Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Global Oil Supply and Demand Trends Overview: Insights from Rextag

06/07/2023

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East.

OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

This article provides an in-depth overview of the prevailing trends in global oil supply and demand, shedding light on crucial developments and their potential impact on the industry as a whole.

BP Forecasts Significant Decline in Oil and Gas Importance by 2050

BP, a big energy company, expects that oil and gas will become much less important in the world's energy mix by 2050. Instead, clean alternatives like wind and solar power will become more popular. According to BP's latest report, fossil fuels will drop from making up 80% of primary energy in 2019 to between 55% and 20% by 2050. Meanwhile, renewables will increase from 10% to between 35% and 65% during the same period.

This fundamental restructuring of global energy markets is driven by three things:

- Sustainability: There is a growing emphasis on addressing global warming due to the rise in extreme weather events, which is leading to increased demand from citizens and customers for action.

- Security: Countries worldwide are now more determined to enhance their energy security in response to the Russian invasion of Ukraine.

- Affordability: There is a continuous endeavor to maintain stable energy prices for consumers.

BP referred to these three factors as the "energy trilemma." Spencer Dale, BP's chief economist, emphasized the urgency of transitioning to a net-zero future in light of rising carbon emissions and the increasing frequency of extreme weather events. The report stated that the various outcomes presented represent different potential pathways for the energy transition. However, in all three scenarios, the adoption of renewables into the global energy system is projected to be faster than any other fuel in history.

What about Renewables?

The decreasing cost of renewable energy can be attributed to the expansion of these technologies and the inclusion of financial incentives in government policies. BP forecasts that global oil demand will reach a plateau in the next decade before declining. This decline will primarily be driven by the transportation sector, which is becoming more efficient and transitioning towards electric power instead of relying on oil, despite overall demand increasing in emerging economies.

Energy Transition seems to be this way:

- The future of natural gas hinges on the pace of global decarbonization and economic growth in emerging economies, according to the report.

- These two forces, decarbonization and economic growth, often have conflicting effects on the natural gas industry.

- Scaling up carbon capture technology, wind and solar facilities, batteries, hydrogen, CO2 pipelines, and energy storage capacities is necessary to meet evolving global energy demands.

- The increased deployment of these technologies will drive up the demand for minerals such as lithium, copper, and nickel.

The conflict in Ukraine is causing countries to reconsider their reliance on energy imports and explore opportunities for domestic energy generation.

How the Energy Transition Will Reshape Oil Markets

The future of the oil market, the world's most significant commodity market, will be shaped by the direction, timing, and progress of the energy transition. Recent events, such as the Ukraine crisis, have heightened concerns about energy security and emphasized the need for a well-planned transition. However, climate experts caution that a slow transition is not viable if we want to avert a climate catastrophe.

The recent release of the UN climate science "synthesis" report underscores the urgency of meeting the objectives of the Paris Agreement, which aims to limit global warming to well below 2°C. While effective policies to achieve these goals are yet to be implemented in major countries and globally, it is crucial to examine how meeting the Paris goals would impact future oil demand and supply, oil flows, benchmarks, prices, and the Organization of the Petroleum Exporting Countries (OPEC).

Oil Consumption Targets to Meet Paris Agreement Goals:

- According to the International Institute for Sustainable Development, global oil consumption would need to decrease by at least 15% by 2030 and a significant 65% by 2050 to align with the Paris Agreement objectives.

Projected Oil Demand in the Paris-Compatible Scenario:

- The International Energy Agency (IEA) envisions a decline in oil demand by 6% annually in its Net-Zero Emissions (NZE) Paris-compatible scenario.

- Current global oil demand, which stands at approximately 100 million barrels per day, is expected to reduce to 75 million barrels per day by 2030, as per the IEA's NZE scenario.

Factors Impacting Oil Demand:

- The growing adoption of electric vehicles (EVs) and increased plastic recycling will contribute significantly to the decline in oil demand.

- As the monopoly of oil in the transportation sector diminishes, the demand for oil will become more elastic. Higher oil prices will lead to decreased demand and expedite the transition to EVs.

Shifting Oil Flows:

- In the IEA's NZE scenario, OPEC's share of global oil production is projected to increase from 35% in 2021 to over 50% in 2050.

- The United States, Guyana, and Brazil are expected to contribute to the majority of the remaining oil supply.

- US tight oil production, enabled by fracking technology, is likely to remain resilient due to its lower risk of stranded assets amid declining demand. This resilience could result in US production surpassing that of Saudi Arabia by a significant margin.

Price Squeeze

Increasing price elasticity of oil demand and declining demand are putting pressure on oil prices, forcing high-cost producers out of the market. Russia, viewed as an unreliable supplier in Europe, has shifted its focus to the East, directly competing with Opec in a crucial growth market. This tension is likely to result in the collapse of the Opec-plus alliance. Meanwhile, Opec itself will emerge stronger but in a smaller market that is more sensitive to prices.

Investment in new conventional oil is already decreasing as it is a risky and potentially stranded asset that takes up to 20 years to reach production. Many oil companies are choosing to distribute dividends to shareholders instead. These economic factors are driving up short-term prices and expediting the transition to cheaper and cleaner energy alternatives.

The growth in demand and new refining capacity is primarily occurring in the East of Suez region. These new refineries, often accompanied by petrochemical units, aim to safeguard against the anticipated decline in demand. While they may temporarily alleviate the spike in demand in Western markets, their long-term viability remains uncertain given the expected decrease in demand.

New Benchmarks?

The pricing power for oil is shifting towards the Middle East and Asia-Pacific regions, as evidenced by futures contracts for Oman, Murban, and a basket of crudes into China. However, this transition is not expected to occur soon due to various factors.

The Chinese Yuan-denominated contract on the Shanghai International Exchange (INE) is tied to a regulated economy dominated by state-owned firms, limiting its global influence. Middle East exchanges have support from the Chicago Mercantile Exchange (CME) and ICE, but their contracts are fragmented. It would be beneficial to incorporate different crudes from the region into a single contract, enhancing market liquidity and depth.

Despite these developments, the dominant roles of WTI and Brent are unlikely to be seriously challenged. The US will continue to dominate global markets in terms of production and exports for the foreseeable future. Brent, the primary global benchmark, will even include WTI as a deliverable grade starting in June 2023. The significant volume of US-exported oil and fewer restrictions will strengthen the Brent contract and further align the two benchmarks.

Focus on Carbon

The European Commission plans to introduce charges on high carbon imports through the Carbon Border Adjustment Mechanism (CBAM), initially targeting select commodities and potentially extending to fossil fuels. This will have implications for the global oil trade, as the carbon content of exchanged goods and services becomes crucial.

Different types of crude oil carry varying carbon intensities (CI) based on their production methods. Crude oils with higher CI will face a discounted price in the market due to their greater environmental impact. For instance, heavy and high-sulfur Arab Heavy crude, with a lower CI, should trade at a premium compared to lighter and lower sulfur Iraqi Kirkuk crude. These premiums will fluctuate with changes in carbon pricing and increase over time as governments impose stricter carbon emission regulations.

While these ideas require further development, particularly in terms of independent emission verification, they indicate the direction for the oil market to adapt to new environmental realities and combat the climate emergency.

Opec: What is it and what is happening to oil prices?

Major oil-exporting countries, including Saudi Arabia, Iraq, and several Gulf states, have announced production cuts, leading to a significant increase in crude prices. These countries, along with Russia as part of the OPEC+ group, are reducing supplies by a total of one million barrels of oil per day. OPEC+ is a group consisting of 23 oil-exporting nations that regularly meet to determine global crude oil sales.

OPEC, formed in 1960, is the core of this group and comprises 13 mainly Middle Eastern and African countries. Initially established as a cartel to control oil supply and prices worldwide, OPEC currently produces approximately 30% of the world's crude oil. Saudi Arabia, the largest producer within OPEC, alone produces over 10 million barrels per day.

In 2016, OPEC collaborated with 10 other oil-producing countries, including Russia, to form OPEC+. Together, these nations account for around 40% of global crude oil production. OPEC+ adjusts supply and demand to maintain market balance, keeping prices high by reducing supplies during periods of low oil demand. Conversely, they can lower prices by increasing oil supply to the market.

Why is Opec+ cutting oil output?

OPEC+ recently implemented a production cut of 1.16 million barrels per day, which followed a previous cut of two million barrels per day in October 2022. This unexpected decision resulted in an immediate 5% increase in the international oil price. The move by OPEC+ may be a preemptive response to a perceived decrease in global oil demand.

In 2020, OPEC+ reduced production by over nine million barrels per day due to the pandemic, which caused oil prices to plummet. While prices temporarily soared after Russia's invasion of Ukraine, they have since dropped to 15-month lows of just above $70 per barrel. The rising oil prices are likely to contribute to higher petrol prices globally, including in the UK, adding to the cost of living pressures.

The US has criticized OPEC+'s latest action as "inadvisable."

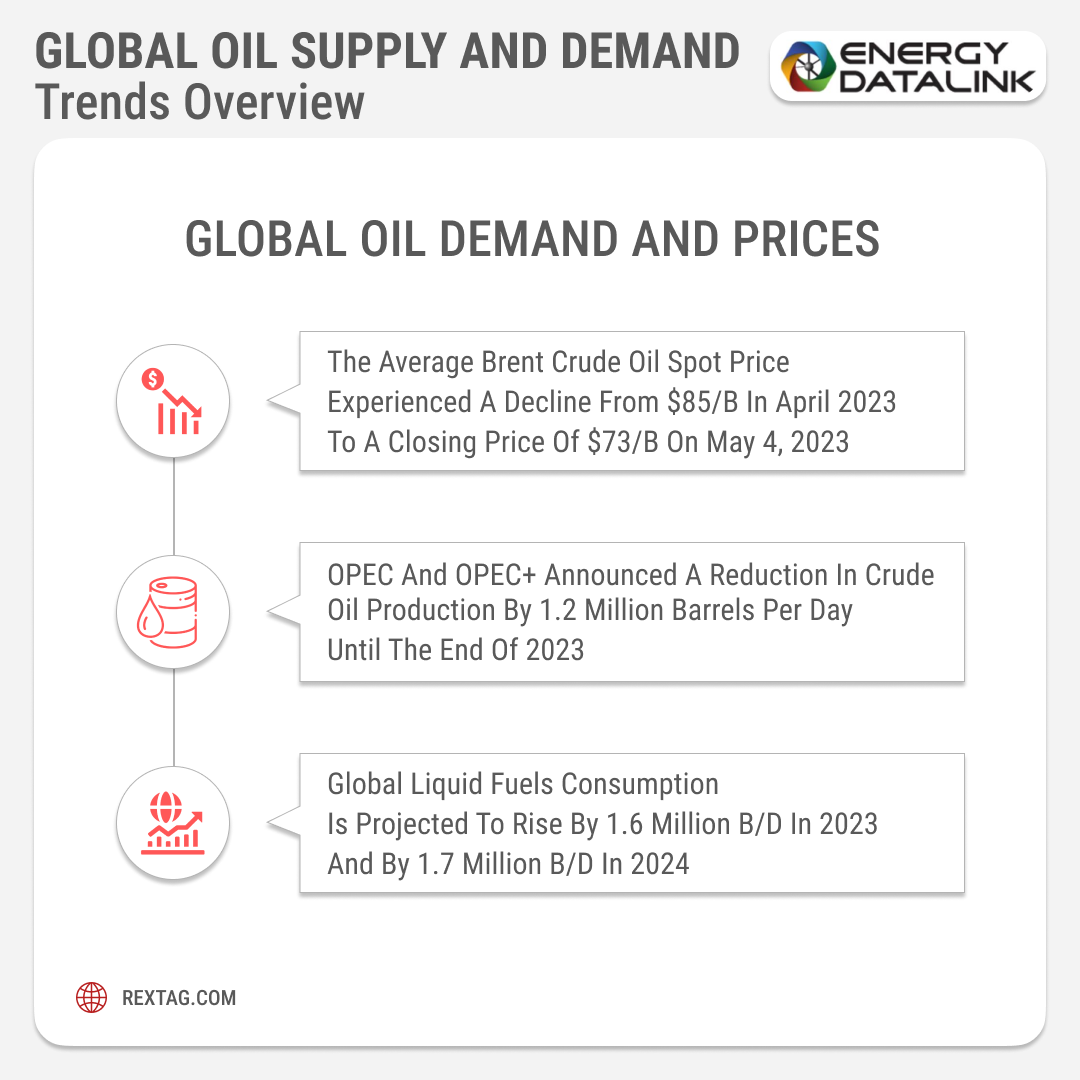

Global oil demand and prices

U.S. Energy Information Administration predicted that this demand growth will bring the global oil market into equilibrium between the third quarter of 2023 (3Q23) and the first quarter of 2024 (1Q24), resulting in the Brent price returning to a range between $75/b and $80/b.

The average Brent crude oil spot price experienced a decline from $85 per barrel (b) in April 2023 to a closing price of $73/b on May 4, 2023. In April, OPEC and its partner countries (OPEC+) announced a reduction in crude oil production by 1.2 million barrels per day (b/d) until the end of 2023. This move initially raised crude oil prices due to expectations of tightening oil supplies.

Concerns over weakening global economic conditions, perceived risks in the global banking sector, and persistent inflation have outweighed the initial price increase, leading to a decrease in oil prices.

While the demand growth for liquid fuels faces potential risks until the end of 2024, we anticipate that the seasonal increase in oil consumption coupled with a decline in OPEC crude oil production will exert upward pressure on crude oil prices in the coming months.

According to EIA forecast, global liquid fuels consumption is projected to rise by 1.6 million b/d in 2023 and by 1.7 million b/d in 2024. The majority of this expected demand growth will occur in non-OECD Asia, primarily led by China and India.

Global oil supply

In the U.S. Energy Information Administration forecast, global liquid fuels production is expected:

- To increase by 1.5 million b/d in 2023 compared to 2022, primarily driven by non-OPEC producers.

- Excluding Russia, which is forecasted to experience a decline of 0.3 million b/d in 2023, non-OPEC liquid fuels production is projected to grow by 2.2 million b/d in 2023 and an additional 1.1 million b/d in 2024.

- Russia's crude oil and other liquid fuels production is expected to decrease from 10.9 million b/d in 2022 to 10.6 million b/d in 2023 and 10.5 million b/d in 2024.

The decline in production in March and April was influenced by announced production cuts and refinery maintenance, which we anticipate to end in June. As refinery operations return to near-normal levels, Russia's liquid fuels production is expected to increase slightly from 10.4 million b/d in the second quarter of 2023 to 10.5 million b/d throughout 2024.

Total OPEC crude oil output is forecasted to decrease by 0.3 million b/d in 2023, largely due to the production cuts announced by OPEC+ on April 3. Additionally, recent disruptions to crude oil exports in Iraq and a force majeure impacting crude oil exports in Nigeria have further reduced our near-term OPEC forecast for 2023. However, we anticipate a 0.6 million b/d increase in total OPEC liquid fuels production in 2024 as the current OPEC+ production cuts are phased out.

Global oil demand could hit record high as China reopens

Global oil demand is set to reach its highest level ever this year, largely fueled by China's rapid economic recovery. According to the International Energy Agency (IEA), oil demand could surge by 1.9 million barrels per day, reaching a record 101.7 million barrels per day. The IEA expects China to be the main driver of this growth, despite uncertainties surrounding the speed and shape of its reopening.

China's easing of its zero-Covid policy has resulted in a rebound in travel, trade, and business activity, stimulating demand in the world's second-largest economy. The resurgence in Chinese demand, coupled with Western sanctions on Russian oil, could tighten the global oil market. Russia's oil exports already experienced a decline of 200,000 barrels per day in December due to the European Union's import ban and price caps imposed by G7 nations.

While the outlook for oil prices remains uncertain, the IEA notes that global oil inventories are currently at their highest levels since October 2021, despite the anticipated supply decrease from Russia. Additionally, efforts to promote electric vehicles and enhance energy efficiency may help moderate oil demand, particularly in a market constrained by supply.

Mood shift?

Cautious optimism is growing among business leaders who believe that the world can avoid a recession in 2023. This positive outlook is largely attributed to China, as its reopening is expected to bring a surge in spending that can help offset economic weaknesses in the United States and Europe.

The International Monetary Fund recently warned that about one-third of the global economy could enter a recession this year, characterized by a decline in growth for two or more consecutive quarters.

In response to the anticipated decrease in demand, the Organization of Petroleum Exporting Countries (OPEC) and its allies began reducing their oil production by 2 million barrels per day in November. This policy is set to continue throughout 2023, as they anticipate a drop in demand.

To be continued…

Global crude supplies are projected to exceed demand in the coming years, even with the production cuts implemented by OPEC and its partners. The US Energy Information Administration's Short-Term Energy Outlook indicates that supply is expected to surpass demand by approximately 530,000 barrels per day in 2024.

While oil prices initially surged following OPEC's supply cut announcement, concerns remain about China's slow demand growth and ongoing economic uncertainty. Furthermore, diesel demand is anticipated to decline this year, reflecting a shift in consumer spending habits toward services rather than manufacturing. These factors may indicate a potential economic slowdown.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 161_ Blog - US Midstream Research Overview TOP Providers, Their Assets and Stories.png)

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

Breaking Barriers FireBird II, Empowered by Quantum Technology, Surpasses $500MM Funding Milestone for Permian Ventures

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/147Blog_FireBird Energy Permian Basin assets.png)

Following the success of FireBird Energy's $1.75 billion sale to Diamondback last year, the emergence of FireBird II signals a new chapter in the Permian Basin. Get ready for some exciting news from the energy industry. FireBird Energy II, the new player in the Permian Basin, has just secured $500 million in equity funding to fuel their acquisitions. With backing from the esteemed private equity firm Quantum Energy Partners, FireBird Energy II is poised to make waves in the industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.