Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Global Oil Supply and Demand Trends Overview: Insights from Rextag

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East. OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

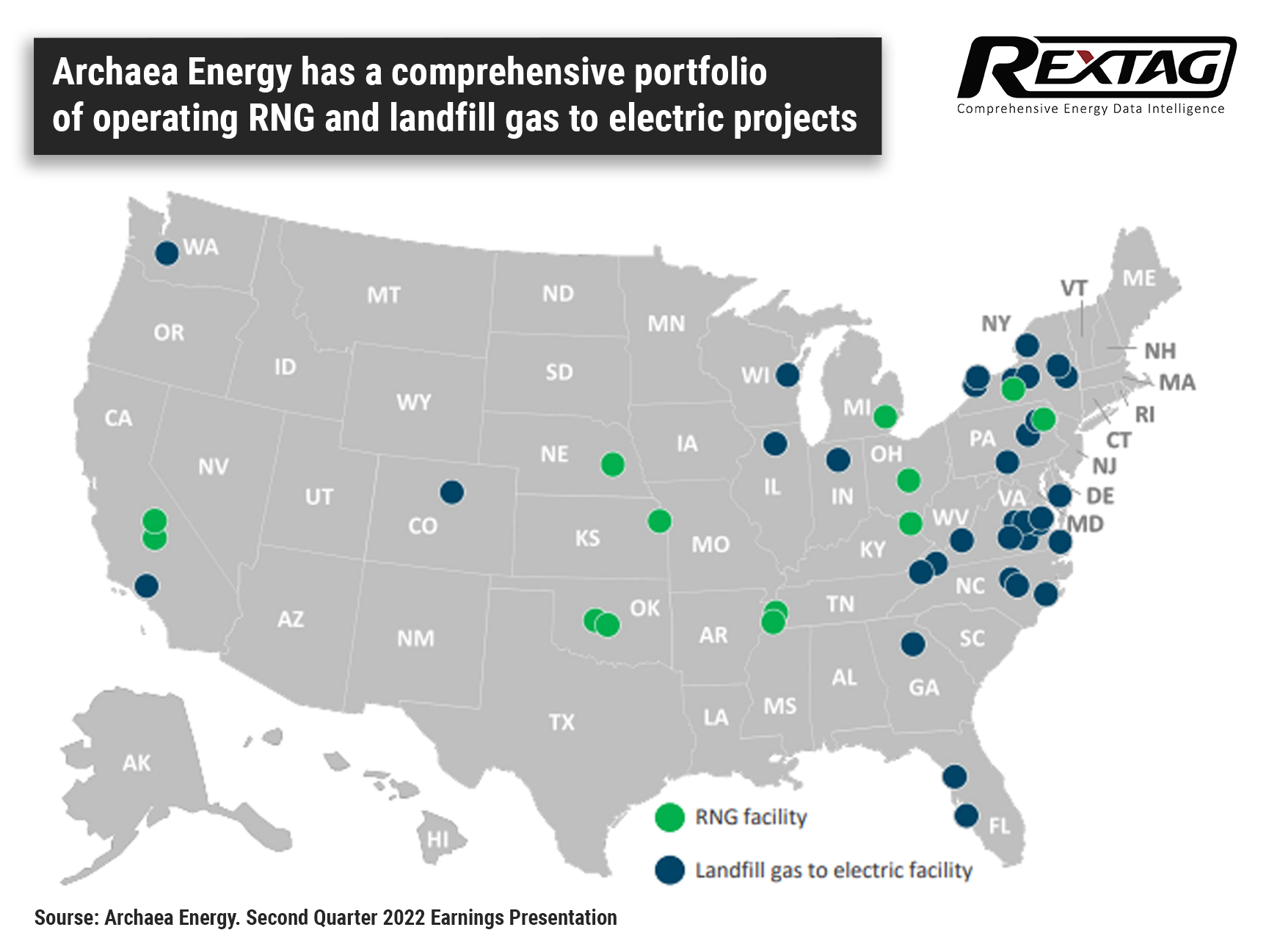

BP Has Acquired Archaea Energy for $4.1 Billion Developing Its bioenergy business

BP acquired renewable natural gas (RNG) provider Archaea Energy Inc. for $4.1 billion on December 28, marking a milestone in the growth of BP’s strategic bioenergy business. The acquisition, announced in October, was finalized following BP’s completion of regulatory requirements and Archaea obtaining shareholder approval.

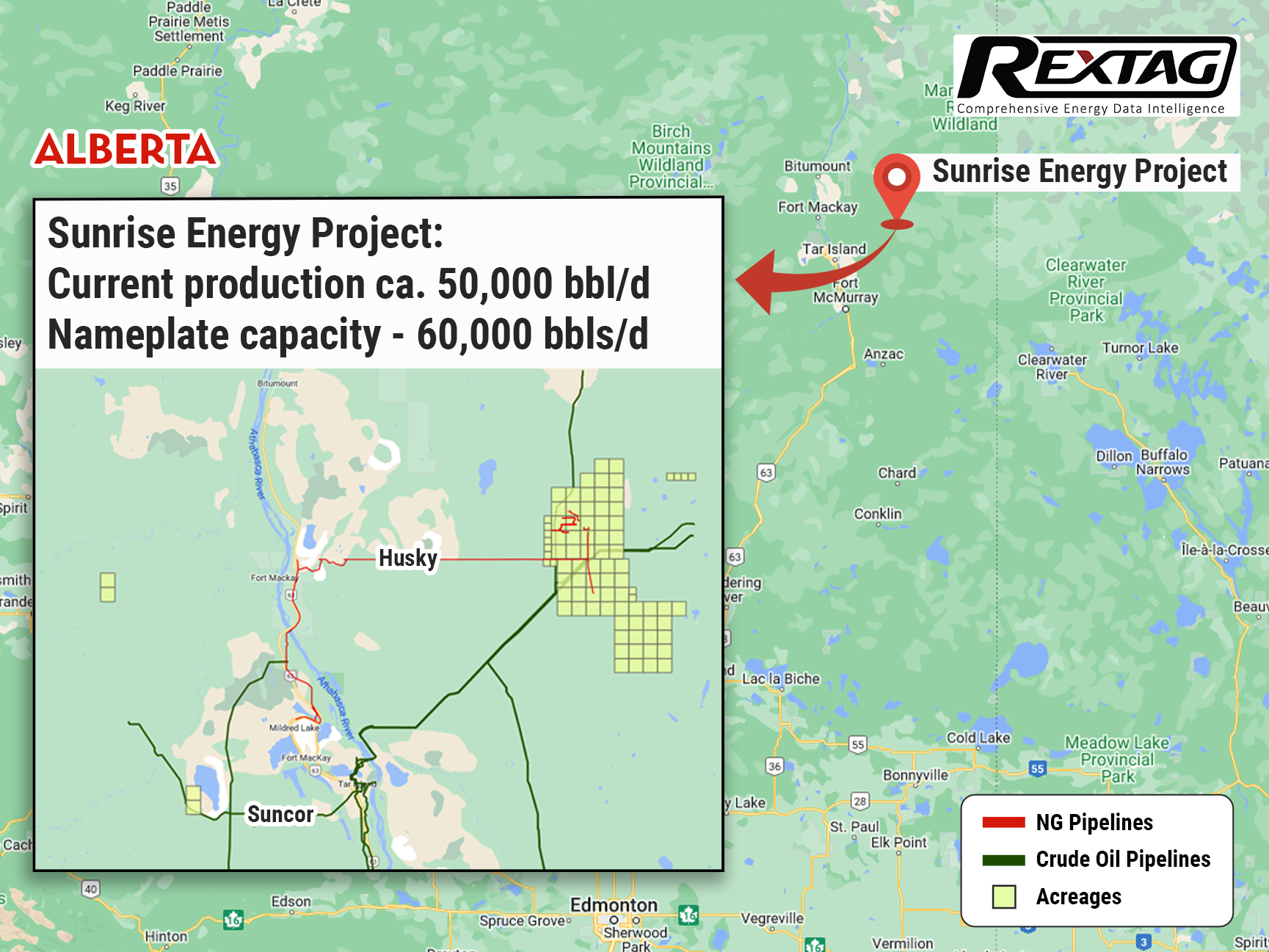

Mutually Profitable Transaction for CA$600 Million Between BP and Cenovus

BPPlc agreed on June 13 to exit the Canadian oil sands in an asset swap with Cenovus Energy Inc. potentially worth up to CA$1.2 billion. 50% non-operated interest in the #SunriseOilSands project will be sold by BP in an agreement reached with Cenovus Energy, a company based in Alberta. Two companies agreed on the following conditions: total consideration for the transaction includes CA$600 million in cash, additionally, a contingent payment with a maximum aggregate value of CA$600 million expiring after two years, and concerning Cenovus, it will have a 35% position in the undeveloped Bay du Nord project offshore Newfoundland and Labrador. Current production from the Sunrise Oil Sands asset is about 50,000 bbl/d and the company anticipates achieving a nameplate capacity of 60,000 bbls/d through a multi-year development program.