Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

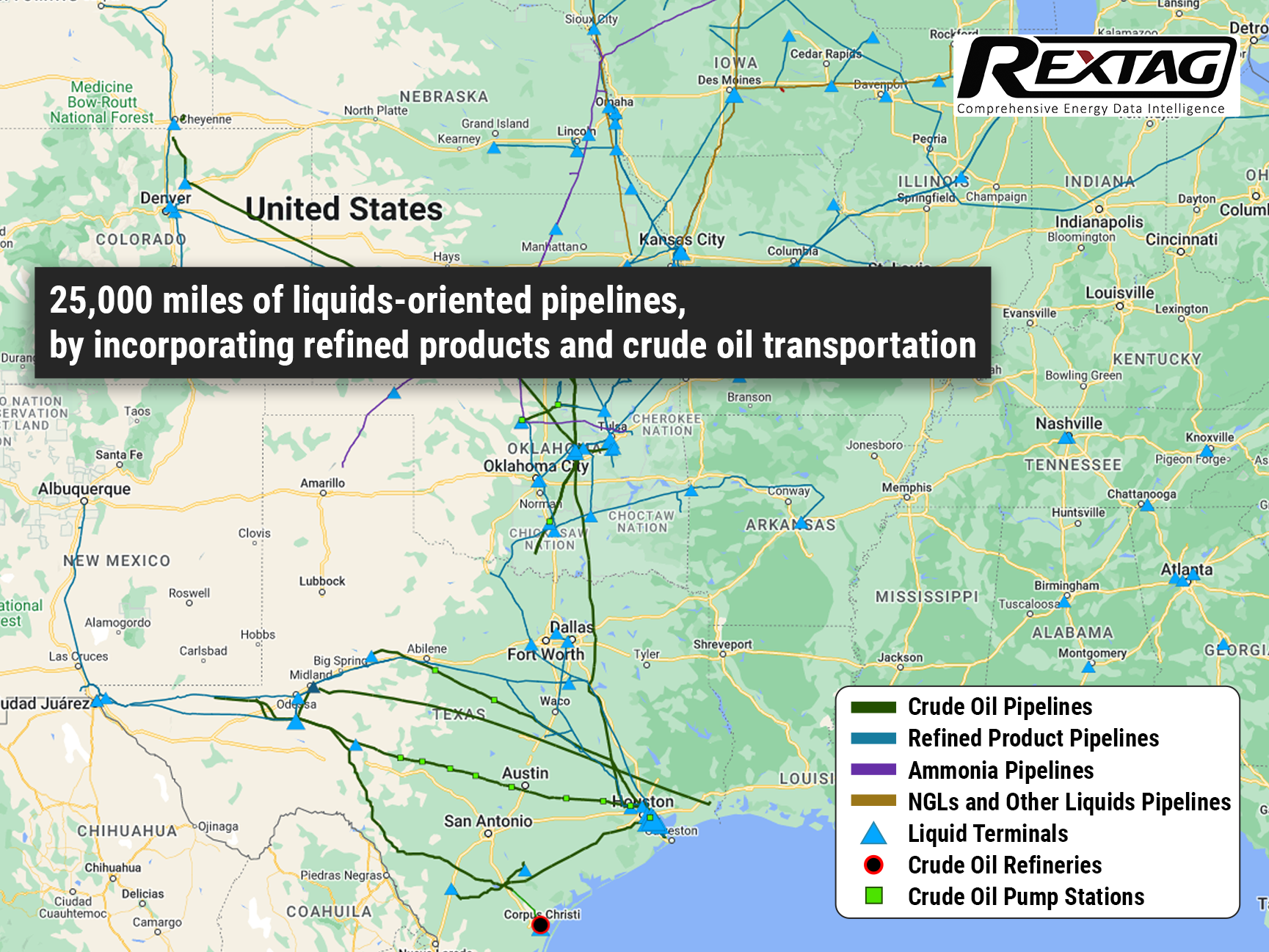

ONEOK Finalizes Purchase of Magellan Midstream Partners

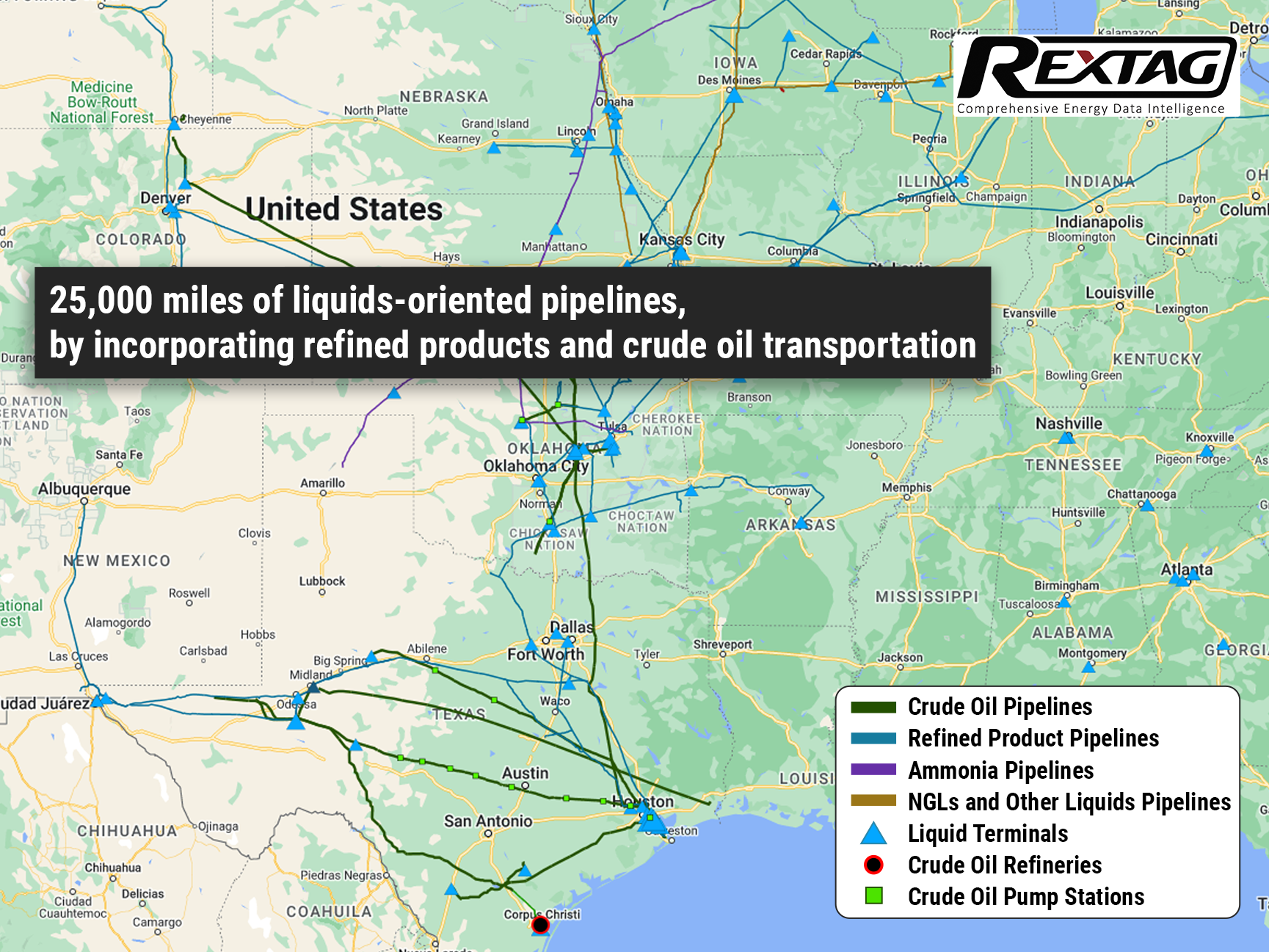

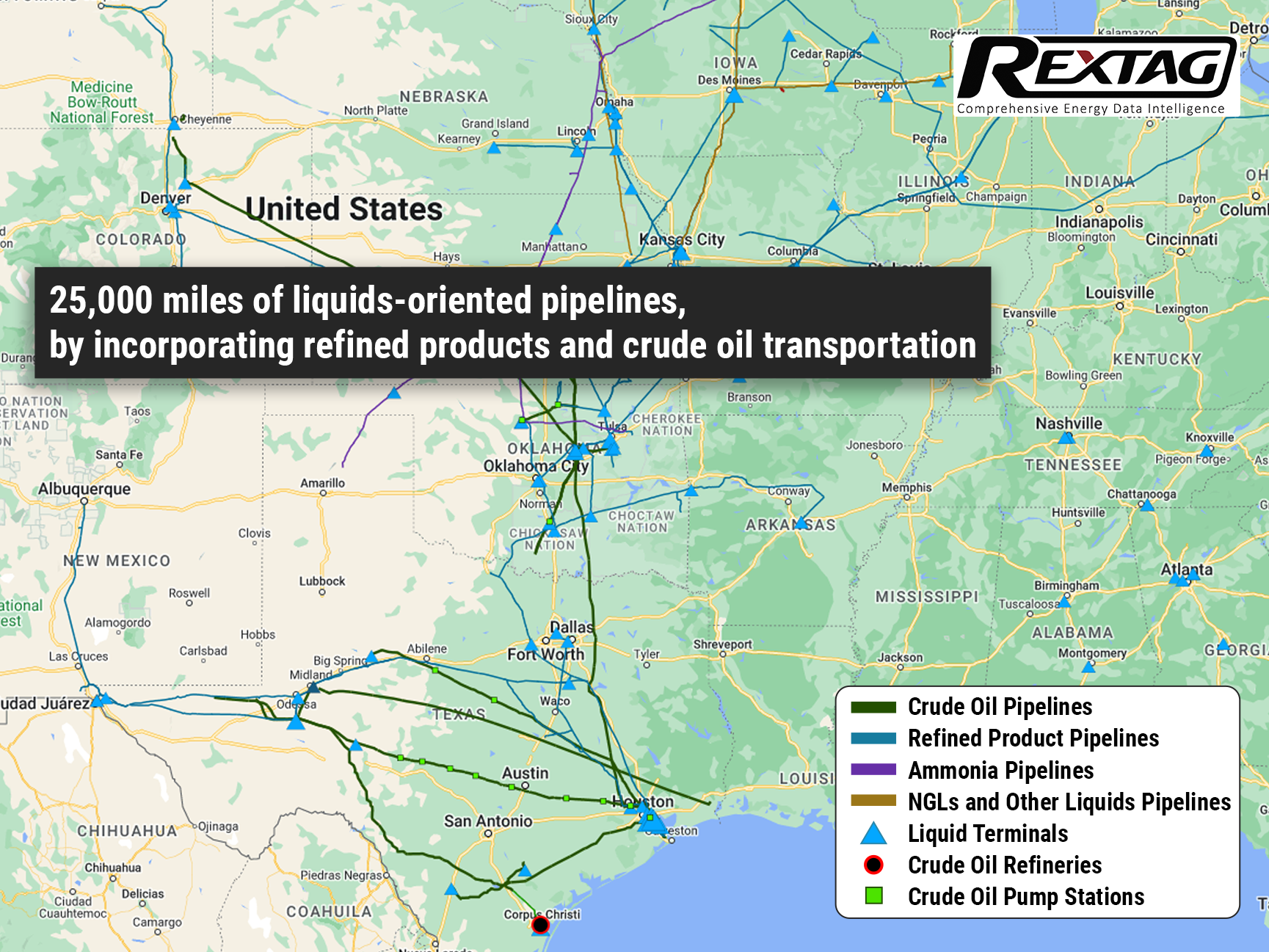

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

TC Energy sells 40% Stake in Columbia Gas Pipeline Systems for $3.9 Billion to GIP

Calgary-based pipeline operator TC Energy is selling a 40% stake in its natural gas pipeline systems for $3.9 billion as part of its efforts to reduce debt. TC Energy Corporation (TRP) has agreed to sell a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission systems to Global Infrastructure Partners (GIP). This move will help TC Energy reduce its debt and establish a valuable long-term partnership with GIP, a prominent infrastructure investor.

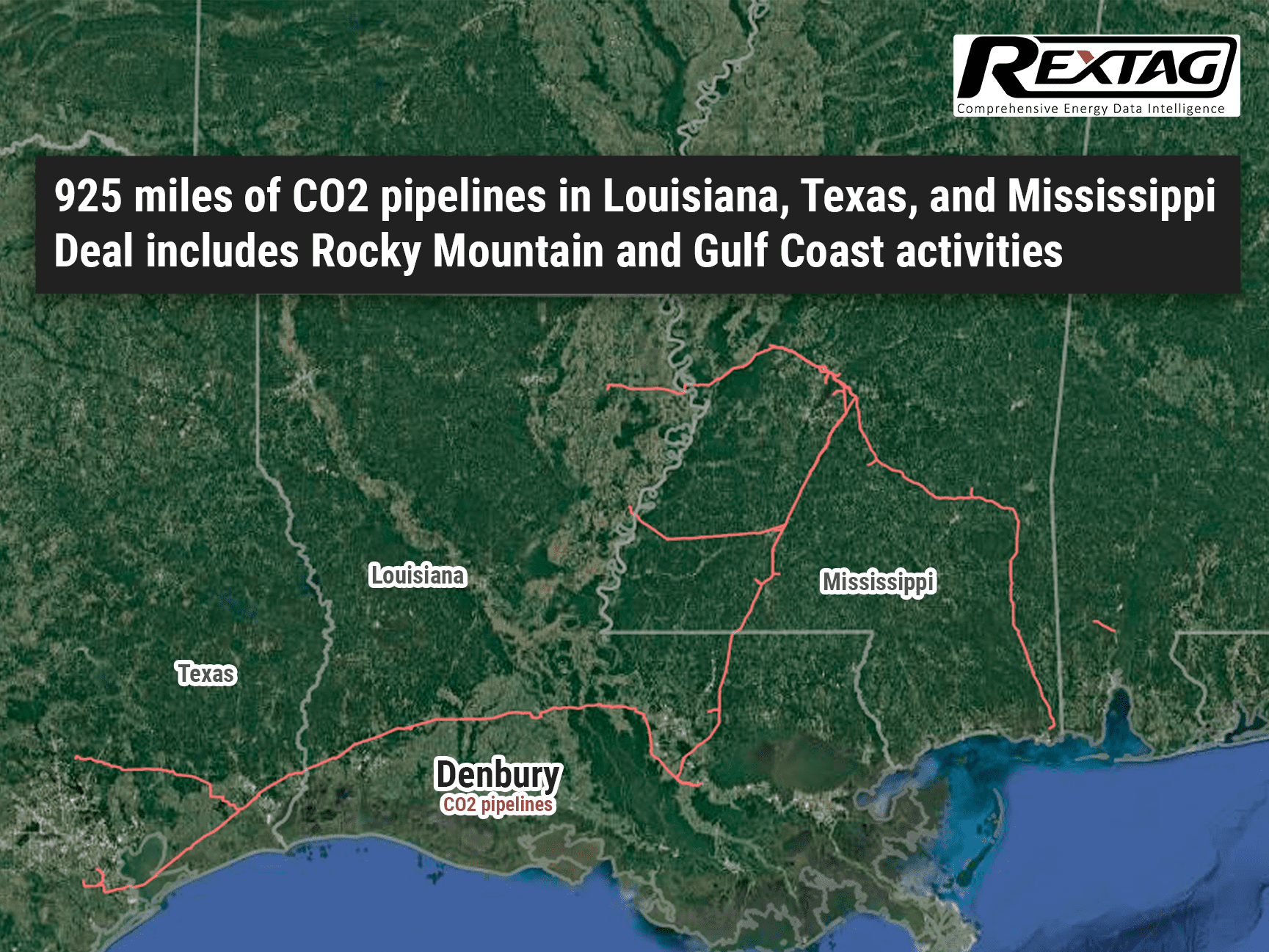

ExxonMobil Acquires Denbury and Enhances carbon, capture, and storage efforts

ExxonMobil's joined assets speed up their Low Carbon Solutions business, offering better decarbonization options for customers. ExxonMobil's top CCS network supports their commitment to low carbon value chains, like hydrogen and biofuels. The transaction synergies will cut over 100 MTA of emissions, leading to strong growth and returns. Exxon Mobil Corporation revealed that it will acquire Denbury Inc., a company specializing in carbon capture, utilization, and storage (CCS) solutions and enhanced oil recovery. $4.9 billion deal will be completed through an all-stock transaction. Darren Woods, Chairman and CEO said “Acquiring Denbury reflects our determination to profitably grow our Low Carbon Solutions business by serving a range of hard-to-decarbonize industries with a comprehensive carbon capture and sequestration offering”.

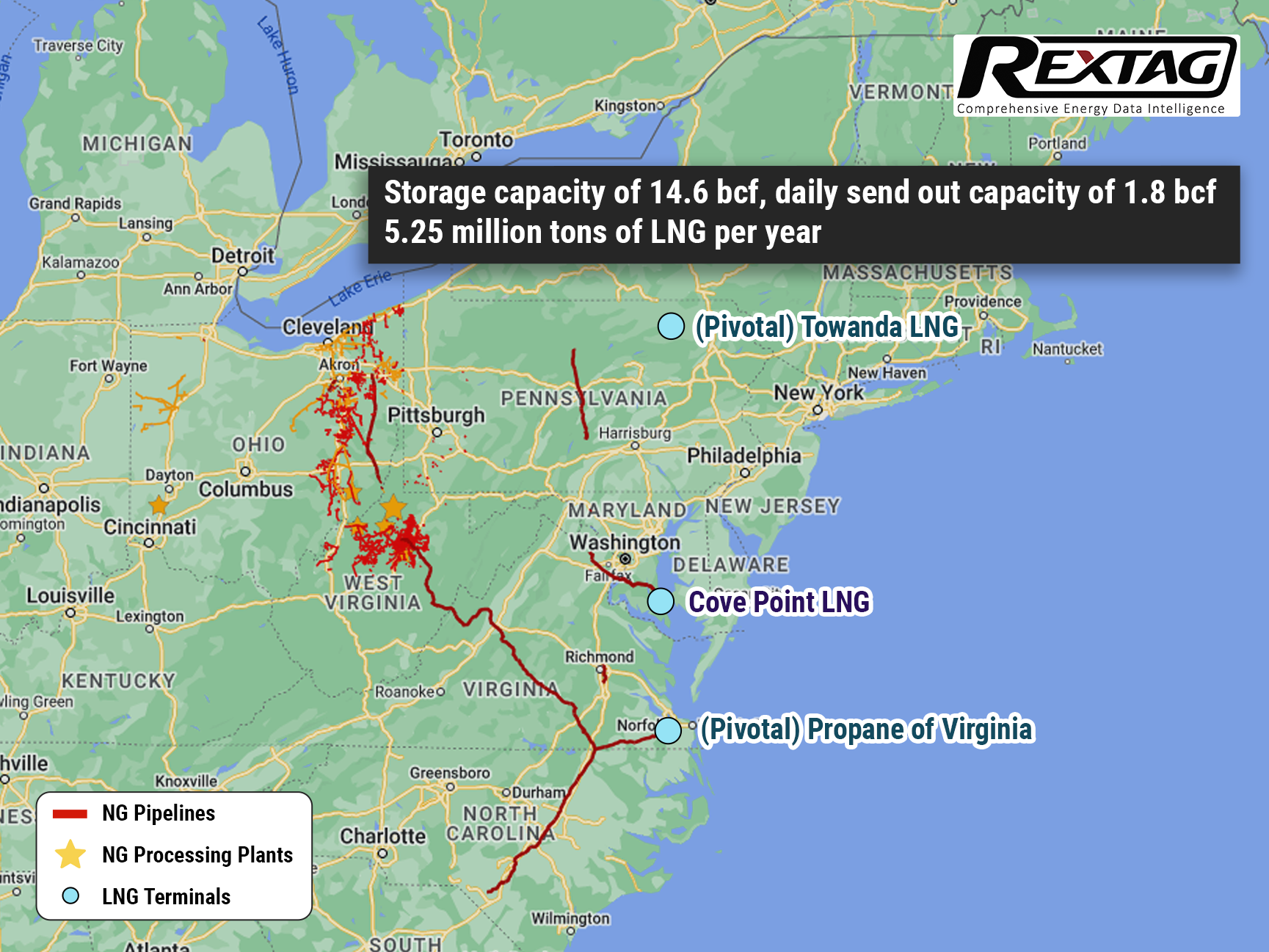

Warren Buffett’s Berkshire Hathaway Energy Acquires $3.3 Billion Stake in LNG Terminal

One of Warren Buffett's Berkshire Hathaway subsidiaries is set to raise its ownership in the Cove Point liquefied natural gas (LNG) export terminal located in Maryland. This comes after the company signed a substantial $3.3 billion agreement with Dominion Energy. Under the agreement, Dominion Energy has agreed to sell its 50 percent noncontrolling limited partner interest in Cove Point LNG to Berkshire Hathaway Energy. Berkshire Hathaway Energy is the current operator of the facility and already holds a 100 percent general partner interest and a 25 percent limited partner interest.

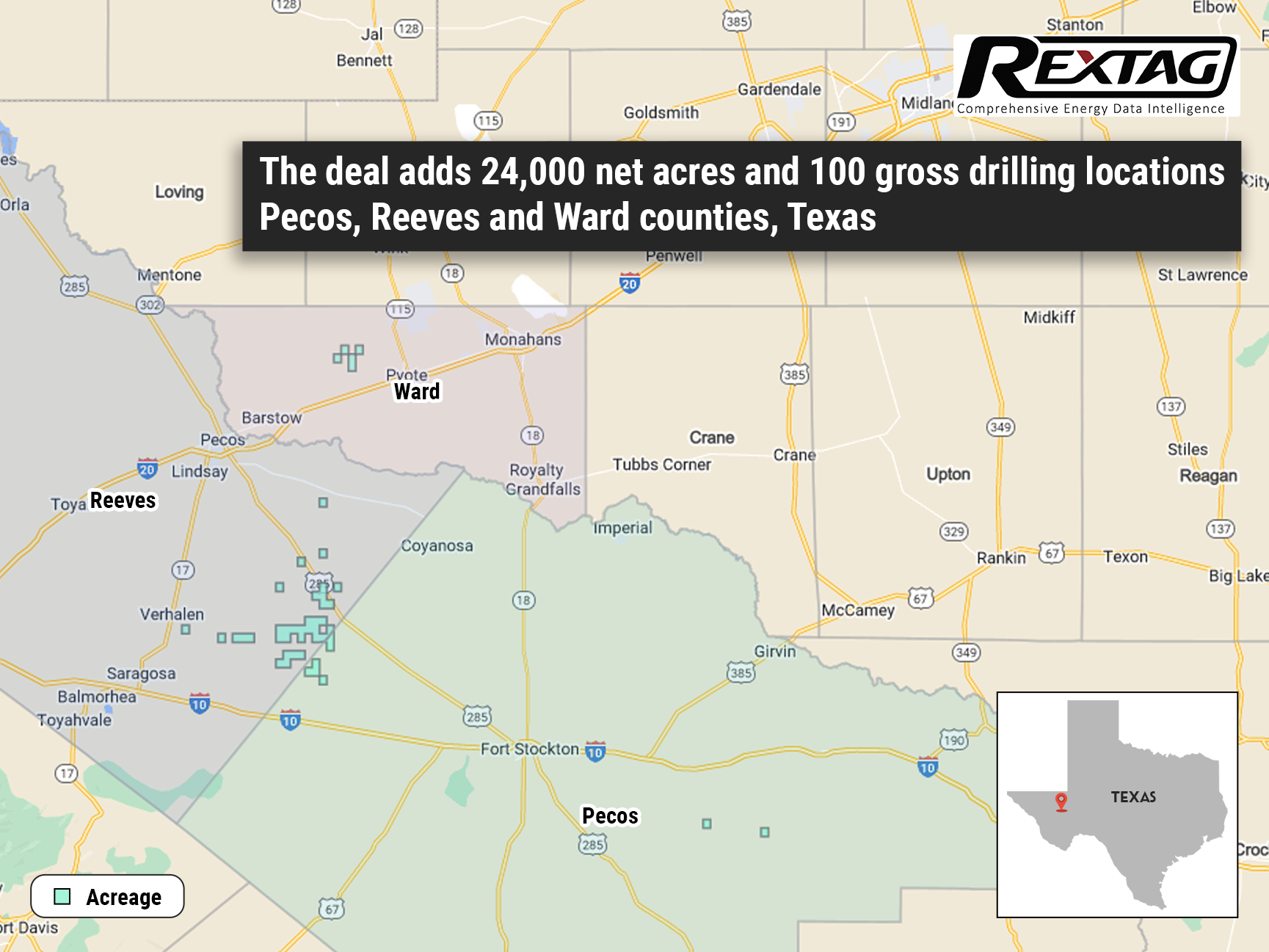

Vital Energy Raises Production Outlook and Capital Spending with Significant Permian Basin Acquisition

Vital Energy’s deal adds 24,000 net acres and 100 gross drilling locations in Texas, growing its Permian Basin footprint to around 198,000 net acres. Vital Energy is revising its projections for oil and gas production and capital spending upward following the successful acquisition of a substantial area in the Permian Basin. The company has gained around 24,000 net acres and 100 gross drilling locations in Texas. As a result of this deal, Vital Energy is now increasing its full-year production and capital spending guidance.

Civitas Makes $4.7B Entry into Permian Basin

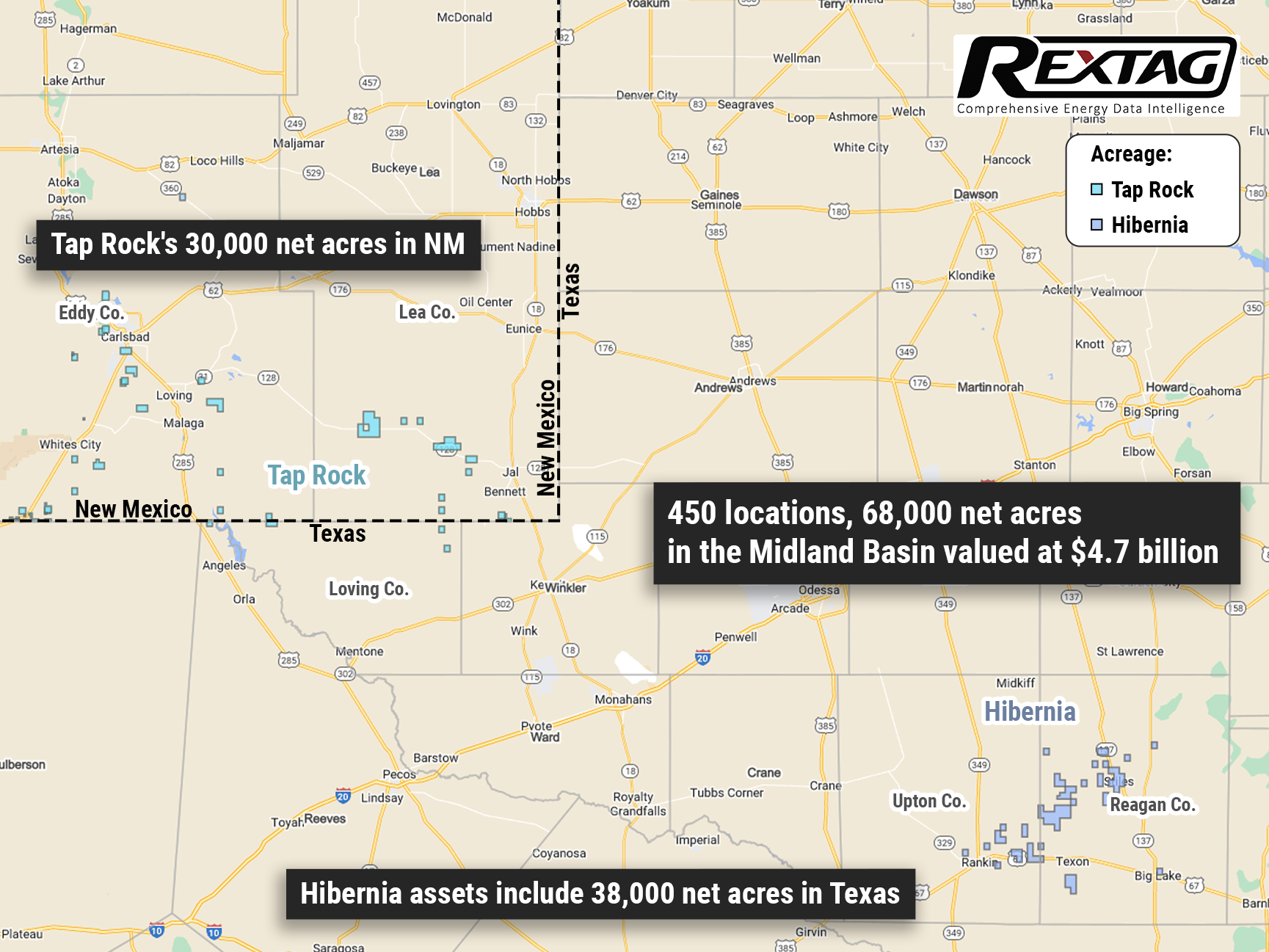

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia. Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

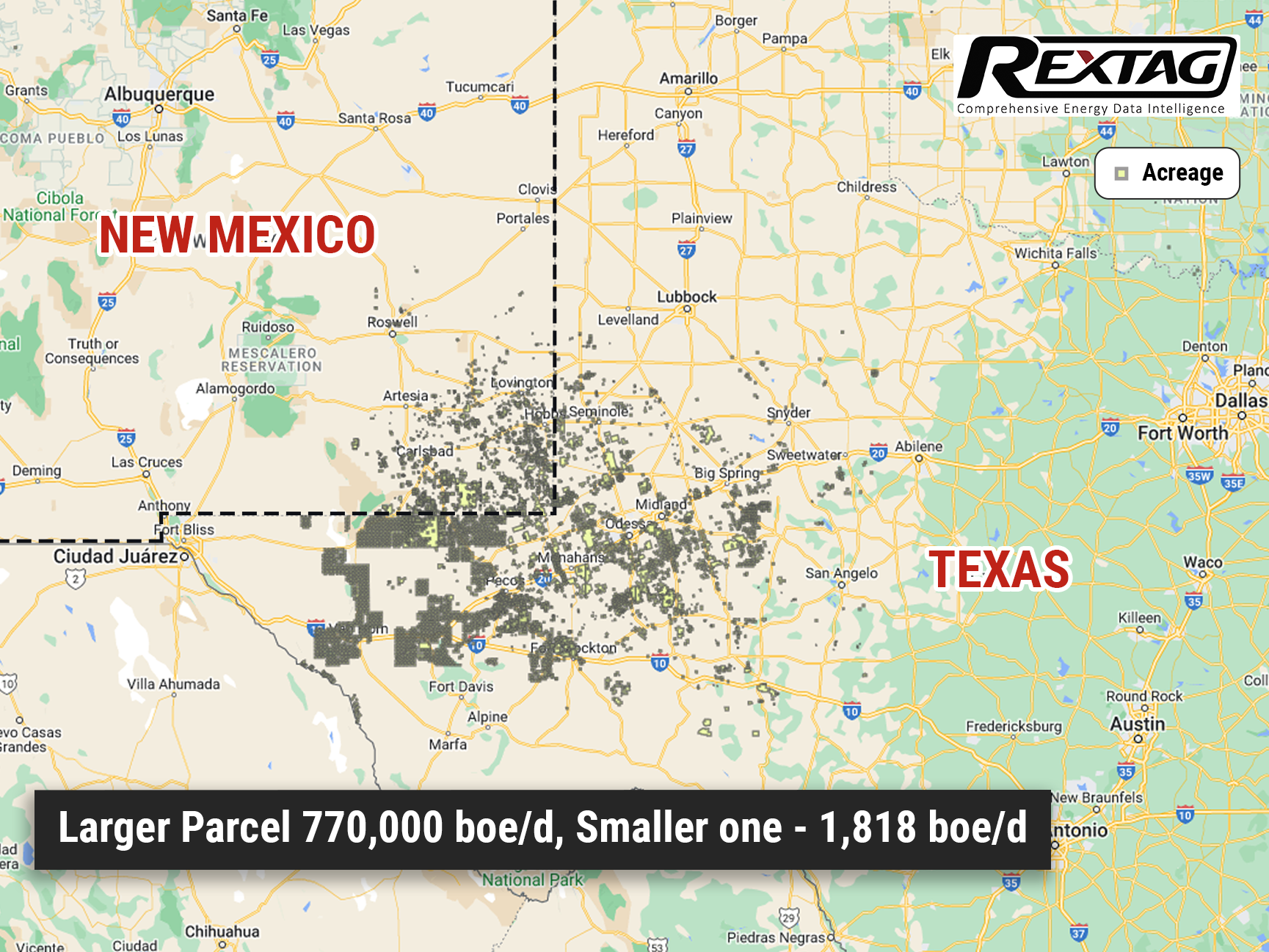

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

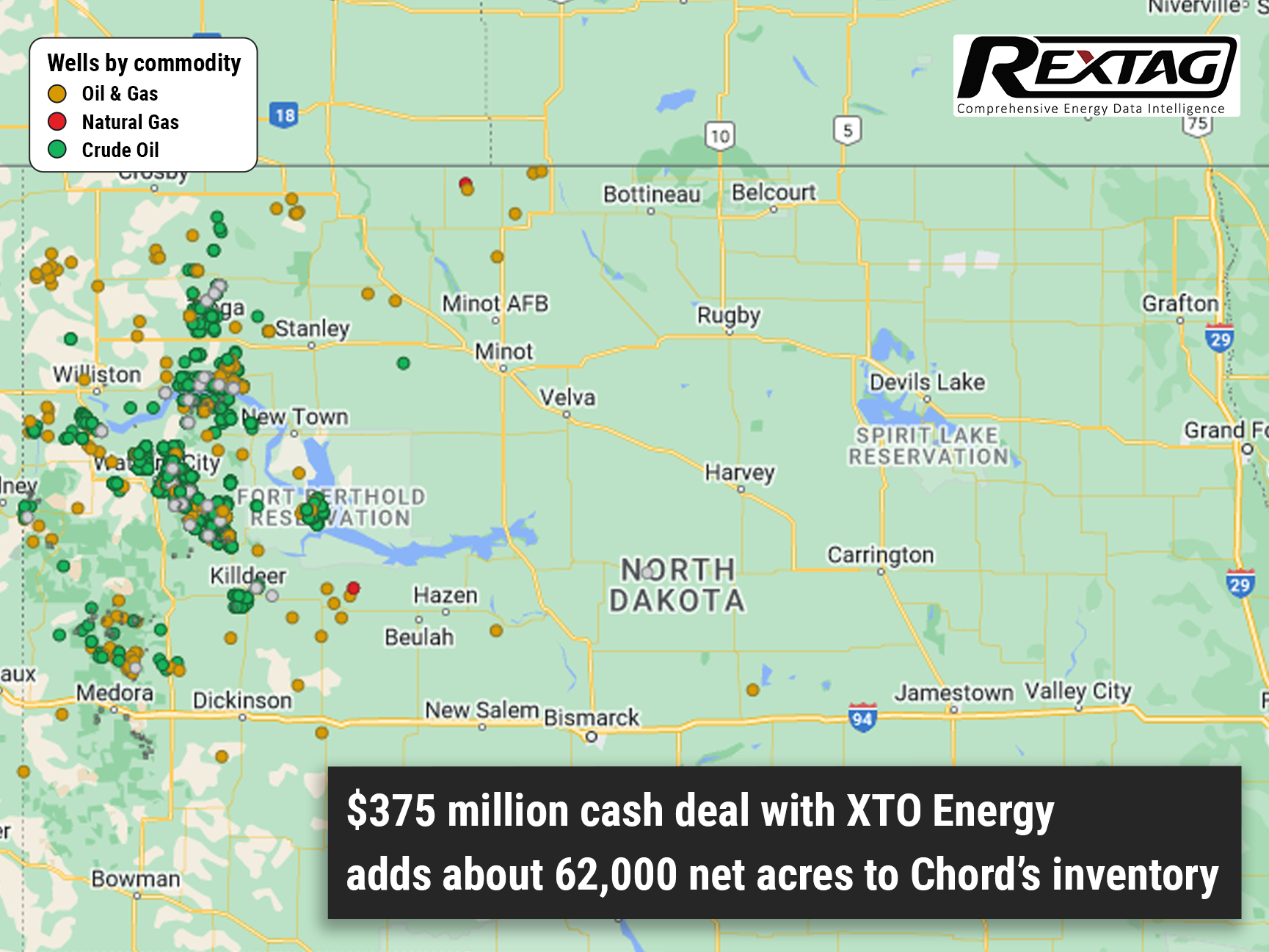

Chord Energy Corp. Expands Williston Basin Footprint with $375 Million Acquisition from Exxon Mobil

Chord Energy Corp.'s subsidiary has entered into an agreement to purchase assets in the Williston Basin from Exxon Mobil, and its affiliates for $375 million. Chord Energy, a US independent company, is strategically expanding its presence in the Williston Basin of Montana and the Dakotas. While industry attention remains fixated on the Permian Basin, Chord Energy recognizes the potential of the Williston Basin and is capitalizing on the opportunity to enhance its reserve portfolio. Chord Energy successfully completed the acquisition of 62,000 acres in the Williston Basin from XTO Energy for a substantial cash consideration of $375 million.

ONEOK Buys Magellan for $18.8 Billion: Overview of the Huge M&A Deal in the Pipeline Industry

In May, ONEOK (OKE) made an announcement regarding its acquisition of Magellan Midstream Partners LP (MMP) for a total value of $18.8 billion, which includes cash and stocks. This move drew attention as it positions ONEOK, primarily known for its involvement in the provision, gathering, and processing of Natural Gas (NG), to become one of the largest pipeline companies in the United States. The acquisition also allows ONEOK to expand its services by including Oil (CL), another significant energy commodity.

Revolutionary Merger: ONEOK Set to Unleash $18.8 Billion Acquisition of Magellan Midstream Partners

ONEOK Inc. and Magellan Midstream Partners LP have announced a merger agreement that will result in the formation of a formidable midstream company headquartered in Tulsa, Oklahoma. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

A&Ds in O&G forecast for 2023, trends and factors that influence this

“Our view is in 2023 M&A picks up. There was some this 2022 year, but again, it was such a funky, weird macro world. We expect fewer surprises in 2023.” — Dan Pickering, Pickering Energy Partners. Modern companies in the world operate in a rapidly changing external environment, so the process of reorganization is one of the basic tools for solving the problem of adapting companies to new conditions. Recently, the number of Acquisitions and Divestitures in the oil and gas industry has been growing rapidly, i.e. it can be said that the market for these deals is dynamically developing.

2022 A&Ds in O&G Summary and Trends for the past 4 years

More than 60% of all A&D deals by value are in US oil and gas companies. Despite their leading market position, U.S. fields are developing unevenly, and investors are quite cautious about investing in them at this stage. The top 5 oil & gas industry A&D deals in 2022 were concluded by Omega Acquisition, Tokyo Gas, Diamondback Energy, Suncor Energy, and IMM Private Equity. The main motives of oil and gas companies to carry out A&D transactions can be considered the achievement of the synergy effect, and the presence of fundamental shocks in the market.

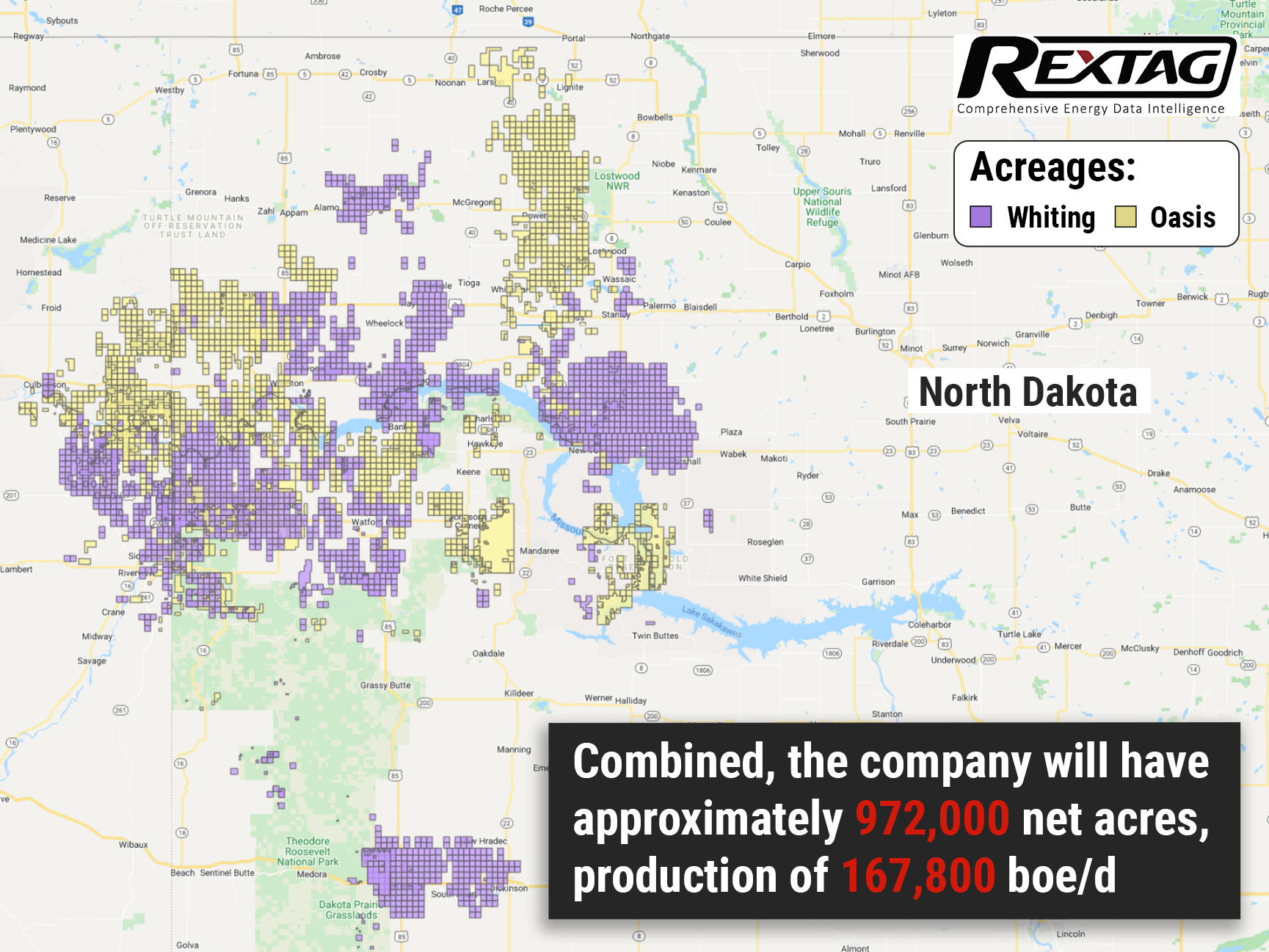

Merger of Equals: Whiting and Oasis $6B Deal

The two Bakken shale producers announced in a joint statement on March 7 that they had reached an agreement to unite in a $6 billion "merger of equals." Combining these two companies will create a leading Williston Basin position with assets covering approximately 972,000 net acres, production of 167,800 boe/d, and an enhanced free cash flow generation that will generate capital returns to shareholders. A historic collapse in oil prices prompted both Whiting and Oasis oil companies to file for Chapter 11 bankruptcy protection in 2020. Thus, the merger can be viewed as a preventive measure to avoid going out of business.

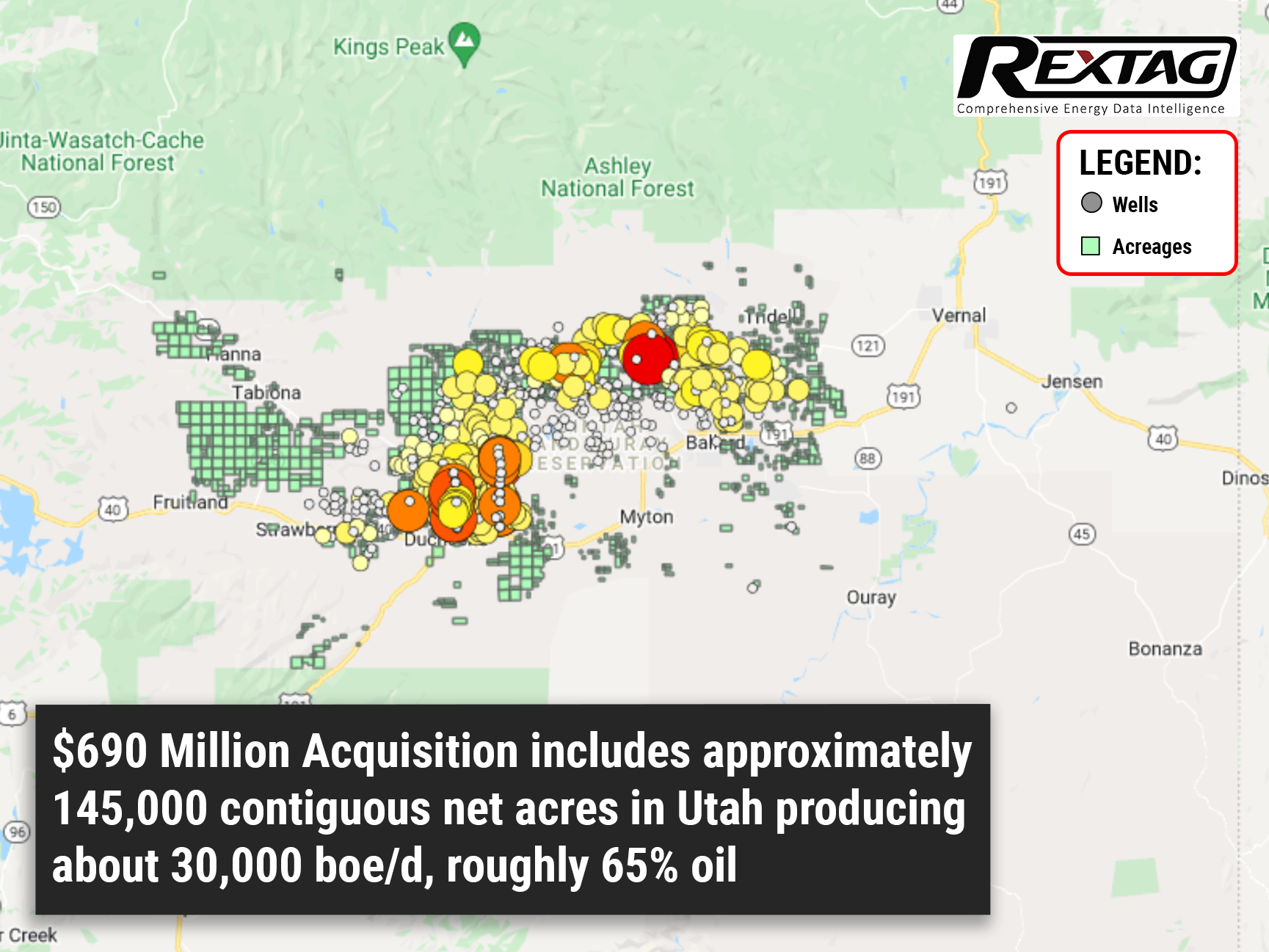

$690 Million Deal Moves Ahead: Crescent Energy to Complete Purchase of EP Energy's Uinta Assets

Crescent Energy closed the acquisition of Uinta Basin assets in Utah that were previously owned by EP Energy for $690 million, a few hundred million dollars below the original price. The accretive deal increases Crescent's Rockies position and adds significant cash flow and a portfolio of high-quality oil-weighted undeveloped sites. In addition to its acquired Uinta assets, Crescent's pro forma year-end 2021 provided reserves totaled 598 million boe, of which 83% was developed, 55% was liquid, and its provided PV-10 was $6.2 billion.

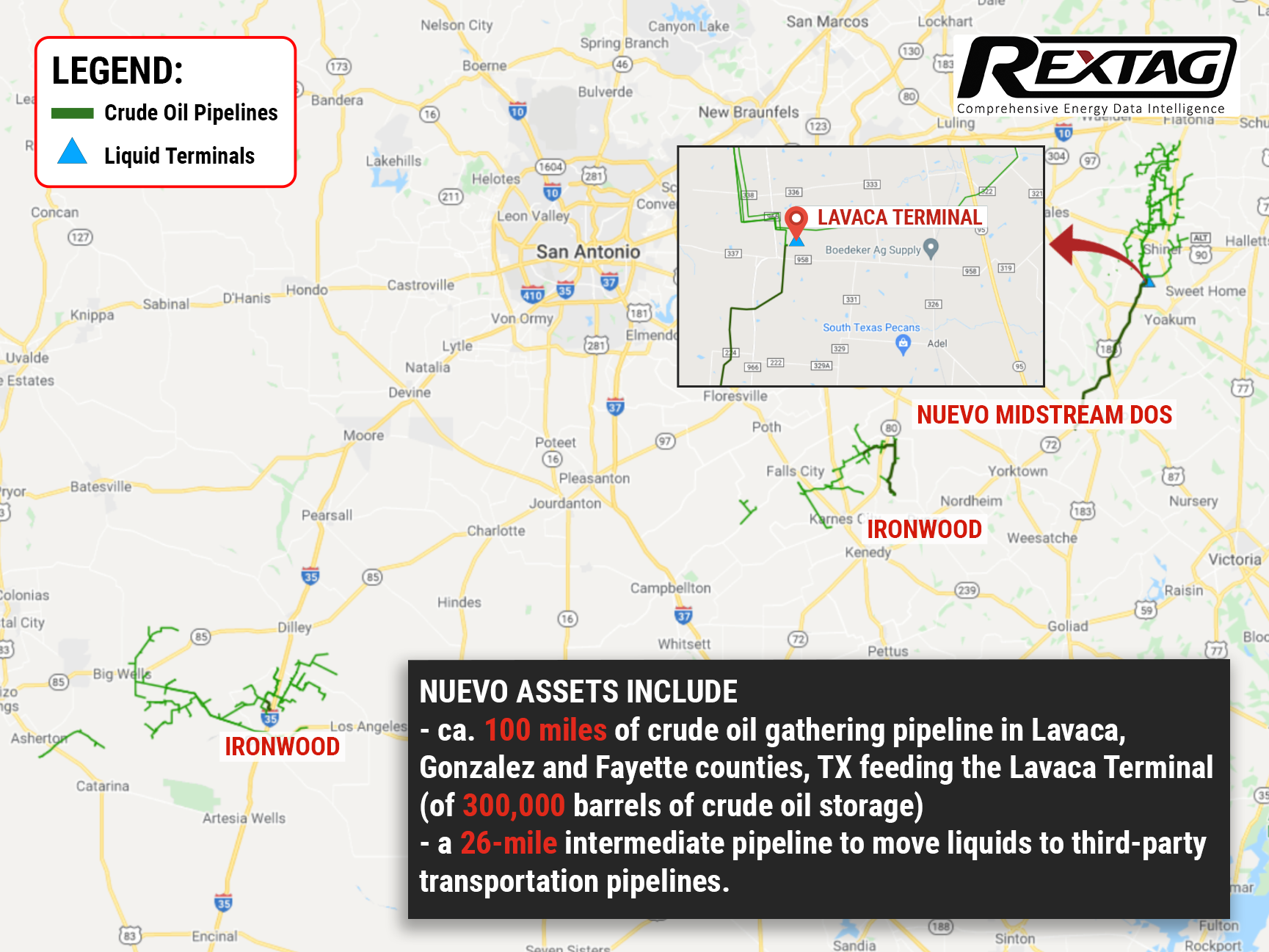

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

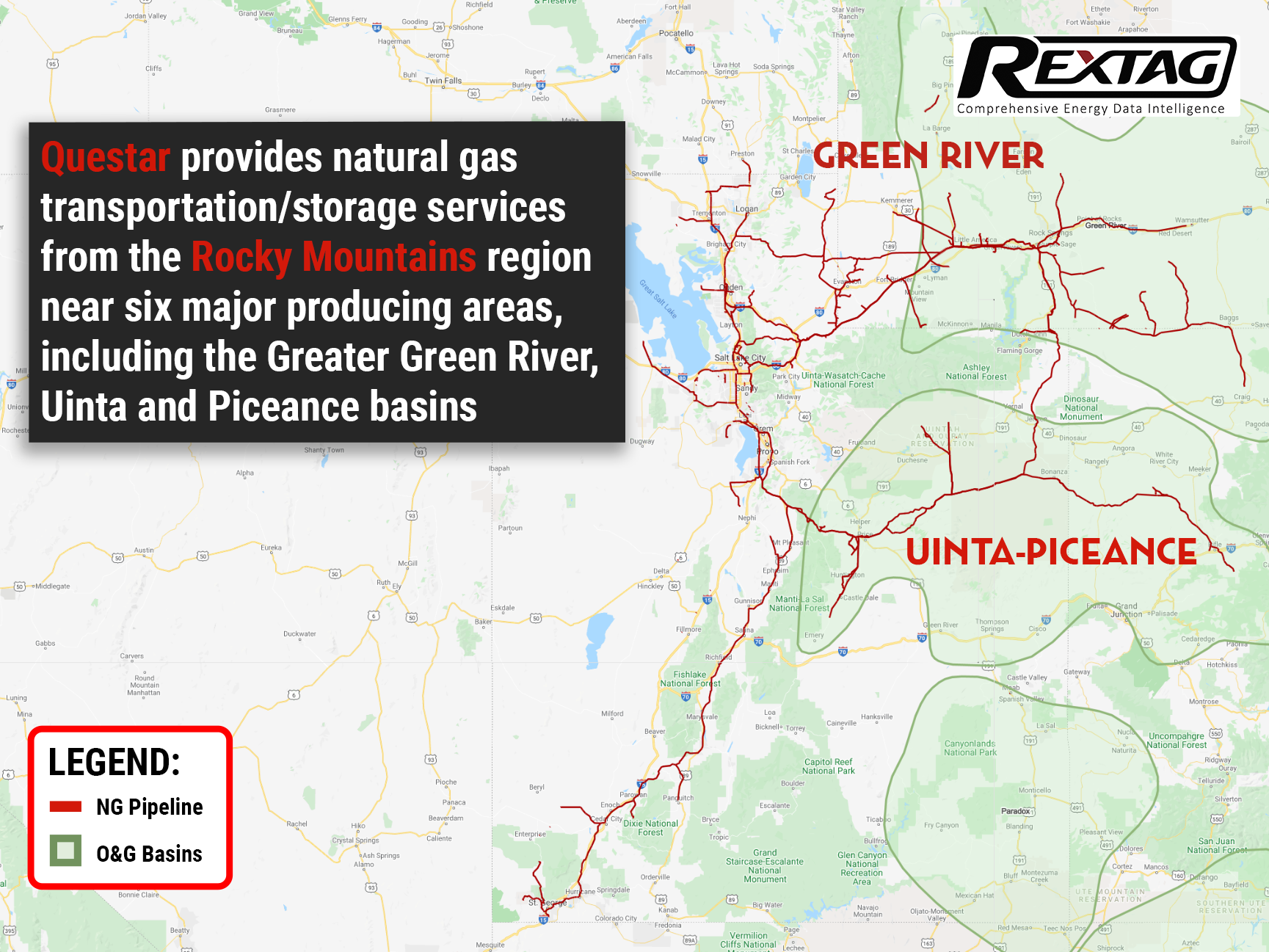

A $2 billion deal saw Dominion Energy sell Questar Pipelines to Southwest Gas

A good asset will not sit on the market for long. After a deal with Berkshire Hathaway fell through, Dominion Energy managed to secure another one for Questar Pipelines in a drop of a hat. And get that, it is better than the former one by more than half a billion! Although not everyone is happy with such decisions, it seems that even Carl Icahn’s complaints won't be able to sway Southwest Gas Holdings’ decision. Though we will have our eyes peeled in any case… If everything goes as planned, a $2 billion deal will be closed before the end of the year.

Restructuration is in a full-speed: Comstock to sell Bakken for $154 million

Comstock Resources decided to go through with asset divestment, selling its Bakken Shale actives for $150M to Northern Oil and Gas. The proceeds from these sales will be reinvested by Comstock Resources Inc. into the Haynesville Shale, at which point the company may acquire additional leasehold and fund drilling activities starting in 2022. Meanwhile, Northern clearly gunning for the pack leading position in the Texas shale play, but whether they succeed or not is remains to be seen.

A major U.S. shale oil producer is looking to start a land selloff in the lone star state

Pioneer Natural resources is looking to divest properties in the lone star state. According to Rextag, Pioneer’s Delaware assets on sale have a trailing 12 month production of just over 22 MBOE against a total Permian Basin production of almost 212 MBOE. (The sale, if it happens, will effectively lead to a 10% decrease of Pioneer’s asset base in terms of the previous year's production.)