Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Arena Energy Makes a Deal with Cox in GoM, Adding ca. 1,000 net boe/d to Arena's Total Production

03/01/2023

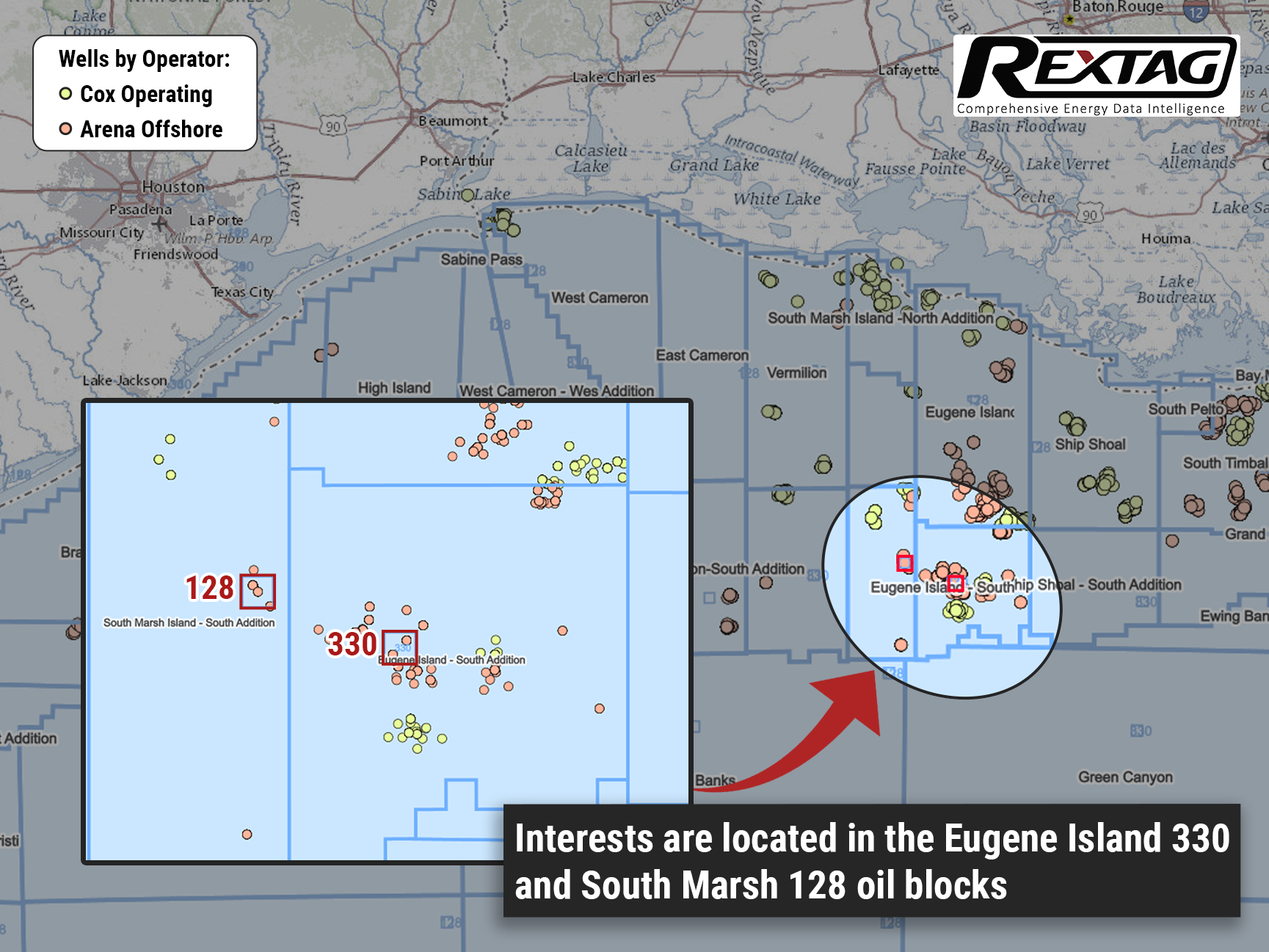

On January 24 Independent E&P Arena Energy LLC acquired Cox Operating LLC's interests in the Eugene Island 330 and South Marsh 128 oil blocks.

Cox Operating, based in Dallas, Texas, includes interests to Arena's existing ownership interest in the Gulf of Mexico fields, which it purchased from GOM Shelf LLC.

According to Arena co-founder and CEO Mike Minarovic, the transaction and the recent purchases from GOM Shelf, LLC, as well as the leases awarded under Lease Sale 257, guarantee many years of additional inventory, which let Arena proceed with producing some of the cleanest barrels for the U.S. and the world. All the interests include almost 1,000 net boe/d to Arena's total production.

The Woodlands, Texas-based Arena is one of the largest private offshore oil and natural gas producers with over 300 decommissioned wells and 45 platforms and other structures in the U.S. Gulf of Mexico.

Arena Energy primarily focuses on acquiring and developing oil and gas properties in the shallow waters of the Gulf of Mexico. The company's strategy is to acquire and develop assets with low-risk development opportunities and exploration potential.

Arena Energy has a highly experienced management team with a proven track record of success in the oil and gas industry. The company's management team has extensive knowledge of the Gulf of Mexico region and has successfully developed and operated numerous offshore oil and gas projects.

Meanwhile, Cox Operating is primarily focused on the Permian Basin region of West Texas and New Mexico. Cox is known for its strong technical capabilities and expertise in reservoir engineering and geology.

While both companies are privately held, Cox Operating stands out as a larger business compared to that of Arena Energy (by both production volumes and the number of employees).

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Targa Resources: $3.55 Billion Cash Transaction to Acquire Lucid Energy

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/73Blog_Targa Resources to Pay $3.55 Billion Cash to Acquire Lucid Energy.png)

On June 16 Targa Resources Corp. decided to acquire Lucid Energy Group, located in the Permian Basin, which is a part of Riverstone Holdings LLC and Goldman Sachs Asset Management. Firstly, Targa enlarged due to the recent “blot-on” acquisition of Southcross Energy in the Eagle Ford for $200 million and it will become bigger thanks to the $3.55 billion cash transaction. Targa’s financial position allowed it to utilize convenient opportunities to extend its company so it bought #Lucid using available cash and debt with an estimated pro forma year-end 2022 leverage around 3.5 times. According to Targa’s estimates, the acquisition of Lucid will increase the number of natural gas pipelines by 1,050 miles and add about 1.4 Bcf/d of cryogenic natural gas processing capacity in service or under construction located mainly in Eddy and Lea counties of New Mexico. The investment-grade producers source approximately 70% of current system volumes. According to the press release, a full-year standalone adjusted EBITDA is expected to be between $2.675 billion and $2.775 billion and reported year-end leverage ratio of about 2.7 times. Targa’s updated financial expectations assume NGL composite prices average $1.05 per gallon, crude oil prices average $100/bbl, and Waha natural gas prices average $6 per MMBtu for the remainder of 2022.

Riley Will Pay $330 MM to Acquire Assets in NM from Pecos Oil & Gas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/134Blog_Riley_Will_Pay_330_MM_to_Acquire_Assets_in_NM_from_Pecos_Oil_and_Gas.png)

Oklahoma City-based Riley Exploration Permian Inc. is extending its presence in New Mexico through the acquisition of oil and gas assets from Pecos Oil & Gas LLC, valued at $330 million in cash, according to the company's announcement on February 28.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.