Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

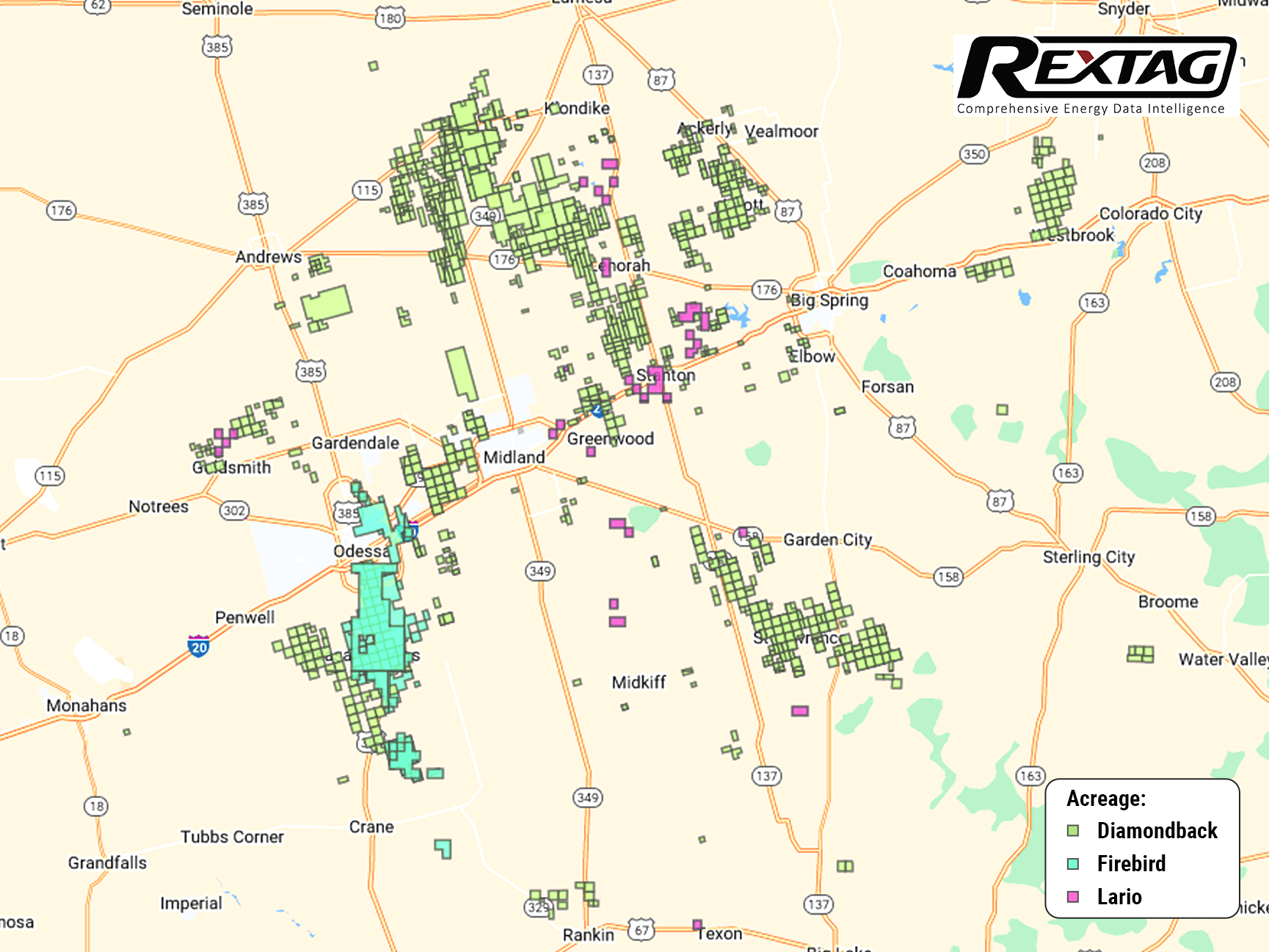

$1.55 Billion Deal, Diamond Energy Acquires Lario Permian

12/14/2022

On November 16 Diamondback Energy Inc. decided to expand in the Midland portion of the Permian Basin with the acquisition of Lario Permian LLC in a $1.55 billion cash-and-stock transaction.

The Permian operator announced another billion-dollar agreement to purchase FireBird Energy LLC, a private Midland Basin operator. In total, Diamondback is paying almost $3.3 billion to extend in the Midland Basin.

When combined with the pending FireBird acquisition, Diamondback is increasing its Midland Basin footprint by roughly 83,000 net acres, is adding 500 high-quality drilling opportunities that compete for capital with the current development plan and is raising the 2023 production profile by almost 37,000 bbl/d of oil (50,000 boe/d).

In 2007, Diamondback started with 10,000 acres in Midland Basin and has since built up to 500,000 acres in the Permian today.

The acquisition of Lario Permian adds about 25,000 gross (15,000 net) acres and over 150 gross locations in the core of the northern Midland Basin. Full-year 2023 estimated average production of about 18,000 bbl/d of oil (25,000 boe/d).

Founded in 1927, Lario Oil & Gas has operated throughout both the U.S. and Canada concentrating its resources and capital on rate-of-return driven projects. Over the last several years, Lario divested over $500 million worth of properties, according to the company website.

Lario buys a chunk of its Permian footprint in 2017 with the $345 million acquisition of 10,000 net acres mainly in Midland and Martin counties.

Meanwhile, Diamondback purchases all leasehold interest and related assets of Lario Permian from Lario Oil & Gas and certainly associated sellers in exchange for 4.18 million shares of Diamondback common stock and $850 million of cash.

The cash portion of this transaction is anticipated being funded through a combination of cash on hand, borrowings under the Diamondback’s credit facility, and/or proceeds from senior notes offering.

The cash outlay at closing is anticipated being roughly $775 million because of the expected free cash flow to be generated by the bought assets between the deal's effective date of November 1 and the closing date, which is expected to be January 31.

The transaction is estimated at almost 3.3x 2023 EBITDA with a 21% unlevered free cash flow yield at strip pricing. According to the company release, it is reducing the operated rig count from 2 now to 1 or less post-closing for 2023 development.

Jefferies LLC is serving as financial adviser to Diamondback and Kirkland & Ellis LLP is serving as legal adviser to Diamondback.

J.P. Morgan Securities LLC is serving as financial adviser to Lario and the associated sellers and Vinson & Elkins LLP and Boigon Law Ltd. are serving as legal advisers to Lario and the associated sellers.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Diamondback Acquires FireBird In Midland, For $1.6 Bln

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/99Blog_Diamondback_Acquires_FireBird_10_2022.png)

FireBird Energy LLC, a private Midland Basin operator backed by RedBird Capital Partners and Ontario Teachers’ Pension Plan, purchases Diamondback Energy Inc. in a cash-and-stock transaction estimated at almost $1.6 billion, according to a company release on Oct. 11. Moreover, Diamondback also unveiled an aim to sell not less than $500 million of noncore assets by year-end 2023, with proceeds earmarked for further debt reduction, to support the Midland, Texas-based company’s pledge to reward shareholders.

SM Energy Acquires 20,000 Acres in Texas for $90.6M

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/171Blog_SM Energy Buys 20,000 Acres in Dawson and north Martin Texas in Q2 2023.png)

SM Energy acquired 20,000 net acres in Dawson and north Martin counties in Texas, completing the transaction in cash. SM Energy Co., based in Denver, intends to expand on its success from the second quarter by increasing its drilling and completion activities in the coming quarter. This plan also includes preparations to develop the newly acquired land in the Midland basin. In June, the company's president and CEO, Herb Vogel, along with his team, raised their target for total oil and gas production for the second quarter to 13.9 MMboe, up from 13.4 MMboe. They exceeded this target, reaching nearly 14.1 MMboe, with oil making up 42% of that figure. During the quarter, SM Energy drilled 17 wells, with 12 located in South Texas and five in the Midland basin. They also completed 25 wells, 17 of which were in the Midland basin.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.