Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Appalachian O&G Basin 2022 Review

04/20/2023

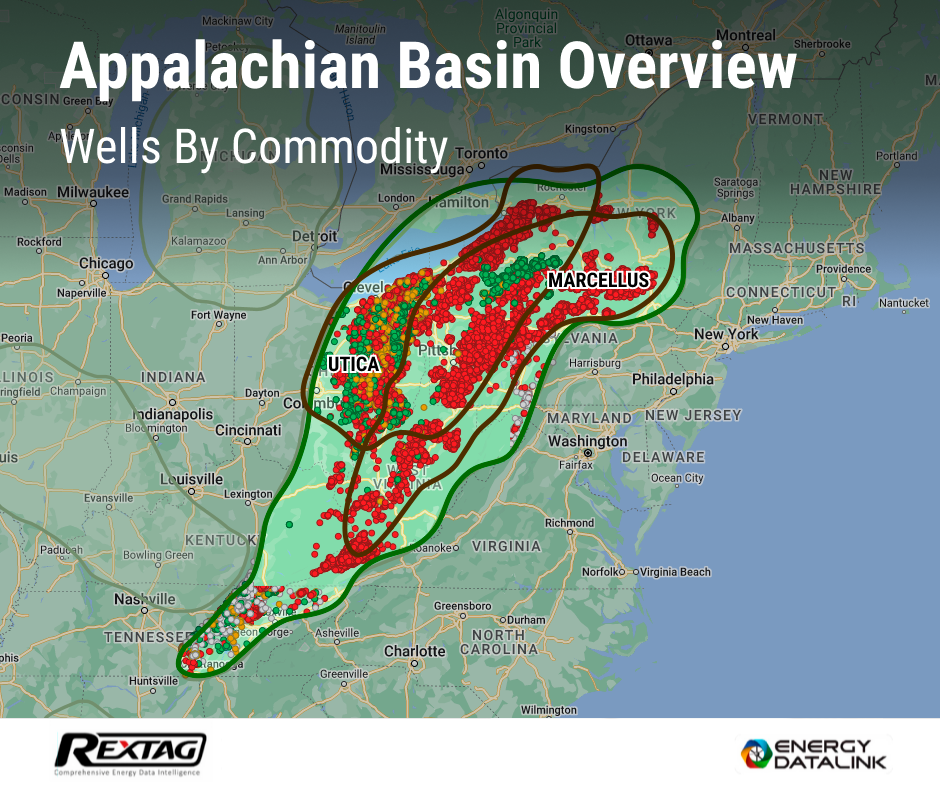

The Appalachian oil and gas basin is a geological formation that spans several states in the eastern United States, including Pennsylvania, West Virginia, Ohio, and New York. It is one of the largest natural gas reserves in the world, with estimates of recoverable natural gas exceeding 141 trillion cubic feet.

The Marcellus Shale formation was formed over 350 million years ago and is composed of sedimentary rocks. Initially, the Marcellus Shale was not considered a significant source of natural gas due to the low permeability of the rock, which made it difficult for gas to flow through it and be extracted. However, with the development of hydraulic fracturing and horizontal drilling technologies in the early 2000s, it became economically viable to extract natural gas from the Marcellus Shale, and it has since become a major source of natural gas production in the United States.

The commence of drilling and producing in the Appalachian Basin

Oil and gas drilling has been taking place in the Appalachian Basin for over 150 years, with the first oil well in the region drilled in 1859 in Titusville, Pennsylvania.

In the late 1800s and early 1900s, oil and gas production in the Appalachian Basin was focused on conventional reservoirs, which were relatively easy to access and produced large volumes of oil and gas. By the mid-1900s, many of these reservoirs had been depleted, and production in the region began to decline.

In the 1970s and 1980s, drilling technology and techniques improved, and operators began to target deeper, unconventional reservoirs in the Appalachian Basin. This led to a resurgence in oil and gas production in the region.

The Marcellus Shale, which is located deep underground and spans several states in the Appalachian Basin, was first identified as a potential source of natural gas in the 1990s. However, it wasn't until the early 2000s that advances in hydraulic fracturing and horizontal drilling made it economically feasible to extract natural gas from the shale.

The first Marcellus Shale well was drilled in 2004 in Washington County, Pennsylvania, and production quickly ramped up in subsequent years. By 2011, the Appalachian Basin was the largest producer of natural gas in the United States, and it has remained a major producer ever since.

In addition to natural gas, the Appalachian Basin also produces oil and natural gas liquids (NGLs) such as ethane, propane, and butane. These resources are often processed and transported to other parts of the country for use in manufacturing, transportation, and heating. As of 2021, the Appalachian Basin is one of the most productive natural gas regions in the world.

The first and best-known producers in the Appalachian basin.

The Appalachian Basin has a long history of oil and gas exploration and production, with many different companies involved over the years.

Standard Oil, founded in 1870 by John D. Rockefeller, was one of the first major oil companies in the United States. It played a significant role in the early development of the Appalachian Basin, particularly in Pennsylvania, where it controlled many of the region's oil refineries and pipelines. Standard Oil also owned drilling operations in Ohio and West Virginia.

Founded in 1901, Gulf Oil was another major player in the Appalachian Basin. It owned several large refineries in Pennsylvania and had extensive drilling operations throughout the region. At its peak, Gulf Oil was one of the largest oil companies in the world.

The modern-day ExxonMobil company can trace its roots back to the early 1900s, when the Standard Oil Trust was broken up by the U.S. government. One of the resulting companies, Standard Oil of New Jersey, eventually became ExxonMobil. Today, ExxonMobil is one of the largest producers of oil and natural gas in the world, and it has significant operations in the Appalachian Basin.

Another major oil and gas company with operations in the Appalachian Basin is Chevron. The company was formed in 1984 through the merger of Chevron and Gulf Oil, both of which had extensive operations in the region.

Range Resources was one of the first companies to begin developing the Marcellus Shale in the early 2000s. The company is based in Texas but has significant operations in Pennsylvania, where it is one of the largest producers of natural gas from the Marcellus. Range Resources has also been a leader in the use of horizontal drilling and hydraulic fracturing techniques in the region.

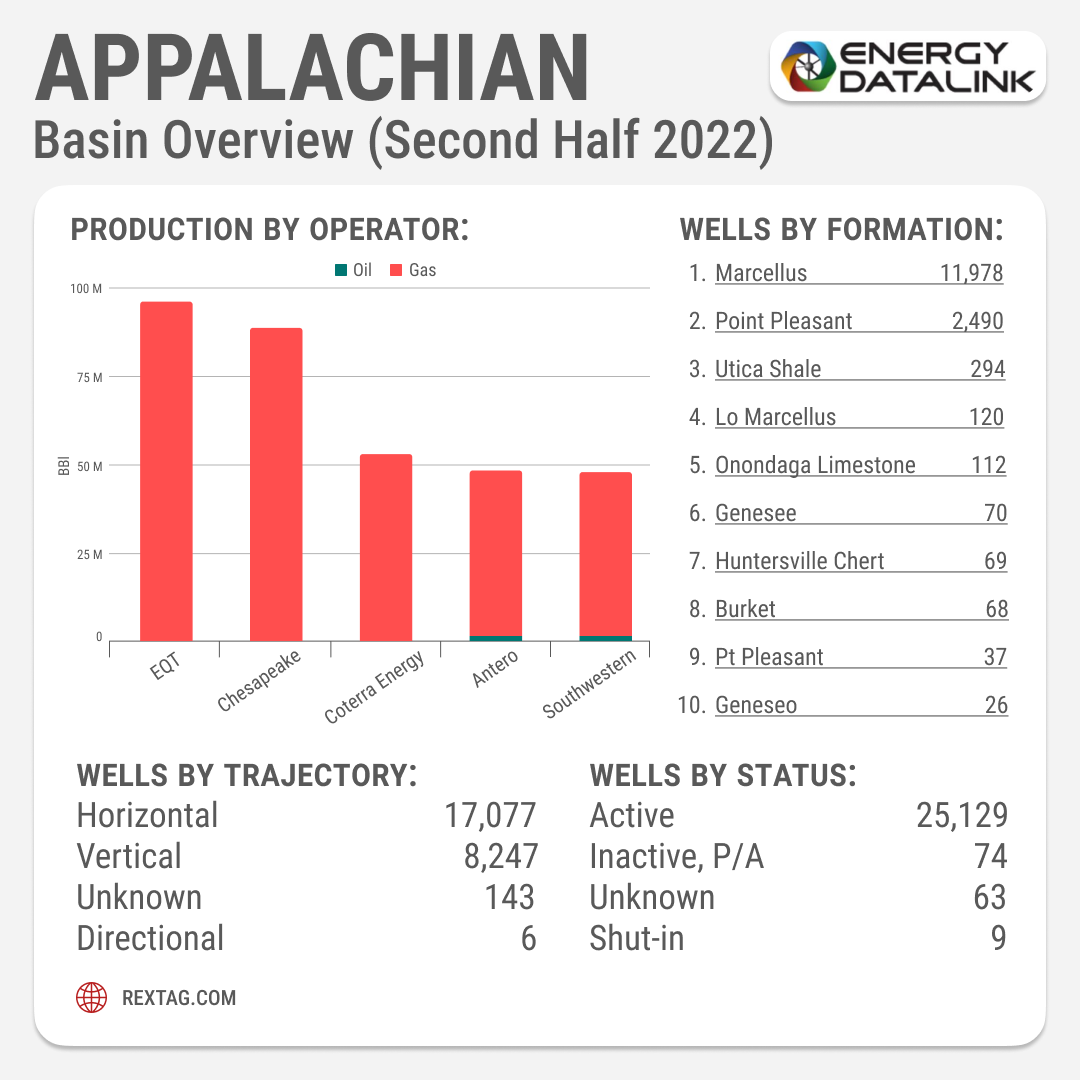

EQT is another major player in the Appalachian Basin, with significant operations in Pennsylvania, West Virginia, and Ohio. The company was founded in 1888 as Equitable Gas Company and has since expanded into natural gas exploration and production. Today, EQT is one of the largest natural gas producers in the United States, and it has been a major player in the development of the Marcellus Shale.

These companies are still active in the Appalachian Basin and in the broader energy industry today, although their operations and strategies have evolved over time.

Standard Oil was broken up into several smaller companies in the early 1900s, including Exxon and Mobil (which later merged to form ExxonMobil). Today, ExxonMobil is one of the largest publicly traded energy companies in the world, with operations spanning oil and gas exploration, refining, and marketing.

Gulf Oil was acquired by Chevron in 1984, and today Chevron is one of the largest energy companies in the world, with operations in over 180 countries. In the Appalachian Basin specifically, Chevron has interests in natural gas exploration and production, including in the Marcellus and Utica shale plays.

ExxonMobil continues to be a major player in the energy industry, with operations spanning oil and gas exploration, refining, and marketing. In the Appalachian Basin, ExxonMobil has interests in natural gas exploration and production, as well as in the development of new technologies for carbon capture and storage.

In the Appalachian Basin, Chevron has interests in natural gas exploration and production, including in the Marcellus and Utica shale plays.

Range Resources continues to be a major player in natural gas exploration and production in the Appalachian Basin, with significant interests in the Marcellus and Utica shale plays. The company has also been a leader in the development of new technologies for hydraulic fracturing and horizontal drilling.

EQT is one of the largest natural gas producers in the United States, with significant operations in the Appalachian Basin. The company has interests in both the Marcellus and Utica shale plays, and has been a leader in the development of new technologies for hydraulic fracturing and horizontal drilling. EQT has also been expanding into renewable energy, with a focus on solar power development.

Has the unconventional drilling age changed the Appalachian?

Fracking technology and horizontal drilling have had a significant impact on the oil and gas industry in the Appalachian Basin, leading to the emergence of the unconventional drilling era.

Prior to the emergence of fracking and horizontal drilling techniques, the Marcellus and Utica shales in the Appalachian Basin were considered uneconomical to produce. However, the use of these techniques has allowed for the extraction of vast amounts of natural gas and oil from these formations.

The use of fracking and horizontal drilling has led to a significant increase in natural gas and oil production in the Appalachian Basin. This has made the United States a major player in the global energy market and has helped to reduce dependence on foreign oil.

The increase in natural gas production in the Appalachian Basin has led to a shift away from coal and other fossil fuels in the region. Natural gas has become the primary source of energy for electricity generation in many parts of the region.

What were the major technological challenges that the O&G companies faced when continuing working in the Appalachian in 2010 and after?

Although the development of fracking and horizontal drilling techniques has enabled the extraction of vast amounts of natural gas and oil from the Appalachian Basin, there were still several major technological challenges that the oil and gas industry faced when continuing to work in the region in 2010 and after.

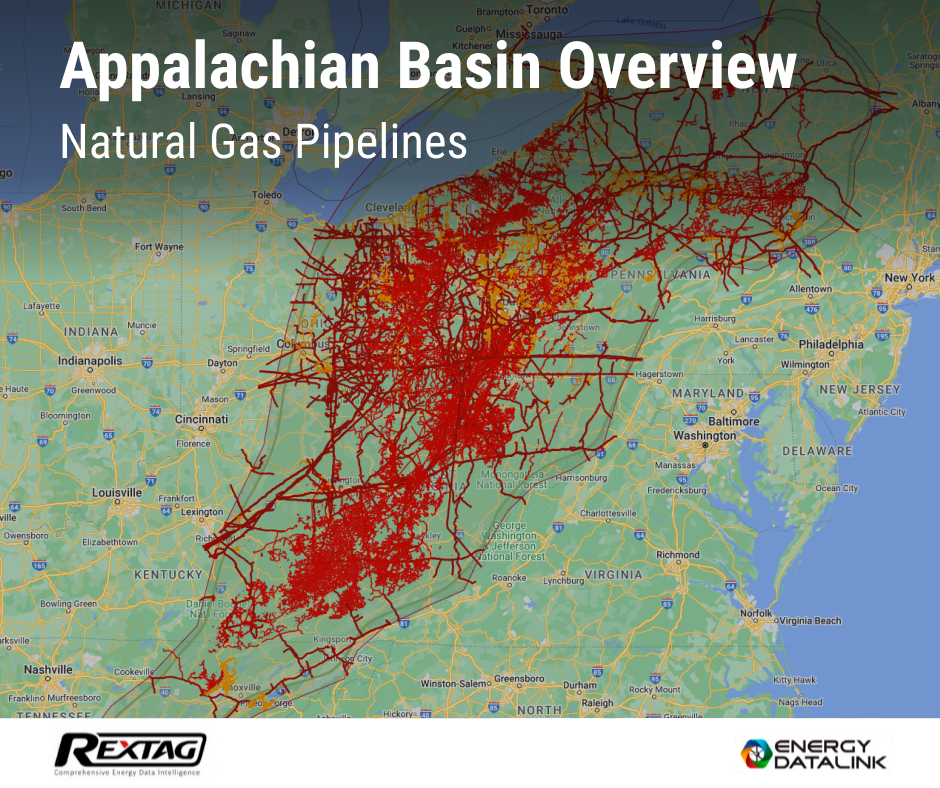

The increase in natural gas production in the Appalachian Basin has led to a need for new pipeline infrastructure to transport the gas to markets. This has been a significant challenge, as many communities and landowners have opposed new pipeline construction.

Fracking requires significant amounts of water to be injected into shale formations to extract the gas and oil. This has led to concerns about the amount of water that is being used and the potential impact on local water supplies. In addition, there are concerns about the disposal of wastewater that is generated during the fracking process.

Fracking and horizontal drilling have raised concerns about the potential environmental impacts of oil and gas production in the Appalachian Basin. This includes concerns about air and water pollution, as well as the potential impact on local ecosystems and wildlife.

The development of fracking and horizontal drilling techniques has outpaced regulatory oversight in some cases, leading to concerns about the safety and environmental impact of these activities. The industry has faced regulatory challenges related to issues such as water usage, wastewater disposal, and air pollution.

The biggest drops in production

The oil and gas industry in the Appalachian Basin has faced several periods of decline in production, with the most notable drop occurring in 2020 due to the COVID-19 pandemic and subsequent economic downturn. Here are some of the key reasons for the drops in production and what the industry did to survive:

The oil and gas industry is closely tied to the broader economy, and declines in economic activity can lead to drops in demand for natural gas and oil. This was the case during the economic downturns of the early 1980s and 2008, which led to significant drops in production in the Appalachian Basin. In response, the industry reduced drilling activity and focused on efficiency and cost-cutting measures to survive.

The shale revolution in the United States led to a significant increase in natural gas production, which in turn led to a drop in prices. This was particularly true in the Appalachian Basin, where there was a significant increase in production from the Marcellus and Utica shales. Low prices made it difficult for some companies to remain profitable, leading to a drop in production. In response, the industry focused on efficiency and reducing costs through improved drilling techniques and better technology.

The COVID-19 pandemic led to a drop in demand for natural gas and oil as economic activity slowed down. This led to a significant drop in production in the Appalachian Basin in 2020. In response, the industry once again focused on reducing costs and improving efficiency to survive the downturn.

What environmental challenges the Appalachian basin has faced?

The Appalachian Basin has faced a range of environmental challenges related to oil and gas production.

Fracking involves injecting large volumes of water and chemicals into shale formations to release natural gas and oil. This process can lead to contamination of groundwater and surface water if the wastewater is not properly managed and disposed of.

Oil and gas production can release pollutants such as volatile organic compounds, nitrogen oxides, and particulate matter into the air. This can have negative impacts on air quality and human health, especially in areas with high levels of oil and gas activity.

Oil and gas production often requires clearing of forests and other natural habitats, which can have negative impacts on wildlife and biodiversity.

The burning of fossil fuels such as natural gas and oil is a major contributor to greenhouse gas emissions, which are a primary driver of climate change. The increase in natural gas production in the Appalachian Basin has led to concerns about its impact on climate change.

There have been concerns about the potential for fracking to cause earthquakes in the Appalachian Basin, particularly in areas with high levels of oil and gas activity.

Mergers and acquisitions

Mergers and acquisitions (M&A) have been a common occurrence in the oil and gas industry, including in the Appalachian Basin.

In the early 2000s, there was a wave of consolidation in the natural gas industry in the Appalachian Basin. This was driven by a desire for increased scale and efficiencies, as well as a response to low natural gas prices. Companies such as EQT, Range Resources, and Chesapeake Energy were involved in a number of major M&A deals during this period.

The mid-2010s saw another period of consolidation in the natural gas industry in the Appalachian Basin. This was driven in part by the growth of shale gas production, which created opportunities for companies to acquire assets and increase their scale. Companies such as EQT, Rice Energy, and Antero Resources were involved in major M&A deals during this period.

In more recent years, M&A activity in the Appalachian Basin has slowed somewhat, as the industry has faced a range of challenges including low natural gas prices, environmental concerns, and increased regulatory scrutiny. However, there have still been some notable deals, such as Chevron's acquisition of Noble Energy in 2020.

What technologies have recently been implemented by companies in the Appalachian to keep producing oil and gas with maximum efficiency?

Oil and gas companies operating in the Appalachian Basin have implemented a range of technologies in recent years to improve efficiency and optimize production.

Companies have been using advanced drilling techniques such as horizontal drilling and hydraulic fracturing to maximize oil and gas production from wells. These techniques involve drilling horizontally through shale formations and injecting fluids at high pressure to release oil and gas trapped within the rock.

Sensors and monitoring systems are being used to optimize production and reduce costs. For example, downhole sensors can be used to measure temperature, pressure, and other parameters in real-time, allowing operators to make adjustments and optimize production.

Automation is being used in a range of areas, from drilling and well completion to production operations. This can include the use of autonomous drilling rigs, remotely operated wellheads, and other technologies that can reduce costs and improve safety.

Companies are using digital technologies such as artificial intelligence (AI), machine learning, and predictive analytics to optimize production and reduce costs. These technologies can be used to analyze large amounts of data and make predictions about well performance and production trends.

Companies are also investing in environmental technologies to reduce the environmental impact of oil and gas production. This can include technologies such as water treatment and recycling systems, methane detection and capture systems, and other measures to reduce greenhouse gas emissions.

What is the importance of the Appalachian for the rest of the O&G industry in the US?

The Appalachian Basin is an important region for the oil and gas industry in the United States for several reasons:

- Natural gas production: The Appalachian Basin is one of the largest natural gas-producing regions in the United States. The development of shale gas resources using hydraulic fracturing and horizontal drilling has transformed the region into a major natural gas producer, helping to reduce U.S. dependence on foreign natural gas imports.

- Petrochemical production: The region's abundant natural gas resources have also spurred the growth of the petrochemical industry in the United States. Ethane and other natural gas liquids (NGLs) produced in the Appalachian Basin are used as feedstocks for the production of chemicals and plastics, driving economic growth and job creation in the region.

- Energy security: The Appalachian Basin's abundant natural gas resources have helped to improve U.S. energy security by reducing reliance on foreign energy sources. This has important geopolitical implications, as it reduces the need for the United States to rely on unstable or unfriendly foreign suppliers of oil and gas.

- Infrastructure: The region's natural gas production has also driven investment in infrastructure such as pipelines, processing plants, and export facilities, creating jobs and economic growth in the region and across the country.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

The Denver-Julesburg Basin Overview

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Post 146 Blog Denver-Julesburg Basin Overview.png)

Geologically, the Denver-Julesburg (DJ) Basin is a large structural basin with a complex history of sedimentary deposition, tectonic activity, and hydrocarbon generation. The basin covers approximately 20,000 square miles and extends into parts of Colorado, Wyoming, Nebraska, and Kansas. It is primarily composed of several stacked formations, including the Niobrara, Codell, and Greenhorn formations, which contain significant amounts of oil and gas reserves.

The Final Stretch: Energy Transfer Pushes For Mariner East Project Ahead Of The Stunning Q3 Results

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Energy-Transfer-Pushes-For-Mariner-East-Project-Ahead-Of-The-Stunning-Q3-Results .png)

Energy Transfer's lead in the world's NGL exports booked the company another successive quarter. With a global market share of almost 20%, the company is nigh unstoppable. But will it be enough to, finally, push the Mariner East project over the edge? If everything goes as planned, Mariner East's last segment could be operational by the end of the first half of 2022.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.