Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Diamondback's Viper Energy Acquires $1 Billion in Royalty Interests in the Permian Basin

09/25/2023

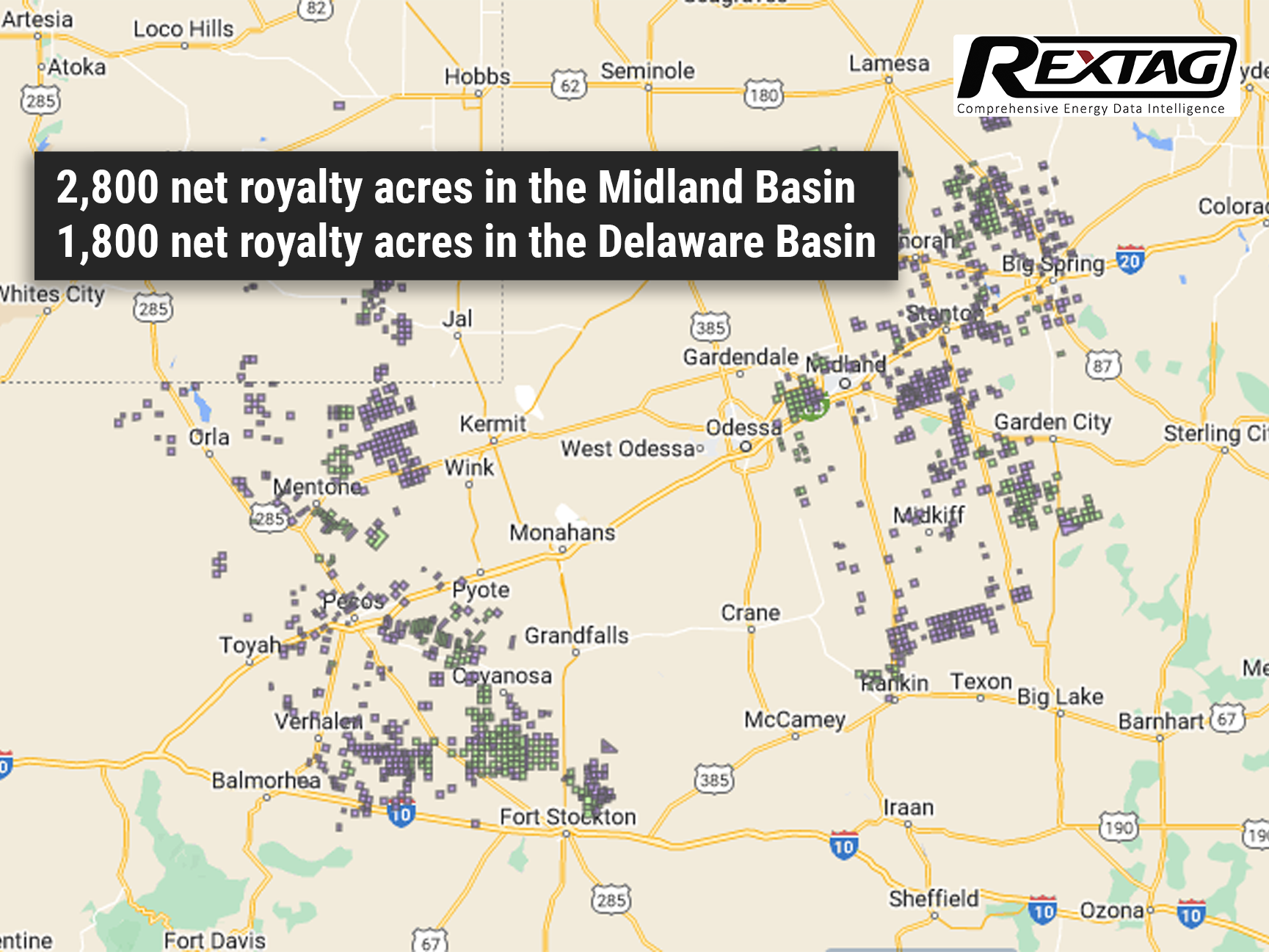

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin.

Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital.

Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.

Deal Overview

Total Acquisition Value: Approximately $1 billion.

Payment Structure:

- $750 million in cash

- 9.02 million common units of Viper

- Subject to standard adjustments

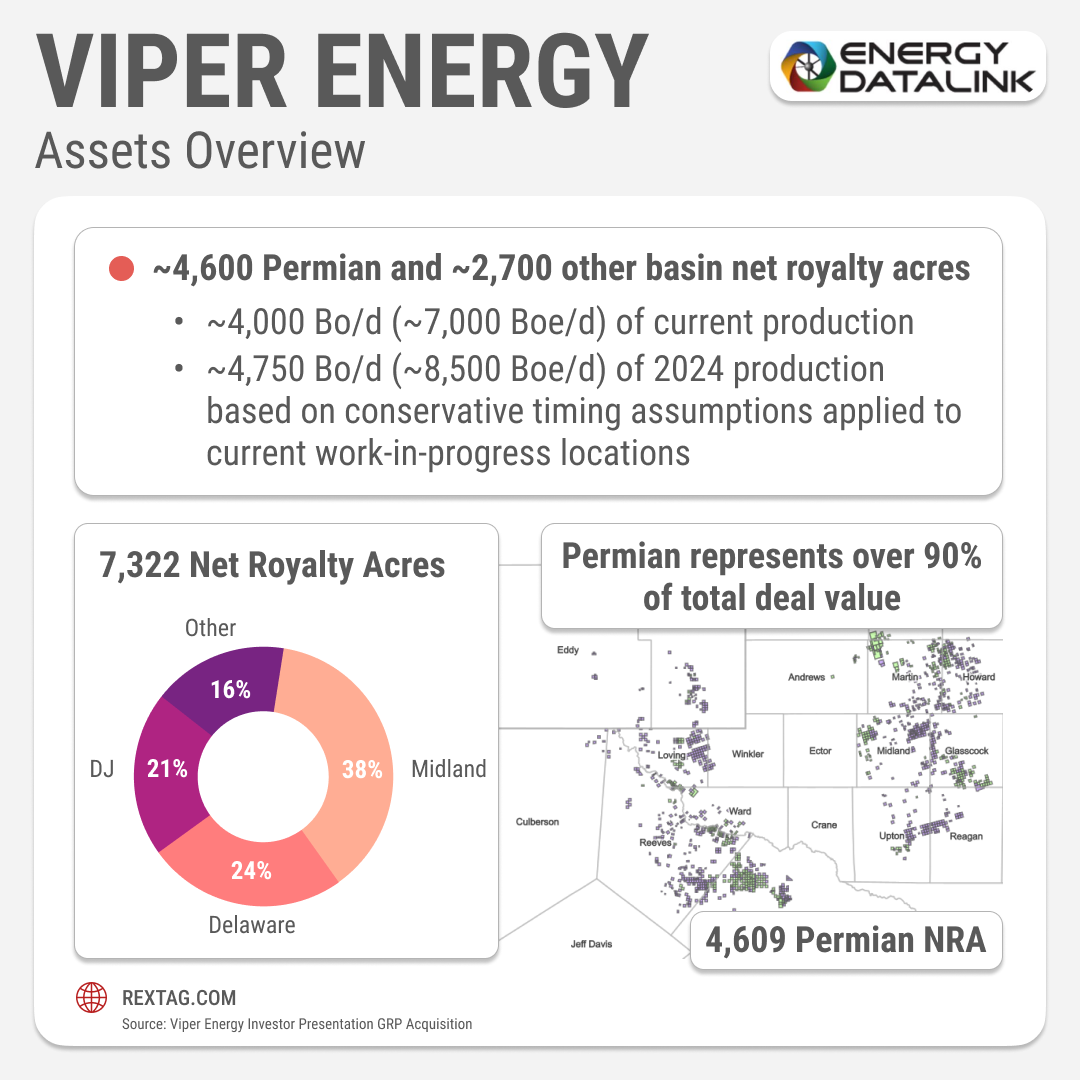

Total Net Royalty Acres: 7,300 net royalty acres involved in the deal

Regional Focus:

- Permian Basin: Over 90% of deal's value and current production

- Midland Basin: 2,800 net royalty acres, primarily in Martin and Midland counties, Texas

- Delaware Basin: 1,800 net royalty acres, mainly in Reeves and Loving counties, Texas

Additional Acreage: 2,700 net royalty acres in other key basins, including the Denver-Julesburg

After the deal, Viper will control about 32,000 net royalty acres in the Permian Basin. Travis Stice, CEO of Viper’s general partner and Diamondback Energy, emphasized the acquisition's strategic value. He stated, "We believe the high-quality nature of our assets will position us to capture an increasing amount of activity, particularly within the Northern Midland Basin."

Market Outlook

Stice also mentioned Viper's intent to play a significant role in consolidating the fragmented mineral market. The deal is estimated to offer a greater than 15% 2024 unlevered free cash flow yield based on current strip prices and existing production.

Production Forecasts

The acquired interests currently yield an average production of 4,000 barrels per day (about 7,000 boe/d), with projections to rise to approximately 4,750 barrels per day (8,500 boe/d) by the full year 2024. These estimates are based on existing production and are considered more conservative than Viper's typical assumptions.

Financing Details

To finance the acquisition, Diamondback will purchase up to 7.22 million common units of Viper for $200 million. The remaining cash portion will be sourced from Viper's available cash, its revolving credit facility, and additional capital market transactions.

The acquisition is expected to close in the fourth quarter of 2023, with an effective date set for October 1, 2023. Stice highlighted the quality of the acquired assets and the opportunity for significant value for Viper and its unitholders.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Permian Resources Corp. Newly Established, Acquires Earthstone Energy for $4.5B

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/180Blog_Permian Resources Shop Earthstone’s Midland Assets for $4.5B.png)

Permian Resources to buy Earthstone Energy for $4.5B, focusing on Delaware Basin. Earthstone's Midland Basin assets may be up for sale. “This is a Delaware Basin company. That’s how we think about the focus going forward,” Permian Resources co-CEO James Walter said.

Diamondback Sells More After Hitting $1B Target

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/169Blog_Diamondback announces $1.1 Billion in asset sales since program start.png)

Diamondback Energy sold more midstream assets in Q2 as part of a $1B plan to shed non-core assets, reducing debt in the Permian Basin. In July, Texas-based Diamondback Energy Inc. sold a 43% stake in the OMOG crude oil system, revealing this in its Q2 earnings on July 31. OMOG JV LLC, running 400 miles of pipelines and 350,000 bbl of storage in Midland, Martin, Andrews, and Ector counties, was detailed in Diamondback's filings. The sale provided $225 million in gross proceeds. Diamondback has announced or completed $1.1 billion in non-core asset sales since initiating the program. Initially aimed at raising $500 million, the 2023 target was increased to $1 billion.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.