Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Crude oil pipelines in North America: a current perspective

07/06/2022

Being the main means of transferring crude oil around the world, pipelines rapidly convey oil and its derivative products (gasoline, jet fuel, diesel fuel, heating oil, and heavier fuel oils) to refineries and empower other businesses.

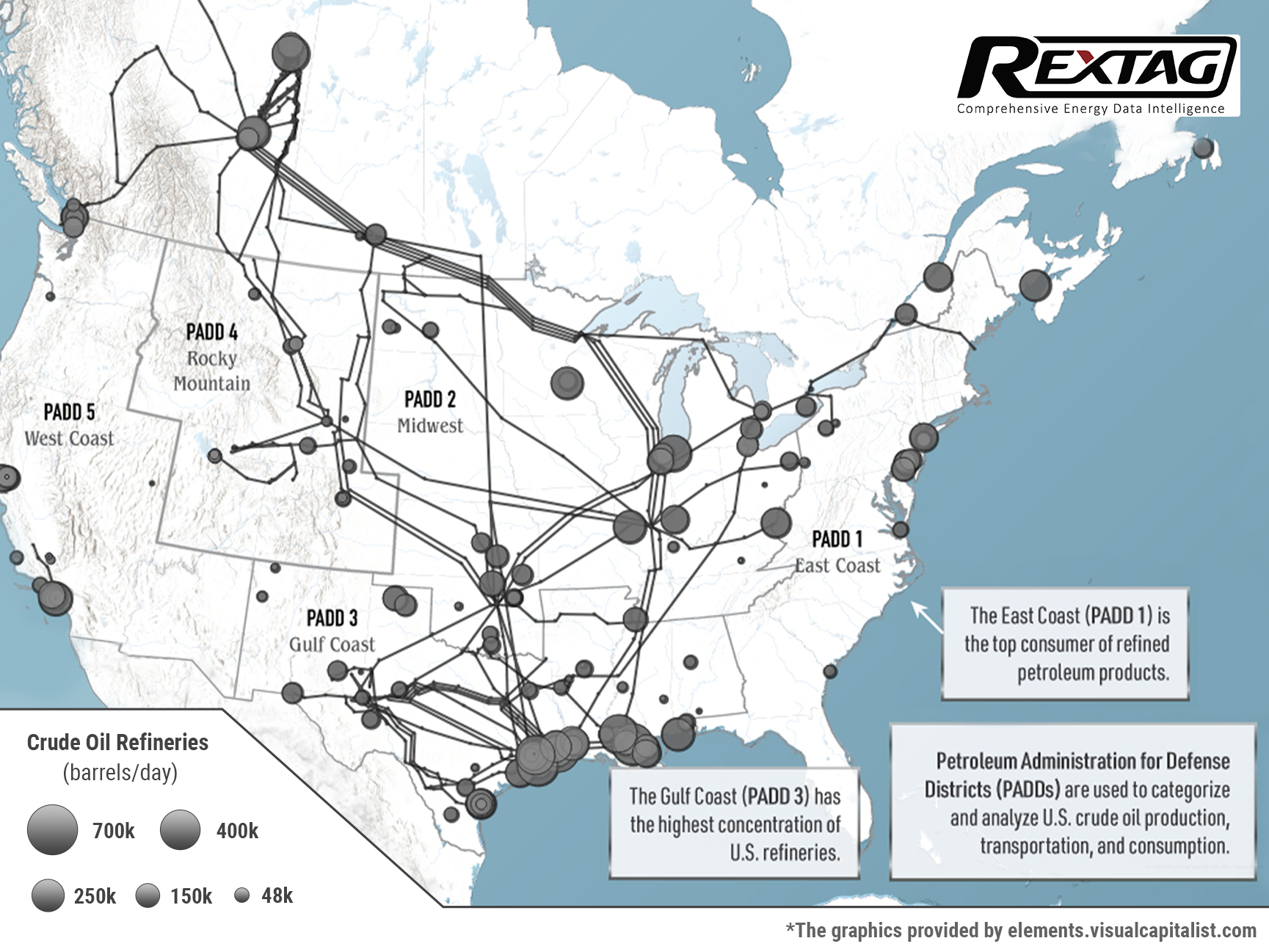

The U.S. and Canada solely make North America a major oil hub for more than 90,000 miles of crude oil and petroleum product pipelines, which are connected to more than 140 refineries daily processing about 20 million barrels of oil.

All data provided in this article are based on Rextag's application to demonstrate crude oil pipelines and refineries across the U.S. and Canada.

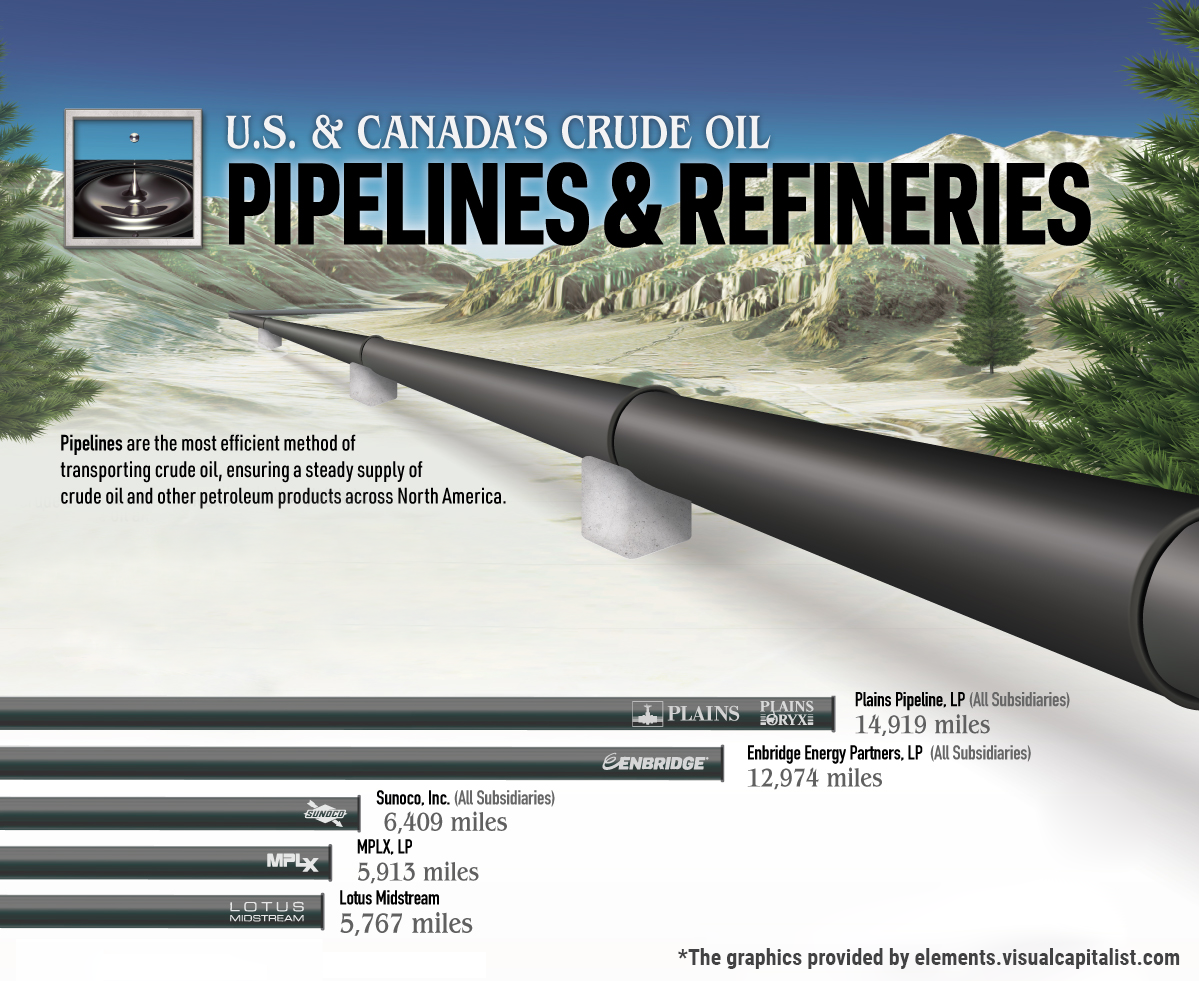

Compared to 2010, U.S. crude oil production has increased more than twice: from 5.4 to 11.5 million barrels a day. Therefore, newly produced oil obliged energy companies to expand their pipeline networks, but it has only increased by 56%. According to the latest data, Plains manages the largest pipeline network across the U.S. and Canada (its diameter is at least 10 inches) which is the 14,919-mile network that spans from the northwestern tip of Alberta down to the southern coasts of Texas and Louisiana.

Other companies with the largest length of pipeline networks are Enbridge Energy Partners LP (12,974 miles), which transports about 30% of the crude oil produced in North America., then Sunoco Inc. (6,409 miles), MPLX LP (5,913 miles), and Lotus Midstream (5,767 miles).

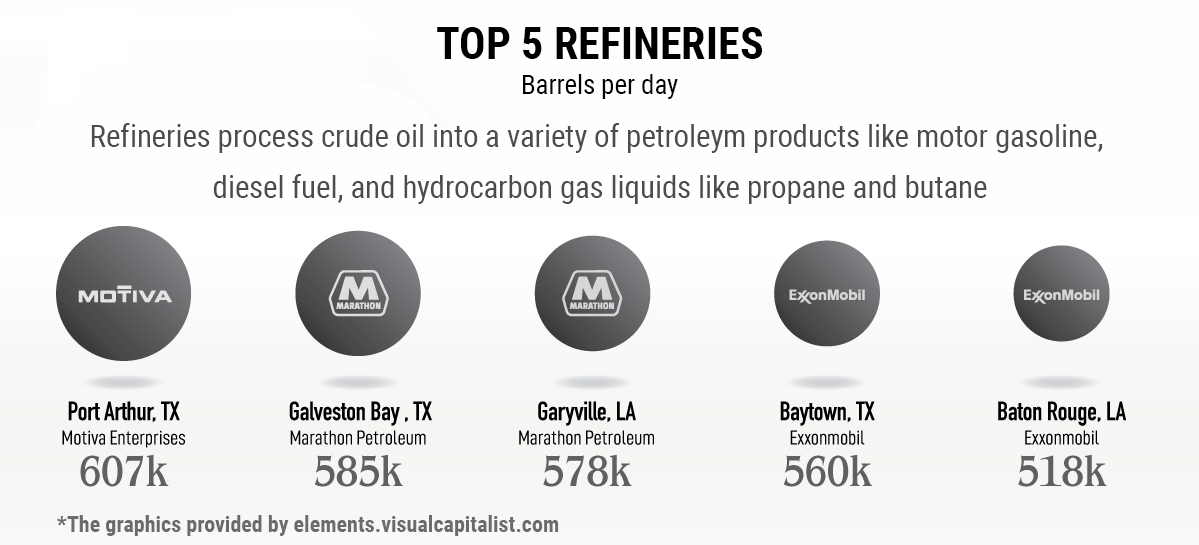

The place where all these various spreading pipeline networks carry crude oil is refineries, where it is transformed into different petroleum products. Gulf Coast (PADD 3) possesses several refineries with the largest throughput in North America that process more than 500,000 barrels per day. They are located in the states of Louisiana and Texas: Motiva Enterprises (607,000 bpd), Marathon Petroleum in Galveston Bay (585,000 bpd), Marathon Petroleum in Garyville (578,00 bpd), ExxonMobil in Baytown and Baton Rouge (560,000 and 518,000 respectively).

It is important to admit that Texas and Louisiana have six refineries that process more than 400,000 barrels per day, nevertheless, there are only two facilities outside of these states with the same throughput: Whiting, Indiana (435,000 bpd) and Fort McMurray, Alberta (465,000 bpd).

However, Fort McMurray’s facility is an upgrader, which upgrades heavy oils like bitumen into lighter synthetic crude oil which flows through pipelines more easily, that is why it differs, as lots of oil refineries are not able to directly convert bitumen, consequently it makes upgraders an obligatory part in the production and processing of crude oil from oil sands.

Not only does the development of new pipelines give a plethora of opportunities for economic growth but also it remains a contentious issue in Canada and the U.S., with the cancellation of the Keystone XL pipeline emblematic of growing anti-pipeline sentiment. In 2021, only 14 petroleum liquids pipeline construction plans were completed in the U.S., which is considered the lowest amount of new pipelines and expansions ever since 2013.

Since the U.S. has banned Russian oil imports and Russia’s impending export of raw materials, domestic energy production is needed as never. It turned out that North American consumers are now facing surging gasoline and energy prices as foreign oil is proving to be far less reliable in times of geopolitical mess.

Anti-pipeline sentiment did not come out unexpectedly as leaks and spills in just the last decade have resulted in billions of dollars of damages. From 2010 to 2020, the Pipeline and Hazardous Materials Safety Administration reported 983 incidents that resulted in 149,000 spilled and unrecovered barrels of oil, even five fatalities, 27 injuries, and more than $2.5B in damages.

Fortunately, over the last five years, liquid pipeline incidents have decreased by 21% while pipeline mileage and barrels delivered have grown by more than 27%. In addition to these infrastructure improvements, pipeline developers and operators stress the lack of better alternatives, as freight and seaborne transportation are both far less efficient and result in more carbon emissions.

Meanwhile, pipelines stay vital components of energy consumption all over the U.S. and Canada, and as global energy markets meet supply squeezes, sanctions, and geopolitical turmoil, the focus on them has increased.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

ExxonMobil Acquires Denbury and Enhances carbon, capture, and storage efforts

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/165Blog_ExxonMobil Acquires Denbury in 5 Billion Deal.png)

ExxonMobil's joined assets speed up their Low Carbon Solutions business, offering better decarbonization options for customers. ExxonMobil's top CCS network supports their commitment to low carbon value chains, like hydrogen and biofuels. The transaction synergies will cut over 100 MTA of emissions, leading to strong growth and returns. Exxon Mobil Corporation revealed that it will acquire Denbury Inc., a company specializing in carbon capture, utilization, and storage (CCS) solutions and enhanced oil recovery. $4.9 billion deal will be completed through an all-stock transaction. Darren Woods, Chairman and CEO said “Acquiring Denbury reflects our determination to profitably grow our Low Carbon Solutions business by serving a range of hard-to-decarbonize industries with a comprehensive carbon capture and sequestration offering”.

ESG - what are the criteria O&G companies should meet?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/123Blog_ ESG_what_are_the_criteria_O_G_companies_should_meet.png)

Most companies have plans in place to identify and manage the normal operational risks of enterprise asset management (EAM). But, it is equally important to consider the potential emergence of ESG risks that a company may face. While predicting events such as hurricanes, pandemics, and regulatory violations is difficult, preparing for or mitigating the impact can avoid potentially devastating effects on an asset-rich organization, as well as its employees and shareholders. As a reminder, ESG investing looks at three elements: environmental (E), social (S), and governance (G) issues, with stakeholders looking not only at the financial parameters of a transaction but also the non-financial parameters. For example, oil and gas companies should develop plans to restore power lines or pipelines after an earthquake or other natural disaster. These plans should describe procedures for how employees will access remote sites, which assets will be prioritized, what additional equipment will be needed, and how it will be obtained.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.