Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Ranger Oil Acquisition by Baytex: Boosting Shareholder Returns and Introducing Dividend with Improved Free Cash Flow in Eagle Ford Operations

03/29/2023

Baytex Energy, a Canadian oil and gas company, has announced its acquisition of Ranger Oil, an Eagle Ford operator based in Texas, in a deal worth $150 million. The acquisition will accelerate Baytex's shareholder returns and introduce a dividend with enhanced free cash flow.

With this acquisition, Baytex is set to expand its operations in the Eagle Ford region, one of the largest shale formations in the United States. Ranger Oil holds approximately 22,000 net acres in the region, with production averaging around 2,400 barrels of oil equivalent per day.

According to Baytex CEO Ed LaFehr, the acquisition will enhance the company's free cash flow and enable it to increase shareholder returns. The company plans to achieve this by optimizing Ranger Oil's production, reducing costs, and implementing efficient drilling and completion techniques.

LaFehr also stated that the acquisition aligns with Baytex's strategy of maintaining a strong balance sheet while continuing to grow its business. The company plans to fund the acquisition using its credit facility and expects the transaction to close in the fourth quarter of 2021.

The transaction includes

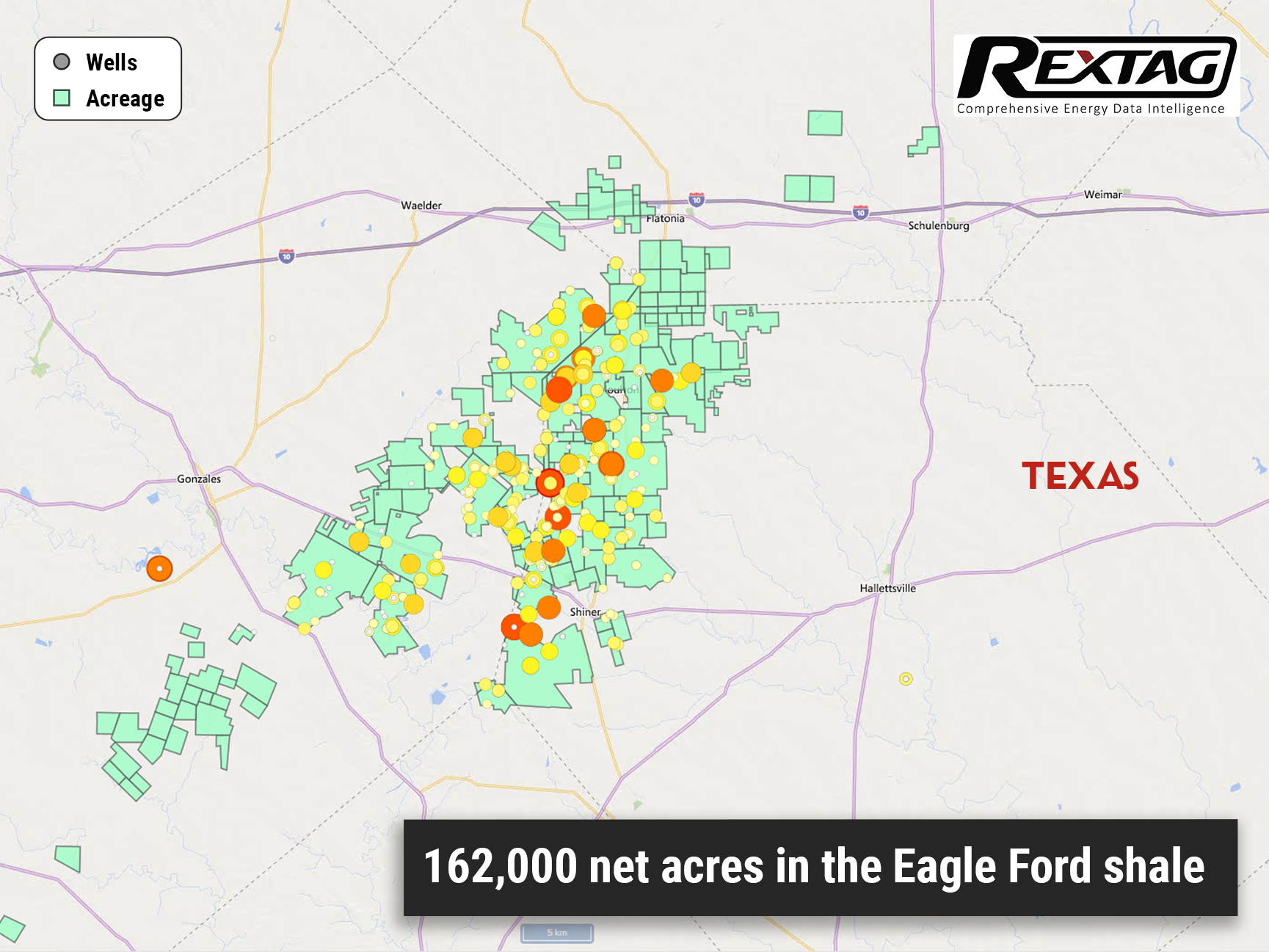

- Acquisition of 162,000 net acres in the crude oil window of the Eagle Ford shale, concentrated in Gonzales, Lavaca, Fayette, and Dewitt counties. The area is on-trend with Baytex's non-operated position in the Karnes Trough.

- Production of 67-70 Mboe/d (working interest), with 96% operated. The breakdown is 72% light oil, 15% NGLs, and 13% natural gas.

- 174 MMboe of proved reserves (working interest before royalties), comprising 120 MMbbls of tight oil, 27 MMbbls of NGLs, and 162 Bcf of shale gas.

- 258 MMboe of proved plus probable reserves (working interest before royalties), comprising 180 MMbbls of tight oil, 39 MMbbls of NGLs, and 232 Bcf of shale gas.

- Baytex's production is expected to average 155,000 to 160,000 boe/d (52% light oil, 22% heavy oil, 11% NGLs, and 14% natural gas) for the twelve months following closing.

An enhanced inventory of 741 net undrilled locations that immediately compete for capital in Baytex's portfolio. This represents an inventory life of 12 to 15 years and includes 523 quality Lower Eagle Ford opportunities and 218 additional Upper Eagle Ford and Austin Chalk opportunities. Baytex anticipates modest production growth from the acquired assets using two rigs and around 50 to 55 net wells per year.

Once the acquisition is complete, Baytex plans to recommend an initial quarterly dividend of $0.0225 per share ($0.09 per share annualized), representing a dividend yield of approximately 1.6%. This dividend is expected to be fully funded up to US$47/bbl WTI and would represent 4% of adjusted funds flow and 8% of free cash flow at US$75 WTI. The first dividend is expected to be paid in October 2023, subject to approval by the Baytex Board of Directors.

Baytex's balance sheet will remain a priority following the acquisition, with a total debt target of $1.5 billion, which represents approximately 1x total debt to EBITDA at US$50/bbl WTI. Once this debt level is achieved, Baytex plans to increase direct shareholder returns to 75% of free cash flow.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Energy Giant Baytex Makes a Bold Move: Snaps Up Ranger Oil in $2.5 Billion Deal

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/139Blog_Ranger Oil Acquisition by Baytex.png)

Baytex Energy Group has announced that it will acquire Eagle Ford exploration and production company, Ranger Oil, for approximately $2.5 billion in cash and stock, which includes taking over the company's existing debt. Upon the successful closure of the acquisition, Baytex will have a controlling stake of approximately 63% in the newly merged company, leaving Ranger shareholders with around 37%. This significant move is in line with a trend of substantial mergers and acquisitions in the Eagle Ford area, with Marathon Oil, Devon Energy, and Chesapeake Energy among the companies involved in recent transactions.

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/150Blog_Permian Resources Secures a Major Deal in the Thriving Delaware Basin.png)

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres. In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.