Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

CA$375 Million Bolt-on Deal to Expand Crescent Point

12/19/2022

On December 9, Crescent Point Energy Corp. announced a purchase and sale agreement to develop its core Kaybob Duvernay assets, which will bolt on production, the midstream infrastructure and technical data. With the deal, the company has committed more than US $1 billion to the play.

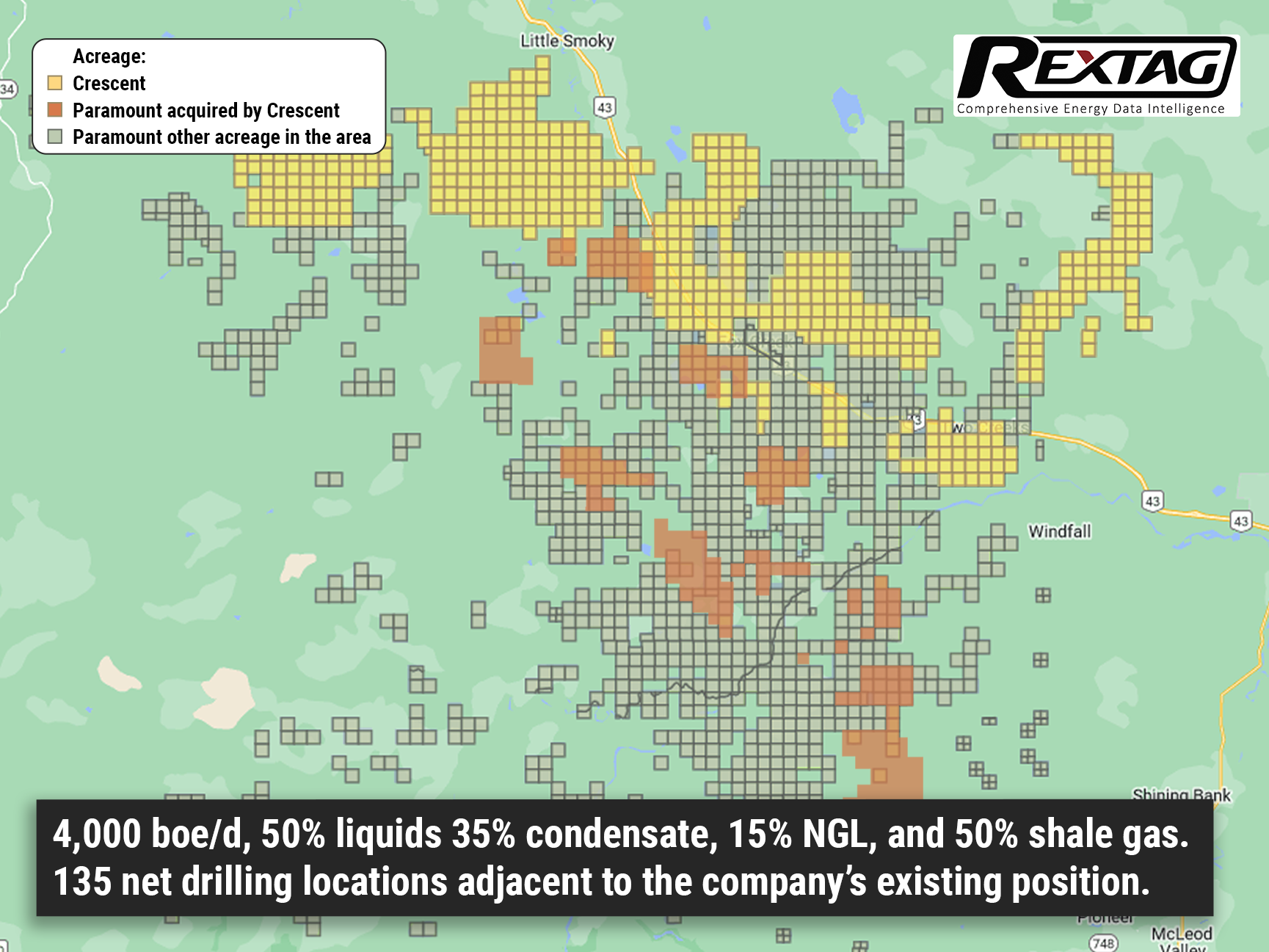

Crescent Point, the Alberta-based company, is purchasing almost 65,000 net acres from Paramount Resources Ltd. for CA $375 (US $274 million) cash. The assets estimate more than 4,000 boe/d, 50% liquids, and include a gas plant, associated pipelines, water infrastructure, and seismic data. The acquired asset’s production consists of 35% condensate, 15% NGL, and 50% shale gas.

The deal adds 135 net drilling locations that are adjacent to the company’s existing position. The company anticipates funding the purchases through its existing credit facility with an expected close in February 2023.

The company entered the liquids-rich play in February 2021 after deciding to purchase Shell’s position in the Kaybob Duvernay play for CA $900 million (US $709 million). In the third quarter of 2022, Crescent Point added a CA $87 million (US $64 million) bolt-on in the Kaybob.

Tudor, Pickering, Holt & Co. analyst Matt Murphy said the package primarily includes undeveloped land and inventory that will bolster the company’s Duvernay inventory. The company increased its 2023 production guide to 138,000 boe/d to 142,000 boe/d with its capital spend guidance unchanged.

Crescent Point keeps on generating strong full-cycle returns from the Kaybob Duvernay assets, which are top quartiles within its overall portfolio. Through this acquisition, the company is raising its drilling inventory in the play to over 20 years, based on current production. Moreover, its land position will grow up to about 400,000 net acres.

Crescent Point considers expanding its Kaybob Duvernay asset to more than 55,000 boe/d within its five-year plan from roughly 35,000 boe/d in 2022. According to the company’s development program, a second rig will be added in the Kaybob Duvernay in 2024.

Including base production with an estimated net present estimate of almost $200 million at current strip commodity prices, the purchase adds an attractive ESG profile, consistent with the existing Kaybob Duvernay assets, including low emissions intensity and minimal asset retirement obligations.

Crescent Point admits that it is now drilling its seventh pad in the play and anticipates starting its sixth fully operated pad on-stream in early 2023. Its fourth and fifth fully operated multi-well pads were recently brought on-stream and are creating strong initial production results that are in line with or ahead of its internal type wells.

According to the company, average IP rates for the fourth and fifth pads were almost 785 boe/d per well (IP90) (75% liquids) and about 950 boe/d per well (IP30) (65% liquids). Additionally, the drilling days have also been decreased to between 11 to 13 days per well on its recent pads, a 40% decline since entering the play.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Tokyo Gas Is Set to Buy Rockcliff Energy: One of the Top Haynesville's Producers

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/114Blog_Tokyo_Gas_Wants_to_Acquire_Rockcliff_Energy_01_2023.png)

On January 3, U.S. natural gas producer Rockcliff Energy from private equity firm Quantum Energy Partners was set to be sold to a unit of Tokyo Gas Co. Ltd. for roughly $4.6 billion, including debt. The all-cash agreement with Houston-based TG Natural Resources, which is 70% possessed by the Japanese energy firm, is decided to be claimed this month, according to anonymous resources, as the discussions were requested to be confidential. Castleton Commodities International (CCI) owns the rest of TG Natural Resources.

NOG Grows Its Acreage Position in Delaware

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/113Blog_NOG_Closes_Northern_Delaware_Basin Acquisition_12_2022 (1).png)

According to the company’s press release on December 19, Northern Oil and Gas Inc. (NOG) closed its announced deal with a private seller of non-operated interests in the Northern Delaware Basin for $131.6 million in cash. The acquisition was announced with a $13 million deposit in October and is the third Permian Basin acquisition since August, adding to NOG’s $400 million of Permian Basin acquisitions in 2022. The assets of 2,100 net acres are primarily operated by a private company Mewbourne Oil Co., with production anticipated to total almost 2,500 boe/d in 2023. Also, Coterra Energy Inc. and Permian Resource Corp. are operators of the assets. The assets contain high-quality, low breakeven development that is leveraged to some of NOG’s top operating partners, as our investors have come to expect.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.