Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Permian Resources Corp. Newly Established, Acquires Earthstone Energy for $4.5B

09/05/2023

- Strengthens the company's dominant presence in the Delaware Basin while boosting operational scale.

- Integrates valuable assets adjacent to the company's core acreage in New Mexico.

- Aims to realize synergies, leading to an estimated annual cash flow increment of around $175 million.

- Anticipated to bolster free cash flow per share by over 30% annually for the upcoming two years and over 25% annually over the next five to ten years.

Permian Resources to buy Earthstone Energy for $4.5B, focusing on Delaware Basin. Earthstone's Midland Basin assets may be up for sale.

“This is a Delaware Basin company. That’s how we think about the focus going forward,” Permian Resources co-CEO James Walter said.

Deal Details

Permian Resources Corp., formed by merging Centennial Resource Development and Colgate Energy Partners in 2022, is expanding its Permian Basin holdings by 223,000 net acres through a $4.5B acquisition of Earthstone.

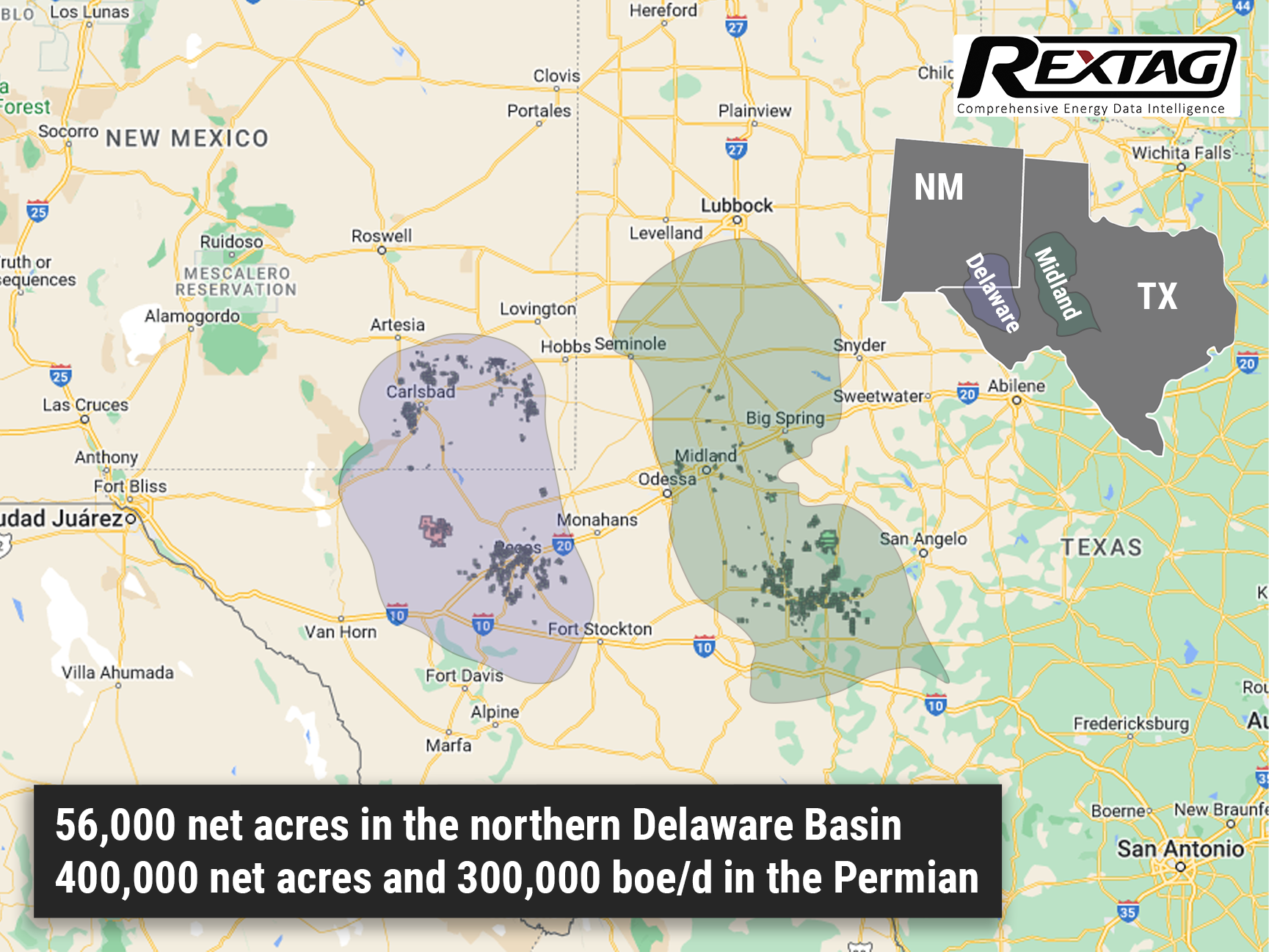

The deal boosts the combined firm's total acreage to over 400,000 and adds about 300,000 boe/d production in the Permian.

The acquisition also includes 56,000 acres in the northern Delaware Basin, adjacent to Permian Resources' existing assets.

The acquisition incorporates Earthstone's holdings in the Midland Basin, although Permian Resources plans to focus almost all its capital expenditure on the Delaware Basin. According to co-CEO Will Hickey, the combined company is currently operating 11 drilling rigs across the Permian, with nine specifically in the Delaware Basin.

Long-Term Midland Asset Strategy

- In the short term, Permian Resources will maintain Earthstone's Midland Basin asset for its strong free cash flow.

- The free cash flow from the Midland Basin will be redirected to higher-return Delaware projects.

- Long-term options for the Midland asset are open, but no immediate plans for strategic alternatives.

- Analyst Gabriele Sorbara notes that a potential sale of the Midland assets could be financially beneficial.

- Earthstone is in the process of selling its remaining Eagle Ford acreage in Texas, marking a complete exit from the region.

Expectations

After the merger, Permian Resources plans to relocate at least one of Earthstone's Midland drilling rigs to the Delaware Basin. For the next year, the company aims to allocate 90% of its capital expenditure to Delaware-based projects, focusing specifically on Lea and Eddy counties in New Mexico, as well as Reeves and Ward counties in Texas.

The acquisition will boost Permian Resources' pro forma market capitalization to around $10 billion, surpassing other exploration and production companies like Matador Resources and Civitas Resources.

Once Earthstone divests its remaining Eagle Ford Shale acreage, Permian Resources will rank as the third-largest pure-play Permian E&P, trailing only Pioneer Natural Resources and Diamondback Energy. Private equity asset valuations have increased over the past year, public company mergers and acquisitions are becoming a more appealing way for buyers to scale up, compared to pursuing private equity deals.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Earthstone Offers Eagle Ford Assets for Sale, Considers Departure from South Texas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/174Blog_Earthstone Energy is targeting the sale of acreage in the Eagle Ford's black oil window.png)

Earthstone Energy is selling Eagle Ford locations to concentrate on the Permian Basin, streamlining its exploration and production focus. Earthstone Energy Inc., based in The Woodlands, Texas, is putting an Eagle Ford asset on the market as the company focuses on divesting non-core properties and directing investment towards the Permian Basin. The assets that Earthstone is planning to sell include production and land in northeast Karnes County, Texas, as well as in southern Gonzales County, Texas, as outlined in the marketing documents. For the sales process, Earthstone has engaged Opportune Partners LLC to serve as its exclusive financial adviser.

Diamondback's Viper Energy Acquires $1 Billion in Royalty Interests in the Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.