Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Civitas Makes $4.7B Entry into Permian Basin

07/24/2023

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia.

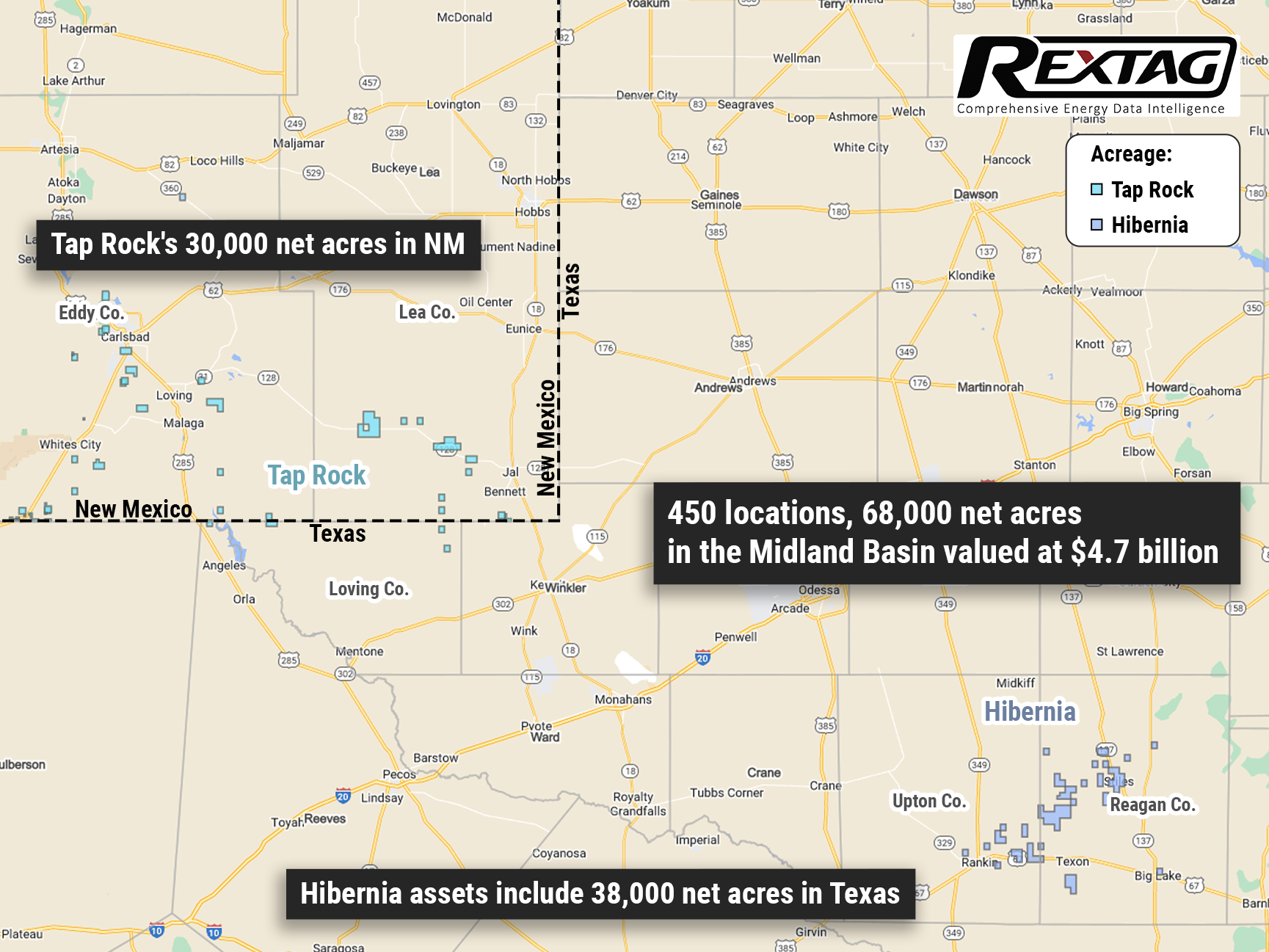

Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

"These accretive and transformative transactions will immediately create a stronger, more balanced and sustainable Civitas," Chris Doyle, Civitas president and CEO.

Scale and Reserves

- Civitas has gained immediate scale by acquiring 68,000 net acres in the Permian Basin, with 90% of these acres held by production (HBP).

- The acquired assets come with proved reserves totaling approximately 335 million barrels of oil equivalent (MMboe) as of the end of 2022.

Increased Production Base

- The acquisitions will result in a substantial increase in Civitas's existing production base, adding 100,000 barrels of oil equivalent per day (boe/d).

- This represents a 60% increase in Civitas's production, with 54% of the increase being oil production.

- Civitas anticipates that its production will average 105,000 boe/d from the time the deals close until the end of 2023.

Acquisition of Tap Rock's Delaware Basin Assets

- In the Delaware Basin, Civitas has agreed to purchase a portion of Tap Rock Resources LLC's assets for $2.45 billion.

- The deal includes $1.5 billion in cash and approximately 13.5 million shares of Civitas common stock valued at around $950 million.

- Tap Rock will retain ownership of the Olympus development area.

Delaware Basin Assets Details

- The acquired assets comprise approximately 30,000 net acres primarily located in Eddy and Lea counties, New Mexico.

- These acres are considered core Delaware acreage, an area known for its oil and gas potential.

- Tap Rock's production from these assets averaged around 59,000 boe/d in the first quarter, with 52% of it being oil production.

- Civitas also gains access to an inventory of approximately 350 drilling locations, providing valuable opportunities for future development.

Civitas is set to acquire Hibernia Energy III LLC's assets in the Midland Basin for $2.25 billion in cash, covering approximately 38,000 net acres in Upton and Reagan counties, Texas. These assets offer significant potential in the active and well-established region. The acquired assets averaged production of 41,000 boe/d in Q1 2023, with 56% being oil.

This expansion will give Civitas access to 450 drilling locations in the Midland Basin. With the acquisition of Hibernia Energy III LLC and Tap Rock Resources LLC, both managed by NGP Energy Capital Management LLC, Civitas aims to become a stronger, more diversified, and sustainable enterprise. This move establishes Civitas with two production centers: one in the Permian Basin, strengthened by the Midland and Delaware Basin acquisitions, and another in the Denver-Julesburg Basin (D-J Basin).

"By acquiring attractively priced, scaled assets in the heart of the Permian Basin, we advance our strategic pillars through increased free cash flow and enhanced shareholder returns. We will soon have nearly a decade of price-resilient, high-return drilling inventory," said Chris Doyle, Civitas president and CEO.

Civitas has stated that these deals will contribute a total of 800 gross locations. As a result, the company's pro forma oil-weighting is anticipated to increase significantly, approaching 50%. Civitas also expects to generate approximately $1.1 billion from these transactions. The company announced two private placements for a senior unsecured debt amounting to $2.7 billion.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/162Blog_Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas1.png)

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

Breaking Barriers FireBird II, Empowered by Quantum Technology, Surpasses $500MM Funding Milestone for Permian Ventures

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/147Blog_FireBird Energy Permian Basin assets.png)

Following the success of FireBird Energy's $1.75 billion sale to Diamondback last year, the emergence of FireBird II signals a new chapter in the Permian Basin. Get ready for some exciting news from the energy industry. FireBird Energy II, the new player in the Permian Basin, has just secured $500 million in equity funding to fuel their acquisitions. With backing from the esteemed private equity firm Quantum Energy Partners, FireBird Energy II is poised to make waves in the industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.