Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

The Final Stretch: Energy Transfer Pushes For Mariner East Project Ahead Of The Stunning Q3 Results

12/08/21

A market share of almost 20%, double that of 18 months ago, was held by Energy Transfer LP in the third quarter, the most of any country or company in the world in NGL exports. The company, however, has a bit of a slip in the results, compared to the strong showing over the same period a year prior.

In 2020, consolidated adjusted EBITDA in the third quarter was $2.9 billion, compared to $2.6 billion this time around. In line with this, discounted cash flow (DCF) is also down to $1.31 billion, from $1.69 billion a year ago.

Energy Transfer also reported earnings of $0.20 per unit and revenues of $16.66 billion, which solidly outperformed expectations from the likes of the Zacks Consensus with their estimate of $14.96 billion.

Tom Long, co-CEO of Energy, noted that the company was able to tie itself over the higher volumes in most segments seamlessly this year due to the one-time gain of $103 million in the midstream segment and the success of the former optimizations. Long also noted that the winter storm of 2021 resulted in higher utility bills and other expenditures.

All of these gains and expenses — the result of Energy Transfer owning and operating one of the largest and most diversified portfolios of energy assets in the United States, with strategic stakes in all major domestic production basins. All of this is in addition to midstream, intrastate, and interstate natural gas transportation and storage assets, oil and petroleum products transportation and terminal assets, NGL fractionation assets, and acquisition and marketing assets.

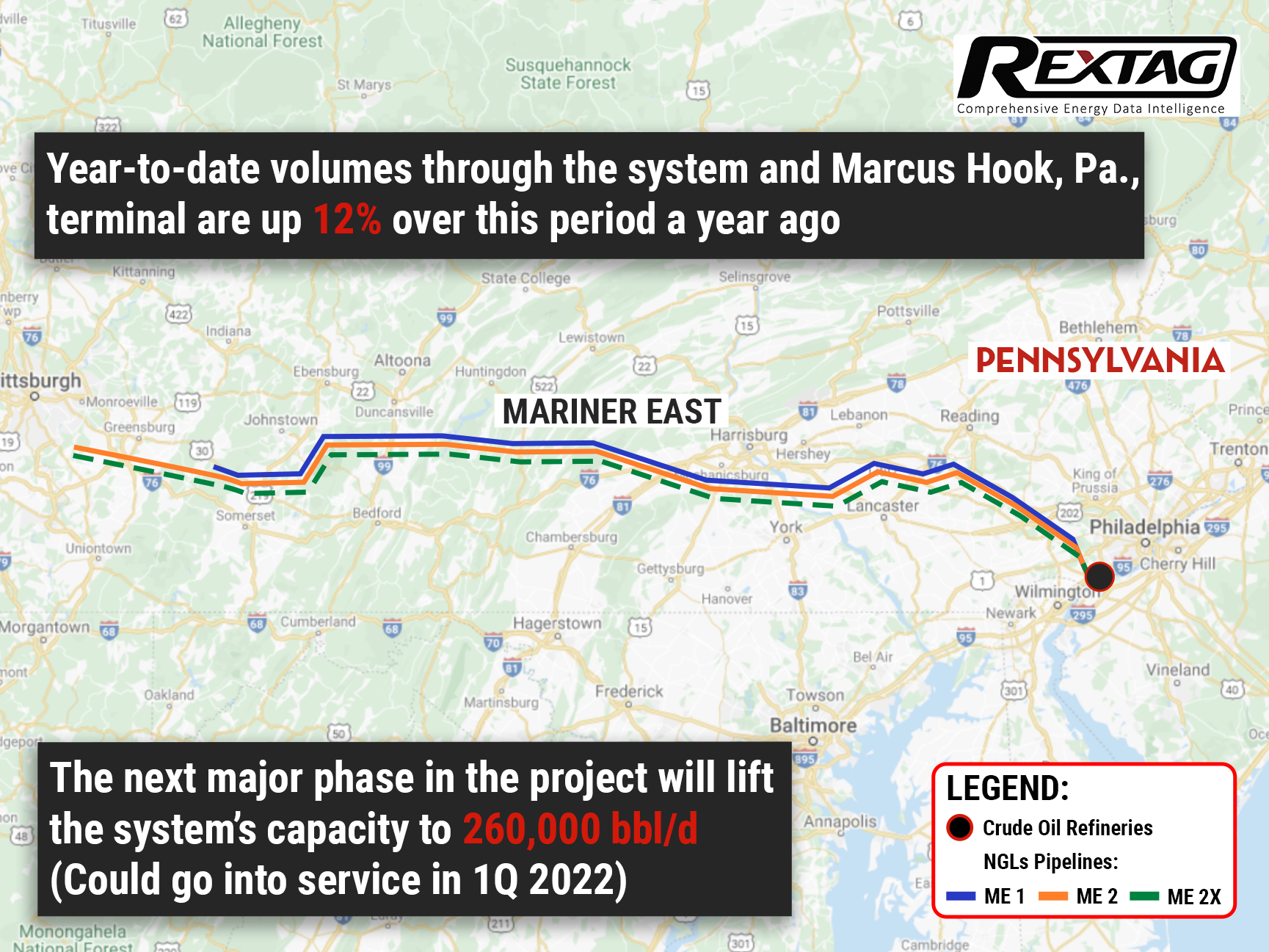

In the meantime, though, one of the heaviest things on Energy's plate is the Mariner East project with its myriad of challenges. A new phase in the project has been commissioned, which will increase the project's capacity to 260,000 bbl/d. Yet, even with the uncompleted project, the volumes going through the system and the terminal in Marcus Hook, Pa saw a 12% increase compared to the last year.

However, the project is handicapped at the moment. New permit modifications are required for converting the final directional drill to an open cut. Afterward, Mariner East's last segment could be operational by the end of the first half of 2022. But whether or not this timeline will hold to be true is unknown for now.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Smart Investments Are The Key To Success: Williams JV Brought Benefits At The End Of The Year

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Williams-JV-Brought-Benefits-At-The-End-Of-The-Year.png)

Williams boasts its Q3 results. With a revenue of $2.48 billion, the company beat the analyst estimate of $2.09 billion and also improved upon its own results over the same period in 2020. Mind you, much of this success was attributed to production in Wyoming's Green River Basin's Wamsutter Field and Williams JV with Crowheart.

No More Gas Flaring: the Permian's Double E Pipeline is brought into service in West Texas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/The-Permians-DoubleE-Pipeline-is-brought-into-service-in-West-Texas.png)

Permian Basins gas infrastructure boom: Summit Midstream puts into service a new pipeline system, aimed at reducing gas flaring in the area. Besides ecological concerns, the project will also transport almost 1,5 billion cubic feet of gas per day — enough to supply 5 million U.S. homes every day. According to Federal Energy Statistics, the project cost a whopping $450 million.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.