Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Discover How Top NGL Producers Keep Growing

05/01/2020

Each year a substantial growth in volume can be observed in both gas processing and NGL production.

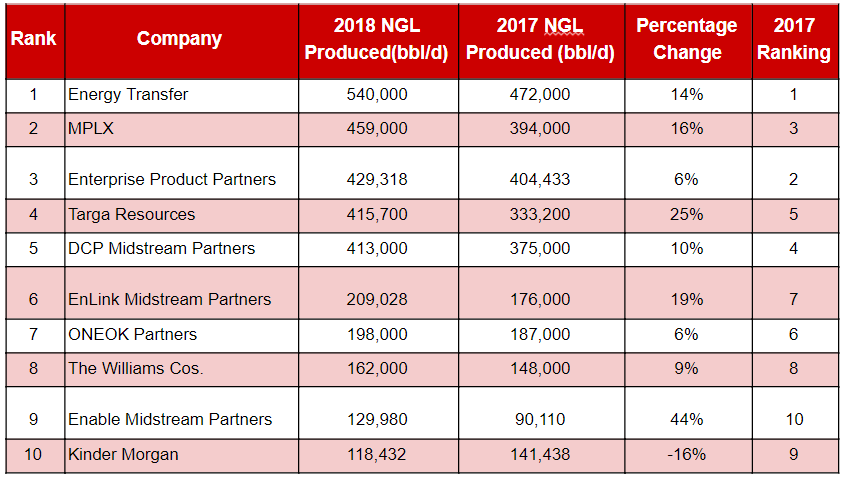

Energy Transfer Partners was the top NGL producer, with a 14% growth compared to previous year. Their NGL production reached 540,000 barrels per day. For 2019, Energy Transfer has reported NGL production of 571,000 bbl/d. That is a 6% increase in production compared to 2018.

Energy Transfer did not supply processing figures, but the company has reported an increase in gathered natural gas (Permian, Northeast, and North Texas) and this is likely to push them onto one of the top positions of the natural gas processor rankings. However, due to the lack of specific figures they were placed on the 10th spot in Midstream Business’ annual rankings.

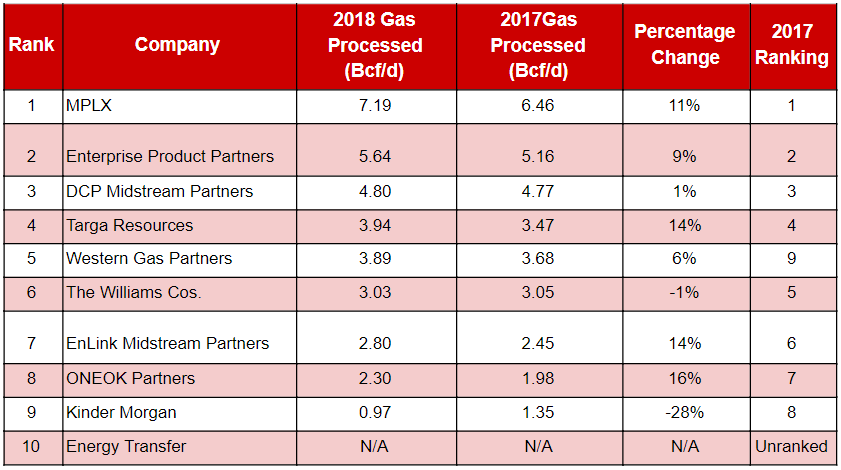

The rise in processed volumes in the Marcellus Shale has kept MPLX (previously MarkWest Energy Partners) in the first spot as top gas processor. The company reported a 15% increase in earnings for the 2018 fiscal year. No wonder Gary Heminger,MPLX’s chair and CEO said “2018 was a transformational year for MPLX”.

The most significant increase in gas processing with a 16% growth compared to the previous year was recorded by ONEOK Partners. This growth is mainly attributed to high production in the Rockies and the Midcontinent.

DCP Midstream Partners has ranked number 5 in the top NGL producers with a 10% increase from the previous year. A 1% increase in processed gas has kept the company ranking 3rd in the gas processor rankings.

Ranking second in top gas processors and third in NGL producers, Enterprise Product Partners has kept a constant growth in volume in the past several years.

Targa Resources is one of the companies that has been steadily increasing NGL production in the past several years. Targa reported a 25% growth of NGL produced in 2018 compared to 2017 and a 21% increase in 2019 compared to previous year.

Here are the TOP NGL Producers

Here are the TOP Gas Processors

Get more information on pipelines operated by top ranking gas processors and NGL producers by signing up for a Free Energy Datalink account.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

How Big Is U.S. NG Pipeline Network?

![$data['article']['post_image_alt']](https://rextag.com/images/public/blog/pipelines.jpg)

See how U.S. NG pipeline network length compares to that of other countries.

3D visualization for Oil & Gas industry: leaders of the O&G market in 2022

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/3D-visualization-for-Oil-Gas-industry-2022-Outlook.png)

3D Modeling helps to optimize oil and gas exploration and production, and evaluate the potential of energy sources. Companies CGG, ESA, Schneider Digital, and Continental Resources have been pioneering in 3D visualization for the O&G industry in 2022.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.