Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Chesapeake Sells Its Brazos Valley Assets to Be Sold for $1.43 Billion to WildFire Energy

02/02/2023

In order to sell its part of the sprawling Eagle Ford Shale acreage, Chesapeake Energy Corp. on January 18 concluded an agreement to trade its Brazos Valley region assets to WildFire Energy I LLC for $1.425 billion.

Chesapeake will maintain other assets in the Eagle Ford that at one time were estimated at from $4.6 billion to $5.9 billion by Enverus Intelligence Research, according to strip prices in mid-2022.

Chesapeake may have defied some expectations by selling to a private company, as in 2022 two high-profile Eagle Ford deals were transacted by public companies Devon Energy Corp. and Marathon Oil Corp. for privately-held E&Ps. Devon and Marathon Oil, spending a total of $4.8 billion in the mature shale play.

Chesapeake decided to sell roughly 377,000 net acres and almost 1,350 wells in the Brazos Valley, along with related property, plant, and equipment, the company said. A subsidiary Brazos Valley Longhorn LLC has been used to manage those assets. In 2019, Chesapeake acquired approximately 420,000 net acres from WildHorse Resource Development Corp. for almost $4 billion.

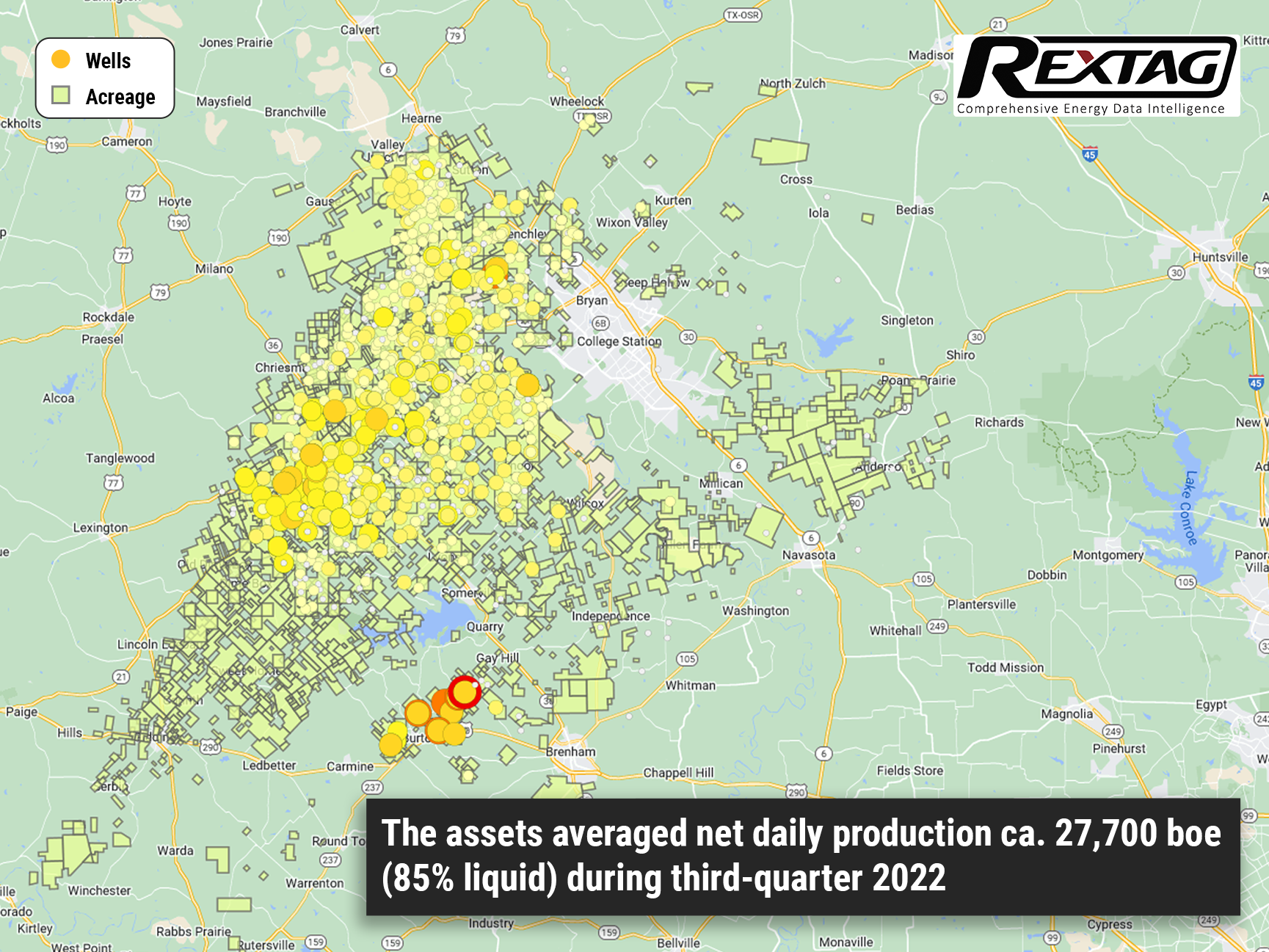

The assets sold to WildFire averaged net daily production of almost 27,700 boe (85% liquid) during the third quarter of 2022. As of December 31, 2021, net proved reserves associated with these properties were approximately 96.8 MMboe.

The company will collect $1.2 billion upon closing, subject to customary adjustments, with the additional $225 million received in yearly installments of $60 million over the next three years and a final $45 million payment in year four.

For WildFire, the purchase follows the company’s acquisition of MD America Energy in March 2022 and the acquisition of Hawkwood Energy LLC, which commenced the process of consolidating the basin in August 2021.

The Chesapeake purchase includes acreage in Burleson, Brazos, Robertson, Madison, Lee, Washington, and Grimes counties Texas.

Chesapeake said it expects proceeds will be used to repay borrowings under its revolving credit facility and be available for its share repurchase program. Chesapeake anticipated the WildFire transaction to close in the first quarter of 2023.

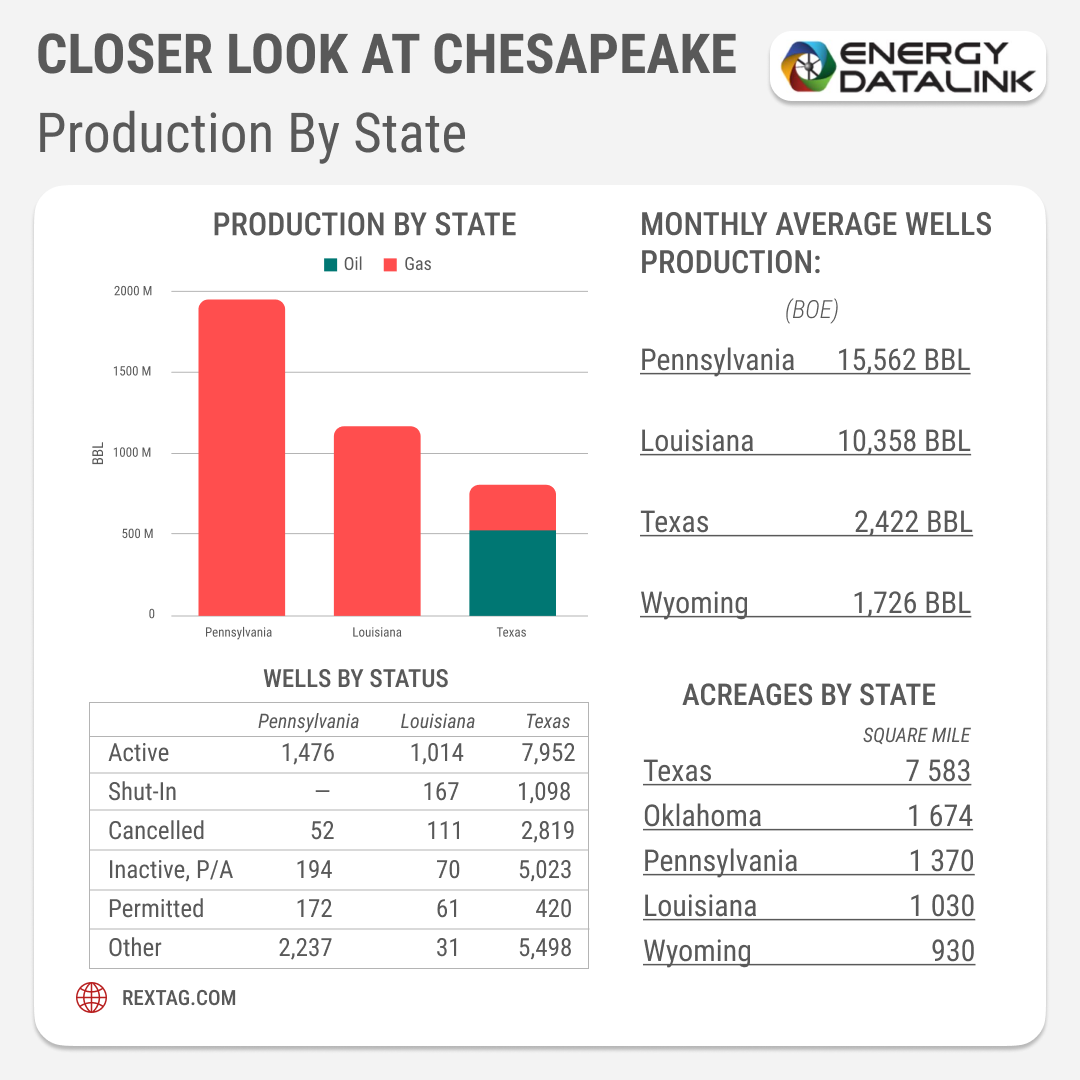

Chesapeake’s Eagle Ford divestiture comes as it pivots toward a focus on producing natural gas. Analysts had anticipated that, given the size of its holdings, the Oklahoma City-based company would look to divest its South Texas assets in pieces.

Also, Chesapeake is one of the largest operators in the Marcellus, having entered the area through an acquisition in 2005. The company's position is concentrated in northeast Pennsylvania with about 650,000 net acres under lease. Additionally, Chesapeake began developing natural gas in the Haynesville in 2008 and currently holds leases covering roughly 350,000 net acres.

RBC Capital Markets, Citi, and Evercore are serving as financial advisers, Haynes and Boone, LLP is serving as legal adviser, and DrivePath Advisors is serving as a communications adviser to Chesapeake.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Chesapeake Divests More Eagle Ford Assets; 172,000 n.a. and 2K+ Wells Sold to INEOS For $1.4 billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/133Blog_Chesapeake_Divests_More_Eagle_Ford_Assets.png)

Chesapeake Energy Corp. has announced that it will receive $1.4 billion from INEOS Energy for the sale of its remaining Eagle Ford asset, just a month after selling its Brazos Valley assets for a similar amount. This brings the total value of Chesapeake's Eagle Ford assets to over $2.82 billion. The Oklahoma City-based company will continue to market its other Eagle Ford assets.

Talos Energy Buys EnVen for $1.1 Billion to Expand

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/96Blog_Talos_Purchases_EnVen_2022_10.png)

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.