Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Grand Prix Pipeline Will Be Completely Owned by Targa: To Buy Remaining Stake For $1.05 Billion

01/18/2023.png)

On January 3, Targa Resources Corp asserted that it is purchasing the remaining stake for $1.05 billion in cash from Blackstone Inc's energy unit in its Grand Prix NGL Pipeline that it does not already own.

Targa, which is going to acquire a 25% stake from Blackstone Energy Partners, purchased 75% interest in the pipeline last year when it repurchased interests in its development company joint ventures from investment firm Stonepeak Partners LP for almost $925 million.

The Stonepeak agreement also included 100% interest in its Train 6 fractionator in Mont Belvieu, Texas, and a 25% equity interest in the Gulf Coast Express Pipeline.

Grand Prix has the capacity to transfer up to 1 MMbbl/d of NGL to the NGL market hub at Mont Belvieu.

As Targa CEO Matt Meloy claimed, the performance of Grand Prix NGL Pipeline has exceeded anticipations since it began full operations in the third quarter of 2019, integrating the company’s leading NGL supply aggregation position in the Permian Basin to key demand markets in Mont Belvieu and along the U.S. Gulf Coast.

The advantage of the pipeline is that it connects Targa's gathering and processing positions throughout the Permian Basin, North Texas, and Southern Oklahoma to Targa's fractionation and supply complex at Mont Belvieu.

The same day Targa maintained the price of the Blackstone Energy Partners agreement, which is anticipated closing in the first quarter of 2023, representing roughly 8.75 times Grand Prix's valued 2023 adjusted EBITDA multiple.

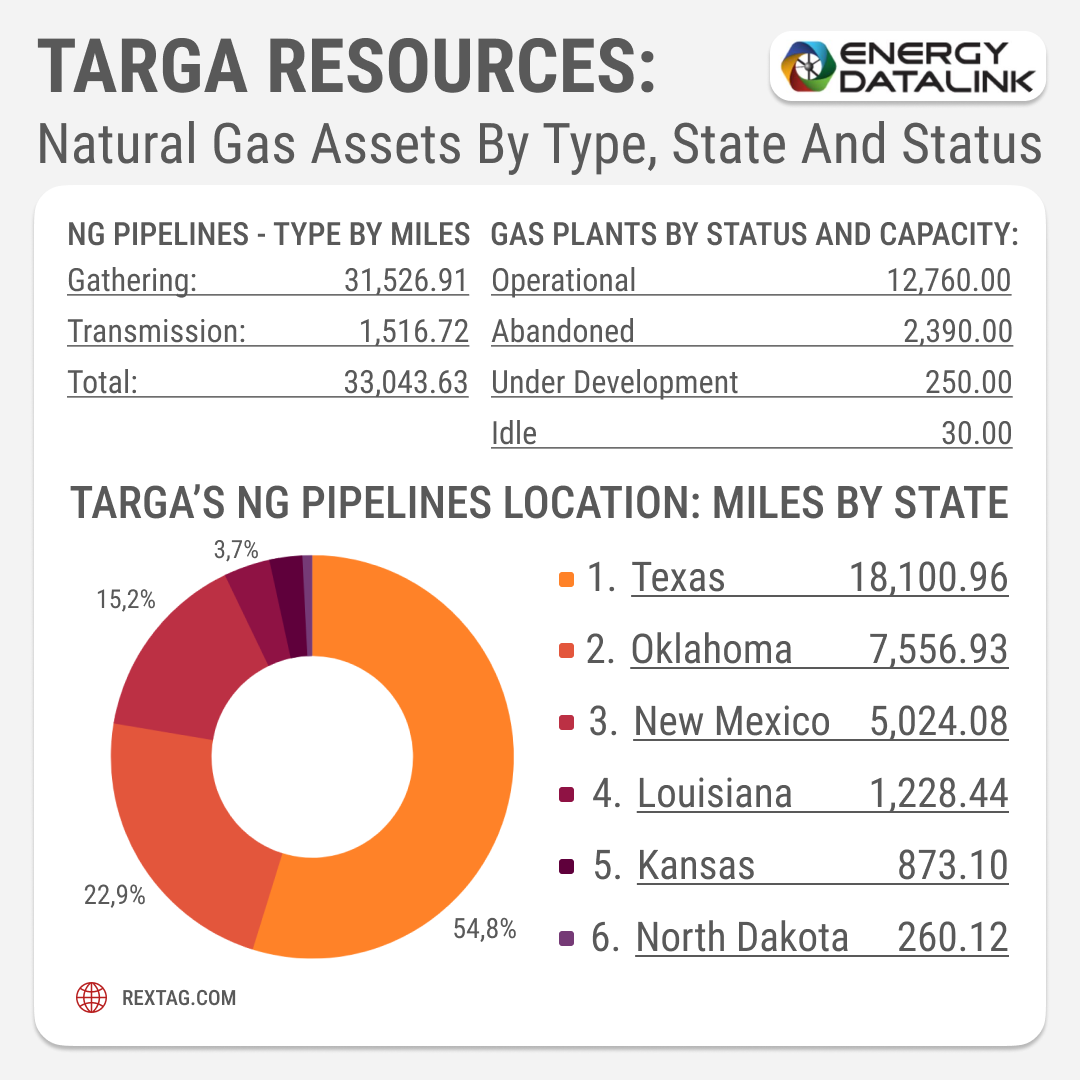

Targa Resources Corp is mainly engaged in the business of gathering, compressing, treating, processing, and selling natural gas; transporting, storing, fractionating, treating, and selling NGL and NGL products, including services to liquefied petroleum gas (LPG) exporters.

It has a leading position in Mont Belvieu, Texas the NGL hub of North America, as the company has one of the largest fractionation ownership positions in Mont Belvieu and world-class LPG export facilities on the Gulf Coast at its Galena Park Marine Terminal, which is interconnected to Mont Belvieu.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Matador Expands In Delaware; Purchases Acreage from Advance Energy at $1.6 Billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/127Blog_Matador_Expands_In_Delaware_Purchases_Acreage_from_Advance_Energy.png)

On January 24, Matador spread the word that it will add oil- and gas-producing assets in Lea County, N.M., and Ward County, Texas, and some midstream infrastructure. Most of the acreage is strategically situated in Matador’s Ranger asset area in Lea County. The bolt-on includes about 18,500 net acres, 99% held by production, in the core of northern Delaware. The deal would also extend Matador’s inventory by 406 gross (203 net) drillable horizontal locations with prospective targets in the Wolfcamp, Bone Spring, and Avalon formations.

BP Has Acquired Archaea Energy for $4.1 Billion Developing Its bioenergy business

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/122Blog_BP_Closes_Purchase_of_RNG_Producer_Archaea_Energy.png)

BP acquired renewable natural gas (RNG) provider Archaea Energy Inc. for $4.1 billion on December 28, marking a milestone in the growth of BP’s strategic bioenergy business. The acquisition, announced in October, was finalized following BP’s completion of regulatory requirements and Archaea obtaining shareholder approval.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.