Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Enterprise, Oxy Low Carbon Ventures Will Join Efforts on Houston Area CO2 Project

04/29/2022

Oxy Low Carbon Ventures and Enterprise Products Operating will partner in order to provide services to carbon emitters from Houston to Port Arthur, Texas, due to the development of CO2 transportation and sequestration.

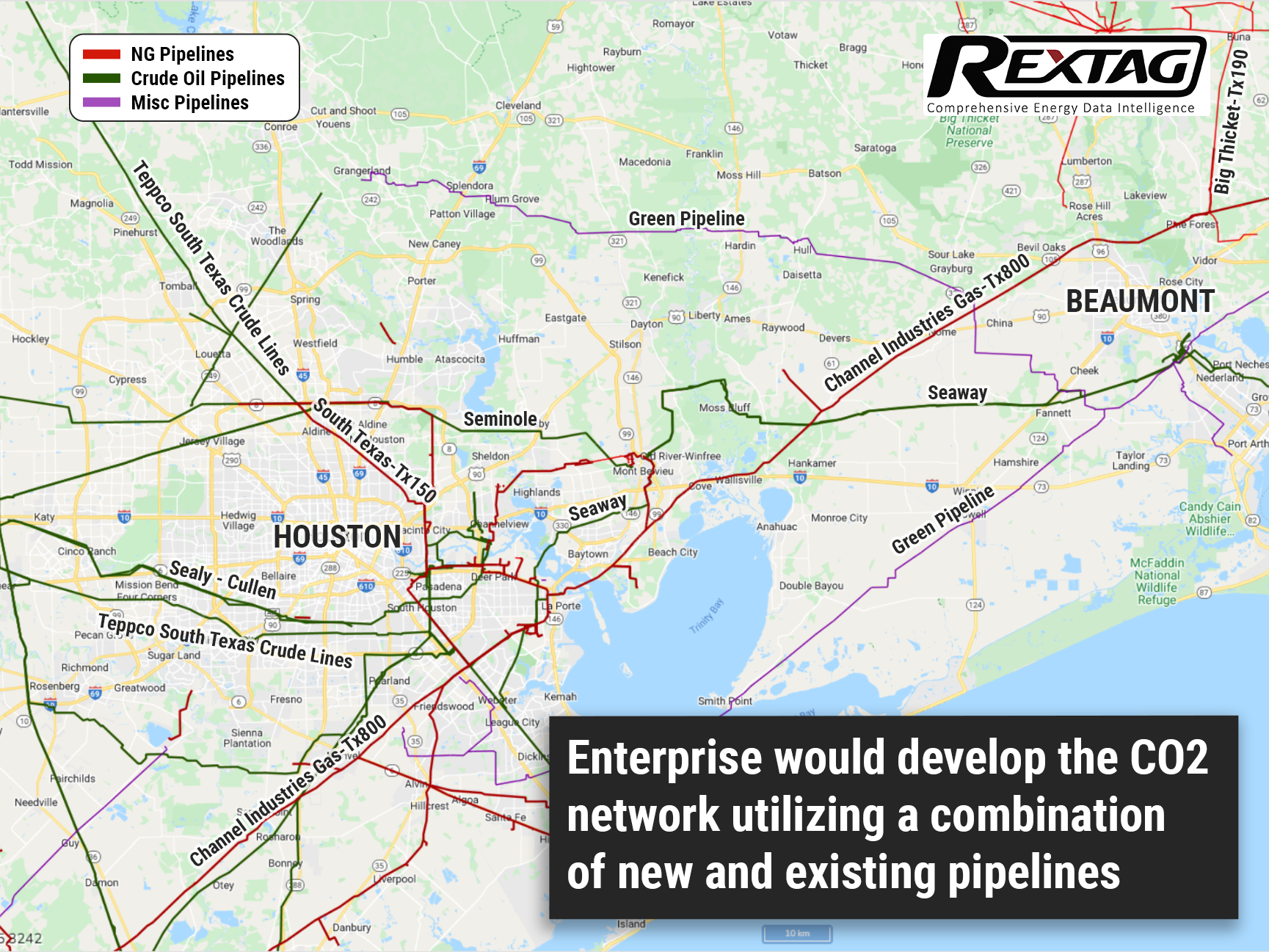

A letter of intent for a potential CO2 transportation and sequestration solution was inked on April 25 by Oxy Low Carbon Ventures (OLCV) and Enterprise Products Operating LLC (Enterprise). This joint project could primarily be focused on providing services to emitters in the industrial corridors from the greater Houston to Beaumont/Port Arthur in Texas, a region that is filled with refineries and petrochemical plants.

Due to the press release, the initiative would combine Enterprise’s leadership position in the midstream energy sector with OLCV’s extensive experience in subsurface characterization and CO2 sequestration.

“We look forward to collaborating with Enterprise to develop a sequestration solution to help industrial emitters reach their net-zero goals,” said Richard Jackson, Occidental president of U.S. onshore resources and carbon management and operations. “We believe that our low-carbon strategy enhances Oxy’s business value and creates a path to net-zero for ourselves while providing organizations everywhere with the tools they need to achieve net-zero or net-negative emissions.”

No financial terms were disclosed in the announcement. Nevertheless, Occidental's latest annual report noted that OLCV plans to invest approximately $300 million into the development and commercialization of new technologies and low-carbon business models in 2022.

It’s an international energy company with assets primarily in the United States, the Middle East and North Africa. OLCV is focused on advancing cutting-edge, low-carbon technologies and business solutions that enhance Oxy’s business while reducing emissions. Therefore, OLCV also invests in the development of low-carbon fuels and products, as well as sequestration services to support carbon capture projects globally.

Enterprise would develop the CO2 aggregation and transportation network utilizing a combination of new and existing pipelines along with its expansive Gulf Coast footprint. OLCV, through its 1PointFive business unit, is developing sequestration hubs on the Gulf Coast and across the U.S., some of them are thought to be anchored by direct air capture facilities. The hubs will provide access to high-quality pore space for industrial plants trying to find a way to capture their carbon emissions and efficient transportation infrastructure, bringing more options to emitters looking to explore viable carbon management strategies. The partnership’s assets include more than 50,000 miles of pipelines; over 260 million barrels of storage capacity for NGLs, crude oil, refined products and petrochemicals; and 14 billion cubic feet of natural gas storage capacity.

Both companies have begun exploring the commercialization of the potential joint service for these carbon emitters. “For many years, Enterprise and Oxy have successfully collaborated in developing traditional oil and gas projects," A.J. “Jim” Teague, co-CEO of Enterprise’s general partner, commented. “We are excited to evolve that relationship with OLCV to provide reliable and cost-efficient CO2 transportation and sequestration services to advance a low-carbon economy for the energy capital of the world.”

Moreover, it is noticed that Oxy is one of only three oil and gas companies aspiring to set emissions reduction aims which are quite ambitious to reach Net Zero by 2050 and the alignment with TPI’s 1.5°C benchmark.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

It’s all about the ESG (and RSG): Southwestern Energy and Kinder Morgan stroke a deal for gas transportation

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/ESG_RSG_Southwestern_Energy_Kinder_Morgan_gas_transportation.png)

Southwestern Energy Co. signed an agreement with Kinder Morgan Inc. for the transportation of responsibly sourced natural #gas (RSG) to the Northeast markets. Tennessee Gas Pipeline, a subsidiary of Kinder Morgan, will be carrying out this notion come November. This move proves yet again, that the energy market is tilting towards sustainability and renewability.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R131_B_ESG_Management.png)

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.