Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Diamondback Wraps Up Permian Divestitures, Sets Sights on Midstream Deals

06/14/2023

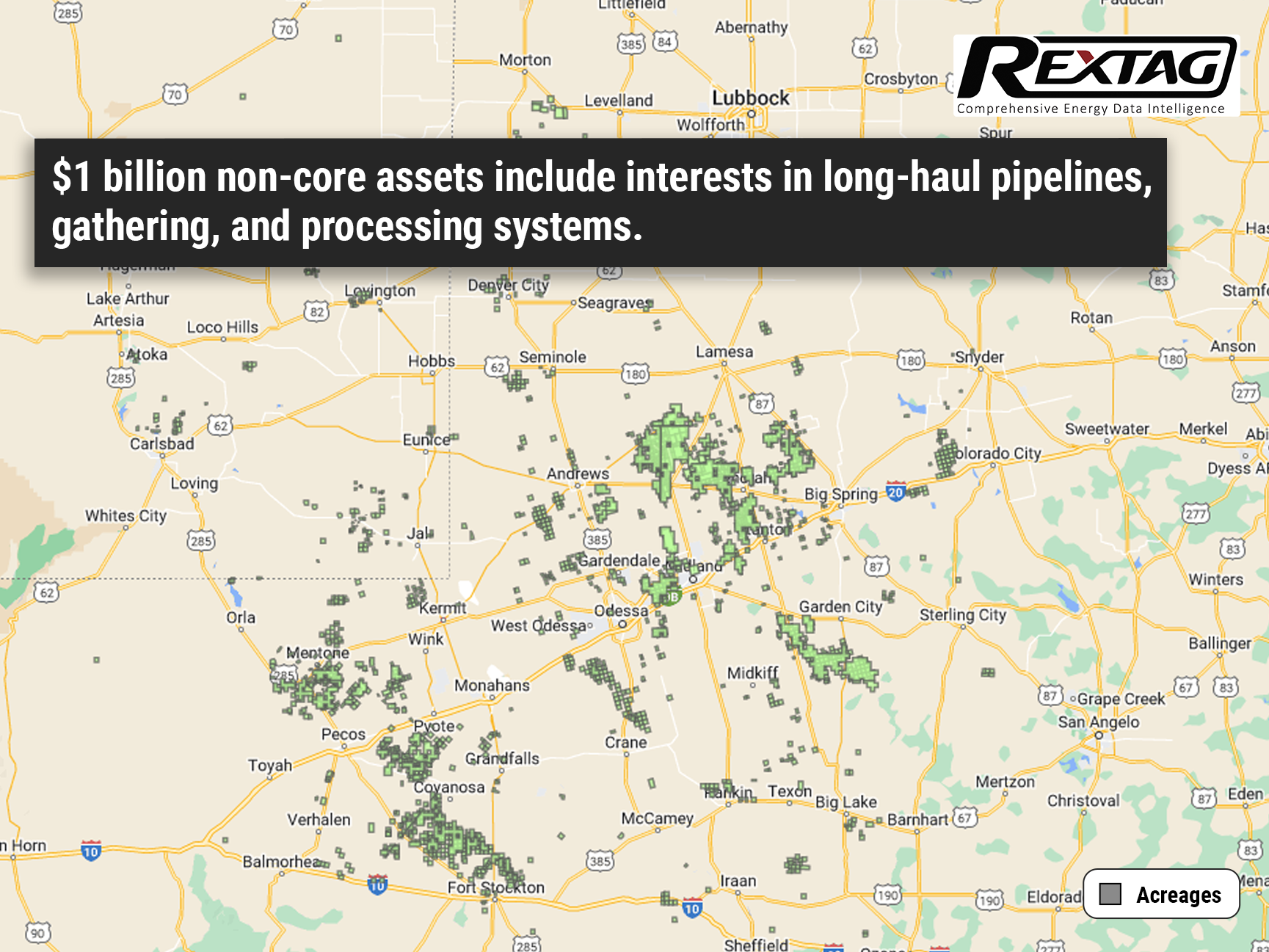

Diamondback Energy is on a roll! In the first quarter, they made impressive strides towards their goal of divesting $1 billion in non-core assets by year-end. They successfully sold their upstream and midstream assets, marking a significant achievement.

During this period, Diamondback closed two major deals in Texas, selling around 19,000 net acres in Glasscock County and an additional 4,900 acres in Ward and Winkler counties. These deals, initially announced in the company's fourth-quarter earnings report, generated $439 million.

Diamondback Energy remains dedicated to optimizing its portfolio and maximizing value for stakeholders. Their progress in shedding non-core assets showcases their strategic focus and commitment to delivering strong results. Exciting times ahead for Diamondback Energy!

Strategic Divestitures and Expansions in Permian Basin

- Diamondback expects a decrease in companywide production by approximately 2,000 bbl/d of crude oil or 7,000 boe/d due to Permian divestitures.

- The company completed a divestiture of royalty interests to its subsidiary, Viper Energy Partners LP, acquiring 819 net royalty acres for $115.8 million, including a $75.1 million dropdown from Diamondback.

- Diamondback has successfully sold $773 million in assets, excluding the Viper dropdown, since announcing its original target, surpassing the initial $500 million goal.

- Initially planning to raise $500 million through asset sales, Diamondback raised its divestiture target to $1 billion earlier this year.

- These acquisitions added 500 drilling locations and are expected to boost Diamondback's 2023 production profile by around 37,000 bbl/d of oil (50,000 boe/d).

In terms of expansion, Diamondback closed a $1.55 billion acquisition of Lario Permian LLC and a $1.75 billion acquisition of FireBird Energy LLC, increasing its presence in the Midland Basin by approximately 83,000 net acres.

Diamondback's Strategic Push to Monetize Midstream Assets

“I can't guarantee it's going to happen today, but certainly there's a few things in the works, either on the JV [joint venture] side or some of the small operated midstream assets that could be up for sale,” Van’t Hof, Diamondback President and CFO.

Diamondback Energy, a prominent player in the energy sector, has doubled its divestiture target to a staggering $1 billion, driven by the potential monetization of its midstream holdings. The company's President and CFO, Kaes Van't Hof, revealed this ambitious plan during the fourth-quarter earnings call in February.

In line with their strategy, Diamondback wasted no time and swiftly made a significant move in the first quarter. They successfully sold a 10% equity ownership in the highly sought-after Gray Oak crude pipeline for a remarkable $180 million. This pipeline, boasting a capacity of 900,000 barrels per day, serves as a vital conduit for transporting crude oil from the Permian Basin and the Eagle Ford Shale to the Gulf Coast's demand centers.

Adding to the excitement, Enbridge Inc., a Canadian midstream powerhouse, seized the opportunity and acquired an additional 10% interest in the Gray Oak pipeline from Diamondback's subsidiary, Rattler Midstream, in January. This strategic acquisition not only enhances Enbridge's portfolio but also strengthens Diamondback's commitment to unlocking the full value of its midstream assets.

Beyond the Gray Oak pipeline, Diamondback Energy holds equity interests in various other midstream assets, including long-haul product pipelines and advanced in-basin processing and gathering systems. During the first-quarter earnings call on May 2, Van't Hof expressed confidence in the likelihood of selling these assets throughout the year, stating that they have "a pretty high probability" of being divested. He further hinted at potential joint ventures and the possible sale of smaller operated midstream assets, indicating that negotiations are already underway.

Financial Performance Update

- Diamondback, a leading energy company, has reported impressive production figures for the first quarter.

- The company's average daily production reached 251,400 barrels of oil per day (bbl/d) or 425,000 barrels of oil equivalent per day (boe/d).

- This represents a significant increase compared to the previous quarter, where the average daily production was 226,100 bbl/d (391,400 boe/d) in the fourth quarter of 2022.

- Looking ahead to 2023, Diamondback maintains a positive outlook for crude oil production.

- The company expects production levels to remain consistent, ranging between 256,000 bbl/d and 262,000 bbl/d, aligning with its previous forecasts.

- Net production is projected to range between 430,000 boe/d and 440,000 boe/d for the entire year.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 161_ Blog - US Midstream Research Overview TOP Providers, Their Assets and Stories.png)

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

Civitas Makes $4.7B Entry into Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/163Blog_Hibernia and Tap Rock Combine Forces Across Texas and New Mexico.png)

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia. Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.