Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

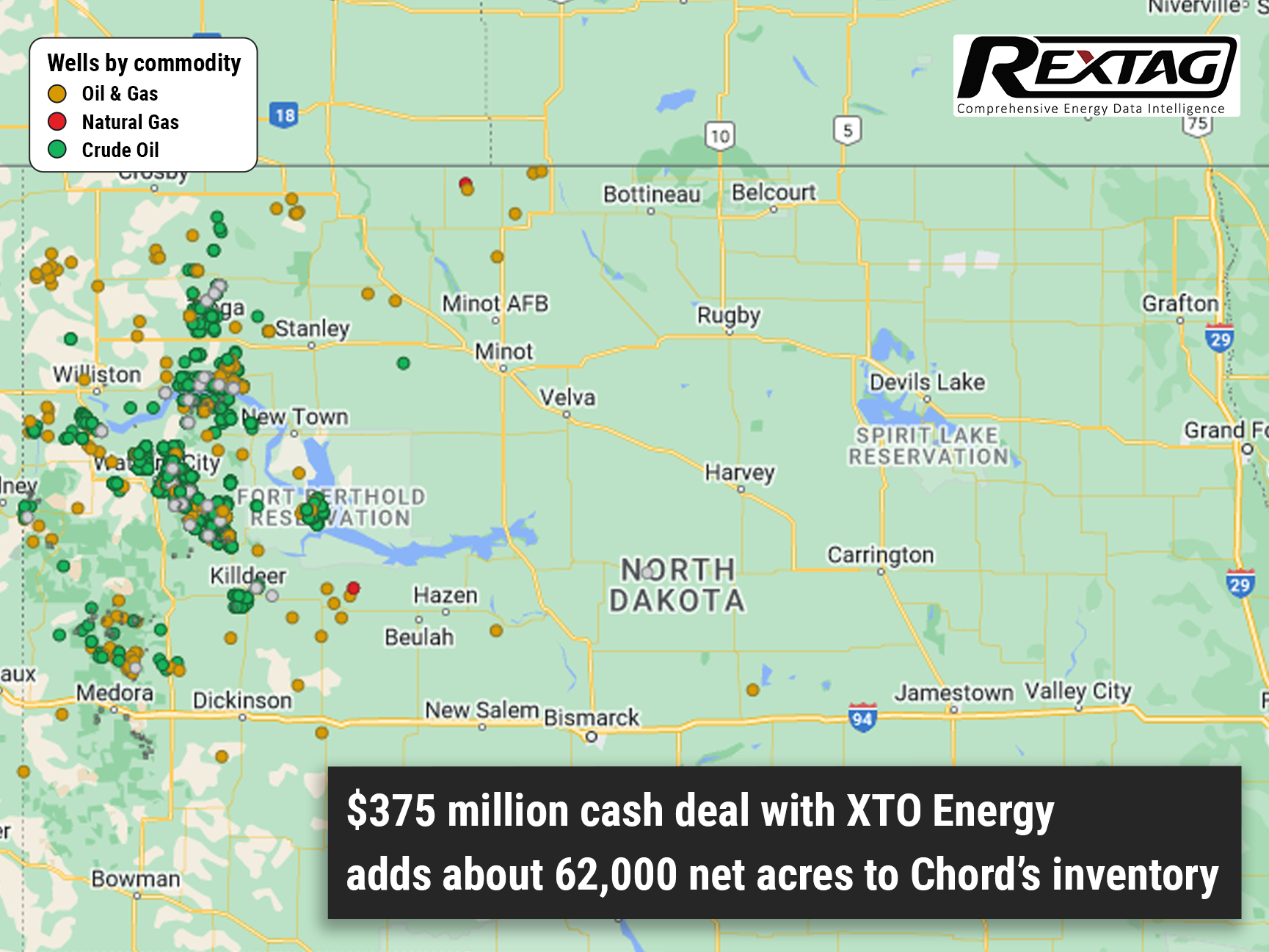

Chord Energy Corp. Expands Williston Basin Footprint with $375 Million Acquisition from Exxon Mobil

06/26/2023

Chord Energy Corp.'s subsidiary has entered into an agreement to purchase assets in the Williston Basin from Exxon Mobil, and its affiliates for $375 million.

Chord Energy, a US independent company, is strategically expanding its presence in the Williston Basin of Montana and the Dakotas. While industry attention remains fixated on the Permian Basin, Chord Energy recognizes the potential of the Williston Basin and is capitalizing on the opportunity to enhance its reserve portfolio. Chord Energy successfully completed the acquisition of 62,000 acres in the Williston Basin from XTO Energy for a substantial cash consideration of $375 million.

"The acquired assets are an excellent strategic and operational fit to Chord's premier Williston Basin acreage position," stated Danny Brown, President and Chief Executive of Chord Energy.

"These low-cost, tier-one assets are highly competitive with our existing portfolio and further extend our inventory runway. Consolidation in the core of the basin supports longer laterals, higher capital, and operating efficiencies, strong financial returns, and sustainable free cash flow generation,” he said.

Williston Basin Holdings with Strategic Acquisition

- The deal encompasses production of over 6,000 barrels of oil equivalent per day (62% oil) and 62,000 net acres, with the majority being undeveloped. The acquired assets are primarily located adjacent to Chord Energy's core Indian Hills area.

- Within the acquired acreage, there are 123 estimated net 10,000-ft equivalent locations, with 77 of them being operated by Chord Energy. Approximately 40-50% of these locations are expected to be developed as 3-mile laterals, aligning with Chord Energy's 2023 activity plan.

- Chord Energy's drilling spacing units will expand from 2 miles to 3 miles as a result of the acquired acreage, allowing for enhanced operational efficiency.

Chord Energy: Merger Success

Following a $6 billion merger in 2022, Chord Energy emerged as a major player in the Williston Basin, combining the operations of Oasis Petroleum and Whiting Petroleum. With its headquarters in Houston, Chord Energy presently boasts an extensive land portfolio of approximately 963,000 net acres within the Williston Basin. In the first quarter of 2023, the company achieved a production rate of about 165,000 barrels of oil equivalent per day (BOE/D).

Chord Energy plans to finance the acquisition using its available cash reserves, which amounted to $592 million as of March 31. The transaction is set to conclude by the end of June 2023, pending the completion of standard closing requirements.

.png)

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R-149 - Blog Exploring the Energy Lifeline_ A Tour of Williston Basin's Pipeline Infrastructure.png)

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/162Blog_Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas1.png)

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.