Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

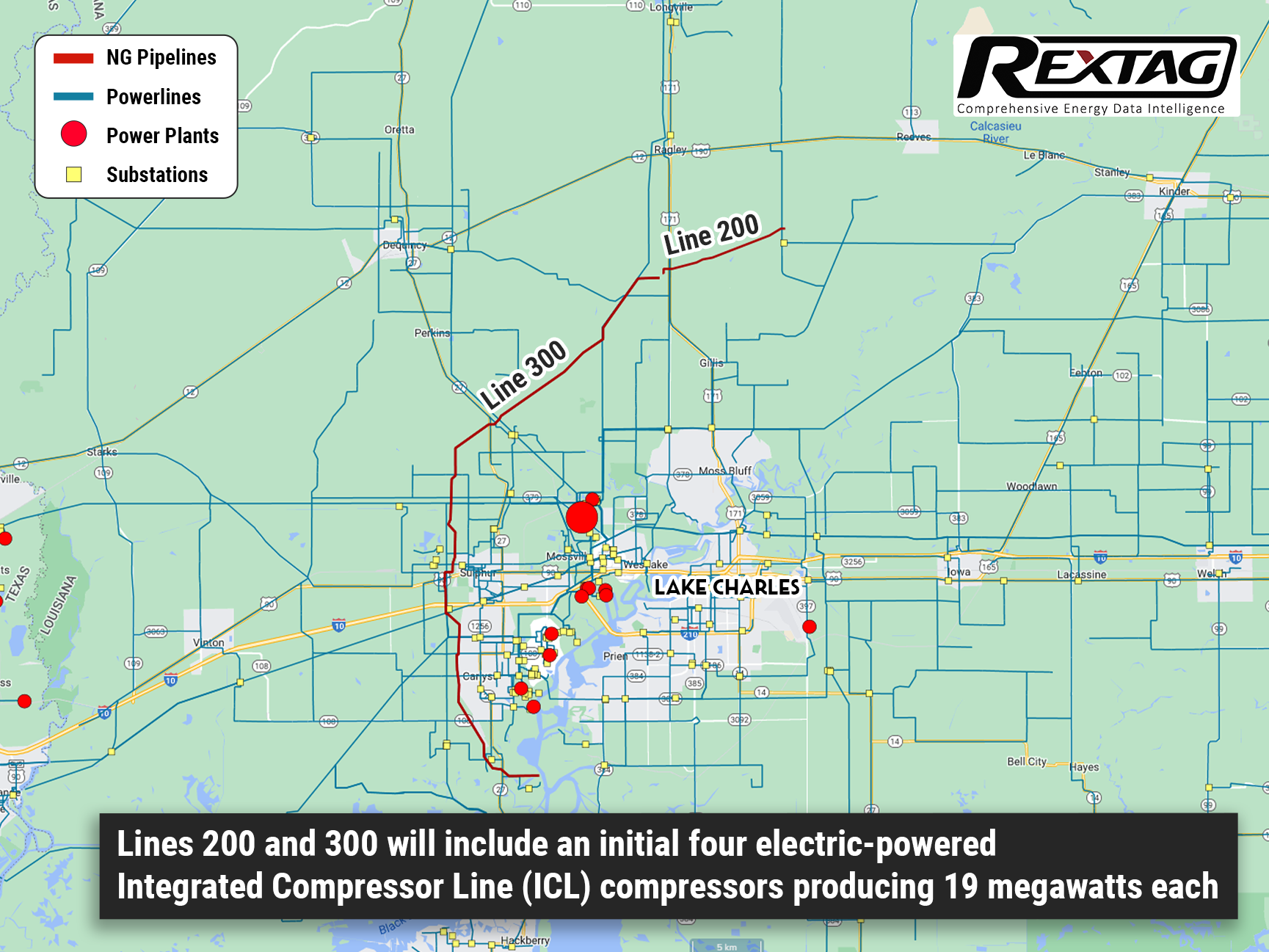

Baker Hughes To Help Driftwood Pipeline Decarbonize Its Lines 200 and 300 Projects

08/08/2022

According to a press announcement on June 29, Baker Hughes got a contract to supply electric-powered Integrated Compressor Line (ICL) decarbonization technology and turbomachinery equipment for an upcoming natural gas transmission project by a subsidiary of Tellurian Inc. – Driftwood Pipeline LLC.

Driftwood Pipeline decided that the projects of Lines 200 and 300 would be situated in Beauregard and Calcasieu Parishes in southwest Louisiana and it will be the first time when Baker Hughes installs its ICL technology for pipeline compression in North America.

Lines 200 and 300 will combine an initial four ICL compressors generating 19 megawatts each and other turbo machinery equipment, totalling four compressor trains. Moreover, the project will include a LM6000PF+ gas turbine for backup power at Driftwood's Indian Bayou Compressor Station.

The LM6000PF+ aero-derivative gas turbine combines the latest innovations with the best-proven technologies and operating experience from more than 5,000 aircraft engines with over 450 million flight hours and 1,300 LM6000 units with over 40 million operating hours in the last 30 years.

Joey Mahmoud, president of Tellurian Pipelines, says the company expects that the project will give upwards of 5.5 Bcf of natural gas every day, with virtually no emissions. As a part of the agreement, Tellurian makes the initial $240 million pipeline investment as part of the broader Driftwood Pipeline system, which will keep enhanced supply reliability to meet the area’s projected industrial enlargement in a purer, more sustainable way.

Baker Hughes has installed over 50 ICL units across the different pipeline and offshore applications, mainly in Europe. The compressors exert a reduced environmental footprint because their hermetically sealed casing prevents emissions from obviating. It is important to mention, that they require minimal downtime as magnetic bearings are resulting in more efficient operations and low maintenance.

Using modular gas processing, our turbomachinery solutions can capture flare gas for use as a highly efficient power source. The compression technology upgrades can also help reduce fugitive venting on installed equipment.

Not only do the company's ICL units extend its technology portfolio but also contribute to its mission to minimize the carbon footprint across the natural gas supply chain.

The field-proven ICL zero-emissions integrated compressor combines high-technology components in a simple, robust, and easy-to-operate system that's emission-free and particularly advantageous for applications where high efficiency, small footprint, and low noise are important.

ICL zero-emissions integrated compressors are the ideal product for lifecycle cost optimization. Its simplicity drastically reduces installation time and, with no wear parts and no critical auxiliary system, ICL zero-emissions integrated compressors provide 10 years of maintenance-free operation in clean-gas applications.

Baker Hughes is sure, that the zero-emissions ICL technology is already decreasing the climate footprint of pipeline projects in lots of regions that deliver vital gas supplies and now the company is bringing it to North America, a region crucial to meeting global natural gas demand.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Momentum Midstream Becomes a Leader in Haynesville Due to Latest Acquisitions

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/94Blog_Momentum's_Aquisition_of_Midcoast_2022_10 (1).png)

Houston-based company Momentum Midstream LLC on September 22 purchased Midcoast Energy LLC’s East Texas business from an affiliate of Arc Light Capital Partners LLC and Align Midstream LLC from Tailwater Capital and claimed that it establishes a leading presence in the Haynesville Shale. New Generation Gas Gathering or NG3 project will collect natural gas produced in the Haynesville Shale for re-delivery to premium Gulf Coast markets, including LNG export. Moreover, the NG3 project includes a carbon capture and sequestration component that will eliminate 100% of the CO₂ and accumulate it underground for a long time, creating a net negative carbon footprint. With the combined assets of Midcoast ETX and Align Midstream, Momentum is currently delivering volumes of more than 2 Bcf/d for a diverse customer base composed of producers, utilities, end-users, and LNG exporters. Momentum’s footprint in the Haynesville includes about 3,000 miles of gathering pipelines, 1.5 Bcf/d of treating capacity, 700 MMcf/d of processing capacity, 200,000 HP of compression, and 820 miles of pipelines transporting gas to the Gulf Coast markets in southeast Texas and the Carthage and Bethel markets in East Texas.

Cheniere’s LNG Is on the Next Level Due to Corpus Christi Expansion FID

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/76Blog_Cheniere's_LNG_terminals_2022_06 (1).png)

According to CheniereEnergy’s board of directors announcement on June 22, the company declared the further expansion of its CorpusChristi, Texas. Moreover, the LNG plant could come sooner than expected due to the announcement of a final investments decision (FID) related to Stage 3 Liquefaction Project work at the export facility. It will ensure the capacity to ship 10-plus million tonnes per annum (mtpa) from 7 midscale trains. Furthermore, TudorPickering, Holt & Co. (#TPH) declared on June 23, that the possible ultimate capacity of the facility could be in the 11-12 mtpa range given 10.7 mtpa of long-term contracts have been signed with companies such as CPC, PGNiG, Sinochem, Foran, ENGIE, Apache, EOG and ARX CN. Additionally, Cheniere announced two sale and purchase agreements (SPAs) with #ChevronCorp.: Firstly, Chevron will obtain 1 mtpa of LNG from Sabine Pass Liquefaction LLC with deliveries considered to start in 2026. Deliveries will reach full capacity in 2027 and expire in mid-2042. Secondly, Chevron will obtain 1 mtpa of LNG from Cheniere Marketing LLC with deliveries considered to start in 2027 and continue for about 15 years. The purchase price for the LNG under both SPAs will be indexed to the Henry Hub price, plus a fixed liquefaction fee as Cheniere claimed. Since the expansion will have been completed, Cheniere’s aggregate nominal production capacity will be increased to more than 55 mtpa by the end of 2025 compared to 45 mtpa now. It will become a part of the industry-wide decarbonization movement away from coal and oil as this allows Cheniere to provide the global market with additional low-carbon fuels. First exports from the facility are anticipated in 2025.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.