Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Eagle-Ford Republic Midstream System Has a New Owner

04/09/2019

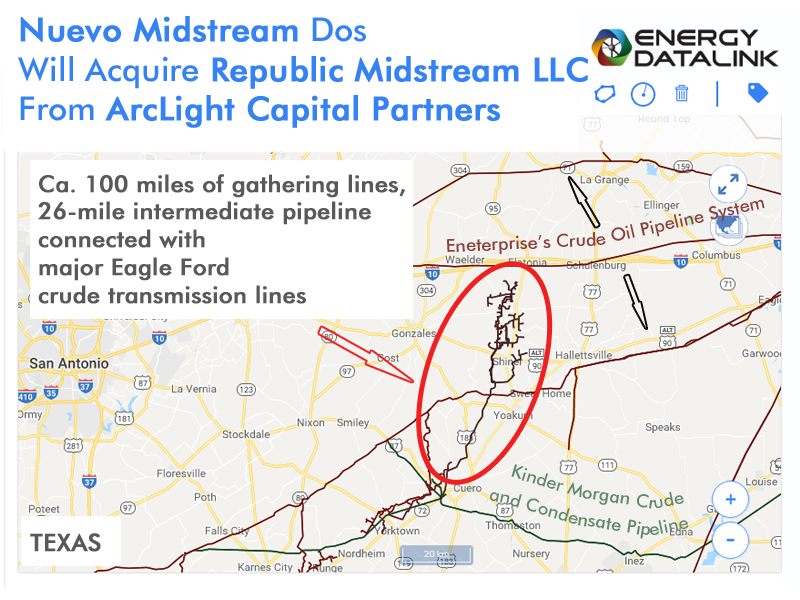

Nuevo Midstream Dos LLC, Houston, will expand its crude oil gathering, storage, and intermediate transportation system in the Eagle Ford shale. It has entered into a definitive agreement with an affiliate of ArcLight Capital Partners to acquire the Republic Midstream System.

Most of the company's assets are located in Gonzales, Lavaca, and Dewitt counties in Texas. The system consists of some 100 miles of gathering pipeline that feeds a central delivery point with 300,000 barrels of crude oil storage and a six-bay truck station.

The 26-mile intermediate pipeline moves volume from this delivery point to the Kinder Morgan Crude and Condensate Pipeline and the Eagle Ford Crude Oil Pipeline System, which is owned and operated by Enterprise.

The transaction is expected to close early in the 2Q 2019.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Delays Are Finally Over: Enbridge Reports Strong Third Quarter 2021

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Enbridge-Reports-Strong-Third-Quarter-2021.png)

Enbridge Inc. finally delivered on several of its long-overdue promises, including the $4 billion Line3 Replacement project. Which consisted of replacing an existing 34-inch pipe with a new 36-inch one for 13 miles in North Dakota, 337 miles in Minnesota, and 14 miles in Wisconsin. Midstream companies, in general, had a stunning Q3. It was the first quarter in two years that no midstream index members cut their dividends.

U.S. Crude Breakevens at Less Than $50/Bbl - Pipelines Help

![$data['article']['post_image_alt']](https://rextag.com/images/public/blog/U.S.-Crude-Breakevens-at-Less-Than-50-per-Bbl.jpg)

U.S. Shale Breakevens now at $50 instead of $68/bbl. Pipeline management (field and maintenance data), as well as new projects introduced lower operation costs and provide path to future industrial success.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.