Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

ONEOK Buys Magellan for $18.8 Billion: Overview of the Huge M&A Deal in the Pipeline Industry

06/19/2023

- Agreement creates major US pipeline operator

- Oneok expands into oil and fuel transportation

In May, ONEOK (OKE) made an announcement regarding its acquisition of Magellan Midstream Partners LP (MMP) for a total value of $18.8 billion, which includes cash and stocks. This move drew attention as it positions ONEOK, primarily known for its involvement in the provision, gathering, and processing of Natural Gas (NG), to become one of the largest pipeline companies in the United States. The acquisition also allows ONEOK to expand its services by including Oil (CL), another significant energy commodity.

However, despite the magnitude of this deal, ONEOK's stock price surprisingly experienced a decline of 9.1% since the announcement. This raises questions about the details of the companies involved, the implications of the deal, the performance of both companies in light of this development, and the potential reasons behind ONEOK's stock decline. Here is an overview of the ONEOK-Magellan deal, providing the necessary information to understand these aspects.

ONEOK and Magellan short overview

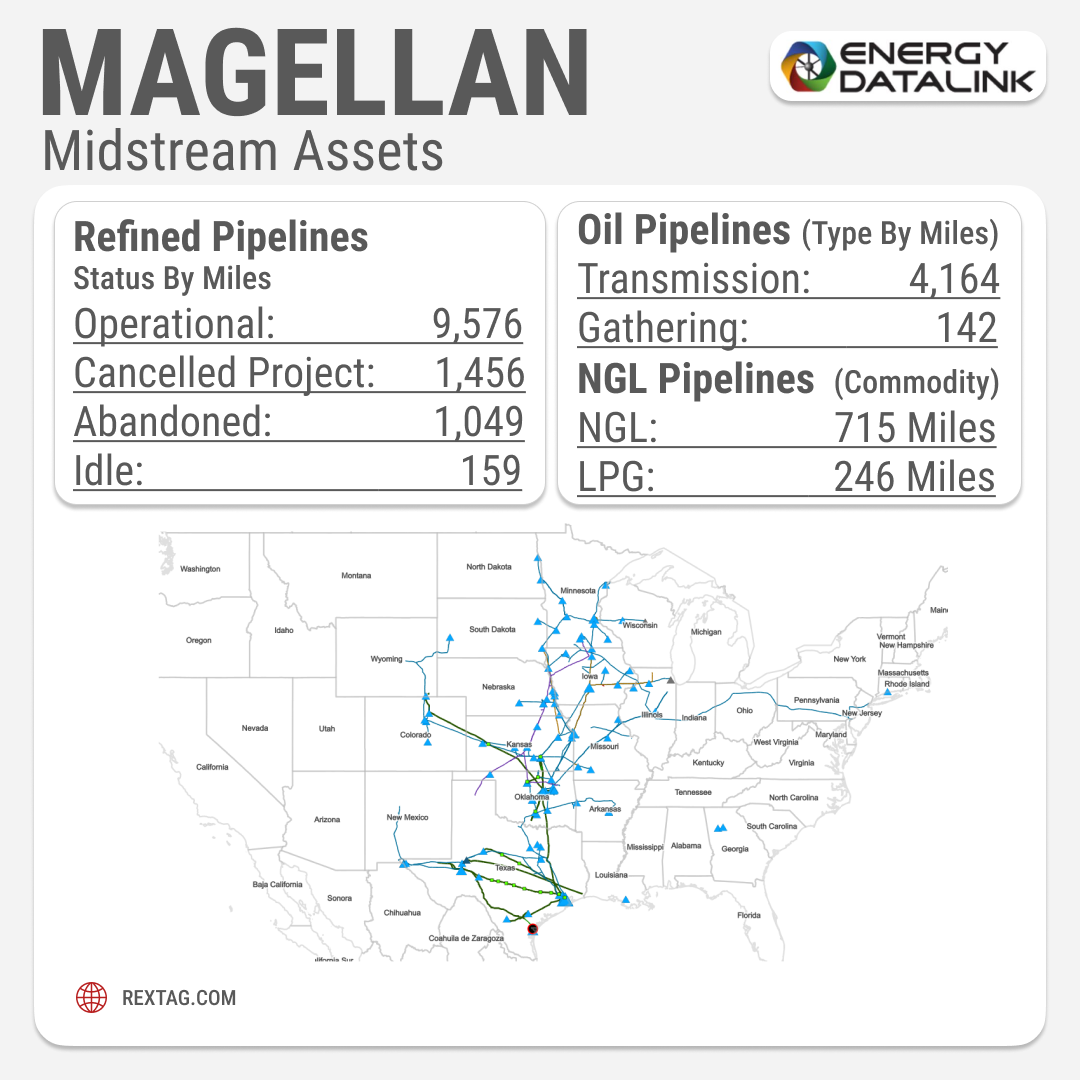

Magellan Midstream Partners LP (MMP) is an Oklahoma-based company listed on the New York Stock Exchange (NYSE). It primarily focuses on owning and operating ammonia and petroleum pipelines in the Mid-Continent oil province. Magellan specializes in transporting and storing crude oil and refined petroleum products.

ONEOK (OKE), also based in Oklahoma, is a company primarily focused on the provision, gathering, and processing of Natural Gas (NG). It is involved in the gathering, processing, storage, and transportation of natural gas across the United States.

While Magellan specializes in crude oil transportation, ONEOK's main focus is on natural gas infrastructure and services.

Insights into the $18.8 Billion Merger

A groundbreaking merger worth $18.8 billion has been announced, encompassing Magellan's assumed debt and establishing a merged entity with a combined valuation of $60 billion.

Under the agreement, ONEOK has outlined its commitment to provide Magellan shareholders with $25 in addition to 0.667 shares of ONEOK for each Magellan share they hold, equating to a value of $67.50 per share.

Pierce Norton II, the CEO of ONEOK, expressed that this merger will enable the natural gas-focused company to venture into the realm of oil and expand its operations across various sectors. Additionally, it positions ONEOK to actively participate in the ongoing energy transformation, particularly in sustainable fuel and hydrogen corridors. Aaron Milford, the CEO of Magellan, highlighted that this deal will grant Magellan shareholders upfront access to ONEOK's dividend, offering them a significant advantage.

Following the acquisition, ONEOK will become the proprietor of the longest pipeline for refined petroleum products in the United States, securing access to approximately half of the nation's refining capacity. Furthermore, this strategic move will position ONEOK among the top five largest pipeline operators in the United States. Despite these significant developments, why is ONEOK's stock experiencing a decline instead of a surge in response to this news?

Factors Behind ONEOK's Downward Movement

- Perceived Risk and Complexity of the Deal

Analysts suggest that the nature of the ONEOK-Magellan merger, with its diversification strategy and increased debt, might have created a cautious sentiment among investors. The complexity of the deal could be viewed as challenging and potentially dilutive to the value for current shareholders.

- Resistance to Expansion into the Oil Sector

Some investors may have been hesitant about ONEOK's foray into the oil sector as part of the merger. The shift in focus and diversification strategy might have raised concerns among shareholders, leading them to turn away from ONEOK.

- Mixed Analyst Sentiment

Analyst opinions on the deal vary, ranging from positive views due to the relatively low valuation and potential earnings growth to more cautious perspectives. The conflicting sentiments contribute to the uncertainty surrounding the outcome of the merger and its impact on ONEOK's future prospects.

- Market Volatility

Financial markets are known for their volatility and unpredictability. Even though Magellan's stock experienced a positive trend following the announcement, the fortunes of both companies can change rapidly, making it essential for traders, analysts, and investors to monitor energy-related news closely.

- Energy Commodities

Traders should keep an eye on oil and natural gas price patterns to assess any potential effects of the merger. While the impact on prices is not yet clear, slight changes have been observed, with a slight increase in oil prices and a slight decrease in natural gas prices.

Oneok deal propels top-five US pipeline status

The newly merged company will possess a combined enterprise value of $60 billion. Based on data compiled by Bloomberg, this would position it as one of the top five pipeline operators in the United States in terms of that criterion.

In a note to clients, analysts J.R. Weston and Justin Jenkins from Raymond James Financial Inc. expressed their view on the matter, stating that they perceive this as a bold move to reshape the long-term strategies of both companies. They believe that this merger will propel the resultant entity closer to the top of the industry in terms of scale and diversification. Despite the high cost for Oneok, they added that the deal could still be sensible. They also mentioned their support for consolidation within the midstream sector.

According to Timm Schneider, an analyst from The Schneider Capital Group, the deal presents an opportunity for Magellan to exit the master limited partnership (MLP) structure at a higher premium compared to recent transactions involving similar entities. MLPs have experienced a decline in popularity among investors since the crude-market crash of 2014-2016 and changes in US tax policy.

The closing of the transaction is anticipated to take place in the third quarter, pending approvals from shareholders and regulatory authorities. Oneok has secured $5.25 billion in fully committed bridge financing to fulfill the cash component of the deal.

Oneok foresees a positive impact on both per-share earnings and free cash flow resulting from the transaction. Both companies are headquartered in Tulsa, Oklahoma.

Summary: Magellan's Hamish McLennan Prioritizes M&A Prior to Board Pay Vote

Magellan's chairman, Hamish McLennan, acknowledges the company's turbulent year and expresses willingness to pursue mergers and acquisitions (M&A) to restore morale and recover from setbacks. Seeking shareholder support, McLennan aims to increase annual director pay from $750,000 to $1.75 million, despite recognizing the unfavorable optics following staff departures, client losses, and a significant share price decline.

Hamish McLennan emphasized the need for the proposed increase in director pay, stating, "The move was needed to transition from a founder-led organization to one that is more mature and traditional. We simply won't attract the caliber of people that we want, and expect to get, unless we pay the market rates. There's never a good time with what we've been through, but we have to set the company up for success in the future."

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 181_Blog_From Beginnings to a $7.1 Billion Milestone Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag .png)

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 161_ Blog - US Midstream Research Overview TOP Providers, Their Assets and Stories.png)

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

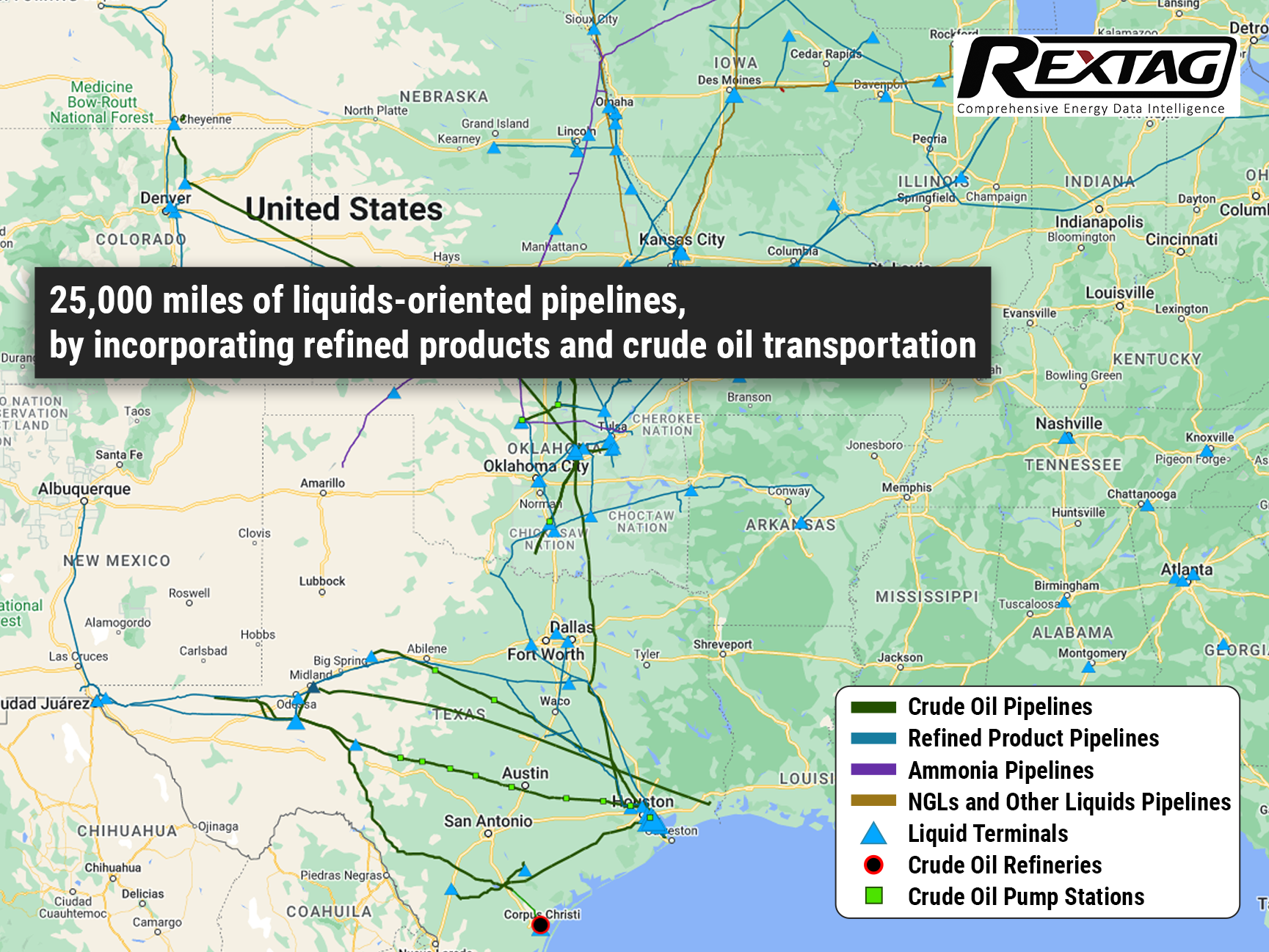

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.