Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

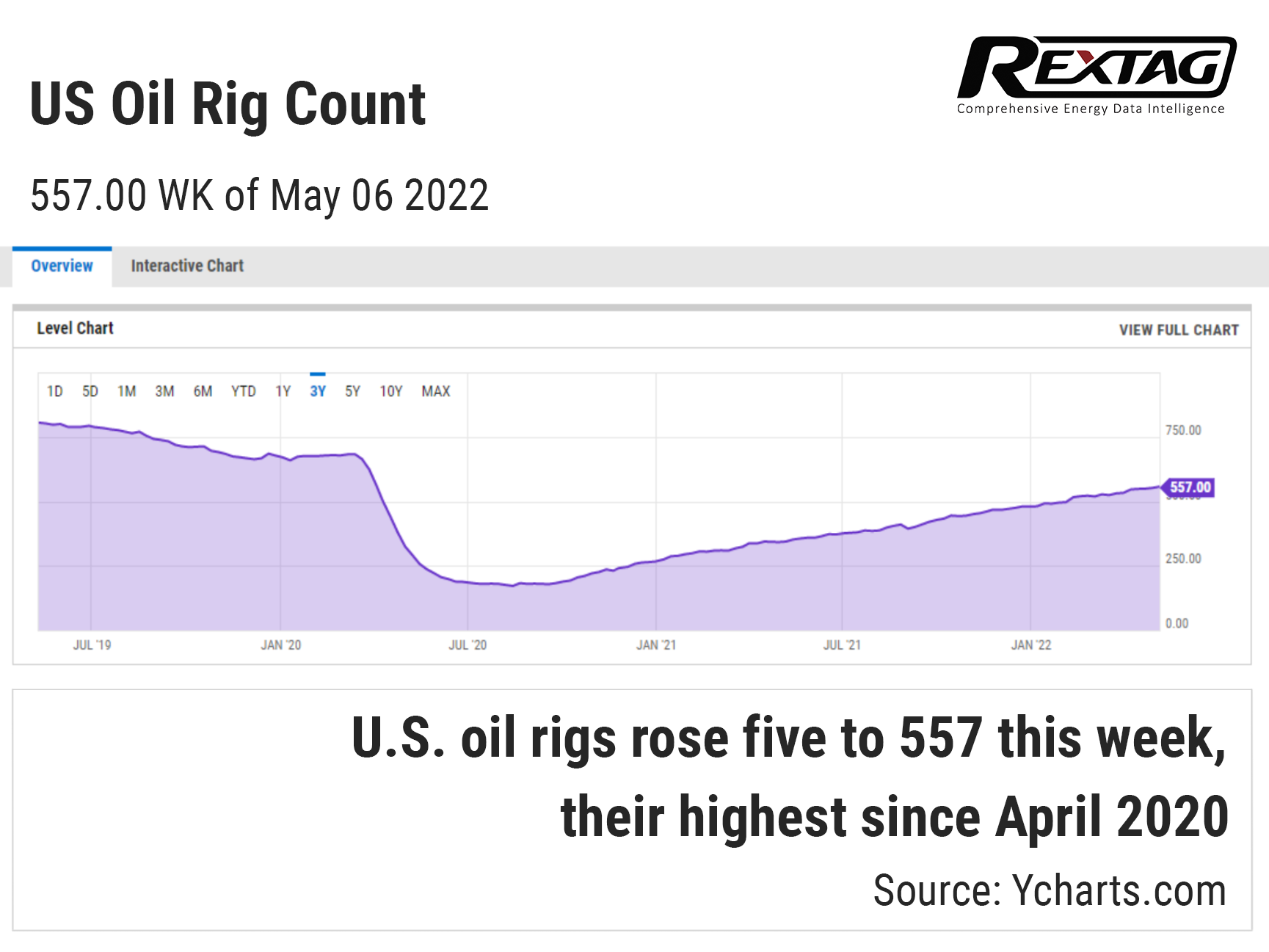

7th week of Oil and Gas Rigs’ Growth

05/13/2022

In the midst of the high prices and the U.S. government’s pushing, in the last week, the number of oil rigs increased by 5 and in total makes 557, its highest since April 2020, according to Baker Hughes Co BKR.N. Concerning the gas rigs, they gained 2 to 146, their highest since September 2019.

However, most shale producers preferred shareholder returns over new spending on production.

Due to the Russian invasion of Ukraine on 24th, February, the U.S. government has insisted that drillers produce more oil and gas in order to reduce local prices and support other countries to avoid Russian energy dependence.

Being an early indicator of future output, the rig count climbed for a record 21 months in a row through April. Nevertheless, weekly increases have mostly been in single digits and oil production is still far below pre-pandemic record levels.

Moreover, crude production was aimed to rise from 11.2 million barrels per day (bpd) in 2021 to 12.0 million bpd in 2022 and 13.0 million bpd in 2023, according to federal energy data.

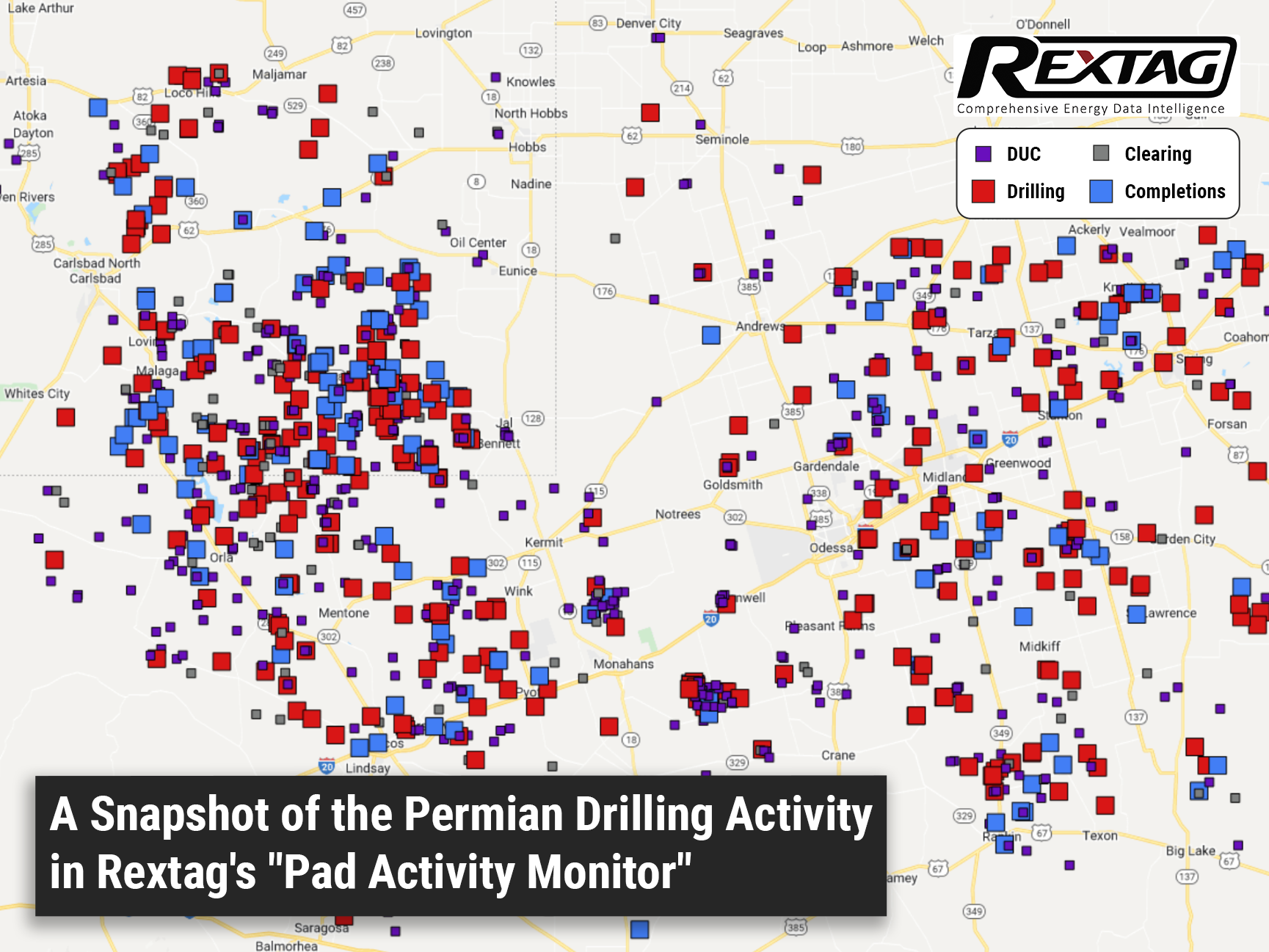

Given that this growth has been expected, recent global market changes make forecasting the output even more challenging. Learning how production will change is easier with early activity tracking, a new service recently launched by Rextag.

Rextag's Pad Activity monitor (#PAM) assists to learn about potential increases or decreases in oil and gas production months ahead of others and how potential volumes could impact storage and transportation across the Permian Basin. With the help of satellite imagery and artificial intelligence, you are able to monitor well pad clearing, drilling operations, fracking crew deployment and completions with new data collected approximately every 2 days.

The incredible first-quarter profits were reported by top U.S. shale producers that week. As oil prices churned at the highest levels in years, lots of money was poured into higher dividends and share buybacks.

A large number of energy companies are going to increase capital spending for a second year in a row in 2022 as the oil prices are up about 47% so far this year to about $110 a barrel, after soaring 55% in 2021.

The independent exploration and production (#E&P) companies intend to raise expenditures by about 29% in 2022 compared with 2021 after increasing spending by about 4% in 2021 regarding 2020, as U.S. financial services firm Cowen & Co. declared.

As a result, there is a drop in capital expenditures of roughly 48% in 2020 and 12% in 2019.

The overall amount of rigs in the U.S. would grow to an average of 684 in 2022 and 783 in 2023, due to U.S. investment bank Piper Sandler forecast. As Baker Hughes claimed that compares with an average of 478 in 2021.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Persistent Production Uptick in the Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/65Blog_Permian_Drilling_Activity_Summary_May_2022_Rextag_3psd.png)

No sooner had the crude prices soared above $100/bbl than the industry professionals believed in an incredible growth of drilling activity in North America’s largest shale patch. Analysts speculate that additional output of 500,000 barrels of oil daily would become a significant part (4%) of overall U.S. daily production. That is going to flatter oil and gasoline prices. Drilling permits in the Permian Basin are persistently growing, averaging approximately 210 at the beginning of April. Moreover, the permits trend is noticed as an all-time high as a total of 904 horizontal drilling permits were awarded last month. Nowadays, learning and analysing the current situation and predicting the future development become easier with early activity tracking, a new service recently launched by Rextag. Rextag's Pad Activity monitor (PAM) allows you to see well pad clearing, drilling operations, fracking crew deployment and completions with new data collected approximately every 2 days with the help of satellite imagery and artificial intelligence. While the increase in drilling will result in higher production, U.S. shale producers will have to overcome several hurdles including labor shortages and supply constraints.

Staying on Top of Drilling Activity Trends in the Permian Basin

Oil output in the Permian Basin in Texas and New Mexico is supposed to go up 88,000 bbl/d to a record 5.219 million bbl/d in June, as the U.S. Energy Information Administration (EIA) announced in its report on May 16. Additionally, gas productivity in the Permian Basin and the Haynesville in Texas, Louisiana and Arkansas will rise to record highs of 20 Bcf/d and 15.1 Bcf/d in June, respectively. Given that this growth has been expected, recent global market changes make forecasting the output even more challenging. Learning how production will change is easier with early activity tracking, a new service recently launched by Rextag – Pad Activity Monitor. With the help of PAM, you are able to monitor well pad clearing, drilling operations, fracking crew deployment and completions with new data collected approximately every 2 days. Additionally, it cuts down activity reporting lag times by at least 98%, from 120-180 days down to just 5-8 days. In order to access reports, charts, tables, and mapping visualizations via Rextag’s Energy DataLink use a web-based application allowing users to filter, download and identify activity on a map or data table. Moreover, customers will be able to set up daily, weekly, and monthly email report notifications.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/184Blog_Rangeland Energy Divests Canadian Pipeline to Kingston Midstream.png)

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/187Blog_ONEOK Completes Acquisition of Magellan Midstream.png)

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/186Blog_Viper Energy Secures $1 Billion in Permian.png)

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.