, Citizens Bank NA, KeyBanc Capital Markets, and Mizuho Securities.

Stronghold’s asset base is almost 99% operated, 99% working interest, and 99% HBP. In July, Ring announced the current net production of Stronghold’s asset base was approximately 9,100 boe/d (54% oil, 75% liquids).

McKinney shared that the acquisition further spreads out Ring Energy’s commodity mix, essentially improving the company’s size and scale and lowering its per barrel operating costs while also bringing meaningful synergies and raising operations optionality on multiple fronts.

The merger of lower per barrel operating costs and a considerably extended inventory of high-margin, capital-efficient development opportunities is anticipated to raise free cash flow, hastening the rate at which the company pays down debt, and improves the leverage metrics.

Thanks to this, the company holds a much stronger position to expand through supplementary acquisitions or enlarge stockholder returns through the potential return of capital opportunities in the future.

All Stronghold’s owners now are Ring’s largest stockholders, according to the release. Ring’s board of directors has been extended from seven to nine directors, adding two members proposed by Stronghold.

The effective date of the transaction was June 1. Raymond James and Truist Securities are financial advisers to Ring, and Piper Sandler & Co. is financial adviser to Stronghold for the transaction. Mizuho Securities compiled a fairness opinion for Ring’s board. Jones & Keller, P.C. provided legal counsel to Ring and Kirkland & Ellis LLP provided legal counsel to Stronghold.

On the Central Basin Platform, Ring Energy, Inc. is targeting the San Andres formation. The San Andres is a high oil-saturated “conventional shallow non-contiguous carbonate reservoir” at approximately 5,000’ and is primarily an oil-bearing formation (approximately 96% oil) that has been drilled and produced for over 90 years. Of the over 30 billion barrels produced from the Permian Basin approximately 40%, or 12 billion barrels, came from the San Andres reservoir.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Significant Growth of MPLX; Pipeline Throughput Raised by 6%

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/84Blog_MPLX_Marathon_Petroleum_Texas_Assets_2022_08.png)

According to a midstream oil and natural gas company release on August 2, MPLXLP has increased total pipeline throughputs by 6% in the second quarter of 2022 and terminal throughput by 4%, versus year-ago levels. In an earnings statement of MPLX, the total pipeline throughputs were 5.9 million bbl/d, with terminal throughput of 3.1 million bbl/d for the second quarter. The company reported a net income of $875 million and adjusted earnings of $1.457 million in the second quarter, both higher than in the same period of 2021. Gathered volumes grew up by 11% from year-ago levels to an average of 5.6 Bcf/d. In the Marcellusregion, gathered volumes fell 1% compared to year-ago levels to an average of 1.3 Bcf/d. MPLX is expanding several projects, including in the Permian Basin where the Whistler pipeline is increasing from 2 Bcf/d to 2.5 Bcf/d, in addition to lateral pipelines into the Midland Basin and Corpus Christi domestic and export markets. Moreover, the construction is also maintained on the 200 MMcf/d Tornado ll processing plant, which MPLX anticipates coming online in the second half of 2022. Additionally, 68,000 bbl/d Smithburg de-ethanizer project in the Marcellus is expected to come online in the third quarter.

Aera Energy Sold to IKAV Exxon&Shell Divest of CA Crude Producer

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/88Blog_Aera_Energy_Sold_By_Exxon_CA_assets_2022_09.png)

California oil joint venture, Aera Energy, of Exxon Mobil Corp. and ShellPlc is being sold to German asset manager IKAV, according to the agreement of Sept. 1. Shell noted that the sale of its 51.8% membership interest in Aera Energy is for a total consideration of about $2 billion in cash with additional contingent payments based on future oil prices, subject to regulatory approval. However, the total transaction value was not disclosed. Being one of California’s largest oil and gas producers, Aera Energy accounts for nearly 25% of the state’s production. The sale by Exxon Mobil and Shell ends a 25-year-long partnership in California, meanwhile, it persists a streak of divestments of mature oil and gas properties by the two supermajors. Aera Energy LLC operates about 13,000 wells in the San Joaquin Valley in California, producing oil and associated gas. In 2021, Aera took out about 95,000 boe/d. Exxon Mobil’s interests in the Aera oil-production operation in California contained a 48.2% share of Aera Energy LLC and a 50% share of Aera Energy Services Co. held by Mobil California Exploration & Producing Co. Moreover, Exxon Mobil affiliates have signed a separate agreement for the sale of an associated loading facility and pipeline system. The sale effectively ends Shell’s upstream position in California. The company reported that the divestiture is valued to result in a post-tax impairment of $300 million to $400 million, subject to adjustments.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.