Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

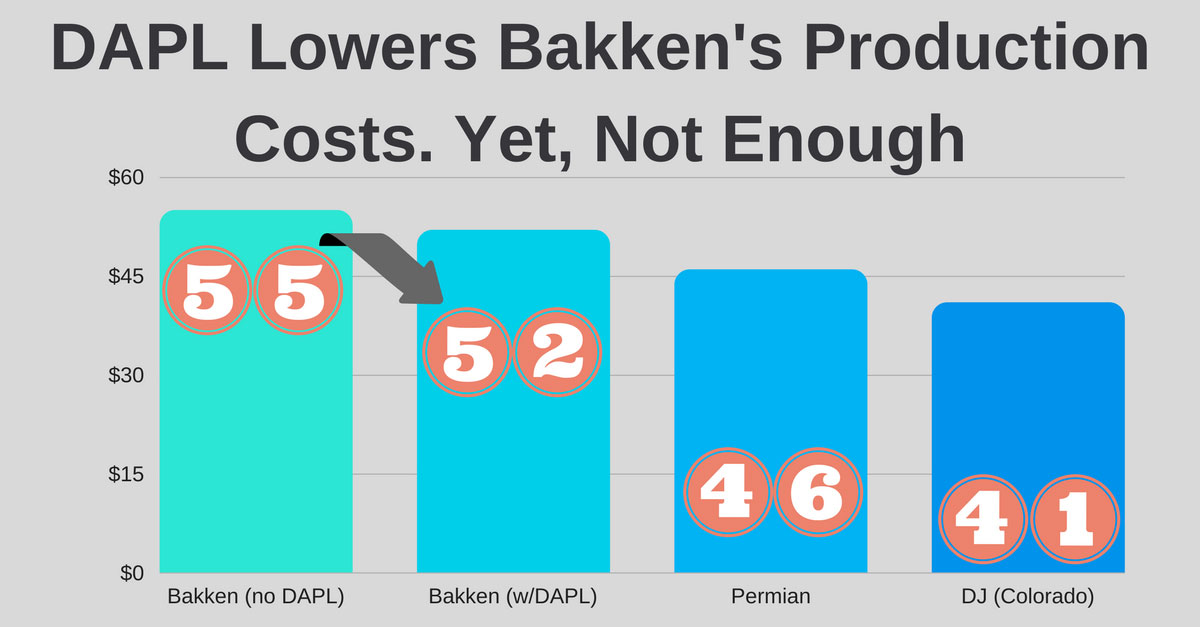

Bakken After DAPL Is in Operation: Still Hard to Compete

10/27/2017

North Dakota’s Bakken shale play will remain at certian disadvantage against Texas and Oklahoma even after the DAPL pipeline is in full service.

The break-even cost drilling cost for the basin is estimated to drop to $52 a barrel from $55 due to shift away from rail transportation to the DAPL. However, that compares with about $46 on average in Texas’s Permian play and $41 in Colorado’s DJ basin.

The 1,172-mile (1,886-kilometer) pipeline is designed to ship as much as 570,000 barrels of crude.

Bakken was named for Henry Bakken, a North Dakota farmer whose land hosted the first well in the region in the early 1950s,

It is expected to produce an average of 1.1 million barrels a day of oil this year and next, a figure lower than the 1.2 million barrels produced in 2015, according to the Energy Information Administration.

At the same time, Permian production is expected to reach 2.9 million barrels a day by the end of next year, the EIA said in July.

Bakken activities are easy to trace and examine with a complete and up-to date oil and gas information from well activity to processing and exporting on our Bakken Infrastructure Map.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Fueling Up for Success: Harvest Midstream, Hilcorp's Affiliate, to Acquire Bakken and Eagle Ford Assets from Paradigm

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/140Blog_Paradigm_Acquisition_by_Hilcorps_Harvest_Midstream.png)

Harvest Midstream, a Hilcorp affiliate, is set to acquire three midstream gathering systems that serve the Bakken, as well as system located in the Eagle Ford. Harvest, an affiliate of Hilcorp Energy Corp, has entered into an agreement to purchase three Bakken midstream gathering systems and one in the Eagle Ford from Paradigm. Paradigm is set to sell these midstream assets to Harvest in the near future.

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R-149 - Blog Exploring the Energy Lifeline_ A Tour of Williston Basin's Pipeline Infrastructure.png)

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.