Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Canadian Assets on Sale: Energy Transfer Sells Gas Processing Bussines to Pembina-KKR for $1.3 Billion

04/19/2022

Under the agreement, Energy Transfer will sell its 51% interest in Energy Transfer Canada to the Pembina-KKR joint venture, for more than CA$1.6 billion (US$1.3 billion) including debt and preferred equity. KKR's funds already own the remaining stake.

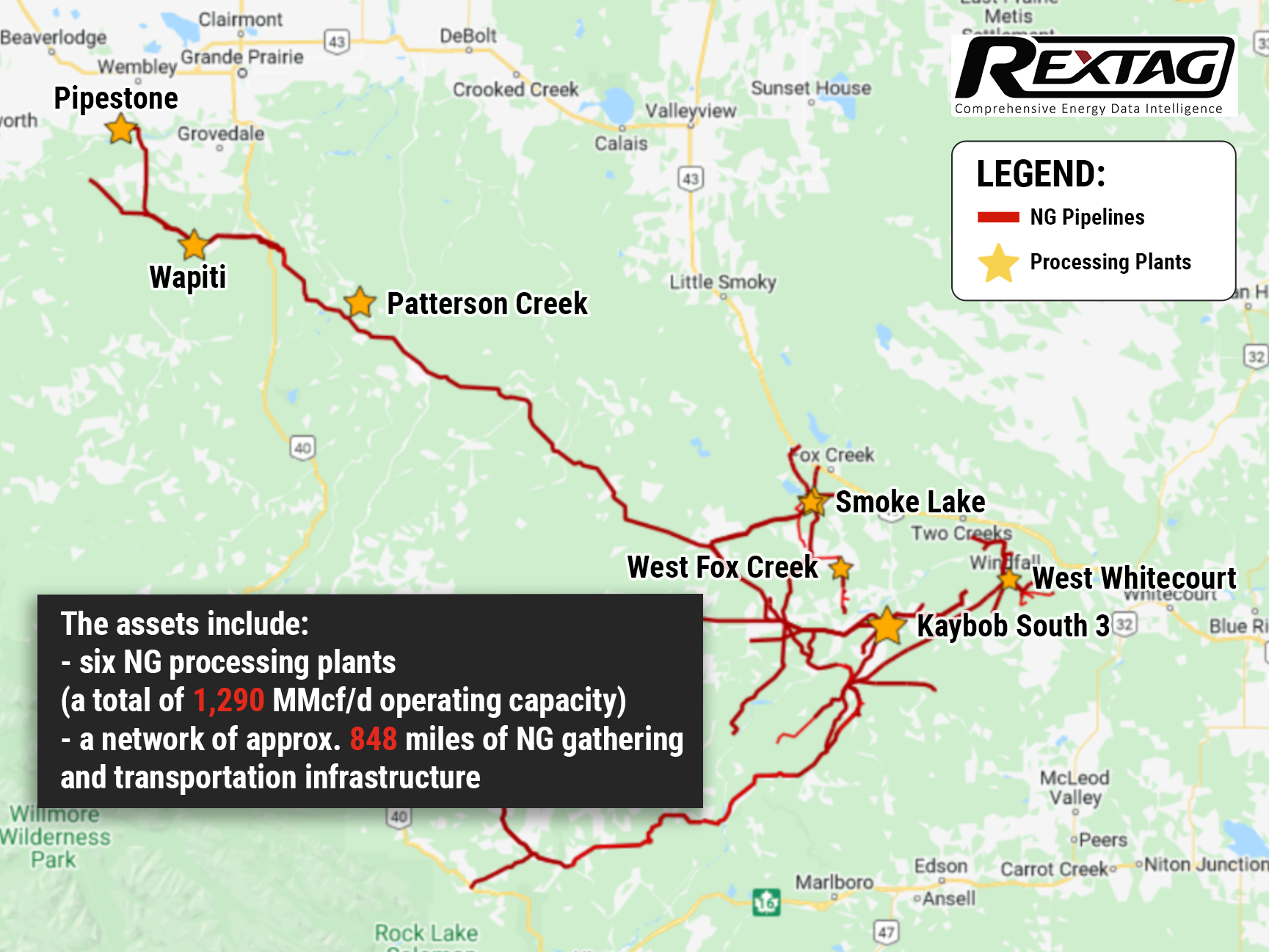

TC’s assets include six natural gas processing plants with a combined operating capacity of 1.29 Bcf/d and an 848-mile natural gas gathering and transportation network in the Western Canadian Sedimentary Basin.

Through this agreement, Energy Transfer will be able to divest its high-quality Canadian assets at an attractive valuation, deleveraging its balance sheet and allowing it to redeploy capital within the U.S. market.

The Calgary-based company, Energy Transfer Canada, is one of Alberta's largest gas processors. As part of its portfolio of assets, the company owns six gas processing plants with a combined capacity of 1,290 MMcf/d, as well as a network of approximately 848 miles of natural gas gathering and transportation infrastructure.

As a result of the sale, Energy Transfer is slated to receive cash proceeds of approximately 340 million Canadian dollars (US$270 million), and close by the third quarter of 2022.

While this process is underway, Pembina and KKR will combine their western Canadian natural gas processing assets into a single, new joint venture entity — Newco, owned 60% by Pembina and 40% by KKR. Pembina will also be Newco's operator and manager.

This new entity will acquire Pembina's field-based natural gas processing, Veresen Midstream's portfolio (55% owned by KKR funds, 45% by Pembina), and ETC's business. And is expected to have a natural gas processing capacity of about 5 Bcf/d or about 16% of Western Canada’s total processing capacity. The worth of this joint venture will be around CA$11.4 billion (US$8.99 billion).

It is expected that all the deals will close late in the second or third quarter. According to Pembina, it plans to sell its interest in its Key Access Pipeline System as a way to finance the deal, and it is reviewing its portfolio for other noncore, nonoperating assets that might be sold in the process.

After the deal closes, Pembina plans to raise its dividend by 3.6%, as well as raise its share repurchase target to CA$350 million (US$275 million) from CA$200 million.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Decades of free inventory from one deal: Vermilion Energy buys Leucrotta Exploration for $477 million

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/57blog_Vermilion_Acquires_Leucrotta's_Montney_Assets_2022.png)

As part of its effort to expand its Montney Shale play, Vermilion Energy Inc. recently acquired Leucrotta Exploration Inc. for a net cash purchase price of CA$477 million. Vermilion has identified 275 high-quality, high-return, low-risk multi-zone drilling prospects. Top management believes, these prospects represent 20 or more years of low-risk, self-funding, high-deliverability shale drilling. Assuming the anticipated May closing date, Vermilion is increasing its capital budget for E&D in 2022 to $500 million and increasing guidance for production from 86,000 to 88,000 boe/d to take into account the Leucrotta acquisition.

Pine Wave Energy and Silver Hill Reached an Agreement Over Haynesville Assets — Deal is Sealed

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Pine_Wave_Energy_assets_on_sale_in_Haynesville.png)

Looks like Pine pulled the plug on its properties in Caddo Parish, Louisiana, and Harrison and Panola counties, Texas. Which includes a total of 12,500 acres and ownership interests in 10 operated wells with a production capacity of 100 million cubic feet per day along with 18 miles of naturalgas gathering pipelines. Did Pine just give up on Haynesville?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.