Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

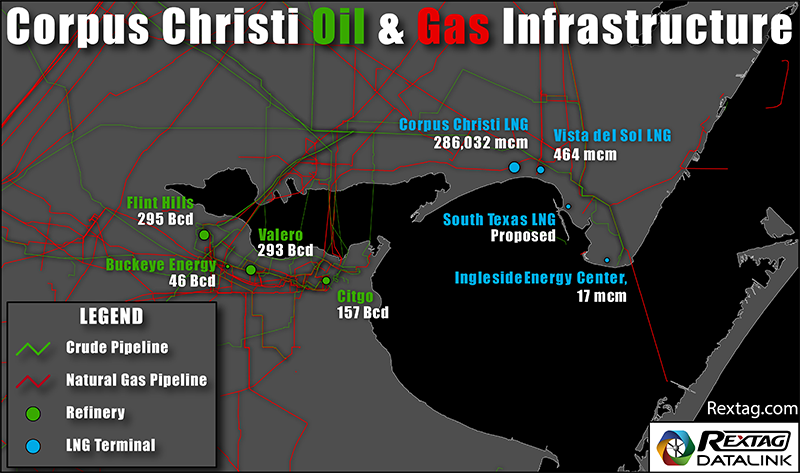

Corpus Christi and its O&G Infrastructure

06/07/2017

Permian’s Midstream Takeaway. Are we in for a problem any time soon? Who are the regional industry champions? Read some facts below. Today looking at Corpus Christi. See key facilities on a map above.

As the threat of too much oil and too few pipelines in the Permian Basin continues to loom, midstream developers are trying to keep up with the aggressive pace of producers with some looking toward growing export opportunities on the Texas Gulf Coast.

Magellan is one of several companies looking to lay a new pipeline from the Permian to Corpus Christi, Texas, and also is currently expanding its BridgeTex Pipeline in the basin.

Why the Permian? If you look at the analysis that shows breakeven economics based on where to spend the money, producers that have acreage in the Permian are getting the most profits.

The rig count in the Permian Basin has more than doubled since 2016 with 361 active rigs in the basin as of May 19 vs. 137 a year ago, according to Baker Hughes Inc. (NYSE: BHI).

At the same time, the Energy Information Administration is also projecting an increase of crude oil production in the Permian Basin to an estimated 2.4 million bbl/d in May. The Permian produced about 2 million barrels per day (bbl/d) of crude oil in May 2016.

However, midstream developers are already addressing the projected constraint with announced midstream projects in the Permian so far during second-quarter 2017 significantly exceeding activity in the rest of the U.S., according to a May 23 report by Stratas Advisors.

So far, Permian midstream developers have announced 23 new projects, expansions or completions at expanding pipelines, terminals and docks, tanks and processing plants during the second quarter compared to the 20 projects elsewhere, the report said.

Through its Longhorn and BridgeTex pipeline systems, Magellan currently has takeaway capacity of roughly 575,000 bbl/d, which is expected to increase by 100,000 bbl/d in a month or so following completion of its BridgeTex expansion project.

“Through the process of doing all that we’ve identified some ways to increase the capacity even further,” he said. “We’re very confident we’ll get to 450,000 and we may even be able to get above 450,000 with fairly limited work that needs to be done.”

Barnes said the new pipeline Magellan is developing to transport Permian crude to Corpus Christi will have multiple origin points, both in the Delaware and Midland basins, as well as multiple delivery points in the Corpus Christi area.

Indeed, Texas continues to rank as the U.S. leading natural gas producing state. As a reflection of that, gas transmission and processing activities mount. The complete landscape of the Lone Star State's natural gas industry can be found on Rextag's Texas Natural Gas Infrastructure Map.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Plains All American Expects 10% Increase in the Permian Oilfield Activity

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/86Blog_Plains_Assets_2022_08.png)

On 3 August the pipeline operator Plains All American LP raised its 2022 profit forecast for the second time this year, as it expects a huge demand on its pipelines transporting U.S. shale oil to the Gulf Coast. The company increased full-year adjusted earnings guidance by $100 million to approximately $2.38 billion, since it anticipates higher crude and natural gas liquids volumes. European buyers have snapped up the U.S. light sweet crude, the largest part of which is delivered in the Permian Basin of West Texas and New Mexico, as they depend on replacing Russian barrels. Average daily crude oil volumes in the second quarter grew 30% on its Permian Basin pipelines with oilfield activity trending about 10% exceeding its initial expectations. Its shares increased 3.6% in after-hours trading on August 3 to $11.19.

Top Crude Refineries Serving Permian

![$data['article']['post_image_alt']](https://images2.rextag.com/public/HEMDS_SiteSupportFiles/BlogImages/GoM_Refineries.png)

A total capacity for the area is as high as 8,576,325 Bcd according to Rextag count

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.