Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

February Top U.S. Midstream Deals: Delaware Appears As the Key Area

03/04/2019

As production in key locations continue to steadily grow, most midstream companies continued expanding their infrastructure to connect their major producing areas to the promising market delivery locations. Delaware saw most of this activity, where gathering infrastructure is still thought to be underdeveloped. Experts point out the proximity of Mexican and U.S. Gulf of Mexico market as well as growth of the U.S. exports capacity to be primary drivers of CAREX going into new projects.

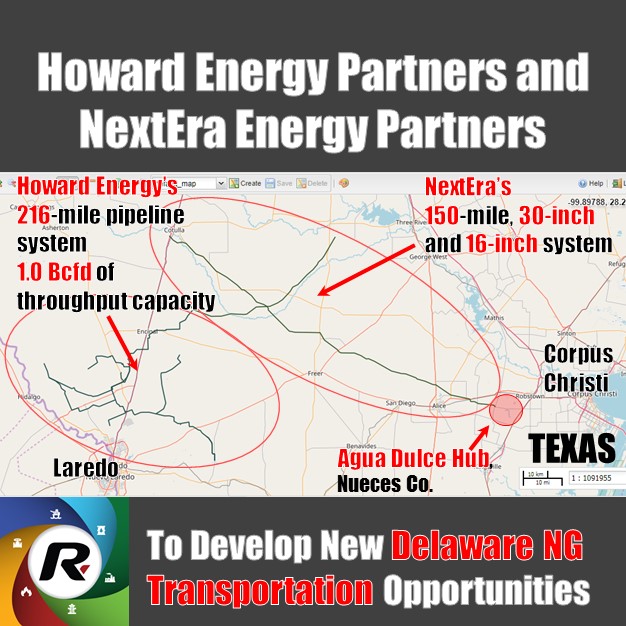

For instance, see how Howard Energy Partners and NextEra Energy Partners connect their systems to reach both domestic downstream as well as exports market.

Similar capital inflow was seen in Agua Blanca NG Pipeline Deal as First Infrastructure Capital Advisors increased its stake in the pipeline.

Another activity - not quite in Delaware but close enough - was seen at New Mexico - Texas border area, where Matador Resources continued expand its gathering, storage and processing facilities as it enetered the San-Mateo II JV, second one with Five Point Energy.

All the midstream sector February 2019 deals that drew our attention can be found in the table below.

More information still can be discovered with Rextag's Energy Datalink as well as with its GIS data services. Request a free-trial access with us today.

| Date announced | Buyer(s) | Seller(s) | Assets | Location | Deal Value | Date closed |

|---|---|---|---|---|---|---|

| Feb 4, 2019 | First Infrastructure Capital Advisors LLC | WPX Energy Inc. | 20% equity interest in WhiteWater Midstream’s 36-inch Agua Blanca natural gas pipeline (see the map) | Delaware Basin | $300 MM | Expected to close 1Q 2019 |

| Feb 4, 2019 | First Infrastructure Capital Advisors LLC | WhiteWater Midstream LLC, Denham Capital Management LP, Ridgemont Equity Partners | WhiteWater Midstream wholly acquired including its 60% stake in Agua Blanca (see the map) | Expected to close 1Q 2019 | ||

| Feb 13, 2019 | NextEra Energy Partners LP | >Howard Energy Partners | Formed JV to develop additional natural gas transportation opportunities in the Eagle Ford shale region of South Texas | South Texas: Webb, Duval, Zapata, Dimmit, La Salle, McMullen, Live Oak and Jim Wells counties | Undisclosed | Feb 13, 2019 |

| Oct 3, 2018 | Salt Creek Midstream LLC, Ares Management LP ARM, Energy Holdings LLC | Noble Midstream Partners LP | Formed 50/50 JV partnership to develop a crude oil pipeline and gathering system | Delaware Basin | Feb 8, 2019 | |

| Feb 19, 2019 | The Blackstone Group LP, GSO Capital Partners LP | Targa Resources Corp. | 45% stake in Targa Badlands, which operates oil and gas gathering and processing assets (see the map) | Bakken and Three Forks shale plays, Williston Basin of ND. | $1,600 MM | Expected to close 2Q 2019 |

| Feb 25, 2019 | Five Point Energy LLC, San Mateo Midstream LLC | Matador Resources Co. | Formed a new midstream JV, San Mateo II, to expand current gathering, processing and saltwater disposal capacity. 51% owned by Matador plus operational control | Northern Delaware Basin | Undisclosed | Feb 25, 2019 |

| Feb 26, 2019 | Hess Infrastructure Partners LP | Summit Midstream Partners LP | Water gathering assets of the Tioga Gathering System in Williams County, Western ND. | Williston Basin; Bakken | $67 MM | Expected to close 1Q 2019 |

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Energy Transfer Secures $7.1 Billion Deal to Take Over Crestwood

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/176Blog_Crestwood's assets to be acquired in Williston, Delaware, and Powder River basins.png)

Energy Transfer is taking on $3 billion of Crestwood's debt in a stock deal. This move expands their reach in the Williston and Delaware basins and gets them into the Powder River Basin for the first time.

The green trend: TC Energy pledges to be carbon-free by 2050

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/TC_Energy_carbon-free_greenhouse-gas_emissions_ESG_midstream_GIS_NG_data_hydrogen_pipeline_maps.png)

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.