Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Energy Transfer Secures $7.1 Billion Deal to Take Over Crestwood

08/30/2023

- Energy Transfer to buy Crestwood for $7.1B.

- Deal includes taking on $3.3B of Crestwood's debt.

- Adds significant gas and crude gathering capacity to Energy Transfer.

Energy Transfer is taking on $3 billion of Crestwood's debt in a stock deal. This move expands their reach in the Williston and Delaware basins and gets them into the Powder River Basin for the first time.

Drilling down into Energy Transfer's latest acquisition

Energy Transfer LP announces plans to buy Crestwood Equity Partners LP in a stock-based transaction worth $7.1 billion, marking another major deal in the midstream industry this year.

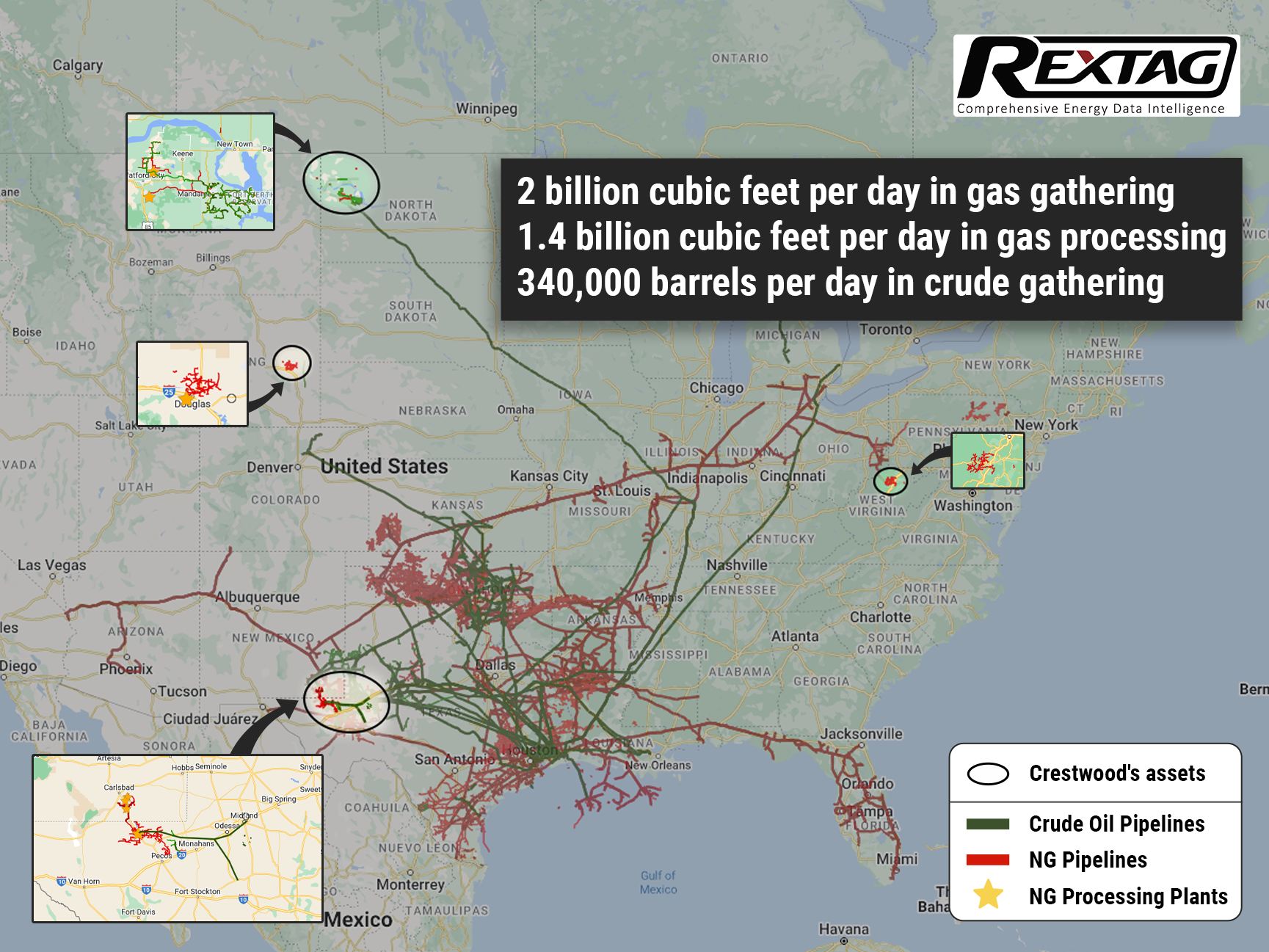

Crestwood's portfolio features gathering and processing facilities in the Williston, Delaware, and Powder River basins. The assets include roughly 2 billion cubic feet per day in gas gathering, 1.4 billion cubic feet per day in gas processing, and 340,000 barrels per day in crude gathering capacity.

“If consummated, this transaction would extend Energy Transfer’s position in the value chain deeper into the Williston and Delaware basins while also providing entry into the Powder River basin,” Energy Transfer said.

Energy companies are increasingly investing in pipeline ventures as a strategy to counterbalance the shrinking revenues from their fossil fuel operations. For example, Phillips 66 announced a $3.8 billion investment to double its ownership in a Denver-based pipeline company earlier this year, aiming to increase sales of natural gas liquids like ethane, propane, and butane. This move came on the heels of Targa Resources' $1.05 billion acquisition of the extensive Grand Prix NGL Pipeline system, which also transports natural gas liquids.

Financial impact

The acquired assets from Crestwood are anticipated to synergize well with Energy Transfer's downstream fractionation facilities at Mont Belvieu. They are also expected to bolster the company's hydrocarbon export operations at its Nederland Terminal in Texas and Marcus Hook Terminal in Philadelphia.

Energy Transfer projects a yearly cost savings of $40 million from the deal, not accounting for other financial and commercial advantages. Crestwood unitholders are set to gain both in distributions per unit and the chance to be part of Energy Transfer's aimed annual distribution growth of 3% to 5%.

Energy Transfer is taking on Crestwood's $3.3 billion debt in the deal but describes it as "credit neutral." According to the terms, Crestwood unit holders will get 2.07 Energy Transfer units for each of their Crestwood units. The acquisition is slated to wrap up in the fourth quarter of 2023, pending approval from Crestwood unit holders, regulatory green lights, and other standard closing conditions.

Energy Transfer boasts one of the most extensive and varied collections of energy assets in the U.S., with close to 125,000 miles of pipelines and other related infrastructure. Crestwood, a Houston-based master limited partnership, also specializes in midstream operations and has a presence in various shale resource areas across the country.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 181_Blog_From Beginnings to a $7.1 Billion Milestone Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag .png)

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

Kimbell Set to Purchase Permian and Mid-Continent Assets for $455 Million

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 170_Blog_Kimbell Set to Purchase Permian and Mid-Continent Assets for $455 Million.png)

Kimbell Royalty Partners' acquisition adds land in Delaware & Midland basins, enhancing its lead in production, active rigs, DUCs, permits & undrilled inventory. Kimbell Royalty Partners LP has recently announced a landmark deal, the largest in its history, to expand its foothold in the oil and gas industry. The company has agreed to purchase Permian Basin and Midcontinent assets for a staggering $455 million in cash from a private seller.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.